Market Overview

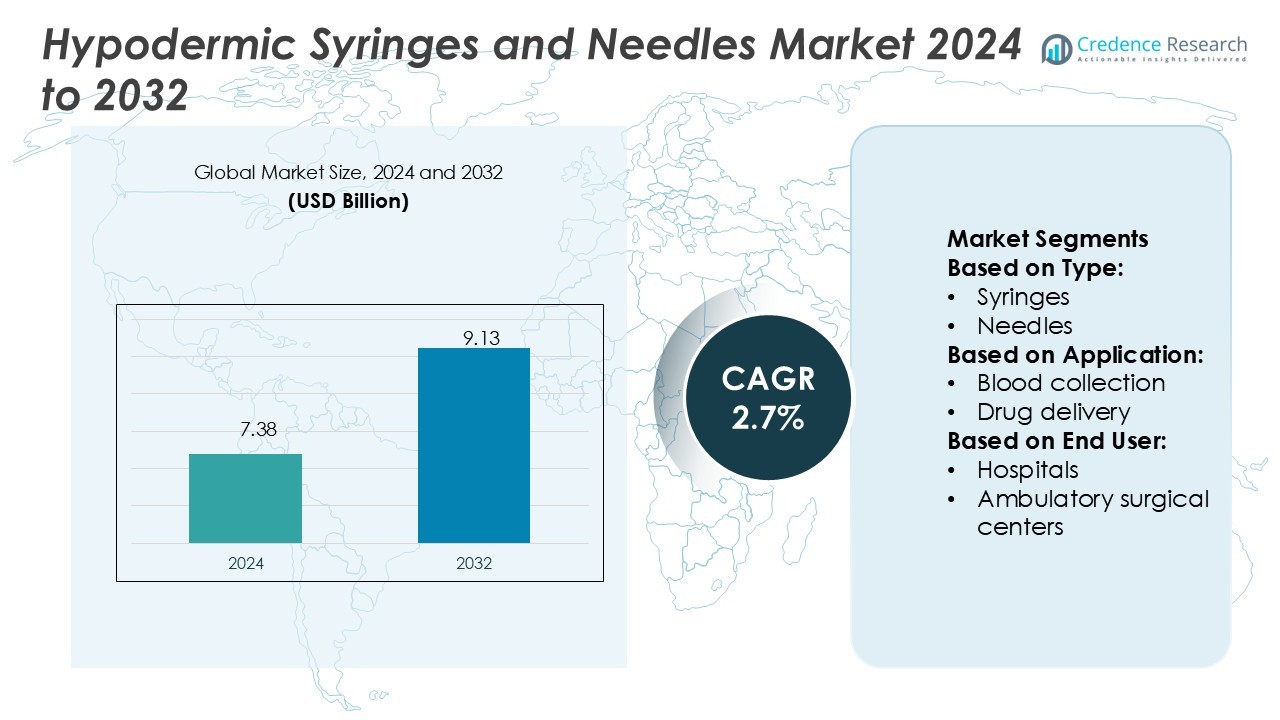

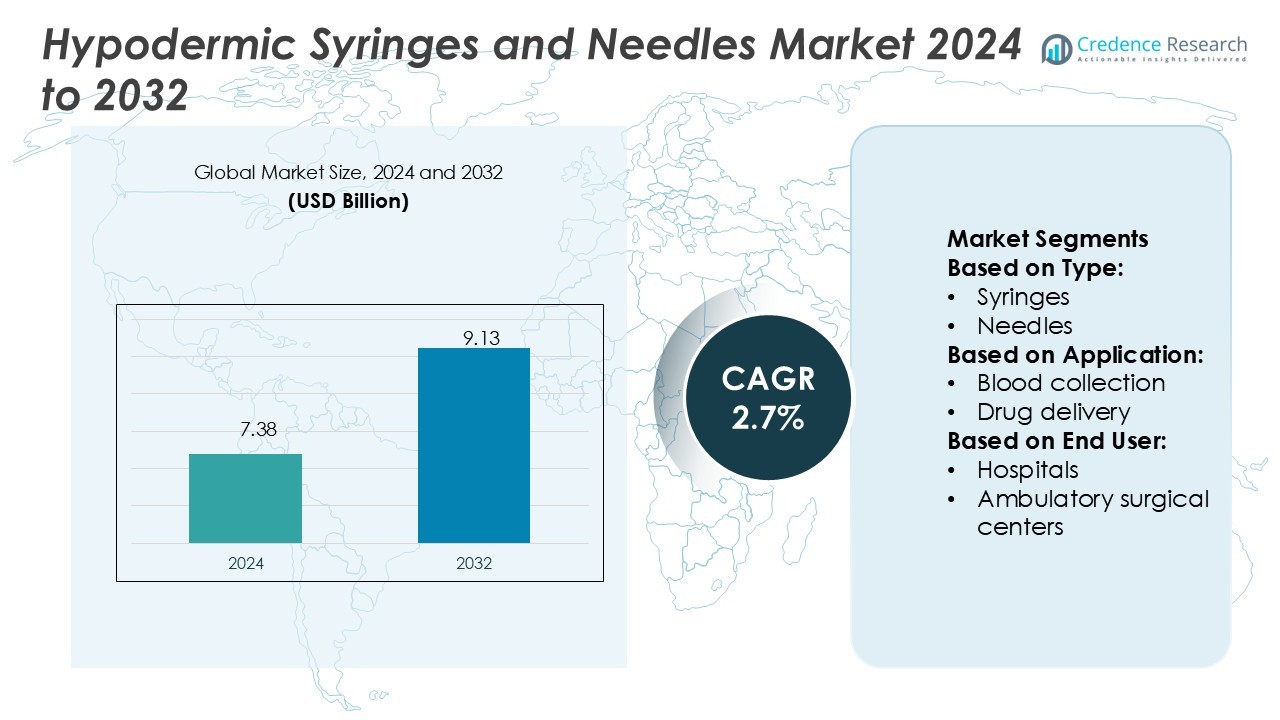

Hypodermic Syringes and Needles Market size was valued USD 7.38 billion in 2024 and is anticipated to reach USD 9.13 billion by 2032, at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hypodermic Syringes and Needles Market Size 2024 |

USD 7.38 Billion |

| Hypodermic Syringes and Needles Market, CAGR |

2.7% |

| Hypodermic Syringes and Needles Market Size 2032 |

USD 9.13 Billion |

The hypodermic syringes and needles market is shaped by prominent players such as BD (Becton, Dickinson and Company), B. Braun, Abbott, Cardinal Health, Catalent, ICU Medical, EXEL, HI-TECH MEDICS, DeRoyal, and Connecticut Hypodermics. These companies strengthen their positions through innovation, safety-focused product development, and expansion of global distribution networks. BD and B. Braun lead with advanced safety-engineered devices, while Cardinal Health and Abbott focus on large-scale supply chains. Catalent drives growth in prefilled syringe manufacturing, supporting biologics and vaccine delivery. Regionally, North America dominates the market with 35% share, driven by strong healthcare infrastructure, high chronic disease prevalence, and widespread adoption of safety-compliant injection solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hypodermic syringes and needles market size was valued at USD 7.38 billion in 2024 and is projected to reach USD 9.13 billion by 2032, growing at a CAGR of 2.7%.

- Rising chronic disease prevalence, increasing vaccination programs, and the shift toward safety-engineered devices remain key drivers supporting steady demand across hospitals and outpatient care.

- Prefilled syringes, disposable formats, and home healthcare adoption represent strong trends, with prefilled syringes gaining share due to biologics and vaccine delivery.

- The competitive landscape is defined by players such as BD, B. Braun, Abbott, Cardinal Health, and Catalent, with innovation, regulatory compliance, and global distribution networks shaping market positioning.

- North America leads with 35% share, supported by advanced healthcare infrastructure and high adoption of safety devices, while syringes hold over 55% of the type segment share, maintaining dominance due to their broad use in drug delivery and immunization.

Market Segmentation Analysis:

By Type

The syringes segment dominates the hypodermic syringes and needles market with over 55% share. Their leadership is driven by widespread use in drug delivery, vaccinations, and diagnostic procedures. The integration of prefilled syringes and safety-engineered designs enhances convenience and minimizes infection risks. Needles continue to hold a strong presence, but rising concerns over accidental needle-stick injuries and demand for minimally invasive devices are encouraging adoption of advanced syringe formats. Increasing global immunization programs and chronic disease prevalence sustain syringes as the leading product category.

- For instance, Catalent’s Brussels facility operates high-speed aseptic filling lines for prefilled syringes, with reported annual capacities of over 200 million units for large-scale drug delivery programs.

By Application

Drug delivery represents the dominant application, accounting for more than 40% market share. This is fueled by the rising use of injectables in chronic disease treatments such as diabetes, cancer, and cardiovascular conditions. The growing preference for biologics and biosimilars further supports higher demand for hypodermic devices. Insulin administration also drives steady growth, particularly in regions with rising diabetes prevalence. Blood collection and vaccination applications remain vital, supported by routine diagnostic practices and government-led immunization campaigns, but drug delivery continues to lead due to its wider, recurrent use across therapeutic areas.

- For instance, ICU Medical’s Plum 360 infusion system supports comprehensive drug libraries with up to 2,500 medications and delivers medication with an accuracy of ±5% for most flow rates. The system, recognized for its safety features, supports millions of safe infusions annually in hospital drug delivery applications.

By End User

Hospitals are the leading end user, holding over 50% of the market share. Their dominance is supported by high patient inflow, extensive use of syringes and needles in surgeries, diagnostics, and therapeutic care. Ambulatory surgical centers also contribute significantly, driven by rising demand for minimally invasive procedures. Diagnostic centers play a growing role due to increasing emphasis on preventive healthcare and routine blood testing. Other end-use settings, including clinics and home care, are expanding steadily as self-administration of medications grows. However, hospitals remain the primary growth driver due to large-scale procurement and standardized medical practices.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic conditions such as diabetes, cancer, and cardiovascular disorders fuels the demand for hypodermic syringes and needles. Frequent medication administration, blood sampling, and long-term injectable therapies drive consistent usage in healthcare facilities. The growing burden of lifestyle-related illnesses worldwide ensures sustained adoption, with insulin administration alone accounting for a significant portion of demand. Expanding access to healthcare in emerging economies further amplifies consumption, positioning chronic disease management as a primary driver for market growth.

- For instance, Cardinal Health’s Insulin Safety Syringes offer graduations at 0.01 mL increments and employ a permanently attached needle to minimize dead space, enabling precise dosing with low residual volume after injection.

Expansion of Immunization Programs

Government-led immunization campaigns and global vaccination drives significantly contribute to market growth. Programs targeting infectious diseases such as influenza, hepatitis, and measles require large-scale syringe and needle usage. The COVID-19 pandemic further highlighted the critical role of reliable injection devices in mass vaccination efforts. Continued focus on preventive healthcare, coupled with international partnerships promoting immunization in developing regions, sustains high demand. The adoption of auto-disable syringes in vaccination programs also drives market expansion by ensuring safety and preventing reuse.

- For instance, DeRoyal’s 12 mL angiographic control syringe uses a three-ring plunger geometry, includes a 0.5 mL reservoir on the plunger tip, and maintains a smooth operation across its stroke length to ensure consistent pressure delivery in interventional procedures.

Advancements in Safety-Engineered Devices

The adoption of safety-engineered syringes and needles is accelerating due to stringent regulations and healthcare worker safety concerns. These devices help reduce the risk of needle-stick injuries and cross-contamination, which remain significant challenges in medical environments. Technological innovations, such as retractable needles and prefilled syringes, improve both safety and efficiency in clinical settings. Hospitals and diagnostic centers increasingly prefer such devices to meet compliance standards and enhance patient care. This shift toward safety-focused products positions innovation as a core driver for market penetration.

Key Trends & Opportunities

Rising Demand for Prefilled Syringes

Prefilled syringes are gaining popularity due to their convenience, accuracy, and reduced contamination risks. Pharmaceutical companies are increasingly packaging biologics and vaccines in prefilled formats, which streamline administration and minimize dosing errors. This trend supports both hospital and home care use, particularly in chronic disease management. As self-administration of drugs grows, demand for prefilled syringes offers significant opportunities for manufacturers to strengthen their product portfolios and capture long-term growth in the evolving healthcare landscape.

- For instance, BD’s Sterifill Advance™ polymer prefillable syringe has been validated for manual injections in 5, 10, and 20 mL formats and for pump-based infusions at 20 and 50 mL volumes, ensuring smooth compatibility with electric syringe pumps.

Growing Shift Toward Home Healthcare

The rise in home healthcare and self-administration of injectable drugs is reshaping market demand. Patients managing conditions such as diabetes and autoimmune disorders increasingly prefer administering medications at home, supported by user-friendly and disposable syringe and needle designs. This shift reduces hospital dependency and improves patient convenience. Manufacturers developing compact, safe, and easy-to-use injection devices can leverage this opportunity to tap into the expanding home care segment, which is expected to grow rapidly in both developed and emerging markets.

- For instance, Connecticut Hypodermics offers a wide range of stainless steel tubing, including large-gauge sizes such as 6RW and 6TW. The company manufactures these and other sizes for precision hypodermic needles and related medical components, which are deployed across a variety of medical applications.

Key Challenges

Risk of Needle-Stick Injuries

Despite technological advances, needle-stick injuries remain a persistent challenge in the medical sector. Such incidents expose healthcare workers to bloodborne pathogens, increasing occupational health risks and raising liability concerns for healthcare providers. The issue also drives higher compliance costs as institutions invest in safety-engineered products. Limited awareness and inconsistent adoption in low-resource settings further compound the challenge. Addressing this requires broader regulatory enforcement, training, and availability of affordable safety devices.

Environmental and Disposal Concerns

Improper disposal of syringes and needles creates significant environmental and public health risks. Medical waste management systems in many regions remain underdeveloped, leading to unsafe recycling and accidental reuse. Regulatory frameworks mandate safe disposal, but compliance varies widely across geographies. Growing scrutiny over plastic waste and sustainability pressures are also pushing manufacturers to explore eco-friendly alternatives. Balancing safety, affordability, and environmental responsibility presents a key challenge that could slow market adoption without innovative waste management solutions.

Regional Analysis

North America

North America holds a leading position in the hypodermic syringes and needles market with over 35% share. The region’s dominance is supported by a high prevalence of chronic diseases, advanced healthcare infrastructure, and strong regulatory compliance. Widespread adoption of safety-engineered syringes, coupled with large-scale vaccination programs, strengthens growth. The United States drives the majority of demand, with increasing use in diabetes management and biologics delivery. Favorable reimbursement policies and strict occupational safety regulations further enhance market penetration. Canada contributes significantly through public health initiatives, ensuring steady demand across both hospital and outpatient care settings.

Europe

Europe accounts for nearly 30% of the global hypodermic syringes and needles market share. The region benefits from robust healthcare systems, strong regulatory frameworks, and rising demand for safety-engineered devices. Germany, France, and the United Kingdom lead consumption, driven by growing chronic disease prevalence and high immunization rates. Strict compliance with EU directives regarding medical device safety fosters rapid adoption of retractable and auto-disable syringes. Additionally, investments in biologics and biosimilar drugs fuel demand for prefilled syringes. Expansion of outpatient care services and rising focus on preventive healthcare further support market growth across European countries.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding over 25% share of the hypodermic syringes and needles market. Rapid population growth, rising chronic disease cases, and government-led immunization programs drive expansion. Countries such as China, India, and Japan lead adoption due to increasing healthcare investments and expanding pharmaceutical industries. The prevalence of diabetes and infectious diseases further boosts syringe demand. Low manufacturing costs and large-scale production capabilities make the region a key supplier to global markets. Growing demand for disposable and safety syringes, coupled with expanding home healthcare adoption, positions Asia-Pacific as a crucial growth hub.

Latin America

Latin America contributes nearly 6% of the global market share, supported by expanding healthcare access and rising vaccination campaigns. Brazil and Mexico lead regional adoption, driven by government immunization programs and increasing awareness of infection control practices. Growing investments in public healthcare infrastructure and rising chronic disease prevalence, particularly diabetes, strengthen demand. However, challenges in regulatory compliance and uneven adoption of safety syringes limit faster penetration. The shift toward disposable syringes and rising partnerships with global medical device manufacturers present opportunities for expansion, especially as healthcare spending continues to increase in key countries.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for close to 4% of the market share, with gradual growth driven by rising healthcare investments and public health initiatives. Gulf countries, including Saudi Arabia and the UAE, dominate regional demand due to advanced healthcare facilities and higher adoption of modern injection devices. In Africa, vaccination programs supported by global health organizations sustain syringe consumption, though limited infrastructure and affordability issues remain key barriers. Increasing incidence of infectious diseases and government focus on expanding healthcare access create growth opportunities for affordable, safety-engineered syringe and needle solutions.

Market Segmentations:

By Type:

By Application:

- Blood collection

- Drug delivery

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hypodermic syringes and needles market is shaped by leading players including Catalent, ICU Medical, EXEL, HI-TECH MEDICS, Cardinal Health, Abbott, DeRoyal, BD (Becton, Dickinson and Company), Connecticut Hypodermics, and B. Braun. The hypodermic syringes and needles market is highly competitive, driven by innovation, regulatory standards, and expanding healthcare demand. Manufacturers focus on developing safety-engineered devices to minimize needle-stick injuries and enhance patient care. The growing preference for disposable and prefilled syringes is reshaping market strategies, with strong emphasis on automation, precision, and compliance with international safety guidelines. Companies are also investing in sustainable manufacturing practices and eco-friendly designs to address environmental concerns related to medical waste. Strategic partnerships, capacity expansions, and regional distribution agreements further define the competitive environment, ensuring wider market reach and stronger positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Terumo launched the Injection Filter Needle, featuring an integrated 5-micron filter to prevent particulate transfer in hypodermic and intravitreal injections.

- In May 2024, Gerresheimer, one of the healthcare and pharmaceutical packaging companies based in Germany, expanded its Queretaro capacity of ready-to-fill (RTF) syringes in Mexico.

- In March 2024, SCHOTT Pharma built its first U.S. facility to manufacture pre-fillable polymer syringes required to meet the need for deep-cold storage and transportation of mRNA medications.

- In March 2024, Hindustan Syringes and Medical Devices (HMD), one of the leading providers of auto-disable and disposable syringes, launched Dispojekt, an indigenous single-use safety syringe to minimize instances of needle stick injuries.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing due to the rising prevalence of chronic diseases.

- Demand for safety-engineered syringes will increase with stricter healthcare safety regulations.

- Prefilled syringes will gain traction as biologics and biosimilars become more common.

- Home healthcare adoption will expand, driving demand for user-friendly injection devices.

- Vaccination programs will remain a major growth driver across developing and developed regions.

- Manufacturers will focus on sustainable syringe designs to address disposal challenges.

- Emerging markets will witness strong growth supported by healthcare infrastructure development.

- Technological innovation will improve efficiency and reduce risks of needle-stick injuries.

- Strategic collaborations and partnerships will expand global distribution networks.

- Competitive pressure will drive continuous product upgrades and cost-effective solutions.