Market Overview

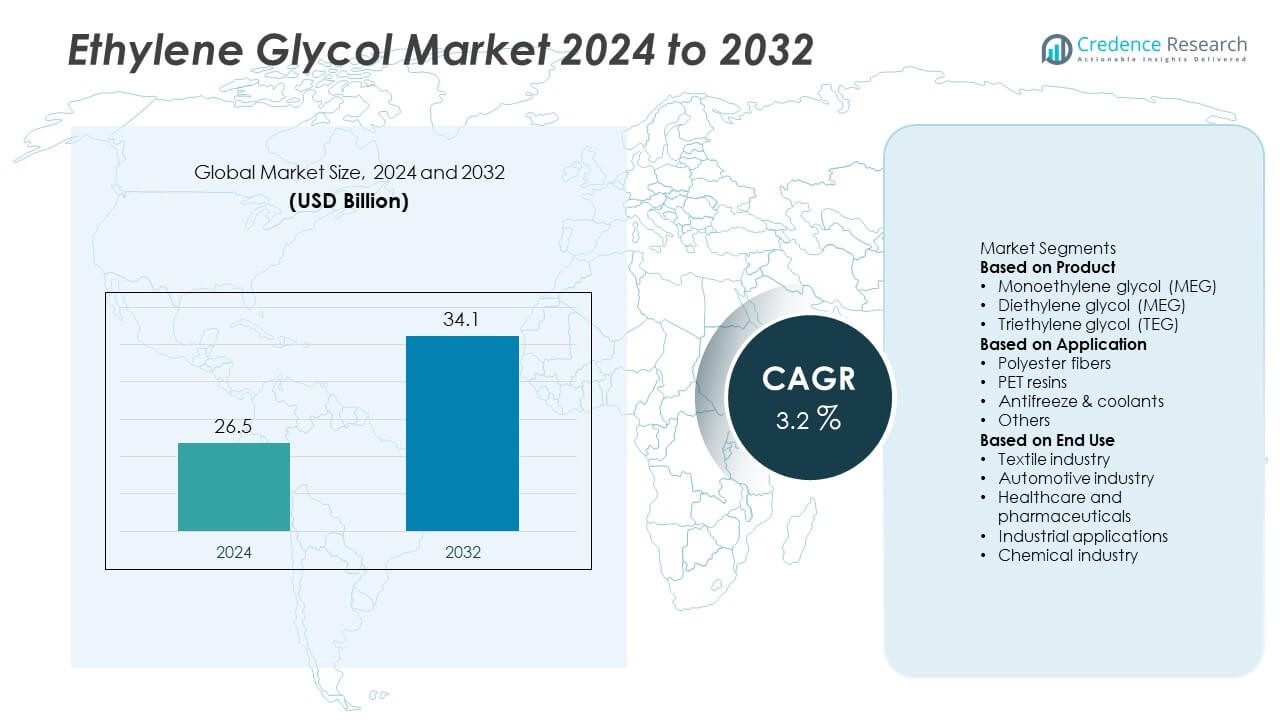

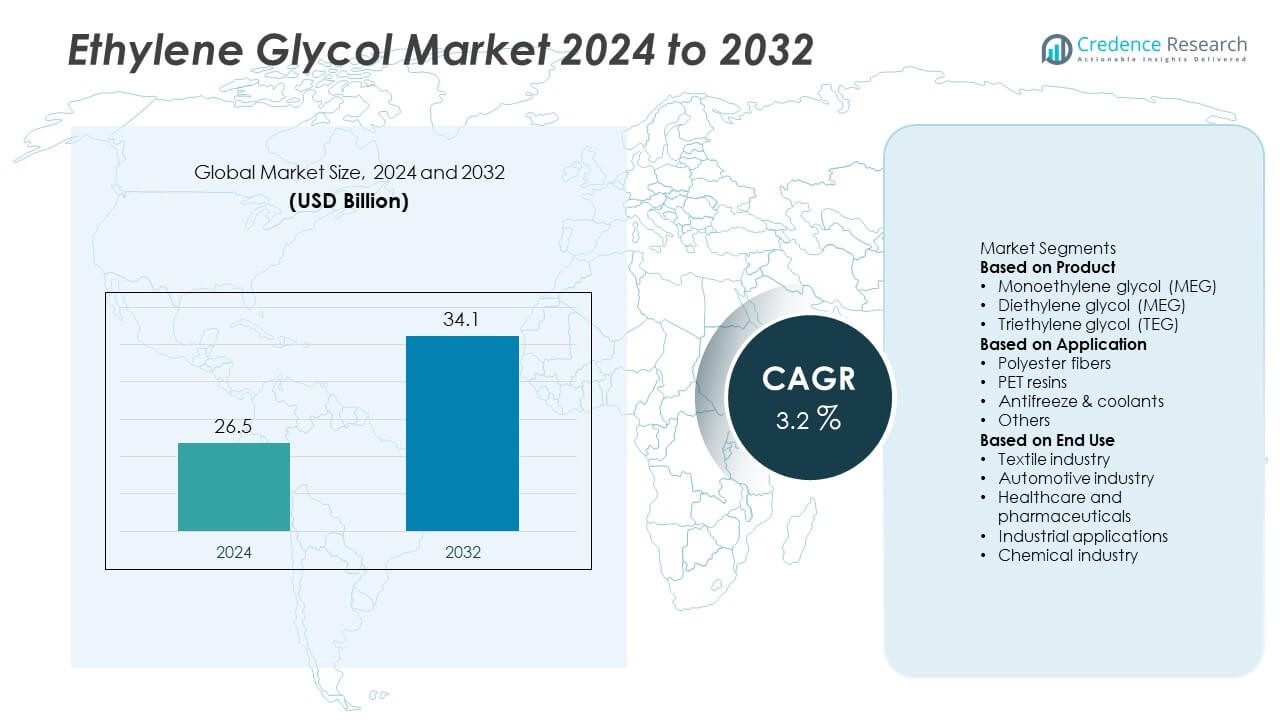

The Ethylene Glycol Market size was valued at USD 26.5 billion in 2024 and is projected to reach USD 34.1 billion by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylene Glycol Market Size 2024 |

USD 26.5 Billion |

| Ethylene Glycol Market, CAGR |

3.2% |

| Ethylene Glycol Market Size 2032 |

USD 34.1 Billion |

The Ethylene Glycol Market grows steadily due to strong demand from polyester fiber, PET resin, and automotive coolants. Rising textile consumption in emerging economies, coupled with expanding packaging needs, reinforces large-scale adoption. It benefits from urbanization, rising disposable incomes, and industrial development across Asia-Pacific and Latin America.

The Ethylene Glycol Market demonstrates strong geographical diversity, with Asia-Pacific leading demand through large-scale polyester fiber and PET resin production in China, India, and Southeast Asia. North America maintains steady growth driven by advanced automotive, packaging, and construction sectors, while Europe emphasizes sustainable production methods and eco-friendly applications. Latin America and the Middle East & Africa show rising demand supported by expanding urbanization, industrial development, and petrochemical investments. It benefits from increasing infrastructure projects and consumer-driven growth in these regions. Key players such as BASF SE, LOTTE Chemical, LyondellBasell, and Mitsubishi Chemical focus on strategic expansions, technology upgrades, and sustainability initiatives to strengthen their global presence. Their investment in bio-based alternatives, advanced catalysts, and integrated production facilities enhances efficiency and competitiveness across regional markets, ensuring the product remains essential in both traditional and emerging applications worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Ethylene Glycol Market size was valued at USD 26.5 billion in 2024 and is projected to reach USD 34.1 billion by 2032, growing at a CAGR of 3.2%.

- Rising demand from polyester fiber and PET resin industries drives consumption, supported by population growth, urbanization, and affordability of polyester textiles.

- Strong trends include a shift toward bio-based ethylene glycol and the integration of advanced catalysts and digital monitoring in production processes.

- Competitive landscape features global players such as BASF SE, Dow Chemical, LOTTE Chemical, and Mitsubishi Chemical focusing on capacity expansion and sustainability.

- Key restraints include volatile crude oil prices, dependence on petrochemical feedstocks, and regulatory pressures on emissions and fossil-based production methods.

- Asia-Pacific leads consumption due to its large textile and packaging base, while North America and Europe maintain steady growth with advanced automotive and construction applications.

- Latin America and the Middle East & Africa show emerging opportunities, supported by industrial development, petrochemical projects, and rising demand for packaging and automotive products.

Market Drivers

Rising Demand from Polyester Fiber and Textile Industry

The Ethylene Glycol Market expands steadily with strong demand from the polyester fiber industry. Polyester fibers dominate global textile applications due to durability, affordability, and versatility. It enables efficient production of fabrics used in clothing, furnishings, and industrial materials. Rapid urbanization and population growth fuel higher consumption of polyester-based textiles in emerging economies. Rising middle-class income levels support broader adoption of affordable apparel in Asia-Pacific. The integration of advanced manufacturing technologies further improves fabric quality, securing consistent demand for ethylene glycol.

- For instance, For 2023, Indorama Ventures had a consolidated production volume of 13.87 million tonnes across its business segments: Combined PET, Fibers, and Indovinya. Operating globally, the company uses significant amounts of mono-ethylene glycol (MEG) as a crucial raw material for its polyester products.

Growth in Packaging Applications and PET Resin Production

Polyethylene terephthalate (PET) resin production acts as a key growth driver for the Ethylene Glycol Market. PET resins are widely applied in packaging for beverages, food, and consumer goods. It supports the rising demand for lightweight, durable, and recyclable packaging solutions. Increasing consumer preference for bottled water and carbonated drinks continues to strengthen market needs. Expanding global e-commerce activity also increases consumption of safe and sustainable packaging materials. Regulations promoting recyclable products further accelerate PET resin demand and secure ethylene glycol usage.

- For instance, Indorama Ventures has recycled 150 billion post-consumer PET bottles since 2011, with global operations now processing 789 bottles every second, reflecting significant material reuse feeding back into its resin production network.

Expanding Automotive and Industrial Coolants Segment

The automotive sector represents another major contributor to the Ethylene Glycol Market. Coolants and antifreeze products use ethylene glycol extensively to maintain engine performance. It ensures thermal stability, corrosion resistance, and year-round protection in internal combustion engines. The steady rise of vehicle ownership in developing regions directly increases coolant consumption. Heavy industries, power plants, and chemical processing facilities also rely on ethylene glycol-based coolants. These applications extend the product’s role beyond transportation, solidifying its industrial relevance.

Infrastructure Growth and Construction Industry Applications

The construction industry contributes to the growth of the Ethylene Glycol Market through usage in paints, adhesives, and coatings. Ethylene glycol enhances performance by providing improved drying, durability, and moisture resistance. It plays an essential role in construction materials supporting large-scale infrastructure projects. Rapid urban development and government-led housing initiatives drive strong consumption in developing nations. Paints and coatings used in residential and commercial buildings remain consistent demand drivers. Continuous infrastructure spending reinforces ethylene glycol’s role in construction-related applications across global markets.

Market Trends

Shift Toward Bio-Based and Sustainable Production Methods

The Ethylene Glycol Market shows a clear shift toward bio-based alternatives driven by sustainability goals. Traditional production relies heavily on fossil fuels, which face regulatory and environmental pressures. It now benefits from growing research in renewable feedstocks such as bio-ethanol. Leading manufacturers invest in green ethylene glycol projects to reduce carbon emissions. This transition aligns with global commitments to achieve climate-neutral operations. Rising consumer awareness about sustainable products strengthens adoption and supports long-term growth.

- For instance, India Glycols Limited produces up to 175,000 tonnes of various bio-glycols (including mono-ethylene glycol) annually from molasses-derived ethanol. This positions the company as one of the largest bio-glycol producers worldwide, particularly noted for its unique molasses-based manufacturing process.

Technological Advancements in Manufacturing Processes

Innovation in process technology continues to shape the Ethylene Glycol Market. Advanced catalysts and energy-efficient production methods reduce operational costs while improving yields. It enhances profitability for large-scale manufacturers facing competitive global pricing. Integrated petrochemical complexes provide economies of scale and strengthen supply stability. Continuous digitalization improves monitoring, control, and process safety in plants. These advancements reflect a trend toward efficiency-focused solutions that reinforce competitiveness.

- For instance, Shell’s OMEGA (Only Mono-Ethylene Glycol Advantage) technology achieves a selectivity of over 99% toward mono-ethylene glycol, compared with conventional processes that yield only about 90%, significantly reducing byproduct waste and energy consumption.

Increasing Applications Across Emerging End-Use Industries

Diversification of applications creates new opportunities for the Ethylene Glycol Market. Demand extends beyond textiles, packaging, and automotive to include electronics, pharmaceuticals, and specialty chemicals. It supports the production of solvents, plasticizers, and resins with growing niche uses. Expansion of consumer electronics drives higher demand for heat transfer fluids. Pharmaceutical industries increasingly explore glycol derivatives for controlled formulations. Such diversification strengthens resilience against market volatility in traditional segments.

Regional Expansion and Strategic Capacity Investments

Global capacity expansion remains a strong trend in the Ethylene Glycol Market. Producers establish new plants in Asia-Pacific and Middle East regions to capture growing demand. It ensures closer proximity to raw material sources and fast-developing consumer markets. Strategic partnerships and joint ventures accelerate investment in high-capacity projects. Regional governments support infrastructure development, enabling faster deployment of large-scale facilities. These investments reflect a trend toward securing supply chains and market dominance.

Market Challenges Analysis

Environmental Regulations and Sustainability Pressures

The Ethylene Glycol Market faces significant challenges from rising environmental regulations. Traditional production depends on petrochemical feedstocks, which raise concerns about carbon emissions and resource depletion. It must comply with strict standards that increase operational costs and limit expansion in certain regions. Growing restrictions on fossil fuel-based products push manufacturers to explore greener alternatives. Bio-based production remains costly and limited in scale, creating difficulties in meeting global demand. Market players balance profitability with the need to invest heavily in sustainable technologies.

Volatile Raw Material Prices and Global Supply Risks

Dependence on crude oil derivatives exposes the Ethylene Glycol Market to raw material price fluctuations. Volatility in oil and natural gas markets creates uncertainty for producers and end users. It impacts profitability and disrupts supply agreements across global value chains. Geopolitical instability in energy-rich regions further adds to cost unpredictability. Supply chain disruptions, such as shipping delays and trade restrictions, intensify these challenges. The need for stable sourcing strategies forces companies to diversify feedstock and optimize production networks.

Market Opportunities

Expansion of Bio-Based Alternatives and Green Technologies

The Ethylene Glycol Market presents strong opportunities through the adoption of bio-based technologies. Rising demand for sustainable chemicals creates space for investment in renewable feedstocks. It enables companies to differentiate products and align with environmental regulations. Government incentives and corporate sustainability targets encourage wider acceptance of green ethylene glycol. Partnerships between chemical producers and biotechnology firms accelerate innovation in this field. Expanding green capacity offers both market growth and a long-term competitive advantage.

High Growth Potential in Emerging Economies and New Applications

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East creates untapped opportunities for the Ethylene Glycol Market. Rising urban populations increase demand for textiles, packaging, and automotive products. It supports long-term consumption growth across both consumer and industrial sectors. Emerging applications in electronics, pharmaceuticals, and specialty chemicals extend product use beyond traditional industries. Infrastructure investments in developing regions also enhance adoption in construction materials and paints. These factors establish strong opportunities for global producers to diversify and expand reach.

Market Segmentation Analysis:

By Product

The Ethylene Glycol Market is segmented by product into monoethylene glycol (MEG), diethylene glycol (DEG), and triethylene glycol (TEG). MEG dominates due to its widespread application in polyester fiber and PET resin production. It serves as the primary raw material in the textile and packaging industries. DEG finds demand in applications such as solvents, lubricants, and plasticizers, providing value in industrial formulations. TEG is applied in gas dehydration, heat transfer fluids, and specialty chemical processing. Each product type addresses specific industrial requirements, reinforcing ethylene glycol’s versatile role across sectors.

- For instance, SABIC operates a MEG production facility in Jubail with a capacity exceeding 700,000 tonnes per year, supplying polyester and PET producers globally, while LyondellBasell expanded TEG output at its Bayport plant to 45,000 tonnes annually to meet rising demand in gas dehydration applications.

By Application

Applications of ethylene glycol span polyester fiber, PET resin, antifreeze and coolants, films, and industrial solvents. Polyester fiber remains the largest segment, driven by global demand for affordable textiles and apparel. It supports steady growth in developing regions with rising urban populations. PET resin applications expand rapidly with high consumption in beverage and food packaging. Antifreeze and coolants ensure engine efficiency, supporting demand from the automotive industry. Industrial solvents and film applications extend market reach to niche end users such as electronics and coatings.

- For instance, Indorama Ventures produced 13.9 million tonnes of product, including polyester fibers and yarn, in 2023, requiring large-scale MEG consumption. Meanwhile, BASF’s Glysantin® coolant range is supplied to millions of vehicles worldwide each year, demonstrating the scale of ethylene glycol usage in automotive antifreeze formulations.

By End Use

End-use segmentation highlights the role of ethylene glycol in textiles, packaging, automotive, construction, and industrial processing. The textile sector accounts for a major share due to polyester fiber integration in fabrics and furnishings. It supports the steady expansion of affordable clothing markets worldwide. Packaging represents another strong end-use segment with increasing demand for PET bottles and containers. Automotive applications strengthen usage in coolants and heat transfer fluids, ensuring vehicle performance. Construction and industrial sectors contribute through adoption in paints, adhesives, and chemical formulations. These diverse end uses establish ethylene glycol as a critical material across multiple industries.

Segments:

Based on Product

- Monoethylene glycol (MEG)

- Diethylene glycol (MEG)

- Triethylene glycol (TEG)

Based on Application

- Polyester fibers

- PET resins

- Antifreeze & coolants

- Others

Based on End Use

- Textile industry

- Automotive industry

- Healthcare and pharmaceuticals

- Industrial applications

- Chemical industry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 22% share of the Ethylene Glycol Market in 2024, supported by strong industrial demand and advanced infrastructure. The United States remains the dominant country, driven by large-scale polyester fiber imports, packaging needs, and automotive coolant applications. It benefits from a mature automotive industry where ethylene glycol plays a vital role in antifreeze and heat transfer fluids. Rising investment in sustainable packaging solutions boosts PET resin consumption across beverage and food sectors. Canada contributes through rising industrial activities and growing adoption of environmentally conscious construction materials. The region’s regulatory focus on reducing emissions and promoting bio-based chemicals creates opportunities for innovative production methods. Strong research capabilities and advanced petrochemical facilities position North America as a steady growth hub.

Europe

Europe accounts for a 19% share of the Ethylene Glycol Market, supported by strict environmental regulations and a mature textile and packaging industry. Germany, France, and the United Kingdom lead demand with established automotive and industrial sectors. It benefits from rising emphasis on recyclable materials, which increases PET resin demand. The region also invests in research and development of bio-based ethylene glycol to align with sustainability targets. Demand from paints, coatings, and adhesives in construction applications further contributes to steady growth. Eastern Europe demonstrates rising consumption with expanding industrial bases in Poland and Hungary. Overall, Europe balances strong environmental focus with consistent consumption across multiple end-use industries.

Asia-Pacific

Asia-Pacific dominates the Ethylene Glycol Market with a 44% share in 2024, making it the largest regional consumer. China leads demand with massive polyester fiber and PET resin industries serving both domestic and export markets. It benefits from low-cost manufacturing capacity, strong government support for industrial growth, and rapid urbanization. India contributes significantly with expanding packaging and automotive industries, supported by a large consumer base. Southeast Asian nations such as Vietnam and Indonesia strengthen regional growth through textile manufacturing and industrial applications. Rising income levels, urban migration, and infrastructure development fuel long-term demand for ethylene glycol. Regional producers also expand capacity to meet both local consumption and international exports, reinforcing Asia-Pacific’s market leadership.

Latin America

Latin America represents a 7% share of the Ethylene Glycol Market, supported by industrial development and growing consumer demand. Brazil dominates consumption, with rising use in automotive, textiles, and packaging applications. It benefits from increasing production of PET bottles and demand for polyester-based textiles. Mexico contributes strongly with expanding automotive manufacturing and packaging industries. Other countries, including Argentina and Chile, gradually increase adoption across industrial chemicals and construction materials. Limited local production capabilities often create reliance on imports, which can influence pricing trends. Despite these challenges, regional demand remains steady due to growing population and urbanization.

Middle East & Africa

The Middle East & Africa hold an 8% share of the Ethylene Glycol Market, primarily supported by abundant raw material availability. Countries such as Saudi Arabia and the United Arab Emirates invest heavily in petrochemical complexes to supply global markets. It benefits from strategic geographic location that supports large-scale exports to Asia and Europe. Domestic demand grows in packaging, textiles, and construction, reflecting rising urban development. Africa demonstrates increasing consumption, with South Africa leading demand in automotive and industrial sectors. Expansion of downstream petrochemical projects enhances the region’s production capacity. Strategic investments position the Middle East & Africa as both a producer and emerging consumer of ethylene glycol.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Formosa Plastics

- Mitsubishi Chemical

- LOTTE Chemical

- Dow Chemical

- BASF SE

- Indian Oil

- LyondellBasell

- Eastman Chemical

- Ineos Group

- LG Chem

Competitive Analysis

The competitive landscape of the Ethylene Glycol Market includes BASF SE, Dow Chemical, Eastman Chemical, Formosa Plastics, Indian Oil, Ineos Group, LG Chem, LOTTE Chemical, LyondellBasell, and Mitsubishi Chemical. These companies compete through large-scale production capacity, technological innovation, and global distribution networks that ensure steady supply to diverse industries. It is shaped by investments in bio-based alternatives, with leading producers developing sustainable pathways to reduce environmental impact and comply with regulations. Strategic expansions in Asia-Pacific and the Middle East strengthen cost advantages by leveraging access to raw materials and high-growth markets. Companies focus on integrated petrochemical complexes, enabling efficiency and economies of scale in production. Digital monitoring and advanced catalysts further enhance operational performance, supporting cost control in a volatile raw material environment. Collaborations and joint ventures expand market reach and reinforce competitiveness across regions. The sector reflects a balance of sustainability-driven innovation and traditional petrochemical capacity, positioning leading firms to meet evolving demand globally.

Recent Developments

- In September 2025, Mitsubishi Chemical joined Asahi Kasei and Mitsui Chemicals in a new limited liability partnership focused on two ethylene manufacturing facilities in western Japan, aiming to drive production optimization and carbon neutrality by 2030.

- In June 2025, Eastman Chemical revealed that its Kingsport, Tennessee recycling facility processes 110,000 metric tons annually of polyester waste into ethylene glycol and other monomers, reaching steady operating rates of approximately 70% capacity as of mid-2024.

- In February 2025, Indian Oil Corporation completed a revamp of its Panipat plant, boosting its Mono Ethylene Glycol (MEG) capacity to 425,000 tpy, and enabling an Ethylene Recovery Unit to handle off-gas.

- In May 2024, INEOS Group completed its acquisition of LyondellBasell’s ethylene oxide and derivatives business in Bayport, Texas, adding a 420,000 t/yr EO plant, a 375,000 t/yr EG plant, and a 165,000 t/yr glycol ethers plant to its portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polyester fiber and PET resin will continue to drive long-term growth.

- Bio-based ethylene glycol will gain traction due to rising sustainability regulations.

- Technological advancements in catalysts will improve production efficiency and cost control.

- Automotive coolants and antifreeze applications will remain stable with expanding vehicle use.

- Packaging demand will increase with growth in beverages, food, and e-commerce sectors.

- Asia-Pacific will strengthen its leadership with large-scale textile and industrial production.

- North America and Europe will focus on eco-friendly solutions and process innovation.

- Middle East investments in petrochemical complexes will expand global supply capacity.

- Diversification into pharmaceuticals, electronics, and specialty chemicals will create new opportunities.

- Strategic partnerships and capacity expansions will define competitive positioning among global players.