Market overview

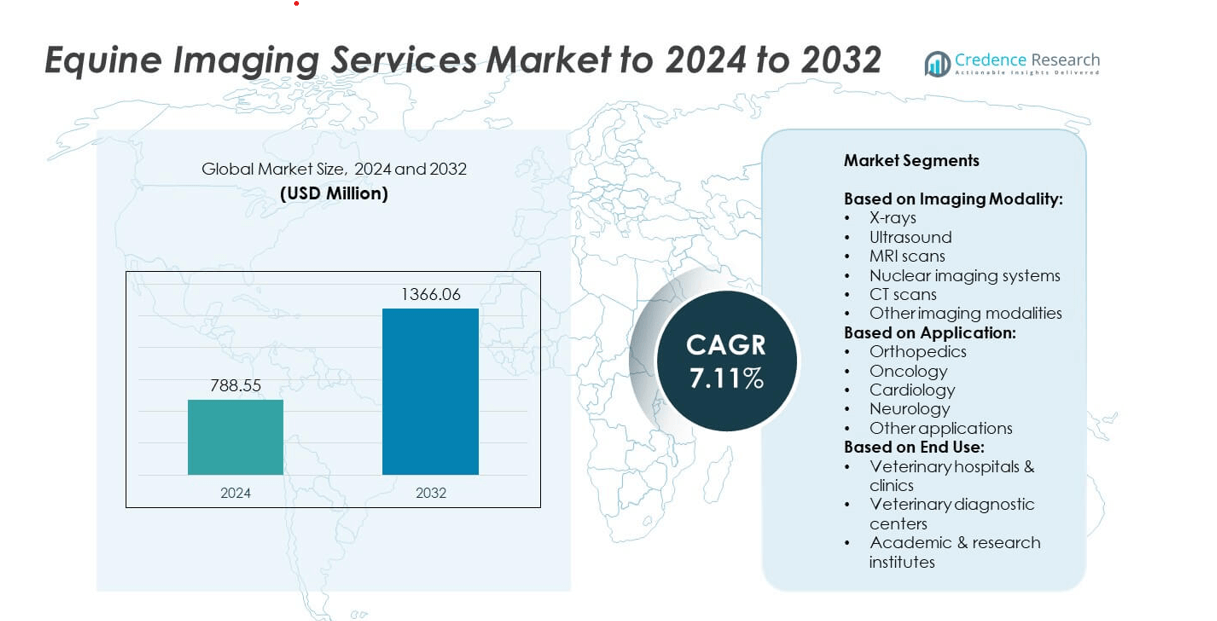

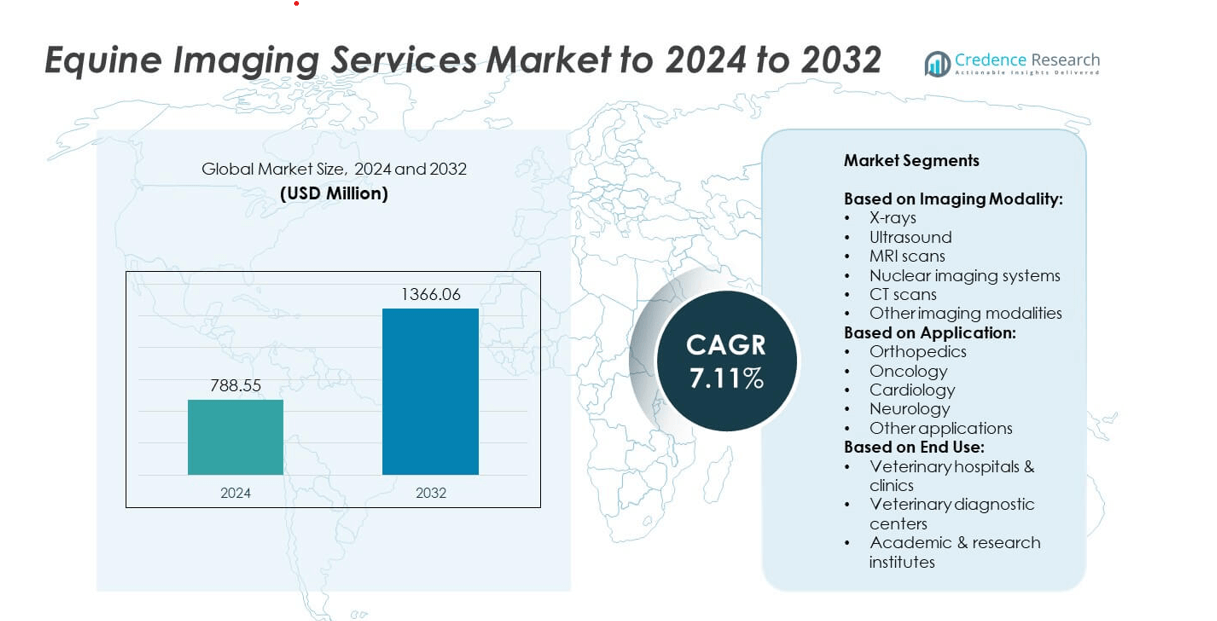

The Equine Imaging Services Market size was valued at USD 788.55 million in 2024 and is anticipated to reach USD 1366.06 million by 2032, at a CAGR of 7.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equine Imaging Services Market Size 2024 |

USD 788.55 million |

| Equine Imaging Services Market, CAGR |

7.11% |

| Equine Imaging Services Market Size 2032 |

USD 1366.06 million |

The equine imaging services market is highly competitive, with key players such as Rainbow Equine Hospital, Virginia Equine Imaging, IDEXX Laboratories, Tennessee Equine Hospital, IMV Imaging, and Hagyard Equine Medical Institute driving advancements in diagnostic capabilities. These companies focus on offering a wide range of imaging modalities, from digital X-rays and ultrasound to advanced MRI and CT systems, to meet the rising demand for equine health management. North America emerged as the leading region in 2024, commanding 38% of the global market share, supported by advanced veterinary infrastructure, significant investments in equine healthcare, and strong participation in equestrian sports.

Market Insights

- The equine imaging services market was valued at USD 788.55 million in 2024 and is expected to reach USD 1366.06 million by 2032, growing at a CAGR of 7.11%.

- Rising equine sports activities and preventive veterinary care are key drivers, with orthopedic applications accounting for 38% of market share in 2024.

- Digital X-rays lead the modality segment with 32% share, while MRI and CT scans are trending due to their ability to detect complex conditions and support advanced diagnostics.

- The market is competitive, with hospitals and specialized centers investing in AI-based interpretation, portable imaging systems, and advanced infrastructure to strengthen their position.

- North America leads with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 20%, while Latin America and Middle East & Africa accounted for 8% and 7% respectively, highlighting strong regional variations in adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Imaging Modality

X-rays accounted for the dominant share in the equine imaging services market in 2024, capturing nearly 32% of the market. Their widespread use stems from affordability, rapid results, and effectiveness in diagnosing bone fractures and joint disorders. Growing demand for portable digital X-ray systems further strengthens this segment’s position. While ultrasound and MRI scans are gaining traction for soft tissue and complex evaluations, X-rays remain the first-line diagnostic tool, driven by increasing adoption in both small clinics and large veterinary hospitals seeking efficient imaging solutions.

- For instance, Carestream’s DRX Core 35×43 cm panel weighs 3.36 kg and uses a 139 µm pixel pitch, operating from 40–150 kVp.

By Application

Orthopedics emerged as the leading application segment, holding around 38% market share in 2024. Rising incidence of bone injuries, joint degeneration, and lameness in performance horses fuels the demand for orthopedic imaging. Veterinarians widely rely on X-rays and MRI scans for detailed musculoskeletal assessments, particularly in racing and show horses. Growth in equine sports and increasing awareness about preventive care also support orthopedic dominance. Meanwhile, oncology and cardiology applications are expanding steadily, driven by growing recognition of complex conditions requiring advanced imaging methods like CT and nuclear scans.

- For instance, Hallmarq reports over 500,000 animal MRI/CT scans performed by customers worldwide.

By End Use

Veterinary hospitals & clinics dominated the end-use segment with a market share exceeding 45% in 2024. Their leadership is attributed to higher patient footfall, advanced infrastructure, and broad adoption of imaging modalities like CT and MRI. Increasing investments in diagnostic capabilities at large equine hospitals also contribute to segment growth. Veterinary diagnostic centers are expanding their role by offering specialized services for referral cases, while academic and research institutes leverage advanced imaging for clinical trials and equine health studies. However, hospitals remain the primary access point for comprehensive equine diagnostic imaging.

Key Growth Drivers

Rising Equine Sports and Performance Care

The expansion of equine sports, including racing, show jumping, and dressage, is a major growth driver for imaging services. Performance horses require frequent monitoring of musculoskeletal health, leading to higher adoption of X-rays and MRI scans for early injury detection. Increasing investments by owners in preventive care and faster rehabilitation directly fuel demand for advanced imaging modalities. This emphasis on maintaining peak performance levels positions equine imaging services as a critical component of sports veterinary care worldwide.

- For instance, MinXray’s HF100+ delivers a variable output with a maximum of 40 mA @ 40–50 kVDC and a timer range of 0.01–2.0 seconds.

Technological Advancements in Imaging Modalities

Advances in digital radiography, portable ultrasound, and high-resolution MRI systems are reshaping equine diagnostics. Portable equipment allows on-site imaging in stables and remote locations, improving accessibility for equine owners. Additionally, advanced CT and nuclear imaging systems enhance the accuracy of detecting internal injuries and complex conditions. These technological upgrades enable faster diagnosis, reduce stress on animals, and expand service adoption. Continuous product innovation by veterinary imaging manufacturers further accelerates growth, making technology-driven solutions a key market driver.

- For instance, Epica’s Vimago HDVI provides resolution down to 0.09 mm.

Rising Awareness of Preventive Veterinary Care

Growing awareness about early disease detection and preventive care among horse owners significantly drives market growth. Equine veterinarians increasingly recommend periodic imaging checks to identify orthopedic, cardiac, or neurological disorders before symptoms escalate. Rising disposable incomes and willingness to spend on animal healthcare strengthen this trend. Preventive imaging not only improves horse well-being but also reduces long-term treatment costs. This preventive approach establishes imaging services as essential for maintaining equine health and supports steady market expansion.

Key Trends and Opportunities

Integration of AI and Digital Platforms

Artificial intelligence is creating new opportunities by enhancing imaging accuracy and interpretation in equine diagnostics. AI-powered platforms support faster analysis of X-rays and MRIs, reducing errors and providing real-time diagnostic insights. Digital platforms also facilitate telemedicine by allowing remote consultation with equine specialists. These developments improve efficiency, particularly in areas with limited access to advanced veterinary care. Integration of AI and digital systems is a key trend, offering service providers new pathways to improve quality and expand reach.

- For instance, SignalPET serves 2,300+ clinics with a guaranteed radiology turnaround time of up to 45 minutes.

Expansion of Specialized Diagnostic Centers

Specialized veterinary diagnostic centers are emerging as significant opportunities within the market. These centers focus on offering advanced imaging modalities like CT and nuclear imaging, which are less common in small clinics. They often serve as referral hubs for complex equine cases, strengthening their position in the healthcare ecosystem. Expansion of such centers, particularly in equine sports regions and developed markets, enhances access to sophisticated diagnostics. This trend highlights a strong opportunity for specialized service providers and investors.

- For instance, Qalibra systems span 32–640 slices with 70–90 cm bores, enabling standing equine CT configurations.

Key Challenges

High Cost of Advanced Imaging Modalities

The cost of acquiring and maintaining advanced imaging equipment like MRI and CT scanners remains a major challenge. Many smaller clinics and independent veterinarians find it difficult to justify such investments, limiting accessibility in certain regions. Additionally, service costs passed on to horse owners can discourage adoption, especially for non-critical conditions. These high costs create a barrier to wider deployment of cutting-edge imaging technologies and restrict market growth in emerging economies with budget-sensitive customers.

Limited Availability of Skilled Veterinary Professionals

A shortage of veterinary professionals trained in advanced imaging techniques presents another critical challenge. Specialized interpretation of MRI, CT, and nuclear scans requires expertise that is not widely available across veterinary practices. This skill gap often leads to reliance on referral centers, increasing costs and delays in diagnosis. In regions with fewer specialized equine veterinarians, access to advanced imaging services remains limited. Addressing this shortage through training programs and education initiatives is essential to improve market penetration.

Regional Analysis

North America

North America held the largest share of the equine imaging services market in 2024, accounting for 38%. The region benefits from a strong presence of advanced veterinary infrastructure, high expenditure on equine healthcare, and a well-established culture of equine sports. Increasing adoption of digital X-rays, portable ultrasound, and advanced MRI systems supports market expansion. The United States leads the regional market with significant investments in diagnostic technology and research. Rising demand for preventive care and the presence of specialized equine hospitals further strengthen North America’s dominance during the forecast period.

Europe

Europe captured a 27% share of the equine imaging services market in 2024. The region is supported by a long tradition of equestrian activities, particularly in countries such as Germany, the United Kingdom, and France. Advanced veterinary clinics and hospitals across Europe increasingly invest in CT and MRI systems to enhance diagnostic accuracy. Strong government support for animal health and regulatory frameworks further promote market adoption. The growing prevalence of orthopedic and neurological conditions in performance horses also drives service demand. Europe continues to be a key hub for technological adoption and equine healthcare services.

Asia Pacific

Asia Pacific accounted for 20% of the equine imaging services market in 2024 and is projected to be the fastest-growing region. Rising investments in equestrian sports in China, India, and Australia contribute significantly to demand. Expanding veterinary infrastructure and growing awareness of preventive equine care further drive adoption of imaging technologies. While X-rays and ultrasound dominate due to cost-effectiveness, the gradual introduction of MRI and CT systems in advanced facilities enhances diagnostic options. Increasing disposable incomes and the expansion of equine events in emerging economies support strong regional growth potential.

Latin America

Latin America represented an 8% share of the equine imaging services market in 2024. The region’s growth is linked to the increasing popularity of equine sports and leisure riding, particularly in Brazil, Argentina, and Mexico. Veterinary clinics are gradually adopting digital X-rays and ultrasound systems as cost-effective diagnostic tools. However, access to advanced imaging modalities such as MRI and CT remains limited to large urban hospitals and specialized centers. Rising awareness of equine health management and gradual investment in veterinary infrastructure are expected to drive steady adoption across the region.

Middle East & Africa

The Middle East & Africa held a 7% share of the equine imaging services market in 2024. Growth in this region is strongly influenced by the cultural significance of horses, particularly in the Middle East, where equestrian activities hold traditional and economic value. Increasing investments in equine hospitals and veterinary diagnostic centers enhance access to imaging services. However, adoption of advanced modalities like nuclear imaging and MRI is still in early stages due to high costs and limited expertise. Rising government initiatives and private investments in animal healthcare support gradual regional growth.

Market Segmentations:

By Imaging Modality:

- X-rays

- Ultrasound

- MRI scans

- Nuclear imaging systems

- CT scans

- Other imaging modalities

By Application:

- Orthopedics

- Oncology

- Cardiology

- Neurology

- Other applications

By End Use:

- Veterinary hospitals & clinics

- Veterinary diagnostic centers

- Academic & research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the equine imaging services market is shaped by key players such as Rainbow Equine Hospital, Virginia Equine Imaging, IDEXX Laboratories, Tennessee Equine Hospital, National Research Center on Equines, Moore Equine P.C, VET.CT, Daniel Equine Services, Mid-Atlantic Equine Medical Center, Chaparral Veterinary Medical Center, Hagyard Equine Medical Institute, Vets Pets, IMV Imaging, Royal Veterinary College’s Equine Referral Hospital, and Chine House Veterinary Hospital. The market is characterized by strong emphasis on advanced diagnostic capabilities, with companies focusing on offering a wide range of imaging modalities including X-rays, ultrasound, MRI, CT, and nuclear imaging. Service providers are investing in expanding infrastructure, integrating AI-based interpretation tools, and developing portable systems to enhance accessibility. The growing importance of preventive veterinary care and rising demand from equine sports further drive competition. Players also seek strategic collaborations, partnerships, and research investments to strengthen expertise and improve service quality, ensuring long-term growth in a competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rainbow Equine Hospital

- Virginia Equine Imaging

- IDEXX Laboratories

- Tennessee Equine Hospital

- National Research Center on Equines

- Moore Equine P.C

- CT

- Daniel Equine Services

- Mid-Atlantic Equine Medical Center

- Chaparral Veterinary Medical Center

- Hagyard Equine Medical Institute

- Vets Pets

- IMV Imaging

- Royal Veterinary College’s Equine Referral Hospital

- Chine House Veterinary Hospital

Recent Developments

- In 2024, Moore Equine P.C. Was acquired by Altano Group, strengthening the new company’s global network and enhancing access to advanced veterinary care, including modern equine imaging services.

- In 2024, National Research Center on Equines (NRCE) Launched an equine eco-tourism initiative and released a mobile app, “Mare-USG,” for veterinarians and academicians in equine theriogenology.

- In 2023, IMV Imaging Acquired Veterinary Solutions, a manufacturer of DR X-ray and PACS systems in Belgium, strengthening its presence in the market.

Report Coverage

The research report offers an in-depth analysis based on Imaging Modality, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for advanced equine diagnostics.

- X-ray systems will continue to dominate due to affordability and widespread use.

- MRI and CT scans will see faster adoption for complex equine health conditions.

- Preventive veterinary care will drive consistent demand for imaging services.

- Veterinary hospitals and clinics will remain the largest end users of imaging solutions.

- Specialized diagnostic centers will expand their role in referral and complex cases.

- North America will retain leadership while Asia Pacific shows the fastest growth.

- Integration of AI will enhance accuracy and efficiency in diagnostic imaging.

- Portable imaging devices will boost accessibility in remote equine facilities.

- Investment in veterinary training will address the shortage of skilled professionals.