Market Overview:

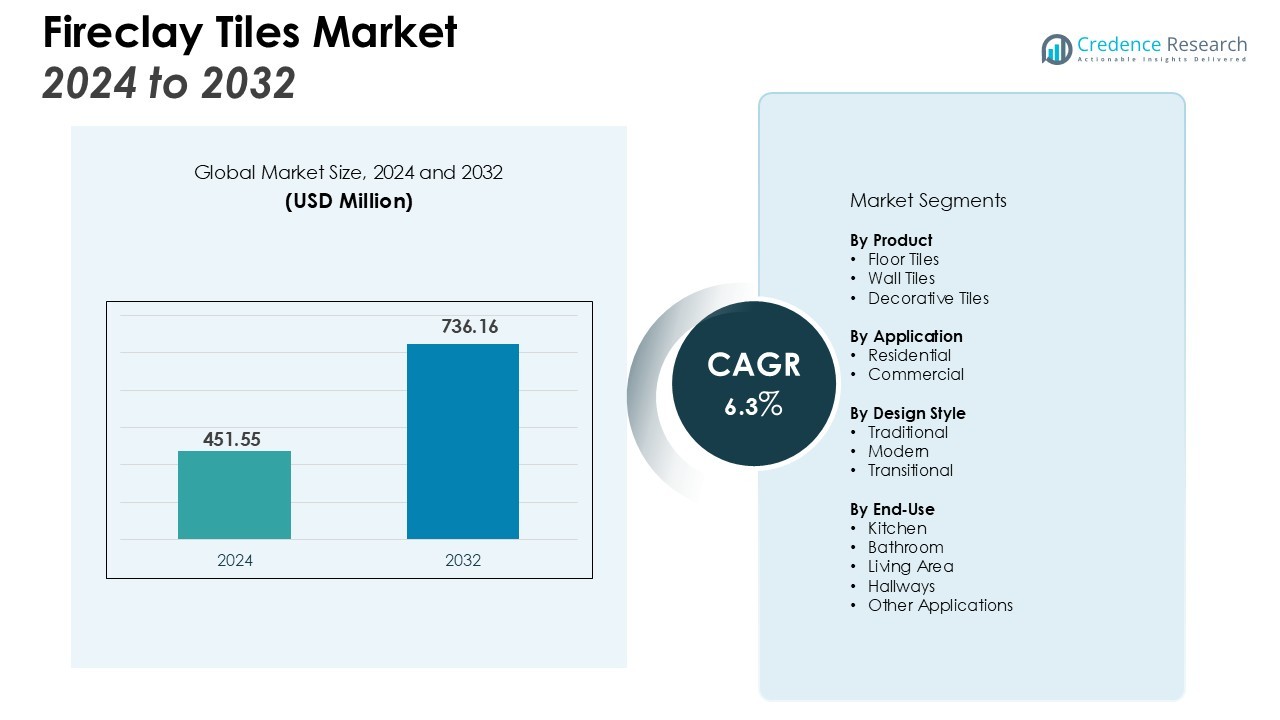

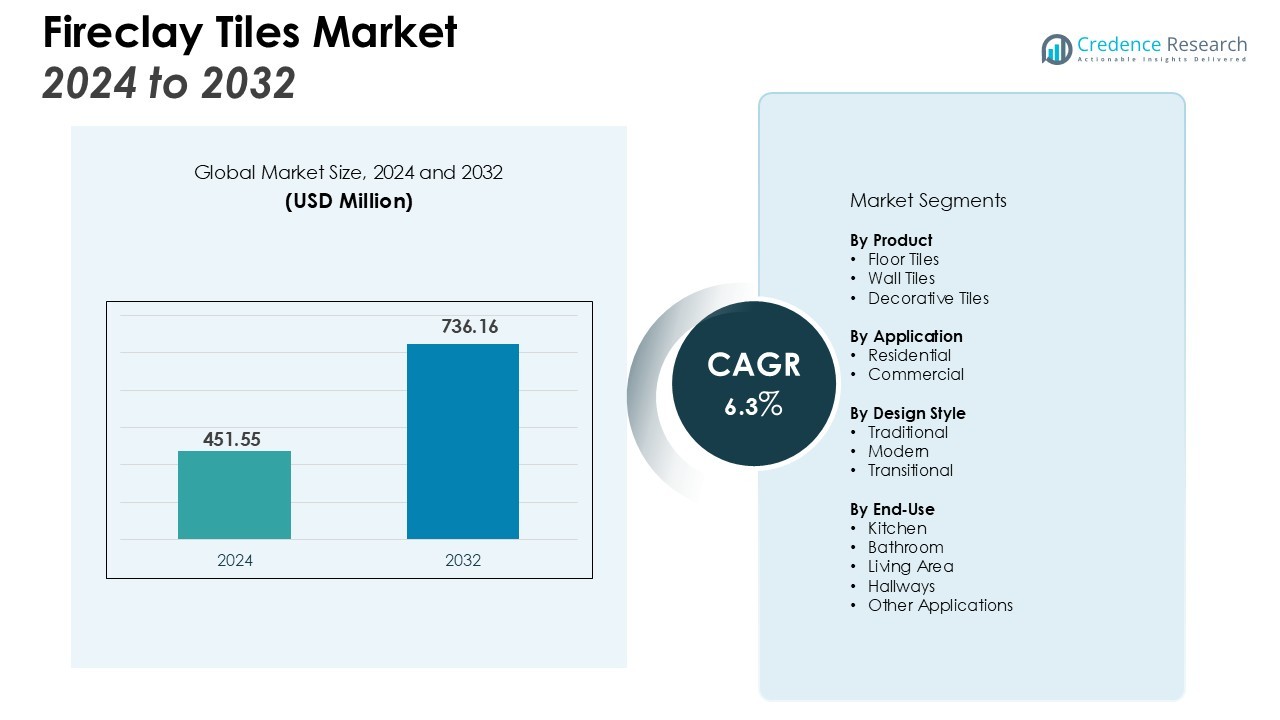

The Fireclay Tiles Market size was valued at USD 451.55 million in 2024 and is anticipated to reach USD 736.16 million by 2032, at a CAGR of 6.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fireclay Tiles Market Size 2024 |

USD 451.55 Million |

| Fireclay Tiles Market, CAGR |

6.3% |

| Fireclay Tiles Market Size 2032 |

USD 736.16 Million |

Market expansion is primarily driven by the rising demand for heat-resistant and aesthetic wall and floor applications. The growing shift toward sustainable architectural materials is supporting the adoption of fireclay tiles due to their longevity and low maintenance. Additionally, evolving consumer tastes toward artisanal finishes and customizable tile designs have boosted their appeal in both high-end homes and commercial projects.

Regionally, North America leads the market due to strong renovation activity and established tile manufacturing infrastructure. Europe follows with high demand for energy-efficient and premium residential spaces. The Asia-Pacific region is witnessing rapid growth driven by urbanization, industrial expansion, and infrastructure modernization in countries such as China and India. Emerging economies in Latin America and the Middle East are also adopting fireclay tiles for modern residential and commercial developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Fireclay Tiles Market size was valued at USD 451.55 million in 2024 and is projected to reach USD 736.16 million by 2032, registering a CAGR of 6.3% during 2024–2032.

- Market growth is driven by rising construction and renovation projects demanding heat-resistant and aesthetic wall and floor materials.

- Increasing adoption of sustainable and eco-friendly building materials strengthens demand, with fireclay tiles meeting global green certification standards.

- Advancements in design customization and artisanal craftsmanship enhance consumer preference for premium and handcrafted interiors.

- High production and energy costs challenge profitability, encouraging manufacturers to optimize kiln efficiency and adopt cleaner energy technologies.

- North America leads the global market with 38% share, followed by Europe at 32%, supported by strong renovation activities and premium housing trends.

- Asia-Pacific holds 24% share, driven by rapid urbanization and infrastructure growth in China and India, while Latin America and the Middle East & Africa collectively account for 6% through rising adoption in modern residential and commercial developments.

Market Drivers:

Rising Construction and Renovation Activities Driving Market Demand

The Fireclay Tiles Market benefits from steady growth in global construction and renovation projects. Expanding residential housing, luxury apartments, and commercial buildings create consistent demand for durable and aesthetic materials. Fireclay tiles are preferred for their resistance to heat, moisture, and wear, making them suitable for kitchens, bathrooms, and high-traffic spaces. The market also gains momentum from increasing home remodeling trends, where consumers prioritize handcrafted and sustainable tile designs. This construction-driven expansion continues to be a key catalyst for market growth.

- For instance, Fireclay Tile manufactures its products to withstand demanding applications by firing them at a temperature exceeding 2,000°F.

Growing Focus on Sustainable and Eco-Friendly Building Materials

The market experiences strong adoption due to rising awareness of environmental sustainability. Fireclay tiles are made from natural clays and recycled materials, aligning with global green building initiatives. Many construction firms prefer these tiles to meet environmental standards such as LEED certification. Their long lifecycle and recyclability reduce material waste, enhancing sustainability goals in both residential and commercial projects. This shift toward eco-friendly solutions strengthens the position of fireclay tiles in modern architecture.

Advancement in Design Customization and Aesthetic Appeal

Customization and design flexibility significantly boost market attractiveness. Manufacturers offer a broad range of colors, textures, and finishes to meet evolving architectural preferences. Consumers increasingly favor handcrafted and artisanal tiles that enhance visual appeal and uniqueness in interior design. It allows designers to integrate modern patterns with traditional craftsmanship, creating distinctive spaces. This focus on design innovation continues to drive premium adoption in upscale housing and hospitality projects.

Increasing Urbanization and Infrastructure Development Across Emerging Economies

Rapid urban expansion in developing regions supports widespread market penetration. Infrastructure growth in Asia-Pacific, Latin America, and the Middle East stimulates higher demand for premium construction materials. Governments invest heavily in residential complexes, commercial hubs, and public infrastructure, generating significant opportunities. It benefits from this trend by providing cost-efficient, durable, and aesthetically versatile tiling solutions. This ongoing urban transformation ensures long-term demand for fireclay tiles worldwide.

- For instance, RAK Ceramics is positioned to supply large-scale global projects with its substantial annual production capacity of 118 million square meters of tiles.

Market Trends:

Adoption of Digital Manufacturing and Technological Integration in Tile Production

The Fireclay Tiles Market is witnessing a major shift toward digital and automated manufacturing processes. Advanced technologies such as 3D printing, laser cutting, and computer-aided design have enhanced production efficiency and precision. These methods enable manufacturers to create complex patterns, customized shapes, and high-quality finishes that meet diverse architectural needs. It benefits from automation by improving consistency, reducing waste, and ensuring higher throughput. Companies are also investing in digital glazing systems and eco-efficient kilns to lower emissions and energy costs. This trend highlights a strong alignment between technology adoption and sustainability, setting new quality standards for modern tile production.

- For instance, in its 2024 sustainability report, Fireclay Tile documented its total 2023 greenhouse gas emissions at 11,974 tCO2e and is actively implementing a heat recovery system to further reduce its carbon footprint.

Growing Influence of Interior Design Trends and Premium Home Aesthetics

Consumer preferences for personalized and visually distinctive interiors continue to shape the market landscape. Rising demand for handcrafted, textured, and matte-finish tiles reflects a shift toward authenticity and artisanal value. Designers and homeowners increasingly favor tiles with bold colors, natural tones, and vintage-inspired aesthetics that enhance spatial character. It benefits from collaborations between manufacturers and design professionals focused on bespoke collections and limited-edition offerings. Global lifestyle shifts, including home renovation and remote work culture, further strengthen focus on aesthetic living spaces. This design-led evolution reinforces the market’s premium positioning and drives consistent innovation across product portfolios.

- For instance, in September 2025, Ann Sacks expanded its collaboration with designer Kelly Wearstler, introducing five unique new patterns to the acclaimed Liaison stone tile collection.

Market Challenges Analysis:

High Production Costs and Energy-Intensive Manufacturing Processes

The Fireclay Tiles Market faces a significant challenge due to high production and energy costs. Manufacturing fireclay tiles requires sustained high-temperature firing, which demands considerable fuel consumption and increases operational expenses. Fluctuating prices of raw materials such as fireclay and natural gas further strain profitability. It also faces competition from alternative materials that offer similar aesthetics at lower costs. These factors compel manufacturers to optimize kiln efficiency and adopt cleaner energy sources. Without process modernization, production sustainability and price competitiveness may remain limited in the long term.

Supply Chain Disruptions and Limited Availability of Skilled Labor

Global supply chain disruptions continue to hinder consistent raw material supply and delivery schedules. Limited availability of skilled artisans affects the ability to maintain quality craftsmanship in handmade tile production. It encounters challenges in scaling production without compromising quality standards. Transportation delays and logistics inefficiencies also contribute to longer lead times and higher costs. The shortage of specialized workers impacts innovation and precision in tile finishing. Addressing these operational barriers is essential for ensuring stable market performance and meeting the growing global demand for fireclay tiles.

Market Opportunities:

Expansion of Green Building Projects and Sustainable Construction Practices

The Fireclay Tiles Market holds strong potential within the expanding green building sector. Growing adoption of sustainable construction practices supports higher demand for eco-friendly and recyclable materials. Fireclay tiles meet these standards through natural clay composition and long product lifecycles that reduce environmental impact. It can benefit from government incentives promoting green certification and energy-efficient infrastructure. Architects and builders increasingly prefer fireclay tiles for LEED-compliant projects due to their durability and thermal resistance. This trend creates significant opportunities for manufacturers to align with sustainability goals and strengthen their market presence.

Rising Demand for Premium Interior Design and Custom Architectural Solutions

Growing interest in premium and personalized home interiors is opening new avenues for market expansion. Consumers seek handcrafted, design-rich tiles that enhance visual appeal and convey uniqueness. It benefits from collaborations between tile makers and design studios offering tailored color palettes and patterns. Increasing investments in luxury residential and hospitality sectors create steady demand for customized tiling solutions. The market also finds new growth prospects in e-commerce platforms that expand product accessibility. This focus on high-end, design-oriented spaces continues to redefine consumer engagement and supports long-term revenue potential.

Market Segmentation Analysis:

By Product

The Fireclay Tiles Market is segmented by product type into floor tiles, wall tiles, and others. Wall tiles dominate due to their aesthetic appeal and durability in kitchens and bathrooms. They offer heat and moisture resistance, making them ideal for high-traffic areas. Floor tiles are increasingly popular for their resilience and versatility, suitable for both residential and commercial spaces. Other products, including decorative tiles, are gaining traction in niche markets, driven by consumer preference for unique and customized designs.

- For instance, Fireclay Tile’s recycled clay body tiles feature a breaking strength of 393 pounds per foot, providing enhanced durability ideal for high-traffic flooring applications.

By Application

The market is segmented by application into residential and commercial uses. Residential applications hold a significant share, driven by growing demand for luxury home renovations and new builds. Kitchens, bathrooms, and living areas benefit from fireclay tiles’ durability and aesthetic qualities. The commercial sector is expanding as hotels, restaurants, and retail spaces seek high-performance, visually appealing materials for flooring and wall coverings. This trend is especially prominent in the hospitality industry, where aesthetics play a crucial role in customer experience.

- For instance, to address safety in commercial environments, Fireclay Tile provides slip-resistant tiles with a Dynamic Coefficient of Friction (DCOF) value exceeding 0.42, meeting the standard for surfaces expected to be walked on when wet.

By Design Style

Fireclay tiles are available in various design styles, including traditional, modern, and transitional. Traditional designs, with their handcrafted appeal and classic patterns, are highly favored in upscale homes. Modern designs cater to contemporary tastes, offering sleek, minimalistic aesthetics. Transitional styles combine elements from both traditional and modern design, appealing to a broader consumer base. It benefits from these diverse design trends, with demand increasing for both artisanal finishes and customizable designs tailored to individual tastes.

Segmentations:

By Product

- Floor Tiles

- Wall Tiles

- Decorative Tiles

By Application

By Design Style

- Traditional

- Modern

- Transitional

By End-Use

- Kitchen

- Bathroom

- Living Area

- Hallways

- Other Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Maintaining Strong Market Leadership

North America holds 38% share of the global Fireclay Tiles Market, while Europe accounts for 32%. The regions lead due to extensive renovation activities, advanced manufacturing capabilities, and strong demand for sustainable materials. The United States and Germany remain key contributors driven by mature construction sectors and consumer preference for premium interior designs. It benefits from strict environmental policies encouraging eco-friendly and recyclable materials in architecture. Rising investments in home remodeling and commercial refurbishments sustain long-term growth. The focus on craftsmanship and handmade aesthetics continues to reinforce the premium position of fireclay tiles across both regions.

Rapid Urbanization Driving Expansion Across Asia-Pacific

Asia-Pacific captures 24% share of the global Fireclay Tiles Market, supported by rapid urbanization and infrastructure expansion. China, India, and Japan lead growth due to rising middle-class populations and government-backed housing initiatives. It experiences increasing adoption in residential and commercial projects focused on durability and design value. Demand for energy-efficient and sustainable materials aligns with regional construction trends. Technological advancements and expanding domestic manufacturing capacities enhance competitiveness. Continuous infrastructure development and urban growth position Asia-Pacific as a primary contributor to future market expansion.

Emerging Demand Across Latin America and the Middle East & Africa

Latin America and the Middle East & Africa collectively account for 6% share of the global Fireclay Tiles Market. Brazil, the UAE, and Saudi Arabia represent key growth areas driven by luxury housing projects and commercial developments. It gains visibility through increased awareness of climate-resilient and eco-conscious building materials. Expanding infrastructure and urban revitalization efforts are creating opportunities for wider product adoption. Rising consumer interest in durable, design-focused tiles supports gradual market penetration. Government-backed construction investments further strengthen long-term growth potential in these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Fireclay Tiles Market is highly competitive, with key players focused on innovation, product quality, and sustainability. Leading manufacturers are investing in advanced manufacturing technologies, such as digital tile printing and 3D design, to offer customized and premium products. Companies are emphasizing eco-friendly production processes, aligning with growing consumer demand for sustainable materials. North America and Europe dominate the market, where established players leverage strong brand presence and extensive distribution networks. The market is also witnessing the entry of smaller, artisanal producers offering unique handcrafted designs that cater to niche markets. Price competition from alternative tiling materials, such as porcelain and ceramic, presents a challenge to fireclay tile producers. To maintain market leadership, companies are focusing on improving manufacturing efficiency, reducing energy consumption, and expanding product portfolios. Strategic partnerships with designers and architects help expand market reach and strengthen brand visibility.

Recent Developments:

- In May 2025, Fireclay Tile reintroduced its Original Ceramic Tile collection, updating the color palette and offering each shade in both a gloss and a slip-resistant matte finish.

- In February 2025, Shaw Floors introduced its early 2025 resilient product line, which featured new designs in its Floorté Classic and Floorté Pro series and debuted new flex and loose lay flooring options.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Design Style, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable building materials will continue to drive fireclay tiles adoption in residential and commercial projects.

- Increasing urbanization in emerging economies, particularly in Asia-Pacific, will contribute to higher demand for premium construction materials.

- Advancements in design customization and manufacturing technologies will enhance product offerings, appealing to a broader consumer base.

- The market will see continued growth in luxury and high-end residential renovations, as consumers increasingly seek artisanal and unique finishes.

- Commercial projects, particularly in the hospitality and retail sectors, will adopt fireclay tiles for their durability and aesthetic appeal.

- Rising awareness of eco-friendly materials and green building certifications will strengthen fireclay tiles’ position in sustainable architecture.

- Technological innovations, such as 3D printing and digital tile manufacturing, will enable more intricate designs and faster production.

- Increasing investments in energy-efficient production methods will help mitigate high manufacturing costs, supporting market competitiveness.

- Growing demand for heat-resistant and moisture-resistant materials in high-traffic areas will drive fireclay tile usage in kitchens and bathrooms.

- The market will expand through new product offerings, such as customized tiles, catering to both residential and commercial clients seeking personalized design solutions.