Market Overview:

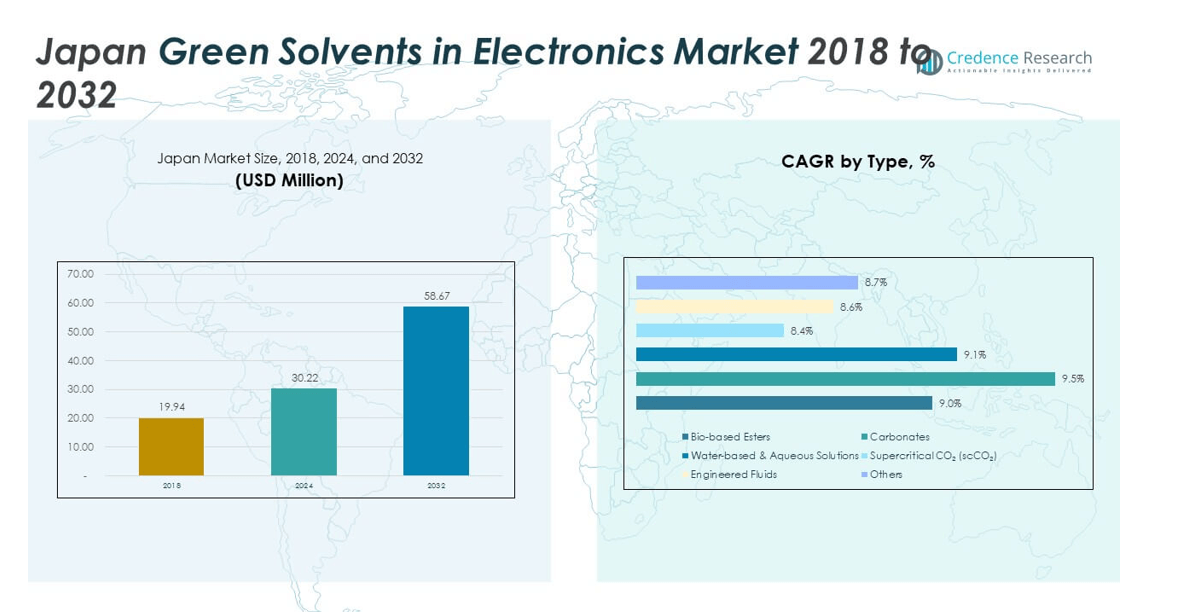

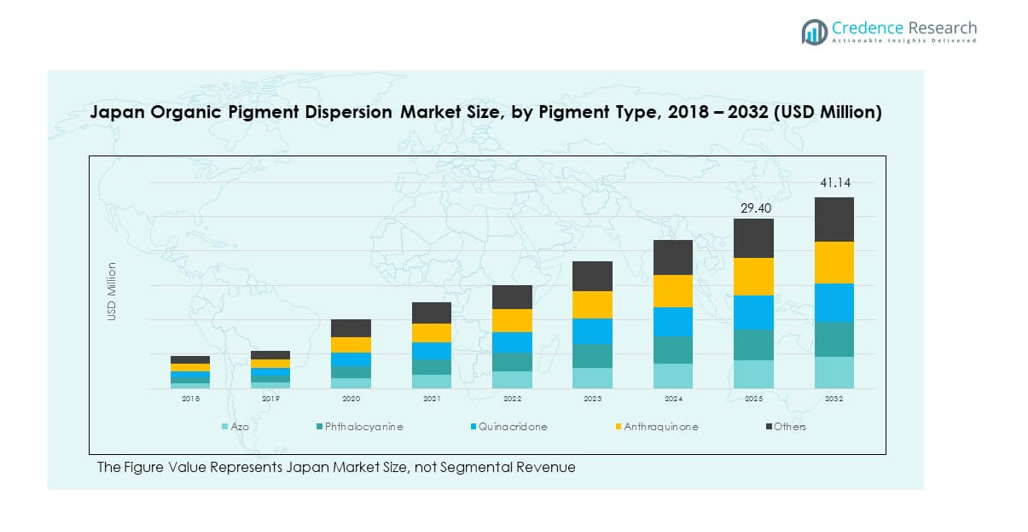

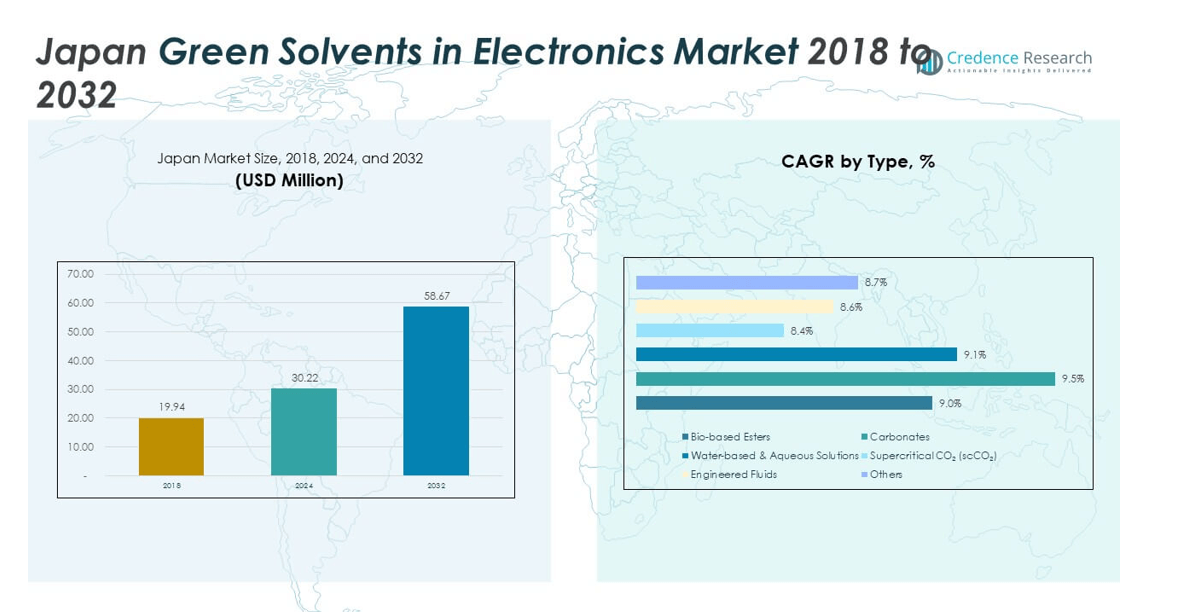

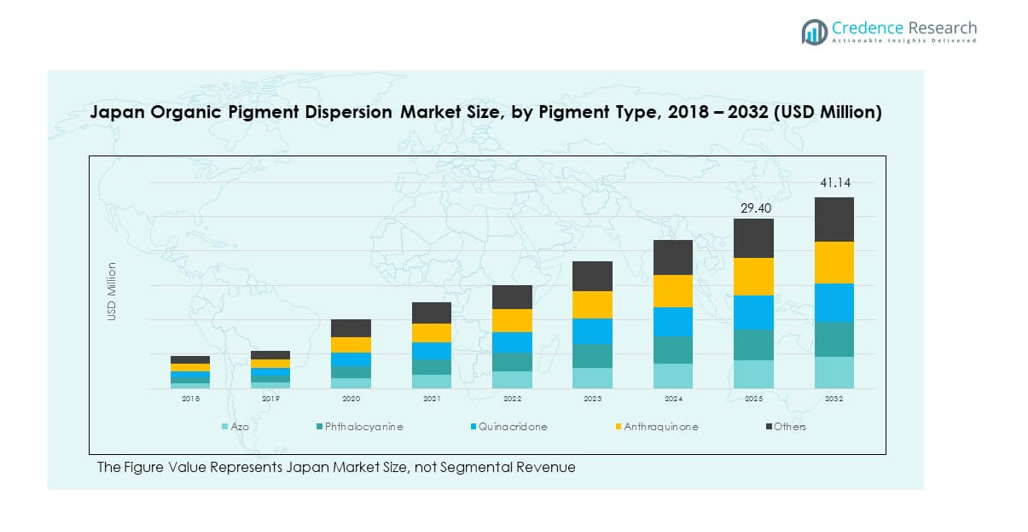

The Japan Organic Pigment Dispersion Market size was valued at USD 19.12 million in 2018 to USD 27.82 million in 2024 and is anticipated to reach USD 41.14 million by 2032, at a CAGR of 4.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Organic Pigment Dispersion Market Size 2024 |

USD 27.82 million |

| Japan Organic Pigment Dispersion Market, CAGR |

4.91% |

| Japan Organic Pigment Dispersion Market Size 2032 |

USD 41.14 million |

The Japan Organic Pigment Dispersion Market is supported by rising demand across packaging, coatings, textiles, and plastics. Strong consumer preference for safe and eco-friendly pigments accelerates adoption over synthetic alternatives. Regulatory frameworks encourage manufacturers to innovate with low-toxicity and sustainable formulations. Expanding automotive and electronics industries create demand for high-performance dispersions with superior stability and color quality. Printing inks remain central to growth due to packaging applications, while cosmetics gain traction for their safety profile. It reflects strong alignment between industrial growth and environmental priorities.

In terms of regional dynamics, Japan holds a leading role in Asia-Pacific due to its advanced industrial infrastructure and focus on sustainable innovation. China dominates large-scale production through volume-driven exports, while India emerges as a growth hub led by its expanding textile and packaging industries. Southeast Asian countries demonstrate steady adoption fueled by rising consumer goods and construction demand. It benefits from Japan’s strong technological base, regulatory support, and close regional trade ties, which position the market for long-term competitiveness.

Market Insights

- The Japan Organic Pigment Dispersion Market was valued at USD 19.12 million in 2018, reached USD 27.82 million in 2024, and is projected to hit USD 41.14 million by 2032, growing at a CAGR of 4.91%.

- The Global Organic Pigment Dispersion Market size was valued at USD 397.20 million in 2018 to USD 549.81 million in 2024 and is anticipated to reach USD 768.02 million by 2032, at a CAGR of 4.18% during the forecast period.

- Eastern Japan holds the largest share at 42% due to strong packaging, printing, and coatings demand; Western Japan follows with 35% supported by automotive and electronics; Northern and Southern regions together account for 23%, driven by textiles and cosmetics.

- Western Japan emerges as the fastest-growing region with 35% share, supported by automotive coatings and electronics exports.

- By pigment type, Azo leads with 34% share, followed by Phthalocyanine at 28%, Quinacridone at 15%, Anthraquinone at 12%, and Others at 11%.

- By application, Printing Inks dominate with 37% share, Paints & Coatings hold 26%, Plastics & Polymers account for 18%, Textiles capture 9%, Cosmetics represent 6%, and Others make up 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Packaging and Printing Industries

The Japan Organic Pigment Dispersion Market experiences strong growth due to rising demand from packaging and printing sectors. Brands prefer organic pigments for their vibrant shades and eco-friendly features. Increasing consumption of packaged food and consumer goods fuels consistent pigment use. The printing industry benefits from water-based and solvent-based dispersions that provide high quality output. Companies invest in advanced dispersion technologies to meet performance standards. Eco-labeling initiatives encourage wider adoption of organic pigments. It supports high stability, compatibility, and durability in different substrates. Such demand ensures long-term growth momentum.

- For example, Nature Coatings announced that Levi’s has expanded use of BioBlack™ into its mainstream denim lines. The pigment dispersions are 100% bio-based, non-toxic, and recently earned GOTS certification.

Expanding Use in Automotive and Industrial Coatings

Automotive and industrial coatings significantly contribute to pigment consumption. Organic dispersions enhance durability, weather resistance, and color retention in coatings. Rising vehicle production and demand for premium finishes increase pigment requirements. Manufacturers focus on dispersions that deliver superior gloss and consistency. Industrial coatings apply these pigments in machinery, equipment, and infrastructure projects. Japan’s strong automotive base supports steady demand. It drives innovation in pigment performance to meet stringent quality norms. Growth in this sector strengthens the market position.

Regulatory Push Toward Sustainable and Low-Toxicity Materials

Environmental regulations encourage manufacturers to shift toward safe pigment solutions. The Japan Organic Pigment Dispersion Market aligns with policies promoting reduced volatile organic compounds. Companies invest in R&D to develop dispersions that comply with strict sustainability rules. Regulations discourage heavy metal-based pigments, increasing reliance on organic variants. Compliance ensures access to domestic and international markets. Consumers prefer products with safer formulations, boosting adoption across industries. It creates new opportunities for eco-friendly innovation. Government support drives long-term market expansion.

- For example, DIC Corporation confirms that its principal plants have obtained ISO 14001 environmental management certification. This demonstrates compliance with international sustainability and environmental safety standards in pigment production and supply for global markets, including Japan.

Rising Demand from Electronics and Consumer Goods Applications

The electronics and consumer goods sectors emerge as new growth drivers. Organic pigment dispersions support product design with appealing colors and finishes. Manufacturers of gadgets, appliances, and household items integrate pigments for visual appeal. Rising consumer spending boosts demand for value-added and decorative products. Electronics require dispersions with high thermal and chemical stability. It ensures consistent performance in demanding applications. Growing lifestyle changes accelerate consumption in premium consumer segments. This broadens the application scope for organic pigment dispersions.

Market Trends

Adoption of Nanotechnology in Pigment Formulations

The Japan Organic Pigment Dispersion Market observes a strong trend toward nanotechnology-based pigment solutions. Nanoparticles provide higher transparency, improved stability, and enhanced color strength. Companies innovate with nanostructures that allow better dispersion in coatings and inks. Advanced pigment technology offers resistance to light, heat, and chemicals. R&D investment in nanotechnology creates high-performance materials for specialized applications. It broadens opportunities in electronics, packaging, and high-end consumer products. Nanotechnology strengthens pigment performance beyond traditional limits. The trend reshapes competitive strategies in the industry.

Integration of Digital Printing Applications

Digital printing accelerates pigment dispersion demand in packaging, textiles, and graphics. The market benefits from the growth of e-commerce packaging and promotional materials. Organic dispersions deliver precision, vibrant colors, and eco-safe formulations. Textile printing increasingly adopts these dispersions for customized designs and fast production cycles. Japan’s advanced printing ecosystem supports adoption of digital-compatible pigments. It ensures better compatibility with modern inkjet systems. Consumer preference for unique, personalized designs supports further expansion. This integration creates steady growth prospects.

- For example, at Drupa 2024, the Artience Group (formerly Toyo Ink) showcased its portfolio of inkjet inks, including water-based, UV, and UV LED systems. The company also presented next-generation digital printing solutions developed for packaging and textile markets with a focus on reducing environmental impact.

Increased Focus on Water-Based Dispersions

Water-based dispersions gain preference across industries for their lower environmental impact. The Japan Organic Pigment Dispersion Market reflects a clear shift toward safer alternatives. Water-based systems reduce emissions and comply with strict regulatory frameworks. Companies launch new water-based pigment dispersions for packaging, textiles, and coatings. It helps manufacturers align with consumer demand for green solutions. Adoption ensures cost savings in waste treatment and disposal. Water-based formulations also offer superior work safety. This trend accelerates the phase-out of solvent-heavy systems.

Customization and Functional Additives in Pigments

Market players emphasize customization to meet industry-specific needs. Pigments are modified with functional additives to enhance resistance and performance. The Japan Organic Pigment Dispersion Market incorporates solutions tailored for plastics, textiles, and electronics. Manufacturers deliver dispersions with UV stability, scratch resistance, or chemical resilience. It creates unique value propositions for customers seeking advanced features. Functional customization drives differentiation in a competitive market. Adoption of premium formulations supports higher margins. This trend establishes new benchmarks for performance-driven products.

- For example, in April 2024, Sun Chemical (DIC Group) showcased pigments at Chinaplas 2024 designed to enhance food safety, recyclability, and vivid coloration. These innovations were presented for plastics applications, including food packaging, electric vehicles, and fine fibers.

Market Challenges Analysis

High Production Costs and Intense Competition

The Japan Organic Pigment Dispersion Market faces cost-related challenges due to expensive raw materials and complex processing methods. Smaller manufacturers struggle to match the efficiency of larger companies. High energy requirements in production also add to operational expenses. Intense competition from both domestic and international players creates price pressure. It reduces profit margins and complicates investment planning. Limited economies of scale further restrict profitability for smaller firms. Achieving cost efficiency while maintaining quality remains difficult. This challenge slows down potential growth opportunities.

Limited Awareness and Substitution Threats

Awareness regarding advanced organic pigment dispersions remains low in smaller industries. Many users still rely on cheaper synthetic pigments despite regulatory concerns. The substitution threat from inorganic pigments adds further pressure on the market. It challenges companies to justify premium pricing and benefits of organic variants. Resistance from cost-sensitive industries hinders wider adoption. Customer education and outreach programs demand significant investment. Regulatory complexity also slows product approvals in some applications. These factors create barriers that delay adoption across diverse sectors.

Market Opportunities

Expansion into Sustainable Packaging and Textiles

The Japan Organic Pigment Dispersion Market shows strong opportunities in packaging and textiles. Sustainability trends drive demand for eco-friendly pigments. Companies can capitalize on growth in biodegradable and recyclable packaging. Rising global demand for printed textiles boosts pigment requirements. It offers long-term prospects for players investing in green solutions. Collaboration with textile and packaging leaders enhances penetration. Consumer preference for safe, colorful designs supports expansion. This opportunity ensures consistent demand across industries.

Innovation in High-Performance Specialty Applications

Emerging specialty applications create new opportunities for manufacturers. Electronics, automotive coatings, and advanced plastics demand high-quality dispersions. The Japan Organic Pigment Dispersion Market can benefit by focusing on innovation-driven products. It creates space for dispersions with enhanced thermal, chemical, and UV stability. Companies investing in R&D gain competitive advantage. Expansion into niche, premium applications supports revenue growth. The focus on performance differentiates offerings from low-cost alternatives. This opportunity positions the market for stronger global integration.

Market Segmentation Analysis

By Pigment Type

The Japan Organic Pigment Dispersion Market is segmented into Azo, Phthalocyanine, Quinacridone, Anthraquinone, and Others. Azo pigments hold a significant share due to their cost-effectiveness and versatility in printing and coatings. Phthalocyanine pigments follow with strong demand for their high stability, lightfastness, and vibrant blue and green shades. Quinacridone pigments find applications in premium coatings and plastics where high-performance color properties are required. Anthraquinone pigments cater to specialized needs in textiles and cosmetics. It demonstrates diverse opportunities, as pigment types are tailored to different industry demands and performance requirements.

- For example, Dainichiseika Color & Chemicals Manufacturing Company produces anthraquinone pigments for applications such as textile dyeing. These pigments are developed to meet the rigorous performance and quality standards required by industrial users, including the fashion sector in Japan.

By Application

The market is also divided into Printing Inks, Paints & Coatings, Plastics & Polymers, Textiles, Cosmetics, and Others. Printing inks dominate the Japan Organic Pigment Dispersion Market due to growing packaging, labeling, and publishing industries. Paints and coatings remain another major application, supported by demand in automotive, construction, and industrial finishes. Plastics and polymers use dispersions for color strength and durability, while textiles apply pigments for fabric printing and dyeing. Cosmetics represent a niche but rising segment, with organic pigments used for safe and vibrant formulations. It continues to see expanded usage across these applications, reflecting diverse consumption patterns and emerging growth opportunities.

- For example, Sakata INX produces low-VOC, water-based organic pigment dispersions that are supplied for food packaging applications in Japan. These dispersions are formulated to comply with official safety and migration standards for packaging inks.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Eastern Japan

Eastern Japan accounts for 42% of the Japan Organic Pigment Dispersion Market, driven by Tokyo and surrounding industrial hubs. Strong demand comes from packaging, printing, and coatings industries linked to consumer goods and construction. Tokyo-based manufacturers invest heavily in R&D for eco-friendly pigment technologies. The presence of global headquarters and design centers enhances regional adoption. It benefits from advanced logistics networks that support both domestic and international supply chains. Regulatory bodies in this region also push for sustainable material use, creating a favorable market environment.

Western Japan

Western Japan holds 35% of the market share, supported by Osaka, Kyoto, and Nagoya’s industrial activities. The automotive and electronics industries generate consistent demand for high-performance pigments. Coatings, plastics, and polymers dominate applications in this area. Manufacturers here focus on developing dispersions with enhanced durability, thermal stability, and compliance with international standards. It gains strength from export-oriented production facilities that supply pigments to Asia-Pacific markets. Academic collaboration with research institutions in Kyoto further supports innovation. Strong industrial clusters ensure continued regional growth.

Northern and Southern Japan

Northern and Southern Japan collectively represent 23% of the market, with Hokkaido and Kyushu as key contributors. Agricultural packaging, textiles, and cosmetics industries lead pigment consumption in these regions. Kyushu’s expanding electronics sector adds new demand streams. Northern Japan leverages regional manufacturing hubs that cater to specialized pigment formulations. It benefits from regional policies encouraging environmentally sustainable materials. Growing investment in consumer goods and lifestyle products enhances pigment adoption. These subregions provide emerging opportunities for niche and value-added applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SANYO COLOR WORKS, Ltd.

- Mikuni-Color Ltd.

- Dainichiseika Color & Chemicals Mfg Co Ltd

- DIC Corporation

- Taihei Chemicals Limited

- Toyo Ink Co., Ltd.

- Toyochem Co., Ltd.

- Toyo Morton, Ltd.

- Skychem

- Artience Co., Ltd.

Competitive Analysis

The Japan Organic Pigment Dispersion Market is highly competitive with strong domestic and multinational presence. Companies such as DIC Corporation, Toyo Ink Co., Ltd., and Dainichiseika Color & Chemicals Mfg Co Ltd dominate with diversified portfolios and advanced dispersion technologies. Medium-sized firms like Mikuni-Color Ltd. and Taihei Chemicals Limited strengthen the competitive landscape through specialization and regional market focus. It shows intense rivalry with companies investing in R&D, sustainable solutions, and product customization to secure market share. Global players compete with established Japanese firms by introducing eco-friendly and performance-driven pigment dispersions. Strategic partnerships, mergers, and country-wise expansions increase competition intensity. Local manufacturers gain advantage from proximity to customers and faster response to regulatory demands. It encourages continuous innovation, cost optimization, and differentiation strategies across pigment types and applications. Competitive dynamics in this market favor companies that combine innovation, regulatory compliance, and customer-centric approaches for long-term growth.

Recent Developments

- In March 2025, Sudarshan Chemical Industries completed the acquisition of Heubach Group, positioning itself as one of the largest global players in the organic pigments sector. This move is expected to influence the supply chain and technological portfolio in the Japanese market, as both companies have previously maintained distribution relationships with major local converters and processors in Japan.

- In April 2025, Dainichiseika Color & Chemicals Mfg Co Ltd transferred its 40% ownership in Plalloy Mtd B.V. to Kisco Ltd. as part of ongoing portfolio restructuring. The transaction, first agreed in March 2025, had a reported value of ¥1 million and supports both companies’ growth strategies in the specialty chemicals sector.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Organic Pigment Dispersion Market will expand with growing use in packaging and printing inks.

- Strong regulatory push for sustainable materials will drive continuous innovation in eco-friendly dispersions.

- Advanced applications in electronics and automotive coatings will strengthen demand for high-performance pigments.

- Investments in nanotechnology will enhance pigment strength, stability, and compatibility with diverse substrates.

- Water-based dispersions will see wider adoption due to compliance with environmental standards.

- Expanding consumer goods and lifestyle industries will support demand for premium pigment dispersions.

- Domestic firms will focus on R&D partnerships to remain competitive against multinational players.

- Regional manufacturing hubs in Eastern Japan will maintain leadership through innovation and supply chain strength.

- Export-oriented growth from Western Japan will support integration into broader Asia-Pacific pigment markets.

- Customization and specialty pigment development will open opportunities in niche high-value industries.