Market Overview:

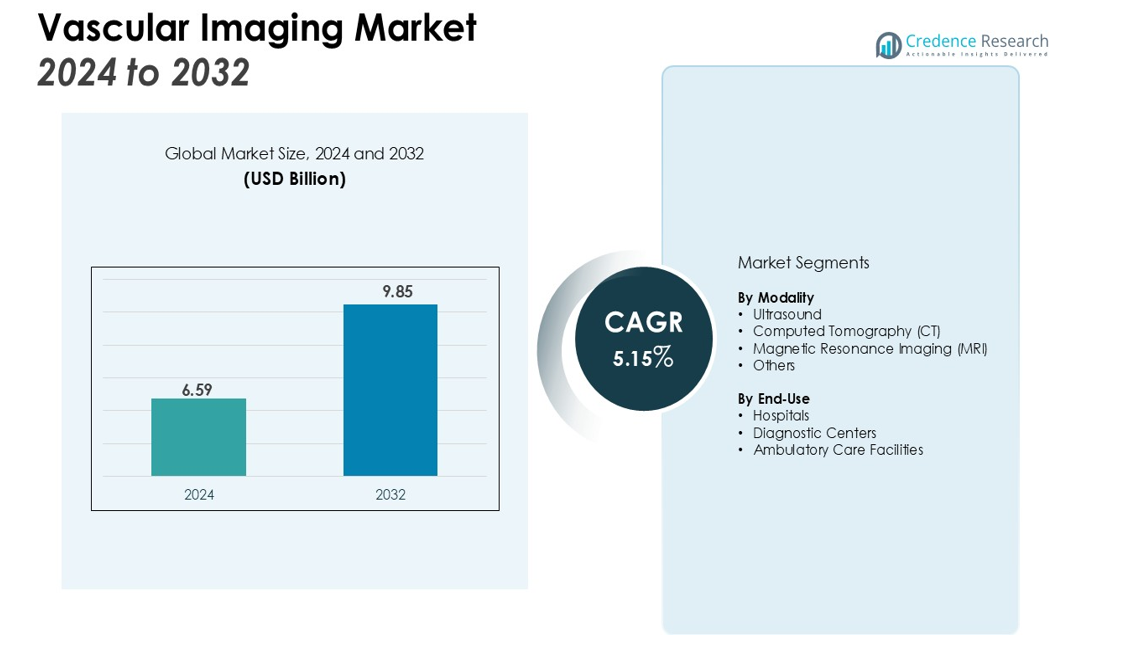

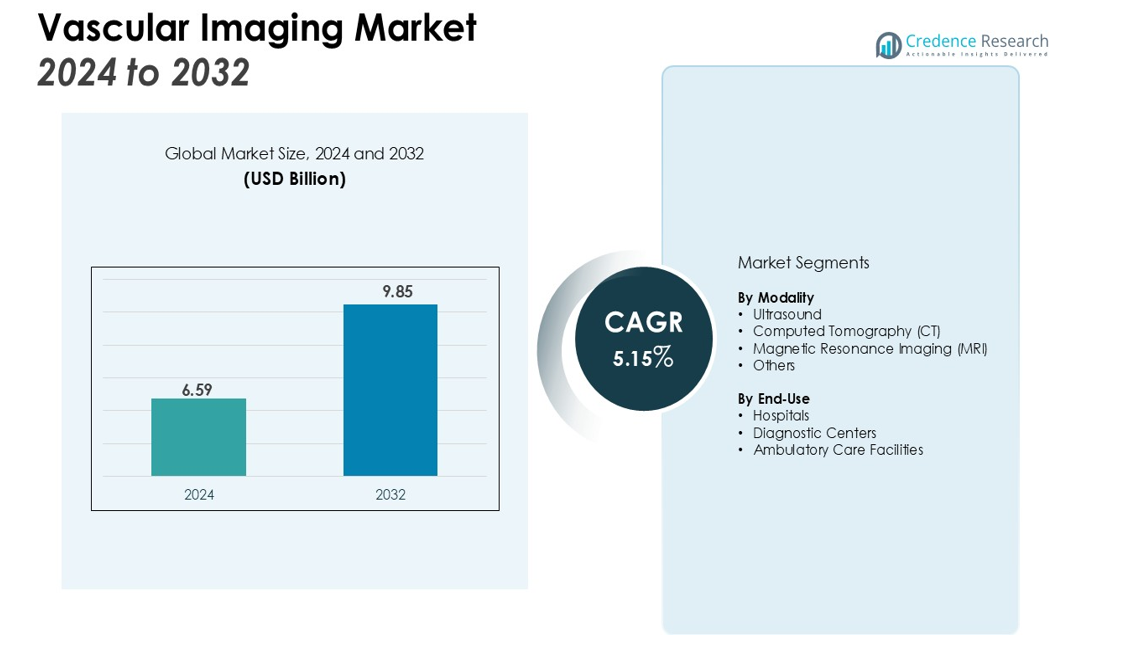

The Vascular Imaging Market size was valued at USD 6.59 billion in 2024 and is anticipated to reach USD 9.85 billion by 2032, at a CAGR of 5.15% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vascular Imaging Market Size 2024 |

USD 6.59 billion |

| Vascular Imaging Market, CAGR |

5.15% |

| Vascular Imaging Market Size 2032 |

USD 9.85 billion |

Key drivers include the growing geriatric population, rising healthcare expenditures, and increasing incidence of lifestyle-related vascular conditions. The integration of artificial intelligence and machine learning in imaging systems enhances diagnostic accuracy and workflow efficiency, while strong investments in R&D support the development of portable and cost-effective imaging devices. Furthermore, the shift toward preventive healthcare and early disease detection underscores the strategic role of vascular imaging in clinical practices worldwide.

Regionally, North America dominates the market, supported by advanced healthcare infrastructure, high adoption of innovative imaging systems, and strong presence of key industry players. Europe follows with significant demand driven by government-funded healthcare programs and expanding clinical research. Asia-Pacific is expected to witness the fastest growth, attributed to large patient populations, improving healthcare facilities, and rising investment in digital health technologies.

Market Insights:

- The Vascular Imaging Market was valued at USD 6.59 billion in 2024 and will reach USD 9.85 billion by 2032, growing at a CAGR of 5.15%.

- Rising prevalence of cardiovascular diseases and aging populations is driving consistent demand for advanced imaging solutions.

- Integration of AI and machine learning improves diagnostic accuracy, automates workflows, and reduces reporting delays.

- Preventive healthcare models highlight the importance of early diagnosis, boosting investments in vascular imaging infrastructure.

- High system costs and limited access in low-resource regions remain key barriers to market penetration.

- North America leads with 38% share, followed by Europe at 27%, supported by strong infrastructure and adoption rates.

- Asia-Pacific holds 24% share and is the fastest-growing region, while Latin America and Middle East & Africa together account for 11%, offering untapped opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Cardiovascular Diseases and Aging Population

The increasing global burden of cardiovascular diseases is a primary driver of the Vascular Imaging market. A growing aging population contributes to higher risk factors such as hypertension, diabetes, and obesity. Healthcare providers prioritize early detection and monitoring of vascular conditions to improve patient outcomes. This rising demand strengthens adoption of advanced imaging solutions in hospitals and specialty clinics.

- For instance, Philips’ Transcend Plus platform for its EPIQ CVx and Affiniti CVx ultrasound systems integrates 26 separate FDA-cleared AI applications to simplify workflows and reduce manual steps for clinicians.

Technological Advancements in Imaging Modalities and Artificial Intelligence Integration

Continuous innovation in imaging modalities supports the market by enhancing precision, speed, and safety. Artificial intelligence integration enables improved diagnostic accuracy, automated image analysis, and reduced reporting time. Vendors invest heavily in AI-driven software and advanced imaging platforms to meet clinical requirements. Vascular Imaging benefits from these advancements by offering more reliable and non-invasive diagnostic tools.

- For instance, Siemens Healthineers’ ACUSON Origin ultrasound system incorporates AI technology that delivers more than 5,600 AI-powered measurements for cardiovascular assessments, enhancing workflow efficiency and diagnostic precision.

Shift Toward Preventive Healthcare and Early Diagnosis

Healthcare systems emphasize preventive strategies to reduce long-term treatment costs and improve survival rates. Vascular Imaging plays a vital role in identifying vascular abnormalities before they progress into severe conditions. Patients and providers recognize the value of early diagnosis supported by accurate imaging technologies. This focus increases investments in diagnostic infrastructure across both developed and emerging economies.

Expanding Healthcare Infrastructure and Government Support in Emerging Regions

Improved healthcare facilities in developing markets create significant opportunities for advanced diagnostic tools. Governments allocate funds for modern medical technologies to address rising cases of vascular disorders. Growing awareness among patients encourages demand for accessible diagnostic solutions. The expansion of digital health technologies and tele-radiology services further boosts adoption of Vascular Imaging in underserved regions.

Market Trends:

Integration of Advanced Technologies and AI for Precision Diagnostics

The Vascular Imaging market is witnessing strong adoption of artificial intelligence and machine learning to enhance diagnostic accuracy and efficiency. AI-powered algorithms support clinicians in identifying subtle vascular abnormalities, reducing errors, and improving workflow management. It enables predictive analytics that assist in risk assessment and treatment planning for complex vascular diseases. Cloud-based platforms and advanced software enhance image sharing across healthcare systems, supporting collaboration between specialists. Hybrid imaging solutions that combine modalities such as PET-CT or MRI-ultrasound are gaining traction for delivering detailed vascular insights. These advancements strengthen clinical confidence and create demand for integrated diagnostic systems.

- For instance, the medical imaging company Aidoc has developed an AI platform that includes 17 FDA-cleared algorithms to help physicians by automatically detecting and triaging critical abnormalities from medical scans.

Growing Emphasis on Minimally Invasive and Preventive Healthcare Solutions

Global healthcare systems prioritize non-invasive and preventive methods, fueling demand for advanced imaging procedures. Vascular Imaging supports early detection of aneurysms, arterial blockages, and venous disorders, reducing the need for complex surgical interventions. Patients prefer safer diagnostic options with shorter recovery times, encouraging hospitals to adopt next-generation imaging technologies. Portable and handheld imaging devices expand accessibility in remote and resource-limited settings. It aligns with the increasing focus on personalized healthcare, enabling tailored treatment decisions. Rising investments in tele-radiology and digital imaging networks further extend the reach of vascular diagnostic services across emerging and developed markets.

- For instance, GE HealthCare’s Innova IGS 3 interventional system includes a fast-spin rotational angiography feature capable of reaching speeds of 40° per second, which enhances procedural efficiency and detailed imaging.

Market Challenges Analysis:

High Cost of Advanced Imaging Systems and Limited Accessibility

The adoption of Vascular Imaging faces barriers due to the high cost of advanced equipment and supporting infrastructure. Smaller hospitals and clinics in low-resource settings struggle to invest in modern imaging systems. It limits the availability of precise diagnostic tools for large patient populations. Maintenance expenses and specialized training requirements add further financial pressure on healthcare providers. Patients in developing regions often encounter long waiting times or must travel significant distances for vascular diagnostics. These constraints hinder equal access and slow down market expansion.

Regulatory Complexities and Data Management Challenges

Strict regulatory approvals for imaging devices and software create delays in product launches. The Vascular Imaging market must meet rigorous safety and quality standards before clinical use. It requires continuous updates to comply with evolving healthcare regulations across regions. Managing large volumes of imaging data presents further challenges for hospitals and diagnostic centers. Data privacy concerns and interoperability issues between different imaging platforms complicate integration into healthcare workflows. Limited skilled professionals in interpreting advanced imaging results further slows adoption and reduces efficiency in clinical settings.

Market Opportunities:

Expansion of AI-Enabled Imaging and Personalized Healthcare

The Vascular Imaging market has significant opportunities in AI-driven diagnostics and personalized healthcare. Advanced algorithms enhance precision, automate image interpretation, and reduce reporting delays for clinicians. It supports tailored treatment planning by providing detailed insights into patient-specific vascular conditions. Personalized healthcare initiatives increase demand for diagnostic tools that deliver accurate and timely results. Integration of AI with cloud-based platforms further expands access to remote consultations and collaborative analysis. These innovations create strong growth prospects for vendors investing in intelligent imaging solutions.

Growing Demand in Emerging Economies and Preventive Care Models

Emerging economies present large untapped markets for advanced diagnostic technologies. Rising healthcare expenditure and government support accelerate adoption of modern imaging systems in these regions. Vascular Imaging benefits from expanding preventive care programs that prioritize early disease detection. It aligns with the global shift toward cost-effective healthcare and reduced hospitalization. Portable and mobile imaging devices create opportunities in rural and underserved areas, improving diagnostic reach. The combination of infrastructure development and increasing awareness among patients strengthens long-term market growth potential.

Market Segmentation Analysis:

By Modality

The Vascular Imaging market by modality is segmented into ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and others. Ultrasound leads due to its affordability, non-invasive nature, and wide adoption in routine vascular diagnostics. It remains the preferred choice for detecting arterial blockages, venous disorders, and aneurysms. CT and MRI are gaining strong momentum with superior accuracy, high-resolution imaging, and advanced capabilities for complex vascular assessments. It benefits from technological integration such as AI-driven analysis, improving precision and efficiency across clinical workflows. Growing demand for hybrid modalities combining different imaging techniques supports broader diagnostic applications.

- For instance, DeepHealth, a subsidiary of RadNet, advanced imaging efficiency by connecting more than 300 of its MR, CT, PET/CT, and Ultrasound systems with its TechLive™ remote scanning solution, enabling centralized operation of procedures.

By End-Use

End-use segmentation covers hospitals, diagnostic centers, and ambulatory care facilities. Hospitals dominate with the largest share due to high patient volumes, advanced infrastructure, and strong adoption of cutting-edge imaging platforms. It benefits from well-established reimbursement frameworks that encourage use of advanced diagnostic modalities. Diagnostic centers represent a growing segment, driven by rising demand for outpatient imaging and specialized vascular assessments. Ambulatory care facilities are expanding their role with portable and handheld imaging devices that provide faster and more accessible services. The increasing preference for preventive healthcare accelerates adoption across all end-use segments, reinforcing the importance of vascular diagnostics in diverse care settings.

- For instance, RadNet, Inc. exemplifies the scale of the outpatient imaging sector by performing more than 10 million diagnostic procedures annually across its network of centers.

Segmentations:

By Modality

- Ultrasound

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Others

By End-Use

- Hospitals

- Diagnostic Centers

- Ambulatory Care Facilities

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Leading with Advanced Infrastructure and Strong Adoption

North America holds 38% share of the Vascular Imaging market, while Europe accounts for 27%. These regions together represent the largest revenue contribution supported by advanced healthcare systems and high diagnostic adoption. Strong reimbursement policies and widespread use of AI-enabled imaging technologies strengthen regional dominance. It benefits from robust clinical research networks and established presence of leading manufacturers. Government initiatives promoting preventive healthcare further reinforce adoption across hospitals and specialty centers.

Asia-Pacific Emerging as the Fastest-Growing Regional Market

Asia-Pacific holds 24% share of the Vascular Imaging market and is projected to expand rapidly. Large patient populations in China, India, and Japan drive significant demand for advanced diagnostic tools. It gains further momentum from growing healthcare investments and digital health reforms. Regional players collaborate with global firms to provide cost-effective imaging solutions across diverse healthcare settings. Improved awareness of preventive care increases patient demand for early and precise vascular diagnosis. Expansion of urban healthcare facilities positions Asia-Pacific as the fastest-growing regional segment.

Latin America and Middle East & Africa Offering Untapped Growth Potential

Latin America holds 6% share of the Vascular Imaging market, while Middle East & Africa represent 5%. These regions are at an early stage of adoption but display strong potential for growth. Limited diagnostic infrastructure is gradually improving through government initiatives and private investments. It gains traction through mobile imaging units and tele-radiology services reaching underserved populations. Training programs enhance clinical capacity while affordable technologies expand access. Growing burden of cardiovascular diseases supports steady demand in these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Samsung Medison Co., Ltd

- GE Healthcare

- Abbott Laboratories

- Koninklijke Philips N.V.

- Siemens Healthineers

- Shimadzu Corporation

- Hologic Inc.

- Hitachi Medical Corporation

- Carestream Health Inc.

Competitive Analysis:

The Vascular Imaging market is highly competitive with global and regional players focusing on innovation, product differentiation, and strategic partnerships. Leading companies invest heavily in research and development to integrate artificial intelligence and advanced software into imaging platforms, enhancing diagnostic accuracy and workflow efficiency. It benefits from collaborations between healthcare providers and technology firms that accelerate adoption of next-generation imaging solutions. Major players also expand their presence through mergers, acquisitions, and distribution agreements to strengthen global reach. Pricing strategies and customer service remain critical differentiators in a market where hospitals and diagnostic centers demand cost-effective yet precise tools. The competitive landscape reflects strong emphasis on portable and non-invasive technologies, addressing the rising demand for accessible and preventive healthcare solutions. This dynamic environment pushes companies to continually improve offerings and sustain their position in a growing global market.

Recent Developments:

- In September 2025, Siemens Healthineers launched its first United States-based Experience Center in Charlotte, North Carolina, to showcase its latest technologies.

- In September 2025, Hitachi Ltd. announced its agreement to acquire Synvert, a German data and artificial intelligence consulting firm, through its U.S. subsidiary, GlobalLogic Inc.

- In January 2025, Siemens Healthineers launched its NAEOTOM Alpha.Prime CT scanner at Arab Health 2025.

Report Coverage:

The research report offers an in-depth analysis based on Modality, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for advanced vascular diagnostics will rise with increasing global cardiovascular cases.

- Artificial intelligence will play a central role in improving accuracy and reducing reporting delays.

- Portable and handheld imaging devices will expand access to underserved and rural populations.

- Cloud-based platforms will support image sharing, collaboration, and tele-radiology across healthcare networks.

- Hybrid imaging systems combining modalities will gain adoption for comprehensive vascular assessments.

- Hospitals will continue to dominate adoption due to infrastructure and integration of advanced platforms.

- Diagnostic centers will grow rapidly, driven by outpatient demand and specialized imaging services.

- Preventive healthcare initiatives will strengthen the role of vascular imaging in early diagnosis.

- Emerging economies will offer strong growth potential supported by investments in healthcare infrastructure.

- Strategic collaborations between technology providers and healthcare institutions will shape the competitive landscape.