Market Overview

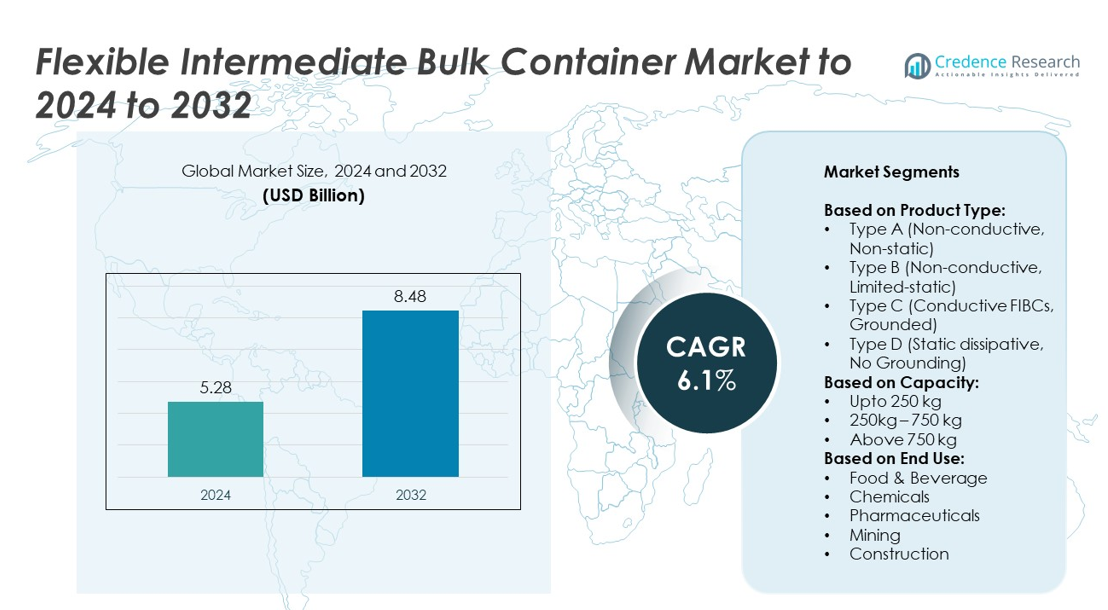

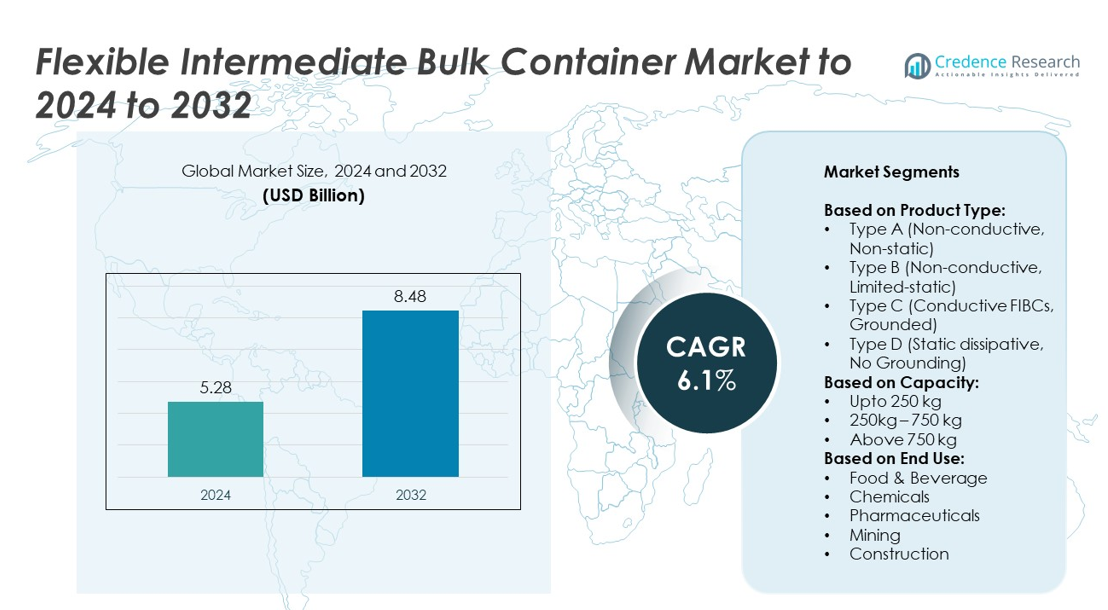

The Flexible Intermediate Bulk Container Market size was valued at USD 5.28 Billion in 2024 and is anticipated to reach USD 8.48 Billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Intermediate Bulk Container Market Size 2024 |

USD 5.28 Billion |

| Flexible Intermediate Bulk Container Market , CAGR |

6.1% |

| Flexible Intermediate Bulk Container Market Size 2032 |

USD 8.48 Billion |

The Flexible Intermediate Bulk Container market is shaped by prominent players including Genpak LLC, Mauser Packaging Solutions, LC Packaging International BV, Golden Paper Cups, Greif Inc., Berry Global Group, Georgia-Pacific Consumer Products LP, Dart Container Corporation, Dispo International, and Detmold Group. These companies focus on expanding product portfolios, developing sustainable and recyclable solutions, and strengthening global distribution networks to address rising demand across industries. Regionally, Asia Pacific dominated the market in 2024 with a 32% share, supported by rapid industrialization, agricultural exports, and strong presence of manufacturing hubs. North America followed with 28% share, driven by food, chemical, and pharmaceutical demand, while Europe accounted for 25%, supported by stringent safety and sustainability regulations.

Market Insights

- The Flexible Intermediate Bulk Container market size was USD 5.28 Billion in 2024 and is projected to reach USD 8.48 Billion by 2032, growing at a CAGR of 6.1%.

- Rising demand from food and beverage, chemical, and pharmaceutical industries is a key driver, as bulk packaging solutions ensure safety, hygiene, and cost efficiency in global supply chains.

- Trends include adoption of sustainable and recyclable FIBCs, innovations such as baffle bags for better space utilization, and integration of RFID for supply chain tracking.

- Competition is intense with leading players focusing on eco-friendly product lines, acquisitions, and global distribution expansion to capture larger shares across high-demand sectors like construction, mining, and agriculture.

- Asia Pacific led with 32% share in 2024, North America followed with 28%, and Europe held 25%, while the 250–750 kg capacity segment and Type C conductive FIBCs dominated product preferences globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The product type segment of the Flexible Intermediate Bulk Container market is dominated by Type C conductive FIBCs, which accounted for over 35% of the share in 2024. Their ability to prevent static charge accumulation through proper grounding makes them the preferred choice in industries handling flammable powders and hazardous chemicals. The rising adoption of stringent workplace safety standards and regulatory compliance across chemical and pharmaceutical sectors is fueling demand. While Type D FIBCs are gaining traction for their no-grounding requirement, Type C remains the leading product category due to its reliability and cost-effectiveness.

- For instance, RAFF Plastics began purchasing approximately 60,000 big bags a year from LC Packaging starting in 2008.

By Capacity

Among capacity-based segments, the 250 kg – 750 kg range held the largest share with nearly 40% in 2024. This range offers a balanced combination of portability and storage efficiency, making it ideal for food, chemicals, and construction applications. Industries favor this size range due to its compatibility with standard handling equipment and reduced logistics cost per unit. Demand is further driven by its ability to support both medium-scale manufacturing and bulk export needs, particularly in the food and chemicals supply chain where mid-sized shipments dominate operations.

- For instance, Jumbo Bag Ltd. has a combined production capacity of more than 4.3 million bags per year across its four units located near Chennai, India.

By End Use

The food and beverage sector emerged as the leading end-use segment, commanding over 32% share in 2024. Growth is primarily driven by rising global trade in grains, sugar, flour, and processed food ingredients that require hygienic, durable, and contamination-free packaging. Food-grade FIBCs with high barrier properties and safe handling standards have become essential for exporters. Increasing regulatory focus on safe transport and the shift toward flexible packaging solutions for bulk foods further support market expansion. This segment is expected to maintain dominance due to consistent demand from global agriculture and food processing industries.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage industry is the largest consumer of Flexible Intermediate Bulk Containers (FIBCs), driving significant growth. These containers ensure safe, hygienic, and contamination-free transport of bulk items like grains, sugar, flour, and processed foods. Food-grade certifications and compliance with international safety standards have further increased adoption. The growing global demand for packaged and processed foods, coupled with expanding exports, continues to accelerate FIBC utilization. This makes the food and beverage sector a primary growth driver in the market.

- For instance, Kanpur Plastipack states capacity over 10 million FIBC bags per year.

Expanding Chemical and Pharmaceutical Applications

FIBCs are increasingly used in chemical and pharmaceutical industries due to their safety, durability, and ability to handle hazardous materials. Conductive Type C and Type D FIBCs have gained prominence for transporting volatile powders without static risks. Regulatory frameworks around chemical handling and rising global trade in specialty chemicals and APIs support demand growth. As manufacturers emphasize safe bulk packaging and international logistics efficiency, these sectors represent a strong driver for market expansion. Their adoption ensures compliance with stringent safety standards and enhances supply chain effectiveness.

- For instance, Emmbi Industries lists 29,840 MTPA cumulative annual capacity and serves pharmaceuticals and chemicals.

Cost-Efficient and Sustainable Packaging Solutions

One of the key growth drivers is the shift toward cost-efficient and sustainable bulk packaging solutions. FIBCs reduce transportation costs by enabling large-volume shipments and offering reusability options. Their lightweight yet durable design supports eco-friendly logistics compared to rigid alternatives like drums or cartons. With growing pressure from environmental regulations and corporate sustainability goals, industries are prioritizing recyclable and reusable packaging. FIBCs meet these requirements while providing operational efficiency, making them a preferred choice across industries. This demand for affordable and green packaging strengthens their market adoption.

Key Trends & Opportunities

Adoption of Advanced Materials and Designs

A major trend in the FIBC market is the adoption of advanced materials and innovative designs. Manufacturers are focusing on multi-layered fabrics, UV protection, and moisture-resistant linings to improve performance in demanding applications. Innovations like baffle bags enhance space utilization and stability during storage and transit. Additionally, the rising integration of RFID tags for tracking is expanding smart packaging opportunities. These developments address industry needs for safety, efficiency, and supply chain visibility, presenting strong growth potential for technologically advanced FIBCs.

- For instance, Starlinger reports 600+ recycling lines installed and over 2 million t/year recoSTAR capacity.

Rising Demand from Construction and Mining Sectors

The construction and mining industries are creating new opportunities for FIBC manufacturers. Bulk transport of sand, cement, gravel, and minerals requires durable packaging with high load capacity. Above 750 kg FIBCs are witnessing increasing use in these applications due to their ability to handle heavy materials efficiently. Rapid infrastructure growth in emerging economies and increased mining activity for raw materials are further boosting demand. This creates strong opportunities for manufacturers to design high-strength, large-capacity FIBCs that meet heavy-duty industry requirements.

- For instance, In the joint venture Packem Umasree Private Limited (PUPL), Umasree Texplast (UTPL) and its promoters contributed ₹54.78 crore in equity to manufacture 100% rPET FIBCs. The ₹18.45 crore figure was an investment update as of December 31, 2023

Key Challenges

Price Volatility of Raw Materials

The FIBC market faces challenges due to fluctuations in raw material costs, particularly polypropylene, the primary input. Prices of petrochemical-derived polymers are highly volatile, influenced by crude oil market trends and global supply-demand imbalances. This instability increases production costs and squeezes profit margins for manufacturers. Small and medium enterprises, which form a large portion of the market, are most affected. Managing raw material procurement and adopting cost-control strategies remain key challenges for sustaining competitiveness in this industry.

Environmental Concerns and Disposal Issues

Despite being reusable and recyclable, improper disposal of FIBCs contributes to plastic waste management challenges. End-use industries often lack recycling infrastructure, leading to discarded containers entering landfills. Stricter environmental regulations around single-use plastics and packaging waste are pressuring manufacturers to develop eco-friendly alternatives. While innovations in biodegradable and fully recyclable FIBCs are emerging, scalability and adoption remain limited. Overcoming sustainability-related concerns and ensuring compliance with global packaging waste directives represent critical challenges for market players going forward.

Regional Analysis

North America

North America accounted for 28% of the Flexible Intermediate Bulk Container market in 2024, driven by strong demand across food, chemicals, and pharmaceuticals. The U.S. leads the region with rising exports of agricultural products and increasing adoption of food-grade FIBCs. The pharmaceutical sector also contributes significantly due to stringent safety and packaging standards. The presence of established manufacturers and advanced logistics infrastructure further supports market growth. Growing focus on sustainable packaging and compliance with environmental regulations are expected to sustain demand, making North America a key revenue contributor throughout the forecast period.

Europe

Europe held 25% of the market share in 2024, supported by robust demand in food, beverages, and specialty chemicals. Countries such as Germany, France, and the UK are driving growth with strong regulatory standards for safe bulk packaging. The pharmaceutical industry’s reliance on contamination-free packaging has accelerated adoption of advanced FIBCs. Additionally, strict EU sustainability directives have pushed manufacturers to develop recyclable and eco-friendly solutions. With rising exports and industrial activity, Europe continues to represent a mature and steady growth market for FIBCs, maintaining its position as one of the largest consumers globally.

Asia Pacific

Asia Pacific dominated the market with 32% share in 2024, emerging as the largest regional segment. High demand comes from agriculture, food processing, chemicals, and construction industries in China, India, and Southeast Asia. The region benefits from strong export-oriented economies and availability of low-cost raw materials and labor, supporting large-scale production. Rapid industrialization and urbanization are further boosting demand for bulk handling solutions. Expanding infrastructure projects and growing mining activities strengthen usage of large-capacity FIBCs. Asia Pacific remains the most dynamic market, offering the highest growth potential during the forecast period due to its expanding end-use industries.

Latin America

Latin America accounted for 8% of the Flexible Intermediate Bulk Container market in 2024, with demand largely concentrated in Brazil, Mexico, and Argentina. The food and beverage industry drives growth through exports of grains, coffee, and sugar. Mining activities across the region also support usage of large-capacity FIBCs for bulk transport. However, limited manufacturing infrastructure and dependency on imports pose challenges. Increasing foreign investments in agriculture and construction are expected to boost demand. The region presents steady growth opportunities as industrialization accelerates, though its overall share remains smaller compared to North America, Europe, and Asia Pacific.

Middle East and Africa

The Middle East and Africa held a 7% share of the market in 2024, with demand rising from construction, chemicals, and mining industries. Countries such as South Africa, Saudi Arabia, and the UAE are key contributors due to infrastructure development and strong export activities. The construction boom and increased raw material handling requirements are driving adoption of heavy-duty FIBCs. However, limited local production capacity results in higher import reliance. Growth in agriculture exports and expansion of industrial projects are expected to support future market potential, making this region an emerging but smaller player in the global landscape.

Market Segmentations:

By Product Type:

- Type A (Non-conductive, Non-static)

- Type B (Non-conductive, Limited-static)

- Type C (Conductive FIBCs, Grounded)

- Type D (Static dissipative, No Grounding)

By Capacity:

- Upto 250 kg

- 250kg – 750 kg

- Above 750 kg

By End Use:

- Food & Beverage

- Chemicals

- Pharmaceuticals

- Mining

- Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Flexible Intermediate Bulk Container market is shaped by key players such as Genpak LLC, Mauser Packaging Solutions, LC Packaging International BV, Golden Paper Cups, Greif Inc., Berry Global Group, Georgia-Pacific Consumer Products LP, Dart Container Corporation, Dispo International, and Detmold Group. The market is highly competitive, with companies focusing on expanding their product portfolios, enhancing material strength, and integrating sustainable solutions to meet evolving industry needs. Manufacturers are investing in advanced designs such as baffle bags and static-dissipative models to address specific requirements from food, chemicals, and construction sectors. Strategic collaborations, acquisitions, and geographic expansions are frequently undertaken to strengthen distribution networks and capture new customer bases. Increasing emphasis on eco-friendly and recyclable materials is also shaping innovation, as regulatory compliance and sustainability goals remain critical. The competition is expected to intensify further as demand from end-use industries continues to grow across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genpak LLC

- Mauser Packaging Solutions

- LC Packaging International BV

- Golden Paper Cups

- Greif Inc.

- Berry Global Group

- Georgia-Pacific Consumer Products LP

- Dart Container Corporation

- Dispo International

- Detmold Group

Recent Developments

- In 2024, Mauser Packaging Solutions Acquired Consolidated Container Company. This broadened Mauser’s industrial packaging platform and extended its vertical integration into rigid container product lines.

- In 2024, Greif Inc. Partnered with CDF Corporation to introduce the redesigned GCUBE IBC Flex, a sterile solution for transporting highly sensitive liquids used in the food, beverage, and pharmaceutical industries.

- In 2023, LC Packaging announced a strategic partnership with Buenassa and Shankar Packagings Ltd. to distribute and produce FIBCs in the Democratic Republic of Congo (DRC).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, driven by rising global trade and bulk packaging needs.

- Food and beverage applications will continue to dominate due to hygiene and safety requirements.

- Chemical and pharmaceutical industries will increase demand for conductive and static-dissipative FIBCs.

- Sustainable and recyclable FIBCs will gain higher adoption with stricter environmental regulations.

- Asia Pacific will remain the fastest-growing region supported by industrial expansion and exports.

- Advanced designs such as baffle bags will see higher demand for efficient storage and transport.

- Construction and mining sectors will boost sales of heavy-duty, large-capacity FIBCs.

- Integration of smart features like RFID tracking will enhance supply chain visibility.

- Raw material price fluctuations will push manufacturers toward alternative polymers and cost efficiency.

- Strategic partnerships and capacity expansions will shape competitive positioning in the coming years.