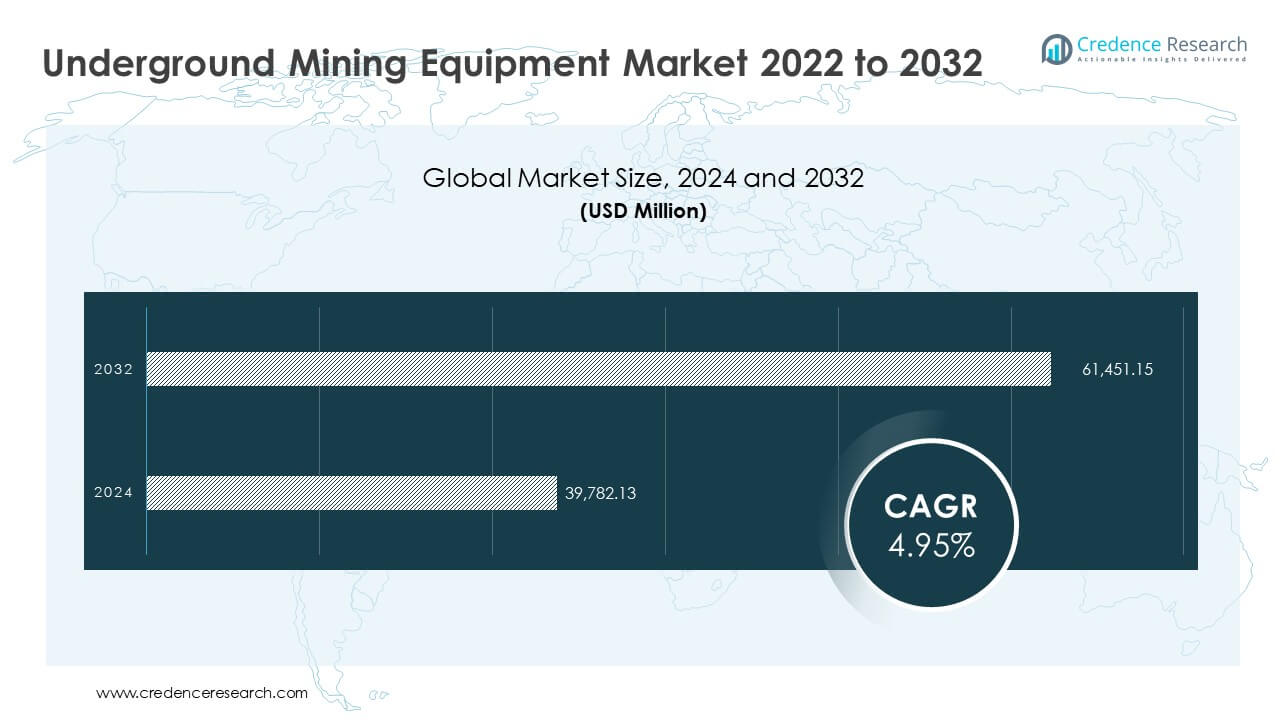

According to a new market research report published by Credence Research the global underground mining equipment market is projected to grow from USD 39,782.13 million in 2023 to USD 61,451.15 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.95% during the forecast period from 2025 to 2032.

Rising Demand for Critical Minerals and Metals is Driving Market Growth

The increasing global demand for essential minerals and metals is a key factor contributing to the growth of the underground mining equipment market. Sectors including construction, automotive, energy, and electronics rely heavily on the availability of raw materials such as iron ore, coal, gold, and rare earth elements. Lithium, in particular, is seeing substantial demand growth driven by its role in electric vehicle battery manufacturing and renewable energy applications. A standard electric vehicle battery pack requires approximately 8 kilograms of lithium and 35 kilograms of nickel.

This demand has grown further due to urbanization and rapid industrialization, particularly in developing countries. As surface-level mineral reserves decline, mining activities are increasingly shifting underground. These operations require more advanced machinery to ensure efficient, safe, and cost-effective extraction. Furthermore, renewable energy expansion has increased demand for specific minerals, reinforcing the importance of underground mining operations in the global supply chain.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Global Underground Mining Equipment Market“

Rapid Shift Toward Battery-Electric Vehicles and Automation in Underground Mines

Battery-electric vehicles (BEVs) are becoming increasingly prominent in underground mining applications. These vehicles support lower ventilation costs, reduce diesel-related emissions, and comply with stricter safety and environmental regulations. Their integration improves air quality in confined underground environments and aligns with organizational sustainability targets.

Alongside electrification, automation is playing a pivotal role in shaping the market. Mining operators are implementing tele-remote drilling systems and autonomous haulage technologies to increase efficiency and reduce risk. These solutions minimize direct human involvement in hazardous environments and enable continuous operation, resulting in increased productivity and reduced downtime. Investment in digital technologies and connectivity infrastructure is further advancing automated equipment usage, making underground mining safer and more efficient.

Market Challenge: High Initial Investment and Labor Constraints

Despite technological advancements, high capital investment remains a major barrier to adoption. Advanced electric and automated equipment requires significant upfront funding, limiting its deployment across small and mid-sized mining operators, particularly in developing regions. These financial barriers delay modernization efforts and reduce equipment replacement cycles.

In addition to cost constraints, there is a notable shortage of skilled labor equipped to operate, maintain, and troubleshoot modern underground mining systems. This labor gap increases reliance on external consultants and specialized training programs, both of which incur added expenses. The lack of workforce readiness slows the pace of digital transformation and hinders equipment performance optimization.

North America to Maintain Significant Market Share

North America currently holds a 27% share of the global underground mining equipment market. This is driven by a robust mining industry presence in the United States and Canada, supported by early adoption of electric and autonomous systems. The region benefits from strong regulatory frameworks promoting occupational safety and emission control, which drive investment in advanced technologies.

North American mining companies continue to prioritize automation, remote monitoring, and data analytics to improve operational control and extend equipment life cycles. Increasing exploration and production of coal and base metals further contribute to stable equipment demand. Overall, North America’s leadership in innovation and regulatory compliance supports its sustained dominance in the global market.

Market Segmentation

By Product Type

- Mining Loaders

- Mining Trucks

- Mining Drills

- Mining Bolters

- Mining Shearer

By Mining Technique

- Soft Rock Mining

- Hard Rock Mining

By End User

- Mining Operators

- Rental Service Providers

By Region

North America

- United States

- Canada

- Mexico

Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Key Players Operating in the Global Underground Mining Equipment Market

- AB Volvo (Volvo Construction Equipment)

- Caterpillar Inc.

- Deere & Company

- Doosan Corporation

- Atlas Copco AB (Epiroc AB)

- Hitachi, Ltd. (Hitachi Construction Machinery Co., Ltd.)

- Komatsu Ltd.

- Liebherr-International AG

- Metso Corporation

- Sandvik AB

Recent Developments-

- Aramine revealed its L440B loader with a built-in charger. This removes the need for fixed charging stations and allows fast battery swaps. The loader uses LFP batteries to stay safe and reliable in tough underground settings.

- On June 15, Sandvik received a SEK 430 million order from La Cantera Desarrollos Mineros. The deal includes loaders, drill rigs, and rock bolters. Deliveries will take place from 2025 to 2028.

- On March 31, Epiroc launched Total Tunneling. The package includes Underground Manager 2.0, Boomer E-series drills with teleremote control, and Unigrout rigs. These tools support digital drill plans, automated drilling, and connected grouting.

Report published by Credence Research “Underground Mining Equipment Market By Product Type (Mining Loaders, Mining Trucks, Mining Drills, Mining Bolters, Mining Shearers); By Mining Technique (Soft Rock Mining, Hard Rock Mining); By End User (Mining Operators, Rental Service Providers); By Region – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032” provides key insights on market size, segment performance, and future trends. This report enables stakeholders to make informed investment decisions and strategic plans.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com