Market Overview:

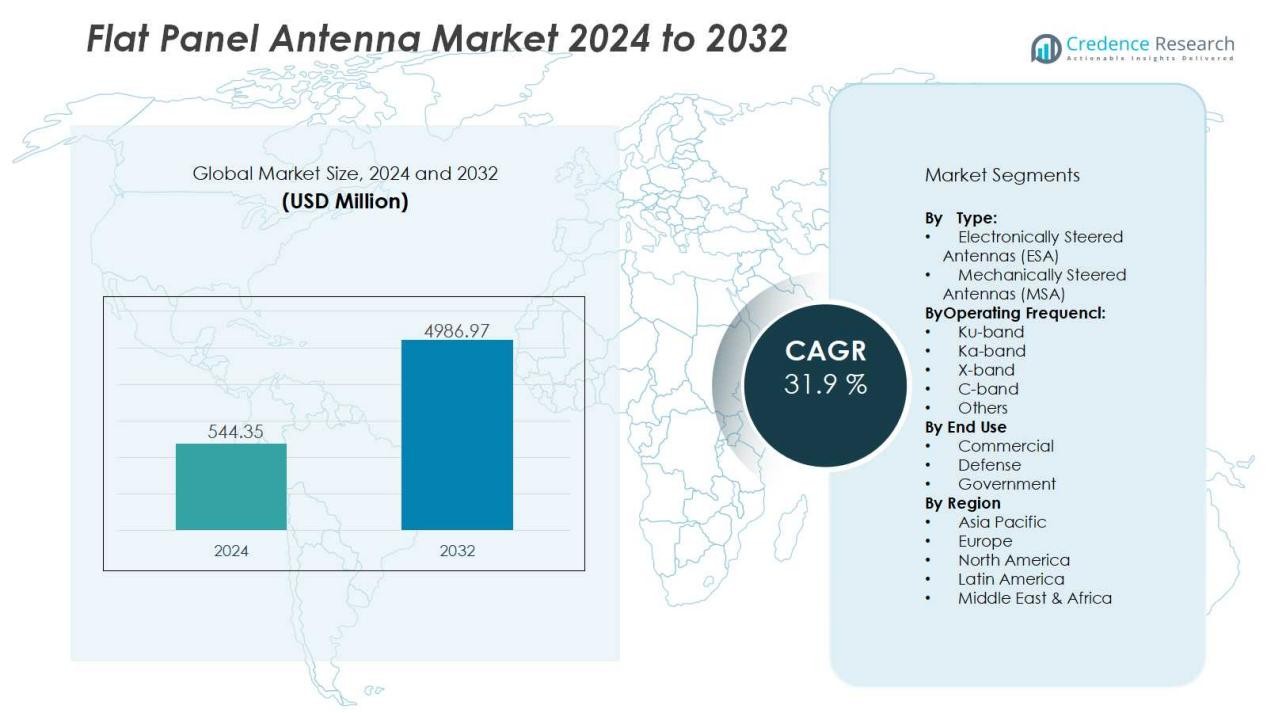

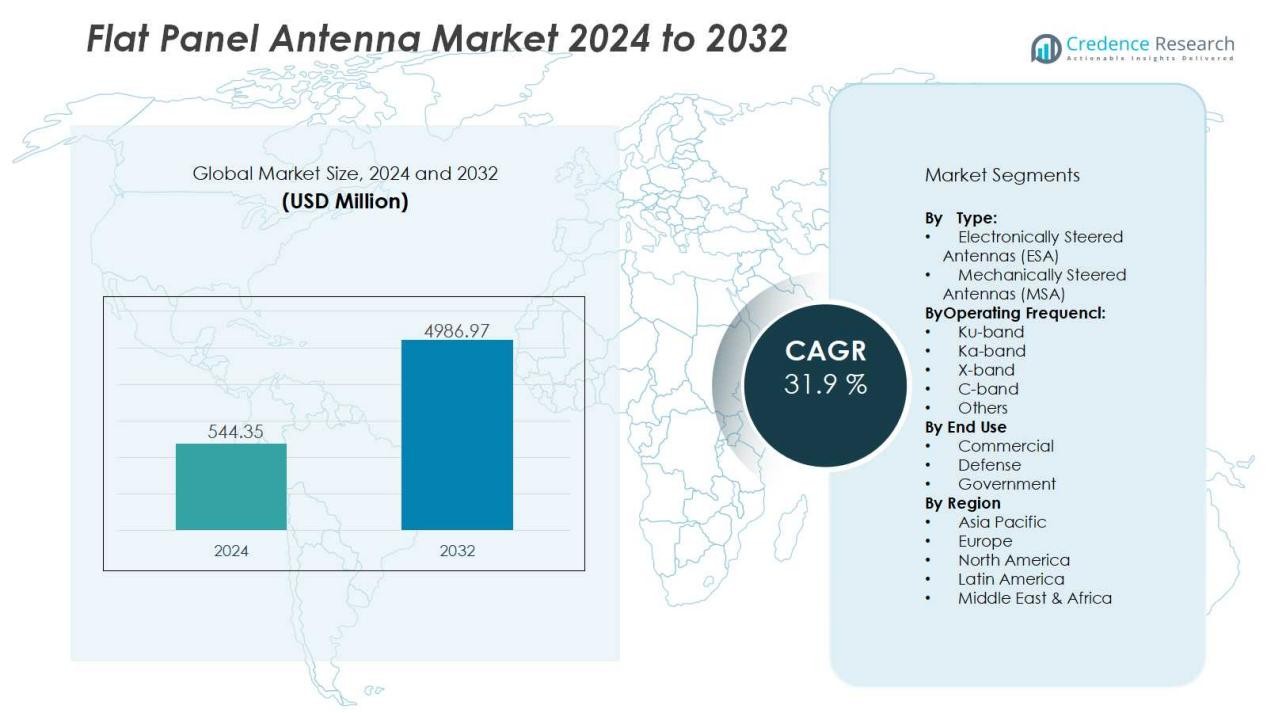

The Flat Panel Antenna Market size was valued at USD 544.35 million in 2024 and is anticipated to reach USD 4986.97 million by 2032, at a CAGR of 31.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flat Panel Antenna Market Size 2024 |

USD 544.35 Million |

| Flat Panel Antenna Market, CAGR |

31.9 % |

| Flat Panel Antenna Market Size 2032 |

USD 4986.97 Million |

Key drivers include the increasing need for high-speed satellite connectivity, particularly for mobile platforms such as aircraft, ships, and vehicles. The rise of 5G infrastructure deployment and growing interest in low-earth orbit (LEO) satellites are further boosting demand. Flat panel antennas provide advantages such as lightweight design, compact structure, and high performance, which makes them ideal for next-generation communication networks.

Regionally, North America dominates the market, supported by strong investments in defense communication and satellite technologies. Europe follows with robust adoption in aerospace and commercial sectors. Asia-Pacific is expected to record the fastest growth, driven by rapid digital transformation, rising internet penetration, and expanding demand for satellite broadband services in countries such as China and India. Emerging economies in Latin America and the Middle East are also investing in advanced communication systems, creating new opportunities for flat panel antenna providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The flat panel antenna market was valued at USD 544.35 million in 2024 and is projected to reach USD 4986.97 million by 2032, growing at a CAGR of 31.9%.

- Rising demand for high-speed satellite connectivity in aviation, maritime, defense, and commercial sectors is a key driver for market expansion.

- The launch of low-earth orbit satellite constellations is boosting opportunities by providing faster data transfer, wider coverage, and low latency.

- 5G infrastructure rollout is fueling adoption, with flat panel antennas enabling seamless integration between terrestrial and satellite networks.

- Defense and aerospace sectors are generating steady demand as governments invest in secure, real-time communication systems and modernization programs.

- High production costs and complex manufacturing processes remain challenges, limiting adoption in cost-sensitive and developing regions.

- North America led with 38% share in 2024, Europe followed with 28%, and Asia-Pacific captured 22% while emerging as the fastest-growing region due to expanding satellite internet adoption and strong government support.

Market Drivers:

Rising Demand for High-Speed Satellite Connectivity Across Industries:

The flat panel antenna market is driven by the increasing requirement for high-speed satellite communication across aviation, maritime, defense, and commercial transport. It offers uninterrupted broadband connectivity in remote and mobile environments where traditional infrastructure is limited. Growing reliance on satellite networks for inflight entertainment, maritime navigation, and mission-critical defense communication is expanding adoption. It supports both fixed and mobile platforms, making it an attractive solution for global industries.

- For instance, the Ku-band flat panel antenna from ThinKom Solutions, used in Gogo’s 2Ku system, has been operated for over 12 million flight hours on commercial aircraft, demonstrating its reliability for in-flight connectivity.

Expansion of Low-Earth Orbit (LEO) Satellite Constellations:

The launch of large-scale LEO satellite constellations is strengthening growth prospects for the flat panel antenna market. These networks promise faster data transfer rates, low latency, and wider coverage, creating new opportunities for antenna manufacturers. It enhances communication for remote communities, disaster recovery, and enterprises seeking robust connectivity. The rising pace of satellite launches by companies and governments is driving demand for advanced flat panel antenna solutions.

- For instance, during a 2019 test, ThinKom’s Ka2517 antenna achieved a full-duplex throughput data rate of 370 Mbps on the downlink with a Telesat LEO satellite, showcasing its high-speed capabilities.

Growing Role of 5G and Advanced Communication Infrastructure:

The rollout of 5G networks worldwide is supporting the need for high-performance antennas that enable seamless integration between terrestrial and satellite communication. The flat panel antenna market benefits from its ability to handle high data throughput with compact and energy-efficient designs. It improves network reliability, particularly in underserved or rural areas where fiber or cable deployment remains costly. Integration with next-generation technologies is fueling long-term market expansion.

Increasing Defense and Aerospace Applications for Secure Communication:

Defense and aerospace sectors are adopting flat panel antennas to support mission-critical communication with higher precision and reliability. It ensures real-time data transfer for surveillance, reconnaissance, and unmanned systems. Governments are investing heavily in satellite-based defense networks, creating steady demand for robust antenna solutions. The market is expected to see sustained growth from military modernization programs and the adoption of satellite-powered aviation systems.

Market Trends:

Adoption of Electronically Steered Antennas for Mobility and Connectivity:

One of the most prominent trends in the flat panel antenna market is the adoption of electronically steered antennas (ESAs) for enhanced mobility and high-speed connectivity. ESAs eliminate the need for mechanical movement, providing fast and reliable tracking of satellites, which is vital for aviation, maritime, and defense applications. It improves performance by enabling seamless switching between satellites, ensuring continuous broadband service in dynamic environments. Growing demand for lightweight, compact, and low-maintenance designs is accelerating the transition toward electronically steered technologies. The rising deployment of LEO and medium-earth orbit (MEO) satellites aligns with this trend, as ESAs support flexible multi-orbit connectivity. Manufacturers are focusing on innovation to reduce costs, increase efficiency, and meet the performance needs of mobile communication platforms.

- For instance, ThinKom Solutions, Inc.’s flagship ThinAir® Ku3030 antenna, based on its VICTS technology, has successfully logged more than 30 million operational hours on commercial aircraft.

Integration with Next-Generation Networks and Expanding Commercial Applications:

Another key trend in the flat panel antenna market is the integration of antenna systems with next-generation networks such as 5G and satellite-based IoT ecosystems. It enables hybrid connectivity solutions that support both terrestrial and satellite communication, bridging gaps in underserved regions. Enterprises are adopting flat panel antennas for logistics, agriculture, and remote industrial operations to ensure consistent data access. Demand is also rising in consumer markets, with broadband service providers leveraging these antennas to expand coverage in rural and low-density areas. The shift toward smart cities and connected vehicles is reinforcing adoption, highlighting the role of antennas in future mobility solutions. Investments in R&D and partnerships between telecom operators and satellite companies are further accelerating commercialization and broadening applications across industries.

- For instance, Satcube’s Ku-band portable satellite terminal enables users to create a Wi-Fi hotspot and establish a high-speed broadband connection in under 1 minute.

Market Challenges Analysis:

High Costs and Complex Manufacturing Processes Limiting Adoption:

One of the major challenges in the flat panel antenna market is the high cost of production and deployment. Advanced materials, precision engineering, and sophisticated electronic components drive up manufacturing expenses. It restricts adoption among small and medium enterprises, especially in cost-sensitive regions. The complexity of design and integration with satellite networks further increases barriers for new entrants. Service providers face difficulty in offering affordable broadband services when equipment costs remain elevated. The challenge is more pronounced in developing markets where budget constraints slow down infrastructure expansion.

Regulatory Barriers and Technical Performance Limitations:

The flat panel antenna market also faces challenges related to regulatory approvals and performance limitations in dynamic conditions. It must comply with stringent satellite communication standards and spectrum regulations, which vary across regions. Delays in approvals can slow product launches and commercial rollouts. Technical hurdles such as reduced efficiency at extreme angles and susceptibility to environmental conditions also impact reliability. Integrating antennas with diverse satellite constellations while maintaining consistent quality remains a challenge for manufacturers. These issues create operational risks and limit widespread adoption in highly demanding applications.

Market Opportunities:

Rising Demand for Connectivity in Remote and Mobile Applications:

The flat panel antenna market presents significant opportunities with the growing need for reliable connectivity in remote and mobile environments. Industries such as aviation, maritime, energy, and logistics are expanding adoption to support uninterrupted communication. It enables broadband access in underserved rural regions where terrestrial infrastructure is limited or absent. The increasing role of satellite internet providers targeting global coverage is also creating growth avenues. Expanding smart transportation systems and the rise of connected vehicles will further strengthen demand. Governments and enterprises are investing in resilient communication networks, boosting the need for advanced antenna technologies.

Integration with Emerging Technologies and Expanding Consumer Base:

Another key opportunity for the flat panel antenna market lies in its integration with emerging technologies such as 5G, IoT, and satellite-based broadband services. It supports hybrid communication models that deliver low-latency, high-speed connectivity across multiple sectors. Consumer applications are also increasing, with antennas enabling direct-to-home satellite internet solutions. Startups and telecom providers are partnering with satellite companies to expand service portfolios, opening doors for new business models. The shift toward digital transformation in industries like agriculture, mining, and defense offers long-term opportunities. Rising investment in satellite constellations worldwide ensures sustained demand for innovative flat panel antenna solutions.

Market Segmentation Analysis:

By Type:

The flat panel antenna market is segmented into electronically steered antennas (ESA) and mechanically steered antennas (MSA). ESAs dominate due to their compact design, low maintenance, and ability to track multiple satellites without mechanical movement. It is gaining strong demand across aviation, maritime, and defense industries where mobility and performance are critical. MSAs retain relevance in cost-sensitive applications but face declining preference due to higher operational complexity. The shift toward electronically steered solutions continues to accelerate with expanding satellite constellations and growing demand for reliable broadband connectivity.

- For instance, Ball Aerospace has engineered an advanced electronically steered antenna for in-flight connectivity featuring a low-profile design that stands less than 3 inches high.

By Operating Frequency:

The market is classified into Ku-band, Ka-band, and other frequency ranges such as X-band and C-band. Ku-band antennas hold a major share, driven by widespread adoption in satellite television and broadband services. Ka-band is witnessing rapid growth due to higher data throughput, making it suitable for aviation, enterprise, and defense applications. It supports growing demand for high-capacity communication in both commercial and government sectors. Other frequency ranges remain important for niche military and maritime operations, offering resilience in diverse environments. The shift toward Ka-band highlights the industry’s focus on high-speed, low-latency services.

- For instance, Beyond Gravity provides specialized Ka-band TTC antennas designed as pipe antennas that operate with a dedicated bandwidth of 0.2 GHz for stable satellite command and control.

By End Use:

End-use segments include commercial, defense, and government sectors. The commercial segment leads, supported by rising adoption in aviation, maritime, and telecom industries. It is expanding further with the demand for in-flight connectivity and remote broadband access. The defense segment holds strong demand due to the need for secure, high-reliability communication. Government projects for rural broadband expansion are also driving adoption. Continuous investment in satellite internet services ensures long-term growth across all end-use categories.

Segmentations:

By Type:

- Electronically Steered Antennas (ESA)

- Mechanically Steered Antennas (MSA)

By Operating Frequency:

- Ku-band

- Ka-band

- X-band

- C-band

- Others

By End Use:

- Commercial

- Defense

- Government

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America accounted for 38% market share in the flat panel antenna market in 2024, supported by advanced communication infrastructure and high defense spending. The United States leads the region with strong demand from aerospace, defense, and satellite broadband service providers. It benefits from the presence of key players investing heavily in research and development. Expansion of low-earth orbit (LEO) satellite programs and growing 5G deployment are driving adoption in both government and commercial sectors. Canada is also witnessing rising demand for rural broadband connectivity, supported by government-backed satellite projects. The region continues to dominate due to strong technological innovation and large-scale implementation of satellite-enabled communication networks.

Europe:

Europe held 28% market share in 2024, driven by robust adoption across aerospace and maritime applications. Countries such as France, Germany, and the United Kingdom are leading adopters, supported by advanced aviation and defense industries. It is gaining traction due to increasing demand for satellite broadband in remote regions and growing focus on maritime safety. Strong regulatory frameworks and government initiatives supporting digital connectivity are fueling market growth. The presence of satellite operators and antenna manufacturers strengthens Europe’s position in global trade. Rising investments in 5G-satellite integration are further accelerating adoption across key industries.

Asia-Pacific:

Asia-Pacific captured 22% market share in 2024, with growth led by China, India, and Japan. It is the fastest-growing regional market due to expanding satellite internet adoption and government investment in space programs. Rising demand for uninterrupted connectivity in rural and urban areas is driving strong adoption. Telecom operators and satellite providers are increasingly collaborating to expand affordable broadband services. Growing aviation traffic, maritime trade, and defense modernization are boosting market expansion in the region. Rapid digitalization and economic growth are positioning Asia-Pacific as a critical market for flat panel antenna manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kymeta

- ThinKom

- Starwin

- SatPro

- SatCube

- Gilat Satellite Networks

- TTI Norte

- Hanwha Phasor

Competitive Analysis:

The flat panel antenna market is highly competitive with leading players focusing on innovation, cost efficiency, and performance improvements. Key companies include Kymeta, ThinKom, Starwin, SatPro, and SatCube, each strengthening their portfolios with advanced antenna solutions tailored for aviation, maritime, defense, and commercial applications. It is characterized by continuous investment in electronically steered technologies that support multi-orbit satellite constellations and high-speed connectivity. Players are expanding partnerships with telecom operators and satellite providers to capture demand in broadband and mobility markets. Companies are also targeting cost reduction strategies to improve adoption across emerging regions. Competition is defined by technological advancement, global expansion, and the ability to deliver reliable communication in dynamic environments.

Recent Developments:

- In June 2025, Kymeta launched a new multiband KuKa antenna supporting seamless network switching and roaming between GEO and LEO satellite networks, designed to enhance military and commercial satellite communications.

- In September 2025, Gilat launched an AI-powered Network Management System (NMS) integrating advanced AI models like GPT-4 and 5 to improve satellite network operations with autonomous monitoring and optimization capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Type, Operating Frequency, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The flat panel antenna market will expand with rising adoption of satellite-based broadband services across industries.

- It will benefit from increasing deployment of low-earth orbit satellite constellations that demand advanced ground communication systems.

- The market will witness higher demand in aviation and maritime sectors as connectivity becomes a critical service.

- Defense modernization programs worldwide will continue to drive procurement of flat panel antennas for secure communication.

- Integration with 5G and hybrid network models will enhance opportunities for telecom and enterprise applications.

- Manufacturers will focus on reducing costs and improving energy efficiency to expand customer adoption.

- Technological advancements such as electronically steered arrays will strengthen market growth by offering superior mobility solutions.

- Asia-Pacific will emerge as a key growth hub, supported by investments in digital infrastructure and space programs.

- The consumer market will expand as satellite internet providers scale services to rural and underserved regions.

- Collaborations between telecom operators, satellite companies, and equipment manufacturers will define the next phase of market development.