Market Overview:

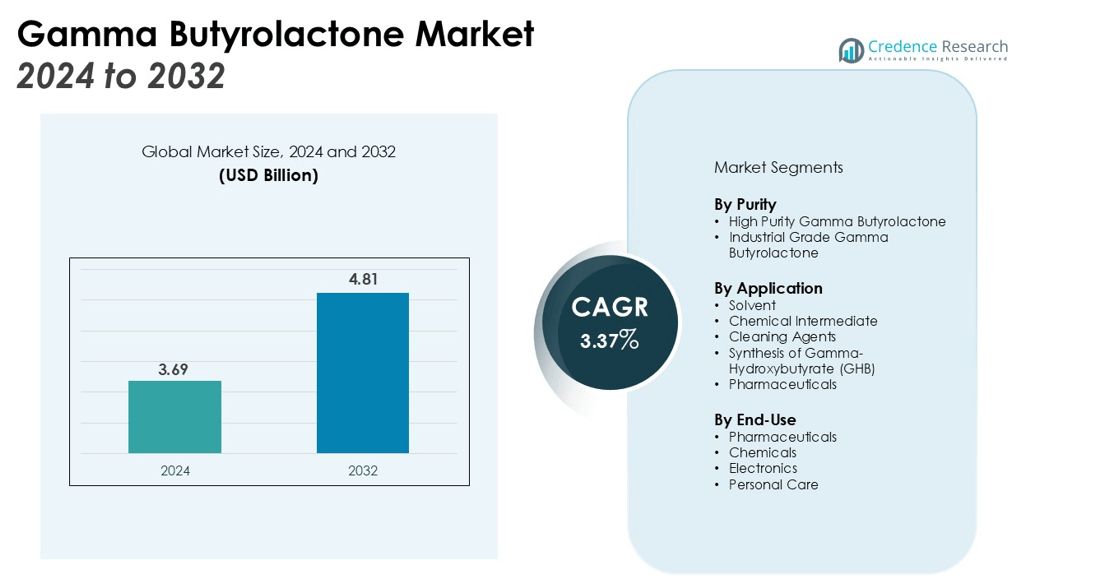

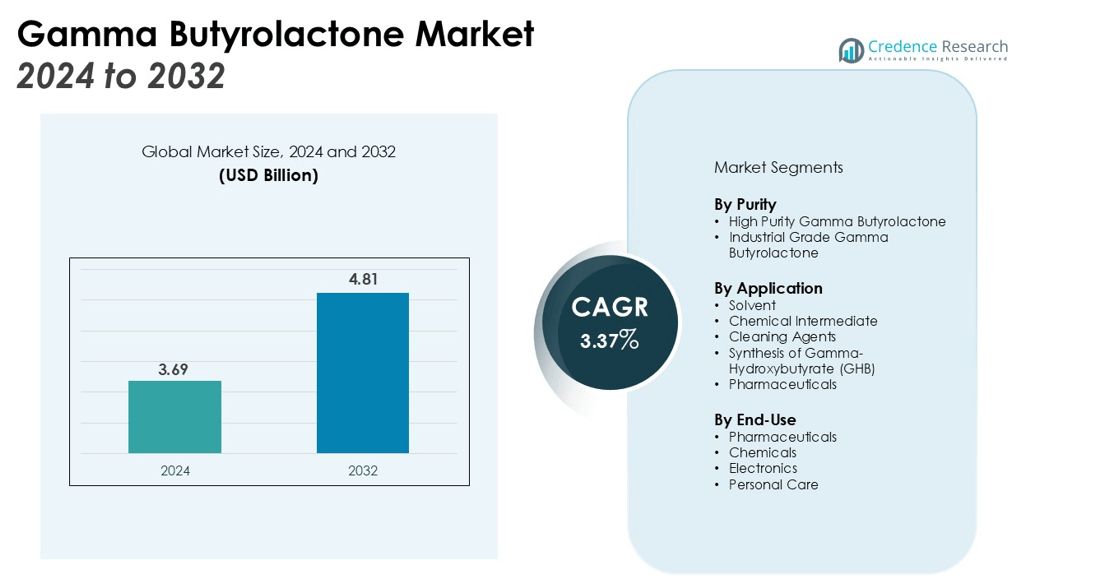

The Gamma Butyrolactone Market size was valued at USD 3.69 billion in 2024 and is anticipated to reach USD 4.81 billion by 2032, at a CAGR of 3.37% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gamma Butyrolactone Market Size 2024 |

USD 3.69 billion |

| Gamma Butyrolactone Market, CAGR |

3.37% |

| Gamma Butyrolactone Market Size 2032 |

USD 4.81 billion |

Key drivers of the Gamma Butyrolactone market include its widespread use as a solvent in industrial applications, particularly in the production of plastics, coatings, and pharmaceuticals. Its use in the synthesis of chemicals such as gamma-hydroxybutyrate (GHB) and its growing demand in the electronics industry are further fueling market expansion. The rise in the adoption of GBL in cleaning agents, industrial solvents, and the cosmetic industry is expected to continue driving demand. Additionally, increasing investments in research and development to expand the applications of GBL in emerging sectors are boosting its market potential.

Regionally, Asia-Pacific dominates the Gamma Butyrolactone market, holding the largest market share, due to high industrial production in countries like China and India. The region’s expanding chemical and pharmaceutical industries, coupled with increasing consumer demand for electronic products, contribute significantly to market growth. North America and Europe also maintain substantial shares, with the presence of key end-user industries and regulatory support for chemical production. The rising adoption of sustainable practices and stricter regulations in these regions is further shaping the market’s development.

Market Insights:

- The Gamma Butyrolactone market size was valued at USD 3.69 billion in 2024 and is expected to reach USD 4.81 billion by 2032, with a CAGR of 3.37%.

- Gamma Butyrolactone is widely used as a solvent in plastics, coatings, and pharmaceuticals, driving significant market growth.

- The growth of the electronics industry, particularly in semiconductors and consumer electronics, fuels increased demand for Gamma Butyrolactone.

- Gamma Butyrolactone is key in synthesizing chemicals like gamma-hydroxybutyrate (GHB), boosting its use in medical, recreational, and agricultural applications.

- The rising adoption of Gamma Butyrolactone in eco-friendly cleaning agents and cosmetics further supports its market expansion.

- Stricter regulations and the classification of Gamma Butyrolactone as a controlled substance in certain regions present challenges to production and distribution.

- Asia-Pacific dominates the Gamma Butyrolactone market, holding 40% of global demand, with North America and Europe following closely behind.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Widespread Use of Gamma Butyrolactone in Industrial Applications

The Gamma Butyrolactone (GBL) market benefits from its extensive use as a solvent in various industrial applications. It plays a crucial role in the production of plastics, coatings, and pharmaceuticals. GBL effectively dissolves a wide range of substances, making it an essential ingredient in chemical synthesis. Its ability to act as a solvent for polymers and resins in the coating industry further drives demand, as manufacturers look for versatile solutions to enhance product performance.

Increasing Demand in the Electronics Industry

The growth of the electronics industry significantly contributes to the expansion of the Gamma Butyrolactone market. GBL is utilized in the production of semiconductors and other electronic components due to its solvent properties. The rapid development of consumer electronics and technological innovations increases the need for high-quality, cost-effective solvents in electronic manufacturing. As the electronics sector grows globally, the demand for Gamma Butyrolactone continues to rise.

- For instance, Shin-Etsu Chemical developed a new manufacturing method for semiconductor package substrates that can process an area of 515 mm × 510 mm on an organic substrate in approximately 20 minutes, demonstrating a technological advancement in semiconductor fabrication processes where high-purity solvents are essential.

Rising Use of Gamma Butyrolactone in Chemical Synthesis

Gamma Butyrolactone is also a key raw material in the synthesis of chemicals such as gamma-hydroxybutyrate (GHB), used in various medical and recreational applications. This growing demand for GBL in chemical synthesis fuels market growth across different regions. Its application in the synthesis of agricultural chemicals and pharmaceuticals further strengthens its position in the market, supporting an expanded use in multiple sectors.

- For instance, recent advancements in polymerization have utilized GBL to produce a high-molecular-weight poly(γ-butyrolactone) of 50,000 g/mol, demonstrating its utility in creating advanced, recyclable polymers.

Adoption in Cleaning Agents, Solvents, and Cosmetics

The adoption of Gamma Butyrolactone in cleaning agents, industrial solvents, and cosmetics has increased due to its non-toxic properties and versatility. Its use in eco-friendly cleaning formulations meets the growing demand for sustainable products. Furthermore, its role in cosmetics, where it is used for its hydrating properties, supports its inclusion in a wide range of personal care products, creating new opportunities for market growth.

Market Trends:

Increasing Demand for Eco-friendly Solvents and Sustainable Practices

One significant trend in the Gamma Butyrolactone (GBL) market is the rising demand for eco-friendly and sustainable solvents. As industries move toward more environmentally conscious practices, the need for non-toxic, biodegradable, and low-emission chemicals has increased. GBL is viewed as an effective solution due to its relatively low environmental impact compared to traditional solvents. Its ability to be used in a range of applications, from cleaning agents to cosmetics, is further enhanced by its eco-friendly profile, aligning with the growing demand for green chemistry solutions. Manufacturers are focusing on developing sustainable production methods for GBL to meet regulatory standards and consumer expectations for environmentally safe products.

- For instance, in September 2023, chemical producer BASF SE partnered with Qore LLC to secure a supply of bio-based 1,4-butanediol (BDO), a key precursor for GBL that is produced via the fermentation of plant-based sugars.

Technological Advancements in Gamma Butyrolactone Production and Application

Another prominent trend is the technological advancements in Gamma Butyrolactone production, improving efficiency and scalability. Innovations in production methods have led to cost-effective, high-purity GBL that meets industry standards. These developments enable manufacturers to meet the rising demand for GBL in diverse sectors, including pharmaceuticals, chemicals, and electronics. Additionally, new applications of GBL in emerging industries, such as renewable energy and advanced materials, are expected to expand its market footprint. As technology evolves, it is anticipated that GBL will play a more prominent role in next-generation applications, further boosting its market presence.

- For instance, in renewable energy, the Gamma-Butyrolactone/1,4-butanediol (GBL/BDO) pair is studied as a liquid organic hydrogen carrier where 1 mole of BDO can be dehydrogenated to produce 2 moles of hydrogen for storage, showcasing a key role for GBL in next-generation energy systems.

Market Challenges Analysis:

Regulatory Challenges and Safety Concerns in the Gamma Butyrolactone Market

One significant challenge in the Gamma Butyrolactone (GBL) market is the increasing regulatory scrutiny surrounding its use, particularly in pharmaceuticals and chemicals. Governments around the world are imposing stricter regulations on chemicals due to concerns about their environmental and health impacts. The classification of GBL as a controlled substance in certain regions further complicates its production and distribution. These regulations may increase production costs and limit its availability in specific markets. Companies must navigate complex compliance requirements to ensure that their products meet local and international safety standards, which can delay product launches and restrict market access.

Fluctuating Raw Material Prices and Supply Chain Instability

Another challenge faced by the Gamma Butyrolactone market is the volatility in raw material prices, which can significantly affect production costs. The price fluctuations of key feedstocks used in GBL production can lead to price instability and affect profit margins for manufacturers. Supply chain disruptions, including those caused by geopolitical factors and natural disasters, can further exacerbate these issues. Manufacturers in the GBL market must adopt strategies to mitigate these risks, such as diversifying suppliers or investing in local production capabilities to ensure consistent material availability and cost control.

Market Opportunities:

Expansion in Emerging Markets and Industrial Applications

The Gamma Butyrolactone (GBL) market presents significant opportunities in emerging markets where industrialization is rapidly increasing. As countries in Asia-Pacific, Latin America, and Africa experience economic growth, demand for chemicals, plastics, and electronics is rising. These regions are expected to become key consumers of GBL as they expand their manufacturing sectors. GBL’s versatility in various applications, such as in the production of coatings, plastics, and pharmaceuticals, positions it well for adoption across a range of industries. This presents an opportunity for manufacturers to target emerging markets and cater to the growing industrial needs, driving market growth.

Advances in Green Chemistry and Sustainable Solutions

The increasing focus on green chemistry and sustainability in industrial processes provides a significant opportunity for the Gamma Butyrolactone market. As industries strive to reduce their environmental impact, the demand for eco-friendly solvents and chemicals, such as GBL, is expected to rise. The development of sustainable production processes for GBL will allow manufacturers to meet these environmental requirements while maintaining product efficacy. As the global shift toward eco-conscious manufacturing intensifies, GBL offers a viable solution for industries looking to comply with strict environmental regulations and meet consumer demand for sustainable products. This trend opens up new opportunities in various sectors, including agriculture, cosmetics, and electronics.

Market Segmentation Analysis:

By Purity:

The Gamma Butyrolactone market is segmented based on purity levels, which include technical grade and industrial grade. High-purity GBL is used in pharmaceuticals and electronics, where stringent quality requirements exist. Technical-grade GBL is primarily used in industrial applications such as coatings, solvents, and cleaning agents. The demand for high-purity GBL is growing as industries require more specialized products with superior quality.

- For instance, companies like BASF ensure high-purity GBL by meeting quality specifications such as a color value of less than 20 on the APHA scale.

By Application:

Gamma Butyrolactone has a wide range of applications, including its use as a solvent, chemical intermediate, and in cleaning agents. It is a vital ingredient in the production of plastics, coatings, and pharmaceuticals. Its use in the synthesis of chemicals like gamma-hydroxybutyrate (GHB) also contributes significantly to market growth. Its versatility across various sectors such as electronics, chemicals, and personal care products is expanding the application base.

- For instance, Mitsubishi Chemical produces a high-grade Gamma-Butyrolactone with a high boiling point of 204°C.

By End-Use:

The Gamma Butyrolactone market’s end-use sectors include pharmaceuticals, chemicals, electronics, and personal care. The pharmaceutical industry drives demand for high-purity GBL due to its role in drug synthesis. Chemicals, such as solvents and agricultural products, contribute to significant market share. Electronics, where GBL is used in semiconductor manufacturing, and personal care products, which use GBL for its hydrating properties, are also crucial end-users. The increasing demand across these sectors is fueling overall market growth.

Segmentations:

By Purity:

- High Purity Gamma Butyrolactone

- Industrial Grade Gamma Butyrolactone

By Application:

- Solvent

- Chemical Intermediate

- Cleaning Agents

- Synthesis of Gamma-Hydroxybutyrate (GHB)

- Pharmaceuticals

By End-Use:

- Pharmaceuticals

- Chemicals

- Electronics

- Personal Care

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific: Leading in Gamma Butyrolactone Consumption

Asia-Pacific holds the largest market share in the Gamma Butyrolactone (GBL) market, accounting for 40% of global demand. Rapid industrialization and growing chemical, electronics, and pharmaceutical sectors in countries like China and India are driving this dominance. The region’s focus on sustainable manufacturing and the rise in consumer demand for electronic products contribute to the expansion of GBL usage. GBL’s versatility across industrial applications, such as in cleaning agents and solvents, further strengthens its position in this rapidly developing market.

North America: Robust Market with Strong Growth Potential

North America represents 25% of the Gamma Butyrolactone market, with the United States and Canada being major consumers. The region benefits from a well-established chemical industry and robust regulatory frameworks, ensuring consistent demand for GBL. Its primary use in pharmaceuticals, electronics, and industrial applications fuels market growth. The increasing adoption of eco-friendly solvents in line with sustainability trends further drives the demand for GBL in North America, especially as industries prioritize regulatory compliance and green manufacturing practices.

Europe: Steady Market Growth with Focus on Innovation

Europe captures 20% of the Gamma Butyrolactone market, driven by advanced industrial sectors and a strong emphasis on environmental sustainability. Countries such as Germany, France, and the United Kingdom lead in demand for GBL, particularly in automotive, pharmaceuticals, and electronics industries. The region’s stringent regulatory standards push for eco-friendly and sustainable chemicals, supporting the growing adoption of GBL in manufacturing processes. With a growing shift towards green chemistry, Europe is set to continue its steady growth in the GBL market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ALPHA CHEMIKA. (India)

- (Switzerland)

- Central Drug House. (India)

- Chang Chun Group. (Taiwan)

- DCC (Ireland)

- SHIJIAZHUANG DONGAO CHEMICAL TECHNOLOGY CO., LTD (China)

- Hefei TNJ Chemical Industry CO., Ltd. (China)

- Mitsubishi Chemical Group Corporation. (Japan)

- Taj Pharmaceuticals Limited. (India)

Competitive Analysis:

The Gamma Butyrolactone (GBL) market is highly competitive, with major players such as BASF, Mitsubishi Chemical, and LyondellBasell leading the market due to their strong manufacturing capabilities and global presence. These companies focus on innovation and maintaining high product quality to meet the increasing demand across sectors like electronics, pharmaceuticals, and sustainable manufacturing. Smaller players also contribute by specializing in specific grades and applications of GBL. Firms often adopt strategies like strategic partnerships, acquisitions, and R&D investments to expand their market share. The growing demand for eco-friendly solvents and stringent regulatory requirements are driving companies to innovate and adopt sustainable production methods to stay competitive.

Recent Developments:

- In July 2025, DCC agreed to sell its Exertis Info Tech distribution business in the UK and Ireland to the investment firm Aurelius for approximately £100 million as part of a strategy to concentrate on its energy division.

- In September 2025, Mitsubishi Chemical Group Corporation, along with Asahi Kasei and Mitsui Chemicals, formed a limited liability partnership (LLP), this partnership will study the joint conversion of their ethylene facilities in western Japan to achieve carbon neutrality by 2030.

Report Coverage:

The research report offers an in-depth analysis based on Purity, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Gamma Butyrolactone market is expected to witness continued growth, driven by increasing industrial demand across various sectors.

- Rising demand for eco-friendly solvents will boost the adoption of Gamma Butyrolactone as industries focus on sustainability.

- Advances in pharmaceutical applications, including the synthesis of gamma-hydroxybutyrate (GHB), will further enhance market prospects.

- The electronics industry’s expansion will continue to fuel demand for Gamma Butyrolactone in semiconductor manufacturing.

- Increased use of Gamma Butyrolactone in personal care and cosmetics products will create new growth opportunities.

- The shift towards green chemistry will drive innovation in Gamma Butyrolactone production, making it a preferred choice for sustainable applications.

- Regulatory frameworks and safety standards will evolve, influencing how Gamma Butyrolactone is produced and distributed globally.

- Asia-Pacific will maintain its dominance, while North America and Europe will show steady growth, fueled by industrial demand and regulatory support.

- Emerging markets in Latin America and Africa will present new opportunities for expansion in the Gamma Butyrolactone market.

- As research and development investments increase, Gamma Butyrolactone’s applications will continue to diversify, particularly in agriculture, energy, and other emerging industries.