Market Overview

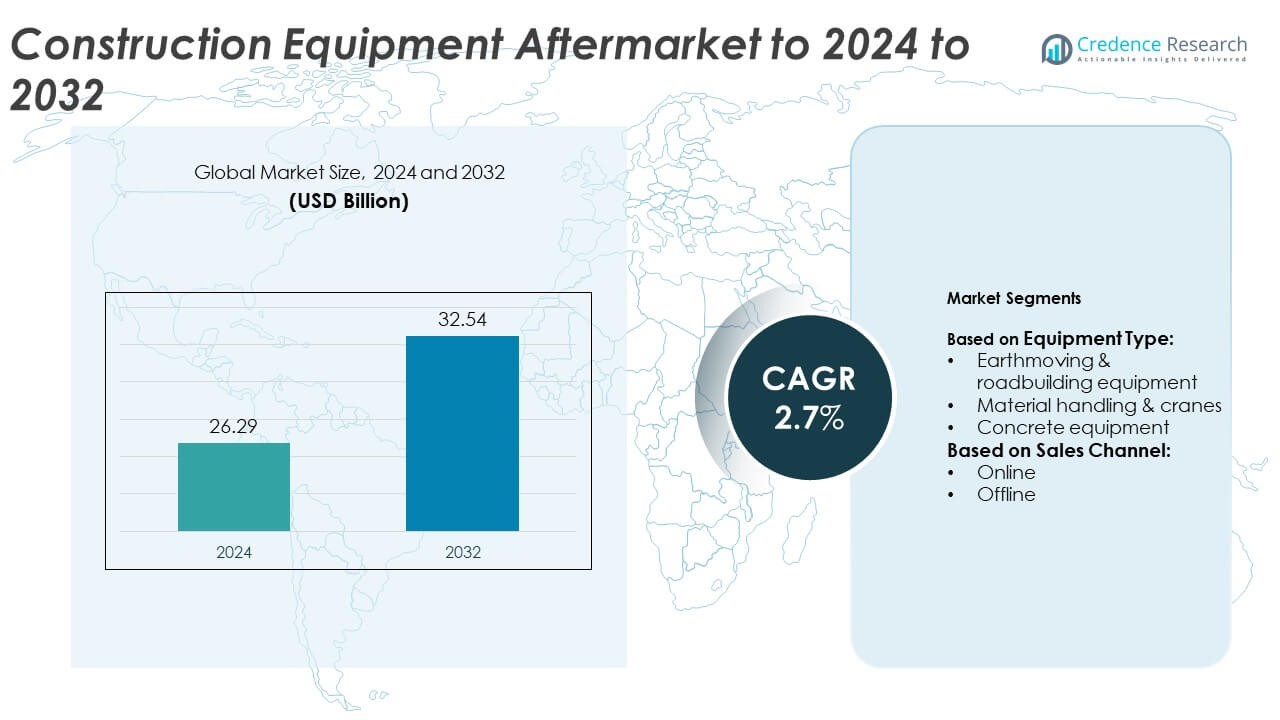

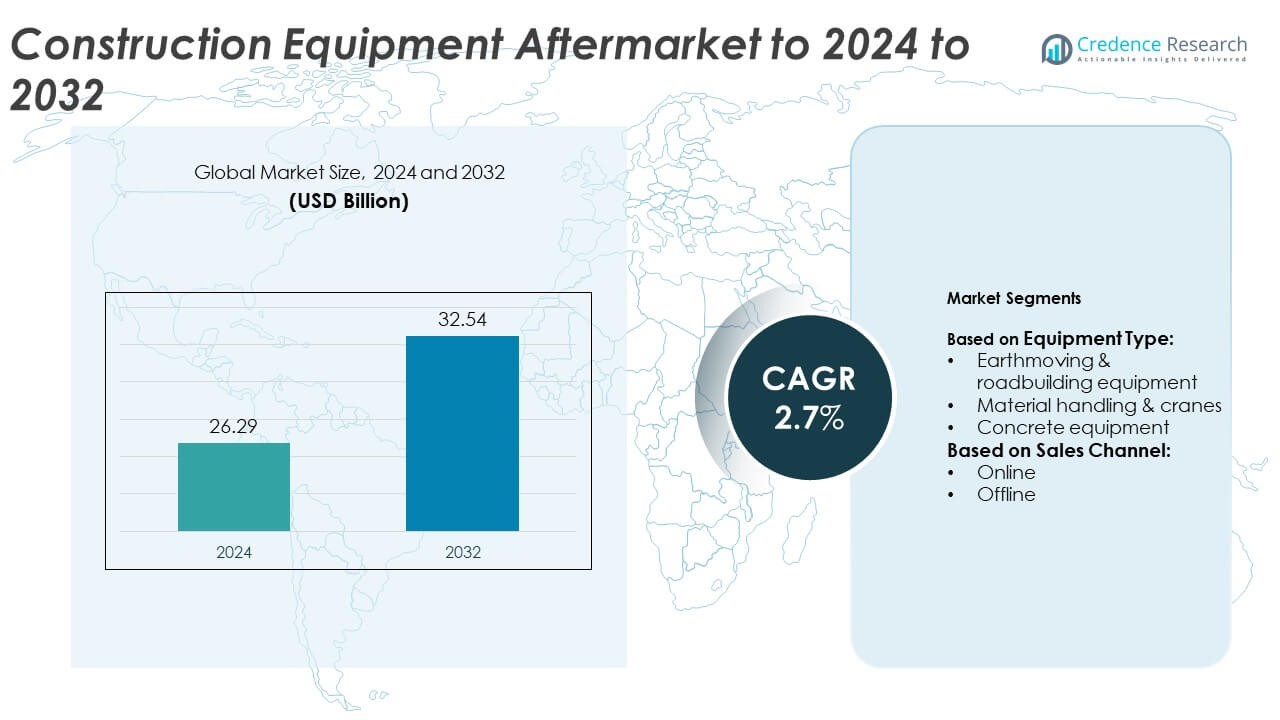

Construction Equipment Aftermarket size was valued at USD 26.29 Billion in 2024 and is anticipated to reach USD 32.54 Billion by 2032, at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Aftermarket Market Size 2024 |

USD 26.29 Billion |

| Construction Equipment Aftermarket Market , CAGR |

2.7% |

| Construction Equipment Aftermarket Market Size 2032 |

USD 32.54 Billion |

The Construction Equipment Aftermarket Market is dominated by global leaders such as Caterpillar, Komatsu Ltd., Liebherr Group, Volvo Construction Equipment, SANY Group, Terex Corporation, Tadano Ltd., XCMG Group, The Manitowoc Company Inc., and Zoomlion Heavy Industry Science and Technology Co., Ltd. These companies focus on expanding service networks, digital aftermarket platforms, and predictive maintenance technologies to enhance equipment lifecycle performance. North America led the market with a 34% share in 2024, supported by aging machinery fleets and advanced telematics adoption. Europe and Asia-Pacific followed closely, driven by large-scale infrastructure projects, strong OEM presence, and increasing investments in component remanufacturing and sustainable maintenance practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Equipment Aftermarket market was valued at USD 26.29 billion in 2024 and is expected to reach USD 32.54 billion by 2032, growing at a CAGR of 2.7%.

- Increasing equipment utilization and aging fleets are driving aftermarket demand, supported by infrastructure expansion and ongoing construction projects worldwide.

- Key trends include the adoption of predictive maintenance, telematics-based diagnostics, and growth in digital parts distribution platforms.

- The market is competitive, with major players focusing on service expansion, remanufacturing programs, and long-term maintenance contracts to strengthen brand loyalty.

- North America led the market with a 34% share, followed by Europe at 27% and Asia-Pacific at 28%, while the earthmoving and roadbuilding segment dominated the equipment type category in 2024.

Market Segmentation Analysis:

By Equipment Type

The earthmoving and roadbuilding equipment segment dominated the Construction Equipment Aftermarket in 2024, accounting for over 45% of the total share. This dominance is due to the high replacement demand for components in excavators, loaders, and graders used in mining and infrastructure projects. Continuous wear of hydraulic systems and undercarriage parts drives strong aftermarket sales, Caterpillar supplied replacement parts globally for its earthmoving line, supporting consistent service revenue through dealer networks and digital maintenance platforms.

- For instance, SENNEBOGEN supports over 180 sales partners and 300+ service stations worldwide, sustaining fast parts replacement for earthmoving fleets.

By Sales Channel

The offline sales channel held the largest market share in 2024, representing nearly 70% of total aftermarket revenue. This segment benefits from customers’ preference for authorized service centers and OEM-certified dealers for component reliability and warranty support. Heavy equipment users rely on in-person diagnostics and immediate part availability, Komatsu’s global dealer network operates authorized service outlets, ensuring rapid part replacement and technical assistance across key markets such as North America and Asia-Pacific.

- For instance, Manitou distributes its equipment and services through a certified network of 800 independent dealers across more than 140 countries.

Key Growth Drivers

Rising Equipment Utilization and Aging Fleet

The expanding global construction fleet and extended equipment lifecycles are driving aftermarket demand. Older machinery requires frequent component replacements, particularly hydraulic parts, filters, and drivetrain systems. Contractors prefer refurbishing equipment over new purchases to control operational costs, Volvo Construction Equipment in 2024 came from maintenance of machines over five years old, reflecting strong dependence on aftermarket solutions for aging fleets.

- For instance, Epiroc has a strong demand for its aftermarket support and services, with Epiroc’s annual report for 2024 showing that the circular service offering grew strongly by 19%.In Q4 2024, Epiroc reported record-high revenues of 17,251 million SEK, with aftermarket support contributing significantly to the company’s overall performance in 2024.

Infrastructure Development and Urbanization Projects

Massive public infrastructure and housing initiatives are boosting demand for construction equipment services. Governments in Asia-Pacific and North America are investing in roadbuilding, metro systems, and renewable projects, increasing the wear and tear on heavy machinery, Komatsu’s service division recorded growth in replacement part orders from infrastructure projects in India and the U.S., highlighting how ongoing urbanization directly supports aftermarket growth.

- For instance, SANY’s Africa business grew 44% in 2024, reflecting strong equipment use on regional infrastructure programs.

Adoption of Predictive Maintenance Technologies

Integration of telematics and IoT-based systems enhances equipment monitoring and predictive part replacement. Fleet owners use real-time data to identify wear patterns and schedule timely maintenance, improving uptime and reducing breakdowns, John Deere’s JDLink platform tracked connected machines in 2024, enabling automated alerts for component replacement and driving a steady rise in aftermarket service subscriptions.

Key Trends & Opportunities

Digitalization and E-Commerce Expansion

The rise of digital platforms is transforming aftermarket parts distribution. OEMs and independent suppliers are adopting online portals for easier ordering and faster delivery. E-commerce channels improve customer accessibility and enable direct-to-end-user sales. Caterpillar’s Parts.Cat.Com platform handled online orders in 2024, reducing procurement time and expanding its global aftermarket footprint through digital logistics.

- For instance, XCMG’s Xrea platform manages over 700,000 connected 5G networking devices, supporting remote diagnostics and parts planning.

Sustainability and Component Re-Manufacturing

Growing environmental focus is driving adoption of remanufactured and recyclable components. Manufacturers are investing in circular economy models to reduce waste and lower repair costs. CNH Industrial’s Reman program recovered used components in 2024, cutting raw material consumption while offering cost-effective alternatives to new parts, thus creating new aftermarket opportunities in eco-efficient operations.

- For instance, Liebherr Reman cuts raw material and energy use by up to 75%, reducing lifecycle impacts for replacement components.

Key Challenges

Price Volatility of Raw Materials

Fluctuations in steel, aluminum, and rubber prices raise the cost of spare parts and repair components. OEMs struggle to maintain stable pricing amid supply chain disruptions and geopolitical tensions. Hitachi Construction Machinery r increase in production costs in 2024 due to steel price hikes, affecting aftermarket profitability and forcing customers to delay non-critical maintenance activities.

Competition from Unorganized Local Suppliers

The aftermarket faces growing pressure from low-cost regional suppliers offering non-OEM parts. These suppliers attract price-sensitive buyers, particularly in developing markets, undermining OEM revenue streams, local manufacturers in Southeast Asia captured the independent parts supply market in 2024, challenging major brands like Caterpillar and Komatsu to enhance warranty-based loyalty programs and value-added services.

Regional Analysis

North America

North America held the largest share of 34% in the Construction Equipment Aftermarket in 2024. The region benefits from a well-established infrastructure sector, aging machinery fleet, and high adoption of telematics-based maintenance systems. Strong presence of OEMs such as Caterpillar, John Deere, and CNH Industrial supports steady replacement part sales. Frequent road maintenance and commercial construction projects in the U.S. and Canada sustain aftermarket service demand. Additionally, digital parts distribution networks and authorized service centers enhance accessibility, driving consistent growth in preventive maintenance and component refurbishment services across the region.

Europe

Europe accounted for 27% of the Construction Equipment Aftermarket in 2024. The market growth is supported by advanced equipment technologies, strict emission standards, and rising demand for sustainable component remanufacturing. The presence of major OEMs like Volvo Construction Equipment, Liebherr, and Wirtgen Group strengthens regional service networks. Increasing investments in urban infrastructure modernization and green building projects promote equipment utilization, boosting part replacement cycles. Additionally, the European Union’s emphasis on circular economy practices encourages the reuse of engine components and hydraulic systems, helping OEMs maintain strong aftermarket revenues.

Asia-Pacific

Asia-Pacific captured a 28% share of the Construction Equipment Aftermarket in 2024, driven by rapid industrialization and large-scale infrastructure projects. Countries such as China, India, and Japan are investing heavily in transport, urban development, and energy sectors, leading to continuous equipment operation and higher maintenance demand. Local manufacturing bases and expanding dealer networks by Komatsu, Hitachi, and SANY support strong aftermarket accessibility. The growing use of connected service platforms enhances predictive maintenance efficiency, while competitive pricing strategies from regional suppliers further boost market expansion across construction-intensive economies.

Latin America

Latin America held an 8% share of the Construction Equipment Aftermarket in 2024. The region benefits from ongoing mining and road construction activities across Brazil, Chile, and Mexico. Demand for replacement components is increasing due to frequent wear in earthmoving and material handling machinery. However, supply chain inefficiencies and import dependency affect part availability. OEMs are investing in local service hubs and training centers to improve equipment uptime. Rising adoption of refurbished parts and fleet maintenance contracts contributes to steady aftermarket development in mid-sized construction firms.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the Construction Equipment Aftermarket in 2024. Expanding construction projects, particularly in the Gulf Cooperation Council countries, drive consistent part replacement demand. Large infrastructure investments in Saudi Arabia’s Vision 2030 and the UAE’s transport initiatives sustain high fleet utilization. Meanwhile, African economies like South Africa and Nigeria are witnessing growing demand for road and mining equipment maintenance. OEMs are strengthening regional partnerships to improve service reach and ensure reliable aftermarket support, addressing logistical and technical challenges in remote project locations.

Market Segmentations:

By Equipment Type:

- Earthmoving & roadbuilding equipment

- Material handling & cranes

- Concrete equipment

By Sales Channel:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Equipment Aftermarket features a competitive landscape led by Caterpillar, Inc., Liebherr Group, Komatsu Ltd., Terex Corporation, SANY Group, Volvo Construction Equipment, Tadano Ltd., XCMG Group, The Manitowoc Company Inc., and Zoomlion Heavy Industry Science and Technology Co., Ltd. Competition is driven by extensive service networks, advanced telematics integration, and growing focus on predictive maintenance solutions. Leading OEMs are investing in digital platforms and connected service technologies to enhance equipment lifecycle management and improve customer retention. The market also sees increasing adoption of remanufactured and eco-friendly components as sustainability becomes a key differentiator. Regional suppliers are expanding their aftermarket presence through competitive pricing and localized service hubs. Companies are focusing on long-term maintenance contracts, operator training programs, and remote diagnostics to strengthen aftermarket loyalty. Strategic collaborations and R&D investments in smart maintenance tools continue to shape the future competitiveness of the global construction equipment aftermarket.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Volvo Construction Equipment (Volvo CE) Investing approximately 2,500 MSEK (about $261 million) to expand global crawler excavator production across key sites, including Changwon (South Korea), Shippensburg (US), and Sweden, to meet growing customer demands and mitigate supply chain risks

- In 2025, SANY Group Inaugurated a state-of-the-art factory in Pune, India, to enhance production capacity and localize manufacturing. This expansion positions SANY to cater to increasing domestic and overseas demand while supporting its after-sales service network.

- In 2024, Komatsu celebrated enrolling over 10,000 units of its Machine Care Program (MCP) equipment in India. The MCP is part of Komatsu’s aftermarket services strategy to ensure machine uptime and performance.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth due to rising demand for equipment maintenance and repair.

- Predictive maintenance solutions using IoT and AI will enhance equipment uptime.

- Digital sales platforms will continue replacing traditional dealer-based parts distribution.

- OEMs will expand global service networks to capture recurring aftermarket revenue.

- Remanufacturing and recycling of components will gain importance for sustainability goals.

- Fleet owners will increasingly prefer long-term service contracts for cost efficiency.

- Emerging economies will drive higher demand through rapid construction activity.

- Integration of telematics will improve monitoring and inventory planning.

- Partnerships between OEMs and local suppliers will strengthen supply chain resilience.

- Continuous innovation in material durability will reduce equipment downtime and boost productivity.