Market Overview

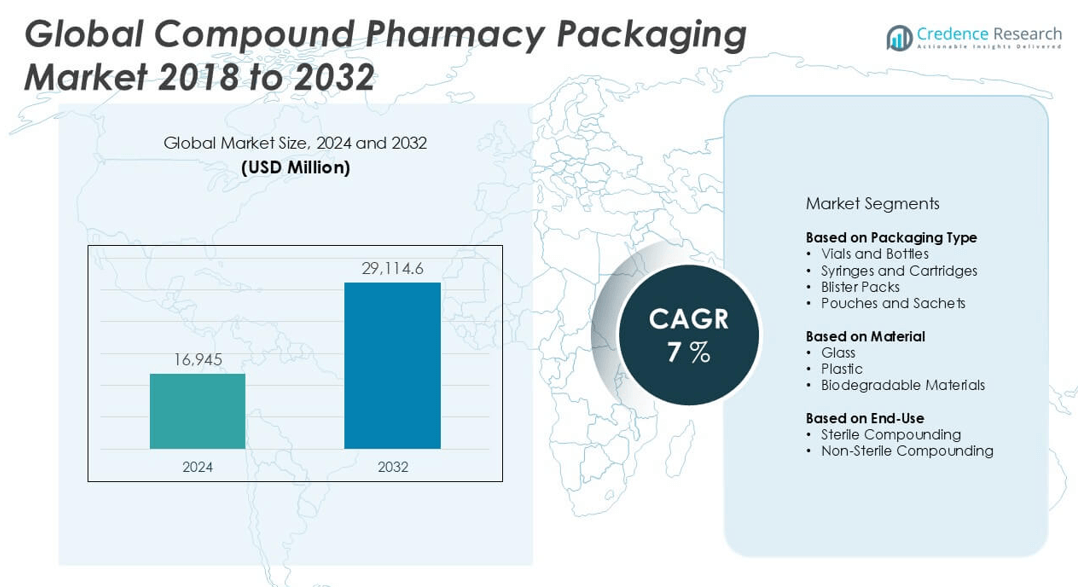

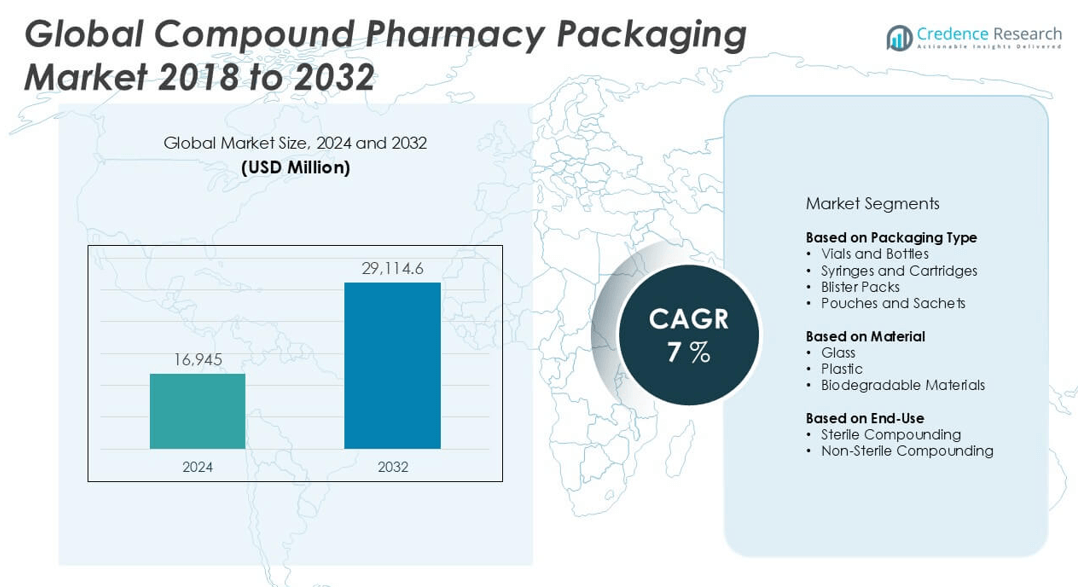

The Compound Pharmacy Packaging market size was valued at USD 16,945 million in 2024 and is anticipated to reach USD 29,114.6 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Packaging Market Size 2024 |

USD 16,945 million |

| Pharmaceutical Packaging Market, CAGR |

7% |

| Pharmaceutical Packaging Market Size 2032 |

USD 29,114.6 million |

The Compound Pharmacy Packaging market is led by key players such as DWK Life Sciences, PCCA, Fagron, Walgreens Co., and Albertsons Companies, all of which offer specialized packaging solutions designed to meet the stringent requirements of both sterile and non-sterile compounding. These companies focus on product integrity, regulatory compliance, and innovation to maintain a competitive position. DWK Life Sciences and PCCA are known for their high-performance containers and technical support, while Fagron provides global reach through its compounding expertise and packaging services. In terms of regional leadership, North America dominates the global market with a 38% share in 2024, driven by an established compounding infrastructure, strict regulatory oversight, and rising demand for personalized medicine. The region benefits from the presence of major players and advanced pharmaceutical capabilities, which collectively contribute to its market leadership.

Market Insights

- The Compound Pharmacy Packaging market was valued at USD 16,945 million in 2024 and is projected to reach USD 29,114.6 million by 2032, growing at a CAGR of 7% during the forecast period.

- Market growth is primarily driven by rising demand for personalized medicine, an aging population, and increasing prevalence of chronic diseases requiring tailored drug formulations and specialized packaging.

- Emerging trends include the adoption of biodegradable materials, smart packaging solutions for traceability, and increased outsourcing of compounding services, especially in developed regions.

- Key players such as DWK Life Sciences, PCCA, and Fagron dominate the competitive landscape, focusing on regulatory-compliant, tamper-evident, and high-barrier packaging formats tailored for both sterile and non-sterile compounding.

- North America leads the market with a 38% share, followed by Europe at 26% and Asia Pacific at 21%; among packaging types, vials and bottles account for the highest segment share due to their widespread usage and safety features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

In 2024, vials and bottles emerged as the dominant packaging type in the Compound Pharmacy Packaging market, accounting for the largest market share due to their widespread application in both sterile and non-sterile compounding. These formats offer excellent sealing properties, dose accuracy, and compatibility with a range of pharmaceutical formulations, particularly for liquid and injectable medications. Growing demand for custom medication delivery and patient-specific dosing has further supported the adoption of these formats. Additionally, their adaptability to tamper-evident and child-resistant features reinforces their preference in regulated pharmacy environments.

- For instance, DWK Life Sciences offers more than 30 types of borosilicate glass vials, including its DURAN® precision-threaded bottles, which support sterile storage and high thermal resistance, essential for compounded injectables.

By Material

Plastic held the leading market share among materials used in compound pharmacy packaging, driven by its cost-effectiveness, lightweight nature, and versatility across various drug types. Its ability to be molded into complex shapes such as prefilled syringes, cartridges, and blister packaging enhances its utility in personalized medicine. Moreover, the increased use of advanced polymers that meet pharmaceutical-grade safety standards contributes to its dominance. While biodegradable materials are gaining attention due to sustainability trends, their adoption remains limited due to regulatory hurdles and higher production costs.

- For instance, PCCA has developed a proprietary line of plastic dispensing containers that support over 5,000 custom compounding formulas, using FDA-compliant polypropylene materials with high chemical resistance and barrier performance.

By End-Use

Sterile compounding represented the dominant end-use segment in 2024, holding a significant share of the Compound Pharmacy Packaging market. This is attributed to the high demand for aseptically prepared medications, especially injectables and ophthalmic drugs that require stringent contamination control. The growing number of patients requiring customized treatments in oncology, pediatrics, and critical care supports the need for sterile compounding. Regulatory emphasis on cleanroom compliance and advanced packaging solutions to maintain sterility also contributes to the growth of this segment, making it a primary focus for packaging innovation and investment.

Market Overview

Rising Demand for Personalized Medicine

The growing preference for personalized medicine is a major driver for the compound pharmacy packaging market. As patients increasingly require tailored drug formulations to address specific health conditions, demand for flexible, small-batch packaging solutions has surged. Compounded medications must be packaged in a way that ensures dosage accuracy, patient safety, and extended shelf life. This trend has spurred innovation in adaptable packaging formats such as syringes, vials, and blister packs, fostering consistent growth in the packaging sector aligned with personalized healthcare delivery.

- For instance, Fagron’s packaging division produces over 20 million customized packaging units annually to meet compounding needs in personalized therapy, with modular designs enabling easy adaptation across dermatological, hormonal, and pediatric formulations.

Expansion of Geriatric and Chronic Disease Populations

An aging global population and the rise in chronic conditions such as diabetes, cancer, and cardiovascular disorders are significantly driving the compound pharmacy packaging market. Elderly patients often require customized medication strengths and formulations, necessitating specialized packaging that enhances usability and compliance. Packaging formats that are easy to open, tamper-evident, and clearly labeled are in high demand. This demographic trend continues to boost the need for safe, user-friendly, and reliable packaging solutions in both sterile and non-sterile compounding.

- For instance, U.S. compounding pharmacies process over 8 million customized prescriptions for patients aged 65 and older each year, addressing complex comorbidity and polypharmacy needs.

Stringent Regulatory Requirements for Sterile Packaging

The market is witnessing strong growth due to increasing regulatory scrutiny around sterile compounding practices. Agencies such as the FDA and USP have set high standards for packaging integrity, sterility assurance, and traceability. To comply, compounders and packaging manufacturers are investing in high-barrier materials, aseptic filling techniques, and tamper-evident designs. This regulatory pressure has driven demand for advanced packaging types like prefilled syringes and sealed vials, supporting market expansion through compliance-focused innovation.

Key Trends & Opportunities

Adoption of Sustainable Packaging Materials

Sustainability is emerging as a significant trend, with increased interest in biodegradable and recyclable materials for compound pharmacy packaging. With regulatory bodies and consumers prioritizing environmental impact, manufacturers are exploring alternatives to traditional plastic and glass. Biodegradable polymers and eco-friendly blister films offer new opportunities for differentiation. Though adoption is currently limited due to cost and regulatory complexity, companies that invest in green packaging solutions are likely to gain a competitive edge in future market scenarios.

- For instance, Roseway Labs partnered with BioPak to pilot recyclable mail-order packaging for compounded prescriptions in 2023, which reportedly reduced plastic waste by over 1.2 tons in six months across their UK fulfillment centers.

Technological Advancements in Smart and Tamper-Evident Packaging

The integration of smart packaging technologies is creating new avenues for market growth. Features such as RFID tags, QR codes, and tamper-evident seals enhance drug traceability, authentication, and patient engagement. These technologies are particularly valuable in sterile compounding, where product integrity is critical. Additionally, the use of digital labeling and real-time monitoring systems supports regulatory compliance and improves inventory management, making these innovations attractive to both pharmacies and packaging providers.

Growth in Outsourced Compounding Services

The increasing trend of outsourcing compounding services to specialized pharmacies offers a key opportunity for packaging suppliers. Outsourcing allows healthcare facilities to reduce in-house compounding risks and comply with quality standards. As outsourcing grows, the need for reliable, pre-qualified packaging that supports extended shelf life and transportability becomes more critical. Packaging companies that partner with outsourcing providers can benefit from steady demand and long-term supply contracts, creating new revenue streams.

Key Challenges

Regulatory Compliance and Packaging Validation Costs

One of the major challenges in the compound pharmacy packaging market is the high cost of meeting stringent regulatory standards. Packaging used for compounded drugs must pass multiple validation tests for sterility, compatibility, and stability. These processes require significant investment in quality control, documentation, and third-party certifications. Smaller compounding pharmacies and packaging vendors may struggle to afford these costs, creating barriers to entry and slowing market expansion among newer players.

Material Compatibility and Drug Stability Issues

Ensuring compatibility between packaging materials and compounded formulations remains a technical challenge. Some active ingredients, particularly in liquid or biologic formulations, may react with plasticizers or leach into container surfaces. Such interactions can compromise drug potency and safety. As a result, selecting the right material requires in-depth analysis, often leading to extended development timelines and additional regulatory testing, which increases costs and complexity for packaging manufacturers.

Supply Chain Disruptions and Raw Material Volatility

Volatility in the availability and pricing of raw materials, including medical-grade plastics and glass, poses a consistent challenge. Global supply chain disruptions, exacerbated by geopolitical tensions or pandemics, can delay production and delivery timelines. For compounding pharmacies that rely on timely packaging to fulfill prescriptions, such delays can affect patient care. Maintaining inventory buffers and sourcing from multiple suppliers adds to operational costs, impacting profitability across the packaging ecosystem.

Regional Analysis

North America

North America held the largest market share in the Compound Pharmacy Packaging market in 2024, accounting for approximately 38% of the global revenue. The region’s dominance stems from a well-established compounding pharmacy infrastructure, high healthcare expenditure, and stringent regulatory standards promoting sterile and high-integrity packaging. The U.S. leads the region due to strong demand for personalized medicine and the presence of advanced pharmaceutical packaging technologies. Rising chronic disease incidence and the aging population further support sustained demand. Additionally, favorable reimbursement policies and the expanding outsourcing of compounded drugs contribute to the region’s robust packaging requirements.

Europe

Europe accounted for around 26% of the global Compound Pharmacy Packaging market in 2024, driven by a rising focus on patient safety, environmental regulations, and innovations in pharmaceutical packaging. Countries such as Germany, France, and the UK lead the regional market due to their mature healthcare systems and adherence to rigorous compounding guidelines. The demand for tamper-evident and eco-friendly packaging formats is increasing amid growing awareness of sustainable healthcare solutions. Additionally, the region’s expanding elderly population and demand for sterile compounding support packaging innovations tailored to sensitive drug formulations and improved shelf life.

Asia Pacific

Asia Pacific captured approximately 21% of the Compound Pharmacy Packaging market in 2024, emerging as a rapidly growing region due to rising healthcare investments, expanding pharmaceutical sectors, and increasing awareness of personalized medicine. Countries like China, India, and Japan are witnessing strong demand for cost-effective and scalable packaging solutions, especially for injectables and oral solid dosages. The shift toward regulated compounding practices and the expansion of healthcare access across rural and urban areas are boosting packaging volumes. Moreover, regional manufacturing hubs are increasingly supplying packaging components globally, enhancing Asia Pacific’s role in the international supply chain.

Latin America

Latin America held around 9% of the Compound Pharmacy Packaging market in 2024. The market is gradually expanding due to improving healthcare infrastructure, rising chronic disease prevalence, and growing interest in personalized treatments. Brazil and Mexico are the leading contributors, supported by evolving regulatory frameworks and increased demand for sterile compounding solutions. However, the region faces challenges related to packaging material availability and regulatory compliance. Investments in local pharmaceutical production and compounding pharmacy services are expected to stimulate demand for reliable, tamper-proof, and cost-efficient packaging solutions in the coming years.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for approximately 6% of the Compound Pharmacy Packaging market in 2024. The market remains in a developing phase, with demand primarily driven by the UAE, Saudi Arabia, and South Africa. Growth in this region is supported by increasing healthcare investments, government initiatives to expand pharmaceutical manufacturing, and a rising burden of chronic diseases. However, infrastructure limitations and reliance on imported packaging materials hinder market scalability. As sterile compounding gains regulatory support, the demand for compliant packaging formats such as vials and blister packs is expected to rise gradually.

Market Segmentations:

By Packaging Type

- Vials and Bottles

- Syringes and Cartridges

- Blister Packs

- Pouches and Sachets

By Material

- Glass

- Plastic

- Biodegradable Materials

By End-Use

- Sterile Compounding

- Non-Sterile Compounding

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compound Pharmacy Packaging market is characterized by a mix of global packaging manufacturers, specialized compounding pharmacy suppliers, and regional players catering to niche needs. Companies such as DWK Life Sciences, PCCA, and Fagron play a significant role by offering a wide range of compliant, high-quality packaging solutions tailored for both sterile and non-sterile compounding. These firms focus on precision, regulatory adherence, and innovation to support patient-specific therapies. Retail pharmacy giants like Walgreens Co. and Albertsons Companies contribute to market consolidation through their in-house and outsourced compounding operations, demanding scalable and standardized packaging solutions. As sustainability and traceability become growing priorities, companies are investing in eco-friendly materials and smart packaging technologies to gain a competitive edge, while partnerships with compounding pharmacies help ensure long-term supply consistency and regulatory compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DWK Life Sciences

- Fusion Apothecary

- Apollo Clinical Pharmacy

- Albertsons Companies

- Fagron

- Walgreens Co

- JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy)

- Galenic Laboratories Ltd. (Roseway Labs)

- Aurora Compounding MEDS Pharmacy

- The London Specialist Pharmacy Ltd. (Specialist Pharmacy)

- Formul8

- PCCA

Recent Developments

- In May 2025, Aptar CSP Technologies, part of AptarGroup, revealed the expansion of its service range with the introduction of a cGMP-compliant manufacturing facility in New Jersey. Using Aptar CSP’s own Activ-Polymer platform and Activ-Blister solutions, the new website will facilitate clinical packaging for oral solid dose (OSD) and capsule-based DPI medications. The expansion responds to the market’s increasing need for improved medication stability and risk reduction from nitrosamines. By incorporating a highly-engineered active film material into thermoform and cold-form blister packaging configurations, Aptar CSP’s Activ-Blister technology creates a microclimate that shields individual doses from oxygen, moisture, volatile organic compounds, and degradation, including lowering the possibility of N-nitrosamine formation.

- In March 2025, Novo Nordisk announced potential legal action against compounding pharmacies producing copies of its obesity drug Wegovy, citing intellectual property violations and concerns about product quality. This signaled increasing tensions between traditional pharmaceutical manufacturers and the compounding sector.

- In March 2025, Sycamore Partners disclosed plans to acquire Walgreens for USD 10 billion. If completed, private ownership could accelerate investment in differentiated services, including compounding, as public-market earnings pressure recedes.

- In January 2025, Cascade Specialty Pharmacy, located in Washington, was acquired by Revelation Pharma, a prominent nationwide network of 503A and 503B compounding pharmacies, today. Revelation Pharma’s expanding portfolio benefits from Cascade Specialty Pharmacy’s strong tradition of competence in ENT and animal health compounding.

- In December 2024, Novo Holdings received European Commission approval for its USD 16.5 billion acquisition of Catalent. By increasing biologics filling capacity, the deal indirectly alleviates production bottlenecks, affecting how often compounders are needed for shortage mitigation.

- In December 2024, Goldman Sachs Alternatives took majority control of Synthon, signaling growing private-equity interest in complex generic APIs that serve as raw material for compounders.

- In October 2024, Strive Compounding Pharmacy acquired a 50,000 sq ft facility in St Louis, showcasing that square footage expansion remains the simplest proxy for projected sterile-volume growth.

- In October 2024, Iterum Therapeutics received FDA approval for ORLYNVAH, potentially decreasing demand for compounded sulopenem suspensions and illustrating how new drug launches can displace compounding volumes in specific niches.

Market Concentration & Characteristics

The Compound Pharmacy Packaging market demonstrates a moderate to high level of market concentration, with a few key players holding a significant share. Companies such as DWK Life Sciences, PCCA, and Fagron maintain a strong presence through their broad product offerings, regulatory expertise, and established distribution networks. It features a blend of global packaging firms and niche providers focused on compounding pharmacy needs. The market operates under strict regulatory oversight, emphasizing packaging integrity, sterility, and traceability. It remains highly quality-driven, with demand centered around tamper-evident, unit-dose, and customized packaging formats. Barriers to entry are relatively high due to stringent compliance requirements and the need for validated packaging solutions. Buyers, including hospital and retail compounding pharmacies, demand consistency, supply reliability, and tailored support. It continues to evolve toward sustainability and digital integration, with growing attention to eco-friendly materials and smart packaging technologies. Innovation, compliance capabilities, and long-term partnerships define the competitive edge in this market.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to increasing demand for personalized and patient-specific medications.

- Adoption of smart packaging technologies will enhance drug traceability and patient safety.

- Sustainable and biodegradable packaging materials will gain traction amid rising environmental concerns.

- Regulatory compliance will remain a key focus, driving demand for validated and tamper-evident packaging.

- Sterile compounding will see higher packaging demand due to stricter hygiene and safety standards.

- North America will retain its leading position, while Asia Pacific will show the fastest growth.

- Pharmaceutical outsourcing trends will increase reliance on standardized, high-quality packaging solutions.

- Innovation in prefilled syringes, blister packs, and barrier vials will support safe and efficient drug delivery.

- Customization and small-batch production will fuel demand for flexible and scalable packaging options.

- Key players will invest in automation and digital tools to streamline production and ensure regulatory readiness.