Market Overview:

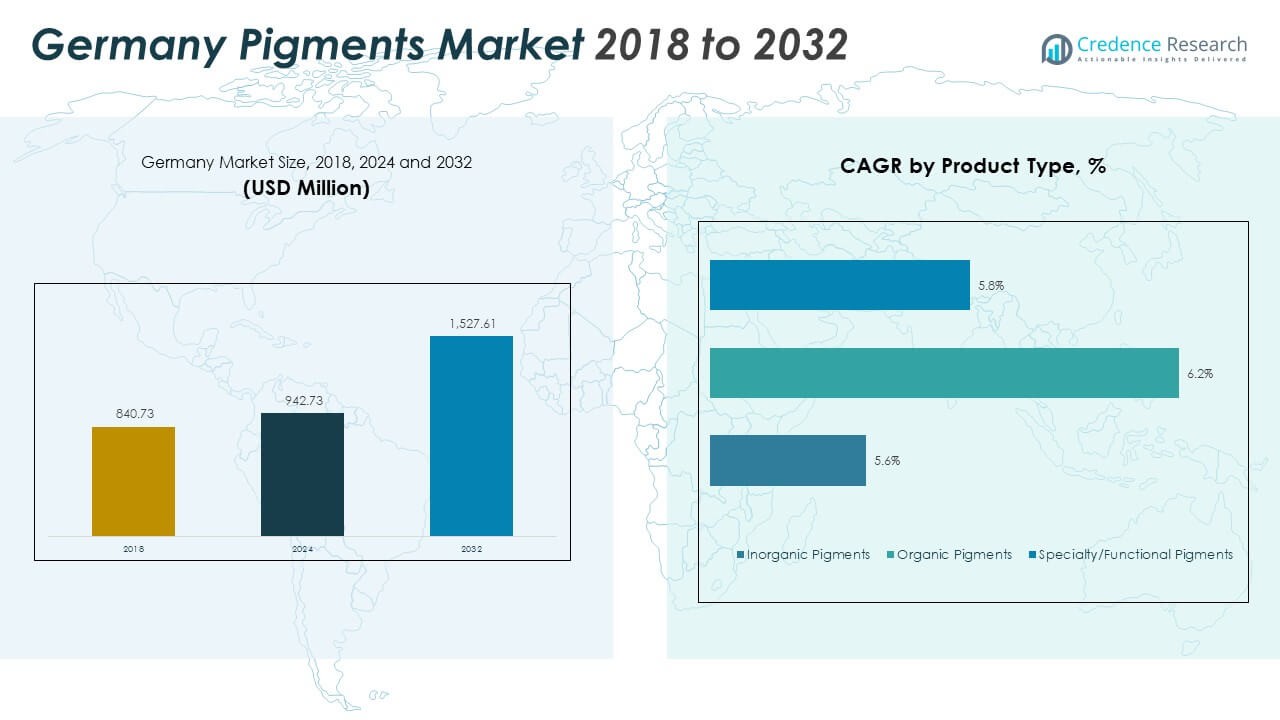

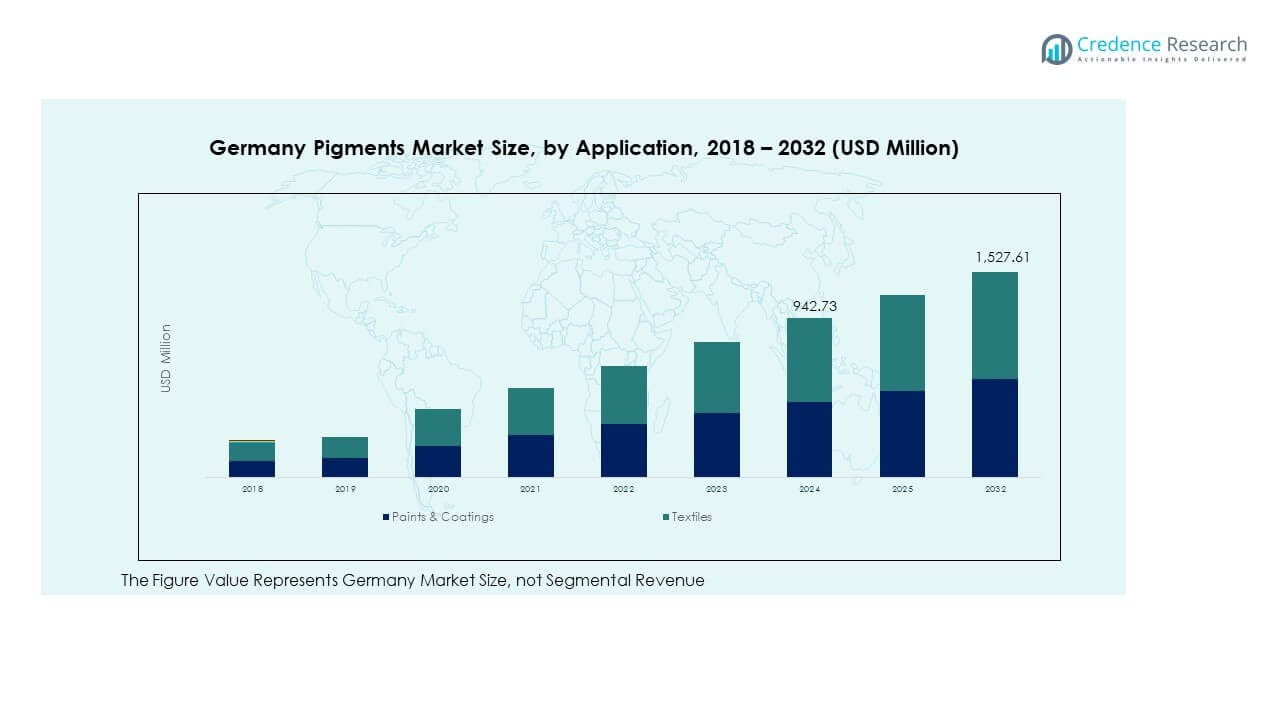

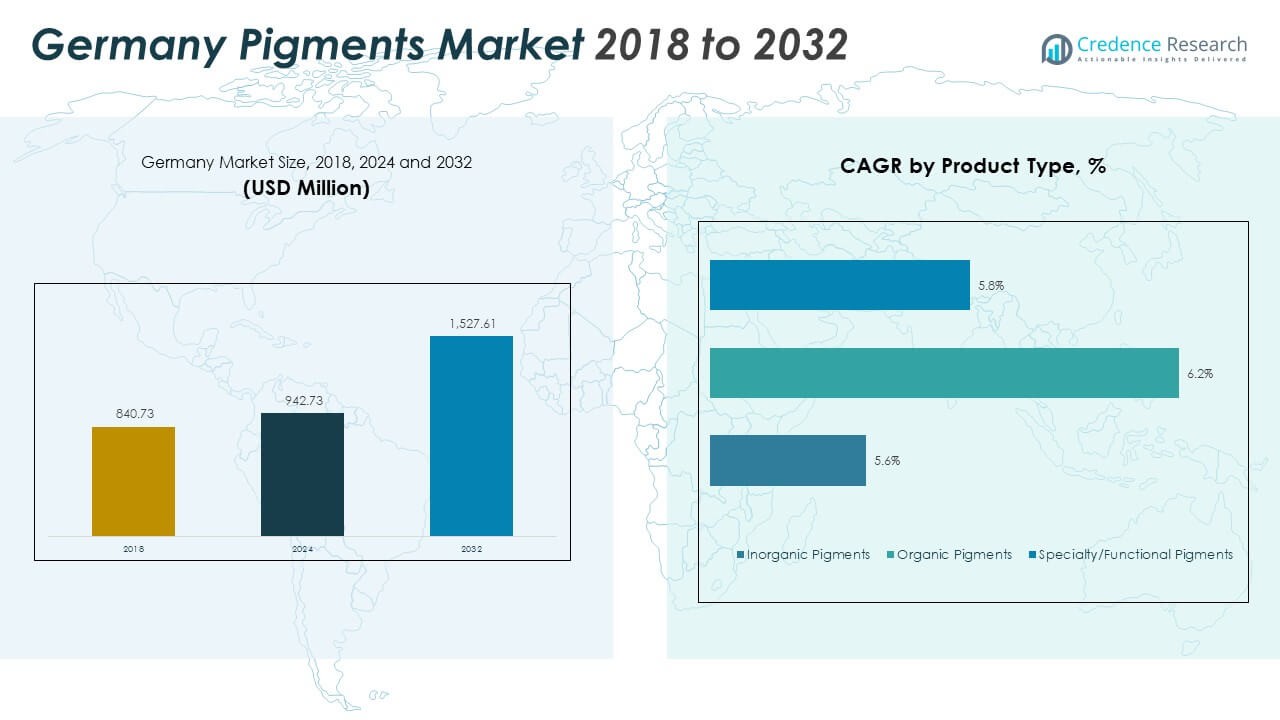

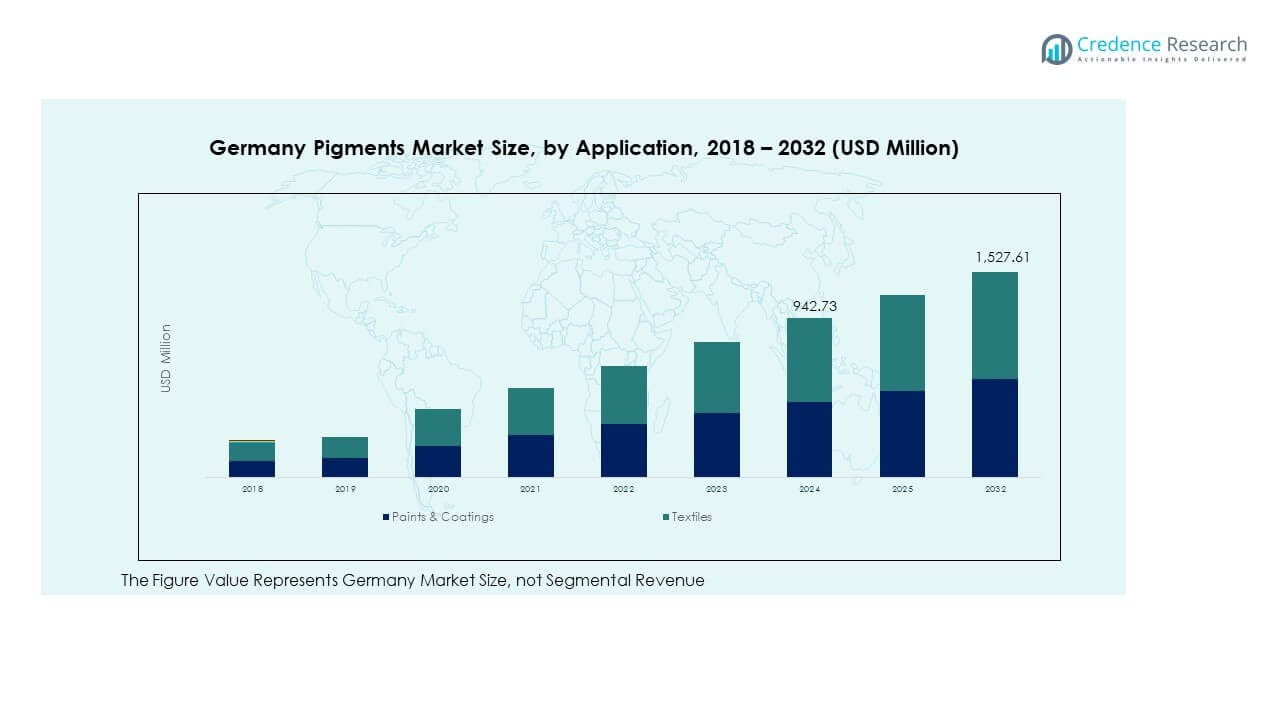

The Germany Pigments Market size was valued at USD 840.73 million in 2018 to USD 942.73 million in 2024 and is anticipated to reach USD 1,527.61 million by 2032, at a CAGR of 6.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Pigments Market Size 2024 |

USD 942.73 Million |

| Germany Pigments Market, CAGR |

6.22% |

| Germany Pigments Market Size 2032 |

USD 1,527.61 Million |

The market growth is driven by rising demand for high-performance pigments in automotive coatings, construction materials, and packaging. Manufacturers are focusing on advanced formulations that enhance color stability, UV resistance, and environmental safety. Increasing adoption of organic and hybrid pigments supports compliance with EU green initiatives. Expanding infrastructure projects and innovation in water-based coatings continue to strengthen pigment consumption across major industries. Strong emphasis on sustainability and recyclable materials is fostering long-term market expansion.

Western Germany leads the pigments market due to its well-established chemical and automotive industries. Southern regions, including Bavaria and Baden-Württemberg, are emerging as innovation centers driven by specialty pigment development and R&D investments. Northern Germany benefits from strong export activities through major ports and growing demand in marine and architectural coatings. Eastern regions are witnessing industrial diversification and new pigment production capacities. The balanced industrial ecosystem across these subregions positions Germany as a major hub for pigment innovation and export within Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Pigments Market was valued at USD 840.73 million in 2018, reached USD 942.73 million in 2024, and is expected to attain USD 1,527.61 million by 2032, growing at a CAGR of 6.22%.

- Western Germany leads with 36% of the market share, driven by its strong industrial base, automotive production, and presence of leading pigment manufacturers such as BASF SE and Clariant AG.

- Southern Germany holds 28% of the share, fueled by innovation in specialty pigments and strong R&D infrastructure in Bavaria and Baden-Württemberg.

- Northern Germany accounts for 21% and is the fastest-growing region, supported by maritime industries, export expansion, and increasing pigment use in construction and packaging.

- Paints and coatings represent 60% of total pigment demand, while textiles contribute nearly 20%, reflecting growing pigment usage in both protective and decorative applications across industries.

Market Drivers

Market Drivers

Rising Demand for High-Performance and Sustainable Pigments Across Industries

Germany Pigments Market is driven by the growing need for high-performance and environmentally sustainable pigments in coatings, plastics, and construction materials. Industries are adopting pigments with improved dispersion, opacity, and UV resistance to meet durability standards. The focus on low-VOC and heavy metal-free formulations aligns with EU environmental goals. Automotive and architectural coating manufacturers increasingly choose pigments offering thermal stability and color consistency. Regulatory frameworks encourage cleaner production technologies, boosting eco-friendly pigment demand. Consumer preference for sustainable products also supports market expansion.

- For example, BASF SE has integrated renewable energy sourcing across several of its European chemical sites, including Ludwigshafen, to lower CO₂ emissions in its dispersions, additives, and materials production. The company continues to enhance dispersion technologies through precision milling processes that improve tinting strength and color uniformity in advanced coating formulations.

Expansion of the Automotive and Construction Sectors Fueling Pigment Consumption

Strong automotive production and large-scale infrastructure development are key drivers of pigment demand in Germany. High-quality pigments are essential for achieving gloss, corrosion resistance, and lasting color in vehicle finishes. Construction projects rely on durable pigments in architectural paints and industrial coatings to ensure weather protection. Automotive OEMs are adopting advanced pigment technologies for heat reflection and color precision. It benefits from increased pigment use in exterior and interior coatings. These developments reinforce pigment consumption across transportation and construction applications.

- For instance, Merck Group’s Xirallic® NXT effect pigment series, produced in Gernsheim, Germany, is based on aluminum oxide flakes engineered with precise particle size distribution to deliver exceptional metallic brilliance and color depth. Its advanced crystallization technology ensures lasting sparkle and durability, and these pigments are widely adopted in automotive OEM coatings for premium brands such as BMW.

Technological Advancements in Manufacturing and Formulation Processes

Continuous innovation in pigment manufacturing is transforming product quality and production efficiency. Companies are investing in advanced milling and dispersion technologies to achieve uniform particle sizes and higher tinting strength. The introduction of digital color matching and nanotechnology-based pigments enhances product performance and application control. Automation in pigment plants improves consistency and reduces production costs. Germany Pigments Market gains from strong R&D support and government-backed clean production initiatives. Technological progress ensures improved sustainability and faster product customization.

Stringent Environmental Regulations Promoting Eco-Friendly Pigment Development

Germany’s strict chemical and environmental standards have accelerated the shift toward eco-friendly pigment production. Manufacturers are replacing heavy metal-based pigments with organic and hybrid alternatives. Regulatory enforcement under REACH and EU Green Deal frameworks ensures adherence to environmental and safety norms. Companies are investing in bio-based and recyclable pigment materials to reduce carbon footprints. It aligns with the country’s goal to advance sustainable industrial practices. The commitment to circular economy principles drives innovation in pigment lifecycle management.

Market Trends

Rising Popularity of Organic Pigments in Decorative and Industrial Coatings

Organic pigments are gaining significant traction due to their superior brightness, color purity, and low toxicity. Coatings manufacturers are shifting from synthetic inorganic pigments to organic types for eco-label compliance. Decorative paint producers favor organic pigments for their vibrant hues and fade resistance. Germany Pigments Market witnesses increased adoption in automotive topcoats and high-end architectural finishes. Growing environmental awareness supports this transition toward organic solutions. These pigments also offer strong performance in plastics and printing inks, expanding their industrial scope.

Adoption of Nanotechnology and Functional Pigments Enhancing Performance

Functional and nanotechnology-based pigments are redefining performance standards across industries. Self-cleaning, antimicrobial, and heat-reflective pigments are in high demand for smart coatings. Titanium dioxide nanoparticles enhance UV blocking in exterior paints and sunscreens. The market benefits from innovative R&D on color-changing and conductive pigments. Germany Pigments Market gains from collaborations between chemical firms and research institutions. These developments enable customized pigment solutions for energy-efficient and functional materials. Adoption of such technologies increases efficiency in multiple industrial applications.

- For instance, LANXESS operates the world’s largest synthetic iron oxide pigment production facility in Krefeld-Uerdingen, Germany, using the energy-efficient Laux process to minimize carbon emissions. The site produces Bayferrox® and Colortherm® pigments that meet high environmental standards and support sustainable industrial coatings and construction applications.

Growing Focus on Circular Economy and Recyclable Pigment Production

Circular economy principles are shaping the pigment production ecosystem. Manufacturers focus on reducing waste and reusing process residues in pigment synthesis. Water-based dispersion systems and solvent-free processing are becoming standard practices. Companies emphasize recyclability and sustainable raw materials to meet green certification standards. It supports long-term industry transformation toward closed-loop manufacturing. Germany Pigments Market benefits from corporate initiatives promoting environmental stewardship. Circular production models help reduce dependency on virgin resources while improving brand image.

- For instance, BASF SE leverages its Refinity® and ColorSource® digital color management platforms within its coatings division to achieve precise color matching for automotive applications. The Heubach Group, which acquired Clariant’s pigments business, continues to advance AI-based process control technologies to enhance pigment consistency and production sustainability in Germany.

Integration of Digital Color Management and Automation Technologies

Automation and digitalization are improving efficiency in pigment manufacturing and color control. AI-based systems enable precise color matching and predictive quality analysis in production lines. Digital pigment libraries help formulators design consistent color solutions across batches. Automation enhances operational safety, reduces labor costs, and minimizes product defects. It supports fast adaptation to customer demands in various industries. Germany Pigments Market evolves with smart factories and integrated pigment management platforms. These technologies strengthen competitiveness and shorten product development cycles.

Market Challenges Analysis

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Disruptions Affecting Profitability

Volatile raw material prices continue to pressure pigment producers’ margins in Germany. Limited availability of key intermediates such as titanium dioxide and organic solvents adds uncertainty. Energy cost fluctuations and supply disruptions impact production schedules and delivery timelines. Germany Pigments Market faces challenges maintaining consistent pricing amid global trade constraints. Dependence on imported raw materials increases vulnerability to geopolitical risks. Producers are adopting cost optimization measures but struggle with margin preservation. These factors collectively hinder growth stability and financial performance.

Strict Regulatory Compliance and High Environmental Costs Restricting Innovation Speed

Stringent environmental laws and compliance obligations raise operational costs for pigment manufacturers. Regulations under REACH and CLP frameworks demand exhaustive testing and certification of chemicals. Smaller firms face difficulty adapting to evolving safety and sustainability standards. Transitioning to eco-friendly processes requires heavy capital investment in new technologies. Germany Pigments Market encounters delays in innovation due to extended approval procedures. Maintaining balance between compliance and profitability remains a complex task. Regulatory burdens also slow product commercialization timelines, impacting market agility.

Market Opportunities

Growing Demand for Bio-Based and Recyclable Pigments Across Sectors

Bio-based pigments are emerging as key growth areas in coatings, packaging, and textiles. Manufacturers are developing formulations using renewable feedstocks to reduce emissions. Growing preference for sustainable colorants opens new opportunities for specialty pigment makers. Germany Pigments Market benefits from the government’s push for green chemistry adoption. It creates avenues for product differentiation and export expansion. Bio-pigments meet consumer expectations for low-impact and high-performance products, encouraging innovation.

Rising Adoption of Smart and Functional Pigments in Emerging Applications

Functional pigments with temperature, UV, and conductivity features are gaining industrial attention. These pigments support the development of advanced coatings for electronics, automotive, and construction. Demand is rising for pigments that enable energy efficiency and surface protection. Germany Pigments Market stands to gain from investments in smart coating technologies. It provides opportunities for collaboration between chemical and technology companies. Functional pigment applications are set to expand across diverse high-value industries.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate the Germany Pigments Market due to their excellent opacity, thermal stability, and chemical resistance. Titanium dioxide and zinc oxide remain key segments for paints, plastics, and coatings applications. Titanium dioxide offers strong whiteness and UV protection, while zinc oxide provides antimicrobial benefits in coatings and cosmetics. Organic pigments show growing demand for their vivid color range and environmental compliance. Specialty or functional pigments, including pearlescent and luminescent types, gain traction in automotive coatings and packaging for aesthetic appeal.

- For instance, Venator operates a titanium dioxide production facility in Duisburg, Germany, with an output exceeding 100,000 tons annually, serving coatings and plastics industries. BASF SE’s Ludwigshafen site continues to support specialty pigment technologies through its coatings division, focusing on high-durability and color-stable formulations for automotive and industrial applications.

By Application

Paints and coatings hold the leading share of pigment consumption in Germany, supported by robust construction and automotive production. The demand for durable, corrosion-resistant, and decorative coatings continues to rise. Textiles use pigments for vibrant, wash-resistant colors across apparel and industrial fabrics. Printing inks benefit from digital printing advancements that require precision pigments. Plastics applications expand with growing packaging and consumer goods demand. Leather finishing and other industrial uses maintain stable growth, supported by innovation in surface finishing materials and color durability.

- For example, The Chemours Company launched its Ti-Pure™ TS-6706 pigment in February 2025, which is a TMP- and TME-free version of its flagship grade Ti-Pure™ R-706. The new grade retains key properties high gloss, excellent hiding power, the characteristic blue undertone and ease of dispersion while meeting evolving regulatory requirements.

Segmentation

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Western Germany – Dominant Industrial and Manufacturing Hub (36% Market Share)

Western Germany holds the largest share of 36% in the Germany Pigments Market, supported by a strong industrial ecosystem and concentration of major chemical manufacturers. The region’s dense automotive and construction sectors create consistent pigment demand for coatings and plastics. North Rhine-Westphalia and Hesse host advanced production facilities from leading firms such as BASF SE and Clariant AG. The presence of specialized pigment research centers strengthens innovation and supply reliability. It benefits from well-developed logistics networks that support exports across Europe. High investment in sustainable chemistry enhances regional competitiveness and product diversification.

Southern Germany – Innovation Center for Specialty and Functional Pigments (28% Market Share)

Southern Germany accounts for 28% of the market, driven by strong automotive, engineering, and coatings industries. Bavaria and Baden-Württemberg lead in R&D activities, promoting high-value pigment innovations for performance coatings and industrial materials. Companies in this region emphasize eco-friendly pigments aligned with EU sustainability directives. The focus on advanced pigment formulations and automation in production facilities enhances efficiency. It attracts investments from global pigment manufacturers seeking proximity to technology clusters. Collaborative research partnerships with universities further accelerate development in specialty pigments.

Northern and Eastern Germany – Expanding Manufacturing and Export-Driven Growth (21% and 15% Market Share Respectively)

Northern Germany contributes 21% of the market, supported by maritime, packaging, and construction activities requiring durable pigments. Hamburg’s port infrastructure facilitates pigment trade across European and global markets. Eastern Germany holds a 15% share and is emerging as a production base due to lower operating costs and growing industrial investments. It witnesses expansion of mid-sized pigment manufacturers focusing on cost-effective production. The region’s pigment exports to Eastern Europe continue to rise, driven by competitive manufacturing capabilities. Ongoing infrastructure development strengthens distribution networks and export efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Color Chemie

- Richard Colorants

- Ocres de Germany

- Venator Pigments Germany SAS

- Arkema S.A.

- BASF SE

- Clariant AG

- Harold Scholz & Co. GmbH

- Farbenwerke Wunsiedel GmbH

Competitive Analysis

The Germany Pigments Market features a competitive environment shaped by innovation, sustainability, and regional manufacturing excellence. BASF SE, Clariant AG, and Arkema S.A. lead the market through diverse pigment portfolios and investments in low-carbon production. Venator Pigments Germany SAS focuses on titanium dioxide production with advanced dispersion and opacity technologies. Harold Scholz & Co. GmbH and Farbenwerke Wunsiedel GmbH strengthen domestic competition through customized pigment solutions. It demonstrates an increasing shift toward environmentally responsible pigment manufacturing. Companies invest in automation, nanotechnology, and R&D partnerships to enhance product differentiation. Mergers and acquisitions remain a strategic approach to expand regional reach and product diversity. Competitive pressure encourages ongoing innovation and operational efficiency across all tiers of the pigment industry.

Recent Developments

- In October 2025, LANXESS showcased its diverse polymer additives, colorants, and heat-stable inorganic pigments at the K 2025 event from October 8 to 15, emphasizing product innovation in the specialty chemicals sector that supports the pigments market in Europe.

- In February 2025, The Chemours Company launched Ti-Pure™ TS-6706, a TMP- and TME-free titanium dioxide pigment aimed at European coatings applications. The product is part of Chemours’ sustainability series, offering regulatory-compliant solutions for appearance-critical uses and responding to evolving EU chemical regulations.

- In October 2024, Sudarshan Chemical Industries Limited entered into a definitive agreement to acquire the global pigment business operations of Germany’s Heubach Group, including assets in Germany, Switzerland, Luxembourg, India, and the USA. The transaction, valued at €127.5 million, will create one of the world’s largest pigment producers, significantly strengthening Sudarshan’s portfolio and European presence.

- In October 2024, Heubach GmbH agreed to be acquired by Sudarshan Chemical Industries Limited in a strategic move that cements a global pigment powerhouse with strong European market influence. This acquisition will address Heubach’s recent financial and operational challenges.

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly pigments will strengthen as industries prioritize compliance with EU green policies.

- Growth in automotive and construction sectors will continue to drive pigment use in coatings and plastics.

- Advancements in nanotechnology will enhance pigment performance, improving dispersion and durability.

- Adoption of bio-based pigment formulations will expand across packaging, textiles, and consumer products.

- Integration of digital color management systems will streamline production and improve product consistency.

- Investment in R&D will rise to meet growing demand for high-performance and functional pigments.

- Regional manufacturers will focus on export expansion through improved supply chain and trade networks.

- Smart pigments with self-cleaning and temperature-sensitive properties will gain broader industrial applications.

- Strategic collaborations among chemical producers and research institutions will drive material innovation.

- The market will witness steady consolidation as key players enhance competitiveness through mergers and product diversification.

Market Drivers

Market Drivers Market Challenges Analysis

Market Challenges Analysis Segmentation

Segmentation