Market Overview

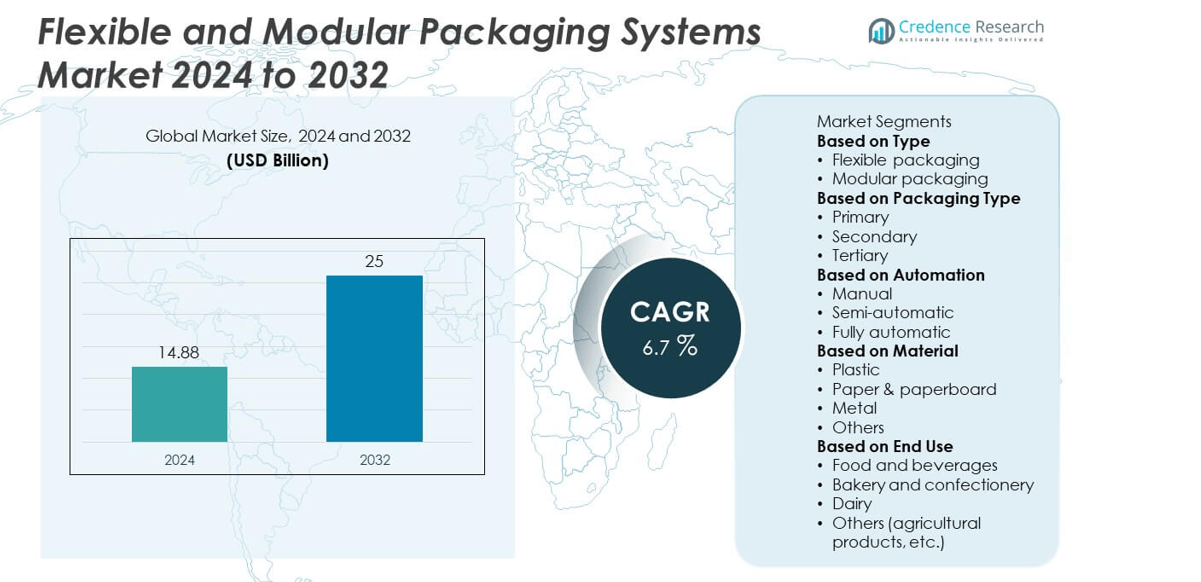

The Flexible and Modular Packaging Systems Market was valued at USD 14.88 billion in 2024 and is projected to reach USD 25 billion by 2032, expanding at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible and Modular Packaging Systems Market Size 2024 |

USD 14.88 billion |

| Flexible and Modular Packaging Systems Market, CAGR |

6.7% |

| Flexible and Modular Packaging Systems Market Size 2032 |

USD 25 billion |

\

The flexible and modular packaging systems market is led by top players including ProMach Inc., Marchesini Group, IMA Group, Ishida Co., Ltd., Fuji Machinery Co., Ltd., Multivac Group, KHS GmbH, Barry-Wehmiller Companies, Haver & Boecker, and Coesia Group. These companies strengthen their positions through innovation in automation, modular design, and sustainable packaging technologies. North America emerged as the leading region in 2024, holding 33% of the global market share, supported by strong adoption in food, beverage, and pharmaceuticals. Europe followed with 30% share, driven by sustainability regulations and customization demand, while Asia Pacific held 25% share, making it the fastest-growing region due to rapid urbanization, rising disposable incomes, and expansion of e-commerce packaging solutions.

Market Insights

- The flexible and modular packaging systems market was valued at USD 14.88 billion in 2024 and is projected to reach USD 25.00 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

- Rising demand for sustainable, lightweight, and efficient packaging in food, beverage, pharmaceutical, and e-commerce sectors is driving adoption, with flexible packaging holding 55% share of the market in 2024.

- Key trends include automation, smart packaging integration, and modular systems supporting customization to meet changing consumer and retailer needs.

- The competitive landscape is led by ProMach Inc., Marchesini Group, IMA Group, Ishida Co., Ltd., Fuji Machinery Co., Ltd., Multivac Group, KHS GmbH, Barry-Wehmiller Companies, Haver & Boecker, and Coesia Group, who focus on innovation and sustainable packaging solutions.

- Regionally, North America led with 33% share, Europe followed with 30%, while Asia Pacific accounted for 25% and remained the fastest-growing region due to urbanization and e-commerce expansion.\

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Flexible packaging dominated the flexible and modular packaging systems market in 2024, holding over 55% of total market share. Its lightweight, cost-efficient, and sustainable properties make it the preferred choice across food, beverage, and pharmaceutical industries. Flexible formats such as pouches, bags, and films provide durability, extended shelf life, and reduced material waste. Growing consumer preference for convenient and eco-friendly packaging further strengthens demand. Modular packaging continues to gain traction, particularly in e-commerce and retail sectors, where customization and scalability are critical to reducing logistics costs and supporting brand differentiation.

- For instance, Multivac Group has introduced various packaging systems for the food industry, including the W 500 flowpacker that offers an output of up to 120 packs per minute.

By Packaging Type

Primary packaging led the market in 2024, accounting for over 50% of overall share, driven by its essential role in ensuring product safety, freshness, and shelf appeal. Widely used in food, beverages, and healthcare, primary packaging offers direct protection while also serving as a branding tool. Rising consumer demand for packaged foods and pharmaceuticals has reinforced its leadership. Secondary packaging, covering cartons and wraps, plays a vital role in distribution, while tertiary packaging supports large-scale handling and transportation, increasingly benefiting from automation-driven efficiencies in logistics.

- For instance, Marchesini Group deployed its modular blister packaging lines capable of processing 500 blisters per minute, enhancing pharmaceutical companies’ capacity to meet high-volume primary packaging requirements.

By Automation

Fully automatic systems dominated the market in 2024 with over 60% market share, supported by the rising adoption of Industry 4.0 technologies and demand for high-speed production lines. These systems enhance efficiency, reduce labor costs, and improve accuracy in large-scale operations across FMCG, pharmaceuticals, and e-commerce. Semi-automatic solutions remain relevant for mid-sized companies seeking cost-effective upgrades without full automation. Manual systems hold a smaller share but continue to serve small enterprises and niche applications. Increasing investment in smart factories and digital monitoring ensures the continued dominance of fully automatic packaging systems.

Key Growth Drivers

Rising Demand for Sustainable and Lightweight Packaging

The shift toward eco-friendly solutions is a major driver of the flexible and modular packaging systems market. Flexible formats use fewer raw materials and reduce transportation costs, lowering the overall carbon footprint. Modular systems allow customization and reuse, aligning with circular economy goals. Growing consumer awareness, coupled with stricter government regulations on plastic waste, accelerates adoption. Companies are investing in recyclable films, bio-based polymers, and modular designs to address sustainability needs. This rising demand for green solutions continues to push market growth across food, beverage, and healthcare sectors.

- For instance, Coesia Group company ACMA offers a modular flow-wrapping system called the FP EDGE that can process sustainable monomaterial and paper-based films for confectionery applications, such as snack bars, at high speeds of up to 150 meters per minute.

Expansion of E-Commerce and Retail Sector

The rapid growth of e-commerce and organized retail significantly drives the flexible and modular packaging systems market. Online platforms demand lightweight, durable, and customizable packaging that ensures product safety during shipping. Flexible materials meet these requirements with reduced logistics costs, while modular packaging supports scalability and brand-specific designs. Rising consumer expectations for convenience and secure delivery further reinforce the need for advanced packaging. As global e-commerce expands, particularly in emerging economies, demand for efficient packaging solutions continues to grow, fueling adoption across multiple industries.

- For instance, ProMach Inc. integrates solutions from its Roberts PolyPro brand, which manufactures a wide range of plastic packaging handles and carriers to enhance shipping durability for multipacked products distributed to retail and e-commerce markets.

Tehnological Advancements in Automation

Advances in automation and digital technologies are accelerating adoption of fully automatic packaging systems. Smart sensors, robotics, and AI-enabled solutions improve packaging efficiency, reduce errors, and enhance productivity. Industry 4.0 integration allows real-time monitoring, predictive maintenance, and data-driven optimization, making automated systems attractive to large manufacturers. Fully automatic solutions dominate due to their ability to handle high production volumes while ensuring consistency. Investments in R&D for modular machinery and digital upgrades continue to expand the role of automation, making it a key growth driver for packaging systems.

Key Trends & Opportunities

Growth of Smart and Connected Packaging

Smart packaging is emerging as a major trend, offering enhanced tracking, monitoring, and consumer engagement. Flexible and modular systems are increasingly integrated with QR codes, RFID tags, and digital printing technologies. These features improve supply chain visibility, ensure product authenticity, and provide interactive experiences for consumers. The rise of smart labeling in pharmaceuticals, food safety, and retail further strengthens this trend. As brands look to differentiate themselves, the adoption of connected packaging offers significant opportunities for growth and innovation in global markets.

- For instance, Ishida Co., Ltd. developed weigh-price-labeling systems capable of printing and applying up to 150 smart labels per minute, integrating barcodes and QR codes for real-time product traceability in food packaging lines.

Increased Adoption of Modular Packaging in Customization

Customization is becoming a key opportunity for modular packaging systems. Retailers and e-commerce platforms demand adaptable designs that allow quick changes in pack sizes, shapes, and branding. Modular packaging supports flexible production lines, reducing downtime and enhancing efficiency. This adaptability is critical in meeting diverse consumer preferences, seasonal demands, and promotional campaigns. With companies emphasizing differentiation and cost optimization, modular packaging adoption is expanding across FMCG, cosmetics, and food industries. The growing importance of customization creates strong opportunities for modular solutions in global markets.

- For instance, KHS GmbH introduced its Innopack Kisters modular shrink packer that can handle up to 120,000 cans per hour, enabling rapid format changes for seasonal and promotional packaging in beverage production.

Key Challenges

High Initial Investment and Operational Costs

The adoption of advanced flexible and modular packaging systems often requires significant capital investment. Fully automated machinery, smart technologies, and digital integration involve high setup and maintenance costs, which limit adoption among small and medium-sized enterprises. Operational expenses such as energy, skilled labor, and maintenance further add to the challenge. While larger corporations can absorb these costs, smaller firms often face barriers to entry. This high financial burden remains a key challenge, slowing down market penetration of advanced packaging technologies in cost-sensitive regions.

Complex Supply Chain and Recycling Barriers

The flexible and modular packaging systems market faces challenges from complex supply chains and recycling limitations. Flexible materials often involve multi-layer films that are difficult to recycle, raising environmental concerns. Modular packaging, while reusable, still requires efficient collection and reuse systems. Supply chain disruptions, raw material shortages, and varying regional recycling infrastructure add further complexity. Companies are under pressure to design packaging that meets both performance and recyclability standards. Overcoming these barriers is essential for long-term sustainability and market acceptance of advanced packaging solutions.

Regional Analysis

North America

North America led the flexible and modular packaging systems market in 2024, holding 33% of global market share. The U.S. dominates regional demand, driven by its advanced food, beverage, and pharmaceutical industries, where packaging efficiency and product safety are critical. Rising consumer preference for sustainable and lightweight packaging further boosts adoption of flexible formats. Modular systems gain traction in e-commerce and retail due to their adaptability and scalability. Canada and Mexico contribute significantly, supported by expanding logistics and manufacturing sectors. Strong investments in automation and compliance with strict packaging regulations reinforce North America’s leadership.

Europe

Europe accounted for 30% of the global market share in 2024, supported by strong demand from its established food, beverage, and personal care industries. Countries such as Germany, France, and the U.K. lead in adopting sustainable and modular packaging solutions, driven by strict EU regulations on waste reduction and recyclability. Flexible packaging is widely used due to its lightweight and eco-friendly profile, while modular packaging supports customization in retail and cosmetics. Innovation in automation and sustainable materials ensures Europe remains a key contributor, with strong growth in premium and clean-label packaging solutions.

Asia Pacific

Asia Pacific held 25% of the flexible and modular packaging systems market share in 2024, making it the fastest-growing region. Rapid urbanization, population growth, and rising disposable incomes fuel demand for packaged foods, beverages, and consumer goods. China, India, and Japan lead regional consumption, with flexible packaging dominating due to cost efficiency and convenience. Modular systems are expanding in e-commerce, which continues to grow rapidly across the region. Increasing investments by global and local manufacturers in automation and eco-friendly materials strengthen Asia Pacific’s role as a hub for packaging innovation and large-scale production.

Latin America

Latin America represented 7% of the global market share in 2024, supported by growth in packaged food, beverage, and pharmaceutical sectors. Brazil and Mexico dominate regional demand, with expanding retail networks and rising consumer preference for convenience products driving packaging innovation. Flexible packaging leads adoption due to affordability and wide application, while modular systems are gradually entering e-commerce and logistics. Economic fluctuations and supply chain challenges affect consistent growth, but opportunities exist in sustainable solutions and mid-scale automation. The region continues to attract investment from multinational companies seeking to expand their presence in emerging markets.

Middle East & Africa

The Middle East & Africa accounted for 5% of the global flexible and modular packaging systems market share in 2024, driven by rising urbanization and growing demand for packaged food and beverages. Gulf countries such as Saudi Arabia and the UAE lead adoption, supported by strong retail infrastructure and increasing imports of packaged products. Flexible packaging dominates due to its lightweight, cost-effective nature, while modular systems are gaining interest in logistics and e-commerce. Although limited local manufacturing capacity presents challenges, the region shows steady growth supported by rising consumer awareness and expanding retail channels.

Market Segmentations:

By Type

- Flexible packaging

- Modular packaging

By Packaging Type

- Primary

- Secondary

- Tertiary

By Automation

- Manual

- Semi-automatic

- Fully automatic

By Material

- Plastic

- Paper & paperboard

- Metal

- Others

By End Use

- Food and beverages

- Bakery and confectionery

- Dairy

- Others (agricultural products, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flexible and modular packaging systems market is shaped by leading companies such as ProMach Inc., Marchesini Group, IMA Group, Ishida Co., Ltd., Fuji Machinery Co., Ltd., Multivac Group, KHS GmbH, Barry-Wehmiller Companies, Haver & Boecker, and Coesia Group. These players maintain strong market positions through advanced machinery portfolios, global distribution networks, and strategic partnerships with food, beverage, pharmaceutical, and personal care industries. Innovation in automation, sustainability, and modular system designs remains central to their strategies, addressing the demand for cost efficiency and flexibility. Companies are also focusing on smart packaging technologies, incorporating IoT and AI features to improve operational performance. Mergers, acquisitions, and regional expansions further enhance competitiveness, particularly in high-growth regions such as Asia Pacific. The ability to deliver sustainable, customizable, and efficient packaging solutions continues to define leadership, as players invest heavily in research and development to meet evolving consumer and industry needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ProMach Inc.

- Marchesini Group

- IMA Group

- Ishida Co., Ltd.

- Fuji Machinery Co., Ltd.

- Multivac Group

- KHS GmbH

- Barry-Wehmiller Companies

- Haver & Boecker

- Coesia Group

Recent Developments

- In September 2025, Marchesini Group confirmed Pack Expo Las Vegas participation with new innovations.

- In September 2025, Ishida Co., Ltd. showcased integrated, modular protein line solutions. The lineup spans multihead weighers, X-ray, and labeling systems. Designs emphasize seamless line integration.

- In May 2025, ProMach Inc. acquired DJS Systems to expand automation for disposable packaging. The deal adds counting, bagging, and thermoforming capabilities. This broadens ProMach’s flexible systems portfolio.

- In April 2025, IMA Group promoted its modular FTB TL cartoners. The top-loading series supports robotic feeding and quick reconfiguration. It targets versatile, flexible packaging lines

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging Type, Automation, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for sustainable and lightweight packaging solutions.

- Flexible packaging will continue to dominate due to its cost efficiency and versatility.

- Modular packaging will gain traction as e-commerce and retail sectors demand customization.

- Fully automatic systems will see higher adoption with Industry 4.0 integration.

- Smart and connected packaging will emerge as a key opportunity for manufacturers.

- Asia Pacific will remain the fastest-growing region, driven by urbanization and retail growth.

- North America and Europe will sustain leadership through advanced automation and sustainability initiatives.

- Investments in recyclable and bio-based materials will shape product innovation.

- High initial investment costs will push companies toward collaborative and scalable solutions.

- Strategic mergers, acquisitions, and R&D will intensify competition and expand market reach.