Market Overview

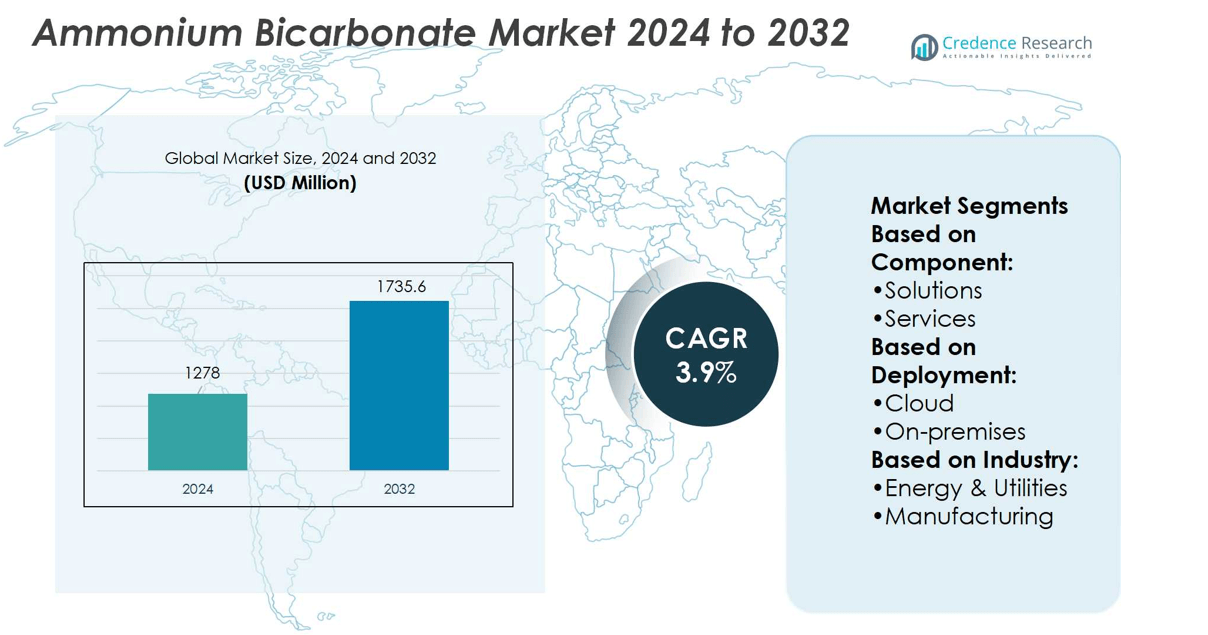

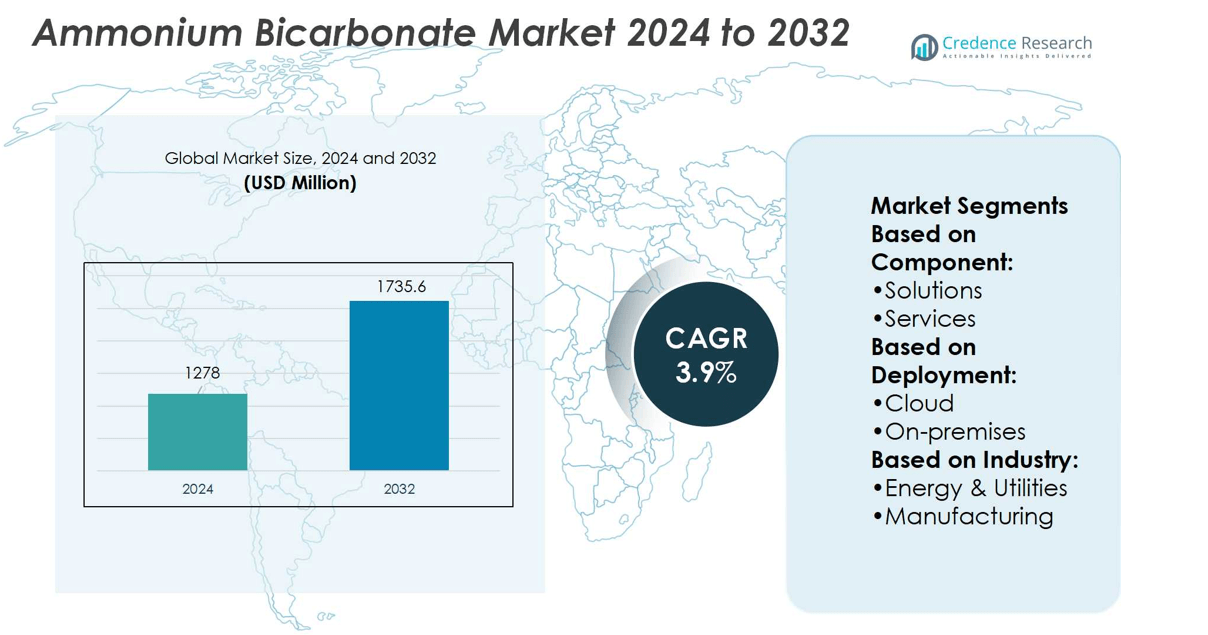

Ammonium Bicarbonate Market size was valued at USD 1278 million in 2024 and is anticipated to reach USD 1735.6 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ammonium Bicarbonate Market Size 2024 |

USD 1278 million |

| Ammonium Bicarbonate Market, CAGR |

3.9% |

| Ammonium Bicarbonate Market Size 2032 |

USD 1735.6 million |

The Ammonium Bicarbonate Market is driven by strong demand in agriculture for nitrogen-based fertilizers, rising adoption in food processing for baking and preservation, and its versatile role in chemical and pharmaceutical industries. Farmers value it for cost efficiency and soil nutrient support, while manufacturers rely on it for consistent product quality. Trends highlight the shift toward eco-friendly and sustainable fertilizers, expanding use in processed foods, and broader industrial applications. Innovation in formulation stability and digital supply chain integration further strengthens market prospects, with Asia Pacific leading growth and other regions aligning demand with sustainability and regulatory compliance.

The Ammonium Bicarbonate Market shows strong geographical presence, with Asia Pacific leading due to extensive agricultural activities, followed by Europe with its sustainability focus and North America driven by food processing demand. Latin America and the Middle East & Africa record steady growth supported by expanding agriculture and industrial sectors. Key players shaping the market include BASF SE, Anhui Haoyuan Chemical Group, Shandong Lianmeng Chemical, Weijiao Holdings Group, Shijiazhuang Shuanglian Chemical Industry, and Sumitomo Chemical, each leveraging scale, innovation, and regional strength.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ammonium Bicarbonate Market size was valued at USD 1278 million in 2024 and is projected to reach USD 1735.6 million by 2032, at a CAGR of 3.9%.

- Strong demand in agriculture for nitrogen-based fertilizers drives adoption across staple crops.

- Rising use in food processing for baking and preservation supports consistent product quality.

- Trends highlight growing focus on eco-friendly fertilizers and wider industrial applications.

- Competition remains defined by players such as BASF SE, Shandong Lianmeng, Anhui Haoyuan, Weijiao Holdings, Shijiazhuang Shuanglian, and Sumitomo Chemical.

- Restraints include limited product stability, short shelf life, and stricter regulatory compliance.

- Asia Pacific leads global demand, followed by Europe, North America, Latin America, and the Middle East & Africa, each shaped by regional agriculture, food, and industrial activities.

Market Drivers

Rising Demand in Agriculture Due to Fertilizer Applications

The Ammonium Bicarbonate Market benefits strongly from its widespread use as a nitrogen fertilizer. Farmers adopt it for enhancing crop yield and soil nutrient balance, particularly in regions with intensive agricultural activity. Its cost-effectiveness compared to other nitrogen sources increases its appeal among small and medium farmers. Governments promoting food security and crop productivity create favorable conditions for demand. It supports staple crops like rice, wheat, and maize, which dominate food supply chains globally. Expanding agricultural practices in Asia Pacific further reinforce the significance of ammonium bicarbonate in modern farming.

- For instance, EnergyCAP customers report saving 37 hours per month on average in employee time, thanks to automated utility bill entry, audits, forecasting, accruals, and approvals.

Expanding Role in Food Processing Industry for Leavening and Preservation

Food processing industries drive consistent demand for ammonium bicarbonate due to its leavening and preservative properties. The compound enables uniform texture in baked goods and extends shelf life across packaged products. Its low cost and established safety record ensure continuous acceptance by regulatory authorities. Rising consumption of processed and ready-to-eat foods accelerates its importance in this sector. It supports bakery, confectionery, and snack manufacturing, creating long-term stability for producers. Growing urban populations and shifting dietary habits amplify demand for ammonium bicarbonate within global food chains.

- For instance, Cority’s EHS platform, which incorporates the legacy Enviance cloud-based system, monitors chemical usage in manufacturing plants with dashboards that integrate over 800,000 active environmental and chemical profiles globally.

Industrial Utilization Across Pharmaceuticals, Chemicals, and Fire Extinguishers

The Ammonium Bicarbonate Market gains traction from its industrial versatility beyond agriculture and food. Pharmaceutical manufacturers use it in certain formulations, while chemical industries rely on it for synthesis processes. Fire extinguisher applications highlight its role in safety solutions, enhancing relevance across public and private sectors. Demand rises with the growth of chemical manufacturing hubs and industrial expansion in emerging markets. It provides functional value in multiple production lines, supporting efficiency and cost management. Continuous innovations in application areas expand its commercial footprint in diverse industries.

Environmental Regulations and Sustainable Alternatives Enhancing Market Growth

Stringent environmental regulations influence the Ammonium Bicarbonate Market, as industries shift toward sustainable and efficient solutions. Its biodegradable nature and low toxicity support acceptance among regulators and eco-conscious stakeholders. Governments encourage adoption of fertilizers with reduced ecological impact, strengthening ammonium bicarbonate’s role in sustainable agriculture. It offers an alternative to synthetic chemicals that often raise concerns about long-term soil health. Demand also aligns with green initiatives in manufacturing sectors aiming for reduced carbon footprints. Expansion of sustainable practices across industries ensures ongoing relevance of ammonium bicarbonate worldwide.

Market Trends

Increasing Preference for Eco-Friendly and Sustainable Fertilizers

The Ammonium Bicarbonate Market reflects a strong trend toward eco-friendly fertilizer adoption. Farmers and policymakers support inputs that improve yield while maintaining soil health. It meets sustainability goals due to its biodegradability and minimal environmental footprint. Governments across Asia and Europe emphasize fertilizers with lower ecological risks, driving higher acceptance. This shift aligns with the global focus on sustainable agriculture and responsible food production. Rising awareness about climate impact further promotes demand for environmentally responsible fertilizer solutions.

- For instance, Accuvio (now Diligent ESG) maintains a database of over 62,000 emissions factors globally, which helps clients measure fertilizer-related nitrogen emissions across supply chains in consistent units.

Rising Applications in Packaged and Processed Food Products

Food manufacturers highlight ammonium bicarbonate’s importance in baking and processed foods. The compound ensures consistent leavening, texture, and extended shelf life in consumer products. It maintains wide regulatory acceptance, strengthening its role in packaged food production. The Ammonium Bicarbonate Market benefits from urban population growth and increasing consumption of bakery items. Demand accelerates with rising preference for convenience foods across emerging economies. This trend positions ammonium bicarbonate as a critical additive in global food supply chains.

- For instance, The company maintains a Disclosure and Emissions Factor Database called CaDI, which includes over 35,000 carbon records. These records cover business, product, and international grid factors.

Expanding Utilization in Industrial and Chemical Processes

Industrial applications expand significantly, with ammonium bicarbonate used in pharmaceuticals, chemicals, and fire safety products. Its versatility supports multiple production lines, ensuring consistent integration across diverse industries. It plays a role in chemical synthesis, pharmaceutical ingredients, and industrial safety solutions. The Ammonium Bicarbonate Market grows as emerging economies increase chemical production and infrastructure investment. Industries adopt it for cost efficiency and functional performance across various applications. Broader industrial usage strengthens its relevance beyond agriculture and food segments.

Technological Advancements and Regional Shifts in Demand

Technological innovation in fertilizer formulations supports the evolution of ammonium bicarbonate applications. Research institutions and manufacturers focus on improving stability, efficiency, and handling properties. It also benefits from regional demand shifts, with Asia Pacific leading in adoption due to large-scale farming. The Ammonium Bicarbonate Market observes steady growth in food and chemical industries across North America and Europe. Demand diversification across regions reduces reliance on single-market drivers. This trend highlights a balanced global outlook supported by innovation and regional expansion.

Market Challenges Analysis

Short Shelf Life and Limited Stability Restricting Wider Adoption

The Ammonium Bicarbonate Market faces a major challenge due to its limited stability and short shelf life. Exposure to heat and moisture reduces product effectiveness, leading to storage and transportation difficulties. Farmers and distributors often prefer alternatives with longer durability and fewer handling issues. It loses nitrogen content quickly, making application timing critical for maintaining crop productivity. These limitations create inefficiencies for end-users in both agriculture and food industries. Competition from more stable nitrogen fertilizers restricts ammonium bicarbonate’s ability to secure a stronger market position.

Health, Safety, and Environmental Concerns Influencing Regulatory Scrutiny

The Ammonium Bicarbonate Market encounters hurdles from regulatory restrictions linked to safety and environmental concerns. Prolonged exposure to ammonium bicarbonate dust can pose health risks to workers in handling environments. Food safety authorities maintain strict controls over usage levels, limiting flexibility for manufacturers. It also faces environmental scrutiny where excessive application may impact soil balance and water quality. Compliance with evolving regulatory frameworks increases costs for producers and distributors. These challenges pressure market participants to invest in safer formulations and stricter quality assurance measures to retain competitiveness.

Market Opportunities

Expanding Demand in Sustainable Agriculture and Food Processing

The Ammonium Bicarbonate Market holds opportunities in the shift toward sustainable agricultural practices. Farmers seek fertilizers that balance crop productivity with environmental safety, which supports wider acceptance of ammonium bicarbonate. It aligns with global policies promoting eco-friendly inputs for soil health and food security. Food processing industries also present growth avenues, as the compound remains vital for baking and preservation. Rising consumption of packaged foods in urban markets drives steady demand from manufacturers. These dual applications in farming and food ensure long-term potential for market expansion.

Emerging Applications Across Industrial and Regional Growth Markets

Industrial diversification creates further opportunities for ammonium bicarbonate adoption across chemical, pharmaceutical, and safety product lines. It provides functional advantages in cost-sensitive industries seeking reliable raw materials. The Ammonium Bicarbonate Market also benefits from expanding infrastructure and industrialization in Asia Pacific and Africa. Rising investments in food manufacturing and fertilizer distribution networks enhance regional growth prospects. Producers can capitalize on demand by developing higher stability formulations and improving supply chains. These opportunities position ammonium bicarbonate as a versatile solution across multiple sectors worldwide.

Market Segmentation Analysis:

By Component

The Ammonium Bicarbonate Market is segmented into solutions and services, reflecting the dual role of product supply and support systems. Solutions dominate the segment as ammonium bicarbonate continues to be adopted across agriculture, food processing, and industrial applications. It provides consistent performance in fertilizers, baking, and chemical processes, making product solutions the backbone of demand. Services complement this segment by supporting distribution networks, handling requirements, and application guidance. Companies offering advisory services and tailored supply chains strengthen their competitive positioning. Growth in this segment highlights the importance of efficient product delivery along with technical expertise for end-users.

- For instance, Enablon’s platform is used by over 1,000 global companies and more than 1 million end-users to manage risk, environmental reporting, health & safety, and operational compliance.factors.

By Deployment

Deployment in this market is categorized into cloud and on-premises models, driven by digital integration of distribution and logistics. Cloud-based systems enable real-time monitoring of supply chains, inventory, and regulatory compliance. The Ammonium Bicarbonate Market benefits from these advancements, as producers and distributors adopt cloud platforms for efficiency. It ensures transparent pricing, faster procurement, and streamlined customer engagement. On-premises deployment remains relevant for large industrial users and localized fertilizer distributors who prefer direct control of operations. Both deployment models support the scalability of ammonium bicarbonate supply in global markets.

- For instance, Schneider’s internal move to a cloud-first strategy (using SaaS apps like Microsoft 365 and Salesforce) supports over 100,000 connected users globally who access these apps across 100+ countries.

By Industry

The market spans multiple industries including energy and utilities, manufacturing, residential and commercial building, transportation and logistics, IT and telecom, and others. Energy and utilities use it in emission control and environmental safety applications. Manufacturing industries rely on ammonium bicarbonate for chemical synthesis, food processing, and pharmaceutical production. The residential and commercial building sector links to demand for fire safety equipment using this compound. Transportation and logistics emphasize its role in secure packaging and efficient distribution networks. IT and telecom leverage digital platforms to optimize demand forecasting and regulatory reporting for ammonium bicarbonate supply chains. It maintains strong relevance across these industries, ensuring diverse growth avenues.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Component:

Based on Deployment:

Based on Industry:

- Energy & Utilities

- Manufacturing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 17% of the global Ammonium Bicarbonate Market, driven by advanced agricultural practices and a steady food processing industry. Farmers in the United States and Canada adopt nitrogen-based fertilizers to enhance yields of maize, soybeans, and wheat. It supports the demand for ammonium bicarbonate as a cost-efficient option in fertilizer formulations. Food manufacturers in the region rely on the compound for bakery, confectionery, and packaged snack products, ensuring consistent leavening and texture quality. Environmental regulations limit excessive use, but the market benefits from growing interest in sustainable agricultural inputs. Industrial applications in pharmaceuticals and chemicals further reinforce its presence in North America.

Europe

Europe represents 22% of the global Ammonium Bicarbonate Market, reflecting the region’s emphasis on sustainability and strict food quality standards. Germany, France, and the United Kingdom remain key consumers, with a strong focus on eco-friendly fertilizers. The compound finds significant use in the bakery and confectionery sector, where it delivers consistent performance under regulated conditions. It also contributes to industrial safety products such as fire extinguishers, adding further stability to demand. European governments encourage fertilizer solutions with reduced environmental impact, supporting ammonium bicarbonate adoption across agricultural supply chains. This regulatory alignment enhances its position as a preferred additive within both agriculture and food industries.

Asia Pacific

Asia Pacific dominates the Ammonium Bicarbonate Market with a 45% share, making it the largest regional contributor. China leads global production and consumption due to extensive rice and wheat cultivation supported by nitrogen fertilizers. It benefits from government initiatives promoting high-yield farming to sustain large populations. India, Vietnam, and Indonesia also record rising usage in agriculture, reflecting the compound’s role in cost-effective crop management. Food processing industries in China and Southeast Asia utilize ammonium bicarbonate for baking, packaged snacks, and instant noodles. Rapid industrial growth in chemicals and pharmaceuticals further enhances its demand across Asia Pacific, securing the region’s leadership in this market.

Latin America

Latin America contributes 8% of the global Ammonium Bicarbonate Market, with Brazil and Mexico leading regional consumption. Agricultural expansion in soybean, sugarcane, and maize cultivation drives demand for nitrogen fertilizers, where ammonium bicarbonate offers affordability. It supports productivity improvements for small and mid-scale farmers who dominate the regional agricultural sector. Food industries in Brazil adopt the compound for baked goods and confectionery products, reinforcing consistent demand. Infrastructure development and chemical manufacturing also highlight opportunities for wider application in industrial processes. While competition from alternative fertilizers exists, the compound maintains stable demand due to its low cost and functional versatility.

Middle East & Africa

The Middle East & Africa holds 8% of the global Ammonium Bicarbonate Market, with steady adoption across agriculture and industrial sectors. Countries like Egypt and South Africa utilize it in farming to support wheat, maize, and fruit cultivation. Gulf countries adopt ammonium bicarbonate for food processing and niche chemical applications, strengthening demand diversity. It also supports local industries producing fire safety equipment and pharmaceuticals. Governments invest in improving fertilizer distribution networks to enhance farming productivity under challenging climates. Despite regional challenges such as import dependency, the market sustains demand due to its affordability and multi-industry relevance.

Key Player Analysis

Competitive Analysis

The Ammonium Bicarbonate Market include ESP, EnergyCap, Enviance, Accuvio, IBM, Envirosoft, Engie, Carbon Footprint Ltd., Enablon, and Dakota Software. The Ammonium Bicarbonate Market is defined by steady competition where companies focus on product quality, sustainable manufacturing, and reliable supply chains. Producers emphasize cost-effective formulations to strengthen their presence in agriculture, food processing, and industrial applications. Market participants invest in environmentally responsible production practices to meet regulatory requirements and align with global sustainability goals. Innovation in fertilizer efficiency, stability improvements, and eco-friendly food additives creates opportunities for long-term growth. Strong regional distribution networks, coupled with advancements in digital supply management, help companies expand their market reach. Competition remains shaped by the ability to deliver consistent performance, regulatory compliance, and value-added services across diverse industries.

Recent Developments

- In January 2025, Sanofi’s Sarclisa, an anti-CD38 treatment, received approval in China for newly diagnosed multiple myeloma (NDMM) ineligible for transplant, based on IMROZ phase 3 study results.

- In November 2024, Tata Chemicals Europe Limited (TCEL) announced a USD 60 million investment to build a pharmaceutical-grade sodium bicarbonate plant in Northwich, UK. The new facility, set to begin construction in 2025 and start production in 2027, will triple TCEL’s current production capacity.

- In October 2024, Fraunhofer researchers, in collaboration with partners, developed an eco-friendly method for soda production through bipolar electrodialysis of brine. This process eliminates carbon dioxide emissions and saline wastewater, offering a sustainable alternative to traditional soda manufacturing.

- In May 2024, Kohima SP Markad introduces AVL 437 DUO vehicle checking machine funded by the National Clean Air Programme for enforcing the emission norms. The machine is launched for checking the emission level on the petrol and diesel vehicles.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in agriculture due to rising adoption of nitrogen-based fertilizers.

- Food processing industries will continue using it for baking and preservation applications.

- Industrial usage will expand in chemicals, pharmaceuticals, and fire safety products.

- Asia Pacific will remain the largest market with strong agricultural and food industry demand.

- Europe will emphasize eco-friendly applications supported by strict sustainability regulations.

- North America will focus on efficiency and compliance within food and industrial sectors.

- Innovation will improve product stability and handling for broader adoption.

- Regulatory frameworks will shape production practices and promote sustainable formulations.

- Digital supply chain integration will optimize distribution and inventory management.

- Long-term opportunities will emerge in eco-friendly and cost-effective industrial solutions.