Market Overview

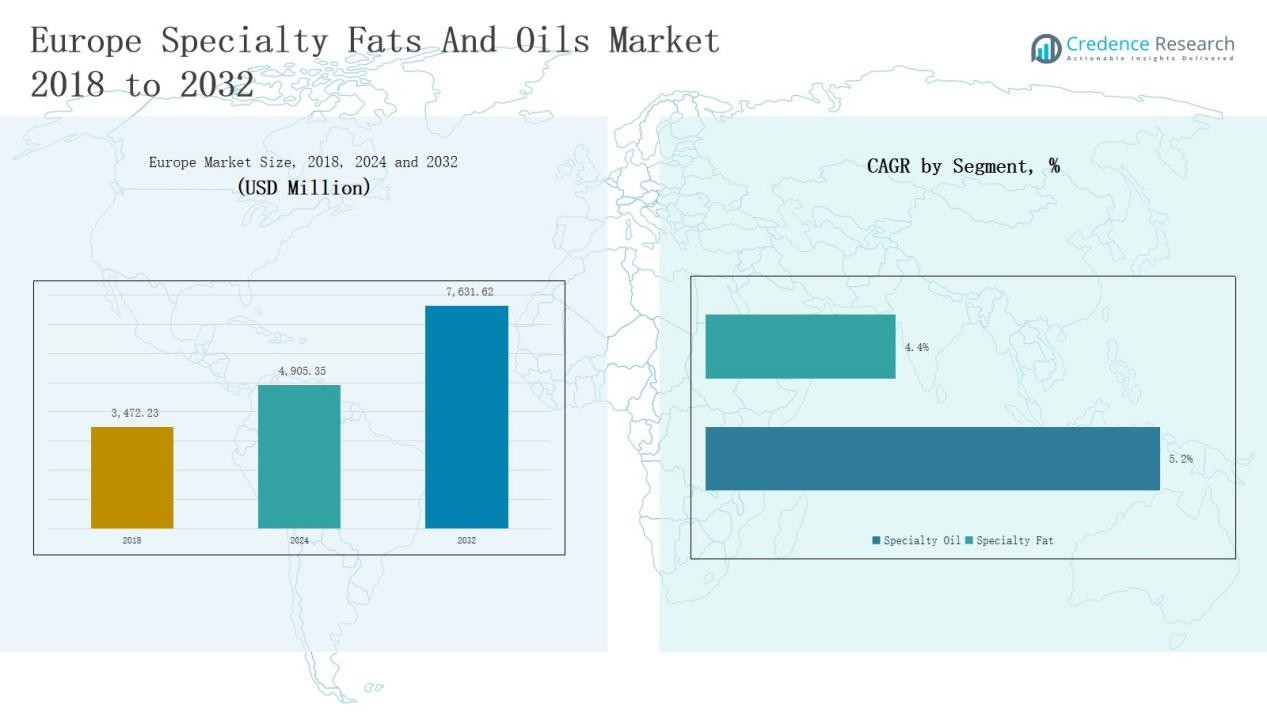

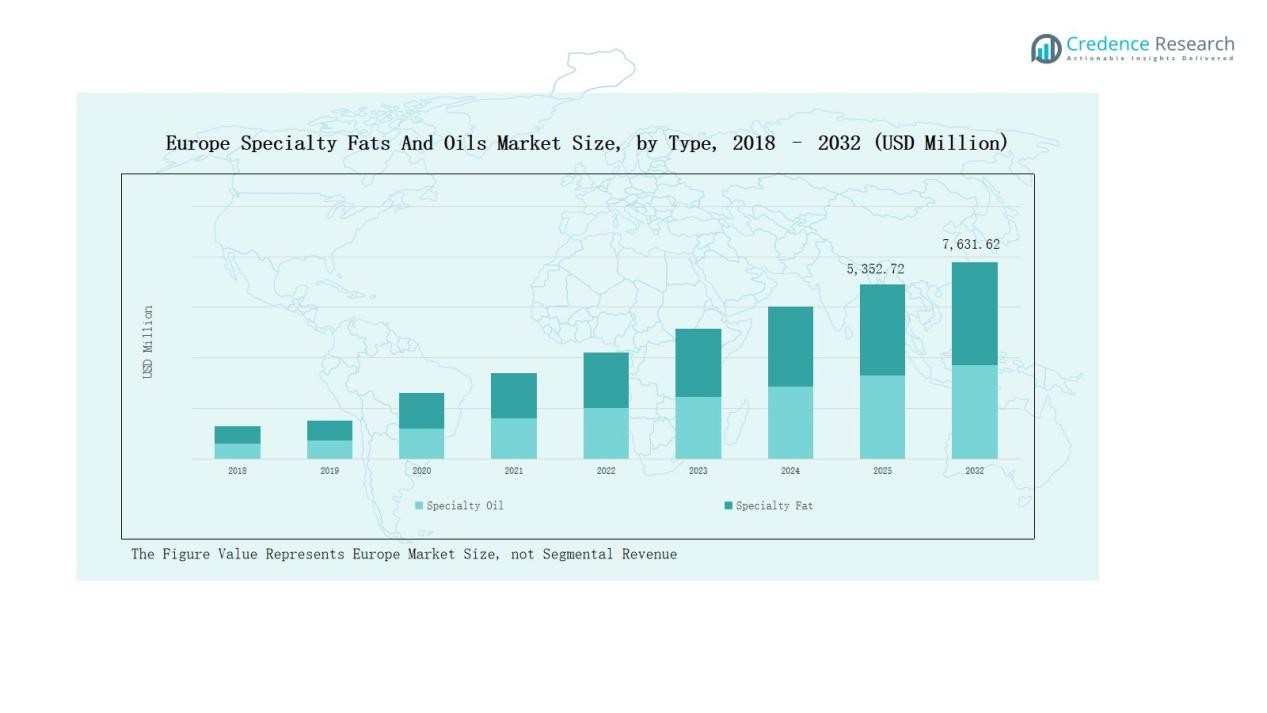

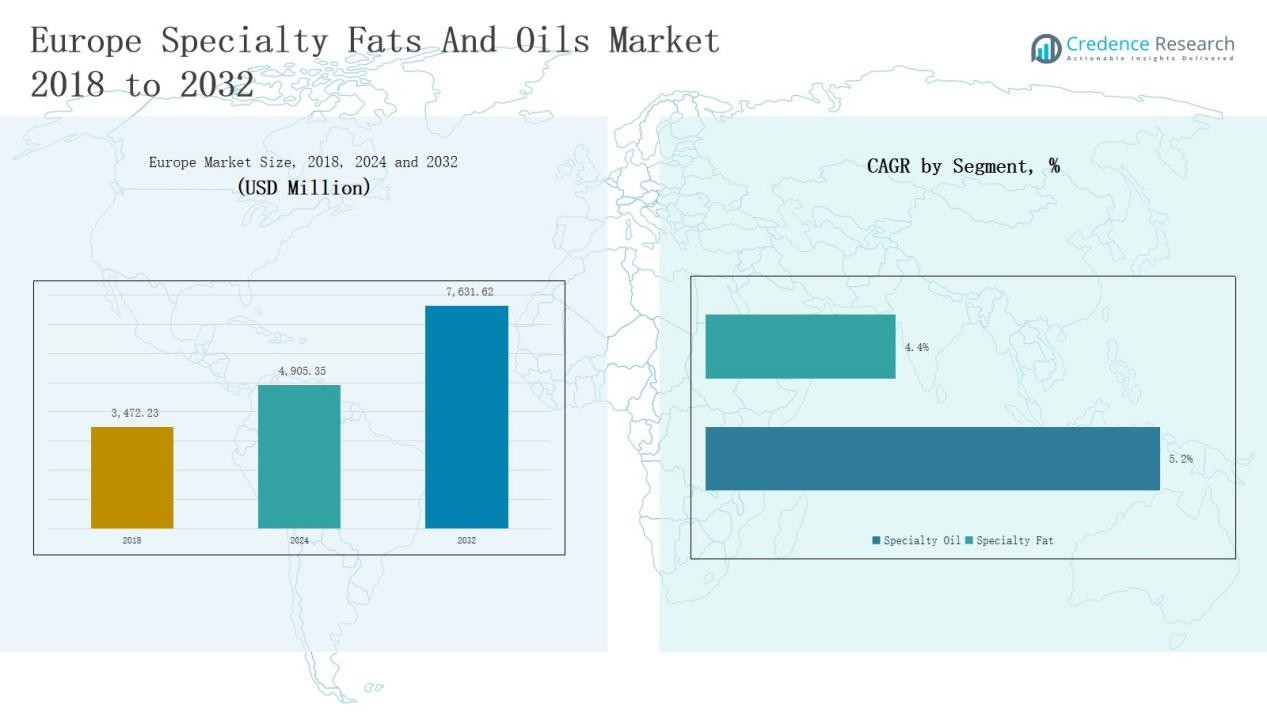

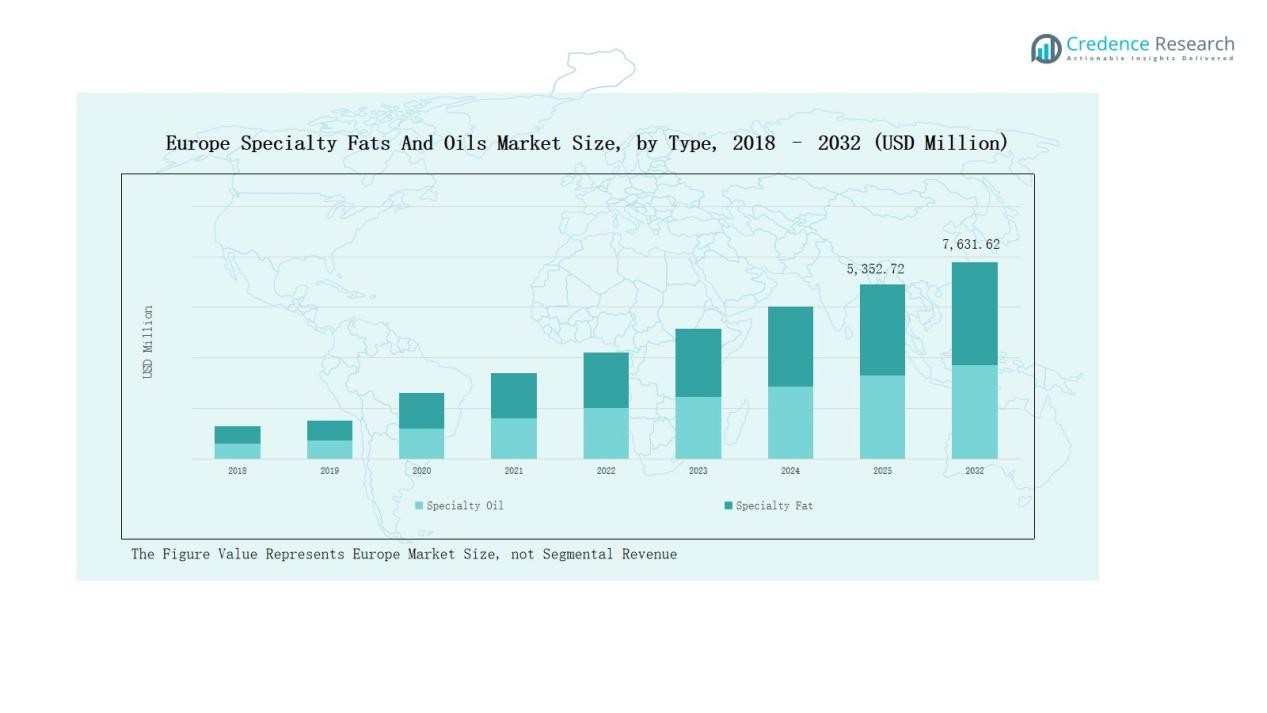

Europe Specialty Fats And Oils Market size was valued at USD 3,472.23 million in 2018 to USD 4,905.35 million in 2024 and is anticipated to reach USD 7,631.62 million by 2032, at a CAGR of 5.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Specialty Fats And Oils Market Size 2024 |

USD 4,905.35 Million |

| Europe Specialty Fats And Oils Market, CAGR |

5.20% |

| Europe Specialty Fats And Oils Market Size 2032 |

USD 7,631.62 Million |

The Europe Specialty Fats and Oils Market is shaped by prominent players including BASF SE, Dow, Solvay, Ashland, Lubrizol, Evonik, dsm-firmenich, Givaudan Active Beauty, Croda, Nouryon, CP Kelco, Gelymar, KitoZyme, EcoSynthetix, and Clariant. These companies maintain competitive strength through product innovation, sustainable sourcing practices, and partnerships with leading food manufacturers. They focus on developing trans-fat-free solutions, functional fats, and clean-label specialty oils to align with strict EU regulations and evolving consumer health preferences. Regionally, Germany leads the market with a 20% share, supported by its strong processed food, bakery, and chocolate industries, making it the largest contributor within Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Specialty Fats and Oils Market grew from USD 3,472.23 million in 2018 to USD 4,905.35 million in 2024, projected at USD 7,631.62 million by 2032.

- Specialty oils lead with 58% revenue share, where palm oil dominates at 28%, while bakery fats hold 18% within specialty fats, supported by industrial bakery demand.

- The industry application segment accounts for 46% share, with households contributing 32% and restaurants 15%, driven by Mediterranean cuisine and premium oil usage.

- By end user, chocolate dominates with 30% share, followed by bakery at 25%, while confectioneries account for 18% and infant food holds 12% market contribution.

- Germany leads regionally with 20% share, followed by France at 16%, the UK at 18%, Italy at 12%, Spain at 11%, Russia at 9%, and Rest of Europe with 14%.

Market Segment Insights

By Type

In Europe, specialty oils account for around 58% of market revenue, with palm oil dominating at nearly 28% due to its versatility in bakery, confectionery, and processed foods. Sunflower and olive oils follow, driven by consumer preference for healthier oils rich in unsaturated fats. Specialty fats contribute the remaining 42%, where bakery fats lead with 18% share, supported by demand from industrial bakeries and premium pastries. Growing interest in trans-fat alternatives and clean-label products continues to drive this segment’s expansion.

- For instance, Cargill offers its Clear Valley® line of high-oleic sunflower oils, a clean-label, non-GMO solution for the food industry, including bakery and snack foods.

By Application

The industry segment holds the largest share at approximately 46%, fueled by large-scale chocolate, bakery, and dairy processing facilities across Europe. The household segment contributes about 32%, supported by rising home cooking trends and health-oriented oil usage. Restaurants capture nearly 15%, where premium olive and sunflower oils drive consumption in Mediterranean cuisine. The growing “food away from home” culture and emphasis on sustainable sourcing further strengthen application-based demand.

- For instance, Upfield expanded its Flora Plant-based spreads in the UK, using rapeseed and sunflower oils to cater to household consumers seeking healthier, plant-based cooking options.

By End User

The chocolate segment dominates with an estimated 30% share, as specialty fats such as cocoa butter equivalents and replacers are extensively used in European chocolate manufacturing. The bakery segment follows at 25%, driven by demand for specialty fats in pastries, biscuits, and bread. Confectioneries hold 18%, while infant food accounts for 12%, reflecting consumer trust in high-quality specialty oils for nutritional products. Rising adoption of functional fats in health-oriented foods contributes nearly 10%, supported by demand for omega-enriched and plant-based alternatives.

Key Growth Drivers

Rising Demand from Bakery and Confectionery Industry

The bakery and confectionery industry remains the largest consumer of specialty fats and oils in Europe. Increasing consumption of pastries, biscuits, and chocolates continues to push demand for palm oil, cocoa butter equivalents, and bakery fats. Industrial bakeries rely heavily on these products for texture, stability, and shelf-life extension. Furthermore, premium confectionery products across markets like Germany, France, and Belgium fuel consistent uptake. This strong linkage between specialty fats and Europe’s mature bakery sector underpins sustained market growth.

- For instance, AAK introduced its range of specialty fats for European biscuit makers, formulated to improve shelf-life and reduce fat bloom in chocolate-coated applications.

Shift Toward Healthier Oils and Clean Labels

Health-conscious consumers across Europe are driving demand for specialty oils like sunflower, olive, and rapeseed due to their unsaturated fatty acid profile. Rising preference for trans-fat-free and low-cholesterol products accelerates adoption of clean-label and functional oils in both household and industrial use. Regulatory support, including EU restrictions on trans fats, further propels reformulation in food processing. This shift is encouraging manufacturers to innovate with healthier alternatives, boosting specialty oil penetration in multiple applications.

- For instance, Bunge Loders Croklaan expanded its Vream Elite range of specialty rapeseed and sunflower oils in Europe to reduce saturated fats in bakery margarines while maintaining functionality.

Expansion of Processed Food and Convenience Sector

Growing urbanization and busy lifestyles across Europe are increasing reliance on packaged and ready-to-eat products. Specialty fats and oils play a critical role in processed foods, providing consistency, flavor enhancement, and stability. The rising popularity of frozen bakery, confectionery snacks, and dairy-based desserts strengthens demand for high-performance fats. Countries like the UK, Germany, and Spain show strong momentum in convenience food consumption, creating long-term opportunities for specialty fat and oil suppliers.

Key Trends & Opportunities

Growth of Plant-Based and Functional Fats

The surge in veganism and flexitarian diets across Europe is boosting demand for plant-based specialty fats and oils. Functional fats enriched with omega-3, omega-6, or tailored for nutritional enhancement are gaining prominence in infant food and dietary supplements. Manufacturers are capitalizing on this trend by offering sustainable, plant-derived solutions that meet consumer health priorities. The convergence of plant-based eating and functional nutrition presents a strong growth opportunity for specialty oil producers.

- For instance, Avril Group’s subsidiary Oleon produces plant-based fats, and Roquette also creates plant-based ingredients for the vegan and flexitarian market.

Increasing Focus on Sustainable and Ethical Sourcing

Sustainability has become a major trend shaping Europe’s specialty fats and oils market. Consumers and regulators demand traceable, ethically sourced palm and cocoa alternatives to minimize deforestation and carbon footprints. Certification programs like RSPO (Roundtable on Sustainable Palm Oil) and industry collaborations with NGOs are strengthening credibility. This shift is not only ensuring compliance but also creating opportunities for brands to differentiate through responsible sourcing. Sustainability is evolving into a competitive advantage in the market.

- For instance, AAK partnered with the NGO Solidaridad to train more than 12,500 smallholders in Latin America and West Africa on sustainable palm cultivation, enhancing both supply chain transparency and farmer livelihoods.

Key Challenges

Price Volatility of Raw Materials

The specialty fats and oils market in Europe faces significant challenges from fluctuations in raw material prices, particularly palm, soybean, and sunflower oils. Supply chain disruptions, geopolitical tensions, and climate variability in producing regions often impact availability and cost. These fluctuations directly affect production margins for manufacturers and pricing stability for end users. Managing raw material risk while ensuring affordability remains a critical hurdle for market participants.

Stringent Regulatory Environment

Europe’s regulatory landscape around food safety, labeling, and trans-fat content is among the strictest globally. While these frameworks encourage healthier formulations, they increase compliance costs for manufacturers. Continuous reformulation to meet evolving EU standards requires investment in R&D and testing, straining smaller producers. Additionally, regulations surrounding sustainability reporting and packaging further add to operational pressures. Companies must balance compliance with cost efficiency to remain competitive.

Rising Competition from Substitutes

The specialty fats and oils market also faces rising competition from substitutes such as synthetic emulsifiers, butter, and other fat alternatives. Health-conscious consumers are increasingly opting for natural substitutes like nut-based oils, which can reduce demand for conventional specialty fats. Furthermore, the growing appeal of innovative fat replacers in the food industry poses a risk to traditional segments like bakery and confectionery fats. This competitive pressure may limit growth potential if not addressed through innovation and differentiation.

Regional Analysis

United Kingdom

The United Kingdom accounts for 18% share of the Europe Specialty Fats and Oils Market, driven by strong demand from bakery and confectionery sectors. Consumers in the UK show high preference for clean-label oils and sustainable sourcing. Growth is also supported by the presence of major chocolate and biscuit manufacturers. The retail sector remains vital, with packaged food products using specialty oils to improve texture and shelf life. It benefits from rising home cooking culture, which has increased household oil consumption.

Germany

Germany holds 20% share, the largest in Europe, supported by its strong processed food and chocolate manufacturing industry. German consumers prioritize high-quality oils, especially sunflower and rapeseed, due to health awareness. Industrial bakeries and confectioneries form the backbone of demand. The presence of global and regional food brands ensures consistent market expansion. It is also witnessing rising interest in functional fats, aligning with consumer demand for nutritional enhancements.

France

France contributes 16% share, led by its dominant bakery and patisserie culture. Specialty fats are widely used to maintain quality and taste in premium baked goods. French consumers also drive demand for olive oil, reinforcing cultural and dietary preferences. Strong culinary traditions sustain market growth across both household and restaurant applications. It benefits from consistent adoption of sustainable sourcing practices within its food industry.

Italy

Italy represents 12% share, with demand supported by its Mediterranean diet, which emphasizes olive and sunflower oils. Italian bakeries and confectionery producers remain important end users of specialty fats. Growth is reinforced by the popularity of artisanal and premium food products. The household sector continues to prefer healthier oil choices, boosting rapeseed and olive oil usage. It also reflects strong consumer alignment with sustainability certifications.

Spain

Spain accounts for 11% share, with olive oil dominating specialty oil demand. The restaurant sector forms a key growth driver, using premium oils in traditional cuisine. Spain’s food industry incorporates specialty fats in confectionery and dairy products to enhance shelf stability. Household adoption also remains strong due to cultural reliance on olive oil. It demonstrates steady growth supported by both domestic consumption and export demand.

Russia

Russia contributes 9% share, supported by increasing demand for specialty fats in confectionery production. Chocolate and bakery industries rely on palm and soya oils for large-scale output. Consumer focus on affordable products encourages manufacturers to adopt cost-efficient specialty fats. It shows growing adoption of frying fats in the fast-food sector. Demand from households is rising, driven by packaged food consumption.

Rest of Europe

The Rest of Europe segment holds 14% share, reflecting demand across Eastern and Northern countries. Markets such as Poland, the Netherlands, and Belgium remain vital due to strong food processing industries. Specialty oils like sunflower and rapeseed dominate due to regional production advantages. Growth is also supported by exports of bakery and confectionery goods. It demonstrates resilience, with rising adoption of functional fats in niche applications.

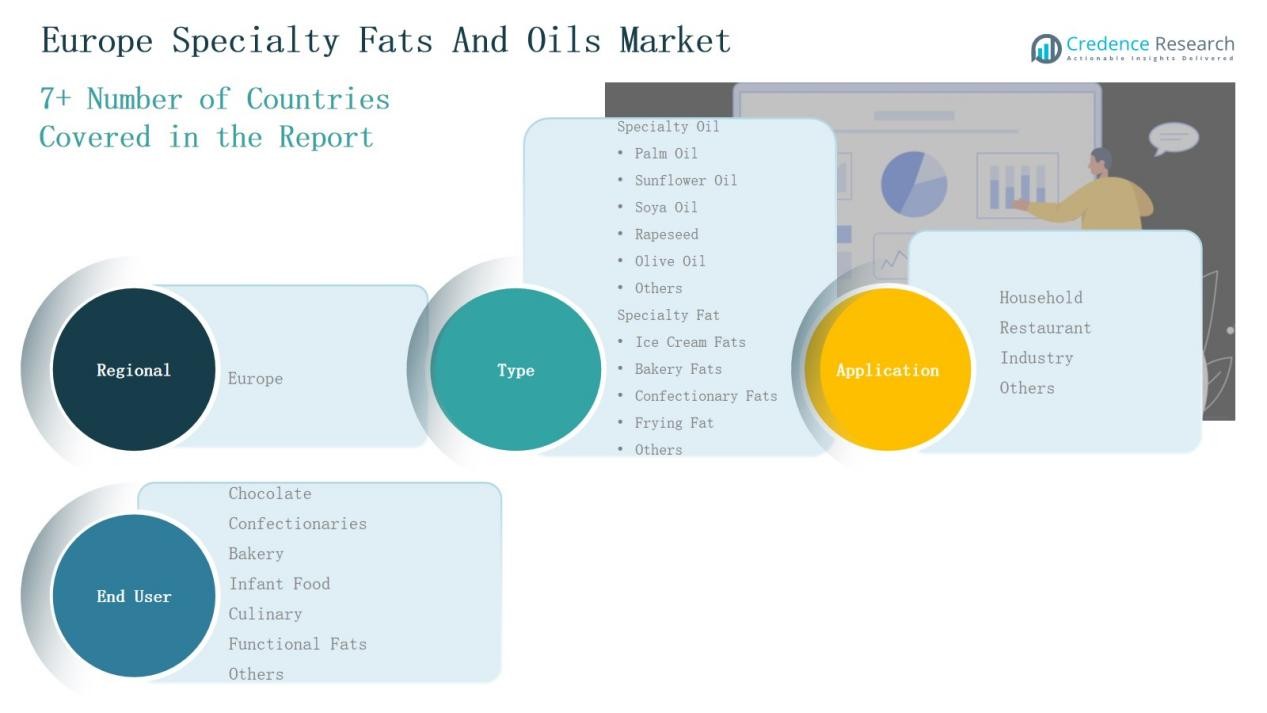

Market Segmentations:

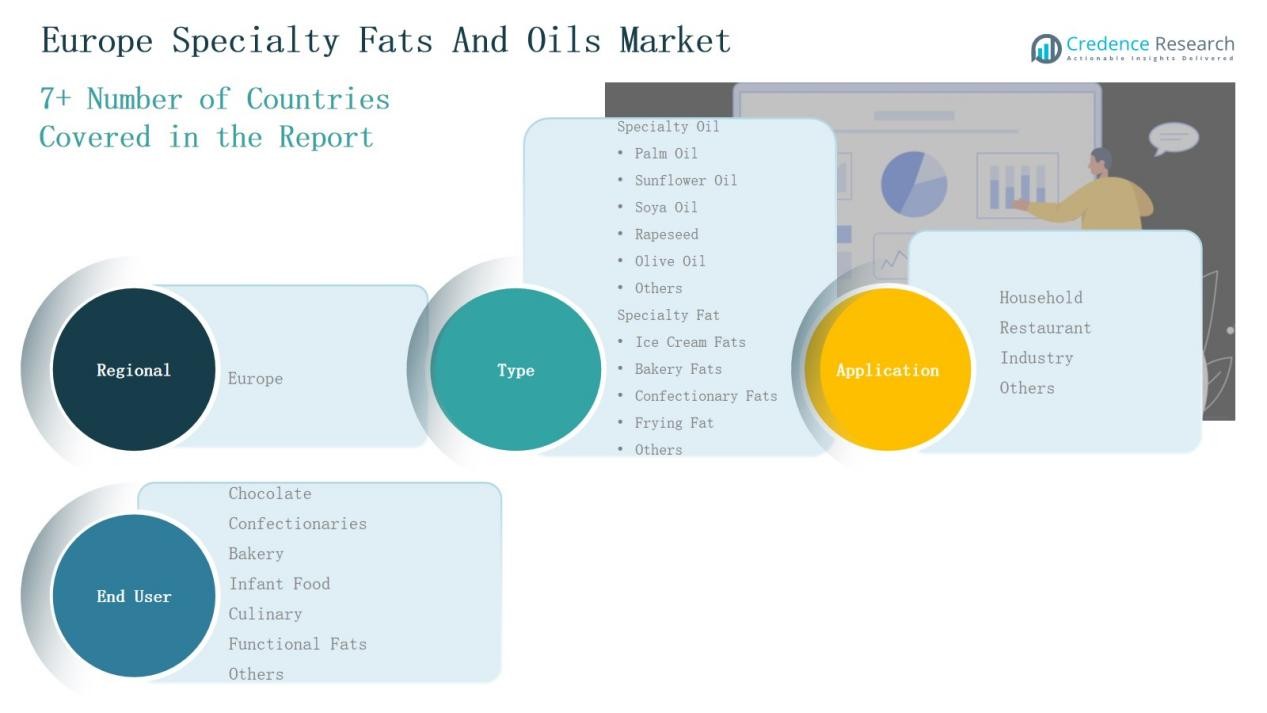

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fat

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectionaries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Other

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Specialty Fats and Oils Market is highly competitive, shaped by multinational corporations and regional specialists that focus on innovation, sustainability, and product differentiation. Leading players such as BASF SE, Dow, Solvay, Ashland, Lubrizol, Evonik, dsm-firmenich, Givaudan Active Beauty, Croda, Nouryon, CP Kelco, Gelymar, KitoZyme, EcoSynthetix, and Clariant maintain strong positions through diverse portfolios. These companies emphasize R&D to develop trans-fat alternatives, functional fats, and clean-label oils aligned with EU regulations. Partnerships with food and beverage producers further strengthen their market reach, while certifications such as RSPO enhance brand credibility in sustainable sourcing. Regional players complement this landscape by offering customized solutions tailored to bakery, confectionery, and household applications. Price competition, regulatory compliance, and raw material volatility remain core challenges, pushing firms to optimize supply chains and invest in efficiency. The market demonstrates moderate consolidation, with innovation, health focus, and sustainability serving as the primary differentiators among competitors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- BASF SE

- Dow

- Solvay

- Ashland

- Lubrizol

- Evonik

- dsm-firmenich

- Givaudan Active Beauty

- Croda

- Nouryon

- CP Kelco

- Gelymar

- KitoZyme

- EcoSynthetix

- Clariant

Recent Developments

- In June 2024, OMV launched a co-processing facility at its Schwechat refinery in Austria with nearly EUR 200 million investment to convert up to 160,000 metric tons of liquid biomass into premium renewable hydrogenated vegetable oil components.

- In 2025, Marubeni Corporation acquired Gemsa Enterprises to broaden its specialty oils portfolio, showing ongoing mergers and acquisitions in the market.

- In February 2025, SD Guthrie International Ltd. acquired a 48% stake in Marvesa Supply Chain Services B.V. to expand its specialty oils and fats presence across Europe.

- In March 2025, Bunge agreed to sell its European margarines and spreads business to Vandemoortele, a family-owned European food group. This transaction allows Bunge to realign its focus toward its core operations in specialty plant-based oils and fats.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trans-fat-free and clean-label products will continue to drive specialty fat adoption.

- Sunflower, rapeseed, and olive oils will gain wider use due to health-conscious preferences.

- Chocolate and bakery industries will remain the strongest end users of specialty fats.

- Functional fats enriched with nutrients will expand presence in infant food and dietary supplements.

- Sustainable and certified sourcing will become a critical factor in purchasing decisions.

- Household demand will rise as consumers increasingly use premium oils in cooking.

- Restaurants will adopt more specialty oils to align with Mediterranean and health-driven menus.

- Manufacturers will invest in R&D to develop plant-based fat alternatives for vegan diets.

- Regional players will grow by offering customized solutions for local bakery and confectionery markets.

- Competitive intensity will increase as companies balance innovation with regulatory compliance and cost efficiency.