Market Overview

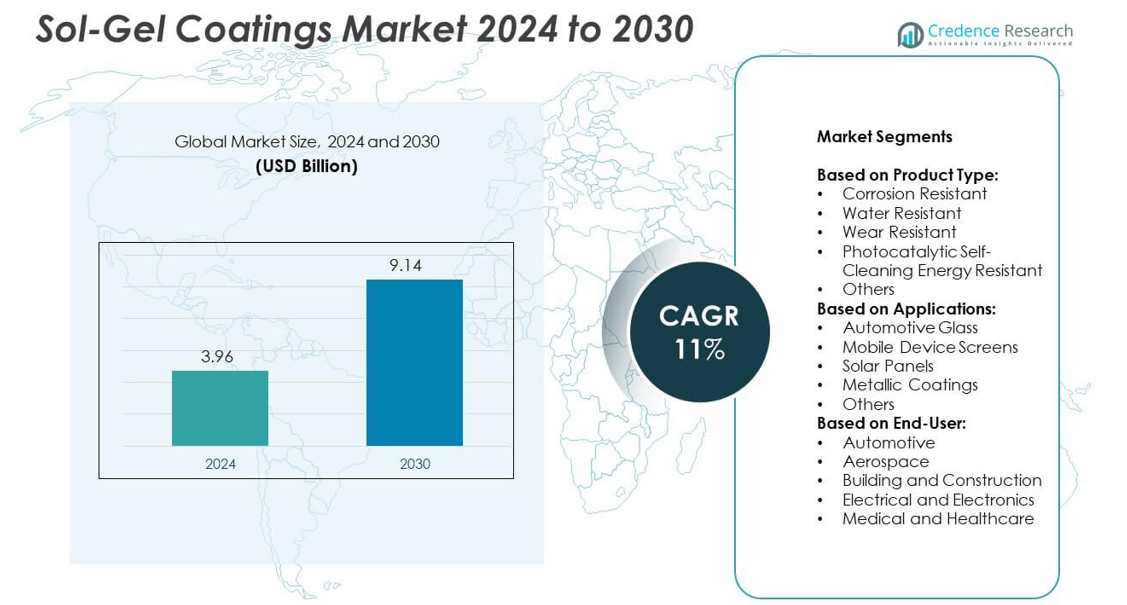

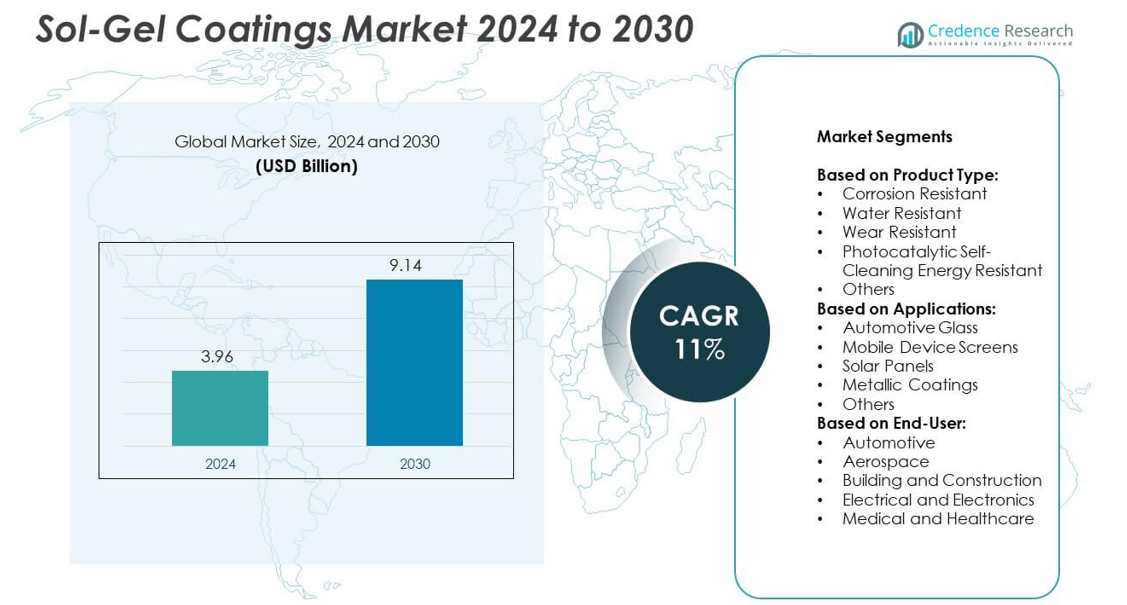

The Sol-Gel Coatings market size was valued at USD 3.96 billion in 2024 and is expected to reach USD 9.14 billion by 2032, growing at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sol-Gel Coatings Market Size 2024 |

USD 3.96 billion |

| Sol-Gel Coatings Market, CAGR |

11% |

| Sol-Gel Coatings Market Size 2032 |

USD 9.14 billion |

The Sol-Gel Coatings market grows with rising demand for corrosion-resistant, self-cleaning, and eco-friendly solutions across automotive, aerospace, electronics, and construction sectors. Manufacturers focus on water-based, low-VOC formulations to meet global sustainability standards. Nanotechnology integration enhances durability, UV protection, and surface performance, driving adoption in solar panels and electronic displays. Expanding renewable energy projects and increasing production of high-performance glass accelerate market penetration. Continuous R&D investment supports multifunctional coatings that combine protection, aesthetic appeal, and energy efficiency for diverse applications.

North America leads the Sol-Gel Coatings market, supported by strong automotive, aerospace, and electronics industries. Europe follows with high demand driven by strict environmental regulations and renewable energy initiatives. Asia-Pacific shows rapid growth fueled by expanding solar panel production and infrastructure projects. Latin America and Middle East & Africa witness steady adoption in construction and automotive sectors. Key players include NanoTech Coatings, Akzo Nobel N.V., 3M, and PPG Industries Inc., focusing on advanced formulations and sustainability-driven product development.

Market Insights

- The Sol-Gel Coatings market was valued at USD 3.96 billion in 2024 and is projected to reach USD 9.14 billion by 2032 at a CAGR of 11%.

- Rising demand for corrosion-resistant, water-based, and self-cleaning coatings in automotive, aerospace, and construction sectors drives market expansion.

- Growing adoption of nanotechnology enhances scratch resistance, UV protection, and hydrophobic properties, boosting use in solar panels, mobile screens, and advanced glass.

- Leading players such as NanoTech Coatings, Akzo Nobel N.V., 3M, and PPG Industries Inc. invest in R&D, sustainability initiatives, and partnerships with OEMs to strengthen market presence.

- High production costs, process complexity, and performance challenges under extreme conditions restrict faster adoption in some industries.

- North America leads with strong demand from automotive and aerospace, while Europe focuses on eco-friendly coatings, and Asia-Pacific records rapid growth through solar and electronics sectors.

- Emerging opportunities lie in renewable energy, healthcare, and green construction projects, where sol-gel coatings improve durability, efficiency, and compliance with environmental standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Surface Protection in Automotive and Aerospace

The Sol-Gel Coatings market benefits from growing adoption in automotive and aerospace sectors. These coatings provide superior corrosion resistance and improved surface durability for critical components. Automotive OEMs use sol-gel technology to enhance paint adhesion and reduce maintenance needs. Aerospace manufacturers apply it to protect aluminum and titanium structures from oxidation. The coatings offer weight reduction advantages by replacing heavy primer layers. It supports compliance with stringent performance standards in high-stress environments. Increased vehicle production and rising air traffic continue to boost demand.

- For instance, sol-gel film can improve the pull-off adhesion strength of epoxy coatings on aluminum alloys like AA7075-T6 and AA2024-T3. An analysis of a study on AA7075 and AA2024 showed pull-off adhesion values for AA7075-T6 ranging from 2.98 MPa (reference) to 9.59 MPa (sol-gel),

Expanding Use in Electronics, Glass, and Solar Applications

The Sol-Gel Coatings market grows with rising demand from electronics, glass, and solar panel production. Sol-gel layers improve scratch resistance on mobile device screens and display panels. Glassmakers use these coatings to enable anti-reflective and self-cleaning properties. Solar manufacturers rely on it to enhance light transmission and increase panel efficiency. Growth in smart devices and connected electronics expands opportunities for sol-gel solutions. The coatings deliver high transparency and durability, making them ideal for precision applications. Rapid adoption of solar energy projects worldwide strengthens market growth.

- For instance, A research work on titanium oxide sol-gel films (organic-inorganic composite) deposited by spin-coating achieved film thickness between 80 and 200 nm, with root mean square roughness below 2 nm, and refractive index tunable between 1.76 and 2.05 at 589 nm.

Focus on Sustainability and Environment-Friendly Coating Solutions

The Sol-Gel Coatings market gains traction from sustainability-focused initiatives in construction and manufacturing. These coatings are water-based and emit low VOCs, aligning with green building regulations. It allows manufacturers to meet REACH and RoHS compliance requirements. Construction companies adopt sol-gel solutions for energy-efficient, self-cleaning facades and glass surfaces. Governments support eco-friendly products through incentives and certifications. Growing demand for sustainable infrastructure and low-emission technologies accelerates product penetration. It creates a strong opportunity for manufacturers to expand in regulated markets.

Technological Innovations and Product Performance Improvements

The Sol-Gel Coatings market advances with innovations in nanotechnology and hybrid formulations. Manufacturers develop coatings with improved hardness, UV resistance, and chemical stability. It helps industries extend product lifecycles and reduce replacement costs. Robotic and automated application systems ensure consistent layer thickness and faster production cycles. New hybrid sol-gel systems combine organic and inorganic benefits, offering enhanced flexibility. Strategic R&D investments lead to multifunctional coatings with tailored properties. Collaborations between material suppliers and end users drive adoption in emerging sectors.

Market Trends

Growing Adoption of Multi-Functional and Self-Healing Coatings

The Sol-Gel Coatings market witnesses rising demand for multi-functional coatings with self-healing capabilities. Manufacturers design coatings that repair micro-cracks and maintain surface integrity. It improves product reliability in automotive, aerospace, and electronic devices. Self-healing technology reduces maintenance costs and extends service life of coated components. Customers prefer coatings that combine protection with aesthetic appeal. Companies invest in R&D to integrate advanced chemistries for superior performance. This trend supports long-term growth across high-value applications.

- For instance, A study published in Scientific Reports investigated sol-gel derived organic-inorganic hybrid coatings (using tetraethyl orthosilicate (TEOS) and 3-aminopropyltriethoxysilane (APTES)) on 304 stainless steel. The research found that coatings with an optimal weight ratio of organic and inorganic phases, including those with a 1:1:1 ratio, provided significant corrosion resistance when exposed to a 3.5 wt% NaCl solution for one month, primarily due to an enhanced Si-O-Si network.

Shift Toward Eco-Friendly and Water-Based Formulations

The Sol-Gel Coatings market experiences a strong shift toward eco-friendly, water-based solutions. Regulations encourage low-VOC and solvent-free products to minimize environmental impact. It enables compliance with global sustainability standards like LEED and BREEAM. Water-based sol-gel systems reduce hazardous emissions during application. Manufacturers promote these coatings for green building projects and energy-efficient infrastructure. Adoption of sustainable coatings grows in construction, automotive, and consumer electronics sectors. Demand rises as industries move toward cleaner production methods.

- For instance, A study on silica-based sol-gel coatings on steel, detailed in Ceramics International (December 2022), investigated the influence of different organic solvents on coating properties. The research found that the greatest thickness, nearly 1.5 µm, was obtained with the ethanol-based coatings. However, the coating synthesized in a methanol environment actually showed a polarization resistance almost an order of magnitude greater than those synthesized in the other organic solvents. The study used tetraethoxysilane (TEOS), 3-aminopropyltriethoxysilane (ApTEOS), and 3-glicydoxypropyltrimethosysilan (GPTMS) as precursors.

Integration of Nanotechnology for Enhanced Performance

The Sol-Gel Coatings market benefits from integration of nanotechnology in product development. Nano-scale particles improve hardness, chemical resistance, and optical clarity. It provides enhanced anti-fogging, anti-bacterial, and hydrophobic properties for surfaces. Electronics and healthcare industries increasingly adopt these advanced coatings. Nanotechnology enables thinner, more uniform layers for high-precision applications. Manufacturers partner with research institutes to commercialize innovative nanostructured products. This trend strengthens competitiveness and broadens the application base.

Increased Use in Renewable Energy and Solar Applications

The Sol-Gel Coatings market gains traction from rapid expansion of renewable energy projects. Solar panels use sol-gel coatings to improve light transmittance and durability. It helps maximize energy output and extend panel life under harsh weather. Wind turbine manufacturers explore sol-gel solutions for anti-erosion blade protection. Governments support renewable projects, creating consistent demand for high-performance coatings. R&D efforts focus on improving efficiency and lowering coating costs for large-scale use. Growth in clean energy sectors fuels steady adoption worldwide.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Process

The Sol-Gel Coatings market faces challenges due to high production costs and process complexity. Raw material prices for precursors and catalysts remain volatile, affecting profit margins. It requires controlled processing conditions to achieve uniform coating quality. Small deviations in temperature or pH can lead to product defects and higher rejection rates. Scaling up production while maintaining consistency remains difficult for many manufacturers. Limited availability of skilled workforce and specialized equipment adds to operational costs. These factors slow adoption among cost-sensitive end users in emerging markets.

Performance Limitations Under Extreme Operating Conditions

The Sol-Gel Coatings market struggles with performance issues in certain demanding environments. Coatings may exhibit reduced adhesion or durability under extreme thermal cycling or high humidity. It can lead to early failure in aerospace, marine, and heavy industrial applications. Manufacturers invest in R&D to overcome these weaknesses and improve chemical stability. Customers demand coatings with proven long-term performance in real-world conditions. Slow validation cycles delay market entry for new formulations. These technical barriers create hurdles for widespread adoption in critical sectors.

Market Opportunities

Rising Demand from Emerging Applications and High-Growth Sectors

The Sol-Gel Coatings market holds strong opportunities from expanding applications in healthcare, defense, and electronics. Medical device manufacturers adopt sol-gel coatings for biocompatible and antimicrobial surfaces. It improves patient safety and reduces infection risks in surgical instruments. Defense sectors explore coatings for thermal protection and stealth technology in equipment. Consumer electronics companies demand anti-smudge and scratch-resistant coatings for premium devices. Growth of EVs and autonomous vehicles drives interest in protective coatings for sensors and cameras. These sectors create new revenue streams for producers worldwide.

Expansion in Renewable Energy and Sustainable Construction Projects

The Sol-Gel Coatings market benefits from large-scale investments in solar energy and green building projects. Solar panel makers use sol-gel coatings to enhance efficiency and reduce maintenance. It supports energy transition efforts and improves project returns over time. Construction firms apply coatings for self-cleaning facades and energy-efficient glass installations. Governments promote sustainable infrastructure with funding and performance standards. Manufacturers offering eco-friendly, high-performance coatings gain an edge in competitive bids. This opportunity strengthens market presence in regions pursuing aggressive sustainability targets.

Market Segmentation Analysis:

By Product Type

The Sol-Gel Coatings market is segmented into corrosion resistant, water resistant, wear resistant, photocatalytic self-cleaning energy resistant, and others. Corrosion resistant coatings lead demand due to their ability to protect metals in automotive and aerospace applications. Water resistant coatings gain traction in construction and glass industries for improved moisture protection. Wear resistant types see strong adoption in industrial tools and high-friction components. Photocatalytic self-cleaning energy resistant coatings grow quickly with demand for low-maintenance glass surfaces and solar panels. It supports efficiency by reducing dirt accumulation and enhancing light transmission. Other niche products include anti-fog and anti-bacterial coatings for specialized uses.

- For instance, A study titled “Sol-gel Coatings for Chemical Protection of Stainless Steel” investigated composite coatings on 316L stainless steel foils, measured via potentiodynamic polarization curves in an aqueous 15% H₂SO₄ solution. The study used sol-gel thin coatings of ZrO₂, SiO₂, 70SiO₂–30TiO₂, and 88SiO₂–12Al₂O₃ compositions. The results indicated that the films acted as a geometric block against the corrosive media and increased the lifetime of the substrate, with the coatings increasing the lifetime up to a factor of 8.5 compared to the uncoated steel.

By Applications

The Sol-Gel Coatings market covers applications in automotive glass, mobile device screens, solar panels, metallic coatings, and others. Automotive glass applications dominate due to increasing demand for scratch resistance and anti-glare properties. Mobile device screens use sol-gel technology to achieve anti-smudge and durable finishes. Solar panel coatings enhance performance and extend lifespan in outdoor conditions. Metallic coatings provide superior adhesion and corrosion resistance for industrial equipment. It also finds use in decorative finishes, optical devices, and specialty packaging. Rising demand for functional coatings drives growth across diverse application areas.

- For instance, The TiO₂ films with thickness between 80-200 nm, rms roughness < 2 nm, allowed refractive index tuning and high optical transparency, making them suitable for display/screen applications.

By End-User

The Sol-Gel Coatings market serves automotive, aerospace, building and construction, electrical and electronics, and medical and healthcare sectors. Automotive OEMs adopt sol-gel solutions for glass, body panels, and underbody protection. Aerospace manufacturers use them to safeguard critical components from oxidation and wear. Construction companies apply coatings for self-cleaning glass and energy-efficient facades. Electrical and electronics sectors rely on it for display panels and circuit protection. Medical and healthcare industries benefit from antimicrobial and biocompatible coatings for instruments and implants. Growing demand across these sectors ensures a diverse and resilient market base.

Segments:

Based on Product Type:

- Corrosion Resistant

- Water Resistant

- Wear Resistant

- Photocatalytic Self-Cleaning Energy Resistant

- Others

Based on Applications:

- Automotive Glass

- Mobile Device Screens

- Solar Panels

- Metallic Coatings

- Others

Based on End-User:

- Automotive

- Aerospace

- Building and Construction

- Electrical and Electronics

- Medical and Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32% share of the Sol-Gel Coatings market, driven by strong automotive, aerospace, and electronics industries. Demand is supported by high investments in research and adoption of advanced coating technologies. Manufacturers focus on developing eco-friendly and high-performance coatings that meet strict VOC and environmental regulations. It benefits from growing use of sol-gel coatings in self-cleaning glass, automotive windshields, and defense applications. The United States leads the region with major production facilities and technology developers working on hybrid formulations and nanotechnology-enabled products. Canada contributes steadily with demand from construction projects and renewable energy installations. Strategic collaborations between coating suppliers and OEMs strengthen market penetration across multiple sectors.

Europe

Europe accounts for 28% share of the Sol-Gel Coatings market, supported by a mature automotive industry and strong sustainability regulations. Stringent REACH and RoHS directives push manufacturers toward low-VOC and water-based solutions. Germany, France, and the United Kingdom lead in adoption due to focus on energy-efficient building materials and premium automotive production. It also gains momentum from investments in renewable energy, where sol-gel coatings improve solar panel performance and reduce maintenance costs. Aerospace applications in France and Germany drive demand for corrosion and wear-resistant products. Building renovation programs and green construction initiatives expand opportunities for self-cleaning and anti-reflective glass coatings. European R&D hubs focus on developing innovative sol-gel technologies with enhanced functional properties.

Asia-Pacific

Asia-Pacific holds 30% share, making it one of the fastest-growing markets for Sol-Gel Coatings. China leads with large-scale manufacturing of solar panels, electronics, and glass products requiring advanced coatings. Japan and South Korea focus on high-quality coatings for automotive and semiconductor industries. It benefits from rapid infrastructure development and expansion of construction projects in India and Southeast Asia. Rising demand for smartphones and electronic devices fuels adoption of scratch-resistant coatings. Governments in the region encourage domestic production of eco-friendly materials to reduce imports and meet environmental goals. Strategic investments by local and global players boost production capacity and technology availability across the region.

Latin America

Latin America represents 6% share of the Sol-Gel Coatings market, with Brazil and Mexico leading demand. Automotive manufacturing growth in Mexico creates opportunities for corrosion-resistant and water-repellent coatings. It also finds application in solar energy projects, particularly in Brazil’s expanding renewable sector. Construction activities drive adoption of self-cleaning coatings for commercial buildings and glass facades. Limited local manufacturing capacity encourages imports from North America and Europe. Regional players focus on cost-effective solutions to serve price-sensitive markets. Government-led infrastructure programs and trade partnerships stimulate steady growth.

Middle East and Africa

Middle East and Africa account for 4% share, driven by demand for high-performance coatings in construction and oil & gas sectors. The UAE and Saudi Arabia invest in smart city projects that require advanced glass and metal coatings. It supports energy efficiency goals and reduces maintenance needs for large building facades. Solar energy projects in the region create opportunities for anti-soiling and anti-reflective coatings. Africa’s emerging construction market slowly adopts sol-gel solutions as urbanization rises. Import dependency remains high due to limited local production capacity. Partnerships with global suppliers improve technology transfer and product availability.]

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NanoTech Coatings

- Henkel AG & Co.

- CCM GmbH

- Covestro AGO

- Akzo Nobel N.V.

- Nano Care Deutschland AG

- The Sherwin-Williams Company

- OPTICOTE Inc.

- Premium Coatings and Chemicals Pvt Ltd.

- 3M

- Arkema SA

- PPG Industries Inc.

- Euroglas GmbH

- Axalta Coatings Systems LLC

- Ferro Corporation

Competitive Analysis

The leading players in the Sol-Gel Coatings market include NanoTech Coatings, Henkel AG & Co., CCM GmbH, Covestro AGO, Akzo Nobel N.V., Nano Care Deutschland AG, The Sherwin-Williams Company, OPTICOTE Inc., Premium Coatings and Chemicals Pvt Ltd., 3M, Arkema SA, PPG Industries Inc., Euroglas GmbH, Axalta Coatings Systems LLC, and Ferro Corporation. These companies compete by focusing on advanced formulations, eco-friendly solutions, and industry-specific applications. They invest in research and development to improve coating performance, including corrosion resistance, scratch durability, and UV stability. Many players expand their product portfolios to meet demand from automotive, aerospace, electronics, and renewable energy sectors. Strategic collaborations with OEMs and research institutes help bring innovative solutions to market faster. Regional expansions and manufacturing facility upgrades strengthen supply chains and ensure consistent quality. Companies also focus on sustainability by introducing water-based and low-VOC sol-gel coatings to comply with global regulations. Competitive differentiation often comes from offering multifunctional coatings that combine anti-fogging, self-cleaning, and protective properties. The market remains dynamic with acquisitions and partnerships aimed at broadening technology capabilities. Continuous innovation and customer-focused product development are critical for maintaining leadership and capturing emerging opportunities in this growing market.

Recent Developments

- In 2025, AkzoNobel signed an agreement to sell its decorative paints business in India to JSW Group as part of a strategy to focus on its performance coatings, which include marine, protective, and powder coatings. The deal is pending regulatory approval and is expected to close in the fourth quarter of 2025.

- In 2024, PPG introduced PPG FUSION® Pro II, a new sol-gel “ceramic” non-stick coating with improved hardness, abrasion resistance, and performance versus earlier versions.

- In 2023, AkzoNobel launched a pioneering low-energy powder coating.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sol-Gel Coatings market will expand with higher demand from automotive and aerospace sectors.

- Manufacturers will invest in nanotechnology to deliver stronger and more durable coating solutions.

- Adoption of eco-friendly water-based coatings will rise due to strict VOC regulations worldwide.

- Growth in solar panel installations will increase the need for anti-reflective and self-cleaning coatings.

- Electronics makers will use more sol-gel coatings to improve scratch resistance on device screens.

- Partnerships between material suppliers and OEMs will speed up commercialization of new formulations.

- R&D will focus on multifunctional coatings that combine corrosion, wear, and UV resistance.

- Construction industry will boost demand for energy-efficient and self-cleaning glass coatings.

- Emerging markets in Asia-Pacific will become major production hubs for sol-gel technology.

- Automation and advanced application techniques will reduce production costs and improve consistency.