Market Overview

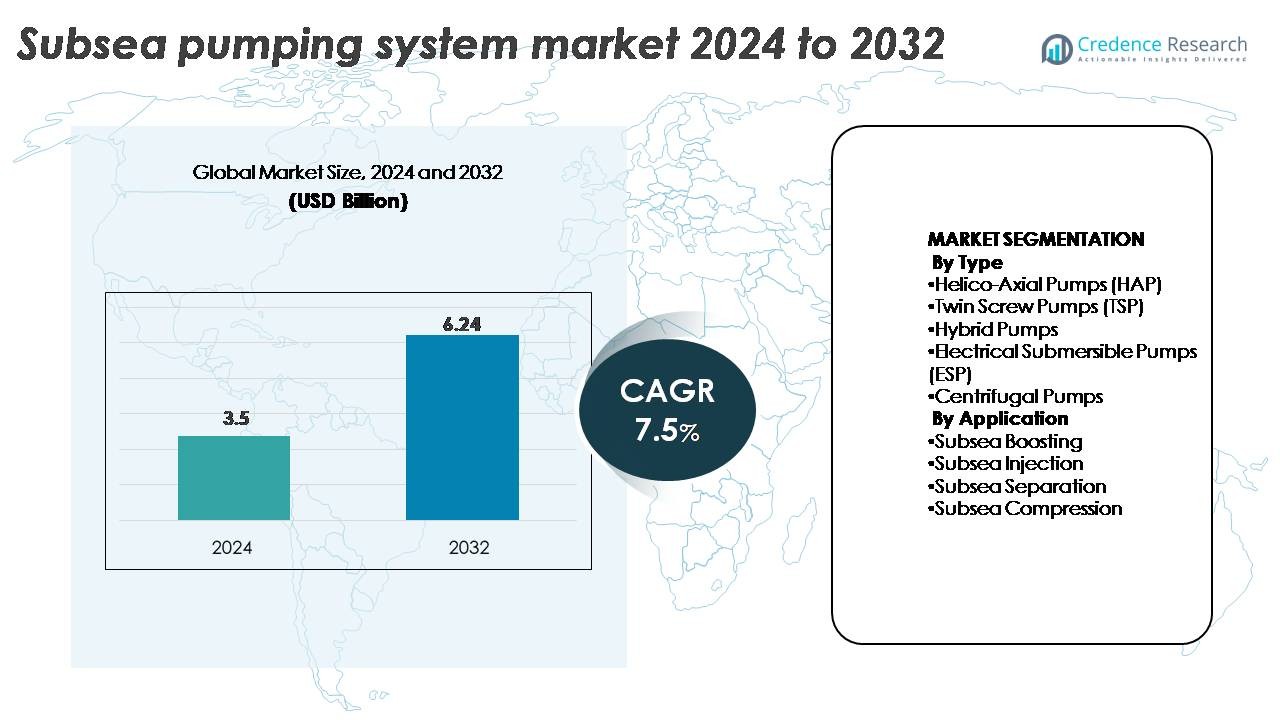

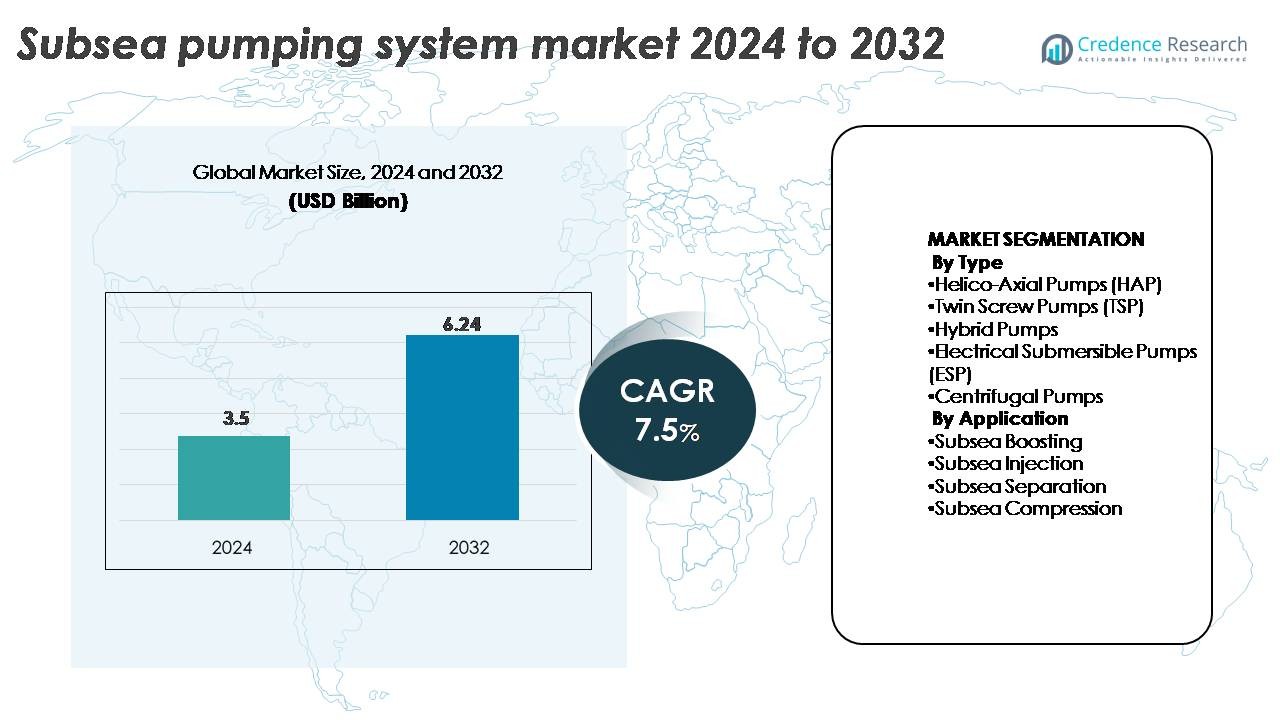

The Subsea Pumping System Market size was valued at USD 3.5 billion in 2024 and is anticipated to reach USD 6.24 billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Subsea Pumping System Market Size 2024 |

USD 3.5 Billion |

| Subsea Pumping System Market, CAGR |

7.5% |

| Subsea Pumping System Market Size 2032 |

USD 6.24 Billion |

The Subsea Pumping System Market is characterized by strong competition among global and regional players focusing on deepwater efficiency, digitalization, and equipment reliability. Key companies include Baker Hughes, SLB (Schlumberger), TechnipFMC, Aker Solutions, OneSubsea, Halliburton, and Oceaneering International. These firms emphasize modular designs, predictive maintenance technologies, and high-efficiency motors for challenging subsea environments. North America leads the market with a 34.6% share, supported by Gulf of Mexico operations, while Europe follows with 29.2%, led by the North Sea’s mature offshore fields. Strategic alliances, R&D investments, and technological advancements in multiphase and electrical submersible pumps remain the primary strategies driving competitiveness and regional dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market insights

- The Subsea Pumping System Market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.24 billion by 2032, registering a CAGR of 7.5% during the forecast period.

- Market growth is driven by rising deepwater and ultra-deepwater exploration, enhanced oil recovery (EOR) projects, and increasing demand for multiphase boosting solutions that optimize flow assurance and reduce surface dependency.

- Key trends include digital monitoring integration, predictive maintenance, and energy-efficient subsea designs that align with global carbon-reduction targets. Vendors emphasize modular, compact pump systems for reliability and easier deployment.

- The market is competitive with leading players such as Baker Hughes, SLB (Schlumberger), TechnipFMC, and Aker Solutions, focusing on innovation, partnerships, and long-term service contracts to strengthen offshore presence.

- North America leads with a 34.6% share, followed by Europe (29.2%) and Asia Pacific (21.5%), while Subsea Boosting remains the dominant segment within applications.

Market Segmentation Analysis:

By Type

Electrical Submersible Pumps (ESP) hold the dominant market share due to their high efficiency and compact design, enabling deepwater and ultra-deepwater production. ESPs deliver reliable performance under high-pressure conditions and reduce maintenance needs compared to mechanical alternatives. Helico-Axial Pumps are also gaining traction for multiphase flow handling and longer tiebacks. Twin Screw Pumps remain preferred for heavy or viscous crude transfer, while Hybrid Pumps and Centrifugal Pumps cater to niche or low-pressure applications. The growing demand for extended field life and reduced production downtime drives steady adoption across all categories.

- For instance, Baker Hughes FLEXPump™ ESP systems handle flow rates from 50 B/D up to 10,500 B/D, reducing downtime and improving production in mature wells.

By Application

Subsea Boosting represents the leading segment, driven by the need to enhance production rates in mature oilfields and deepwater reservoirs. It improves recovery factors by maintaining flow assurance and minimizing backpressure on wells. Subsea Injection ranks second, supported by rising water and gas reinjection activities for enhanced oil recovery. Subsea Separation applications expand as operators target efficiency gains and reduced topside load. Subsea Compression continues to grow with offshore gas developments, where maintaining pressure in long-distance tiebacks is critical to sustaining production output.

- For instance, Baker Hughes deployed a seawater injection system treating and injecting seawater subsea, eliminating surface risers and reducing chemical supply requirements on the sea floor.

Key Growth Drivers

Expansion of Deepwater and Ultra-Deepwater Exploration

The growing focus on untapped offshore reserves drives strong adoption of subsea pumping systems. As shallow-water fields mature, operators move toward deeper basins requiring advanced boosting and pressure management solutions. Deepwater projects in regions such as Brazil’s pre-salt fields and West Africa’s offshore blocks demand pumps capable of handling extreme pressures and temperatures. Subsea pumps minimize topside dependency, lowering operational risks and improving flow assurance. The ability to optimize production from long tiebacks makes these systems vital for modern offshore developments, ensuring stable yields and extended field life.

- For instance, Baker Hughes’s Hammerhead system operated in water depths up to 10,000 ft and withstood pressures near 25,000 psi, enabling long-tie-back production in ultra-deepwater environments.

Rising Demand for Enhanced Oil Recovery (EOR) Techniques

Enhanced oil recovery methods increasingly rely on subsea pumping to sustain pressure and maximize extraction efficiency. Subsea boosting and injection systems improve reservoir drawdown and fluid displacement, leading to higher recovery factors. EOR projects in mature offshore fields across the North Sea and Asia Pacific encourage investments in reliable subsea technologies. Pumps designed for multiphase handling enable seamless production with reduced water cut challenges. This trend aligns with operators’ goals to optimize output from existing wells without expanding surface infrastructure, improving the overall economics of offshore production.

- For instance, A subsea raw seawater injection (SRSWI) system with a maximum injection capacity of 20,000 m³/d was installed on the StatoilHydro-operated Tyrihans field on the Norwegian Continental Shelf

Technological Advancements in Subsea Equipment

Continuous innovation in subsea technology fuels market growth. Modern systems incorporate variable speed drives, corrosion-resistant materials, and advanced sensor integration for predictive maintenance. Automation and digital twins enhance reliability and operational visibility. Companies like OneSubsea and Baker Hughes invest in compact, modular designs that simplify installation and reduce costs. These advancements improve energy efficiency and system uptime while minimizing the risk of equipment failure. The integration of smart control systems enables remote diagnostics, extending the operational lifespan of pumps and ensuring stable production even in complex subsea environments.

Key Trends & Opportunities

Integration of Digital Monitoring and Predictive Maintenance

Digitalization is transforming subsea pumping operations through data-driven monitoring and automation. Predictive maintenance solutions use real-time analytics and IoT-enabled sensors to track vibration, pressure, and flow rates, identifying potential issues before they escalate. This technology helps reduce intervention frequency and extend equipment life. Remote monitoring systems improve safety by minimizing human presence in hazardous subsea zones. As oil companies accelerate digital transformation, the integration of AI-based optimization and cloud platforms presents major opportunities for performance enhancement and cost efficiency in subsea operations.

- For instance, Baker Hughes deployed a remote condition-monitoring platform that logged vibration and pressure data from 72 pumps across a basin and identified 58 anomalous events before shutdown

Growing Focus on Energy Efficiency and Carbon Reduction

The energy transition trend encourages operators to deploy low-energy, high-efficiency subsea pumping systems. New pump designs aim to lower power consumption while maintaining optimal flow rates. Electrically driven pumps replace traditional hydraulic systems, cutting emissions and improving energy recovery. This shift aligns with global carbon-reduction targets and sustainability goals. Manufacturers are exploring materials and designs that extend pump service life and reduce the need for energy-intensive interventions. The adoption of green offshore operations opens new opportunities for suppliers offering eco-efficient subsea solutions.

- For instance, Baker Hughes’ CENefficient™ ESP system achieved varying, specific energy efficiency gains in a heavy-oil field, rather than a single 20% reduction.

Key Challenges

High Installation and Maintenance Costs

The capital-intensive nature of subsea pumping systems remains a major barrier to wider adoption. Installation in deep and ultra-deep waters involves complex logistics, specialized vessels, and long lead times. Repairing or replacing a malfunctioning pump can require extensive downtime and high expenditure. While modular designs and remote monitoring reduce costs, financial risk persists in low oil price scenarios. Smaller operators may struggle to justify investment without government incentives or collaborative financing models. Managing lifecycle costs remains crucial for sustainable market expansion.

Technical Complexities and Reliability Issues

Operating under extreme subsea pressures, temperatures, and corrosion conditions poses major engineering challenges. Equipment failures can lead to significant production losses and safety risks. Multiphase flow variations, sand content, and unpredictable reservoir behavior demand robust design and material endurance. Although technological progress improves reliability, real-time response to operational anomalies remains difficult. Ensuring system integrity over decades of service requires continuous testing, monitoring, and innovation in component durability. Manufacturers must balance performance, weight, and longevity to overcome these technical hurdles effectively.

Regional Analysis

North America

North America holds the largest market share of 34.6%, driven by mature offshore developments in the Gulf of Mexico and continued investment in deepwater exploration. The U.S. leads regional adoption with advanced subsea boosting and separation systems to optimize declining wells. Companies like Baker Hughes and SLB (Schlumberger) deploy digitalized pump solutions to enhance production uptime. Canada’s offshore fields, particularly off Newfoundland and Labrador, also witness modernization efforts. Supportive government energy policies and robust offshore infrastructure strengthen regional dominance. The focus on digital monitoring and energy efficiency further sustains long-term market leadership.

Europe

Europe accounts for 29.2% of the global share, with strong contributions from the North Sea basin. The UK and Norway drive demand through large-scale subsea enhancement projects in mature oilfields. Operators like Equinor and Aker Solutions invest heavily in multiphase boosting and electric subsea systems. The transition toward low-carbon oil recovery has accelerated adoption of energy-efficient subsea pumps. Germany and Italy support offshore operations with specialized component manufacturing. Europe’s early technological maturity and focus on sustainability ensure steady replacement demand, positioning it as a key hub for advanced subsea system development and deployment.

Asia Pacific

Asia Pacific represents 21.5% of the market, supported by expanding offshore exploration in China, India, Australia, and Southeast Asia. Deepwater projects in the South China Sea and Bay of Bengal propel demand for robust pumping systems. Regional operators adopt subsea boosting and injection pumps to extend production life and improve flow assurance. Japan and South Korea play major roles in manufacturing subsea components and control systems. Increasing energy consumption and offshore investment by national oil companies such as ONGC and CNOOC strengthen regional growth potential and technological collaboration opportunities.

Latin America

Latin America holds 8.7% of the global share, primarily led by Brazil’s pre-salt basin projects. Petrobras continues to integrate advanced subsea boosting systems to enhance oil recovery from ultra-deepwater wells. Mexico and Argentina follow with increased offshore exploration incentives. Regional focus on maximizing field output with lower operational costs supports rising pump installations. Local manufacturing partnerships and government-backed offshore investments further encourage technology transfer. Despite occasional project delays, strong exploration momentum and favorable policies make Latin America a critical growth region for subsea pumping technology.

Middle East & Africa

The Middle East & Africa region captures 6% of the market, driven by growing offshore projects in Angola, Nigeria, and the GCC nations. Africa’s deepwater blocks attract global investments aimed at optimizing production through multiphase subsea systems. GCC countries, especially Saudi Arabia and the UAE, focus on offshore expansion to diversify hydrocarbon output. Local collaborations and joint ventures promote subsea technology localization. However, limited infrastructure and harsh subsea environments pose challenges. Continued foreign partnerships and rising energy demand ensure a gradual but steady increase in subsea pump deployments across the region.

Market Segmentations:

By Type

- Helico-Axial Pumps (HAP)

- Twin Screw Pumps (TSP)

- Hybrid Pumps

- Electrical Submersible Pumps (ESP)

- Centrifugal Pumps

By Application

- Subsea Boosting

- Subsea Injection

- Subsea Separation

- Subsea Compression

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Subsea Pumping System Market is moderately consolidated, with key players focusing on technological innovation, strategic alliances, and regional expansion to strengthen their market positions. Major companies such as Baker Hughes Company, SLB (Schlumberger Limited), Aker Solutions ASA, TechnipFMC plc, OneSubsea, Flowserve Corporation, Halliburton Company, Sulzer Ltd., ITT Bornemann GmbH, and Oceaneering International, Inc. lead the industry through integrated product portfolios and strong service capabilities. These firms emphasize reliability, energy efficiency, and modular design to support deepwater and ultra-deepwater operations. For instance, Baker Hughes continues to develop high-pressure subsea boosting systems with digital monitoring for real-time performance optimization. Similarly, Aker Solutions and TechnipFMC invest in subsea compression and hybrid pumping solutions to reduce lifecycle costs. Strategic collaborations between oilfield operators and OEMs foster localized manufacturing and faster deployment. Intense competition encourages continuous innovation, improved asset reliability, and enhanced aftersales support across key offshore regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schlumberger (Subsea pumping systems, flow assurance solutions)

- OneSubsea (Subsea pumps, subsea processing equipment)

- Flowserve Corporation (Subsea pumps, industrial pumps)

- Aker Solutions (Subsea pumps, subsea production systems)

- General Electric Company (Electric subsea pumps, subsea systems)

- SPX Corporation (Subsea pumps, pumping solutions)

- Sulzer AG (Subsea pumps, centrifugal pumps)

- Baker Hughes Incorporated (Subsea pumps, subsea systems)

- FMC Technologies, Inc. (Subsea pumps, subsea equipment)

- ITT Bornemann GmbH (Subsea pumps, screw pumps)

Recent Developments

- In April, 2024, Baker Hughes will supply Snam, with three turbocompressors driven by NovaLT 12 gas turbine technology, offering fuel flexibility of up to 10% hydrogen blend with natural gas.

- In March 2024, NOV’s Subsea Production Systems (SPS) business unit signed a contract with an undisclosed customer to deliver an actively heated flexible pipe system for a gas project in the Black Sea. NOV will supply its first active heated pipe system in 2025, introducing a proprietary technology solution of electrically heating the bore of the pipe through the resistance of the pipe’s inner carcass layer.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with deeper offshore exploration and mature field redevelopment projects.

- Operators will prioritize energy-efficient and low-emission subsea pumping solutions.

- Integration of digital monitoring and predictive maintenance will enhance operational reliability.

- Modular and standardized pump designs will reduce installation time and costs.

- Investments will grow in multiphase and hybrid pumping technologies for flexible operations.

- Collaboration between oilfield service providers and equipment manufacturers will increase.

- Asia Pacific and Latin America will emerge as high-growth regions for new installations.

- Replacement and retrofit demand will strengthen in Europe and North America.

- Continuous R&D in materials and corrosion resistance will extend equipment lifespan.

- Automation and AI-based control systems will improve productivity and minimize downtime.