Market Overview

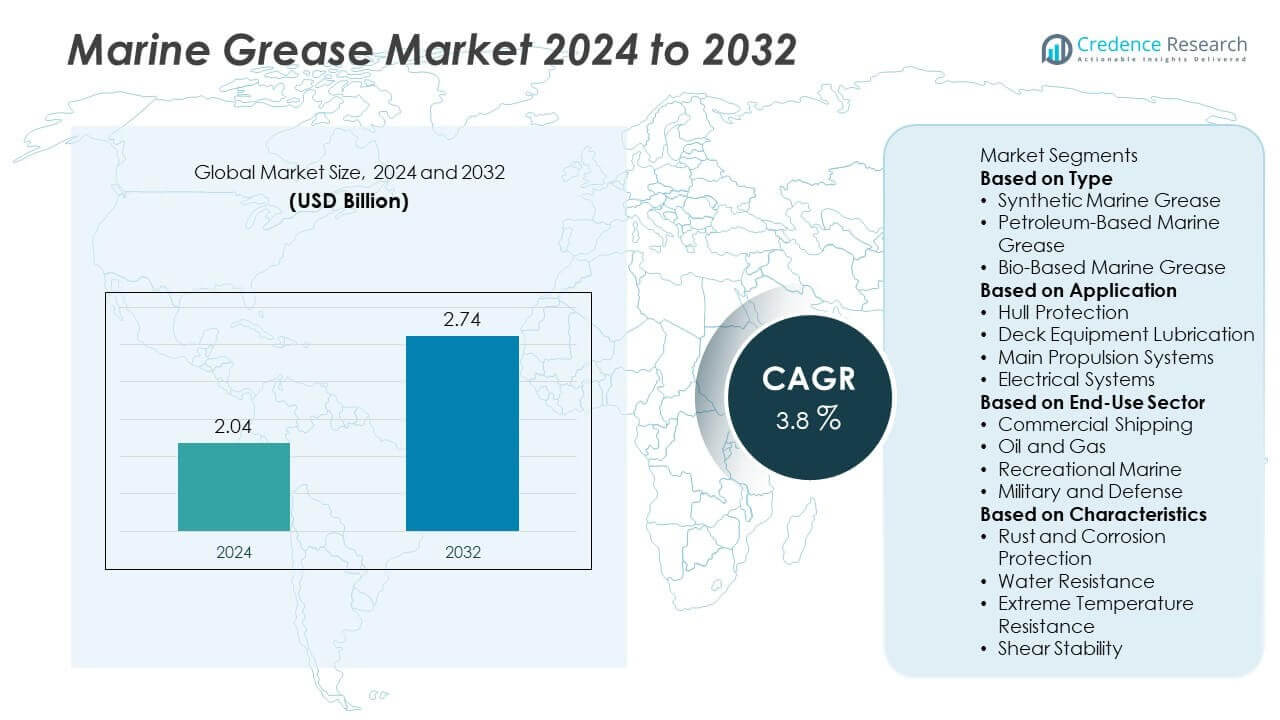

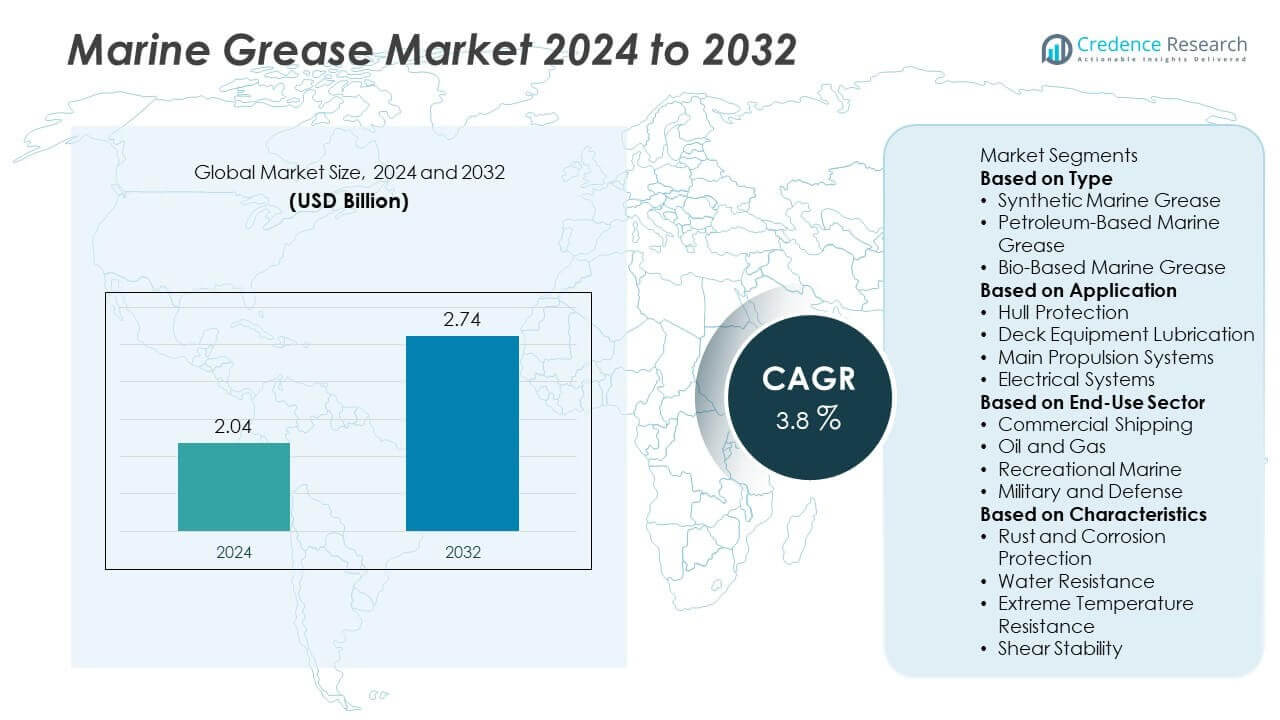

Marine Grease Market size was valued at USD 2.04 billion in 2024 and is anticipated to reach USD 2.74 billion by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Grease Market Size 2024 |

USD 2.04 Billion |

| Marine Grease Market, CAGR |

3.8% |

| Marine Grease Market Size 2032 |

USD 2.74 Billion |

The Marine Grease Market grows with rising demand for high-performance lubricants across shipping, offshore, and naval sectors. Expanding global maritime trade, vessel fleet upgrades, and offshore energy projects drive grease consumption. Operators require greases that resist water washout, handle high loads, and meet strict environmental regulations.

Asia Pacific leads the Marine Grease Market due to strong shipbuilding activity, expanding port infrastructure, and growing offshore operations in countries like China, South Korea, and India. Europe follows with mature maritime networks, strict environmental regulations, and high adoption of eco-friendly lubricants across fleets. North America shows strong demand from naval operations, offshore oil platforms, and inland waterways, supported by advancements in synthetic grease technologies. Latin America and the Middle East & Africa present growing opportunities through expanding coastal trade, naval investments, and energy exploration projects. Each region sees varying demand based on fleet size, weather conditions, and compliance needs. Product development focuses on water resistance, corrosion protection, and load-bearing capacity to match regional operating environments. Key players active across these geographies include Castrol, Shell, TotalEnergies, and Chevron, each offering advanced marine grease solutions tailored to vessel types and regulatory needs.

Market Insights

- Marine Grease Market size was valued at USD 2.04 billion in 2024 and is expected to reach USD 2.74 billion by 2032, growing at a CAGR of 3.8% during the forecast period.

- Growing vessel traffic, offshore oil exploration, and naval modernization are driving grease demand globally.

- Biodegradable and synthetic greases gain popularity due to rising sustainability goals and strict maritime regulations.

- Major players such as Shell, Chevron, Castrol, and TotalEnergies compete through product innovation, eco-certified formulations, and regional supply networks.

- High formulation cost, complex certification processes, and performance degradation in extreme marine conditions challenge widespread adoption.

- Asia Pacific leads in marine grease consumption due to large fleets, expanding ports, and active offshore projects in China, Japan, and South Korea.

- Europe focuses on green grease compliance, North America supports defense and offshore fleets, while Latin America and Middle East & Africa show steady demand from energy and coastal trade sectors.

Market Drivers

Rising Global Maritime Trade Volume Boosts Lubricant Demand Across Commercial Fleets

Expanding global trade drives vessel traffic across major sea routes. Increasing container shipments, oil tankers, and dry bulk carriers require reliable lubrication solutions. The Marine Grease Market benefits from this demand surge, especially in Asia Pacific and Middle East ports. Grease helps protect ship components such as bearings, gears, and propeller shafts from wear in harsh marine environments. It ensures longer intervals between maintenance and reduces unscheduled downtime. The market responds to the need for high-performance grease that meets international shipping standards.

- For instance, SKF launched its LGNL 3 high-load bearing grease, a premium general-purpose NLGI 3 grease formulated with mineral oil and a calcium complex soap. It has been tested to sustain a minimum weld load of 2,800 N in a four-ball test (DIN 51350/4). LGNL 3 is designed for demanding applications such as vertical shafts and those involving high loads and heavy vibrations, where extended relubrication intervals are beneficial for reducing equipment downtime and maintenance costs.

Strict Environmental Norms Encourage Adoption of Biodegradable and Eco-Friendly Greases

Global regulatory bodies impose strict emission and discharge limits for marine lubricants. Authorities like IMO and EPA enforce policies that impact lubricant formulations and disposal methods. The Marine Grease Market sees growth in biodegradable greases that offer reduced ecological harm without compromising performance. Grease that resists water washout and oxidation supports compliance with Vessel General Permit (VGP) regulations. It enables fleet operators to reduce environmental liabilities during offshore and coastal operations. Shipowners increasingly prefer environmentally acceptable lubricants (EALs) to meet port and regional compliance.

- For instance, Castrol introduced its MHP 1-30 and MHP 1-40 marine lubricants in July 2025. The new products were validated through more than 30,000 hours of engine and field testing, which confirmed excellent engine cleanliness and wear protection. The formulations are specifically designed for four-stroke medium-speed engines and are compatible with distillate fuels, LNG, and biofuels.

Demand for High-Performance Grease Increases with Fleet Modernization and Advanced Machinery

Shipbuilders integrate more sophisticated propulsion systems, winches, and steering mechanisms in new vessels. These modern parts require greases with higher load-carrying capacity and corrosion resistance. The Marine Grease Market meets this demand with advanced formulations containing calcium sulfonate, lithium complex, and aluminum complex thickeners. It provides superior protection under shock loads and extreme pressures in both warm and cold seas. High-performance grease extends service life and reduces overall maintenance costs for fleet operators. This makes it an essential part of modern marine asset management.

Offshore Energy Projects and Naval Expansion Programs Drive Strategic Lubricant Use

Expansion of offshore oil rigs, wind farms, and naval defense fleets increases grease consumption. These applications need marine-grade lubricants that operate under heavy loads, saltwater, and variable temperatures. The Marine Grease Market gains traction from countries investing in naval modernization and energy security. It supports critical equipment like deck cranes, mooring lines, and subsea couplings with dependable lubrication. Reliable grease use minimizes failure in mission-critical operations under extreme marine pressure. Governments and contractors require long-lasting grease to support uptime and asset integrity offshore.

Market Trends

Surge in Demand for Biodegradable Greases Aligns with Maritime Sustainability Goals

Maritime operators face growing pressure to adopt environmentally safe products. Ports and regulators now favor vessels that use biodegradable and non-toxic lubricants. The Marine Grease Market is shifting toward formulations that meet EPA VGP and EU Ecolabel criteria. It helps vessel owners lower pollution risks and avoid penalties in sensitive water zones. Greases made from renewable base oils and ashless additives gain traction across commercial and defense fleets. This trend supports green shipping practices without sacrificing performance.

- For instance, TotalEnergies Lubmarine introduced its BIOMULTIS EP 2, a biodegradable grease formulated with synthetic base oil. This product has been proven to achieve over 80% biodegradability in OECD 301B testing. It is an extreme pressure grease that offers a high load-carrying capacity, but its four-ball weld load rating is 315 kgf (~3,090 N), not 4,000 N. BIOMULTIS EP 2 is particularly developed for applications in areas with very high environmental constraints.

Integration of Condition Monitoring Systems to Optimize Lubricant Usage

Fleet managers now adopt predictive maintenance tools to monitor grease condition and application. Real-time data helps track temperature, load, and vibration levels across marine machinery. The Marine Grease Market responds with sensor-compatible formulations that maintain stability across dynamic conditions. It allows operators to extend re-greasing intervals and reduce lubricant waste. Condition-based lubrication improves operational uptime and reduces manual inspections on large vessels. Smart monitoring systems improve decision-making around grease selection and replenishment.

- For instance, SKF introduced its LGEM 2 high-viscosity grease, formulated with lithium soap, molybdenum disulfide, and graphite to protect components under heavy loads and slow rotation; it pairs seamlessly with the SKF Enlight ProCollect system, which integrates vibration and temperature sensors along with cloud-based diagnostics for real-time lubrication tracking.

Rising Preference for Multi-Purpose Grease Grades to Streamline Inventory Management

Ship operators seek grease types that serve multiple equipment classes to simplify storage and procurement. Universal formulations reduce complexity across tugboats, cargo vessels, and offshore platforms. The Marine Grease Market offers products with high load-bearing capacity, corrosion protection, and water resistance in a single formulation. It supports cost savings and efficiency in lubricant logistics onboard. Multi-purpose greases are gaining favor in fleet standardization strategies. It enables faster deployment and easier compliance tracking.

Increased Investment in R&D to Develop High-Performance Formulations for Extreme Conditions

Vessel operations in Arctic and deep-sea environments demand grease that performs under extreme pressure and temperature. R&D efforts target thickeners and additives that boost resistance to oxidation, saltwater, and mechanical shock. The Marine Grease Market benefits from new product lines offering enhanced shear stability and extended service intervals. It supports safer and more efficient operations for energy, exploration, and military vessels. Manufacturers also focus on reducing toxicity and improving biodegradability through advanced chemical engineering. Research-backed innovation helps meet evolving demands from global marine fleets.

Market Challenges Analysis

Stringent Environmental Compliance and Certification Costs Hinder Product Development

Global regulations push marine lubricant producers to meet strict environmental and safety standards. Formulating grease that balances performance and eco-safety often requires costly R&D and extended testing. The Marine Grease Market faces barriers from evolving certification requirements under frameworks like the IMO and EPA VGP. It must align with performance, biodegradability, and toxicity limits while maintaining compatibility with ship systems. Smaller manufacturers struggle to absorb the high compliance costs and time delays tied to approvals. These constraints limit the speed of innovation and entry of new players into regulated markets.

High Operating Temperature and Water Exposure Impact Grease Longevity

Marine equipment operates under extreme conditions involving saltwater, pressure, and fluctuating temperatures. Prolonged exposure leads to washout, oxidation, and degradation of standard grease formulations. The Marine Grease Market must address performance loss that raises maintenance frequency and part failure risk. It faces difficulty delivering consistent protection across diverse vessel sizes and machinery types. Ensuring grease longevity while reducing reapplication intervals remains a technical and logistical challenge. Operators demand durable solutions that minimize dry-docking or component failures under continuous operation.

Market Opportunities

Growth in Offshore Renewable Energy and Marine Infrastructure Expands Grease Application Scope

Offshore wind farms, floating solar, and subsea projects continue to expand across Europe, Asia, and North America. These installations require high-performance grease for cranes, turbines, mooring systems, and support vessels. The Marine Grease Market sees strong opportunity in supporting long-duration operations in corrosive offshore environments. It delivers value by extending equipment life and reducing manual maintenance in remote locations. Grease that resists water washout and temperature fluctuation gains preference for offshore service fleets. Operators demand specialty lubricants that ensure reliability across long installation and maintenance cycles.

Advancements in Synthetic and Calcium Sulfonate-Based Greases Offer Premium-Grade Options

Marine operators increasingly explore synthetic and advanced thickener-based greases to meet demanding performance needs. Calcium sulfonate formulations offer superior water resistance, load capacity, and corrosion protection. The Marine Grease Market benefits from innovation that delivers longer lubrication intervals and better protection under shock loads. It allows fleet owners to cut costs tied to frequent re-greasing or part replacement. OEMs endorse synthetic greases for modern propulsion systems and dynamic-positioning thrusters. Continued R&D investment in premium-grade marine grease creates strong growth potential across high-value vessel segments.

Market Segmentation Analysis:

By Type:

The Marine Grease Market includes several types such as lithium complex, calcium sulfonate, aluminum complex, and clay-based greases. Lithium complex grease leads the segment due to its high temperature stability and load-carrying capacity. It supports diverse applications including deck equipment, winches, and wire ropes. Calcium sulfonate grease sees growing use for its superior corrosion resistance and water tolerance. It performs well under prolonged saltwater exposure and supports long maintenance intervals. Aluminum complex grease remains niche, mainly used for low-speed and low-load applications.

- For instance, Lubrication Engineers (LE), a different company, states that its aluminum complex greases show a bleed characteristic no greater than 2% in the Federal Test Method No. 321. The grease’s quality is indicated by the ability to systematically release oil while maintaining its mechanical stability.

By Application:

Key applications include engine components, propeller systems, deck machinery, steering gear, and offshore rig equipment. The Marine Grease Market meets strong demand from deck equipment and winches where shock loads and vibration are frequent. Propeller and shaft systems also require consistent lubrication to reduce friction and wear. High-pressure hydraulic systems need grease with strong sealing and oxidation resistance. Offshore rigs use heavy-duty greases for cranes and drill units exposed to salt spray and varying pressures. It plays a vital role in reducing downtime across mission-critical systems.

- For instance, Shell Gadus S5 V460KP 1.5 is a synthetic grease primarily designed for wind turbine applications, such as main and yaw bearings. It features a base oil viscosity of 460 mm²/s at 40 °C, and grades like the similar Gadus S5 V460 00 have a 4-ball weld load exceeding 3,100 N (315 kg) and a dropping point of 240 °C. The lubricant provides excellent extreme-pressure performance and thermal stability for heavy-duty bearing applications.

By End-Use Sector:

Major end-users include commercial shipping, offshore oil and gas, naval and defense fleets, and fishing vessels. The Marine Grease Market serves commercial shipping as the largest end-user due to large fleet sizes and constant global operations. Offshore energy platforms follow, driven by their need for durable lubrication in high-load environments. Defense fleets rely on specialty greases for sensitive mechanical systems that must function under extreme conditions. Fishing vessels demand cost-effective and water-resistant options suited for smaller marine engines and gear assemblies. It provides tailored solutions across vessel categories with varying operating conditions.

Segments:

Based on Type

- Synthetic Marine Grease

- Petroleum-Based Marine Grease

- Bio-Based Marine Grease

Based on Application

- Hull Protection

- Deck Equipment Lubrication

- Main Propulsion Systems

- Electrical Systems

Based on End-Use Sector

- Commercial Shipping

- Oil and Gas

- Recreational Marine

- Military and Defense

Based on Characteristics

- Rust and Corrosion Protection

- Water Resistance

- Extreme Temperature Resistance

- Shear Stability

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the Marine Grease Market, accounting for approximately 35%. The region is home to leading shipbuilding nations like China, South Korea, and Japan, supported by growing maritime trade across Southeast Asia and India. Expanding port infrastructure, naval modernization, and high vessel throughput support strong grease demand. Offshore oil and gas exploration, as well as growing offshore wind capacity, further boost lubricant consumption. Environmental regulations across countries such as South Korea and Singapore are driving the adoption of biodegradable greases. It remains the most dynamic region in both volume and product development.

Europe

Europe holds around 25% share in the Marine Grease Market, supported by a well-established shipping sector, stringent environmental norms, and widespread adoption of green lubricants. The region sees strong demand from commercial fleets, fishing vessels, and defense navies operating in the North Sea and Mediterranean routes. Vessels in this region often operate under harsh weather and icy waters, requiring high-performance greases. Shipowners increasingly adopt biodegradable and synthetic greases that comply with IMO and EU directives. It also benefits from strong port connectivity and fleet digitization. Manufacturers focus on eco-label certifications and lifecycle performance.

North America

North America accounts for nearly 20% of the Marine Grease Market. The United States drives demand with its extensive inland waterways, coastal transport routes, and offshore oil platforms in the Gulf of Mexico. Canada and Mexico contribute through commercial fishing and port activities along the Pacific and Atlantic coasts. The U.S. Navy and Coast Guard also support grease consumption through advanced fleet maintenance programs. Ship operators emphasize long-life, synthetic greases that ensure reliability under thermal and mechanical stress. It remains a key region for R&D in grease formulation and marine lubricant technologies.

Middle East & Africa

Middle East & Africa contribute roughly 10% to the Marine Grease Market. Grease demand stems from large port hubs like Jebel Ali, and energy-focused shipping through the Persian Gulf, Suez Canal, and Red Sea. Offshore oil operations in Saudi Arabia, UAE, and Nigeria require specialized greases for high-load equipment exposed to saline environments. The naval and commercial fleet expansion further adds to lubricant demand. While environmental regulation is less strict, interest in low-toxicity grease products is growing. It presents an opportunity for value-added products tailored to high-temperature and desert-coastal conditions.

Latin America

Latin America holds close to 10% share in the Marine Grease Market. Countries like Brazil, Argentina, Chile, and Mexico show demand from port logistics, marine fishing, and coastal defense fleets. Offshore oil activities in Brazil and increasing container traffic along the Pacific and Atlantic corridors drive product use. Marine operators in this region prefer cost-effective, water-resistant greases for vessels operating in tropical and salt-heavy waters. Adoption of synthetic and biodegradable greases is growing slowly in response to ecological preservation efforts. It offers steady long-term opportunity for suppliers investing in regional distribution and product education.

Key Player Analysis

- Chevron Oronite

- SKF

- Molykote

- TotalEnergies

- Timken

- Shell

- Castrol

- Chevron

- SKF Lubricants

- Nye Lubricants

Competitive Analysis

The competitive landscape of the Marine Grease Market features key players such as TotalEnergies, Molykote, Castrol, Shell, Nye Lubricants, SKF Lubricants, SKF, Timken, Chevron, and Chevron Oronite. These companies compete by offering high-performance marine grease products that meet strict environmental and operational standards. Manufacturers invest heavily in R&D to develop advanced formulations with superior water resistance, load-carrying capacity, and corrosion protection. Product lines now emphasize biodegradable and synthetic greases to align with global regulations such as IMO and EPA VGP. Players focus on expanding regional supply chains, particularly in Asia Pacific and North America, to meet growing demand from commercial shipping, offshore rigs, and naval fleets. Strategic partnerships with OEMs and fleet operators help secure long-term contracts and drive customized product development. Digital integration, including condition-monitoring compatibility, strengthens brand value among large-scale marine operators. Competitive success depends on innovation, regulatory compliance, performance testing, and global logistics efficiency across multiple vessel categories.

Recent Developments

- In August 2025, TotalEnergies Lubrifiants signed an MOU with XING Mobility to advance immersion–cooling battery systems, starting with electrified marine applications.

- In July 2025, Castrol launched its new MHP lubricant range for four-stroke medium-speed marine engines (MHP 1-30 & MHP 1-40), validated through 30,000 hours of engine testing.

- In January 2025, DuPont MOLYKOTE® announced that its HP-300 Grease meets the stringent hydrogen purity standards outlined in ISO 14687:2019, showcasing its cleanliness credentials.

- In June 2024, Chevron Oronite passed the WinGD Dual Fuel validated No Objection Letter (NOL) test protocol with two 40 BN marine cylinder oil additive formulations, confirming their suitability for WinGD dual fuel, Mark 9, and higher MAN Energy Solutions engines.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Sector, Characteristics and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Marine grease demand will rise with growing global maritime trade and offshore infrastructure.

- Biodegradable and environmentally acceptable lubricants will gain strong preference across regions.

- Synthetic and calcium sulfonate-based greases will see higher adoption in harsh marine environments.

- Grease with extended re-lubrication intervals will reduce operational downtime and maintenance costs.

- Demand for sensor-compatible greases will grow with increased adoption of condition monitoring systems.

- OEM partnerships will drive customized product development for advanced marine machinery.

- Asia Pacific will continue leading in volume demand due to active shipbuilding and port expansion.

- North America and Europe will drive innovation in sustainable and high-performance grease technologies.

- Regional players will expand production and distribution to serve coastal and inland waterways efficiently.

- Regulatory changes will shape product approvals, driving focus on eco-compliance and technical certification.