Market Overview

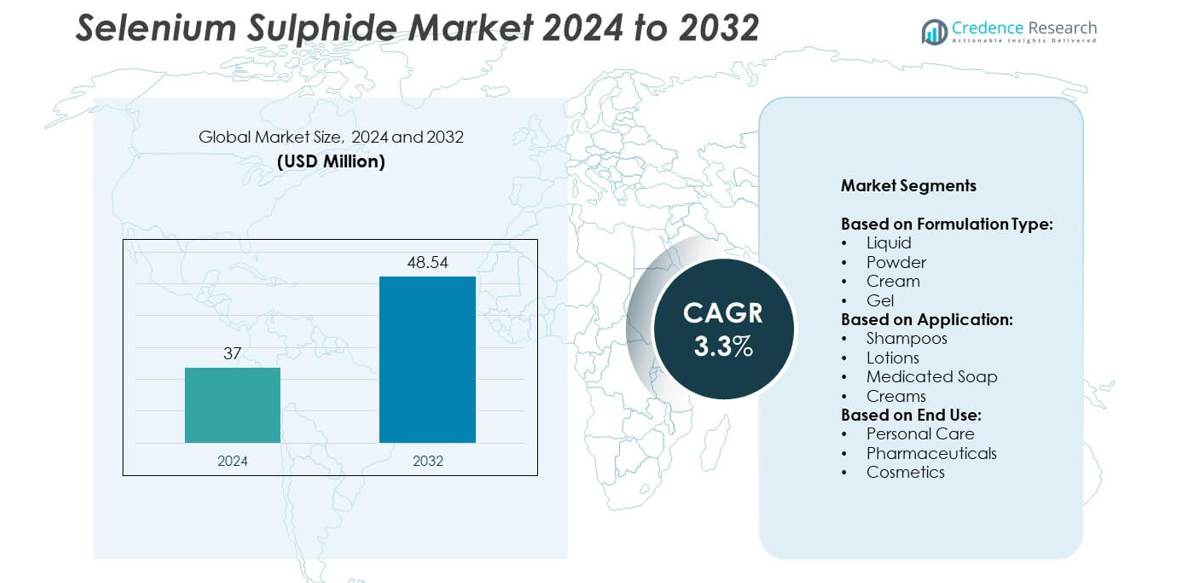

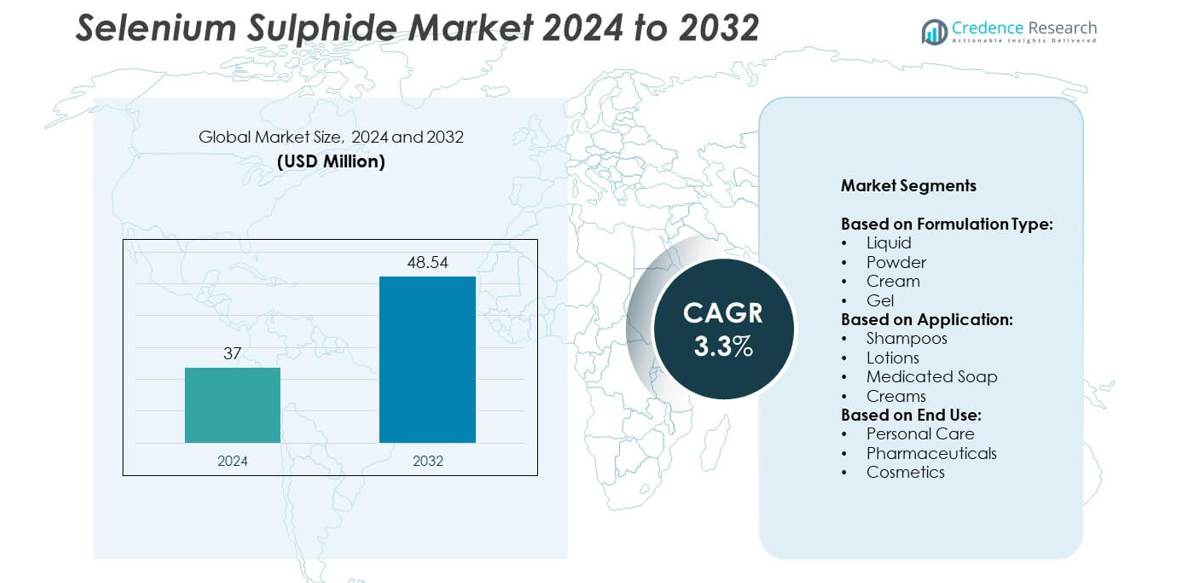

The Selenium Sulphide market size was valued at USD 37 million in 2024 and is anticipated to reach USD 48.54 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Selenium Sulphide Market Size 2024 |

USD 37 million |

| Selenium Sulphide Market, CAGR |

3.3% |

| Selenium Sulphide Market Size 2032 |

USD 48.54 million |

The selenium sulphide market is led by major players such as BASF, Vanderbilt Chemicals, Gujarat Organics, Hubei Lingfeng Chemical, Mitsubishi Gas Chemical, Hunan Jinxiang Chemical, Chemcon Speciality Chemicals, Shaanxi Hanjiang Chemical, Evonik Industries, and Tata Chemical. These companies focus on developing high-quality formulations and expanding their presence across prescription and over-the-counter product categories. Strategic efforts include scaling production capacity, investing in R&D for irritation-free solutions, and strengthening distribution networks through retail and e-commerce partnerships. North America emerged as the leading region with nearly 38% market share in 2024, driven by strong demand for medicated shampoos, high consumer awareness, and wide product availability. Europe followed with around 27% share, supported by premium personal care adoption and regulatory compliance.

Market Insights

- The selenium sulphide market was valued at USD 37 million in 2024 and is projected to reach USD 48.54 million by 2032, growing at a CAGR of 3.3%.

- Rising prevalence of dandruff, seborrheic dermatitis, and fungal scalp infections is driving demand, with liquid formulations holding over 45% market share in 2024.

- Trends include growing consumer shift toward OTC medicated shampoos, development of milder formulations, and increasing adoption through e-commerce and retail platforms.

- The market is moderately consolidated with key players focusing on capacity expansion, new product launches, and partnerships to strengthen global presence.

- North America leads the market with 38% share, followed by Europe with 27% and Asia Pacific with 22%, while Latin America and Middle East & Africa contribute smaller but growing shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Formulation Type

The liquid formulation segment dominated the selenium sulphide market with over 45% share in 2024. Its high demand is driven by widespread use in anti-dandruff shampoos and easy applicability on scalp treatments. Liquid formulations ensure better solubility, uniform application, and faster absorption, making them preferred by personal care brands. Cream and gel formulations are gaining traction for targeted treatments in dermatology, while powder form remains niche for compounding purposes. Rising consumer awareness regarding scalp health and the growing preference for ready-to-use personal care solutions are further supporting the dominance of liquid formulations in the market.

- For instance, Shree Skin Centre (India) conducted a study using a 2.5% selenium sulphide shampoo liquid formulation, applying it every three days for four weeks, reducing the mean total dandruff score from 11.5 (SD 2.15) at baseline to 2.5 (SD 1.17) at week 4.

By Application

Shampoos accounted for the largest share, exceeding 50% of the selenium sulphide market in 2024. This dominance stems from the compound’s proven effectiveness in treating dandruff, seborrheic dermatitis, and scalp fungal infections. The segment benefits from strong consumer preference for medicated hair care products and aggressive marketing by leading shampoo brands. Lotions and creams are increasingly used for skin-related fungal conditions, while medicated soaps cater to niche dermatological applications. Growing demand for specialized scalp care solutions and expanding product availability across retail and e-commerce channels drive growth in the shampoo application segment.

- For instance, in a randomized, double-blind, placebo-controlled trial of 246 patients comparing ketoconazole 2% shampoo and selenium sulfide 2.5% shampoo for moderate to severe dandruff, both medicated shampoos significantly reduced adherent and loose dandruff scores compared to placebo.

By End Use

Personal care emerged as the leading end-use segment with more than 55% market share in 2024. The segment’s growth is driven by rising consumer spending on hair care, urbanization, and increased awareness of scalp health. Personal care brands are introducing innovative products with selenium sulphide to strengthen their anti-dandruff and scalp treatment portfolios. Pharmaceutical end use continues to hold a significant share due to prescription-based treatments for severe dermatological conditions. The cosmetics segment is gradually expanding as selenium sulphide is incorporated into multifunctional beauty products targeting hair and scalp wellness, further broadening its consumer reach.

Market Overview

Rising Scalp and Skin Disorder Cases

Increasing prevalence of dandruff, seborrheic dermatitis, and fungal infections is a major growth driver for the selenium sulphide market. Consumers are increasingly seeking effective medicated solutions to treat chronic scalp issues, pushing demand for selenium sulphide shampoos and creams. Dermatologists recommend these products for their proven antifungal properties, further boosting adoption. Rising awareness campaigns about scalp health, coupled with better access to dermatology services in urban areas, support consistent growth. The expanding population facing stress-related skin and scalp problems is expected to keep this driver highly influential during the forecast period.

- For instance, in the Indian study cited above, 73.3% of participants (n = 22) reported absence of itching by week 4 when using 2.5% selenium sulphide shampoo.

Expanding Personal Care Industry

Rapid growth of the global personal care industry is strengthening demand for selenium sulphide-based formulations. Leading hair care brands are incorporating selenium sulphide in their anti-dandruff product lines, increasing market penetration across supermarkets, pharmacies, and online platforms. The rising popularity of premium hair care solutions and growing disposable incomes are encouraging consumers to spend more on medicated shampoos and scalp treatments. E-commerce platforms are playing a key role by offering wide product availability and competitive pricing. Together, these factors ensure selenium sulphide maintains a strong presence in the personal care product portfolio worldwide.

- For instance, Mayo Clinic documentation confirms both 1% OTC and 2.5% prescription selenium sulphide strengths for scalp treatments of dandruff/seborrheic dermatitis, ensuring regulatory clarity in formulations.

Regulatory Approvals and Product Innovation

Supportive regulatory approvals for selenium sulphide formulations in multiple regions are accelerating market growth. Manufacturers are focusing on developing advanced solutions with optimized concentrations to minimize irritation while ensuring high efficacy. Dermatologist-tested and clinically validated products are gaining consumer trust, encouraging wider adoption. The introduction of new product formats, such as milder cream-based treatments and scalp-targeted leave-in solutions, is expanding the consumer base. These innovations enable brands to serve both prescription and over-the-counter segments, strengthening market reach and encouraging repeat purchases among consumers looking for reliable long-term scalp care.

Key Trends & Opportunities

Shift Toward OTC Medicated Products

There is a growing shift toward over-the-counter (OTC) medicated products, with consumers preferring self-care solutions for mild to moderate scalp issues. Selenium sulphide shampoos and creams are increasingly available in retail stores and e-commerce platforms, removing the barrier of prescription requirements. Attractive packaging and brand-led marketing campaigns are further driving impulse purchases. The convenience of buying OTC solutions for dandruff and fungal issues without consulting a dermatologist is a significant opportunity for manufacturers. This trend is particularly strong in urban markets where consumers prioritize quick access and time-saving treatment options.

- For instance, the U.S. FDA allows a 1% selenium sulphide shampoo or lotion over the counter to treat dandruff and seborrheic dermatitis.

R&D in Dermatology Solutions

Research and development in dermatology is focusing on improving the performance and tolerability of selenium sulphide products. New formulations with reduced irritation potential and improved cosmetic appeal are under development, targeting sensitive scalp users. Companies are also exploring combinations with moisturizing agents to enhance user experience and reduce dryness, which can occur with frequent use. These advancements open opportunities for premium and niche product lines that cater to dermatologists’ recommendations. As consumer preference shifts toward clinically proven yet gentle solutions, innovation in selenium sulphide formulations is expected to fuel market expansion.

- For instance, in a 2025 online survey-based study, a cohort of 95 Chinese dermatologists used a 1% selenium sulfide + 0.9% salicylic acid shampoo for four weeks to treat their mild to moderate scalp seborrheic dermatitis. After the treatment period, severe dandruff cases among participants decreased from 28.4% to 3.2%, and visual analog scale (VAS) scores showed significant improvement in symptoms like scalp scaling (dandruff) and erythema (redness).

Key Challenges

Potential Side Effects

One key challenge for the selenium sulphide market is the potential for side effects with prolonged or improper use. Scalp irritation, dryness, or discoloration may discourage repeat purchases among sensitive consumers. Manufacturers must address these issues by investing in safety testing and providing clear usage guidelines on packaging. Educating consumers on correct application frequency and concentration is crucial to maintaining trust. Developing milder formulations for sensitive scalps will also help reduce adverse reactions and improve adoption among new users who are cautious about using medicated hair care solutions.

Competition from Alternative Ingredients

The market faces strong competition from alternative anti-dandruff ingredients such as zinc pyrithione, ketoconazole, and herbal extracts. These ingredients are marketed as mild, natural, or chemical-free solutions, attracting consumers seeking safer or more sustainable products. This competitive pressure requires selenium sulphide manufacturers to highlight its superior antifungal efficacy and faster results through clinical studies and marketing campaigns. Brands must differentiate by offering dermatologist-endorsed, high-performance products and educating consumers about its benefits. Failure to position selenium sulphide against these alternatives may lead to loss of market share in the long term.

Regional Analysis

North America

North America held the largest share of the selenium sulphide market, accounting for around 38% in 2024. The region’s growth is driven by high consumer awareness of scalp health and strong demand for medicated shampoos. The U.S. leads the market with significant spending on personal care products and wide retail availability. Pharmaceutical approvals and dermatologist endorsements are further boosting adoption. Key players focus on expanding e-commerce distribution and launching new formulations to meet consumer demand for effective scalp care solutions. The presence of established personal care brands ensures sustained market dominance during the forecast period.

Europe

Europe accounted for nearly 27% of the selenium sulphide market in 2024, supported by strong regulatory frameworks and high penetration of premium hair care products. Countries such as Germany, France, and the UK drive demand due to well-developed healthcare infrastructure and consumer preference for dermatologist-tested products. Rising incidence of dandruff and fungal scalp issues in urban populations is fueling product adoption. E-commerce platforms and specialty stores are expanding product reach, enabling higher sales volumes. Manufacturers in the region are also focusing on sustainable formulations, which are gaining traction among environmentally conscious consumers across Europe.

Asia Pacific

Asia Pacific captured around 22% of the selenium sulphide market in 2024 and is projected to grow at the fastest rate during the forecast period. Growth is fueled by a rising population, increasing disposable incomes, and growing awareness of scalp health. India, China, and Japan are key markets where anti-dandruff shampoos are witnessing surging demand. The availability of low-cost products and rapid expansion of online retail platforms are boosting accessibility. Rising urbanization and lifestyle-related scalp issues are further driving product uptake, making Asia Pacific an attractive market for global and regional personal care manufacturers.

Latin America

Latin America represented about 8% of the selenium sulphide market in 2024, with Brazil and Mexico leading demand. Growing middle-class populations and increasing interest in medicated personal care products are key drivers. Regional pharmaceutical companies and global brands are strengthening their presence through retail partnerships and promotional campaigns. The market is benefiting from improved access to dermatological treatments and consumer education about dandruff management. However, economic fluctuations and price sensitivity in some countries may slightly limit premium product adoption, prompting companies to introduce affordable formulations to capture a larger share of the consumer base.

Middle East & Africa

Middle East & Africa accounted for nearly 5% of the selenium sulphide market in 2024, with demand gradually increasing. Growth is supported by improving access to modern personal care products and rising awareness of scalp-related issues. The UAE and South Africa are key contributors, driven by expanding retail channels and growing adoption of medicated shampoos. Limited awareness in rural areas remains a challenge, but increasing urbanization and promotional campaigns by global brands are improving market penetration. Manufacturers are also introducing cost-effective product lines to appeal to price-sensitive consumers, supporting steady growth in the region.

Market Segmentations:

By Formulation Type:

By Application:

- Shampoos

- Lotions

- Medicated Soap

- Creams

By End Use:

- Personal Care

- Pharmaceuticals

- Cosmetics

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The selenium sulphide market is characterized by the presence of key players such as BASF, Vanderbilt Chemicals, Gujarat Organics, Hubei Lingfeng Chemical, Mitsubishi Gas Chemical, Hunan Jinxiang Chemical, Chemcon Speciality Chemicals, Shaanxi Hanjiang Chemical, Evonik Industries, Tata Chemical, Shenzhen Dooku Technology, Vigui Chemical, Sarex Chemicals, and Hubei Xinjing Chemical. The market is moderately consolidated, with companies focusing on maintaining quality standards and meeting regulatory compliance to strengthen their market position. Strategic initiatives include expanding production capacities, developing improved formulations with reduced irritation potential, and introducing products across both prescription and over-the-counter categories. Players are investing in research to enhance product efficacy and cater to rising consumer demand for scalp treatment solutions. Partnerships with personal care brands and distribution network expansion through e-commerce and retail channels are key approaches to reach a wider consumer base. Competitive pricing and product differentiation remain essential for sustaining market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF

- Vanderbilt Chemicals

- Gujarat Organics

- Hubei Lingfeng Chemical

- Mitsubishi Gas Chemical

- Hunan Jinxiang Chemical

- Chemcon Speciality Chemicals

- Shaanxi Hanjiang Chemical

- Evonik Industries

- Tata Chemical

- Shenzhen Dooku Technology

- Vigui Chemical

- Sarex Chemicals

- Hubei Xinjing Chemical

Recent Developments

- In 2025, Evonik launched its Next Markets Program to explore new growth areas adjacent to its core chemical product lines and respond earlier to shifts in customer demand.

- In 2024, BASF opened a new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany to accelerate process innovation and bring new catalysts and chemicals to market faster.

- In 2023, Chemcon Speciality Chemicals an investor presentation revealed the company focused on expanding its bromides and bromobenzene product lines due to weak demand for its HMDS and CMIC products from Indian pharmaceutical manufacturers.

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with rising awareness of scalp health.

- Demand will increase as more consumers adopt medicated shampoos for dandruff treatment.

- Innovation in mild and dermatologically tested formulations will attract sensitive-skin users.

- E-commerce expansion will boost product accessibility across urban and semi-urban areas.

- Companies will focus on sustainable and eco-friendly formulations to meet green regulations.

- Partnerships between personal care brands and chemical suppliers will strengthen distribution networks.

- OTC product launches will continue to replace prescription-only solutions in several regions.

- Emerging markets in Asia Pacific and Latin America will witness the fastest adoption rates.

- Marketing campaigns will emphasize proven antifungal efficacy to counter alternative ingredients.

- Ongoing R&D will drive development of advanced formulations with better user experience.