Market Overview

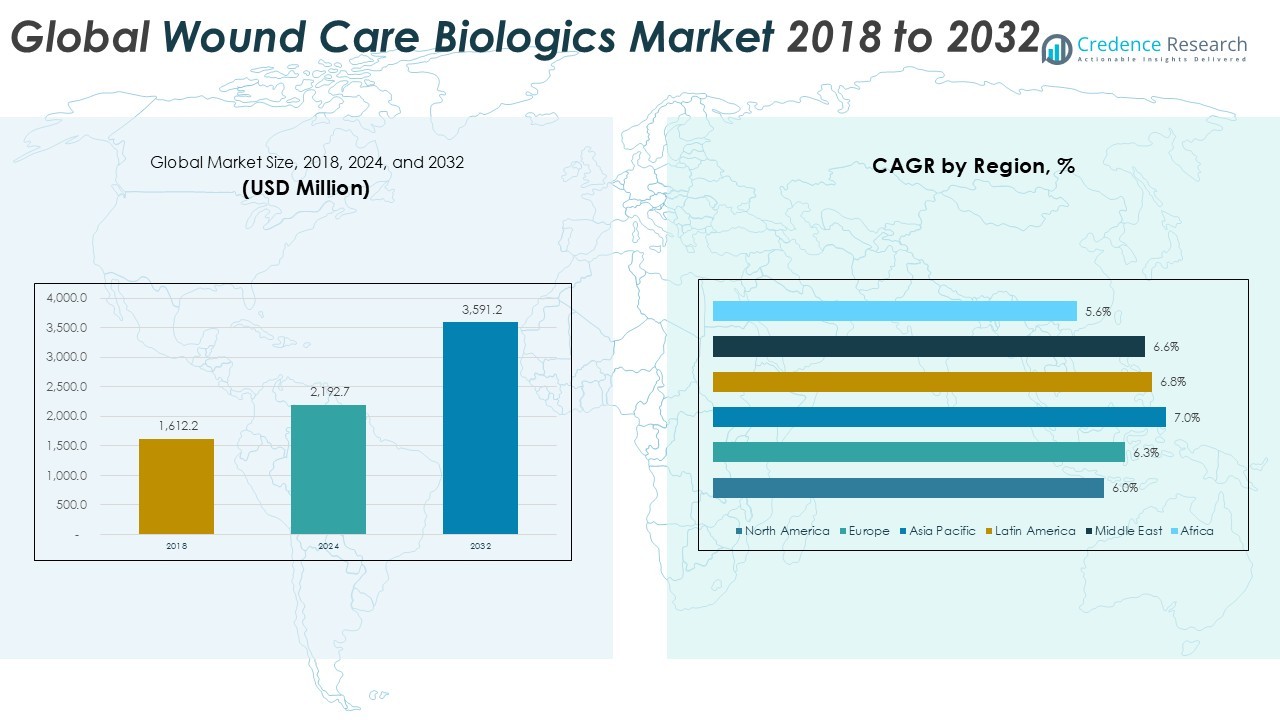

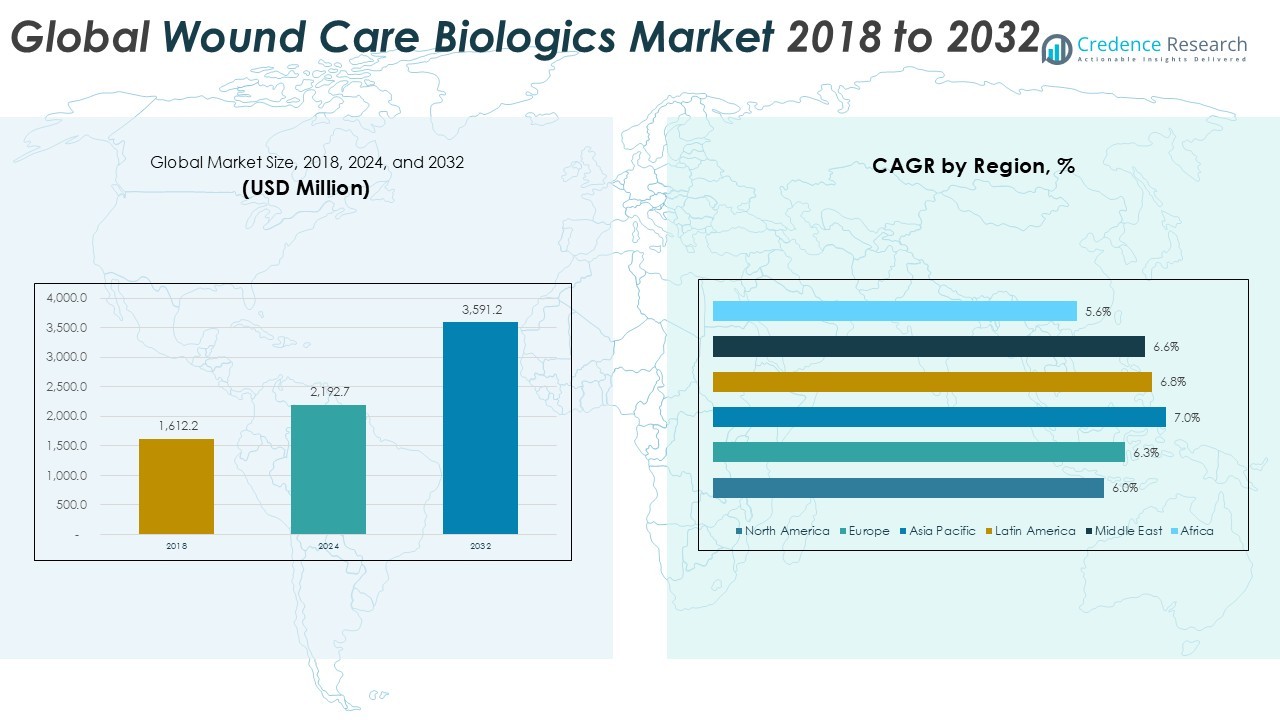

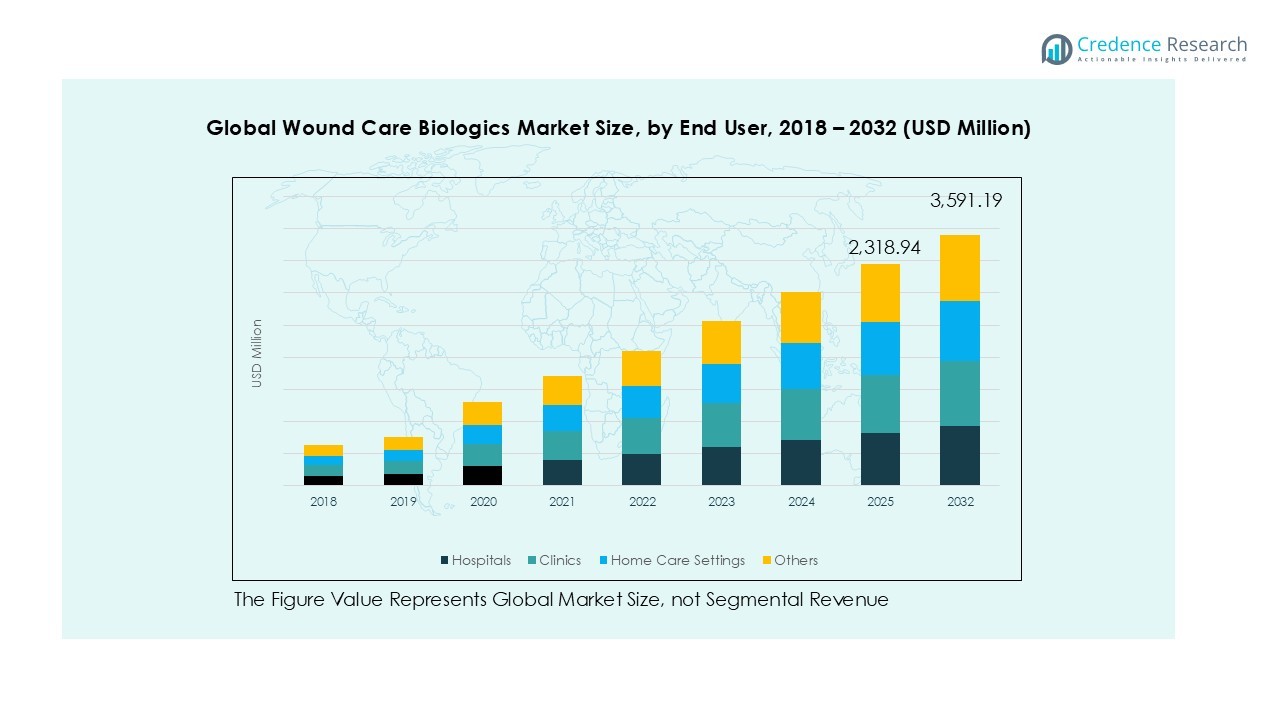

Global Wound Care Biologics market size was valued at USD 1,612.2 million in 2018 and grew to USD 2,192.7 million in 2024. It is anticipated to reach USD 3,591.2 million by 2032, at a CAGR of 6.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wound Care Biologics Market Size 2024 |

USD 2,192.7 Million |

| Wound Care Biologics Market, CAGR |

6.45% |

| Wound Care Biologics Market Size 2032 |

USD 3,591.2 Million |

The Global Wound Care Biologics market is led by established companies such as Smith & Nephew, Mölnlycke Health Care, Coloplast A/S, Integra LifeSciences, Solventum, and Organogenesis, alongside emerging players including Kerecis, Acera Surgical, and PolyMedics Innovations. These firms compete through broad product portfolios, continuous R&D investment, and global distribution networks. Regionally, North America held the largest share in 2024 at 33.1%, supported by strong reimbursement frameworks and advanced healthcare infrastructure. Europe followed with 22.0%, driven by aging populations and diabetes prevalence, while Asia Pacific captured 27.0% as the fastest-growing region. This combination of established leadership and regional expansion highlights a competitive yet opportunity-rich landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Wound Care Biologics market was valued at USD 2,192.7 million in 2024 and is projected to reach USD 3,591.2 million by 2032, growing at a CAGR of 6.45%.

- Rising prevalence of chronic wounds such as diabetic foot ulcers and venous leg ulcers drives strong demand for biologics, particularly skin substitutes which held the largest product share in 2024.

- Market trends highlight rapid adoption of regenerative medicine, cell-based therapies, and home-based wound care solutions, offering new opportunities for patient-centric biologic treatments.

- The competitive landscape features key players including Smith & Nephew, Mölnlycke Health Care, Coloplast A/S, Integra LifeSciences, Solventum, and Organogenesis, alongside emerging innovators like Kerecis and Acera Surgical expanding niche solutions.

- Regionally, North America led with 33.1% share in 2024, followed by Europe at 22.0% and Asia Pacific at 27.0%, while Latin America, Middle East, and Africa together accounted for 17.9%, reflecting balanced global growth opportunities.

Market Segmentation Analysis:

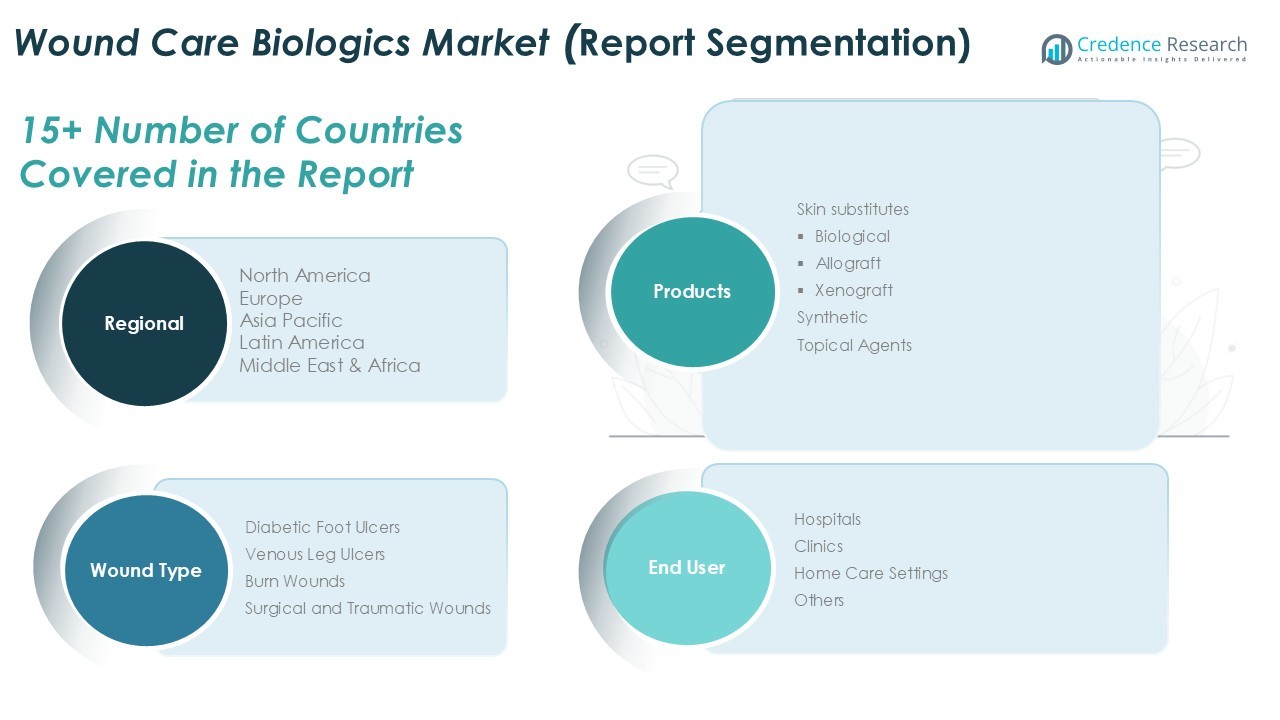

By Product

Skin substitutes represent the dominant segment, holding the largest market share in 2024, supported by strong adoption in chronic and complex wound management. Within this category, biological substitutes, including allografts and xenografts, lead usage due to their effectiveness in promoting tissue regeneration and reducing healing times. Rising incidence of diabetic ulcers and venous leg ulcers strengthens demand. Synthetic substitutes and topical agents also contribute, but their role is secondary compared to biologics, which continue to be driven by improved clinical outcomes and supportive reimbursement structures in key healthcare markets.

- For instance, Organogenesis’s Apligraf and Dermagraft are widely used skin substitutes in U.S. wound care centers. The company reported $433.1 million in total revenue in 2023, reflecting the products’ strong brand recognition and market position.

By Wound Type

Diabetic foot ulcers accounted for the highest share of the wound care biologics market in 2024. The dominance is linked to the increasing global prevalence of diabetes, which directly raises chronic wound incidence. Advanced biologics such as skin substitutes and grafts are widely adopted for these wounds due to their ability to accelerate closure rates and reduce risk of amputation. Venous leg ulcers and burn wounds follow as important sub-segments, while surgical and traumatic wounds also represent significant demand, supported by rising surgical volumes and accident-related injuries worldwide.

- For instance, Smith+Nephew’s PICO and Grafix biologic dressings were used in more than 90,000 diabetic foot ulcer treatments globally in 2023, demonstrating high clinical adoption in chronic wound management.

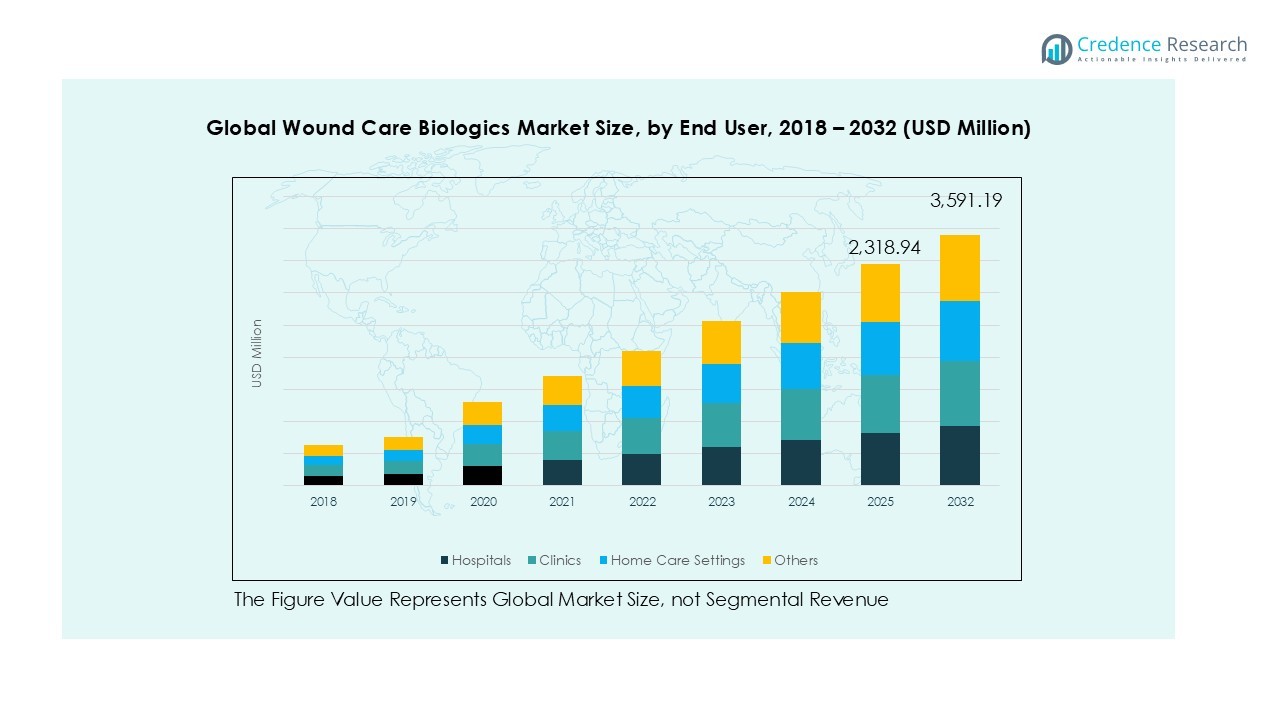

By End User

Hospitals emerged as the largest end-user segment in 2024, capturing the majority of revenue share. This leadership is driven by the concentration of advanced wound care procedures and availability of biologics for critical wound types in inpatient settings. Clinics show growing adoption as outpatient treatments expand, while home care settings gain traction with the rise of telemedicine and self-application kits. The “Others” category, including long-term care facilities, contributes steadily, but hospitals remain the primary revenue contributor due to higher patient inflows, access to reimbursement, and advanced wound care infrastructure.

Key Growth Drivers

Rising Prevalence of Chronic Wounds

The growing incidence of chronic wounds, particularly diabetic foot ulcers and venous leg ulcers, is a major driver for the wound care biologics market. Increasing diabetes prevalence, coupled with lifestyle disorders such as obesity, has created a surge in demand for advanced biologics that promote faster healing and reduce the risk of complications. Skin substitutes, including allografts and xenografts, are increasingly used to manage chronic wounds where conventional dressings fail. Aging populations in developed regions also add to the burden of non-healing wounds, creating a sustained market need. Healthcare providers are prioritizing biologics that demonstrate proven clinical efficacy, pushing this segment toward long-term growth.

- For instance, MiMedx distributed over 3 million allografts for patients in 2023, with chronic wounds like diabetic foot ulcers accounting for a portion of the use cases.

Advancements in Biologic Technologies

Ongoing innovations in biologics, including next-generation skin substitutes, growth factors, and stem-cell-based solutions, are driving market expansion. These technologies enhance healing by mimicking natural biological processes, stimulating cell growth, and supporting tissue regeneration. Biologics are now designed with improved biocompatibility and reduced immunogenicity, ensuring safer outcomes. Companies are investing in research collaborations and product launches that provide clinicians with a broader portfolio of targeted therapies. For example, advanced xenograft and synthetic alternatives are entering the market as cost-effective yet clinically effective solutions. The emphasis on precision wound care, supported by advanced clinical trials, positions biologic technologies as critical solutions to address complex wound management needs.

- For instance, Integra LifeSciences faced significant operational challenges and supply constraints in its Tissue Technologies division in 2023, primarily due to a voluntary product recall related to its Boston manufacturing facility.

Supportive Reimbursement Policies and Healthcare Spending

Expanding healthcare budgets and reimbursement coverage for advanced wound care products are boosting biologic adoption. Many developed economies have recognized the long-term cost benefits of using biologics to treat chronic wounds by reducing hospital stays, preventing amputations, and minimizing repeat procedures. Favorable reimbursement programs in the U.S. and Europe have accelerated patient access to high-cost biologics, particularly skin substitutes. In emerging markets, growing investments in healthcare infrastructure and increased awareness among clinicians are expanding product penetration. As hospitals and clinics adopt standardized wound care protocols, biologics are becoming integral in improving patient outcomes while aligning with value-based healthcare models.

Key Trends & Opportunities

Integration of Regenerative Medicine in Wound Care

Regenerative medicine is reshaping the wound care biologics market by integrating cell-based therapies and tissue engineering. Stem-cell-derived biologics and bioengineered scaffolds offer promising results in restoring damaged tissue, particularly for complex wounds such as burns and diabetic ulcers. These innovations are opening new opportunities for companies to expand beyond conventional skin substitutes into high-value, cutting-edge therapies. Collaborations between biotech firms and academic research institutions are fast-tracking commercialization of regenerative solutions. As regulatory agencies increasingly approve advanced products, the adoption of regenerative medicine in wound care is expected to significantly accelerate, offering a strong growth pathway for the industry.

- For instance, Vericel Corporation reported more than 11,000 applications of its autologous cell therapy products, including Epicel for burn care, in 2023, highlighting the growing role of regenerative medicine in advanced wound management.

Expansion of Home-Based and Outpatient Wound Care

The shift toward outpatient care and home-based treatment presents a significant growth opportunity for biologics manufacturers. Rising healthcare costs and the adoption of telemedicine are fueling demand for biologic products that are easier to apply outside hospital settings. Portable wound care kits, combined with remote monitoring technologies, are enabling patients to receive advanced treatment at home. Clinics and ambulatory centers are also expanding their adoption of biologics as part of cost-effective care delivery models. This trend is particularly strong in regions with aging populations and high chronic wound prevalence, creating a growing market for simplified, patient-friendly biologic solutions.

Key Challenges

High Cost of Biologic Therapies

One of the most significant barriers to widespread adoption of wound care biologics is their high cost. Advanced biologics, particularly skin substitutes and stem-cell-based products, are often priced at levels that restrict access in low- and middle-income countries. Even in developed markets, budget constraints among smaller hospitals and clinics limit usage. While reimbursement programs help mitigate this issue, not all patients qualify for coverage, leading to gaps in accessibility. The cost challenge also slows adoption in home care settings, where patients bear a larger portion of expenses. This remains a major restraint to global market penetration.

Regulatory and Clinical Validation Barriers

The wound care biologics market faces hurdles related to strict regulatory frameworks and clinical validation requirements. Biologic therapies undergo rigorous testing to ensure safety, efficacy, and biocompatibility, which often prolongs approval timelines. High costs associated with clinical trials also pose challenges for smaller companies. Additionally, regulatory variations across regions create difficulties in global product launches, slowing market expansion. Healthcare providers remain cautious about adopting newer biologics without strong clinical evidence, delaying their acceptance. Overcoming these barriers requires robust investment in research and strategic partnerships to ensure compliance and faster product approvals.

Regional Analysis

North America

North America dominated the global wound care biologics market in 2024, accounting for 33.1% share with revenue of USD 725.34 million. The region grew from USD 546.38 million in 2018 and is expected to reach USD 1,149.18 million by 2032, registering a CAGR of 6.0%. High prevalence of diabetes, advanced healthcare infrastructure, and strong reimbursement frameworks support its leadership. The U.S. remains the primary growth contributor, with hospitals adopting biologics for chronic and surgical wound management. Rising demand for regenerative wound therapies further strengthens North America’s dominant market position.

Europe

Europe held the second-largest share in 2024, contributing 22.0% of the global market, with revenue of USD 481.70 million. The market expanded from USD 356.46 million in 2018 and is projected to reach USD 782.16 million by 2032, growing at a CAGR of 6.3%. The region benefits from aging populations, increased diabetic cases, and expanded access to advanced biologics across public healthcare systems. Countries such as Germany, the UK, and France drive adoption, supported by clinical research and government spending. Emphasis on reducing amputation rates positions Europe as a strong growth hub in wound care biologics.

Asia Pacific

Asia Pacific emerged as the fastest-growing regional market, capturing 27.0% share in 2024 with USD 590.27 million in revenue. The market increased from USD 420.95 million in 2018 and is expected to reach USD 1,005.53 million by 2032, advancing at a CAGR of 7.0%. Rapid urbanization, rising diabetes prevalence, and improvements in healthcare access are key growth drivers. China, India, and Japan lead regional demand, with increasing investments in biologics manufacturing and distribution. Expanding patient awareness and adoption of advanced wound care solutions make Asia Pacific a critical growth engine for the industry.

Latin America

Latin America accounted for 9.1% of global revenue in 2024, valued at USD 240.60 million. The market grew from USD 173.80 million in 2018 and is forecasted to reach USD 403.29 million by 2032, with a CAGR of 6.8%. Brazil and Mexico dominate regional adoption, driven by expanding healthcare infrastructure and government initiatives targeting diabetes-related wound complications. Increasing availability of biologic wound care products through hospital systems and clinics supports market expansion. Rising surgical procedures and greater demand for cost-effective biologics strengthen the region’s role in global market growth.

Middle East

The Middle East represented 4.9% of the global market in 2024, reaching USD 105.94 million from USD 77.06 million in 2018. It is expected to achieve USD 175.97 million by 2032, growing at a CAGR of 6.6%. Demand is largely driven by high rates of diabetes and obesity in Gulf countries, creating increased need for chronic wound management. Saudi Arabia and the UAE lead adoption with modern healthcare facilities introducing advanced biologics. Investments in specialized wound care centers further expand accessibility, ensuring steady growth across the region over the forecast period.

Africa

Africa contributed the smallest share in 2024, holding 2.2% of the global market, with revenue of USD 48.83 million. The region grew from USD 37.56 million in 2018 and is projected to reach USD 75.06 million by 2032, expanding at a CAGR of 5.6%. Limited access to advanced biologics and lower healthcare spending remains challenges, but gradual improvements in hospital infrastructure and donor-funded programs are expanding adoption. South Africa leads regional demand, with rising diabetic populations creating the need for biologic wound treatments. Despite slower growth, Africa represents an emerging opportunity for long-term market expansion.

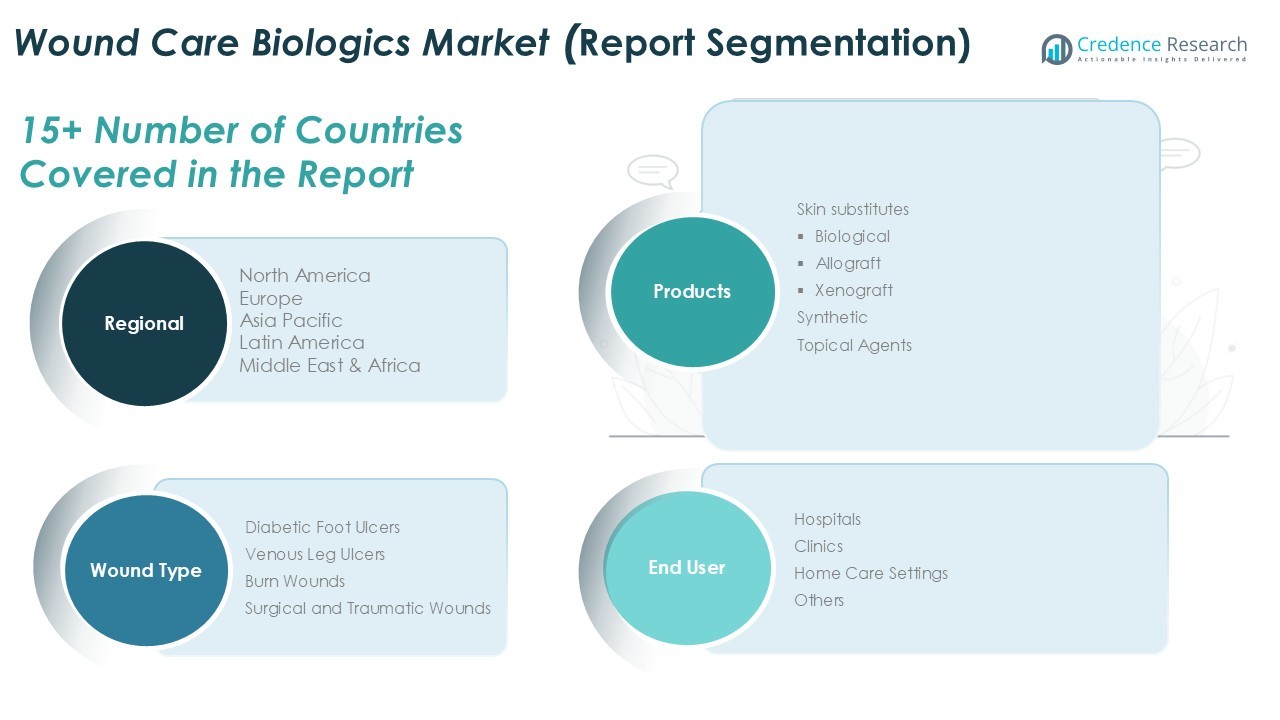

Market Segmentations:

By Product

- Skin Substitutes

- Biological

- Allograft

- Xenograft

- Synthetic

- Topical Agents

By Wound Type

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Surgical and Traumatic Wounds

By End User

- Hospitals

- Clinics

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Wound Care Biologics market is shaped by a mix of established multinational corporations and specialized biotech firms, each contributing to innovation and market penetration. Leading players such as Smith & Nephew, Mölnlycke Health Care, Coloplast A/S, Integra LifeSciences, Solventum, and Organogenesis dominate through diverse biologic product portfolios, including skin substitutes, allografts, and xenografts. Emerging companies like Kerecis, Acera Surgical, and PolyMedics Innovations are strengthening their positions with niche technologies and advanced regenerative solutions. Market competition is fueled by continuous product development, regulatory approvals, and strategic partnerships with healthcare providers. Financial performance remains strong among top companies, supported by investments in R&D and global distribution networks. Consolidation through mergers and acquisitions further intensifies competition, while regional players expand access in Asia Pacific and Latin America. Overall, the competitive landscape is marked by innovation, patient-centered product development, and strategic global expansion initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smith & Nephew plc

- VIVEX Biologics

- Mölnlycke Health Care

- Coloplast A/S

- Integra LifeSciences

- Solventum

- Organogenesis

- Derma Sciences

- Acera Surgical Inc.

- Kerecis

- PolyMedics Innovations

- Other Key Players

Recent Developments

- In September 2022, MiMedx Group, Inc. introduced AMNIOEFFECT, a tri-layer PURION processed human tissue allograft designed for surgical wound management. This innovation enhanced the company’s surgical recovery portfolio and strengthened its position in this market owing to the introduction of this new product.

- In July 2022, Tides Medical launched a new product, Artacent AC, a tri-layer skin graft designed for use in the treatment of complex or difficult-to-treat wounds.

- In July 2022, StimLabs, LLC, which aims to improve patient care by developing novel, patient-specific interventions, recently released Enverse, a placental membrane-based product that can be used to treat both acute and chronic wounds.

- In March 2022, Convatec Group Plc acquired Triad Life Sciences Inc., a U.S. based medical device company which was a manufacturer of biologically derived products for surgical wounds, chronic wounds, and burns. This acquisition marked Convatec’s entry into the wound care biologics market, enhancing its portfolio to address unmet clinical needs.

Report Coverage

The research report offers an in-depth analysis based on Product, Wound Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising cases of chronic wounds worldwide.

- Skin substitutes will remain the leading product category due to proven clinical effectiveness.

- Biological grafts will see stronger adoption with advancements in regenerative medicine.

- Diabetic foot ulcers will continue as the largest wound type segment supported by growing diabetes prevalence.

- Hospitals will remain the dominant end-user, but home care settings will gain faster traction.

- Asia Pacific will record the highest growth rate, supported by expanding healthcare infrastructure.

- North America will maintain leadership due to advanced facilities and reimbursement support.

- Companies will invest more in stem-cell-based and tissue-engineered wound care products.

- Strategic partnerships and acquisitions will shape competition among leading manufacturers.

- Regulatory support for innovative biologics will enhance global access and market penetration.