Market Overview

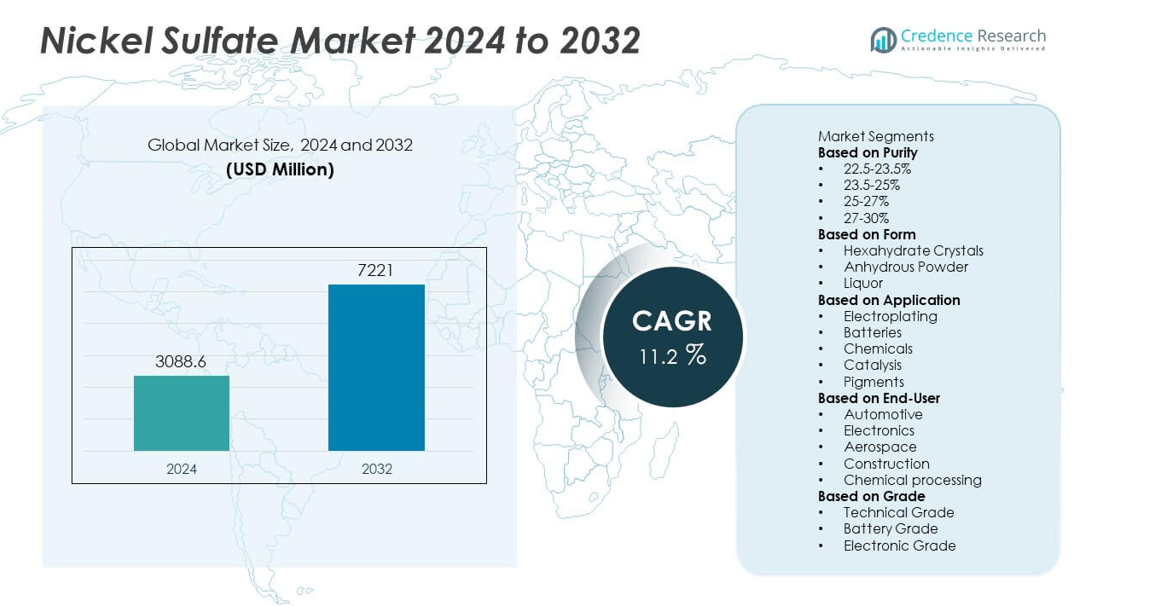

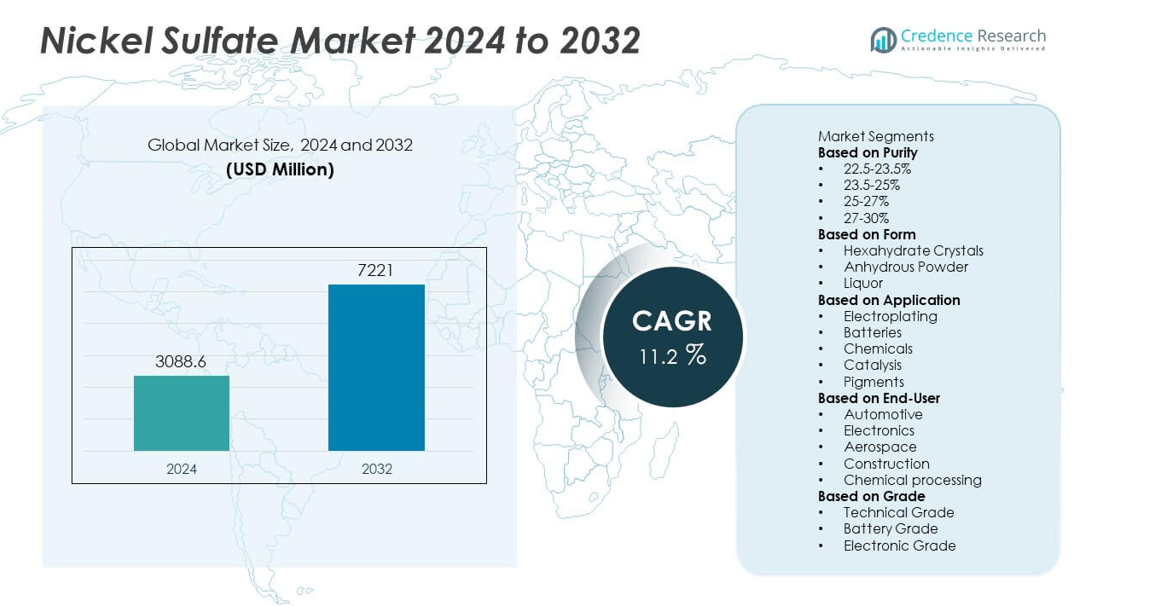

The Nickel Sulfate Market was valued at USD 3,088.6 million in 2024 and is projected to reach USD 7,221 million by 2032, expanding at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nickel Sulfate Market Size 2024 |

USD 3,088.6 million |

| Nickel Sulfate Market, CAGR |

11.2% |

| Nickel Sulfate Market Size 2032 |

USD 7,221 million |

The Nickel Sulfate Market grows steadily due to increasing demand for high-purity nickel sulfate in lithium-ion battery production, driven by the rapid expansion of electric vehicles and renewable energy storage systems. It benefits from the rising adoption of nickel-rich cathode chemistries such as NMC and NCA, which enhance battery performance and energy density. Advancements in hydrometallurgical refining technologies improve production efficiency and purity levels, supporting large-scale battery manufacturing.

The Nickel Sulfate Market demonstrates strong growth potential across major global regions, supported by expanding battery manufacturing capacities and industrial demand. Asia-Pacific leads in production and consumption, driven by large-scale electric vehicle and energy storage system manufacturing hubs in China, Japan, and South Korea. Europe focuses on sustainable sourcing and battery gigafactory projects, while North America advances domestic supply chains to reduce import dependency. Leading industry players such as Vale, Sumitomo Metal Mining, Umicore, and Glencore are investing in capacity expansions, recycling initiatives, and technological upgrades to produce high-purity nickel sulfate for next-generation battery applications. These companies leverage integrated mining-to-refining operations and strategic partnerships with battery manufacturers to secure long-term contracts.

Market Insights

- The Nickel Sulfate Market was valued at USD 3,088.6 million in 2024 and is projected to reach USD 7,221 million by 2032, growing at a CAGR of 11.2% during the forecast period.

- Rising demand for high-purity nickel sulfate in lithium-ion battery production is a primary growth driver, fueled by the rapid expansion of the electric vehicle and renewable energy storage sectors.

- Growing adoption of sustainable and closed-loop production processes is shaping industry trends, with increased focus on recycling nickel from end-of-life batteries to meet environmental targets.

- The competitive landscape features major players such as Vale, Sumitomo Metal Mining, Umicore, and Glencore, emphasizing capacity expansion, technology upgrades, and strategic supply agreements with battery manufacturers.

- Price volatility in nickel feedstock and environmental regulations on mining and refining operations act as key restraints, challenging consistent production costs and supply stability.

- Asia-Pacific dominates in production and consumption, supported by EV battery manufacturing hubs in China, Japan, and South Korea, while Europe and North America focus on sustainable sourcing and domestic processing capabilities.

- Opportunities are emerging in Southeast Asia and Latin America, where investments in nickel sulfate refining facilities are increasing to serve growing global demand from electric mobility and energy storage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from the Electric Vehicle Battery Industry

The Nickel Sulfate Market gains strong momentum from its critical role in manufacturing high-nickel cathode materials for lithium-ion batteries. It is essential in enhancing energy density, extending driving range, and improving charging efficiency for electric vehicles. Automakers and battery producers are investing heavily in high-performance cathode chemistries that require consistent nickel sulfate supply. The rapid growth in EV production globally fuels direct demand for battery-grade nickel sulfate. Leading producers focus on refining technologies to achieve higher purity levels suitable for advanced battery applications. This trend continues to be a major growth driver as the global shift toward electrification accelerates.

- For instance, Vale will supply battery-grade nickel sulfate equivalent to 25,000 metric tons of contained nickel annually to General Motors for Ultium battery cathodes—enough to support around 350,000 EVs per year.

Expansion in Renewable Energy Storage Applications

The Nickel Sulfate Market benefits from its increasing use in stationary energy storage systems that support renewable energy integration. It contributes to the development of high-capacity batteries for grid stabilization and renewable power backup. Renewable energy expansion in wind and solar projects drives the need for large-scale, reliable storage solutions where nickel-rich chemistries excel. Energy storage providers demand stable, high-performance materials to ensure long operational life and efficient charge-discharge cycles. Governments worldwide are supporting storage infrastructure, which indirectly boosts nickel sulfate consumption. It positions itself as a preferred material in meeting the performance requirements of modern energy storage technologies.

- For instance, industry data reports that global nickel sulfate production reached around 1.85 million metric tons in 2023, with approximately 65% directed toward EV battery applications—highlighting the scale and cross-application relevance of supply.

Growth in Electroplating and Industrial Coatings

The Nickel Sulfate Market experiences steady demand from its role in electroplating processes for corrosion resistance and aesthetic enhancement. It is widely used in manufacturing components for automotive, aerospace, electronics, and construction industries. High-quality nickel coatings enhance durability, reduce wear, and improve resistance to harsh environments. Industrial growth in developing economies increases the need for electroplated products across infrastructure and consumer goods. Manufacturers optimize nickel sulfate formulations to improve deposition rates and uniformity in coatings. This sector remains a stable and significant contributor to market demand.

Technological Advancements in Nickel Refining and Recycling

The Nickel Sulfate Market is supported by advancements in refining methods and recycling technologies. It benefits from innovations that enhance extraction efficiency and purity from both primary ores and recycled materials. Recycling of battery scrap and industrial waste emerges as a cost-effective and sustainable supply source. Companies invest in hydrometallurgical processes to improve yield and reduce environmental impact. The ability to recover high-purity nickel sulfate from end-of-life batteries strengthens supply security. It ensures consistent quality standards, meeting the stringent specifications of battery and industrial applications.

Market Trends

Shift Toward High-Nickel Cathode Chemistries in Batteries

The Nickel Sulfate Market is witnessing a clear shift toward high-nickel cathode materials in lithium-ion batteries. These chemistries increase energy density and extend the driving range of electric vehicles. Battery manufacturers prioritize nickel-rich formulations such as NCM and NCA to meet performance and efficiency targets. This trend accelerates demand for battery-grade nickel sulfate with consistent purity and composition. Leading producers are expanding production capacity to cater to growing requirements from automotive and energy storage sectors. It strengthens its role as a critical enabler of next-generation battery technologies.

- For instance, NCA derivatives represent around 90 kilotons of global production in 2023, composed of about 87% nickel—indicating the high nickel content driving sulfate demand.

Expansion of Recycling and Secondary Supply Sources

The Nickel Sulfate Market benefits from a growing focus on recycling to ensure sustainable raw material availability. Recycling of end-of-life batteries and industrial scrap provides an important secondary supply source. Companies are developing advanced hydrometallurgical processes to recover nickel sulfate efficiently with minimal environmental impact. This approach reduces dependence on primary mining and aligns with global circular economy goals. Governments are introducing policies to encourage large-scale recycling infrastructure for battery materials. It enhances supply chain resilience while supporting environmental sustainability targets.

- For instance, current hydrometallurgical recycling techniques yield up to 90% recovery for nickel and cobalt from spent lithium-ion batteries, boosting material efficiency.

Technological Advancements in Production Processes

The Nickel Sulfate Market is evolving with improvements in refining and crystallization technologies. Producers are implementing automated process controls to achieve higher consistency in particle size and chemical composition. Innovations in hydrometallurgical processing enable higher recovery rates from both laterite and sulfide ores. Energy-efficient methods are being adopted to reduce operational costs and emissions during production. The shift toward continuous processing systems improves throughput and product quality. It positions itself to meet the stringent technical standards required by battery and industrial applications.

Geographical Diversification of Supply Chains

The Nickel Sulfate Market is experiencing geographical diversification to reduce reliance on a limited number of producing regions. Manufacturers are investing in production facilities closer to major EV manufacturing hubs to improve supply security. Strategic partnerships between mining companies, refineries, and battery producers are expanding across Asia, Europe, and North America. This regional spread mitigates risks from geopolitical tensions and trade disruptions. Governments are supporting domestic production capabilities through policy incentives and funding programs. It strengthens global availability while balancing regional supply-demand dynamics.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Constraints

The Nickel Sulfate Market faces challenges from volatile nickel prices driven by fluctuations in global demand, mining output, and geopolitical conditions. Price instability affects production planning and investment decisions for battery manufacturers and industrial users. Limited availability of high-grade nickel ores in certain regions puts pressure on supply continuity. Mining disruptions from environmental regulations, labor disputes, and logistical issues further strain the market. Producers must navigate long-term supply agreements and diversify sourcing strategies to mitigate these risks. It remains sensitive to global commodity market dynamics, impacting both cost structure and competitiveness.

Environmental Compliance and Production Sustainability

The Nickel Sulfate Market encounters rising pressure to comply with stringent environmental and sustainability regulations. Production processes, particularly those involving laterite ore refining, generate significant waste and carbon emissions. Companies are required to invest in cleaner technologies, waste treatment facilities, and energy-efficient operations to meet compliance standards. High capital expenditure for environmental upgrades creates a financial burden, especially for smaller producers. Failure to meet environmental norms can lead to operational shutdowns or restrictions. It must balance increasing demand with responsible production practices to maintain industry credibility and long-term growth potential.

Market Opportunities

Expansion of Electric Vehicle Battery Production

The Nickel Sulfate Market holds strong opportunities from the rapid expansion of electric vehicle (EV) manufacturing. It is a critical precursor material for producing high-nickel cathodes, which enhance battery energy density and driving range. Rising EV adoption in major markets such as China, the United States, and Europe increases demand for nickel sulfate in battery production lines. Governments promoting clean mobility through subsidies and emission reduction targets further accelerate consumption. Investment in gigafactories and battery recycling facilities offers scope for long-term supply agreements. It benefits from the growing preference for nickel-rich chemistries in next-generation lithium-ion batteries.

Growth in Energy Storage Systems and Industrial Applications

The Nickel Sulfate Market gains growth potential from expanding energy storage systems for renewable energy integration. It supports high-performance batteries for grid stabilization, peak load management, and backup power systems. Industrial applications in electroplating, catalysts, and specialty chemicals create parallel demand streams. Manufacturers exploring low-carbon production processes can position themselves as preferred suppliers for sustainability-focused clients. Technological advancements in battery manufacturing and recycling enhance raw material efficiency and reduce supply risks. It stands to benefit from strategic collaborations between battery makers, mining companies, and recycling firms aimed at ensuring consistent and responsible material availability.

Market Segmentation Analysis:

By Purity

The Nickel Sulfate Market segments by purity into high-purity and standard-grade categories. High-purity nickel sulfate, typically with purity levels above 99.5%, is in high demand for battery-grade applications, especially in electric vehicle cathode manufacturing. It ensures consistent electrochemical performance and longer battery life, making it a preferred choice for advanced lithium-ion technologies. Standard-grade nickel sulfate, with slightly lower purity, is widely used in electroplating, catalysts, and industrial coatings. Industries value its cost-effectiveness and suitability for non-battery uses. Growth in high-purity demand is closely tied to the scale-up of gigafactories and EV production facilities globally.

- For instance, GEM introduced an ultra-pure nickel sulfate product in 2023 with >99.9% purity, specifically formulated for high-performance EV batteries.

By Form

The Nickel Sulfate Market classifies by form into crystal and liquid types. Crystalline nickel sulfate is the most common form, favored in cathode active material production due to its stable composition, ease of storage, and long shelf life. It is extensively used in battery precursor manufacturing, particularly in the NCM (Nickel Cobalt Manganese) and NCA (Nickel Cobalt Aluminum) chemistries. Liquid nickel sulfate is primarily applied in electroplating and chemical synthesis processes where faster dissolution and integration into solutions are required. It supports high-volume plating operations in the electronics, automotive, and aerospace industries. Demand for crystalline form is expected to outpace liquid form as EV battery production accelerates.

- For instance, Umicore produces crystalline nickel sulfate in two grades: standard and electroless. These are specifically designed for surface treatment applications, particularly in electroplating and electroless plating industries

By Application

The Nickel Sulfate Market divides by application into batteries, electroplating, catalysts, and other industrial uses. Batteries represent the fastest-growing segment, driven by their role in powering electric vehicles, portable electronics, and energy storage systems. High-nickel cathode chemistries are gaining preference for their higher energy density, which directly increases nickel sulfate consumption. Electroplating remains a steady-demand sector, where nickel sulfate is used to create corrosion-resistant coatings for automotive, aerospace, and consumer products. Catalysts form another key segment, supporting chemical manufacturing processes such as hydrogenation. Other applications include pigments, ceramics, and specialized alloys, which collectively contribute to stable base demand. The battery segment will remain the primary growth engine due to global clean energy transitions and large-scale electrification initiatives.

Segments:

Based on Purity

- 5-23.5%

- 5-25%

- 25-27%

- 27-30%

Based on Form

- Hexahydrate Crystals

- Anhydrous Powder

- Liquor

Based on Application

- Chemicals

- Catalysis

- Pigments

Based on End-User

- Automotive

- Electronics

- Aerospace

- Construction

- Chemical processing

Based on Grade

- Technical Grade

- Battery Grade

- Electronic Grade

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 18% of the Nickel Sulfate Market in 2024, driven primarily by the rapid expansion of electric vehicle production and energy storage projects. The United States leads the region with robust investments in battery manufacturing facilities and strong demand from automotive OEMs shifting toward high-nickel cathode chemistries. Federal initiatives supporting EV adoption and localized battery material sourcing further enhance market momentum. Canada contributes significantly through its well-established nickel mining sector and processing capabilities, ensuring a steady supply of raw materials for refining into battery-grade nickel sulfate. Mexico is emerging as a potential manufacturing hub for automotive and industrial applications, benefiting from its proximity to the U.S. market and increasing foreign investment in clean energy technologies. Demand is further boosted by the aerospace and defense sectors, which utilize nickel sulfate in corrosion-resistant coatings and specialty alloys.

Europe

Europe accounts for 22% of the Nickel Sulfate Market, with growth supported by stringent environmental policies and the continent’s aggressive electrification strategy. Germany leads regional demand due to its strong automotive industry and concentration of gigafactories dedicated to lithium-ion battery production. France and the UK follow, both investing heavily in EV infrastructure and localized battery supply chains. Nordic countries contribute through sustainable mining operations and advanced refining technologies aimed at reducing carbon footprints. Electroplating and catalyst applications also maintain steady demand in aerospace, electronics, and industrial manufacturing sectors across the region. EU initiatives, such as the European Battery Alliance, further encourage the establishment of closed-loop recycling systems, which support the recovery of nickel from spent batteries and reduce reliance on imported raw materials.

Asia-Pacific

Asia-Pacific dominates the Nickel Sulfate Market with 46% share in 2024, driven by large-scale battery manufacturing and strong adoption of electric mobility solutions. China leads global demand, supported by massive EV production capacity, government subsidies for clean transportation, and an extensive network of cathode material producers. Japan and South Korea remain critical players in high-performance battery development, focusing on high-nickel cathode chemistries for both automotive and consumer electronics applications. Southeast Asian countries, particularly Indonesia and the Philippines, are emerging as significant nickel ore suppliers, investing in refining infrastructure to produce battery-grade nickel sulfate locally. The region’s strong industrial base also supports demand from electroplating, catalysts, and specialty chemicals sectors. Expanding renewable energy storage projects further reinforce Asia-Pacific’s leadership position.

Latin America

Latin America holds 8% of the Nickel Sulfate Market, with Brazil and Chile leading consumption and production potential. Brazil benefits from its growing EV market, industrial electroplating sector, and proximity to nickel resources. Chile’s role in the battery materials supply chain is strengthening through partnerships aimed at integrating nickel sulfate production with existing lithium operations. Mexico is positioning itself as a strategic location for battery assembly and automotive production serving both local and export markets. The region’s market growth is supported by foreign investment in mining and refining operations, though it faces challenges related to infrastructure development and regulatory frameworks.

Middle East & Africa

The Middle East & Africa region represents 6% of the Nickel Sulfate Market in 2024, with South Africa and Morocco being the primary contributors. South Africa’s mining sector provides a foundation for nickel extraction and processing, while Morocco invests in developing a battery manufacturing ecosystem to serve both domestic and European markets. Gulf Cooperation Council (GCC) countries, including the UAE and Saudi Arabia, are exploring opportunities in EV production and advanced material processing as part of economic diversification strategies. Demand in the region is also supported by electroplating applications in construction, oil and gas, and aerospace industries. However, limited local refining capacity requires reliance on imports for high-purity battery-grade nickel sulfate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LKAB

- Glencore

- Vale

- Anglo American

- Sherritt International

- BHP Billiton

- Jinchuan Group

- Eramet

- Umicore

- Sumitomo Metal Mining

Competitive Analysis

The Nickel Sulfate Market is marked by strong competition among global mining and refining leaders, each leveraging integrated operations, technological expertise, and strategic partnerships to secure market position. Key players include Vale, Sumitomo Metal Mining, Umicore, Glencore, BHP Billiton, Jinchuan Group, Eramet, LKAB, Anglo American, and Sherritt International. Vale focuses on expanding its Class I nickel capacity to meet battery-grade demand, with ongoing investments in low-carbon refining processes. Sumitomo Metal Mining strengthens its presence through advanced high-purity production technologies and supply agreements with major battery manufacturers. Umicore leads in sustainable closed-loop recycling systems, reclaiming nickel from spent lithium-ion batteries. Glencore emphasizes resource integration, securing feedstock supply through diversified mining assets. BHP Billiton invests in refining upgrades to increase high-purity output for the EV market. Jinchuan Group and Eramet expand refining capacity to cater to Asian and European demand. Anglo American advances nickel projects with a focus on ESG compliance, while Sherritt International strengthens mixed-sulfide production for downstream conversion. LKAB explores vertical integration to enter the battery materials supply chain. The competitive landscape is defined by capacity expansion, technological innovation, and securing long-term contracts in the fast-growing electric mobility sector.

Recent Developments

- In July 2025, Vale Indonesia plans to raise USD 1–1.2 billion in financing between 2026–2027 to develop new nickel mines and HPAL smelters, aimed at supplying battery-grade nickel sulfate.

- In July 2025, Sherritt International (Moa JV) completed phase two of its Moa JV expansion. This ramp-up strengthens production capacity and enhances its refinery operations.

- In June 2024, Glencore entered negotiations to participate in the development of an HPAL nickel complex in Southeast Sulawesi, which aims to produce over 146,000 tonnes of mixed hydroxide precipitate annually.

Market Concentration & Characteristics

The Nickel Sulfate Market demonstrates moderate concentration, with a mix of large vertically integrated mining and refining companies alongside specialized producers focused on battery-grade materials. It benefits from the strategic control of upstream nickel resources, enabling stable supply for downstream cathode manufacturing in the electric vehicle and energy storage sectors. Production is increasingly aligned with sustainability goals, integrating low-carbon refining processes and advanced hydrometallurgical techniques to improve yield and reduce waste. The market’s competitive dynamics are shaped by long-term supply agreements with battery manufacturers and partnerships for technological innovation in refining capacity. Product quality, defined by purity levels and consistency, remains a critical differentiator, particularly for applications in lithium-ion battery cathodes. It also exhibits high entry barriers due to capital-intensive processing facilities, stringent environmental regulations, and complex supply chain integration. The market is responsive to shifts in EV adoption, regulatory frameworks, and advancements in battery chemistry that influence nickel sulfate demand profiles.

Report Coverage

The research report offers an in-depth analysis based on Purity, Form, Application, End-User, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with the expansion of electric vehicle production and battery manufacturing.

- Adoption of high-purity nickel sulfate will increase for advanced lithium-ion battery cathodes.

- Sustainable mining and refining practices will gain priority across the supply chain.

- Technological advancements will improve efficiency in hydrometallurgical production methods.

- Strategic partnerships between miners and battery manufacturers will strengthen supply security.

- Recycling of nickel-containing batteries will become a significant source of feedstock.

- Government policies supporting clean energy will boost industrial investment in nickel sulfate production.

- Development of new battery chemistries will influence product specifications and quality standards.

- Asia-Pacific will remain a key hub for manufacturing and consumption of nickel sulfate.

- Digitalization and process automation will enhance productivity and reduce operational costs.