Market Overview:

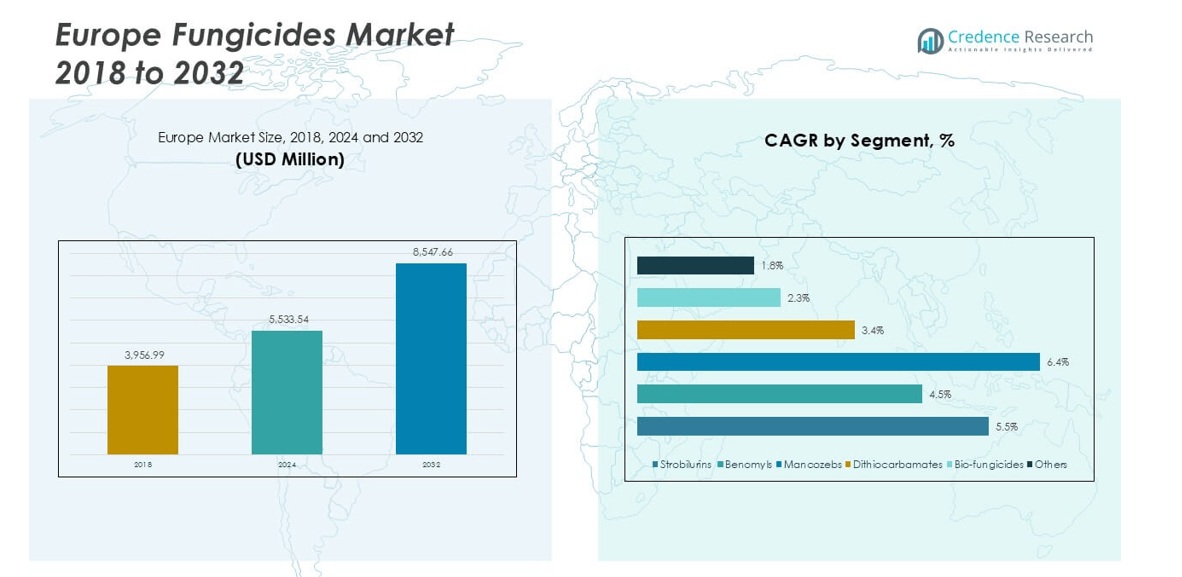

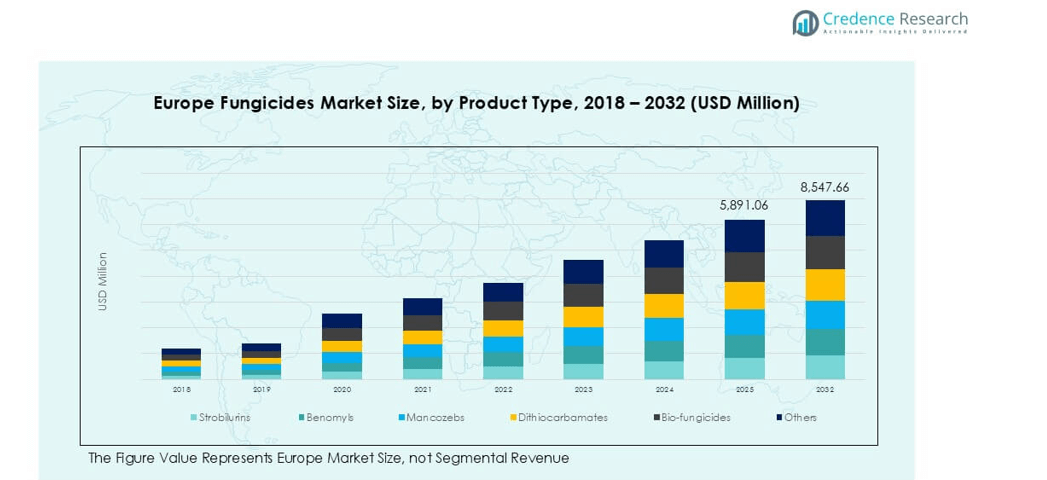

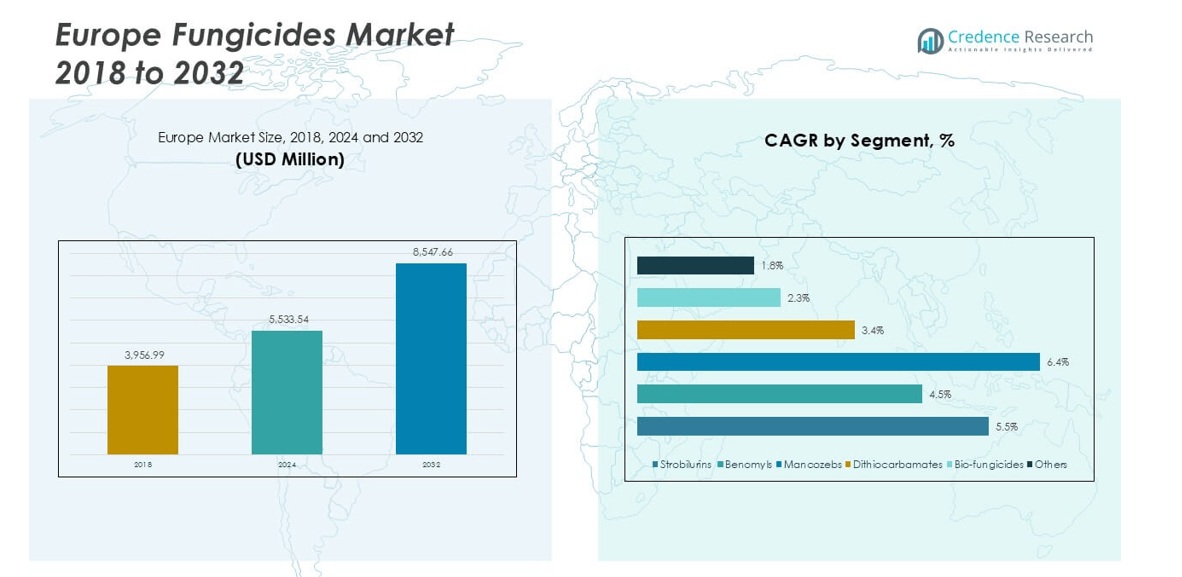

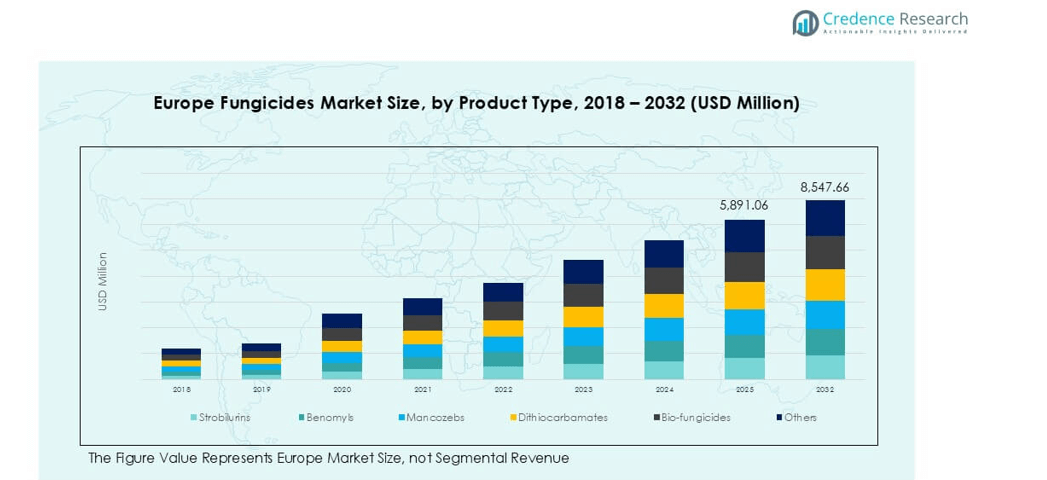

Europe Fungicides market size was valued at USD 3,956.99 million in 2018, increased to USD 5,533.54 million in 2024, and is anticipated to reach USD 8,547.66 million by 2032, at a CAGR of 5.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Fungicides Market Size 2024 |

USD 5,533.54 million |

| Europe Fungicides Market, CAGR |

5.46% |

| Europe Fungicides Market Size 2032 |

USD 8,547.66 million |

The Europe fungicides market is dominated by top players including BASF SE, Bayer AG, Syngenta Group, Corteva Agriscience, FMC Corporation, UPL Limited, ADAMA Agricultural Solutions, Nufarm Limited, Sumitomo Chemical Co., Ltd., and Cheminova A/S. These companies maintain strong positions through advanced formulations, sustainable crop protection solutions, and extensive distribution networks. Western Europe leads the regional market with over 40% share, driven by intensive horticulture, vineyards, and cereals production. Southern Europe follows with nearly 25% share, supported by fruit and vegetable exports. Northern and Eastern Europe together account for around 30%, while Central Europe represents about 5%, reflecting its niche yet high-quality agricultural practices.

Market Insights

- The Europe Fungicides Market was valued at USD 5,533.54 million in 2024 and is anticipated to reach USD 8,547.66 million by 2032, growing at a CAGR of 5.46%.

- Strong demand from fruits and vegetables, which hold the dominant application share, drives adoption, supported by cereals and grains as the second-largest segment.

- Key trends include the shift toward bio-fungicides and sustainable solutions, alongside digital agriculture tools that optimize fungicide use and improve compliance.

- Leading companies such as BASF SE, Bayer AG, Syngenta, Corteva, FMC, and UPL strengthen competitiveness with innovation pipelines, regulatory compliance, and regional expansion strategies.

- Western Europe holds over 40% market share, followed by Southern Europe at nearly 25%, while Northern and Eastern Europe together contribute about 30%; strobilurins remain the leading product type across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Europe fungicides market, strobilurins dominate with the largest market share due to their broad-spectrum activity and effectiveness against fungal resistance. Their adoption has grown in intensive agriculture, particularly in wheat and grape cultivation, where crop losses are high without fungicidal protection. Mancozebs also remain significant, offering multi-site action and cost efficiency, while dithiocarbamates support large-scale cereal production. Bio-fungicides are gaining momentum with sustainable farming initiatives, though their share is smaller. The overall product demand is shaped by regulatory compliance, rising crop protection needs, and resistance management strategies.

- For instance, Bayer produces and markets Serenade ASO, a bio-fungicide based on Bacillus amyloliquefaciens strain QST 713 (previously known as Bacillus subtilis) for use on fruits and vegetables.

By Application

Among applications, fruits and vegetables account for the dominant share in Europe, driven by high-value horticulture and export-oriented farming. Producers rely on fungicides to protect crops such as grapes, apples, and tomatoes from mildew and rot, ensuring quality and longer shelf life. Cereals and grains follow closely, supported by large-scale wheat and barley cultivation across the region. Ornamentals also use fungicides for disease prevention in floriculture. Growing consumer demand for safe, blemish-free produce strengthens fungicide use in fruits and vegetables, particularly under strict EU food safety standards.

- For instance, Bayer launched its Luna Sensation fungicide for protected strawberries in the UK market in the mid-2010s, after successful trials.

Market Overview

Stringent Food Safety and Quality Standards

The European Union enforces strict food safety regulations, encouraging the use of effective and compliant fungicides. Farmers adopt fungicidal solutions to meet residue limits, certification programs, and international trade requirements. Regulatory frameworks such as the Sustainable Use Directive support controlled yet essential usage. This creates sustained demand for advanced formulations with improved efficacy and reduced environmental impact. Compliance with evolving rules ensures crop protection while preserving market access in global exports, driving continued reliance on fungicides across agricultural segments.

- For instance, Corteva Agriscience launched its fungicide Inatreq active across several EU countries in 2021, marking the first new mode of action for cereals in over 15 years, designed to meet residue compliance standards.

Rising Demand for High-Value Crops

The growth of Europe’s fungicides market is fueled by the expanding production of fruits, vegetables, and ornamentals. These high-value crops require strong protection against fungal diseases to meet export quality and food safety standards. Growers adopt advanced fungicides to reduce yield losses from powdery mildew, downy mildew, and blights. The strong export orientation of European horticulture, particularly in countries like Spain, Italy, and the Netherlands, continues to strengthen reliance on fungicides. Rising consumer expectations for fresh, blemish-free produce further drive adoption.

- For instance, Bayer’s Luna Experience fungicide is sold for ornamental crops, as well as a wide range of fruit and vegetable crops, globally.

Expansion of Sustainable and Organic Farming

Growing consumer preference for organic and environmentally safe products boosts demand for bio-fungicides. These eco-friendly solutions align with EU Green Deal objectives and Farm to Fork strategy, which promote reduced chemical inputs. Bio-fungicides gain traction in both large-scale farms and niche organic production due to compatibility with integrated pest management practices. The market experiences rising innovation in microbial and plant-based formulations, supporting sustainability goals. This shift towards greener alternatives creates strong growth opportunities while addressing concerns about resistance and environmental safety.

Key Trends & Opportunities

Adoption of Advanced Formulations

Innovation in fungicides focuses on extended residual activity, resistance management, and reduced environmental impact. Companies develop formulations with novel active ingredients and combined modes of action to improve efficacy. Encapsulation technologies and precision application methods enhance efficiency while minimizing residues. These innovations not only meet regulatory standards but also provide growers with effective tools to sustain yields. The trend creates opportunities for firms investing in R&D to deliver next-generation crop protection solutions.

- For instance, Corteva Agriscience introduced Inatreq active in 2021, the first new fungicide mode of action for cereals in Europe in over 15 years, applied across more than 3 million hectares by 2022.

Rising Integration of Digital Agriculture

The use of precision agriculture technologies opens new opportunities in fungicide application. Digital tools, including remote sensing, drones, and AI-based disease forecasting, enable targeted use of fungicides. This improves cost efficiency and ensures compliance with sustainability guidelines. European farmers increasingly adopt these practices to reduce chemical inputs while maintaining crop protection. The trend fosters growth for companies offering digital platforms alongside fungicidal products, highlighting the synergy between crop protection and smart farming.

Key Challenges

Regulatory Restrictions on Chemical Fungicides

The Europe fungicides market faces increasing restrictions on synthetic chemical products due to environmental and health concerns. EU legislation has already phased out several active ingredients and tightened maximum residue limits. These regulations challenge manufacturers and farmers who rely on traditional fungicides. Companies must invest heavily in developing compliant alternatives, while growers must adapt practices to ensure productivity. The regulatory landscape increases operational costs and slows product availability, pressuring the overall market.

Fungal Resistance and Reduced Efficacy

Rising resistance among fungal pathogens limits the long-term effectiveness of widely used fungicides like strobilurins and triazoles. Resistance development leads to higher application frequencies and greater input costs for farmers. It also drives the need for combination products and integrated pest management approaches. This challenge pushes the industry to innovate continuously in new active ingredients and resistance management strategies. Without such advancements, disease control remains uncertain, threatening yields and profitability in key crop segments.

Regional Analysis

Western Europe

Western Europe holds the largest market share of over 40% in the Europe fungicides market, driven by intensive agricultural practices and strong demand for crop protection. Countries like France, Germany, and Spain lead in fungicide adoption, particularly for fruits, vegetables, and vineyards. The region’s strict regulatory standards push innovation in advanced formulations and eco-friendly alternatives. High-value horticulture and export-oriented farming further sustain demand. Adoption of bio-fungicides is growing due to sustainability programs, yet chemical fungicides remain dominant. Western Europe continues to set the benchmark for quality and compliance, maintaining its leadership position in the regional market.

Southern Europe

Southern Europe accounts for nearly 25% of the market share, supported by favorable climatic conditions for horticulture and extensive fruit and vegetable production. Countries such as Italy, Spain, and Greece heavily rely on fungicides to combat fungal infections in vineyards, olive groves, and greenhouse farming. The warm and humid environment increases the risk of fungal outbreaks, driving consistent use of protective solutions. Export demand for grapes, citrus fruits, and tomatoes also reinforces reliance on fungicides. Southern Europe’s strong agribusiness base and export orientation ensure steady demand, making it a critical growth contributor in the regional landscape.

Northern Europe

Northern Europe contributes around 18% of the regional fungicides market share, primarily driven by cereals, grains, and oilseed cultivation. Countries like the UK, Denmark, and Sweden have large-scale farming operations that depend on fungicides for yield protection. Regulatory frameworks encourage integrated pest management, supporting a gradual shift towards sustainable fungicidal solutions. While chemical fungicides remain important, bio-fungicides are steadily expanding, especially in countries with strong organic farming adoption. Growing demand for export-quality grains and compliance with EU food safety standards sustain market expansion, positioning Northern Europe as a consistent and regulated user of fungicides.

Eastern Europe

Eastern Europe represents about 12% of the Europe fungicides market share, with growth fueled by expanding agricultural modernization in Poland, Hungary, and Romania. The region relies on fungicides for cereals, grains, and vegetable farming, where yield protection is critical for food security. Adoption of advanced formulations is slower compared to Western regions, but investment in agritech and modernization programs supports increasing usage. Rising government support for sustainable farming practices promotes gradual integration of bio-fungicides. Eastern Europe offers strong growth potential due to its vast cultivable land, improving mechanization, and growing alignment with EU agricultural standards.

Central Europe

Central Europe holds close to 5% of the regional market share, led by countries such as Austria, Switzerland, and Czech Republic. The market is smaller in scale but demonstrates steady demand in specialized farming, including vineyards, pulses, and high-value crops. Strong environmental regulations and consumer preference for organic products drive bio-fungicide adoption at a faster rate than in other regions. While traditional fungicides are still used, integrated pest management practices dominate, aligning with EU sustainability objectives. Central Europe’s focus on niche agricultural products and premium quality standards makes it a specialized but important segment in the regional market.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Western Europe

- Southern Europe

- Northern Europe

- Eastern Europe

- Central Europe

Competitive Landscape

The Europe fungicides market is highly consolidated, with leading players such as BASF SE, Bayer AG, Syngenta Group, Corteva Agriscience, FMC Corporation, and UPL Limited holding strong positions through extensive product portfolios and innovation pipelines. These companies emphasize research in novel active ingredients, resistance management, and eco-friendly formulations to comply with evolving EU regulations. ADAMA Agricultural Solutions, Nufarm Limited, and Sumitomo Chemical Co. expand their regional presence by focusing on cost-effective products and targeted crop solutions. Strategic initiatives include mergers, acquisitions, and collaborations to strengthen distribution networks and expand market access. Recent developments highlight a growing focus on bio-fungicides and digital farming integration to address sustainability targets. Competitive intensity remains high as firms balance regulatory pressures with the need for effective disease control. The landscape reflects a mix of global giants driving innovation and mid-sized companies leveraging niche opportunities across high-value crops and emerging farming practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG (Bayer CropScience)

- Syngenta Group

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- ADAMA Agricultural Solutions Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd. (Europe operations)

- Cheminova A/S

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fungicides will rise with expanding fruit and vegetable production.

- Bio-fungicides adoption will increase due to EU sustainability and organic farming targets.

- Advanced formulations with multi-site action will address fungal resistance issues.

- Digital agriculture tools will support precision fungicide applications for efficiency.

- Regulatory pressures will push companies to innovate in eco-friendly products.

- Strobilurins will maintain dominance but face gradual competition from biologicals.

- Western Europe will continue leading, supported by intensive horticulture and vineyards.

- Southern Europe will expand demand from greenhouse farming and export crops.

- Northern and Eastern Europe will see growth from cereals and oilseeds protection.

- Global players and regional firms will intensify competition through R&D and partnerships.