Market Overview

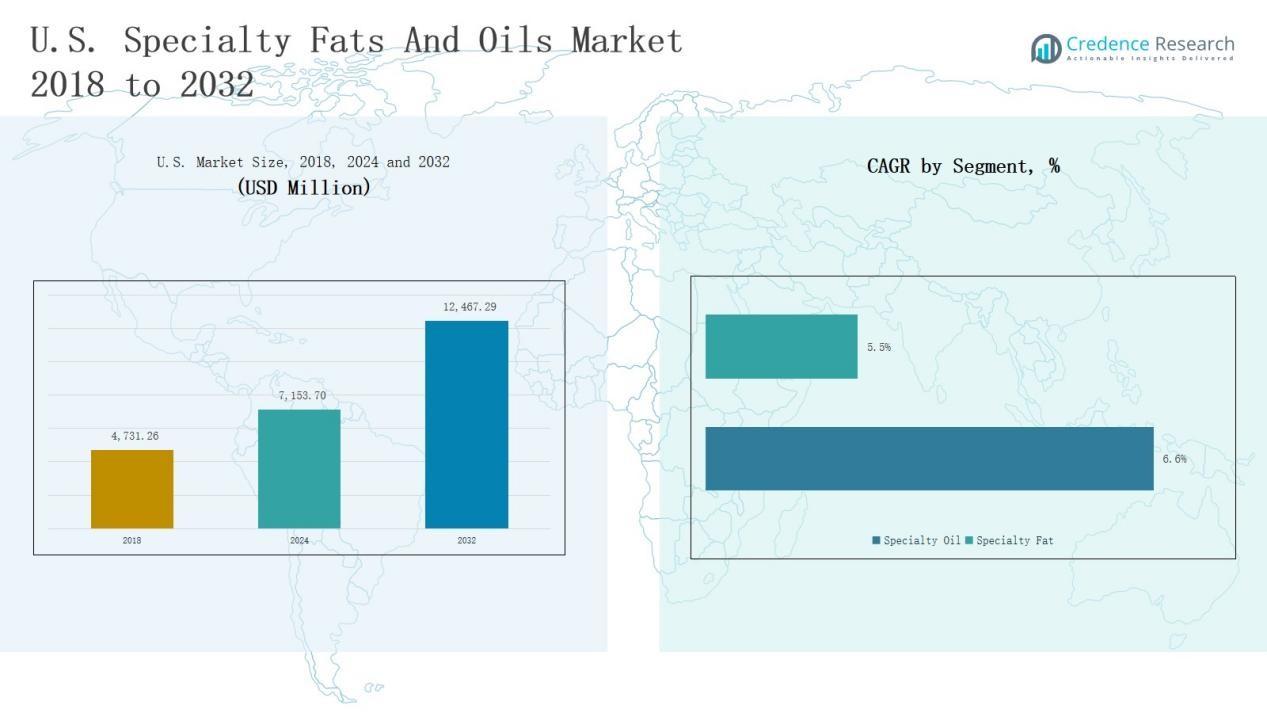

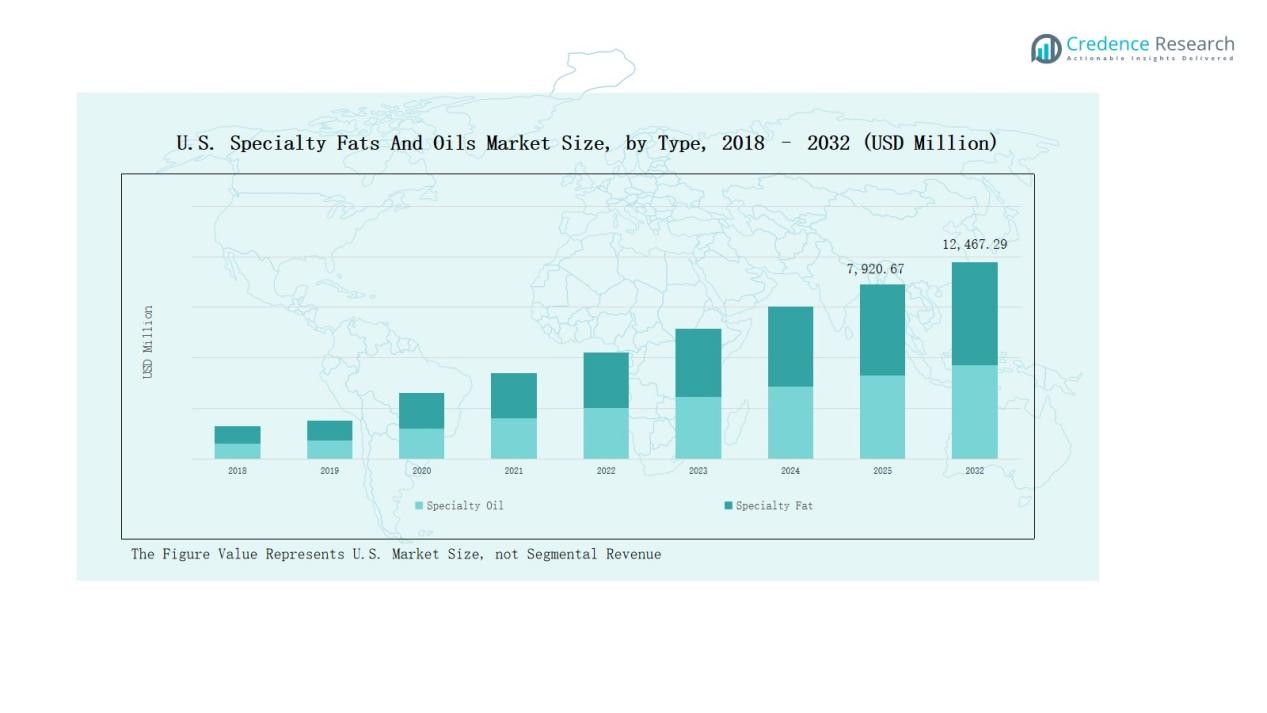

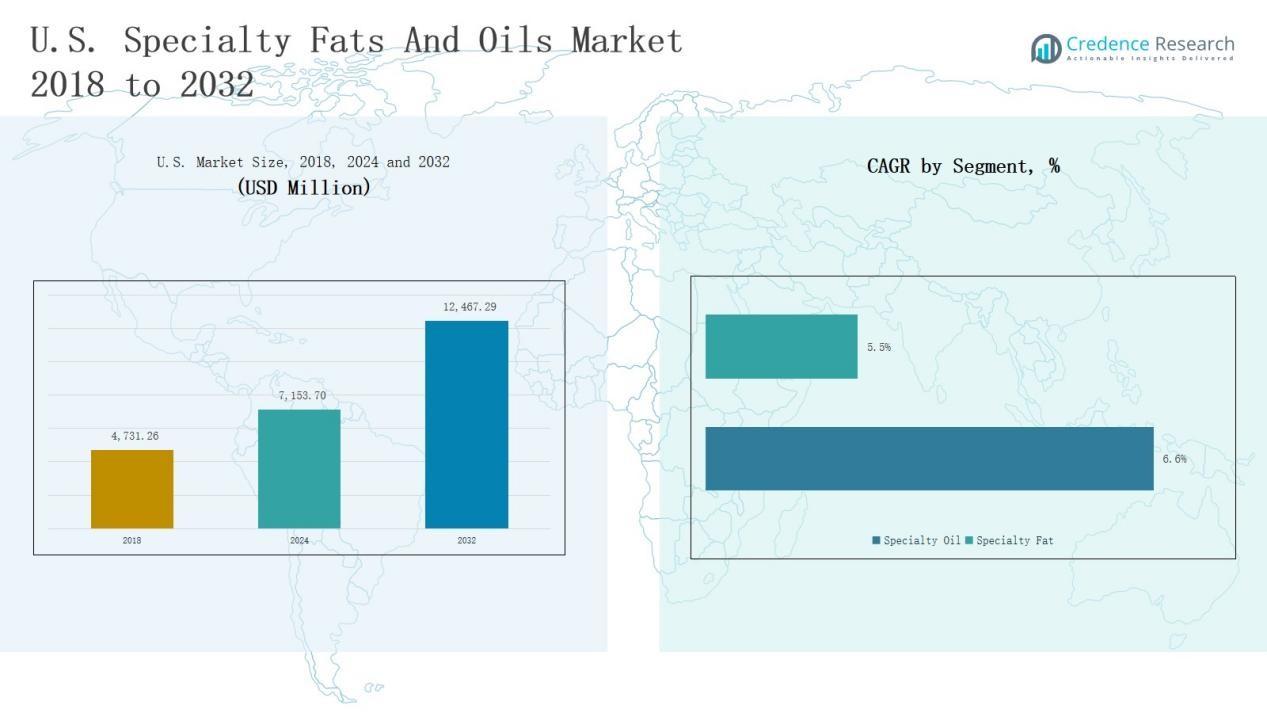

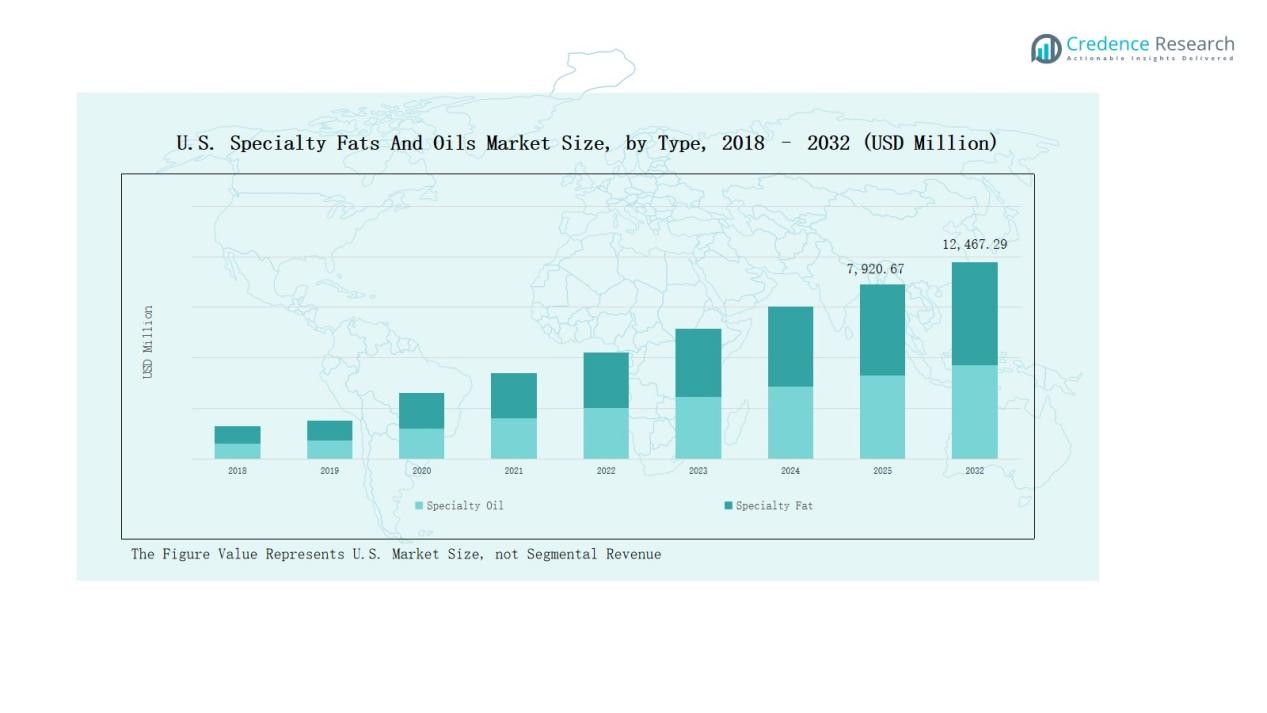

U.S. Specialty Fats And Oils Market size was valued at USD 4,731.26 million in 2018 to USD 7,153.70 million in 2024 and is anticipated to reach USD 12,467.29 million by 2032, at a CAGR of 6.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Specialty Fats And Oils Market Size 2024 |

USD 7,153.70 Million |

| U.S. Specialty Fats And Oils Market, CAGR |

6.70% |

| U.S. Specialty Fats And Oils Market Size 2032 |

USD 12,467.29 Million |

The U.S. Specialty Fats and Oils Market is led by global and regional players including Cargill, Archer Daniels Midland Company (ADM), Bunge Limited, Wilmar International, AAK AB, Ingredion Incorporated, Kerry Group, IOI Loders Croklaan, Conagra Brands, and DuPont de Nemours, Inc. These companies strengthen their positions through diverse product portfolios, sustainable sourcing practices, and continuous innovation in bakery fats, confectionery fats, and specialty oils. Strategic investments in plant-based and trans-fat-free solutions enable them to meet evolving consumer and regulatory demands. Among regions, the Midwest dominates with a 32% market share in 2024, supported by extensive industrial food processing, reliable raw material supply, and large-scale demand from bakery and confectionery manufacturers. This strong regional base reinforces the Midwest’s role as the primary hub for specialty fats and oils distribution across the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Specialty Fats and Oils Market grew from USD 4,731.26 million in 2018 to USD 7,153.70 million in 2024 and is expected to reach USD 12,467.29 million by 2032.

- Specialty oils held 58% share in 2024, led by palm oil use in bakery, confectionery, and processed foods, while bakery fats dominated specialty fats with 22% share.

- Industry applications commanded 46% share in 2024, driven by large-scale food processing, with restaurants contributing 28% and households adopting healthier oils at 20% share.

- Chocolate led end-user demand with 32% share in 2024, followed by confectioneries at 24% and bakery at 20%, highlighting strong dependence on specialty fats and oils.

- The Midwest was the leading region with 32% share in 2024, supported by extensive food processing, while the South held 28%, West 22%, and Northeast 18%.

Market Segment Insights

By Type

Specialty oils dominate the U.S. market, accounting for nearly 58% share in 2024. Palm oil leads within this group due to its versatile use in bakery, confectionery, and processed food applications. Rising demand for plant-based and cost-effective oils continues to sustain palm oil consumption. Specialty fats hold the remaining share, led by bakery fats at around 22%, supported by the growth of ready-to-eat products and indulgent desserts. Confectionery fats and ice cream fats also show steady growth, driven by consumer preference for premium chocolates and frozen treats.

- For instance, Bunge announced the launch of its sustainable palm oil portfolio tailored for processed food and confectionery players, certified by the Roundtable on Sustainable Palm Oil (RSPO).

By Application

Industry represents the largest application, holding 46% share in 2024, as specialty fats and oils are widely used in large-scale food production, processing, and packaging. Rising demand from confectionery, bakery, and functional food manufacturers drives growth in this segment. Restaurants contribute 28%, reflecting the growing popularity of fried foods, baked items, and quick-service meals. Household usage stands at 20%, supported by consumer adoption of olive oil and sunflower oil for healthier cooking. The “Others” category covers smaller uses such as institutional kitchens and food service distributors.

- For instance, Cargill launched its innovative CremoFlex Fillings designed for bakery and confectionery applications, aiming to improve texture and stability in industrial chocolate and pastry fillings.

By End User

Chocolate is the dominant end-user segment, capturing 32% share in 2024, fueled by high consumption of cocoa butter substitutes and specialty fats for texture enhancement. Confectioneries follow closely at 24%, with specialty oils supporting shelf stability and flavor retention. Bakery accounts for 20%, driven by demand for trans-fat-free formulations in bread, cakes, and pastries. Infant food secures 10%, supported by regulations promoting high-quality fats for nutrition. Culinary applications hold 7%, with olive and sunflower oils gaining preference in cooking and dressings. Functional fats and other niche categories together contribute 7%, reflecting innovation in dietary and fortified products.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The expanding consumption of packaged and processed foods in the U.S. fuels strong demand for specialty fats and oils. Bakery, confectionery, and ready-to-eat product manufacturers increasingly use palm oil, bakery fats, and confectionery fats for texture and shelf-life improvements. Rising urbanization and dual-income households support convenient food choices, boosting usage in both retail and foodservice industries. This trend ensures steady volume growth across key specialty oil and fat sub-segments.

- For instance, Bunge introduced its Vream brand shortening solutions in the U.S., designed for cookies and cakes to deliver enhanced texture and extended freshness.

Health-Oriented Reformulations and Trans-Fat Regulations

Regulatory restrictions on trans-fats have compelled food companies to adopt healthier alternatives. Specialty fats and oils formulated from palm, sunflower, and olive oils provide functionality while aligning with consumer health demands. Growth is supported by rising adoption of non-hydrogenated and low-saturated-fat products. Increasing awareness of heart health and wellness strengthens market adoption, particularly in bakery and confectionery industries where reformulation has become a strategic priority.

- For instance, Cargill introduced its PalmAgility® line of non-hydrogenated palm-based bakery shortenings in the U.S., designed to provide improved texture and shelf stability while meeting trans-fat-free requirements.

Expanding Use in Infant Nutrition and Functional Foods

Infant food manufacturers and functional nutrition companies increasingly rely on specialty oils and fats to improve nutritional value. Ingredients such as high-quality rapeseed and olive oils deliver essential fatty acids for infant formula. Similarly, functional fats support dietary supplements and health products, catering to wellness-conscious consumers. The U.S. market benefits from rising parental spending on premium infant nutrition and strong demand for fortified foods, expanding opportunities for specialty oil producers.

Key Trends & Opportunities

Growing Preference for Plant-Based and Sustainable Oils

The rise of plant-based diets in the U.S. creates strong opportunities for sustainable specialty oils. Palm and soy oil suppliers are investing in certified sustainable sourcing to meet consumer expectations. Olive and sunflower oils also gain traction as clean-label, plant-based choices in culinary and packaged food applications. This trend reflects the broader consumer shift toward eco-friendly, transparent, and health-focused products, positioning specialty oils as critical enablers of sustainable food manufacturing.

- For instance, ADM launched its HarvestEdge® Sunflower Oil in the U.S., marketed for its non-GMO and high-oleic profile to serve clean-label snack and bakery applications.

Technological Innovations in Specialty Fat Formulations

Advances in fat structuring and blending technologies enable manufacturers to develop tailored solutions for bakery, confectionery, and frozen desserts. U.S. producers are focusing on high-performance bakery fats and confectionery coatings that deliver functionality without trans-fats. The introduction of fat alternatives for vegan chocolate and dairy-free ice cream expands market opportunities. These innovations support product differentiation for food brands and align with evolving dietary preferences, creating premium growth avenues.

- For instance, AAK launched COBAO Pure, a cocoa butter alternative that prevents bloom in chocolate products and provides greater shelf stability.

Key Challenges

Price Volatility in Raw Material Supply

The U.S. market remains highly sensitive to global price fluctuations of palm oil, soy oil, and rapeseed. Supply chain disruptions caused by climate change, trade restrictions, and geopolitical tensions amplify costs. Frequent price swings create uncertainty for food manufacturers that rely on consistent ingredient sourcing. Managing raw material costs while maintaining profitability remains a significant challenge for both multinational suppliers and local processors in the specialty fats and oils industry.

Growing Competition from Alternatives and Substitutes

Plant-based butter, dairy alternatives, and advanced emulsifiers increasingly compete with specialty fats in bakery and confectionery. Olive oil and avocado oil are also marketed as healthier substitutes for frying and culinary applications. This rising competition challenges traditional specialty fat categories such as bakery fats and frying fats. To remain competitive, suppliers must innovate, expand portfolios, and strengthen health-oriented claims to retain consumer and industrial trust.

Regulatory Compliance and Sustainability Pressures

The specialty fats and oils industry faces strict U.S. regulations on labeling, nutritional content, and sustainability standards. Compliance with FDA rules, non-GMO certifications, and environmental standards requires substantial investment. Increasing demand for deforestation-free palm oil and eco-friendly sourcing further pressures supply chains. Companies unable to adapt to stringent sustainability frameworks risk losing market share to rivals offering transparent, certified, and environmentally responsible products.

Regional Analysis

Northeast

The Northeast accounts for 18% share of the U.S. Specialty Fats and Oils Market. Strong demand comes from the bakery and confectionery industries concentrated in New York, New Jersey, and Pennsylvania. The region benefits from rising consumer preference for premium chocolates and artisan baked goods that rely on specialty fats. Olive oil and sunflower oil also see high adoption in household and restaurant segments due to the health-conscious population. Growing ethnic food diversity supports demand for rapeseed and soy oils. The presence of large food manufacturing hubs continues to reinforce steady consumption.

Midwest

The Midwest holds the largest 32% share of the U.S. Specialty Fats and Oils Market. It is driven by extensive industrial food processing in Illinois, Ohio, and Minnesota. High production volumes of bakery fats, confectionery fats, and frying fats strengthen the segment’s dominance. The agricultural base supports steady supply of soy and corn oils, reducing input costs for manufacturers. Household and restaurant demand also contributes, but industry applications remain the strongest driver. It is positioned as a critical hub for national distribution of specialty oils and fats.

South

The South captures 28% share of the U.S. Specialty Fats and Oils Market. It is supported by a thriving quick-service restaurant industry and widespread fried food culture. Palm oil and frying fats dominate consumption, particularly in Texas and Florida. Rising demand for confectionery and bakery items also fuels growth across this region. Household use of olive oil and sunflower oil is expanding in urban centers. Food manufacturers in the South continue to invest in cost-effective formulations that enhance shelf stability and taste.

West

The West represents 22% share of the U.S. Specialty Fats and Oils Market. It benefits from strong adoption of plant-based and premium oils, particularly olive and sunflower oils. California leads the region with robust demand from households and culinary applications. Specialty fats are increasingly used in confectionery and bakery industries to cater to diverse consumer preferences. Rising health awareness and sustainability-focused sourcing drive steady market expansion. It remains a key growth region, especially for functional fats and high-quality specialty oils.

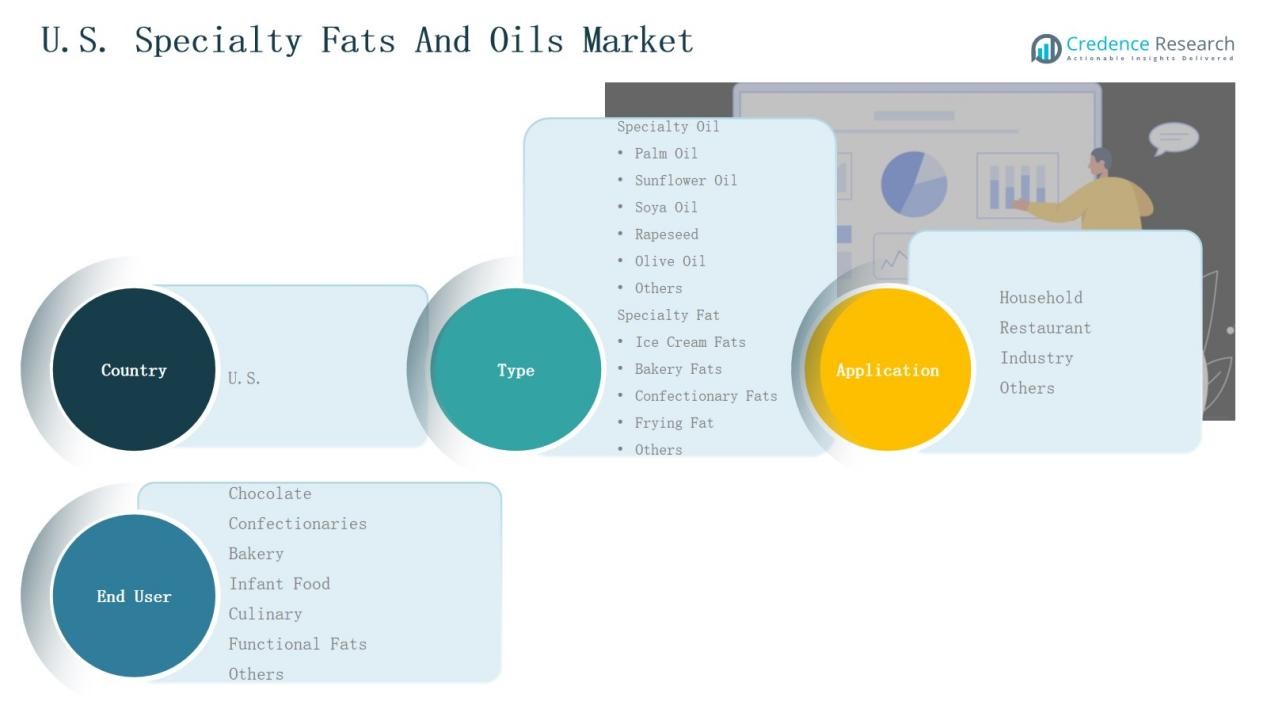

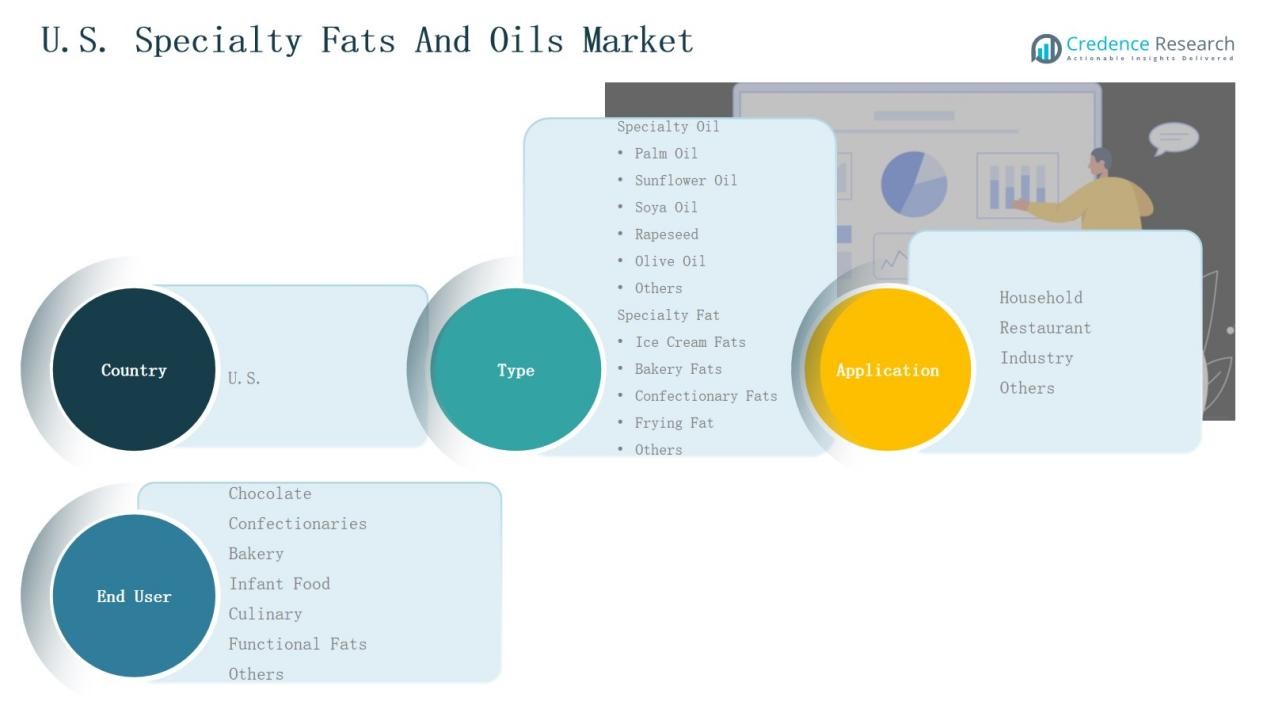

Market Segmentations:

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fat

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectioneries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Specialty Fats and Oils Market is characterized by the presence of multinational corporations and regional suppliers competing through product innovation, sustainability, and strategic partnerships. Leading players such as Cargill, Archer Daniels Midland Company (ADM), Bunge Limited, Wilmar International, and AAK AB maintain strong positions with diversified product portfolios that serve bakery, confectionery, infant nutrition, and culinary applications. Companies focus on developing trans-fat-free, plant-based, and clean-label formulations to align with evolving health and regulatory demands. Sustainable sourcing of palm and soy oils has become a critical differentiator, with several firms investing in traceability and certification initiatives. Regional manufacturers strengthen their market presence through cost competitiveness, localized supply chains, and customized offerings. Intense competition drives continuous investments in R&D, new product launches, and capacity expansions, ensuring that both global and domestic players remain agile in addressing shifting consumer preferences and industrial requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Ingredion Incorporated

- IOI Loders Croklaan

- Wilmar International

- DuPont de Nemours, Inc.

- Kerry Group

- AAK AB

- Conagra Brands

Recent Developments

- In July 2024, Marubeni Corporation acquired the majority shares of Gemsa Enterprises, LLC, a U.S.-based company engaged in processing and marketing edible specialty fats and oils such as olive oil.

- In May 2025, Cargill achieved top ranking on the 2025 Oil Supplier Index after eliminating industrial trans fats from its entire edible oils portfolio.

- In March 2024, Chevron and Bunge launched an oilseed feedstock joint venture to build a new processing plant in the U.S., strengthening domestic specialty oil supply chains and upstream sourcing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-based specialty oils will expand with growing vegan and flexitarian diets.

- Sustainable palm oil sourcing will remain a priority for leading suppliers.

- Specialty fats for bakery and confectionery will see stronger adoption in premium products.

- Olive and sunflower oils will gain higher household penetration driven by health awareness.

- Quick-service restaurants will continue to drive growth in frying fats consumption.

- Functional fats will see rising use in dietary supplements and fortified foods.

- Infant nutrition will create consistent demand for high-quality rapeseed and specialty oils.

- Innovation in non-hydrogenated formulations will help meet stricter U.S. regulatory standards.

- Regional producers will strengthen presence through cost-effective and localized supply chains.

- Digitalization of supply networks will improve transparency and support sustainable certifications.