Market Overview

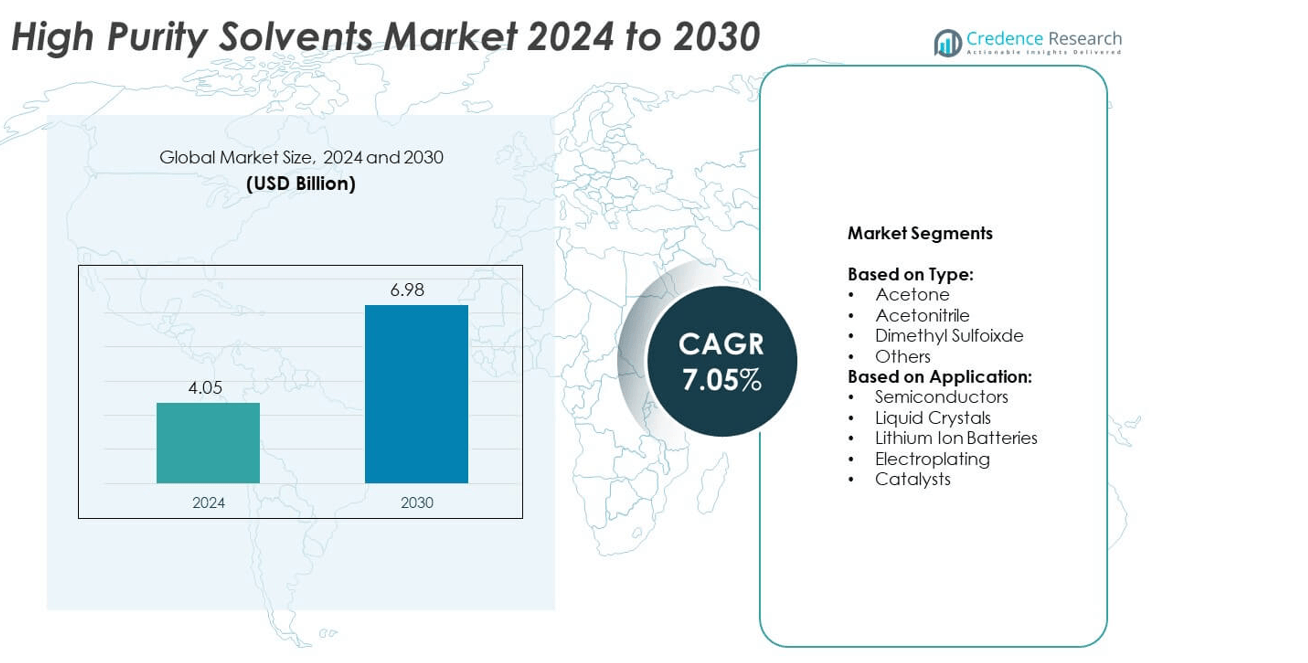

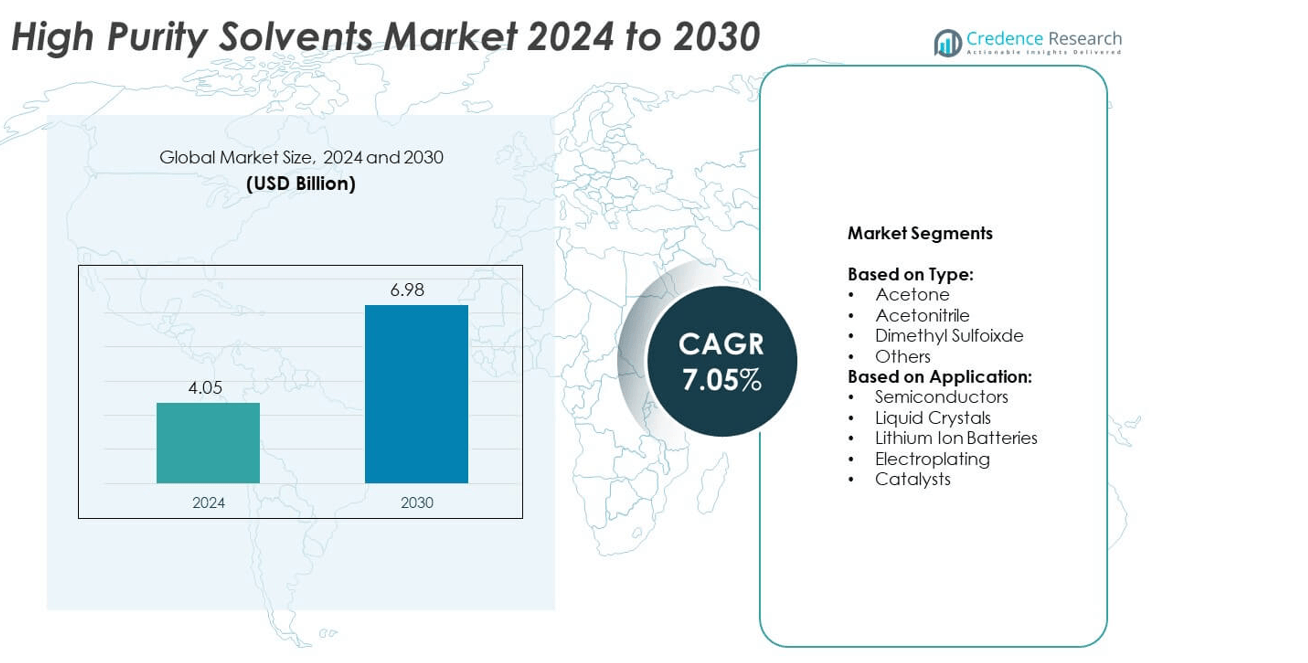

High Purity Solvents Market size was valued at USD 4.05 billion in 2024 and is anticipated to reach USD 6.98 billion by 2032, at a CAGR of 7.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Purity Solvents Market Size 2024 |

USD 4.05 billion |

| High Purity Solvents Market, CAGR |

7.05% |

| High Purity Solvents Market Size 2032 |

USD 6.98 billion |

The High Purity Solvents market grows with rising demand from pharmaceuticals, semiconductors, and battery manufacturing. It supports critical cleaning, synthesis, and formulation processes where trace-level impurity control is essential. Companies invest in advanced purification technologies and green solvent alternatives to meet regulatory and sustainability goals. Trends include growing use in nanotechnology, customized solvent blends, and smart packaging solutions. Digital traceability, low-VOC formulations, and bio-based solvents gain traction as industries shift toward safer, high-performance, and compliant chemical inputs.

Asia-Pacific leads the High Purity Solvents market due to strong presence of semiconductor, electronics, and pharmaceutical manufacturing hubs in China, Japan, South Korea, and India. North America follows, supported by advanced R&D facilities and strict regulatory standards in the U.S. and Canada. Europe sees steady demand from chemical and biotech sectors, while Latin America and the Middle East show emerging growth. Key players include Merck KGaA, BASF SE, Dow, and Mitsubishi Chemical Corporation, each focusing on high-specification solvent production.

Market Insights

- The High Purity Solvents market was valued at USD 4.05 billion in 2024 and is projected to reach USD 6.98 billion by 2032, growing at a CAGR of 7.05% between 2025 and 2030.

- Demand rises due to increasing use in pharmaceuticals, electronics, and battery manufacturing where high-purity inputs are essential.

- Green solvent formulations, trace-level impurity control, and demand for customized blends drive major trends across multiple industries.

- Major companies such as Merck KGaA, Dow, BASF SE, Mitsubishi Chemical Corporation, and Thermo Fisher Scientific compete through innovation, quality control, and distribution networks.

- High costs of purification, storage, and strict regulatory compliance create operational challenges, especially for smaller suppliers.

- Asia-Pacific leads due to strong electronics and pharmaceutical production, followed by North America and Europe with steady demand from R&D, healthcare, and industrial sectors.

- Rising adoption of traceable, bio-based, and low-VOC solvents offers new opportunities in advanced materials, clean energy, and sustainable chemical manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Pharmaceutical Manufacturing Drives Demand for High Purity Solvents Across Drug Formulations

The High Purity Solvents market benefits from the rise in pharmaceutical drug production. These solvents are essential in synthesis, purification, and cleaning of active pharmaceutical ingredients. It ensures product consistency, low toxicity, and minimal residue levels. Growth in biologics, injectables, and advanced therapies boosts the need for ultra-clean solvent grades. Regulatory bodies emphasize quality control in drug manufacturing, increasing the reliance on high-specification solvents. Major pharmaceutical players continue to invest in capacity expansion and localized production facilities.

- For instance, Nova Molecular Technologies offers Tetrahydrofuran 99.9% purity grade, used in analytical and biopharma settings.

Growing Electronic and Semiconductor Sector Fuels Consumption of Ultra-High Purity Solvents Globally

High Purity Solvents market gains traction from increased demand in semiconductor and display manufacturing. Solvents are used in wafer cleaning, etching, and photoresist formulations. It plays a critical role in preventing defects during advanced node fabrication. Miniaturization of chips and development of AI-powered devices require solvents with lower impurity thresholds. Chipmakers invest in expanding fabs across Asia-Pacific and the U.S., ensuring steady consumption of precision-grade solvents. Suppliers align with ISO and SEMI standards to meet stringent purity requirements.

- For instance, Sigma-Aldrich offers several grades of Dimethyl Sulfoxide (DMSO) with varying purities and specific applications. For hybridoma applications, the company supplies a Hybri-Max™ grade with a purity of at least 99.7%, which has been specifically tested for this use. For molecular biology, a distinct Molecular Biology Grade DMSO (Product No. D8418) is available with a higher purity of at least 99.9%, and this grade is verified to be free of DNases and RNases for applications such as PCR, transfection, and DNA sequencing.

Rising Adoption in Analytical Laboratories and Research Institutes Promotes Steady Solvent Usage

The High Purity Solvents market sees stable demand from laboratories engaged in chromatography, spectroscopy, and quality testing. Solvents are used in sample preparation, mobile phases, and analytical dilutions. It must meet trace-level impurity control for consistent analytical performance. Growth in life sciences, environmental testing, and academic research sustains solvent consumption. Government funding in R&D across biotech and chemical sectors supports lab-based applications. Distributors offer solvent grades tailored to LC-MS, HPLC, and GC applications.

Stringent Environmental and Safety Regulations Encourage Use of Cleaner and Certified Solvent Grades

High Purity Solvents market growth aligns with rising environmental awareness and regulatory compliance. Manufacturers shift to low-VOC, low-toxicity formulations to meet workplace safety standards. It addresses concerns related to emissions, storage hazards, and end-user exposure. Regulatory frameworks like REACH, EPA, and GHS drive demand for certified and traceable solvent products. Industrial users prioritize solvents with detailed safety data and batch traceability. This regulatory push creates opportunities for solvent producers offering green and compliant solutions.

Market Trends

Rising Use of High Purity Solvents in Green Chemistry and Sustainable Formulations Across Industries

The High Purity Solvents market is shifting toward green solvents and bio-based alternatives. Industries seek solutions with lower toxicity and better environmental profiles. It aligns with stricter emission laws and sustainability targets across pharmaceutical, electronics, and industrial segments. Manufacturers are replacing traditional solvents with biodegradable or water-based substitutes. These shifts help companies meet internal ESG goals and maintain regulatory compliance. Bio-based solvent suppliers expand portfolios to serve environmentally conscious end-users.

- For instance, PerkinElmer LC/MS Grade Acetonitrile (e.g., product N9304936) has a water specification of ≤ 0.01%, not 0.0006%. While the product is tested for LC/MS suitability, which includes minimizing ionization interference, the specific reserpine-related TIC signal specification is ≤ 50 ppb in ESI+ mode.

Strong Focus on Semiconductor-Grade Solvents With Trace-Level Metal Impurity Control

The High Purity Solvents market sees growing interest in electronic-grade solvents for advanced chipmaking. Semiconductor companies demand solvents with ultra-low metallic contaminants and tight particle size control. It supports defect-free manufacturing in 5 nm and below node production. Foundries and OEMs collaborate with solvent manufacturers to customize high-spec blends. Chip shortages and government-backed semiconductor investments increase production of leading-edge devices. This drives continued innovation in purification and packaging techniques.

- For instance, Kanto Chemical guarantees 100 ppt metal impurities with its Ultrapur-100 series.

Customized Solvent Blending Services Gain Traction Among Niche End-Users Requiring Application-Specific Grades

Demand rises for tailored solvent blends suited to customer-specific applications in pharma, biotech, and lab research. The High Purity Solvents market benefits from suppliers offering custom concentrations, packaging, and delivery options. It helps users reduce solvent waste and improve operational efficiency. On-site blending and small-batch production units enable faster supply and better inventory control. Research labs and CROs adopt pre-mixed solvents to streamline testing processes. Suppliers gain competitive edge by offering flexible, ready-to-use solutions.

Digital Supply Chain Integration and Traceability Solutions Improve Product Quality Assurance

The High Purity Solvents market sees rising adoption of digital monitoring and track-and-trace systems. Users require batch-level documentation and real-time quality tracking for regulatory compliance. It improves transparency, inventory accuracy, and solvent use optimization. Smart labeling and barcoding systems support traceable logistics across pharmaceutical and electronic sectors. Digital integration also reduces human error in critical handling environments. Solvent manufacturers invest in ERP, IoT, and cloud-based tools to enhance customer confidence and process efficiency.

Market Challenges Analysis

Complex and Cost-Intensive Purification Processes Limit Scalability and Supplier Profitability

The High Purity Solvents market faces challenges due to high production and purification costs. Achieving parts-per-billion impurity levels requires advanced filtration, distillation, and material handling systems. It demands strict quality control, skilled labor, and sophisticated infrastructure. These requirements raise operating costs and limit smaller players from entering the market. Scaling production without compromising purity remains a persistent difficulty. Manufacturers must balance purity specifications with cost-efficiency to stay competitive.

Strict Storage and Handling Requirements Increase Operational Risk and Compliance Burden

Handling High Purity Solvents requires specialized storage systems, cleanroom environments, and tight contamination controls. It creates logistical challenges, especially during transport or bulk storage. Any exposure to airborne particles, humidity, or incompatible materials can compromise solvent quality. Regulatory standards such as REACH, OSHA, and EPA impose strict guidelines on solvent use and labeling. Non-compliance can lead to product recalls or supply chain disruptions. Companies must invest in continuous training and monitoring systems to meet regulatory and safety expectations.

Market Opportunities

Expansion of Biopharmaceutical and Cell Therapy Manufacturing Unlocks High Value Growth Potential

The High Purity Solvents market stands to benefit from rapid growth in biopharma, vaccines, and cell therapies. These segments require ultra-clean solvents for buffer preparation, protein purification, and cleaning processes. It supports sterile manufacturing conditions where contamination control is critical. Investment in new biologics plants and contract development facilities drives solvent demand. North America and Asia-Pacific lead in capacity expansion for monoclonal antibodies and gene therapies. Suppliers that offer GMP-certified, endotoxin-free solvent grades will gain long-term contracts and premium margins.

Growing Research in Nanotechnology and Advanced Materials Creates Niche Solvent Applications

Emerging fields like nanotechnology, specialty coatings, and optoelectronics create new demand for custom solvent formulations. The High Purity Solvents market can expand by addressing precision needs in nanoparticle synthesis and ultra-thin film production. It enables consistent dispersion, surface cleaning, and pattern development in critical environments. Universities, research labs, and advanced materials startups seek reliable solvent partners for pilot-scale programs. Government funding in advanced manufacturing boosts demand for high-spec input materials. Suppliers that provide documentation, traceability, and custom packaging stand to capture these niche segments.

Market Segmentation Analysis:

By Type

The High Purity Solvents market includes key solvent types such as acetone, acetonitrile, dimethyl sulfoxide (DMSO), and others. Acetone holds a strong share due to its use in cleaning and surface preparation in electronics and semiconductor manufacturing. It offers fast evaporation, low toxicity, and compatibility with automated cleaning systems. Acetonitrile shows rising demand in pharmaceutical and analytical labs where solvent purity directly impacts test results. It plays a vital role in HPLC and spectrophotometric analysis. Dimethyl sulfoxide finds increasing usage in biotechnology and polymer processing due to its high polarity and solvating power. Other solvents—such as alcohols, ethers, and esters—serve niche markets requiring highly selective or inert chemical properties.

- For instance, Tedia (Anhui Tedia) can produce 3,000 t/year of HPLC-grade acetonitrile.

By Application

The High Purity Solvents market supports critical applications such as semiconductors, liquid crystals, lithium-ion batteries, electroplating, and catalysts. Semiconductors remain the leading segment, driven by advanced chip fabrication and wafer cleaning processes that demand impurity-free solvents. It ensures minimal particle interference in sub-10 nm device nodes. Liquid crystal manufacturing uses high-purity solvents to remove trace metals and maintain optical clarity in display panels. The lithium-ion battery sector is expanding solvent use for electrolyte production and electrode surface treatment. Electroplating processes require pure solvents to avoid contamination in metal deposition on electronics and precision parts. In catalyst production, solvents enable homogeneous mixing and reaction control in lab-scale and commercial synthesis. Each application segment reinforces the need for consistent solvent purity, controlled residue levels, and traceable supply chains.

- For instance, Thermo Fisher is adding 8 bioreactors in 2025: 4×5,000 L and 4×2,000 L.

Segments:

Based on Type:

- Acetone

- Acetonitrile

- Dimethyl Sulfoixde

- Others

Based on Application:

- Semiconductors

- Liquid Crystals

- Lithium Ion Batteries

- Electroplating

- Catalysts

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 31.2% share of the global High Purity Solvents market, making it the second-largest regional contributor. The region benefits from a strong pharmaceutical base, advanced semiconductor facilities, and robust research infrastructure. The United States leads demand through major players in life sciences, contract manufacturing, and chip fabrication. It supports solvent usage in cleanroom processes, laboratory applications, and microelectronics. Canada contributes through pharmaceutical production and materials research, with government-backed funding in clean technologies and healthcare R&D. Stringent regulatory compliance under FDA, REACH, and OSHA standards drives demand for certified and traceable solvent products. The presence of global chemical companies and solvent producers ensures a stable and diversified supply chain across North America.

Asia-Pacific

Asia-Pacific dominates the High Purity Solvents market with a 42.5% share, driven by strong demand from semiconductors, electronics, and lithium-ion battery manufacturing. Countries such as China, Japan, South Korea, and Taiwan lead global chip production, requiring ultra-high-purity solvents for cleaning, etching, and photoresist formulations. China accounts for the largest share within the region due to its fast-growing electronics sector, industrial output, and increasing domestic production of pharmaceutical ingredients. Japan and South Korea are home to several tier-one electronics and display manufacturers that use solvents in LCD and OLED production. India sees growing demand from pharmaceutical and biotech sectors, backed by rising exports and new drug manufacturing facilities. Regional growth is supported by government programs focused on advanced manufacturing, clean energy, and electronics infrastructure.

Europe

Europe holds a 17.6% market share in the High Purity Solvents market, supported by strict quality standards and sustainable manufacturing goals. Germany, France, and the United Kingdom serve as key hubs for pharmaceutical R&D, fine chemicals, and analytical services. Germany leads regional consumption due to its large-scale production of specialty chemicals and active pharmaceutical ingredients. France supports demand through its cosmetics, biotech, and semiconductor sectors, while the UK contributes through academic and commercial labs. European Union policies drive the use of low-toxicity and environmentally friendly solvents, especially under REACH and Green Deal frameworks. Producers in the region focus on circular economy practices and solvent recycling, improving adoption of high-specification, low-emission solvent grades.

Latin America

Latin America accounts for a 4.3% share of the global High Purity Solvents market. Brazil and Mexico are the leading consumers, supported by chemical production, pharmaceutical packaging, and electronics assembly. Brazil sees solvent use in analytical labs and API formulation units, while Mexico supports demand from industrial cleaning and printed electronics. The regional market remains small but shows steady expansion with rising investment in healthcare, automotive electronics, and manufacturing. Supply challenges and regulatory gaps limit local production, making countries reliant on imports from North America and Europe. Distributors in Latin America increasingly stock GMP-compliant solvents to meet demand from multinational pharmaceutical and diagnostic firms.

Middle East & Africa

Middle East & Africa holds the smallest share at 4.4%, with demand concentrated in UAE, Saudi Arabia, and South Africa. The High Purity Solvents market in this region is supported by oil refining, university research, and growing interest in local pharma manufacturing. UAE and Saudi Arabia invest in diversifying their economies through chemicals and life sciences sectors, encouraging the use of clean solvents in R&D and industrial processing. South Africa supports limited demand through university labs, mining R&D, and clinical trial centers. Limited infrastructure and high logistics costs constrain regional growth, but expanding pharmaceutical hubs and tech parks are expected to support future market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- Central Drug House

- Dow

- Akzo Nobel N.V.

- Tedia

- Thermo Fisher Scientific Inc.

- BASF SE

- Evonik Industries AG

- High Purity Laboratory Chemicals Pvt. Ltd.

- Asahi Kasei Corporation

- Mitsubishi Chemical Corporation (a subsidiary of Mitsubishi Chemical Holdings Corporation)

- Apchem Pvt. Ltd.

- Linde

- Spectrum Chemical Manufacturing Corp.

- Exxon Mobil Corporation

Competitive Analysis

The High Purity Solvents market features strong competition among key players including Merck KGaA, Central Drug House, Dow, Akzo Nobel N.V., Tedia, Thermo Fisher Scientific Inc., BASF SE, Evonik Industries AG, High Purity Laboratory Chemicals Pvt. Ltd., Asahi Kasei Corporation, Mitsubishi Chemical Corporation (a subsidiary of Mitsubishi Chemical Holdings Corporation), Apchem Pvt. Ltd., Linde, Spectrum Chemical Manufacturing Corp., and Exxon Mobil Corporation. These companies focus on expanding high-purity production capacities and launching specialized solvent grades for electronics, pharmaceuticals, and battery applications. Many players emphasize strong quality control, traceable supply chains, and ISO-certified manufacturing. Global suppliers maintain technical support networks and regional distribution hubs to meet end-user specifications in fast-growing Asian and North American markets. Firms with integrated R&D, such as those in life sciences or semiconductor chemicals, focus on custom formulations and digital monitoring solutions. Smaller domestic manufacturers build market share through cost competitiveness and targeted supply to local labs and API units. Product differentiation often centers on purity levels, endotoxin control, and contamination prevention packaging. Mergers and partnerships with regional distributors help expand reach and maintain supply consistency in regulated industries. Players that invest in sustainable solvent development and low-VOC solutions gain a competitive edge among environment-focused buyers.

Recent Developments

- In 2025, BASF’s production site in Geismar, Louisiana, obtained certification in 2023 for its home care polymer Sokalan® HP 20, and starting Q1 2025, EcoBalanced grades for certain betaine products will become available.

- In 2025, Asahi Kasei Corporation announced plans to double production capacity for PIMEL™ photosensitive polyimide, a key material for semiconductor industry, in Shizuoka Prefecture by 2030.

- In 2024, Dow announced it will invest in a world‑scale carbonate solvents production facility on the U.S. Gulf Coast to support EV and energy storage markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand from pharmaceutical and biotechnology manufacturing plants.

- Semiconductor industry expansion will drive solvent consumption for precision cleaning and etching.

- Battery-grade solvents will gain traction due to increased electric vehicle production globally.

- Research labs and CROs will adopt pre-mixed and traceable solvent formulations.

- Green solvents and bio-based alternatives will attract buyers seeking regulatory compliance.

- Investments in high-purity production facilities will support capacity and regional supply.

- Automation and digital traceability will become standard in solvent packaging and delivery.

- Asia-Pacific will remain the leading regional market with strong industrial and export capacity.

- Custom solvent blends will find demand in niche applications across catalysts and coatings.

- Stringent purity and certification standards will shape procurement policies in all end-use sectors.