Market Overview

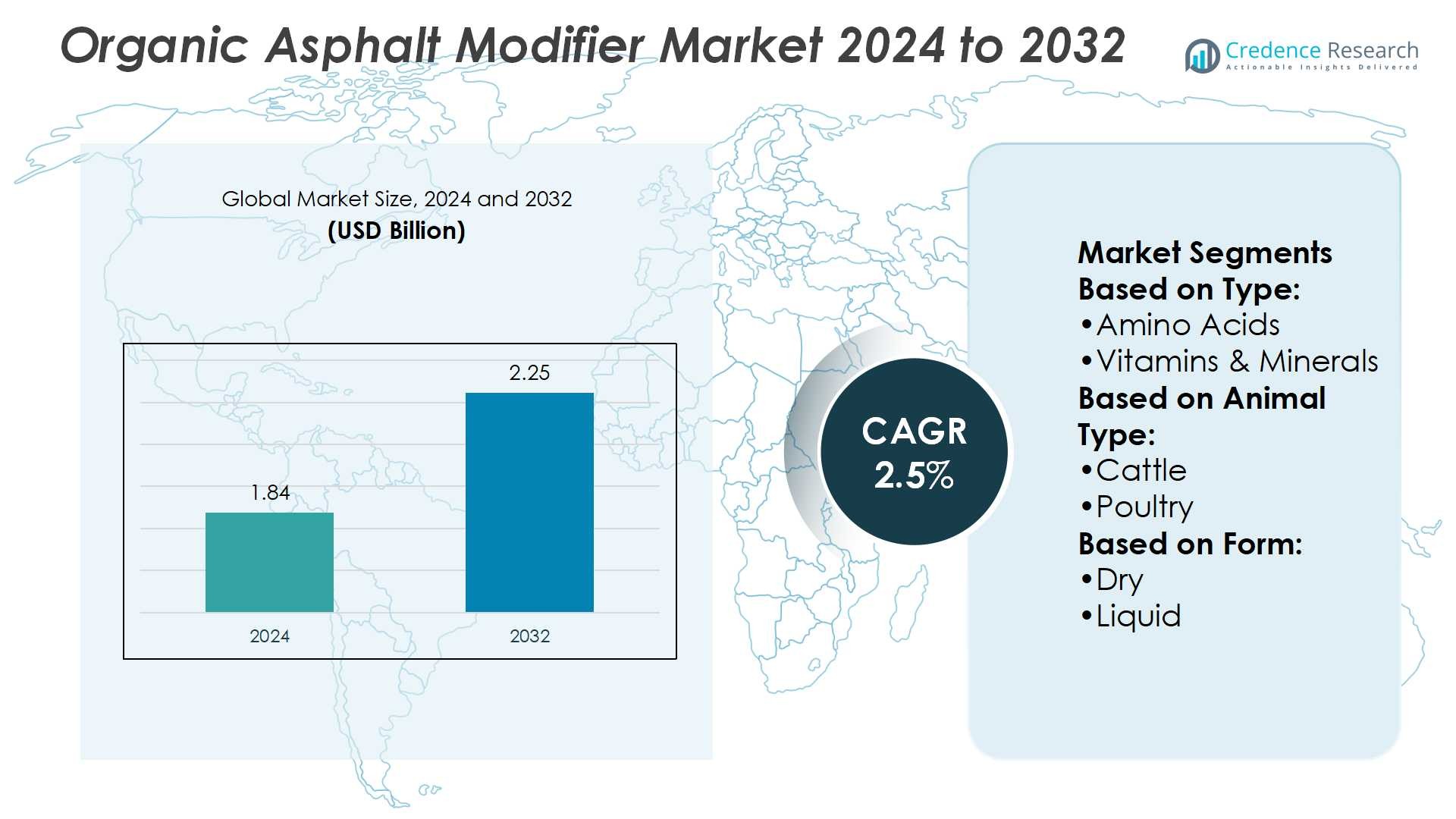

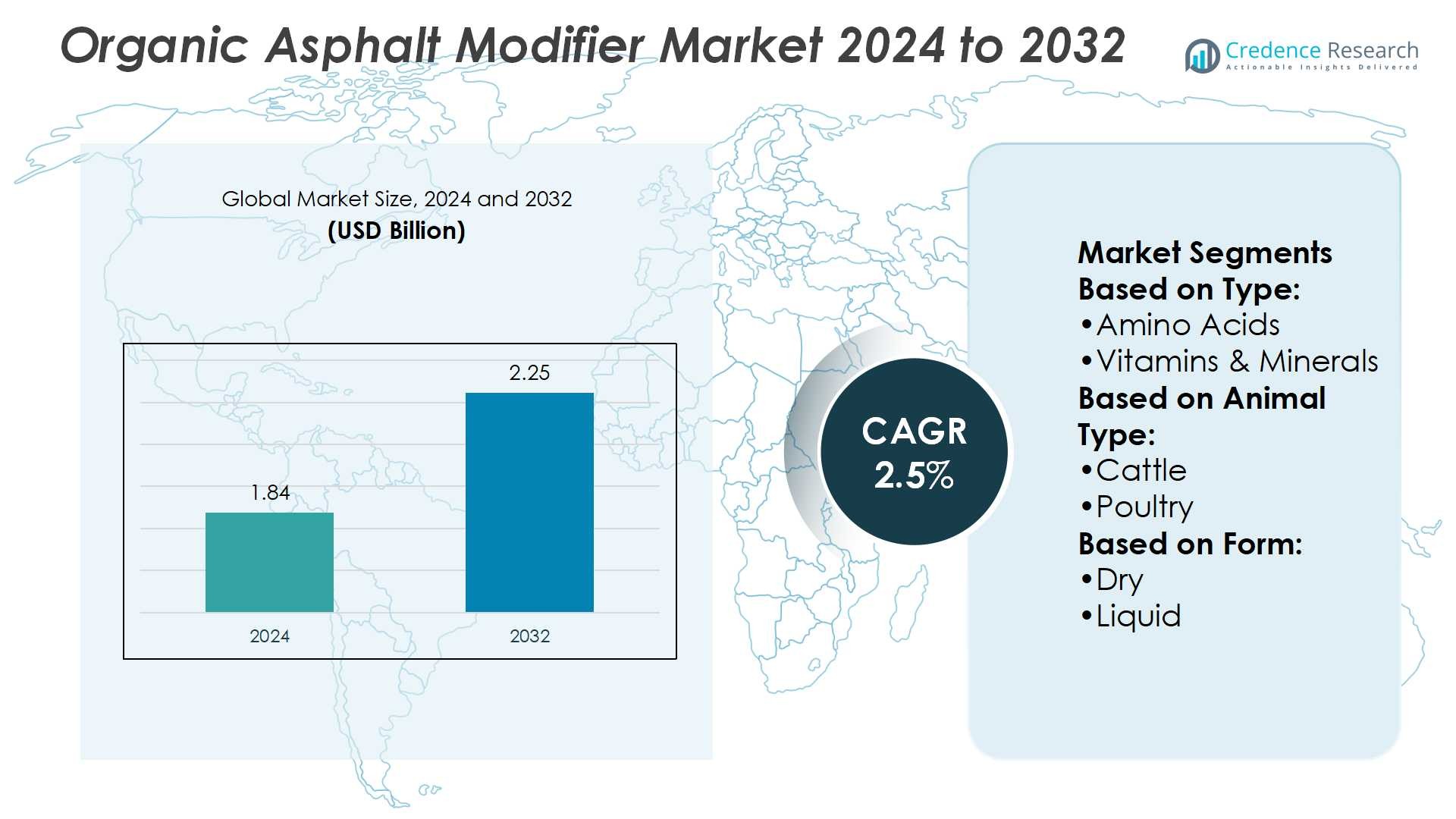

Organic Asphalt Modifier Market size was valued USD 1.84 billion in 2024 and is anticipated to reach USD 2.25 billion by 2032, at a CAGR of 2.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organic Asphalt Modifier Market Size 2024 |

USD 1.84 Billion |

| Organic Asphalt Modifier Market, CAGR |

2.5% |

| Organic Asphalt Modifier Market Size 2032 |

USD 2.25 Billion |

The organic asphalt modifier market is shaped by prominent players such as Kraton Corporation, Honeywell International Inc., Nouryon, BASF SE, Sasol Limited, DuPont de Nemours, Inc., Evonik Industries AG, The Dow Chemical Company, Ingevity Corporation, and Arkema Group. These companies focus on sustainable product innovations, advanced formulations, and strategic partnerships to strengthen their global presence. Competitive strategies include investments in R&D, expansion into high-growth regions, and alignment with government sustainability goals. Regionally, Asia-Pacific leads the market with a 38% share, driven by rapid urbanization, large-scale infrastructure projects, and growing adoption of eco-friendly road construction materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Organic Asphalt Modifier Market was valued at USD 1.84 billion in 2024 and is projected to reach USD 2.25 billion by 2032, registering a CAGR of 2.5%.

- Market growth is driven by the rising adoption of sustainable road construction materials, supported by government policies promoting eco-friendly infrastructure solutions.

- Leading players such as Kraton Corporation, BASF SE, DuPont de Nemours, Inc., and Arkema Group are investing in R&D and advanced formulations to strengthen competitiveness and address performance-based specifications.

- High initial costs and limited awareness among contractors remain key restraints, particularly in developing regions where cheaper alternatives still dominate.

- Asia-Pacific holds the largest market share at 38%, led by China and India, while the amino acids segment remains the dominant type due to its superior performance benefits in enhancing asphalt durability and reducing environmental impact.

Market Segmentation Analysis:

By Type

The amino acids segment holds the largest share in the organic asphalt modifier market. Its dominance is supported by its ability to enhance durability, improve binding strength, and reduce cracking in asphalt mixtures. Demand is rising as infrastructure projects increasingly prioritize sustainable and performance-based road materials. The segment benefits from regulatory support for eco-friendly additives and higher adoption in both developed and emerging economies. These factors make amino acids the preferred choice among modifiers, strengthening their role as the leading type segment.

- For instance, Kraton’s CirKular+™ Paving Circularity Series allows inclusion of reclaimed asphalt content up to 50 units by mass in surface-layer mixes while maintaining mixture performance.

By Animal Type

The cattle segment leads the market by animal type, accounting for the largest share. This dominance is attributed to the high volume of cattle feed production globally and the increasing use of organic modifiers in feed formulations to enhance digestibility and performance. Growing demand for sustainable livestock management and strict quality standards in dairy and meat production drive this trend. Adoption is further supported by rising consumer preference for natural and organic animal products, reinforcing cattle as the key growth driver within this segment.

- For instance, BASF’s Amasil® 85 formic acid product is used in animal feed as an acidifying and hygiene condition enhancer. Its addition helps to lower feed pH, which creates an environment that can inhibit the growth of pathogenic bacteria like Salmonella and extend feed storage life.

By Form

The dry form segment dominates the market with the highest share, favored for its stability, long shelf life, and ease of transportation. Dry formulations offer greater convenience in storage and blending with asphalt mixtures, making them the preferred choice in large-scale construction projects. Their ability to deliver consistent performance and reduced handling costs further strengthens their market position. Increased demand for efficient and cost-effective organic asphalt modifiers in road construction continues to drive the adoption of the dry form segment.

Key Growth Drivers

Rising Demand for Sustainable Road Construction

The market is witnessing strong growth as governments and contractors prioritize sustainable road construction. Organic asphalt modifiers improve durability, reduce emissions, and lower reliance on petroleum-based additives. Infrastructure investments in emerging economies and green construction policies in developed nations are fueling demand. The rising focus on eco-friendly infrastructure and cost-efficient road maintenance positions organic asphalt modifiers as a vital solution. Their ability to extend road life while meeting environmental standards serves as a major driver for market expansion.

- For instance, Sasol’s SASOBIT additive enables the production of Warm Mix Asphalt (WMA), allowing paving temperatures to be reduced by up to 30°C compared to conventional hot-mix asphalt.

Advancements in Modifier Formulations

Technological innovations in organic asphalt modifier formulations are significantly enhancing market adoption. New product developments improve resistance to rutting, cracking, and extreme weather conditions. Companies are investing in research to create modifiers that blend seamlessly with conventional asphalt while ensuring high performance. Enhanced compatibility, lower maintenance costs, and superior road longevity are key benefits attracting widespread adoption. The growing emphasis on performance-based specifications in road projects drives the need for advanced organic modifiers, strengthening this driver further.

- For instance, Dow Inc.’s Elvaloy® 4170 Reactive Elastomeric Terpolymer (RET) is used in asphalt at dosages as low as 0.5 percent by weight of the binder, enhancing compatibility and storage stability. The density of the polymer is 0.94 g/cm³.

Government Regulations and Incentives

Regulatory frameworks promoting sustainable infrastructure development are boosting the use of organic asphalt modifiers. Governments are implementing stricter standards to limit carbon emissions and support environmentally safe construction practices. Incentives for using green materials in highways, urban roads, and airport runways are driving adoption. Public-private partnerships and funding for eco-friendly infrastructure projects reinforce the demand for organic solutions. This regulatory push, combined with the need to meet global sustainability targets, firmly establishes government policies as a crucial market driver.

Key Trends & Opportunities

Integration with Recycling Initiatives

The trend of incorporating recycled materials in road construction is opening new opportunities for organic asphalt modifiers. Their compatibility with reclaimed asphalt pavement (RAP) enhances sustainability and cost efficiency. Growing adoption of circular economy practices by construction firms is driving this trend further. By improving the performance of recycled asphalt mixes, organic modifiers are aligning with global sustainability goals, offering market players significant opportunities to expand their presence in eco-conscious projects.

- For instance, Evonik’s TEGO® Addibit FS 725 A stabilizer is used in foamed bitumen production to improve foam stability and facilitate the use of recycled asphalt pavement (RAP). This additive enhances the wetting properties of aggregates and improves overall mix processability at lower temperatures.

Expansion in Emerging Economies

Emerging economies present substantial growth opportunities due to rapid urbanization and large-scale infrastructure projects. Countries in Asia-Pacific, Africa, and Latin America are heavily investing in highways, airports, and urban development. Organic asphalt modifiers are gaining traction as governments focus on durable and environmentally safe solutions. Rising construction budgets, along with increased awareness of green materials, position these regions as high-growth markets. Companies expanding their operations in these regions can leverage untapped demand and secure competitive advantages.

- For instance, Arkema’s ZEBRA (Zero wastE Blade ReseArch) project achieved a recycled Elium® monomer yield exceeding 75% via thermolysis. The consortium produced a 77 m recyclable thermoplastic wind blade using Carbon-Elium® resin spar cap and a novel adhesive from Bostik.

Adoption of Performance-Based Specifications

A growing opportunity lies in the adoption of performance-based specifications for road projects. Contractors and agencies are seeking modifiers that provide measurable improvements in durability and lifecycle costs. Organic asphalt modifiers meet these criteria, offering enhanced road resilience under varying traffic loads and climates. This trend encourages innovation and quality-driven competition among suppliers. As performance testing becomes standard in road construction, organic modifiers are likely to see increased demand, supporting both product innovation and broader market penetration.

Key Challenges

High Initial Costs

One of the primary challenges for the organic asphalt modifier market is its higher upfront cost compared to conventional modifiers. Construction companies in cost-sensitive regions often prefer cheaper alternatives despite the long-term benefits of organic solutions. Budget constraints in public infrastructure projects further limit widespread adoption. The need for cost justification and demonstration of lifecycle savings remains crucial. Without broader awareness and financial support, the higher initial investment continues to act as a barrier to market penetration.

Limited Awareness and Technical Expertise

The adoption of organic asphalt modifiers is restricted by limited awareness and lack of technical expertise among contractors and engineers. Many stakeholders remain unfamiliar with the benefits, handling, and application processes of organic modifiers. This knowledge gap slows adoption, especially in developing regions. Training programs, product demonstrations, and technical support are essential to overcome this barrier. Unless companies and governments invest in awareness-building initiatives, the market’s growth potential may remain underutilized despite strong demand drivers.

Regional Analysis

North America

North America holds a 28% share of the organic asphalt modifier market, supported by advanced infrastructure and strong regulatory frameworks promoting sustainable construction. The U.S. leads the region with extensive highway modernization projects and investments in eco-friendly materials. Demand is rising due to strict emission reduction policies and government incentives for green road construction. The presence of established modifier producers and adoption of performance-based standards further drive market expansion. Canada also contributes significantly, with its focus on durable road networks and cold-weather performance, reinforcing North America’s position as a mature and innovation-driven market.

Europe

Europe accounts for a 24% market share, driven by its leadership in sustainability initiatives and stringent construction standards. Countries such as Germany, France, and the U.K. are major adopters of organic asphalt modifiers in road and airport projects. The European Union’s policies on carbon neutrality and circular economy practices strongly favor eco-friendly materials. Infrastructure upgrades, particularly in Eastern Europe, also create demand for sustainable road solutions. Growing integration of recycled asphalt and advanced modifiers highlights the region’s innovation focus. With continuous government support, Europe remains a frontrunner in advancing green construction technologies within the global market.

Asia-Pacific

Asia-Pacific dominates the market with a 38% share, making it the fastest-growing regional segment. China, India, and Japan are key contributors due to large-scale infrastructure projects, rapid urbanization, and government-backed sustainability programs. Massive investments in highways, smart cities, and industrial zones create strong demand for organic asphalt modifiers. Rising construction budgets and growing adoption of green materials position the region as a critical growth hub. Emerging economies in Southeast Asia further boost market penetration through new road projects. With its scale and momentum, Asia-Pacific is expected to sustain leadership in both demand and future innovation.

Latin America

Latin America holds a 6% share of the organic asphalt modifier market, with steady growth potential. Brazil and Mexico lead adoption, supported by expanding urban infrastructure and highway development projects. Governments are gradually promoting eco-friendly construction practices, though cost constraints remain a limiting factor. Growing awareness of lifecycle cost benefits and rising investments in resilient road infrastructure are expected to accelerate demand. The market is still in its early stage, but increasing collaborations between local construction firms and global modifier producers may strengthen adoption. Latin America offers opportunities for long-term growth in sustainable road materials.

Middle East & Africa

The Middle East & Africa region captures a 4% share, reflecting its emerging status in the organic asphalt modifier market. Gulf countries, led by the UAE and Saudi Arabia, are investing in sustainable infrastructure as part of long-term development plans. Demand is also supported by large-scale urbanization and projects tied to economic diversification goals. In Africa, South Africa and Nigeria present growth opportunities with rising investments in road networks. However, adoption is limited by higher costs and lack of technical expertise. Despite challenges, infrastructure modernization and sustainability policies will gradually drive adoption across this region.

Market Segmentations:

By Type:

- Amino Acids

- Vitamins & Minerals

By Animal Type:

By Form:

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the organic asphalt modifier market players such as Kraton Corporation, Honeywell International Inc., Nouryon (formerly AkzoNobel Specialty Chemicals), BASF SE, Sasol Limited, DuPont de Nemours, Inc., Evonik Industries AG, The Dow Chemical Company, Ingevity Corporation, and Arkema Group. The organic asphalt modifier market is highly competitive, with companies focusing on sustainability, innovation, and cost efficiency to strengthen their positions. Market participants are investing heavily in research and development to deliver advanced formulations that enhance road durability, reduce maintenance costs, and improve compatibility with recycled asphalt. Strategic initiatives such as partnerships, mergers, and regional expansions are common, as firms aim to capture growth opportunities in both developed and emerging economies. Growing demand for performance-based specifications and environmentally friendly solutions further intensifies competition, pushing companies to differentiate through technological advancements and customer-focused strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kraton Corporation

- Honeywell International Inc.

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- BASF SE

- Sasol Limited

- DuPont de Nemours, Inc.

- Evonik Industries AG

- The Dow Chemical Company

- Ingevity Corporation

- Arkema Group

Recent Developments

- In June 2025, Heartland Paving Partners has announced the purchase of MacAdam Company, thereby broadening the regional strength and partnering itself with the proven industry leader.

- In December 2024, Vulcan’s Materials Company has reached an agreement to buy Superior Ready-Mix Concrete which is a significant provider of building materials in the Los Angeles area. With this acquisition, Vulcan’s California franchise will receive six new aggregate operations and a proven track record of more than 50 years in high-quality resources.

- In July 2024, Brenntag SE has partnered with Nouryon in order to offer an extended portfolio of high-quality products, especially anti-stripping agents and emulsifiers for asphalt, and to further consolidate the partnership with Nouryon.

- In February 2024, Shrieve, one of the major chemical supply and distribution firms, has announced the launching of fresh asphalt additives among the European market. With the company entering Europe, the launching of the PROGILINE® ECO-T range shows the commitment of Shrieve to providing highly sustainable products.

Report Coverage

The research report offers an in-depth analysis based on Type, Animal Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as governments prioritize sustainable infrastructure development.

- Demand will rise with the increasing use of recycled asphalt in construction.

- Technological innovations will improve modifier performance and expand applications.

- Emerging economies will create strong opportunities through large-scale infrastructure projects.

- Adoption will increase as performance-based road specifications become standard practice.

- Companies will expand into new regions to capture untapped growth potential.

- Regulatory support will drive higher usage of eco-friendly construction materials.

- Awareness programs and technical training will improve adoption rates globally.

- Competition will intensify as firms focus on innovation and cost efficiency.

- Long-term growth will be sustained by urbanization and smart city projects.