Market Overview

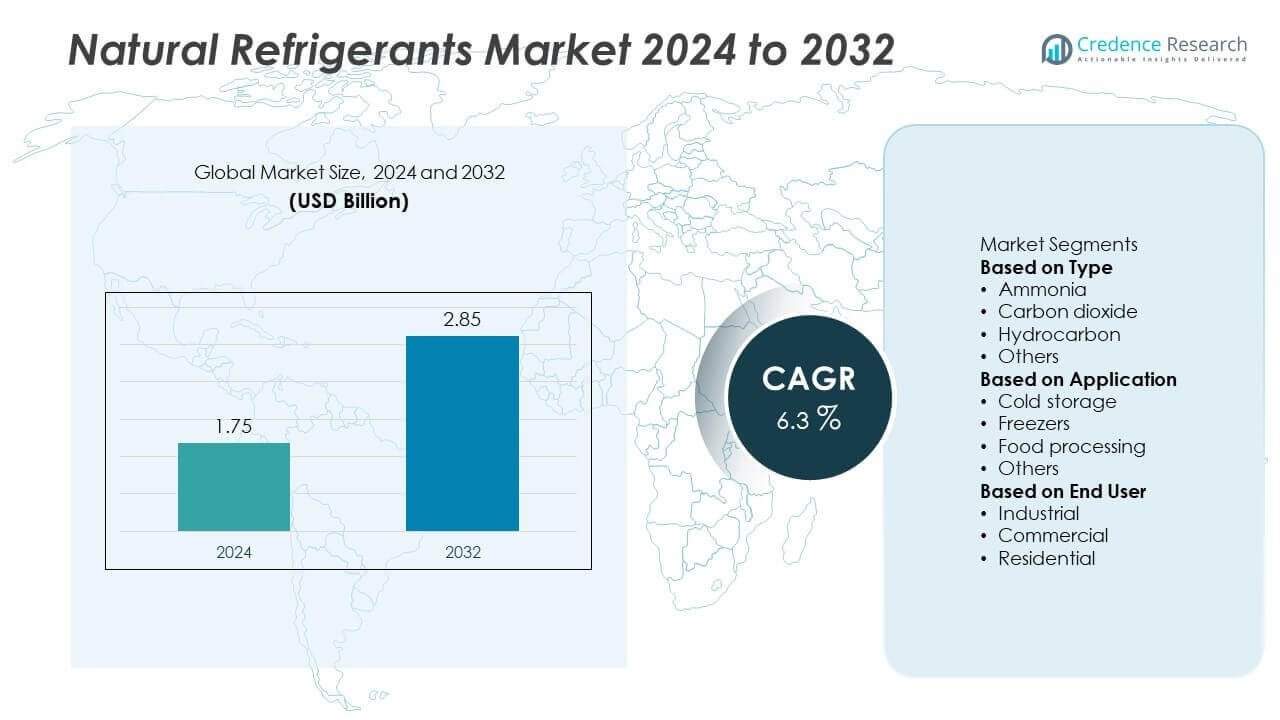

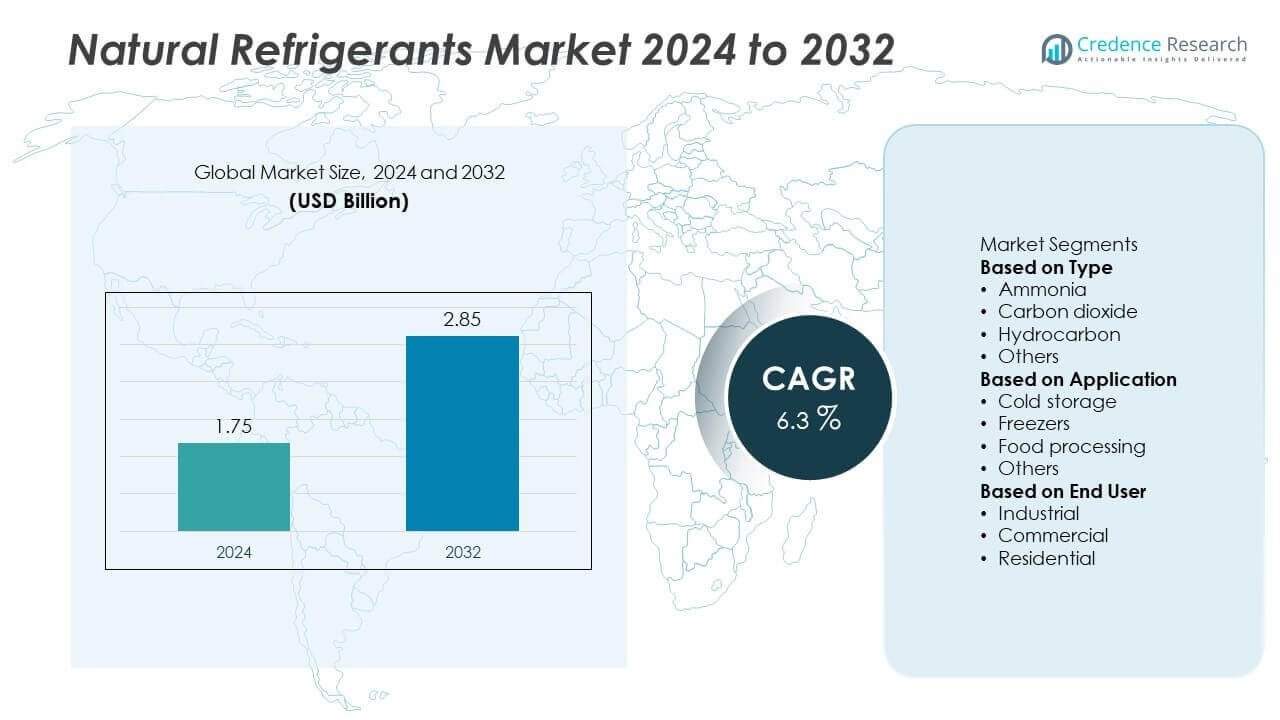

The Natural Refrigerants Market was valued at USD 1.75 billion in 2024 and is projected to reach USD 2.85 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Refrigerants Market Size 2024 |

USD 1.75 Billion |

| Natural Refrigerants Market, CAGR |

6.3% |

| Natural Refrigerants Market Size 2032 |

USD 2.85 Billion |

The Natural Refrigerants Market grows due to rising environmental regulations targeting high-GWP synthetic refrigerants. Governments across regions enforce HFC phasedown policies, prompting demand for low-GWP alternatives like ammonia, CO₂, and hydrocarbons.

Europe leads the Natural Refrigerants Market due to strong environmental regulations, early technology adoption, and high awareness. Countries like Germany, France, and the UK promote CO₂ and hydrocarbon systems through policy incentives and sustainability mandates. North America follows with rising use in retail, cold storage, and residential applications, driven by HFC phase-out regulations and energy efficiency programs. Asia Pacific shows rapid growth led by Japan, China, and Australia, where industrial cooling and commercial HVAC applications adopt natural refrigerants. Latin America and the Middle East & Africa witness emerging adoption supported by food exports, energy savings, and pilot installations. Regional growth depends on training, safety code upgrades, and reliable service networks. Leading players such as HyChill Australia, Linde plc, Danfoss, and Tazzetti S.p.A. focus on expanding product lines, investing in safe low-charge systems, and collaborating with OEMs and installers. These companies support global transitions through R&D, regulatory engagement, and turnkey natural refrigerant solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Natural Refrigerants Market was valued at USD 1.75 billion in 2024 and is projected to reach USD 2.85 billion by 2032, growing at a CAGR of 6.3%.

- Regulatory bans on high-GWP refrigerants are driving demand for ammonia, CO₂, and hydrocarbon-based systems.

- Transcritical CO₂ systems and low-charge ammonia units are gaining traction in retail and industrial applications.

- Companies like Linde plc, Danfoss, HyChill Australia, and Tazzetti S.p.A. invest in low-GWP product innovations and market expansion.

- Technical challenges such as high pressure, flammability, and toxicity limit adoption in sensitive environments without proper system design.

- Europe leads the market due to strict F-gas rules and widespread adoption, followed by Asia Pacific with strong demand from Japan and China.

- North America shows steady growth through commercial retrofits and new builds, while Latin America and the Middle East & Africa see early-stage opportunities in cold chain and green building projects.

Market Drivers

Stringent Global Regulations Promote Shift Toward Low-GWP Alternatives

Governments worldwide are enforcing strict environmental policies targeting high global warming potential (GWP) refrigerants. The Kigali Amendment to the Montreal Protocol mandates the phasedown of hydrofluorocarbons (HFCs), pushing industries to adopt natural options. The Natural Refrigerants Market benefits from these policies that align with climate goals and carbon neutrality targets. Regulatory bodies in North America, Europe, and parts of Asia have introduced bans or quotas on synthetic refrigerants. These restrictions increase demand for natural refrigerants like ammonia (R717), carbon dioxide (R744), and hydrocarbons (R290, R600a). The market gains traction in commercial, industrial, and transport refrigeration applications due to mandatory compliance timelines.

- For instance, Danfoss launched its CO₂ Adaptive Liquid Management (CALM) solution, which includes liquid ejectors and advanced control algorithms, and has been applied to a large number of installations.

Rising Demand from Cold Chain Infrastructure and Food Retail Applications

The expansion of cold chain logistics and food preservation infrastructure drives strong demand for natural refrigerants. Supermarkets, cold storage facilities, and refrigerated transport systems require eco-friendly and efficient refrigerant technologies. The Natural Refrigerants Market grows as end users seek solutions that meet energy performance standards without sacrificing cooling capacity. Equipment manufacturers now offer transcritical CO₂ systems and ammonia-based chillers tailored for these sectors. Companies in frozen food and pharmaceutical logistics adopt these solutions to reduce emissions and align with ESG mandates. End users prefer long-term, regulation-proof systems to avoid retrofitting costs.

- For instance, Carrier, which had installed its 500th transcritical CO₂ system by 2012, has grown significantly since then, delivering its 20,000th transcritical CO₂ rack in Europe by December 2022. Modern CO₂OLtec Evo systems offer cooling capacities up to 600 kW for medium-temperature applications, and up to 450 kW for low-temperature needs, suitable for hypermarkets and large stores.

Energy Efficiency Standards Fuel Market Adoption Across HVAC-R Applications

Global focus on reducing energy use in cooling systems accelerates the adoption of natural refrigerants. These refrigerants offer high thermodynamic efficiency, especially in industrial and large commercial applications. The Natural Refrigerants Market gains from this shift, as energy-efficient equipment lowers operating costs and carbon footprints. Ammonia systems remain preferred in industrial refrigeration due to their high latent heat. CO₂ is increasingly adopted in supermarket refrigeration for its high volumetric cooling capacity. Regional energy labeling schemes and utility incentives further strengthen the market’s position.

Sustainable Building Practices Encourage Use in Commercial Cooling Systems

Sustainable construction and green building certifications encourage integration of natural refrigerant-based systems. Developers targeting LEED or BREEAM certifications often select HVAC systems using CO₂, hydrocarbons, or ammonia. The Natural Refrigerants Market benefits from the need for compliant and future-ready technologies in new and retrofit projects. Real estate firms and facility managers are choosing natural alternatives to meet tenant demand for eco-conscious buildings. Low toxicity and flammability designs improve the appeal of newer generation systems. This trend supports long-term growth across hotels, hospitals, and institutional buildings.

Market Trends

Increased Integration of CO₂-Based Systems in Commercial Refrigeration

CO₂ (R744) is gaining traction in supermarkets, convenience stores, and retail cold rooms due to its low GWP. Transcritical CO₂ systems now operate efficiently in both moderate and high ambient climates with recent technological advancements. The Natural Refrigerants Market is expanding as leading OEMs offer plug-and-play CO₂ refrigeration systems for new installations and retrofits. Retail chains in Europe, Japan, and North America are accelerating adoption to comply with refrigerant phase-down policies. Packaged solutions with heat recovery capabilities further improve total energy efficiency. Demand for CO₂ systems grows in urban locations with high energy costs and strong climate policies.

- For instance, Panasonic sold at least 10,000 CO₂ condensing units in Japan for supermarkets and convenience stores by late 2019. These units have varied cooling capacities, including models for both smaller and larger applications.

Shift Toward Hydrocarbon-Based Cooling in Domestic and Light Commercial Units

Hydrocarbons such as propane (R290) and isobutane (R600a) are increasingly used in domestic refrigerators, freezers, and small commercial cooling equipment. These refrigerants offer excellent thermodynamic performance and low charge requirements. The Natural Refrigerants Market benefits from the regulatory push for low-GWP alternatives in household and light-duty commercial applications. Appliance manufacturers are redesigning systems to meet safety thresholds related to flammability. Units with hydrocarbon refrigerants now dominate new residential refrigerator sales in Europe and Asia. Global appliance standards continue evolving to support wider use of these efficient, low-impact gases.

- For instance, Haier has produced tens of millions of household refrigerators using isobutane (R600a), with some units having charge levels as low as 54 grams to comply with international safety standards.

Rising Popularity of Ammonia in Large Industrial Refrigeration Systems

Ammonia (R717) remains the preferred choice for large-scale industrial refrigeration due to its high energy efficiency. It is widely used in cold storage, dairy processing, breweries, and food production plants. The Natural Refrigerants Market supports this trend as industrial users prioritize operational efficiency and long equipment life cycles. Recent innovations in low-charge ammonia systems improve safety and expand installation in populated areas. Modular packaged units also reduce installation time and simplify maintenance. Market players invest in training and automation to support ammonia system adoption.

Growth in Global R&D Investments for New System Designs and Safety Enhancements

Research and development efforts are focused on enhancing safety, efficiency, and compactness of natural refrigerant systems. Manufacturers work on advanced components like ejectors, heat exchangers, and leak detection sensors. The Natural Refrigerants Market evolves with innovations that address flammability, toxicity, and performance at varying ambient conditions. Governments and industry associations fund pilot projects and training programs to accelerate adoption. Companies develop hybrid systems that combine natural refrigerants with intelligent control platforms. Standardization and certification improvements help ease commercial rollout across regions.

Market Challenges Analysis

Complex Handling Requirements and Safety Concerns Limit Widespread Use

Natural refrigerants often present technical and safety challenges that restrict broader adoption across sectors. Ammonia has high toxicity, hydrocarbons are flammable, and CO₂ operates under high pressure. The Natural Refrigerants Market must address these concerns through better system design, leak detection, and technician training. Strict safety codes, especially in populated or enclosed environments, limit where these systems can be installed. Small businesses may hesitate due to the need for certified personnel and specialized safety systems. It increases upfront planning and compliance costs, which can delay project timelines.

Higher Initial Costs and Limited Technical Expertise Hinder Adoption

Natural refrigerant systems often require custom design, specialized components, and skilled labor for installation. The upfront cost is higher than conventional systems using synthetic refrigerants, creating hesitation among cost-sensitive buyers. The Natural Refrigerants Market faces resistance in emerging economies with limited access to trained engineers and local support networks. Availability of compatible components and service tools is still limited in several regions. It slows down retrofitting activity and discourages new investments. Market growth depends on continued investments in training, awareness programs, and supply chain expansion.

Market Opportunities

Rising Demand for Sustainable Refrigeration Across Emerging Economies Creates New Growth Avenues

Emerging markets in Asia Pacific, Latin America, and Africa are expanding cold chain and HVAC infrastructure to support food safety, healthcare, and urban growth. Governments are introducing green building codes and energy-efficiency programs to lower emissions. The Natural Refrigerants Market has a strong opportunity to supply low-GWP, future-ready systems for these regions. It benefits from rising consumer awareness of climate impact and increasing alignment with international environmental agreements. Multinational retailers and logistics companies are driving demand for standardized, eco-friendly systems across borders. Regional players can capitalize on this momentum by offering low-charge and modular systems adapted to local needs.

Technology Advancements Enable Safe and Scalable Deployment Across Multiple Sectors

Ongoing innovations in system design, component miniaturization, and smart controls make natural refrigerants more viable in diverse applications. Compact, low-charge ammonia systems and advanced CO₂ technologies now suit hospitals, schools, and office buildings. The Natural Refrigerants Market can leverage these advances to penetrate sectors previously restricted due to safety or size concerns. It also benefits from the growing availability of training programs and certified technicians. Partnerships between OEMs, governments, and academia support knowledge sharing and technical upgrades. Export opportunities grow for manufacturers offering turnkey, regulation-compliant solutions to international customers.

Market Segmentation Analysis:

By Type:

The Natural Refrigerants Market is segmented into ammonia (R717), carbon dioxide (R744), hydrocarbons (R290, R600a, R1270), water (R718), and air. Ammonia dominates industrial refrigeration due to its high energy efficiency and zero GWP. CO₂ is gaining traction in commercial systems, especially transcritical and cascade configurations used in retail refrigeration. Hydrocarbons like propane and isobutane lead the domestic appliance sector, offering high thermodynamic performance with low charge requirements. Water and air are niche options used in absorption chillers and specialized cooling applications. Each refrigerant type addresses unique environmental, safety, and performance requirements across end uses.

- For instance, Robur’s gas-fired water-ammonia absorption chiller units are typically available with capacities around 17.7 kW. In Italy, as in other locations, modular configurations of these units could be combined to meet the higher cooling demands of larger commercial HVAC systems

By Application:

Key applications include refrigeration, air conditioning, and heat pumps. Refrigeration holds the largest share due to widespread use in cold storage, supermarkets, food processing, and pharmaceutical logistics. The Natural Refrigerants Market expands in air conditioning with hydrocarbon-based split systems and CO₂-based commercial HVAC units. Heat pump applications grow across Europe and Asia where governments promote electrification of heating. These systems use CO₂ or hydrocarbons to deliver high efficiency at lower emissions. Technological developments in compressor design and system controls support advanced applications across diverse temperature ranges.

- For instance, Johnson Controls is expanding its Holme, Denmark facility, adding 2,300 m² of new production space plus an 1,800 m² test center. The expansion, which is scheduled for completion in early 2026, will also modernize and upgrade existing buildings.

By End User:

End users include commercial, industrial, residential, and transportation sectors. Industrial users prefer ammonia and CO₂ systems in large-scale facilities like warehouses, dairies, and processing plants due to reliability and energy savings. The Natural Refrigerants Market sees growing use in commercial spaces such as supermarkets, hotels, and hospitals where low-GWP and regulation-compliant systems are required. Residential demand is led by hydrocarbon-based refrigerators and air conditioners in Asia and Europe. Transport refrigeration, including trucks, containers, and marine units, increasingly adopts CO₂ and hydrocarbon solutions to meet emissions targets. OEMs and service providers offer compact, modular designs to suit varied user needs.

Segments:

Based on Type

- Ammonia

- Carbon dioxide

- Hydrocarbon

- Others

Based on Application

- Cold storage

- Freezers

- Food processing

- Others

Based on End User

- Industrial

- Commercial

- Residential

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 23.4% of the global market share in 2023. The region sees strong adoption due to strict U.S. policies phasing down HFCs and support from programs like the American Innovation and Manufacturing (AIM) Act. The Natural Refrigerants Market grows steadily with increased use of CO₂ in commercial refrigeration and hydrocarbons in domestic appliances. Supermarket chains across the U.S. and Canada are switching to transcritical CO₂ systems to meet corporate sustainability goals. OEMs focus on retrofit-ready solutions to ease compliance costs for operators. Demand also rises in cold chain logistics and pharmaceuticals, where energy efficiency is a key factor.

Europe

Europe dominates the market with a 37.7% share in 2023, making it the global leader. Strict enforcement of F-gas regulations under the EU’s Green Deal pushes faster transition to natural refrigerants. The Natural Refrigerants Market benefits from widespread CO₂ adoption in retail refrigeration and propane use in residential equipment. Leading companies across Germany, France, and Italy invest in low-charge ammonia systems for industrial cooling. Regional initiatives like EPEE and Eurammon actively promote safety training and policy support. Adoption extends to hospitals, hospitality, and transportation refrigeration, driven by public and private sector alignment.

Asia Pacific

Asia Pacific holds approximately 28% of the market share in 2023. The region sees high demand from food processing, retail, and transport refrigeration sectors. Japan leads in natural refrigerant technologies, especially CO₂-based systems for convenience stores. The Natural Refrigerants Market expands rapidly in China, South Korea, and Australia due to rising environmental awareness and government-led efficiency targets. Growth in residential air conditioning and cold chain investments supports propane and isobutane systems. Despite regulatory differences, local OEMs in China and India are developing natural refrigerant-compatible systems for domestic and export use.

Latin America

Latin America accounts for around 6% of the market share in 2023. Brazil, Mexico, and Chile show early signs of transition, driven by food export demands and energy cost pressures. The Natural Refrigerants Market begins to grow in agriculture, fisheries, and hospitality sectors where end users seek long-term efficiency. Adoption remains low but steady due to lack of standardized safety codes and limited technician training. International programs support pilot projects using ammonia and hydrocarbons in large cold storage. Market players explore partnerships with local service providers to bridge technical gaps.

Middle East and Africa

The Middle East and Africa represent about 5% of the global market share in 2023. Adoption is emerging in segments like green building HVAC, district cooling, and supermarket refrigeration. The Natural Refrigerants Market finds opportunity in premium hospitality, healthcare, and industrial cold storage. CO₂ systems are tested in hot-climate applications with improved compressor technology. Barriers include limited regulatory enforcement, higher initial costs, and lack of trained workforce. Governments in the Gulf Cooperation Council (GCC) and parts of North Africa are exploring energy-saving mandates that could boost adoption long term.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shandong Yuean Chemical Industry

- Danfoss

- HyChill Australia

- Tazzetti S.p.A.

- Air Liquide

- Linde plc

- AGC

- Puyang Zhongwei Fine Chemical

- engas Australasia

- A-Gas International

Competitive Analysis

Competitive landscape of the Natural Refrigerants Market includes key players such as Linde plc, Danfoss, HyChill Australia, Tazzetti S.p.A., Air Liquide, A-Gas International, AGC, Puyang Zhongwei Fine Chemical, Shandong Yuean Chemical Industry, and engas Australasia. These companies focus on regulatory alignment, technological innovation, and expanding global reach to meet rising demand for low-GWP refrigerants. Leading players invest in product development across ammonia, CO₂, and hydrocarbon segments to enhance safety, energy efficiency, and compatibility with various applications. They collaborate with OEMs to integrate low-charge designs and smart control systems into commercial and industrial refrigeration units. European and Japanese manufacturers lead in advanced CO₂ and propane technologies, while regional suppliers in China and Australia strengthen availability for localized needs. Strategic partnerships, pilot projects, and technician training programs are used to support adoption and customer transition. Mergers, acquisitions, and capacity expansions also help secure competitive advantage in a market shaped by environmental policies and innovation pressure.

Recent Developments

- In August 2025, Danfoss published an analysis projecting that by 2032, natural refrigerants such as hydrocarbons, CO₂ (R744), and ammonia (R717) will dominate residential, commercial, and industrial HVAC&R segments in Europe.

- In July 2025, Linde plc Included among key players cited in a Meticulous Research report on natural refrigerants, Linde is recognized for its role in industrial adoption of hydrocarbon and CO₂ refrigerants.

- In June 2025, Danfoss released the latest MLZ/LLZ compressor models (version C) using low-flammability A2L refrigerants—R454A, R455A, and R455C—as qualified refrigerants for improved performance.

- In 2024, ATMOsphere launched its global “natural refrigerants label,” setting a benchmark for best practices in the sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low-GWP refrigerants will grow due to global HFC phasedown regulations.

- Adoption of CO₂ systems will expand in commercial refrigeration across developed and emerging markets.

- Hydrocarbons will gain more share in residential appliances and light commercial cooling.

- Ammonia systems will continue to dominate industrial refrigeration due to high energy efficiency.

- Manufacturers will focus on developing compact, low-charge systems for wider application use.

- Smart controls and automation will enhance safety and performance of natural refrigerant systems.

- Training and certification programs will increase to address technician shortages and safety gaps.

- Regulatory harmonization across regions will boost cross-border adoption and equipment standardization.

- Cold chain infrastructure growth will drive demand in food, pharmaceutical, and logistics sectors.

- Strategic partnerships between OEMs, chemical firms, and service providers will shape market expansion.