Market Overview

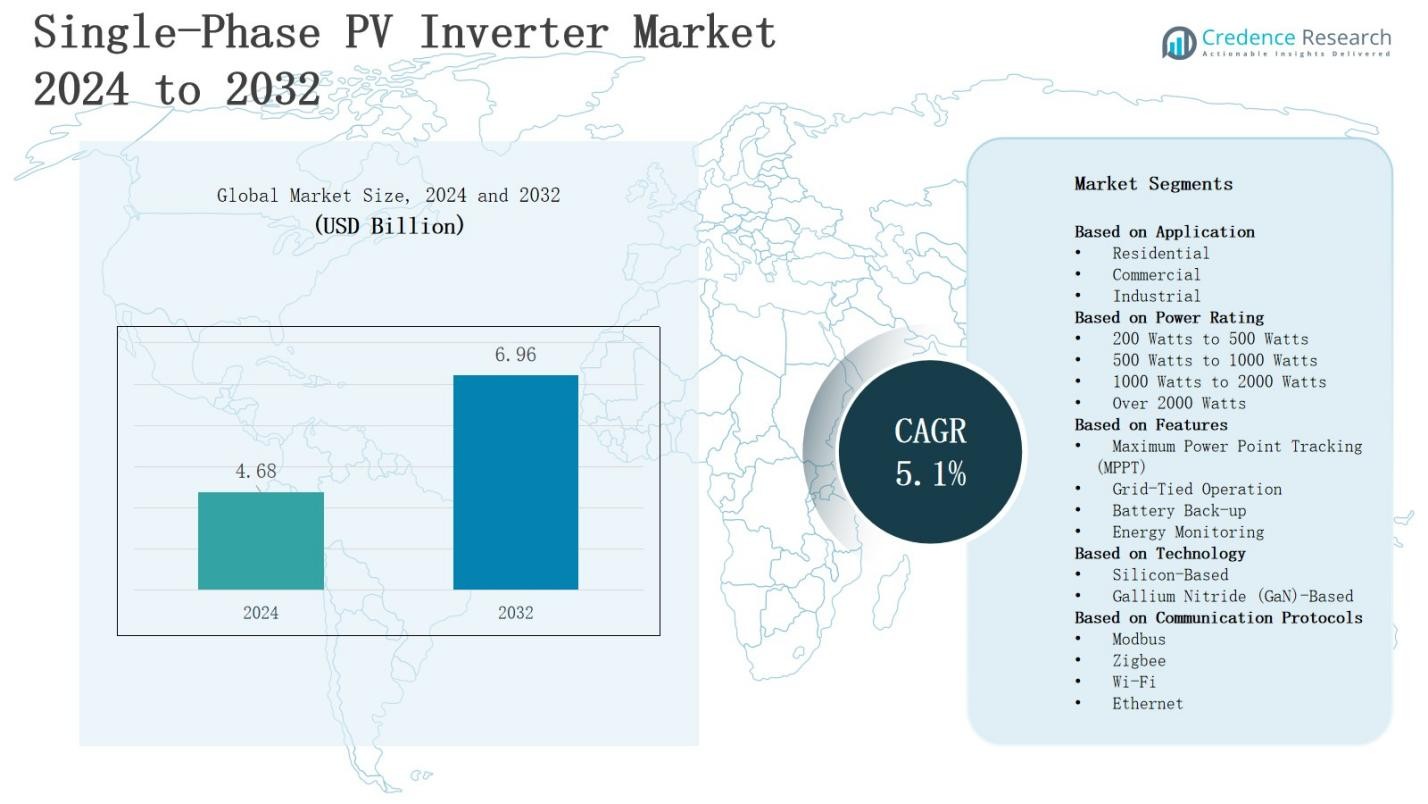

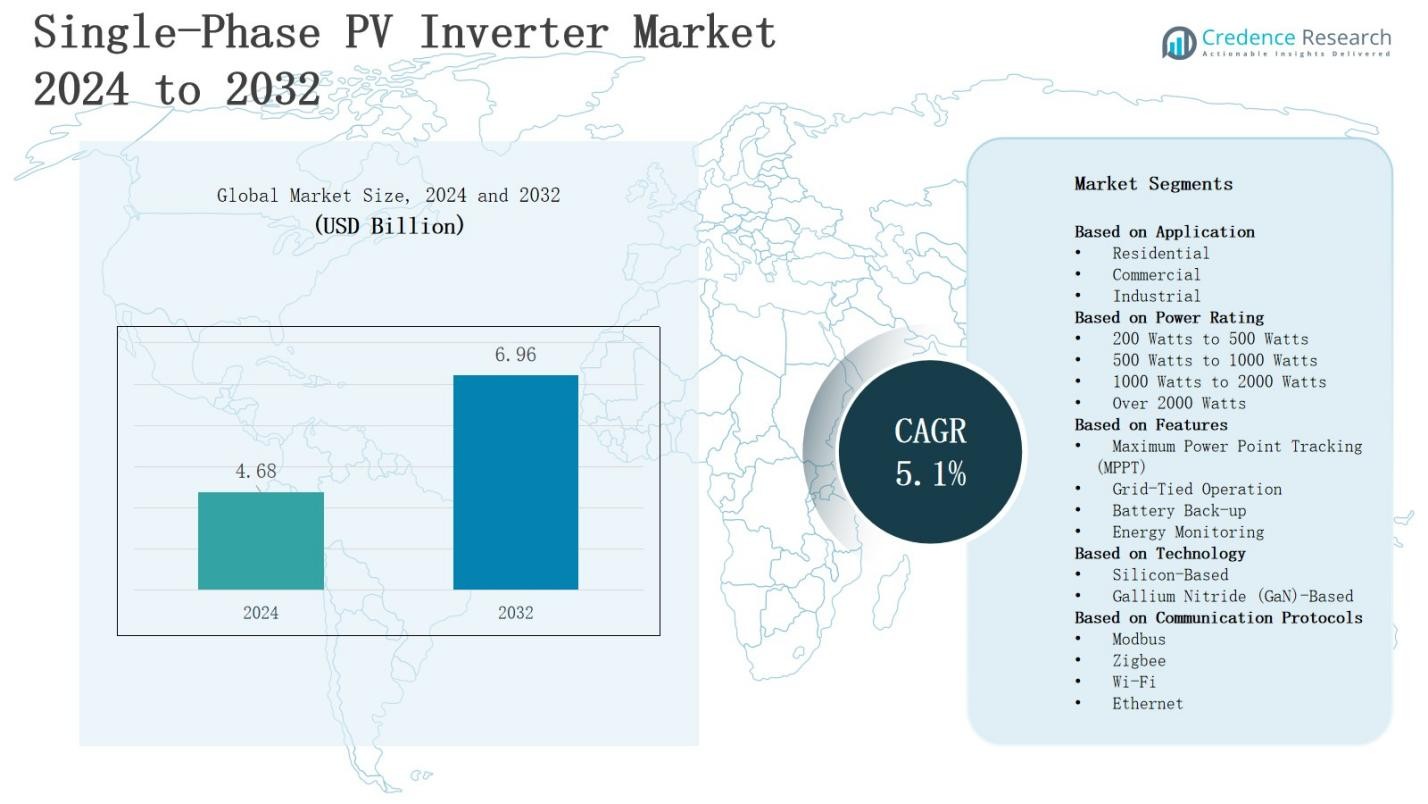

In the single-phase PV inverter market, revenue is projected to grow from USD 4.68 billion in 2024 to USD 6.96 billion by 2032, registering a CAGR of 5.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase PV Inverter Market Size 2024 |

USD 4.68 Billion |

| Single-Phase PV Inverter Market, CAGR |

5.1% |

| Single-Phase PV Inverter Market Size 2032 |

USD 6.96 Billion |

The single-phase PV inverter market is driven by the growing adoption of residential and small-scale commercial solar systems, supported by government incentives and declining solar panel costs. Rising awareness of renewable energy and the need to reduce carbon emissions further boost demand. Technological advancements, such as smart inverters with real-time monitoring and grid-tied capabilities, enhance system efficiency and reliability. Additionally, increasing electricity costs encourage consumers to invest in self-generation solutions. Trends include the integration of energy storage, improved power conversion efficiency, and digitalization for predictive maintenance, positioning single-phase PV inverters as a key component in decentralized renewable energy deployment.

The single-phase PV inverter market shows strong growth across North America, Europe, Asia-Pacific, and the Rest of the World, driven by residential and small commercial solar adoption. North America and Europe lead with supportive policies and high electricity costs, while Asia-Pacific experiences rapid uptake in emerging economies. The Rest of the World focuses on off-grid and hybrid solutions. Key players such as Enphase Energy, Fronius, Ingeteam, Mitsui Seiki, Schneider Electric, Huawei, TMEIC, Hyundai Electric Energy Systems, Soltec, Sungrow, and GoodWe actively expand their presence across these regions through innovation, partnerships, and tailored product offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The single-phase PV inverter market is projected to grow from USD 4.68 billion in 2024 to USD 6.96 billion by 2032, registering a CAGR of 5.1%, driven by rising residential solar adoption.

- Residential applications lead with 55% market share, followed by commercial at 30% and industrial at 15%, fueled by rooftop solar adoption, cost savings, and supportive government incentives.

- Inverters rated 500–1000 Watts dominate with 40% share, while 1000–2000 Watts hold 30%, and 200–500 Watts and over 2000 Watts segments capture 15% each, emphasizing efficiency and scalability.

- Maximum Power Point Tracking (MPPT) inverters hold 45% share, grid-tied 35%, battery back-up 15%, and energy monitoring 5%, reflecting consumer preference for efficiency, reliability, and smart energy features.

- North America leads with 35% share, Europe 30%, Asia-Pacific 25%, and Rest of the World 10%, with key players like Enphase Energy, Fronius, Huawei, Sungrow, and Schneider Electric driving regional growth.

Market Drivers

Rising Adoption of Residential and Small-Scale Solar Systems

The single-phase PV inverter market benefits from increased deployment of residential and small commercial solar installations. Homeowners and small businesses seek energy independence and reduced electricity bills, driving demand for reliable inverters. It enables efficient conversion of DC power from solar panels to usable AC power, ensuring stable energy supply. Government incentives, subsidies, and supportive regulations encourage investments in solar solutions. Consumers prioritize systems with high efficiency, low maintenance, and seamless integration with existing electrical networks. It also supports off-grid and backup power applications, broadening market opportunities.

- For instance, Enphase Energy’s microinverters offer high efficiency and modular design that enables homeowners to install solar panels incrementally with real-time monitoring features.

Technological Advancements and Smart Features

Technological innovation fuels growth in the single-phase PV inverter market. Manufacturers develop inverters with real-time monitoring, grid-tied capabilities, and intelligent fault detection, improving system performance. It enhances energy efficiency and ensures reliable power delivery for residential and commercial users. Digital tools allow predictive maintenance, minimizing downtime and operational costs. Innovations in inverter design reduce size and noise while increasing durability. It enables seamless integration with energy storage solutions, making solar systems more versatile. Consumers increasingly demand smart and connected devices to optimize energy management.

- For instance, Huawei’s single-phase SUN2000 inverters include AI-powered arc-fault circuit interrupters and smart monitoring that helps prevent fire risks, improving safety and uptime

Government Policies and Renewable Energy Incentives

Government policies and renewable energy programs drive investment in the single-phase PV inverter market. It receives strong support through subsidies, tax credits, and feed-in tariffs that reduce upfront costs. Regulatory frameworks promote clean energy adoption and carbon emission reduction. It aligns with national and regional targets for renewable energy capacity expansion. Public awareness campaigns and incentives for distributed generation encourage residential and small commercial users to install solar systems. It contributes to energy security, supports local manufacturing, and stimulates employment in the renewable sector. Policy certainty attracts long-term investments and market stability.

Rising Electricity Costs and Environmental Awareness

Increasing electricity prices motivate consumers to adopt solar power, benefiting the single-phase PV inverter market. It enables cost savings by reducing reliance on conventional grid electricity. Growing environmental awareness drives investment in sustainable energy solutions that lower carbon footprints. Consumers prefer inverters with higher efficiency, reliability, and compatibility with emerging technologies. It plays a key role in supporting decentralized energy generation and storage systems. Rising concerns over climate change and energy security push both households and small businesses to adopt solar-based solutions, fueling market growth.

Market Trends

Integration with Energy Storage Solutions

The single-phase PV inverter market experiences a strong trend toward integration with energy storage systems. It allows users to store excess solar energy for use during peak hours or grid outages, enhancing energy reliability. Consumers increasingly demand inverters compatible with batteries to optimize self-consumption and reduce dependence on the grid. It supports time-of-use energy management, enabling households and small businesses to lower electricity costs. Manufacturers focus on seamless integration and user-friendly interfaces. This trend strengthens the adoption of solar solutions and increases system versatility, supporting energy resilience and sustainability.

- For instance, Solis offers single-phase hybrid inverters in the 3-8 kW range designed for residential PV energy storage, featuring integrated battery management and timed charge/discharge functions that extend battery life and support seamless solar-battery-grid interaction.

Smart and Connected Inverters

The adoption of smart and connected inverters drives significant growth in the single-phase PV inverter market. It enables remote monitoring, diagnostics, and real-time performance tracking through mobile or web applications. Consumers gain precise control over energy generation and consumption, improving operational efficiency. It incorporates fault detection and predictive maintenance capabilities, minimizing downtime. Integration with home automation and IoT platforms enhances system intelligence. Manufacturers develop inverters with adaptive features to respond to changing grid conditions. Smart inverters contribute to energy optimization and system reliability, meeting modern energy management demands.

- For instance, Retgen’s mobile app, which provides on-the-go access to real-time data and notifications, facilitating quicker decision-making and efficient issue resolution for solar inverter systems.

Enhanced Efficiency and Power Conversion

Efficiency improvements in inverter technology remain a key trend in the single-phase PV inverter market. It delivers higher power conversion rates, ensuring maximum utilization of solar energy. Manufacturers focus on reducing energy losses and enhancing thermal management to improve system performance. It supports wider voltage ranges and fluctuating solar inputs, maintaining stable power output. Advanced components and optimized designs increase durability and reduce operational costs. Consumers prefer efficient inverters that deliver long-term savings and reliable performance. This trend promotes adoption in both residential and small commercial applications.

Focus on Decentralized and Grid-Tied Solutions

The single-phase PV inverter market increasingly emphasizes decentralized and grid-tied solar systems. It allows users to generate electricity on-site while maintaining grid connectivity for backup support. Consumers prioritize inverters that provide seamless synchronization with local grids and ensure power stability. It supports distributed generation models and enhances energy security at a local level. Manufacturers offer flexible solutions suitable for different roof sizes and energy demands. This trend aligns with global renewable energy goals, enabling efficient integration of solar power into existing infrastructure. It strengthens the transition to sustainable and resilient energy networks.

Market Challenges Analysis

High Initial Investment and Cost Constraints

The single-phase PV inverter market faces challenges from high upfront costs, which can limit adoption among price-sensitive consumers. It requires substantial investment in quality inverters, installation, and supporting components, making residential and small commercial users cautious. Limited access to financing or favorable loan options further restricts market penetration. Consumers evaluate long-term savings against initial expenses before committing to solar installations. Manufacturers strive to balance cost reduction with performance and reliability. Price competition among suppliers puts pressure on profit margins. It remains critical for stakeholders to offer cost-effective solutions without compromising efficiency or durability.

Grid Compatibility and Technical Limitations

Grid compatibility and technical constraints pose additional challenges for the single-phase PV inverter market. It must comply with varying regional regulations and grid codes, which complicates design and deployment. Fluctuations in voltage or frequency can affect inverter performance and system reliability. Consumers may face difficulties in integrating inverters with older electrical systems. Technical support and maintenance services are essential to address faults and ensure smooth operation. Manufacturers invest in robust testing and certification to meet standards. It requires continuous innovation to overcome limitations and maintain stable energy output, ensuring customer confidence and system longevity.

Market Opportunities

Expansion in Emerging Residential and Small Commercial Segments

The single-phase PV inverter market presents significant opportunities in emerging residential and small commercial segments. It enables homeowners and small businesses to adopt solar power with limited space and lower energy requirements. Growing awareness of renewable energy and rising electricity costs motivate investments in self-generation solutions. It supports off-grid and hybrid systems, providing flexibility for diverse energy needs. Manufacturers can target untapped regions with favorable solar conditions. Customized solutions for small rooftops and local energy demands strengthen market penetration. It also encourages partnerships with installers and energy service companies to expand reach and adoption.

Integration with Smart Grids and Energy Storage Systems

Opportunities in the single-phase PV inverter market arise from integration with smart grids and energy storage solutions. It allows users to store surplus energy, optimize consumption, and reduce dependence on the conventional grid. Consumers increasingly seek inverters compatible with batteries and home automation platforms. It enables participation in demand response programs and time-of-use energy management, enhancing system value. Manufacturers can offer advanced features such as remote monitoring and predictive maintenance to differentiate products. It supports the transition toward decentralized and resilient energy networks. Strategic innovation in storage-compatible and smart inverter technologies drives long-term growth and adoption.

Market Segmentation Analysis:

By Application

In the single-phase PV inverter market, the residential segment leads with approximately 55% share in 2024, driven by rising rooftop solar adoption and homeowners seeking cost savings. Commercial applications hold 30%, supported by small businesses reducing energy expenses. Industrial applications account for 15%, targeting micro and small-scale units requiring reliable solar solutions. Incentives, falling panel costs, and rising electricity prices fuel growth.

- For instance, Tesla’s Powerwall paired with its Solar Roof has been widely adopted across U.S. households, enabling energy independence during peak hours.

By Rating

Inverters rated 500 Watts to 1000 Watts dominate the single-phase PV inverter market with 40% share, ideal for typical residential systems. The 1000–2000 Watts segment captures 30%, preferred by larger households and small commercial users. 200–500 Watts inverters hold 15%, suitable for compact setups, while over 2000 Watts accounts for 15%, serving microgrid and industrial needs. Efficiency and scalability drive adoption.

- For instance, SolarEdge Technologies unveiled a new three-phase solar inverter in 2024 capable of supporting up to 20kW, designed specifically for residential use with backup capabilities, highlighting the innovation in this segment.

By Features

Maximum Power Point Tracking (MPPT) inverters dominate with 45% share, ensuring higher energy yield and efficiency. Grid-tied operation inverters follow with 35%, allowing integration with local grids. Battery back-up systems hold 15%, supporting off-grid reliability, while energy monitoring inverters account for 5%, enabling performance tracking and smart energy management. Consumers prioritize efficiency, reliability, and technology-driven features for solar adoption.

Segments:

Based on Application

- Residential

- Commercial

- Industrial

Based on Power Rating

- 200 Watts to 500 Watts

- 500 Watts to 1000 Watts

- 1000 Watts to 2000 Watts

- Over 2000 Watts

Based on Features

- Maximum Power Point Tracking (MPPT)

- Grid-Tied Operation

- Battery Back-up

- Energy Monitoring

Based on Technology

- Silicon-Based

- Gallium Nitride (GaN)-Based

Based on Communication Protocols

- Modbus

- Zigbee

- Wi-Fi

- Ethernet

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 35% share of the single-phase PV inverter market in 2024, driven by strong residential solar adoption and supportive government policies. It benefits from incentives, tax credits, and net metering programs that encourage homeowners to invest in solar solutions. High electricity costs push small businesses and households toward self-generation. It incorporates advanced inverters with smart monitoring and grid-tied features. Manufacturers focus on reliable and efficient systems suitable for varying climates. Consumer awareness and energy security priorities further boost adoption.

Europe

Europe captures 30% share of the single-phase PV inverter market, led by countries with aggressive renewable energy targets. It emphasizes residential and small commercial solar installations supported by subsidies and green energy programs. It integrates with energy storage and grid-tied solutions to enhance energy efficiency and reliability. Demand rises from households seeking cost savings and carbon footprint reduction. Manufacturers develop compact, high-efficiency inverters compatible with decentralized energy networks. Regulatory support and technological advancements drive market growth.

Asia-Pacific

Asia-Pacific accounts for 25% share in the single-phase PV inverter market, fueled by rapid solar adoption in emerging economies. It experiences high demand in residential and small commercial sectors due to increasing electricity costs and renewable energy awareness. It includes inverters compatible with battery storage and hybrid systems. Government incentives and supportive policies encourage widespread deployment. Manufacturers target urban and semi-urban households with scalable solutions. Rapid urbanization and investments in clean energy infrastructure strengthen market opportunities.

Rest of the World

The Rest of the World region holds 10% share of the single-phase PV inverter market, supported by gradual adoption in Latin America, the Middle East, and Africa. It focuses on off-grid and small-scale commercial installations where grid access is limited. Consumers seek reliable and efficient inverters for energy independence. It integrates with battery systems to ensure consistent power supply. Market growth depends on infrastructure development, government support, and awareness of renewable energy benefits. Manufacturers explore untapped regions for expansion opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sungrow

- Mitsui Seiki

- Enphase Energy

- GoodWe

- Hyundai Electric Energy Systems

- Fronius

- Soltec

- TMEIC

- Ingeteam

- Huawei

- Schneider Electric

Competitive Analysis

The single-phase PV inverter market remains highly competitive, with key players focusing on innovation, efficiency, and reliability to maintain market leadership. Companies such as Enphase Energy, Fronius, Ingeteam, Mitsui Seiki, Schneider Electric, Huawei, TMEIC, Hyundai Electric Energy Systems, Soltec, Sungrow, and GoodWe drive growth through advanced inverter technologies, smart grid integration, and energy storage compatibility. It emphasizes high-performance inverters with Maximum Power Point Tracking (MPPT), grid-tied operation, and battery backup capabilities to meet residential and small commercial demands. Strategic partnerships, regional expansions, and product launches allow companies to strengthen market presence and respond to rising electricity costs and renewable energy adoption. It encourages manufacturers to offer user-friendly, durable, and scalable solutions to address diverse energy requirements. Continuous investment in research and development ensures enhanced efficiency, reduced power losses, and reliable performance under varying environmental conditions. It also focuses on digitalization, remote monitoring, and predictive maintenance to improve operational efficiency and customer satisfaction. Competitive differentiation depends on technology leadership, brand reputation, and ability to meet evolving regulatory and consumer demands.

Recent Developments

- In 2025, GoodWe launched its EHB single-phase hybrid inverter in Australia and New Zealand, designed for residential energy storage systems with enhanced performance, safety, and flexibility.

- In October 2023, Sungrow introduced the SH8.0RS and SH10RS single-phase hybrid inverters at All-Energy Australia, offering high protection, compatibility with large-capacity batteries, and improved energy security for households.

- On January 21, 2025, Solis launched its Solarator Series in India, a hybrid inverter lineup for residential and commercial use, featuring single-phase configurations and advanced functionalities.

- On April 23, 2025, Sunora entered the solar inverter market at RenewX 2025, unveiling a 15kW three-phase grid-connected inverter, demonstrating active innovation in the broader inverter segment.

Market Concentration & Characteristics

The single-phase PV inverter market exhibits a moderately concentrated competitive structure, dominated by key players including Enphase Energy, Fronius, Ingeteam, Mitsui Seiki, Schneider Electric, Huawei, TMEIC, Hyundai Electric Energy Systems, Soltec, Sungrow, and GoodWe. It focuses on technological innovation, high efficiency, and reliability to differentiate products in residential and small commercial applications. It emphasizes Maximum Power Point Tracking (MPPT), grid-tied operation, and battery back-up capabilities to meet diverse consumer needs. Manufacturers invest in research and development to enhance inverter performance, reduce energy losses, and ensure compatibility with energy storage and smart grid solutions. It relies on regional expansion, strategic partnerships, and product launches to strengthen market presence. The market demonstrates strong growth potential due to increasing renewable energy adoption, rising electricity costs, and supportive government policies, encouraging companies to offer durable, scalable, and cost-effective inverters for decentralized energy deployment.

Report Coverage

The research report offers an in-depth analysis based on Application, Power Rating, Features, Technology, Communication Protocols and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The single-phase PV inverter market will expand with higher adoption in residential and small commercial solar systems.

- It will gain from increasing government incentives, subsidies, and policies promoting renewable energy adoption globally.

- Technological innovations will improve inverter efficiency, reliability, and seamless integration with smart grids and monitoring systems.

- Energy storage compatibility will become a standard requirement, supporting hybrid systems and off-grid solar installations.

- Demand for grid-tied and off-grid hybrid systems will grow rapidly in emerging and developing economies.

- Manufacturers will focus on compact, user-friendly, durable, and scalable inverter designs suitable for diverse applications.

- Digital monitoring and predictive maintenance features will see wider adoption among residential and commercial consumers.

- Environmental awareness and increasing electricity costs will encourage households and businesses to invest in solar solutions.

- Regional expansion and strategic partnerships will help key players strengthen their global market presence.

- Continuous product innovation will support decentralized renewable energy deployment and resilient, sustainable power generation solutions.