Market Overview:

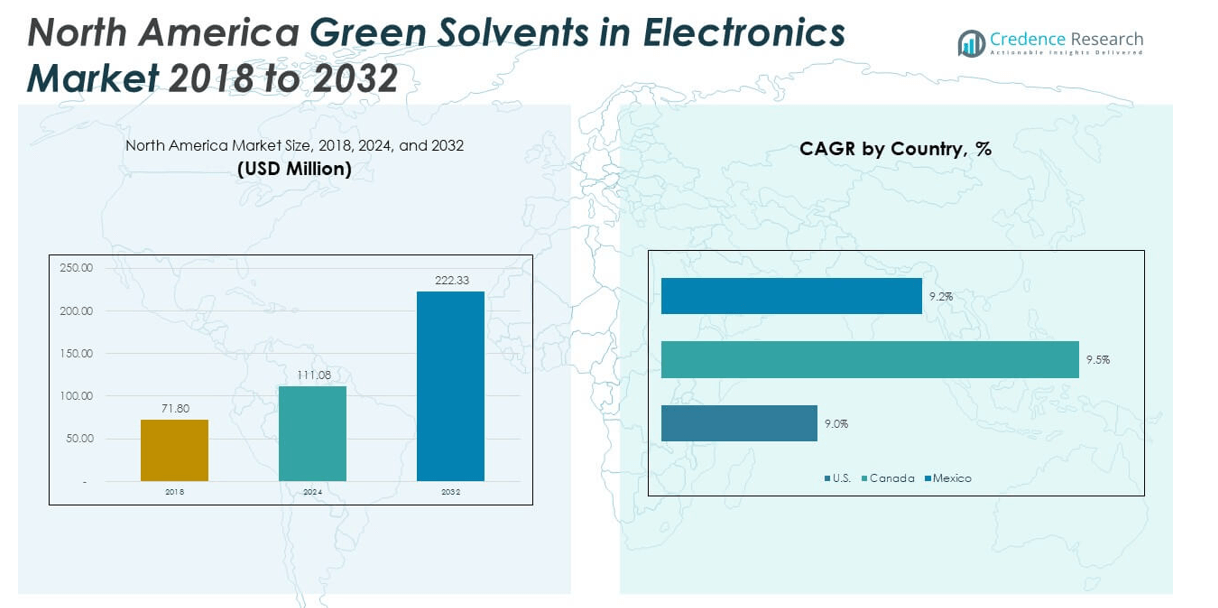

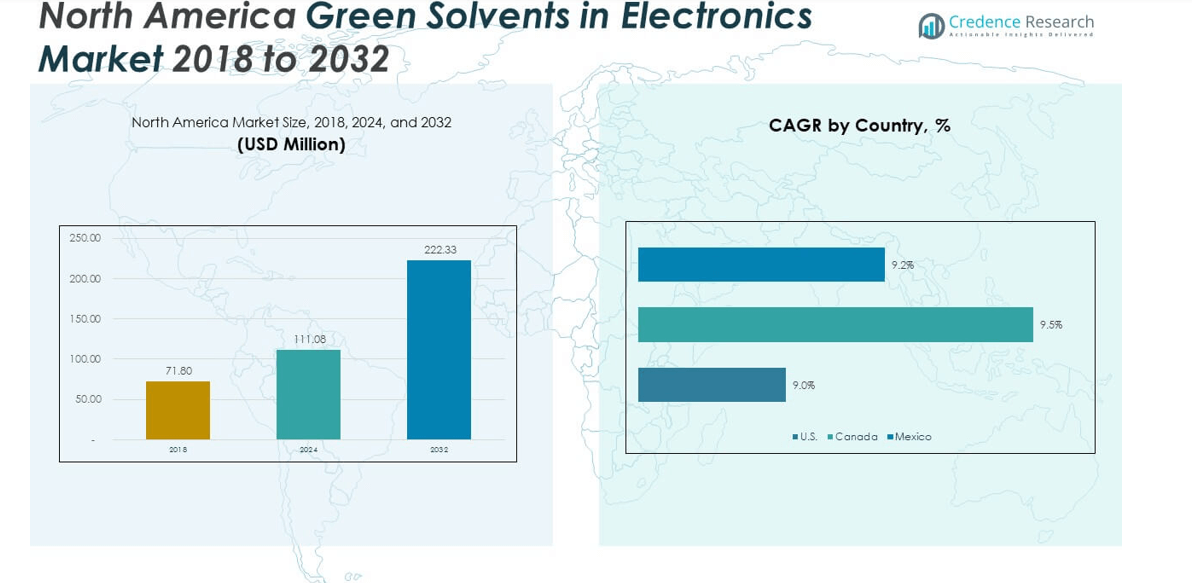

The North America Green Solvents in Electronics Market size was valued at USD 71.8 million in 2018 to USD 111.08 million in 2024 and is anticipated to reach USD 222.33 million by 2032, at a CAGR of 9.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Green Solvents in Electronics Market Size 2024 |

USD 111.08 million |

| North America Green Solvents in Electronics Market, CAGR |

9.06% |

| North America Green Solvents in Electronics Market Size 2032 |

USD 222.33 million |

Growing adoption of eco-friendly materials in electronics manufacturing is driving the market. Companies are shifting toward sustainable solvents to comply with strict environmental regulations and reduce carbon emissions. Rising demand for consumer electronics, combined with increasing awareness of green chemistry, is strengthening adoption. Continuous innovation in bio-based formulations, coupled with pressure to minimize toxic waste, positions green solvents as a preferred alternative in semiconductor cleaning, PCB production, and device assembly. The combination of regulatory support and growing end-user preference is fueling consistent demand across applications.

The North America Green Solvents in Electronics Market demonstrates strong geographic diversity. The United States leads due to advanced semiconductor manufacturing, robust R&D investments, and high electronics consumption. Canada shows steady growth, supported by sustainable policies and an expanding electronics sector. Mexico emerges as a promising market, driven by manufacturing outsourcing and favorable trade conditions that encourage greener production practices. Together, these regions shape a balanced growth pattern, with established markets pushing innovation and emerging ones contributing to broader adoption.

Market Insights:

- The North America Green Solvents in Electronics Market was valued at USD 71.8 million in 2018, reached USD 111.08 million in 2024, and is projected to hit USD 222.33 million by 2032, growing at a CAGR of 9.06%.

- The United States led with 65% share in 2024, supported by advanced semiconductor manufacturing and stringent regulatory frameworks; Canada followed with 20%, driven by sustainability policies; Mexico held 15%, benefitting from expanding electronics assembly.

- Mexico is the fastest-growing region with 15% share, driven by cost-effective labor, favorable trade policies, and investments in electronics manufacturing.

- Bio-based esters accounted for around 30% share in 2024, reflecting strong adoption due to biodegradability and efficiency in electronic cleaning processes.

- Carbonates represented nearly 25% share in 2024, making them a vital segment, supported by their wide use in precision and specialty applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Eco-Friendly Manufacturing Practices Across the Electronics Sector:

The North America Green Solvents in Electronics Market benefits from the strong focus on sustainability in electronics manufacturing. Governments are tightening environmental policies that require manufacturers to reduce toxic emissions and hazardous chemical usage. Electronics producers seek alternatives that align with low-carbon objectives. Green solvents provide a safer, compliant option that reduces harmful residues during cleaning and assembly processes. Consumer pressure for greener electronics further accelerates this adoption. It gains support from both policy and market-driven preferences. The combined influence of regulation and awareness creates consistent momentum across applications.

- For instance, Corbion N.V.’s 2024 annual report mentions that its new circular lactic acid technology reduces cradle-to-gate CO2 emissions by over 30% compared to conventional technology. This demonstrates the practical impact of greener manufacturing practices, even though no public information specifically mentions a 40% reduction in volatile organic compound (VOC) emissions by August 2024.

Technological Advancements Supporting Green Solvent Integration in Device Production:

Continuous innovation in bio-based chemical formulations is expanding opportunities for adoption across electronics processes. Green solvents now achieve comparable performance to conventional solutions, ensuring efficiency in semiconductor cleaning and PCB manufacturing. Research collaborations between chemical companies and electronics producers support scalable integration. It strengthens supply chain readiness and promotes wider use. High-value electronics such as smartphones and laptops increasingly rely on advanced green chemistry inputs. This alignment of innovation with functionality enhances confidence among manufacturers. The North America Green Solvents in Electronics Market continues to grow as technology reinforces reliability.

- For instance, Vertec BioSolvents and Circa Group formed a collaboration in August 2024 to develop the market for the bio-based solvent Cyrene™ in the Americas as a sustainable alternative to traditional petroleum-based solvents. The companies aim to create customized solutions for various demanding applications

Supportive Policies Driving Industrial Transition Toward Sustainable Materials:

Government-led initiatives across North America actively promote eco-friendly chemicals in electronics. Regulations like restrictions on volatile organic compounds create incentives for adopting cleaner alternatives. Industry standards highlight compliance with sustainability certifications, ensuring broader acceptance. It reduces the risks of regulatory penalties and aligns companies with global environmental frameworks. Investments in research grants further strengthen industrial capacity for green solvent production. Universities and R&D centers play a crucial role in scaling these innovations. The market experiences steady progress due to this strong policy and institutional support.

Expanding Consumer Electronics Industry Reinforcing Green Solvent Utilization:

Growing demand for consumer devices such as smartphones, wearables, and tablets pushes the need for sustainable production inputs. Electronics brands highlight eco-conscious practices as a differentiator in competitive markets. Green solvents enable safe cleaning and precision during assembly, making them essential for high-volume production. It builds trust among environmentally aware consumers seeking responsible brands. Electronics leaders integrate such measures into sustainability reports, reinforcing adoption. Expanding product variety drives broader use of solvents across assembly lines. The North America Green Solvents in Electronics Market benefits significantly from this consumer-focused demand.

Market Trends:

Increasing Adoption of Circular Economy Principles in Electronics Manufacturing:

Electronics manufacturers in North America are shifting toward circular economy models that emphasize waste reduction and material reuse. Green solvents fit into this framework by offering non-toxic and biodegradable solutions for electronics processes. Companies highlight closed-loop manufacturing practices that reduce solvent wastage and enhance recovery. It supports brand positioning as environmentally responsible and efficient. Collaboration with recycling partners further boosts demand for eco-friendly solvent solutions. Consumer trust rises when companies adopt transparent sustainability measures. The North America Green Solvents in Electronics Market evolves in line with these principles.

- For instance, in December 2024, Godavari Biorefineries Ltd. signed a license agreement with Catalyxx Inc. to acquire technology for converting ethanol to biobutanol. As of September 2025, the company is in the engineering and planning phase for its first facility, with plans for construction and operation. The company did not implement a closed-loop system in 2024, and specific recovery rates are not publicly available.

Integration of Digital Technologies to Improve Solvent Efficiency and Monitoring:

The market experiences an increasing focus on digital tools that track solvent use in electronics production. Smart monitoring systems ensure precise solvent application and reduce overall consumption. It improves cost efficiency and reduces environmental footprints. Companies deploy automated systems to integrate green solvents more effectively across assembly lines. Data-driven insights enhance quality control in semiconductor cleaning processes. Partnerships with technology providers accelerate this trend. The North America Green Solvents in Electronics Market benefits as industries pair green chemistry with advanced monitoring.

- For instance, Vertec BioSolvents products are used for electronic product manufacturing, chemical formulation, and R&D. The company’s bio-based solvents, which are free of hazardous ingredients, align with evolving corporate responsibility standards.

Growth of Strategic Collaborations Between Chemical and Electronics Companies:

Joint ventures and partnerships across chemical producers and electronics manufacturers are becoming more common. Such collaborations enable tailored solvent formulations that meet specific process requirements. It ensures compatibility with advanced electronic devices and materials. Leading firms invest in joint research centers to accelerate innovation. Collaborative agreements improve supply security for green solvents. Strong relationships also help companies share expertise in sustainable practices. The North America Green Solvents in Electronics Market expands steadily through these cross-industry partnerships.

Rising Interest in Bio-Based Raw Materials for Solvent Production:

Chemical companies are increasing investments in raw materials derived from renewable resources. Bio-based inputs such as plant oils and agricultural by-products reduce reliance on petroleum. It ensures stable sourcing amid fossil fuel market volatility. Manufacturers gain added sustainability certifications when incorporating bio-based solvents into electronics processes. Consumer demand for bio-preferred products strengthens this trend further. Supply chains adapt by prioritizing renewable inputs for long-term resilience. The North America Green Solvents in Electronics Market positions itself as an industry leader through these bio-materials.

Market Challenges Analysis:

High Production Costs and Limited Scalability of Green Solvent Manufacturing:

The North America Green Solvents in Electronics Market faces cost-related challenges that limit broader adoption. Green solvents often involve complex production processes and expensive raw materials. It makes them less competitive than conventional solutions in high-volume applications. Small and mid-sized electronics manufacturers hesitate to switch due to higher upfront costs. Limited scalability of bio-based production plants also restricts output. This gap between demand and supply pressures pricing further. Addressing these issues requires significant investment in process optimization and capacity expansion. Without cost reductions, adoption may progress at a slower pace.

Technical Limitations and Resistance to Shifting Established Manufacturing Processes:

Electronics producers often rely on established solvent systems that have been tested extensively. Transitioning to green alternatives involves technical adjustments in cleaning, coating, and assembly. It creates resistance due to concerns about performance reliability. Manufacturers worry about potential risks to sensitive components if solvents underperform. Training requirements and process redesigns add further complexity. Supply chain readiness also remains uneven across regions. The North America Green Solvents in Electronics Market must overcome these hurdles to achieve large-scale acceptance. Industry education and demonstration of consistent performance are essential to address skepticism.

Market Opportunities:

Expansion of Semiconductor and Electronics Manufacturing in North America:

The North America Green Solvents in Electronics Market gains significant opportunity from expanding semiconductor production in the region. Governments and private investors are funding large-scale facilities to reduce reliance on imports. It creates a robust demand for sustainable chemicals suited for high-precision processes. Electronics clusters in the United States and Mexico offer strong growth prospects. Manufacturers seek eco-friendly materials to meet regulatory demands and global sustainability expectations. This creates consistent opportunities for green solvent suppliers across the electronics ecosystem.

Rising Corporate Sustainability Commitments Across Leading Electronics Brands:

Electronics brands continue to prioritize sustainability commitments as part of long-term strategies. Green solvents align with corporate goals targeting emissions reduction and environmentally safe operations. It allows companies to strengthen market reputation while meeting consumer expectations. Partnerships with chemical firms provide custom solutions that integrate easily into manufacturing. This alignment of sustainability with brand value creates growing opportunities. The North America Green Solvents in Electronics Market stands to benefit strongly from these commitments as they gain prominence in corporate reporting and product positioning.

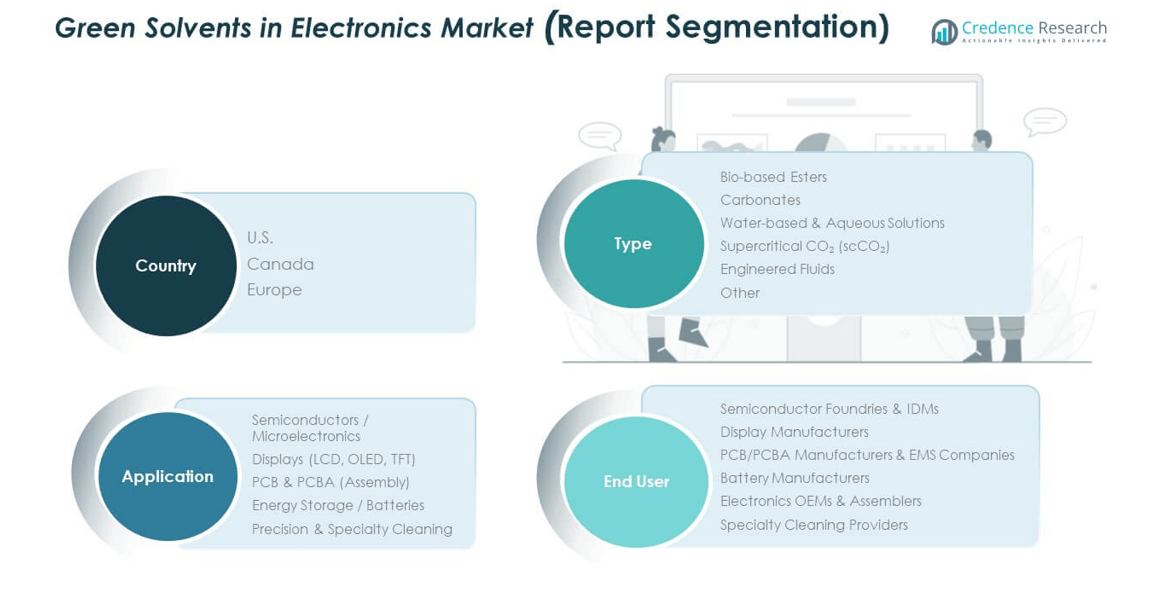

Market Segmentation Analysis:

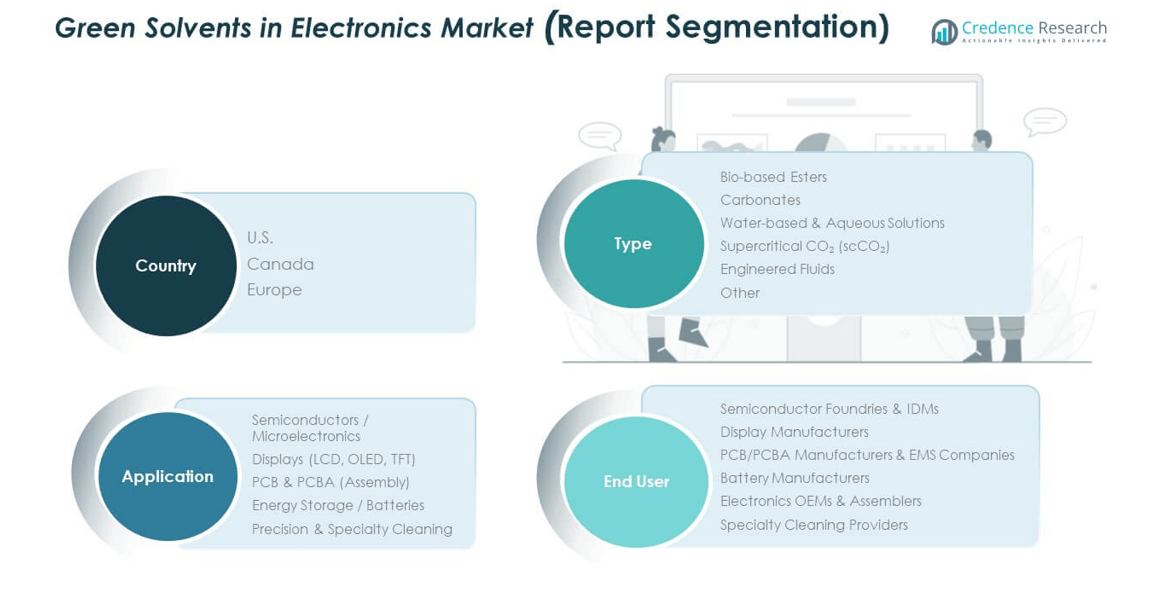

By Type

The North America Green Solvents in Electronics Market is diversified across bio-based esters, carbonates, water-based and aqueous solutions, supercritical CO₂, engineered fluids, and others. Bio-based esters and carbonates gain strong traction due to their biodegradability and compatibility with high-performance electronics. Water-based solutions dominate routine cleaning applications, while engineered fluids and scCO₂ find demand in specialized, high-precision processes. It reflects a shift toward sustainable alternatives without compromising efficiency.

- For instance, in February 2025, UBE Corporation broke ground on a new plant in Louisiana, USA, to significantly expand its production capacity of dimethyl carbonate (DMC) and ethyl methyl carbonate (EMC). This was in response to the growing global demand for high-purity carbonate solvents, primarily for use in electrolytes for lithium-ion batteries in electric vehicles. While DMC is also used in semiconductor manufacturing, the main driver for this new facility was the battery market.

By Application

Semiconductors and microelectronics represent the largest application segment, driven by stringent requirements for purity and sustainable production. Displays such as LCD, OLED, and TFT follow, supported by rising demand for energy-efficient consumer devices. PCB and PCBA assembly show consistent uptake as manufacturers adopt safer solvents in mass production. Batteries and energy storage applications accelerate adoption due to green chemistry integration in electrode preparation. Precision and specialty cleaning also emerge as vital, where non-toxic solvents enhance performance and workplace safety.

- For instance, during its FY25 results, Godavari Biorefineries Ltd. reported growth in EBITDA from its bio-based chemicals segment, attributing the increase to enhanced operational efficiencies and a strategic shift toward high-value, sustainable solutions.

By End User

Semiconductor foundries and IDMs lead adoption due to their scale, strict compliance needs, and focus on sustainable innovation. Display manufacturers follow with strong use in coating and cleaning applications. PCB and PCBA manufacturers, along with EMS companies, show steady demand for efficient and safer cleaning agents. Battery manufacturers gain momentum as they adapt eco-friendly solvents in next-generation technologies. Electronics OEMs and assemblers focus on integrating sustainable practices across product lines. Specialty cleaning providers expand usage to meet customer demand for environmentally responsible solutions.

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Others

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

By Region (Country-Level in North America)

Regional Analysis:

United States: Market Leader with Strong Manufacturing and Innovation Base

The United States holds the largest share of the North America Green Solvents in Electronics Market, accounting for around 65%. Its dominance comes from a strong semiconductor and electronics manufacturing base, supported by advanced R&D activities and large-scale investments in sustainable technologies. Strict environmental regulations drive companies to adopt bio-based and eco-friendly solvents in electronics applications. It benefits from high demand for consumer electronics, combined with strong institutional support for green chemistry. Leading chemical producers and electronics brands collaborate to accelerate innovation. The U.S. market continues to set benchmarks for sustainability adoption in this sector.

Canada: Stable Growth Driven by Policy and Niche Manufacturing Clusters

Canada represents about 20% of the market share and shows consistent growth. Federal and provincial policies emphasize reduced carbon emissions and sustainable chemical use, pushing electronics manufacturers toward green solvents. It benefits from niche manufacturing clusters focused on high-value electronics and specialty cleaning services. Adoption is also encouraged by incentives for companies integrating green technologies into operations. Canadian research institutions actively partner with global chemical companies, enhancing adoption in select segments. The country’s balanced regulatory and innovation environment supports steady expansion.

Mexico: Emerging Growth Hub Supported by Manufacturing Expansion

Mexico holds close to 15% of the North America Green Solvents in Electronics Market, reflecting its role as an emerging hub. Expanding electronics assembly and PCB manufacturing operations drive demand for safer and more sustainable solvents. It benefits from cost-effective labor, favorable trade agreements, and increasing investment by global players. The country is attracting companies that aim to shift part of their supply chain closer to North America. Green solvents gain importance in ensuring compliance with international sustainability standards. Mexico’s position as a rising manufacturing hub gives it significant growth potential in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Corbion N.V.

- Musashino Chemical Laboratory

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- Yancheng Hongtai Bioengineering Co.

- UBE Corporation

- Shandong Shida Shenghua Chemical Group

- Lotte Chemical

- SABIC

- Huntsman Corporation

- Merck KGaA

- BASF SE

- Dow Inc.

- Other Key Players

Competitive Analysis:

The North America Green Solvents in Electronics Market is moderately competitive, with global chemical producers and regional specialists focusing on sustainable chemistry. Companies such as BASF SE, Dow Inc., Huntsman Corporation, Corbion N.V., and Vertec BioSolvents Inc. play a key role in shaping the market. They invest in advanced bio-based formulations, expand production capabilities, and strengthen partnerships with electronics manufacturers. It reflects a competitive landscape where innovation and regulatory compliance drive differentiation. Smaller players emphasize niche applications, while larger firms leverage scale and established supply chains to secure market leadership.

Recent Developments:

- Galactic advanced its US market presence in July 2025 by forming a partnership with a Futures Commission Merchant (FCM) and registering with the National Futures Association to enhance regulatory compliance for its prediction market technology platform.

- UBE Corporation concluded a major acquisition of LANXESS’s Urethane Systems business in the first half of 2025, expanding its specialty chemicals portfolio globally with operations and technical centers across the US, Europe, and China.

- Godavari Biorefineries Ltd. secured an exclusive license agreement in December 2024 with Catalyxx Inc. to manufacture biobutanol and higher alcohols using advanced bio-based chemical technology, setting up a facility for producing up to 15,000 metric tons annually. This move strengthens their sustainable chemical product offerings. In August 2025, Godavari announced investment in a new corn/grain-based distillery aimed at expanding ethanol production capacity, supporting biofuel and green solvent markets.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable solvents in semiconductor manufacturing will drive adoption.

- Expansion of consumer electronics production will reinforce market growth across applications.

- Regulatory frameworks will strengthen the transition toward bio-based and eco-friendly solvents.

- Partnerships between chemical producers and electronics OEMs will shape innovation.

- Engineered fluids and scCO₂ will see rising use in high-precision processes.

- Mexico will emerge as a growth hub with expanding electronics assembly operations.

- Digital monitoring technologies will improve solvent efficiency and reduce waste.

- Corporate sustainability commitments will accelerate adoption across electronics supply chains.

- Bio-based raw materials will gain traction to reduce dependence on petroleum-based solvents.

- Research and development investments will expand scalable production of green solvents.