Market Overview

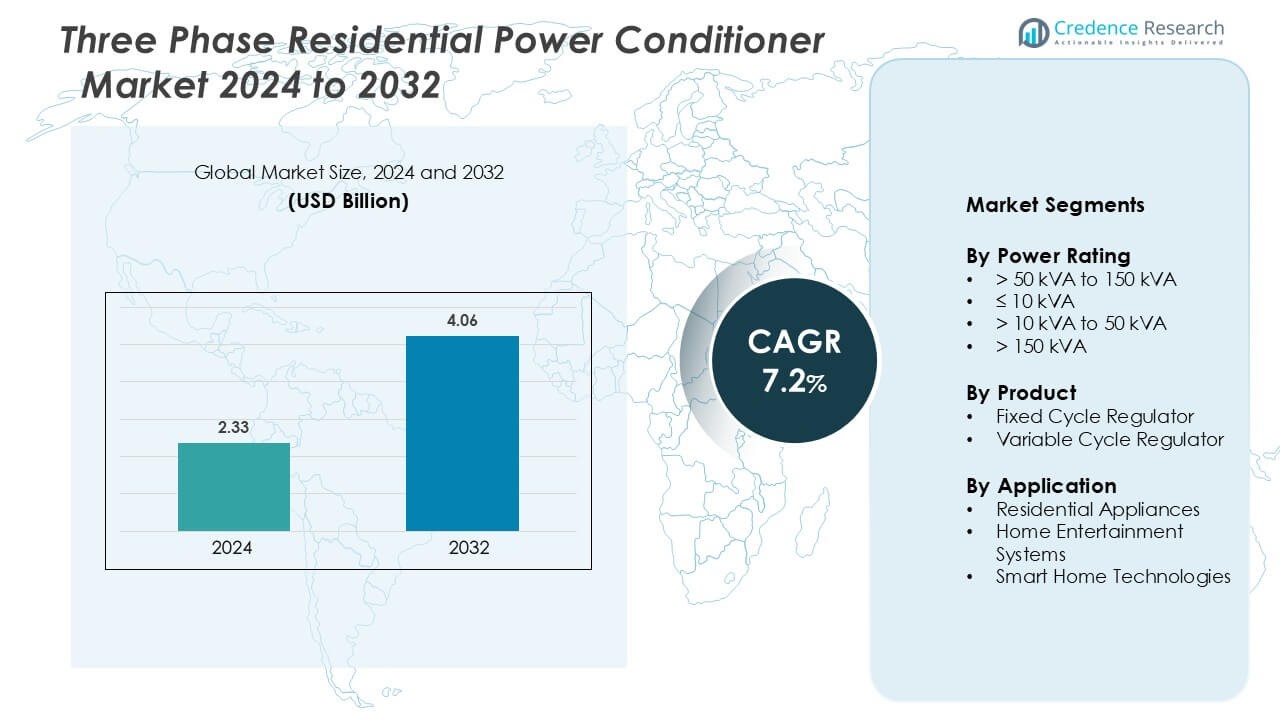

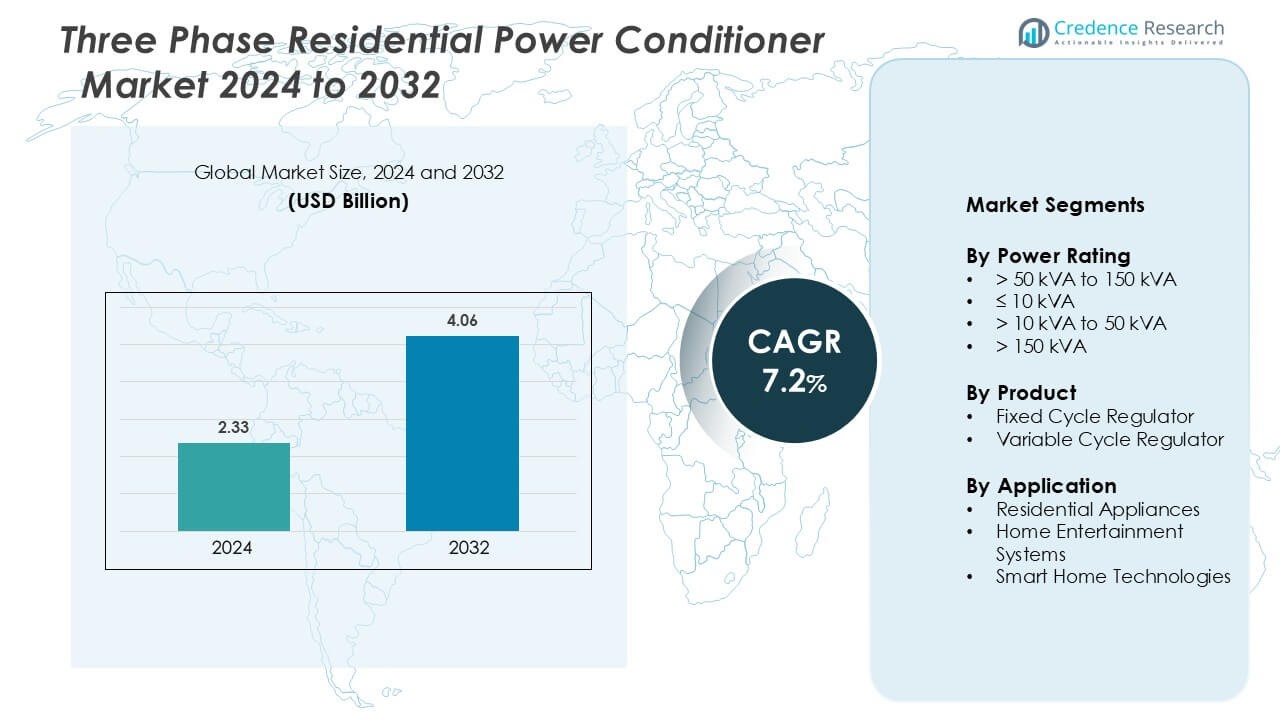

Three Phase Residential Power Conditioner Market was valued at USD 2.33 billion in 2024 and is anticipated to reach USD 4.06 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Residential Power Conditioner Market Size 2024 |

USD 2.33 Billion |

| Three Phase Residential Power Conditioner Market, CAGR |

7.2% |

| Three Phase Residential Power Conditioner Market Size 2032 |

USD 4.06 Billion |

The three-phase residential power conditioner market is dominated by globally recognized players such as Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation, General Electric, Toshiba Corporation, and Legrand. These companies lead through strong product innovation, advanced voltage regulation technologies, and extensive global distribution networks. Their strategic focus on energy efficiency, IoT integration, and smart home compatibility enhances competitiveness across residential applications. Asia-Pacific remains the leading regional market, accounting for approximately 38% of the global share, driven by rapid urbanization, expanding smart home adoption, and increasing investments in residential power infrastructure. Continuous R&D and partnerships further reinforce the dominance of these key players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global three-phase residential power conditioner market is valued at USD 2.33 billion in 2024 and is projected to grow at a CAGR of 7.2% during the forecast period, driven by increasing demand for power stability in modern homes.

- Growing smart home adoption, renewable energy integration, and the need for efficient voltage regulation are key drivers accelerating market expansion across residential sectors.

- Emerging trends include IoT-enabled power conditioners, AI-based monitoring systems, and energy-efficient designs that enhance performance and reduce power losses.

- The competitive landscape is led by major players such as Siemens AG, Schneider Electric SE, ABB Ltd., and Eaton Corporation, focusing on innovation and strategic partnerships to strengthen market presence.

- Asia-Pacific holds the largest regional share at 38%, followed by North America with 25%, while the >10 kVA to 50 kVA segment remains dominant due to its suitability for medium-load residential applications.

Market Segmentation Analysis:

By Power Rating

The >10 kVA to 50 kVA segment dominates the three-phase residential power conditioner market, holding the largest market share due to its suitability for mid-range residential applications. These conditioners efficiently handle variable load demands from high-consumption devices such as HVAC systems, electric vehicle chargers, and advanced home automation setups. Increasing household adoption of high-power appliances and smart home systems drives demand for this range. Moreover, its balance between cost, efficiency, and output capacity makes it the preferred choice for modern residential installations.

- For instance, ABB Ltd.’s PowerScale series covering the 10 kVA to 50 kVA range offers an output power factor of 0.9 and an input THDi ≤ 3 % at full load.

By Product

The Variable Cycle Regulator segment leads the market with a significant share, attributed to its superior adaptability and efficiency in maintaining stable voltage output under fluctuating load conditions. These regulators are increasingly favored in smart residential infrastructures where energy efficiency and reliability are crucial. Their ability to optimize power flow, minimize energy loss, and support advanced monitoring features aligns well with the growing trend of energy-conscious households. The shift toward intelligent, responsive power management systems further accelerates this segment’s growth.

- For instance, the Eaton Power-Sure 700 three-phase line conditioner delivers output within ±3% of nominal despite an input variation from +10% to -23% of rated input and achieves a response time of ½ electrical cycle.

By Application

The Smart Home Technologies segment is the dominant application area in the three-phase residential power conditioner market, capturing the largest market share. This dominance stems from the rapid integration of IoT-enabled systems, connected devices, and automation technologies in modern homes. Power conditioners ensure uninterrupted, clean power for these sensitive systems, preventing operational disruptions and extending equipment lifespan. Rising investments in smart infrastructure, coupled with consumer preference for enhanced home efficiency and safety, are major drivers propelling the segment’s continued expansion.

Key Growth Drivers

Rising Adoption of Smart Home Technologies

The increasing integration of smart home systems significantly drives the demand for three-phase residential power conditioners. As households adopt IoT-enabled devices, automated lighting, HVAC systems, and home entertainment networks, maintaining consistent and high-quality power becomes essential. Power conditioners ensure stable voltage supply, protect sensitive electronics from fluctuations, and enhance overall energy efficiency. This trend is particularly strong in urban areas with high smart home penetration. Additionally, government initiatives promoting energy-efficient housing and home automation are boosting installations, making power conditioners a critical component in smart home infrastructure development.

- For instance, Power Integrations’ InnoSwitch3-CE chip supports an off-line flyback topology up to 65 W output for smart-home modules, enabling ultra-low standby power and highly compact designs.

Increasing Power Quality Concerns in Residential Areas

Growing incidences of voltage instability and power surges in residential grids are fueling the adoption of power conditioning systems. Urbanization and rising electricity consumption have strained local distribution networks, causing irregular power delivery. Homeowners increasingly recognize the need to safeguard electronic appliances and ensure uninterrupted operation. Three-phase power conditioners provide precise voltage regulation, suppress noise, and protect against transient spikes. Their capability to handle multiple loads simultaneously makes them ideal for large households. As reliance on electronics and renewable energy sources grows, maintaining power quality becomes a key driver for market expansion.

- For instance, ABB Ltd.’s PCS100 AVC-20 model offers voltage regulation accuracy of ±1% typical and completes any deviation correction within 20 ms, ensuring reliable supply under disrupted conditions.

Expansion of Residential Electrification and Renewable Integration

The expanding use of renewable energy sources such as rooftop solar systems in residential settings is a major growth driver. These systems often cause voltage fluctuations due to variable generation, creating a need for efficient power conditioning solutions. Three-phase conditioners help manage bidirectional energy flow between the grid and residential units, improving system reliability. Moreover, growing electrification across developing regions, supported by government investments in sustainable power infrastructure, increases product demand. Consumers seek devices that ensure compatibility between renewable systems and home networks, making power conditioners vital for stable, efficient, and eco-friendly energy usage.

Key Trends & Opportunities

Integration of IoT and AI in Power Conditioning Systems

The integration of IoT and artificial intelligence in power conditioning technology presents a transformative trend. Manufacturers are developing smart power conditioners capable of real-time monitoring, predictive maintenance, and remote control. AI algorithms analyze power usage patterns to optimize voltage regulation and reduce energy wastage. These intelligent systems appeal to tech-savvy homeowners who prioritize automation and sustainability. The ability to integrate conditioners into centralized home energy management platforms opens new revenue streams for manufacturers. This trend not only enhances performance reliability but also supports the global shift toward connected, energy-efficient residential ecosystems.

- For instance, the ABB PCS100 AVC-20 model achieves output voltage regulation accuracy of ±1% typical and corrects sags within 20 ms.

Growing Demand for Energy-Efficient and Sustainable Solutions

The market is witnessing increasing demand for energy-efficient power conditioning solutions aligned with sustainability goals. Rising energy costs and environmental awareness are pushing consumers to adopt devices that minimize losses and reduce carbon emissions. Manufacturers are responding with eco-friendly materials, advanced power factor correction technologies, and low-standby energy designs. Additionally, favorable government regulations promoting green building certifications create growth opportunities for power conditioner suppliers. Energy-efficient three-phase conditioners appeal to both homeowners and developers seeking long-term cost savings, positioning the market for sustained growth amid the global clean energy transition.

- For instance, Eaton’s Power-Sure 700 three-phase power conditioner features a typical efficiency of 97 %, with harmonic distortion held below 1 %, thereby reducing energy waste and improving overall system performance.

Key Challenges

High Initial Cost and Installation Complexity

The high upfront cost of three-phase power conditioners remains a significant challenge to widespread adoption. Installation often requires professional expertise and additional electrical infrastructure, increasing total system expenses. For many residential consumers, especially in cost-sensitive regions, this acts as a deterrent. Furthermore, integrating conditioners into existing systems without disrupting household operations can be technically complex. While long-term benefits such as improved efficiency and equipment protection are evident, the lack of immediate financial returns often delays investment decisions, restricting market penetration in price-sensitive segments.

Limited Awareness and Technical Expertise

A major challenge in the market is the limited consumer awareness regarding the benefits and functions of three-phase power conditioners. Many homeowners remain unfamiliar with voltage regulation issues or underestimate the risks of power fluctuations. Additionally, the shortage of skilled technicians capable of installing and maintaining advanced systems hampers market growth. This knowledge gap is more pronounced in developing regions, where consumer education and technical training are limited. Addressing these challenges through awareness campaigns, after-sales support, and skill development initiatives will be critical for accelerating adoption and ensuring sustainable market expansion.

Regional Analysis

North America

North America holds approximately 25% of the global three-phase residential power conditioner market share, driven by widespread adoption of smart home technologies and advanced electrical infrastructure. The United States dominates the regional market, supported by high awareness of power quality management and strong demand for voltage stabilization in modern homes. The integration of renewable energy sources such as rooftop solar systems further strengthens market growth. Additionally, the presence of major technology providers and favorable regulatory frameworks promoting energy efficiency continue to position North America as a key revenue-generating region in the global landscape.

Europe

Europe accounts for around 22% of the global market share, supported by strong emphasis on energy efficiency, sustainable housing, and smart grid initiatives. Countries such as Germany, the UK, and France are leading adopters, driven by stringent carbon reduction targets and widespread renewable energy integration. The region’s proactive government incentives for clean energy solutions and green building certifications encourage residential adoption of power conditioners. Moreover, modernization of home electrical systems and growing investments in intelligent power management technologies are reinforcing Europe’s steady and sustainable market growth trajectory.

Asia-Pacific

Asia-Pacific dominates the global three-phase residential power conditioner market, capturing approximately 38% of the total market share. The region’s growth is fueled by rapid urbanization, rising disposable incomes, and increasing residential electrification. China, Japan, and India are major contributors, driven by high demand for reliable power solutions and expanding smart home adoption. Government programs promoting energy efficiency and renewable energy integration further stimulate market expansion. The region’s robust construction activity and heightened awareness of appliance protection make Asia-Pacific the fastest-growing and most influential market globally.

Latin America

Latin America holds around 8% of the global market share, showing steady growth due to increasing electrification and infrastructure upgrades across residential sectors. Brazil and Mexico are the leading markets, driven by frequent voltage fluctuations and grid instability that create strong demand for power conditioners. Growing awareness of energy efficiency and equipment protection supports adoption, particularly in urban households. Additionally, investments in smart energy technologies and renewable power integration are enhancing the region’s long-term market prospects, positioning Latin America as an emerging market with untapped potential for future expansion.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of the global three-phase residential power conditioner market share, with steady growth supported by rising urban development and modernization of residential power systems. Countries such as the UAE, Saudi Arabia, and South Africa are at the forefront of adoption, driven by smart city projects and increasing need for reliable voltage control. Frequent power fluctuations in developing regions further drive product demand. Ongoing investments in energy infrastructure, grid stability, and sustainable housing are expected to enhance the region’s market presence over the forecast period.

Market Segmentations:

By Power Rating

- > 50 kVA to 150 kVA

- ≤ 10 kVA

- > 10 kVA to 50 kVA

- > 150 kVA

By Product

- Fixed Cycle Regulator

- Variable Cycle Regulator

By Application

- Residential Appliances

- Home Entertainment Systems

- Smart Home Technologies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The three-phase residential power conditioner market is characterized by strong competition among global and regional manufacturers focusing on energy efficiency, voltage stability, and smart power management. Mitsubishi Electric, ABB, and Eaton lead the market with advanced conditioners integrating automatic voltage regulation and harmonic filtering to enhance power quality and protect home appliances. Delta Electronics and Emerson Electric emphasize intelligent digital control systems and modular designs tailored for modern residential grids. Fuji Electric and Legrand expand their portfolios with compact, high-reliability solutions supporting renewable integration and load balancing. NXT Power and AMETEK specialize in precision conditioners designed for sensitive electronic equipment and high-end residential setups. Neelkanth Power Solutions strengthens its regional presence through affordable, customized systems suited to variable grid conditions. Companies are increasingly investing in IoT-enabled monitoring, remote diagnostics, and eco-friendly designs to enhance performance, reduce downtime, and meet evolving residential energy efficiency standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Delta focuses on energy-efficient, compact power conditioning systems with advanced microprocessor-based control for real-time monitoring and adaptive voltage regulation, integrating smart home connectivity for remote monitoring and diagnostics. They have showcased advanced thermal management and precision cooling solutions relevant to power conditioning at OCP 2025 in October 2025.

- In April 2024, Fuji Electric reinforced its unwavering commitment to safety and operational excellence through its expansive service network and state-of-the-art training initiatives. By leveraging its extensive expertise and capabilities, the company continues to serve as a trusted partner for power backup and conditioning solutions across critical industries. This strategic focus underscores Fuji Electric India’s dedication to delivering cutting-edge innovation and superior service quality, ensuring optimal reliability and performance across a wide range of applications.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising adoption of smart home and automation technologies.

- Increasing residential electrification and renewable energy integration will boost demand for efficient power conditioning systems.

- Advancements in IoT and AI will enhance real-time monitoring and predictive maintenance capabilities.

- Manufacturers will focus on developing compact, energy-efficient, and eco-friendly designs to meet sustainability goals.

- Asia-Pacific will continue to lead market growth due to rapid urbanization and infrastructure expansion.

- North America and Europe will see stable demand supported by modernization of residential electrical systems.

- Consumer awareness of power quality and equipment protection will drive wider adoption of conditioners.

- Strategic partnerships between manufacturers and smart home solution providers will create new growth opportunities.

- Integration of power conditioners with renewable energy systems will become increasingly common in residential setups.

- Continuous innovation in digital control and voltage regulation technologies will shape the future market landscape.