Market Overview

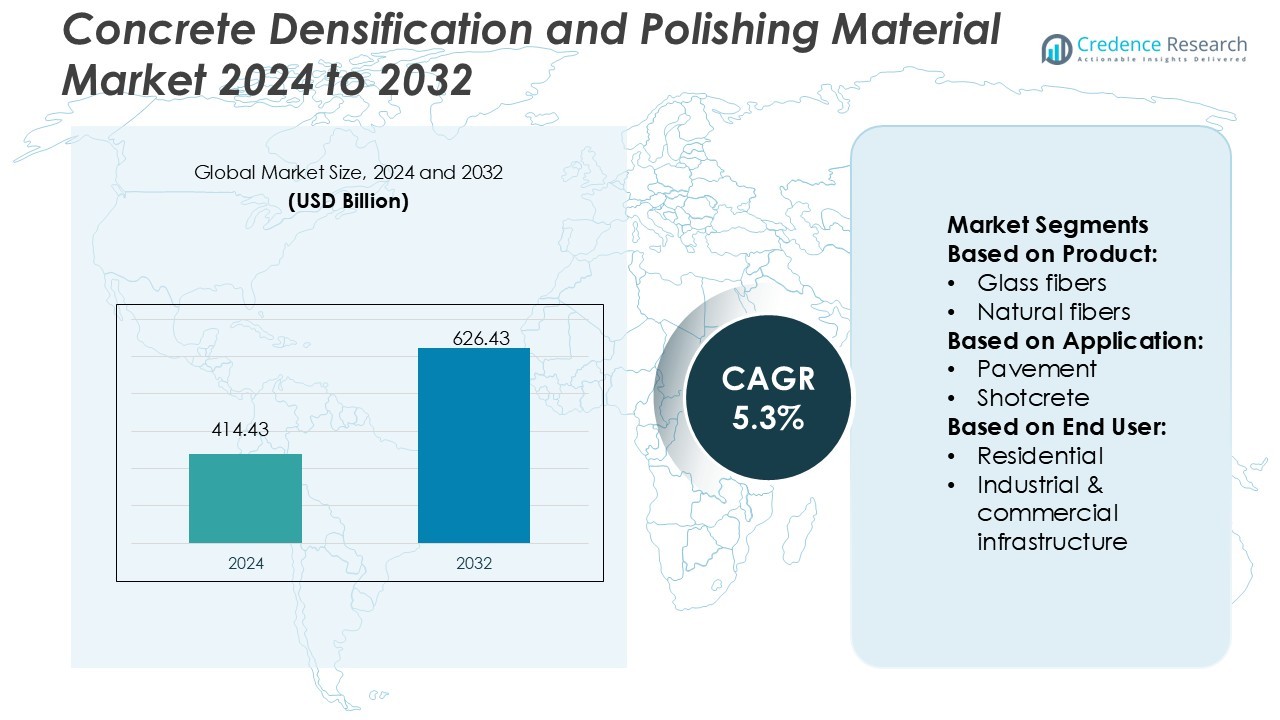

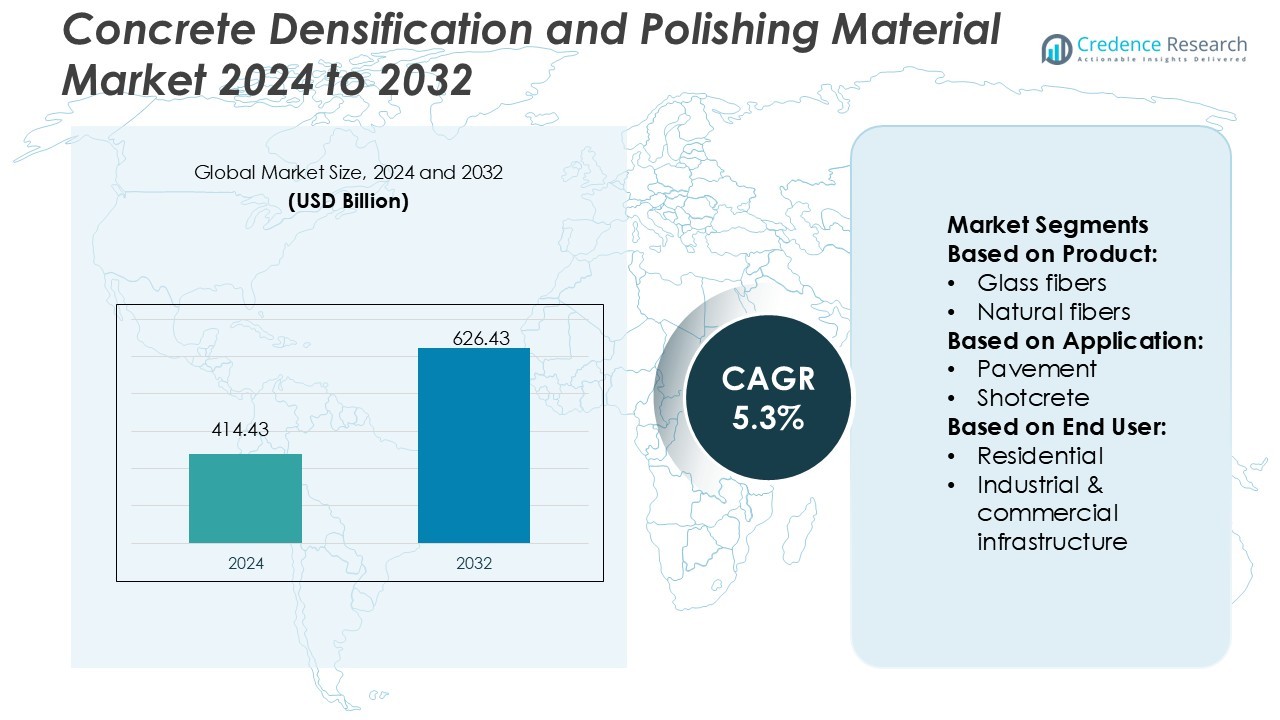

Concrete Densification and Polishing Material Market size was valued USD 414.43 billion in 2024 and is anticipated to reach USD 626.43 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Densification and Polishing Material Market Size 2024 |

USD 414.43 Billion |

| Concrete Densification and Polishing Material Market, CAGR |

5.3% |

| Concrete Densification and Polishing Material Market Size 2032 |

USD 626.43 Billion |

The Concrete Densification and Polishing Material Market is driven by leading players such as Owens Corning, The Euclid Chemical Company, Fibercon International, BASF SE, Sika AG, GCP Applied Technologies, CEMEX S.A.B. de C.V., Bekaert SA, Nycon Corporation, and ABC Polymer Industries. These companies focus on innovation, sustainable material development, and advanced surface treatment technologies to strengthen their market position. Continuous investments in R&D, fiber reinforcement, and eco-friendly densifiers have enhanced product performance and adoption across industrial and commercial sectors. Asia-Pacific leads the global market with a 36% share, supported by rapid urbanization, infrastructure expansion, and increased adoption of polished concrete flooring in smart city and industrial construction projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Concrete Densification and Polishing Material Market was valued at USD 414.43 billion in 2024 and is projected to reach USD 626.43 billion by 2032, growing at a CAGR of 5.3%.

- Rising demand for durable, low-maintenance, and energy-efficient flooring solutions is driving market expansion across industrial and commercial construction sectors.

- Technological advancements in lithium- and silicate-based densifiers and automated polishing systems are improving surface strength, finish quality, and sustainability performance.

- The market is highly competitive, with key players investing in R&D and eco-friendly innovations to expand their global presence and product portfolios.

- Asia-Pacific dominates with a 36% share, supported by large-scale infrastructure development, while the industrial and commercial segment holds the leading position due to increasing adoption of high-performance concrete flooring in logistics, retail, and manufacturing facilities.

Market Segmentation Analysis:

By Product

Steel fibers dominate the Concrete Densification and Polishing Material Market with the largest market share. Their high tensile strength, durability, and crack resistance make them ideal for industrial and commercial flooring. Demand is driven by large-scale infrastructure projects that require superior surface strength and abrasion resistance. Synthetic fibers and polypropylene are gaining popularity for lightweight construction applications due to their corrosion resistance and cost efficiency. The growing use of fiber-reinforced concrete in sustainable and high-performance construction further strengthens this segment’s growth.

- For instance, Owens Corning introduced its Advantex® AR Glass Fiber with a tensile strength of 1,700 MPa and modulus of elasticity reaching 73 GPa, specifically designed for concrete reinforcement applications.

By Application

The slabs-on-grade segment holds the leading market share due to its extensive use in warehouses, factories, and commercial spaces. These surfaces demand high strength and a polished finish for improved durability and aesthetics. Advancements in densification materials have enhanced the resistance of concrete slabs against wear, impact, and chemical exposure. Pavement and precast applications also contribute significantly, supported by growing public infrastructure investments and the increasing adoption of decorative polished concrete in urban landscapes.

- For instance, Euclid Chemical offers TUF-STRAND SF macro synthetic fibers, which can replace welded wire mesh in slabs on ground. While UL-certified for composite metal deck construction, these fibers are also used in Euclid Chemical’s “Slab on Ground” software for design per ACI 360.

By End User

The industrial and commercial infrastructure segment leads the market, driven by high demand from logistics hubs, retail complexes, and manufacturing facilities. Polished concrete offers a low-maintenance, cost-effective flooring solution with superior reflectivity and longevity. The rise of smart factories and large-scale industrial zones has fueled material adoption for both new construction and retrofit projects. Residential and road infrastructure applications are expanding steadily, supported by urbanization trends and government-led modernization initiatives in emerging economies.

Key Growth Drivers

Rising Demand for Durable and Low-Maintenance Flooring

The increasing adoption of polished concrete flooring in commercial and industrial infrastructure is a key driver. Businesses prefer concrete densification materials for their durability, cost-effectiveness, and minimal maintenance. These materials enhance surface strength, reduce porosity, and improve wear resistance, extending the floor’s lifespan. The growing popularity of energy-efficient and reflective flooring solutions in warehouses, retail stores, and factories further supports market growth, as companies prioritize long-term savings and sustainability.

- For instance, Fibercon International markets its SlabMaster® steel fiber reinforcement which can be dosed at 40 to 60 lb per cubic yard (≈ 24 to 36 kg/m³) to control cracking and curling in slabs.

Expanding Construction and Infrastructure Development

Rapid urbanization and large-scale infrastructure projects across developing economies are boosting market demand. Governments are investing heavily in roads, bridges, airports, and industrial parks that require durable concrete surfaces. Densified and polished concrete enhances load-bearing capacity, making it suitable for high-traffic areas. Additionally, the rise in smart city projects and commercial construction has created strong opportunities for manufacturers offering high-performance, eco-friendly concrete enhancement materials.

- For instance, BASF’s Glenium® SKY admixture allowed a 5,500 m³ continuous foundation pour under highly reinforced conditions, with the concrete pumped vertically up to 300 m without loss of workability.

Technological Advancements in Polishing and Densification Systems

Advancements in chemical densifiers and polishing equipment are transforming the market landscape. Modern lithium- and silicate-based densifiers offer superior hardness, dust-proofing, and faster curing times compared to traditional products. Automated polishing machines and diamond tooling technology enable precise surface finishing with reduced labor costs. These innovations improve efficiency, consistency, and aesthetic quality, driving adoption across residential, industrial, and institutional applications seeking modern, high-performance concrete surfaces.

Key Trends & Opportunities

Growing Focus on Sustainable and Green Building Materials

Sustainability is shaping procurement decisions in the construction industry. Polished concrete floors support green building certifications by eliminating coatings, reducing waste, and improving energy efficiency through higher light reflectivity. Manufacturers are developing low-VOC, non-toxic densifiers to meet environmental regulations. The shift toward eco-friendly materials aligns with corporate sustainability goals, creating significant growth opportunities for brands offering greener formulations and energy-efficient solutions for infrastructure and interior projects.

- For instance, Sika AG offers Sikafloor®-956 LD, a lithium silicate densifier that is VOC-free and non-yellowing, with a formulation that penetrates deeply to harden concrete surfaces without film formation.

Increasing Use of Decorative and Aesthetic Flooring Solutions

The demand for decorative concrete flooring is increasing across retail, hospitality, and residential sectors. Polished concrete delivers both functionality and aesthetic appeal through customizable finishes, colors, and designs. This trend is driven by consumer preference for modern, sleek interiors that combine strength with visual appeal. The expansion of architectural design projects emphasizing minimalism and luxury finishes continues to create new opportunities for innovative polishing and surface treatment technologies.

Expansion of Industrial and Logistics Facilities

The surge in e-commerce, warehousing, and manufacturing facilities has increased demand for high-durability flooring. Polished and densified concrete floors support heavy machinery, frequent traffic, and cleaning processes without surface degradation. The global rise in logistics infrastructure investments is creating opportunities for suppliers to provide specialized formulations that enhance surface strength, reduce dusting, and improve reflectivity for energy-efficient lighting.

- For instance, GCP Applied Technologies markets TOP-CAST® Top-Surface Retarder, which can expose aggregate up to 1½ in (38 mm) depth for decorative effect. The product’s coverage is about 200–300 ft² per gallon (4.9–7.4 m²/L), depending on the grade selected.

Key Challenges

High Initial Investment and Equipment Cost

Despite long-term savings, the high upfront cost of polishing machinery and densifiers poses a challenge for small contractors and developers. The need for skilled operators and advanced tools increases project expenses. Many budget-conscious projects in emerging regions still opt for cheaper alternatives like epoxy coatings or tiles. Manufacturers must address this cost barrier by offering affordable systems and scalable solutions to promote wider adoption.

Limited Awareness and Skilled Labor Shortage

Market growth is hindered by limited awareness regarding the benefits of concrete densification and polishing in developing markets. Contractors often lack technical expertise in applying advanced densifiers or achieving desired finishes. The shortage of trained professionals reduces installation quality, leading to inconsistent results. Industry players are focusing on training programs and partnerships with construction firms to improve adoption rates and ensure performance reliability.

Regional Analysis

North America

North America holds a 32% market share in the Concrete Densification and Polishing Material Market, driven by strong demand from commercial and industrial construction sectors. The United States leads the region with widespread adoption of polished concrete in warehouses, retail stores, and institutional buildings. High awareness of sustainable flooring, coupled with advanced manufacturing technologies, supports steady market expansion. Government investments in infrastructure renovation and green building initiatives further strengthen growth prospects. Canada’s growing industrial base and renovation activities also contribute to regional demand for durable and eco-friendly concrete solutions.

Europe

Europe accounts for 27% of the global market share, supported by advanced construction standards and sustainability-focused infrastructure projects. Germany, the U.K., and France are major contributors, emphasizing energy-efficient and long-lasting flooring materials. The region’s stringent regulations promoting low-emission products have accelerated adoption of lithium-based densifiers and VOC-free polishing compounds. The expanding renovation of commercial spaces and heritage buildings has also boosted demand for aesthetic and durable surfaces. European manufacturers focus on technological innovation, offering advanced polishing systems to meet the rising need for performance and visual appeal in modern architecture.

Asia-Pacific

Asia-Pacific dominates the market with a 36% share, driven by rapid urbanization, industrialization, and large-scale infrastructure projects. China, India, and Japan are major markets, supported by government-led investments in smart cities, roads, and industrial parks. The expanding construction of commercial complexes and logistics hubs further fuels demand for polished concrete surfaces. Increasing foreign investments and cost-effective labor encourage global manufacturers to expand production capacities in the region. Growing adoption of modern flooring technologies and rising awareness of energy-efficient solutions position Asia-Pacific as the fastest-growing market during the forecast period.

Latin America

Latin America captures a 3% market share, with growth led by Brazil and Mexico’s expanding construction and industrial sectors. Rising investments in commercial infrastructure and retail spaces have boosted the use of polished concrete for its cost efficiency and durability. Governments’ efforts to modernize transportation and public facilities are encouraging the use of advanced densification materials. However, limited awareness and fluctuating economic conditions restrict faster adoption. Local manufacturers are increasingly partnering with global suppliers to introduce innovative, affordable solutions suited for regional construction needs and climatic conditions.

Middle East & Africa

The Middle East & Africa region holds a 2% share, with the Gulf Cooperation Council (GCC) countries leading due to rapid urban development and megaprojects. The construction of commercial towers, airports, and industrial hubs drives demand for polished concrete surfaces with high durability and aesthetic appeal. The UAE and Saudi Arabia dominate regional consumption, emphasizing sustainable materials in line with Vision 2030 goals. Africa shows gradual growth supported by urban infrastructure projects and rising construction spending. Increasing investments in smart cities and tourism infrastructure are expected to enhance regional market penetration.

Market Segmentations:

By Product:

- Glass fibers

- Natural fibers

By Application:

By End User:

- Residential

- Industrial & commercial infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Concrete Densification and Polishing Material Market players such as Owens Corning, The Euclid Chemical Company, Fibercon International, BASF SE, Sika AG, GCP Applied Technologies, CEMEX S.A.B. de C.V., Bekaert SA, Nycon Corporation, and ABC Polymer Industries. The Concrete Densification and Polishing Material Market is highly competitive, marked by continuous innovation and technological advancement. Companies focus on developing high-performance, sustainable solutions that enhance concrete durability, strength, and surface aesthetics. Growing demand from industrial, commercial, and residential construction sectors has intensified competition, pushing manufacturers to expand their product portfolios and adopt eco-friendly formulations. Strategic partnerships, mergers, and acquisitions are common as firms aim to strengthen global distribution and production capacities. Additionally, investments in automation, nanotechnology, and low-VOC materials are reshaping the market landscape, enabling greater efficiency, cost savings, and compliance with evolving environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, ABC Polymer, LLC launched TruBuilt, the latest venture in the construction supply business. TruBuilt aims to provide a wider selection of high-quality construction materials and tools.

- In May 2024, Fosroc India inaugurated a state-of-the-art construction chemicals plant in Hyderabad, enhancing its capacity to produce concrete admixtures and other products. This facility, covering over 260,000 square feet, aims to improve service levels and expand geographical reach across South and Central India.

- In February 2024, Arkema and Sireg Geotech developed the bendable composite rebar. This is an innovative alternative to traditional steel reinforcement. Sireg’s fiberglass bars developed Glasspree TP bars by using Arkema’s Elium thermoplastic resin.

- In September 2023, Nuvoco Vistas Corp. Ltd., India’s fifth-largest cement group in terms of capacity, announced that it had been granted a patent for its revolutionary product, the ‘Fibre Reinforced Cement Composition, branded in the market as ‘Duraguard Microfiber Cement.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for durable flooring solutions.

- Adoption of eco-friendly and low-VOC densifiers will increase due to stricter environmental regulations.

- Technological advancements in polishing systems will enhance efficiency and surface quality.

- Expanding infrastructure and industrial projects will boost material consumption globally.

- The shift toward sustainable and reflective flooring will support energy-efficient building designs.

- Manufacturers will focus on developing advanced lithium and silicate-based formulations for superior performance.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization and construction activities.

- Automation and robotics in surface finishing will reduce labor dependency and improve precision.

- Strategic collaborations and acquisitions will help companies expand market presence and product reach.

- Increasing renovation and retrofitting projects will create long-term opportunities for polished concrete applications.