Market Overview

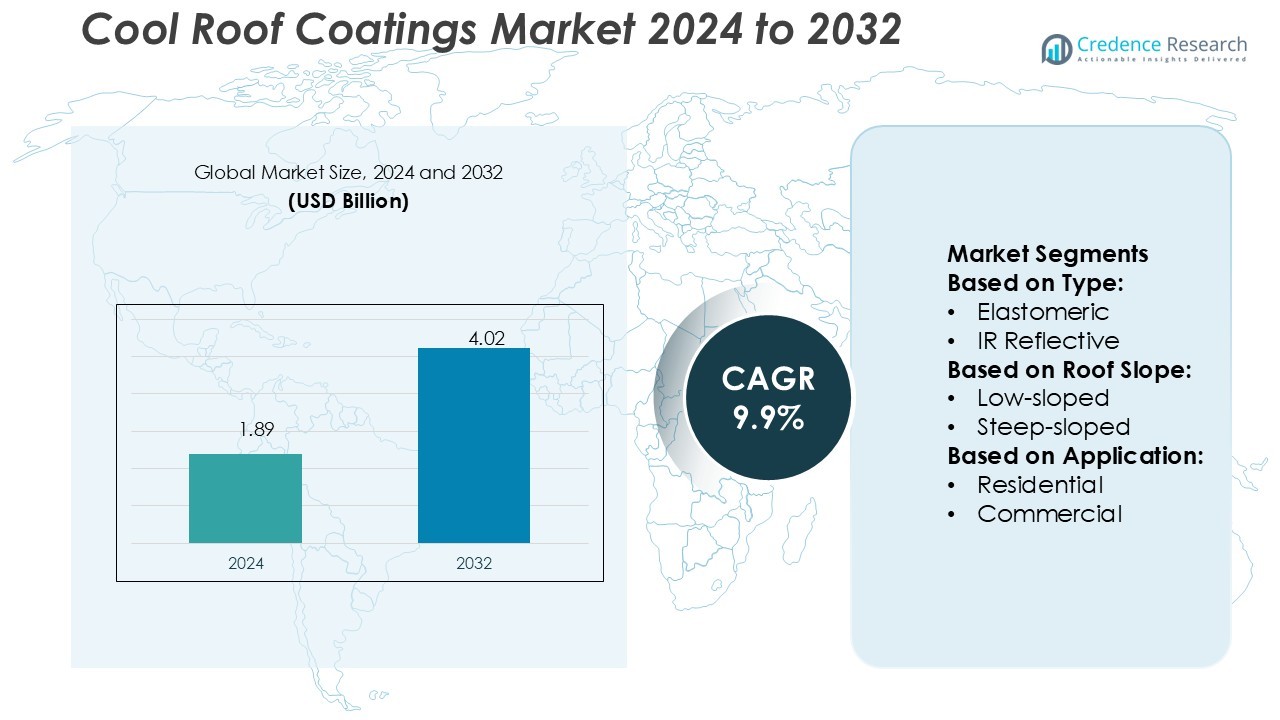

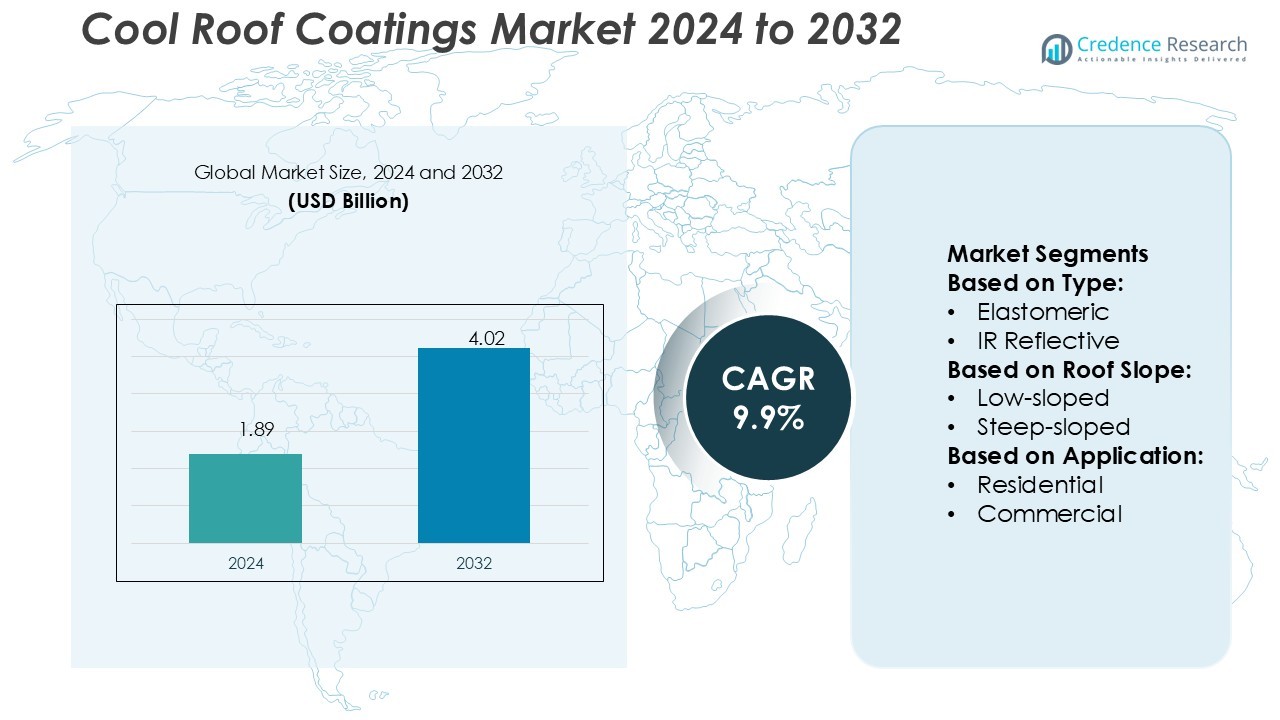

Cool Roof Coatings Market size was valued USD 1.89 billion in 2024 and is anticipated to reach USD 4.02 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cool Roof Coatings Market Size 2024 |

USD 1.89 Billion |

| Cool Roof Coatings Market, CAGR |

9.9% |

| Cool Roof Coatings Market Size 2032 |

USD 4.02 Billion |

The Cool Roof Coatings Market is characterized by strong competition among top players, including Monarch Industrial Products India Private Limited, Huntsman International LLC, Indian Insulation & Engineering, NuTech Paint, Valspar, Excel Coatings, PPG Industries, Inc., NIPPON PAINT (M) SDN. BHD., KST Coatings, and Sika AG. These companies focus on advanced product formulations, reflective coating technologies, and eco-friendly solutions to meet rising energy efficiency standards. Strategic partnerships and expansion of distribution networks are central to their growth strategies. Asia Pacific leads the global market with a 31% share, supported by rapid urbanization, increasing infrastructure projects, and government incentives promoting energy-efficient buildings. The region’s climate conditions and strong policy support make it a key hub for cool roof adoption and innovation. This leadership position is further strengthened by expanding commercial applications and continuous product development efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cool Roof Coatings Market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 4.02 billion by 2032, growing at a CAGR of 9.9%.

- Growing demand for energy-efficient buildings and stricter green building regulations are key drivers boosting product adoption.

- Reflective coating technologies and eco-friendly formulations are shaping market trends, with strong investments in R&D and sustainable solutions.

- The market remains competitive with top players focusing on strategic partnerships, capacity expansions, and distribution network strengthening to increase global reach.

- Asia Pacific leads the market with a 31% regional share, supported by large infrastructure projects, while elastomeric coatings hold the dominant segment share due to their high durability and energy-saving performance.

Market Segmentation Analysis:

By Type

Elastomeric coatings dominate the cool roof coatings market with a 58% share. Their strong market position comes from excellent waterproofing, flexibility, and UV resistance. Elastomeric coatings perform well under temperature changes and reduce thermal expansion damage. They are widely adopted for retrofitting projects due to cost-effectiveness and long service life. IR reflective coatings are growing steadily as governments promote energy-efficient solutions and green building standards. The rising need for sustainable roofing in urban areas supports this segment’s growth.

- For instance, Huntsman’s THERMO-FLEX 1000 acrylic elastomeric coating shows an initial solar reflectance of 0.85 and an aged reflectance of 0.78, with thermal emittance of 0.89.

By Roof Slope

Low-sloped roofs account for 63% of the market share. They are commonly used in commercial and industrial buildings, which require effective heat reflection and waterproofing. Low-sloped surfaces benefit the most from reflective coatings, reducing interior cooling loads and energy bills. Their large surface area also boosts coating efficiency. Steep-sloped roofs, often found in residential buildings, are gaining traction due to rising interest in energy-efficient housing. However, their total market share remains smaller due to limited roof surface coverage.

- For instance, Indian Insulation’s COOLROOF® coating has a solar reflectance of 0.95 and emissivity of 0.91, and achieves a Solar Reflective Index (SRI) of 122 as tested per ASTM/LEED standards.

By Application

Commercial applications lead the market with a 41% share. The dominance comes from large building footprints, strict energy regulations, and high ROI from energy savings. Cool roof coatings in commercial buildings help meet green certification standards and reduce HVAC demand. Industrial facilities also show strong adoption, driven by durability and operational cost reduction goals. Residential use is rising, supported by government incentives and growing consumer awareness. Institutional and other applications contribute moderately but offer strong potential for future expansion.

Key Growth Drivers

Rising Demand for Energy-Efficient Roofing Solutions

Growing energy costs and environmental concerns drive the adoption of cool roof coatings. These coatings reflect solar radiation, reducing heat absorption and lowering air conditioning use in buildings. Government programs like ENERGY STAR and LEED certifications encourage their use in commercial and residential projects. Real estate developers and industrial users are investing in reflective solutions to meet sustainability goals. The growing focus on net-zero energy buildings is pushing coating manufacturers to develop advanced formulations with better thermal reflectivity and longer durability.

- For instance, Valspar’s solar reflective (SR) coatings offer solar reflectance values from 0.25 up to 0.85, with most coatings achieving emissivity around 0.90, per Valspar’s “Green Design by Valspar” documentation.

Increasing Urban Heat Island Mitigation Initiatives

Expanding urbanization has intensified heat island effects in cities, increasing demand for heat-reducing solutions. Cool roof coatings help lower surface temperatures, reducing overall urban heat buildup. Municipal policies in major cities support cool roofing as a sustainable strategy to improve air quality and comfort. Builders use reflective coatings to comply with green construction standards. Rising public awareness of heat resilience and climate adaptation further strengthens the demand for these coatings across both developed and emerging economies.

- For instance, Excel Coatings’ Excel CoolCoat® reflects 90% of infrared rays and 85% of ultraviolet rays, according to product documentation. The manufacturer reports test results showing that under 40°C ambient conditions, the coating can reduce roof surface temperature.

Supportive Government Policies and Incentives

Many governments offer incentives and regulatory frameworks to encourage energy-saving technologies. Rebates, tax credits, and green building mandates are making cool roof coatings more attractive to property owners. Energy codes like ASHRAE 90.1 and local building standards in North America and Europe emphasize reflective roofing solutions. Policy-driven adoption boosts large-scale deployment in commercial and public infrastructure. This regulatory support motivates manufacturers to expand capacity and launch high-performance, cost-effective coating products.

Key Trends & Opportunities

Advancements in Reflective Coating Technologies

Manufacturers are investing in advanced nanotechnology and polymer blends to improve reflectivity and durability. Modern cool roof coatings offer improved solar reflectance index (SRI) values and longer service life. These innovations reduce maintenance needs and increase energy savings. Partnerships between coating companies and construction firms are enabling large-scale smart city projects. These technological upgrades open new opportunities in industrial and large commercial building applications.

- For instance, Nippon Paint’s Roofpaint is a 100% acrylic emulsion coating with a specified dry film thickness of 40–50 µm and a wet film thickness of 90–100 µm.

Rising Green Building Certifications and Awareness

Green certifications such as LEED, BREEAM, and IGBC are driving the preference for sustainable materials. Cool roof coatings align well with green building credits and energy-saving benchmarks. Builders and developers are adopting reflective solutions to improve project value and comply with environmental standards. This trend creates strong growth potential in urban construction projects. Expanding certification programs in Asia-Pacific and the Middle East present new market entry opportunities for global players.

- For instance, Sika’s Cool Roof Solutions include membranes and coatings with initial Solar Reflectance Index (SRI) values exceeding 110, and aged SRI values above 82, per Sika’s product literature.

Expansion into Emerging Economies

Emerging markets with rapid infrastructure development are adopting cool roof solutions to improve energy efficiency. Governments in Asia-Pacific, Africa, and Latin America are launching programs to support sustainable construction. Industrial zones and residential complexes in these regions are early adopters. Manufacturers expanding their distribution networks and localized production gain a competitive advantage. This expansion drives market penetration and supports long-term growth.

Key Challenges

High Initial Costs and Awareness Gaps

Despite long-term savings, cool roof coatings require higher upfront investment compared to conventional options. Many small property owners lack awareness of energy benefits, slowing adoption. Limited access to financing and incentives in developing regions adds to the challenge. Builders may opt for cheaper alternatives despite lower energy performance. Bridging this knowledge gap through education and subsidy programs remains critical.

Performance Limitations in Extreme Conditions

Cool roof coatings face challenges in regions with high dust accumulation, heavy rainfall, or extreme weather. Coating degradation reduces reflectivity and thermal performance over time. Frequent maintenance or reapplication raises operational costs, deterring users. Technical advancements are needed to improve durability under harsh climatic conditions. Addressing these performance gaps will be key to ensuring market competitiveness and broader adoption.

Regional Analysis

North America

North America holds a 34% share of the cool roof coatings market, driven by strict building energy codes and sustainability mandates. The U.S. dominates regional demand due to widespread adoption in commercial and industrial roofing. Energy efficiency programs from the U.S. Department of Energy and LEED certification incentives encourage cool roof installation. The region also benefits from strong participation of major coating manufacturers offering advanced IR-reflective products. High construction activity and retrofitting projects further strengthen market expansion. Canada’s growing green building initiatives also support market penetration in colder climates, improving year-round energy savings.

Europe

Europe accounts for 27% of the global cool roof coatings market, supported by stringent EU energy regulations and climate-neutral targets. Germany, France, and the U.K. lead in adopting cool roofing technologies for public and commercial buildings. The European Commission’s “Fit for 55” strategy encourages low-emission construction solutions, creating favorable conditions for product demand. Rising focus on urban heat island mitigation drives the use of IR-reflective coatings. Key suppliers are investing in eco-friendly formulations to comply with REACH regulations. The retrofit segment also expands due to the region’s aging building stock and energy efficiency goals.

Asia Pacific

Asia Pacific dominates the global cool roof coatings market with a 31% share, fueled by rapid urbanization and rising construction spending. China, India, and Japan lead in adopting sustainable roofing solutions to address heat island effects and lower cooling energy costs. Government-led green building programs and rising awareness of energy-efficient infrastructure boost product demand. The hot and humid climate further accelerates coating adoption in both residential and commercial buildings. Leading global and regional manufacturers are expanding production capacity and distribution networks to tap into large-scale urban development projects across major economies.

Latin America

Latin America accounts for a 3% share of the cool roof coatings market, supported by expanding construction activities in Brazil and Mexico. The region is witnessing growing awareness of energy-efficient building practices to address urban heat and rising energy costs. Green building certifications and incentives are emerging gradually, creating opportunities for cool roofing products. The residential and commercial segments are driving demand as developers aim to meet sustainability goals. Despite lower adoption levels compared to developed markets, improving economic conditions and environmental policies are expected to stimulate regional growth in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the cool roof coatings market, mainly driven by extreme temperatures and increasing focus on energy conservation. Countries like Saudi Arabia and the UAE are adopting cool roofing solutions to reduce air-conditioning loads in buildings. Regulatory measures promoting sustainable construction encourage investments in reflective coating technologies. Rapid infrastructure development under Vision 2030 and similar initiatives drives market growth. Although market penetration remains lower than other regions, expanding awareness and cost-saving benefits are expected to accelerate adoption over the forecast period.

Market Segmentations:

By Type:

- Elastomeric

- IR Reflective

By Roof Slope:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cool Roof Coatings Market features prominent companies such as Monarch Industrial Products India Private Limited, Huntsman International LLC, Indian Insulation & Engineering, NuTech Paint, Valspar, Excel Coatings, PPG Industries, Inc., NIPPON PAINT (M) SDN. BHD., KST Coatings, and Sika AG. The competitive landscape of the Cool Roof Coatings Market is defined by strong innovation, sustainability initiatives, and strategic expansion. Companies are investing in advanced R&D to enhance product performance, focusing on UV resistance, durability, and energy efficiency. Strategic partnerships with construction firms and green building programs support large-scale adoption in commercial and industrial applications. Manufacturers are also expanding production capacity and distribution networks to strengthen their global presence. A growing emphasis on eco-friendly formulations aligned with international certification standards gives companies a competitive edge. This dynamic environment fosters continuous product development and accelerates market growth across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Monarch Industrial Products India Private Limited

- Huntsman International LLC

- Indian Insulation & Engineering

- NuTech Paint

- Valspar

- Excel Coatings

- PPG Industries, Inc.

- NIPPON PAINT (M) SDN. BHD.

- KST Coatings

- Sika AG

Recent Developments

- In May 2024, AkzoNobel launched Interpon A3000, a single-layer powder coating for motorcycles for offering improved cost savings and energy efficiency without sacrificing performance or aesthetics.

- In May 2024, Axalta Coating Systems launched Alesta BioCore powder coatings, a new line that uses non-food organic waste to create biobased resins, which can reduce carbon emissions.

- In July 2023, BASF SE entered a partnership with Zhejiang Guanghua Technology Co., Ltd. (KHUA), which states that BASF SE will supply KHUA with Neopentyl Glycol (NPG). KHUA manufactures polyester resins used for powder coatings. The partnership is expected to help meet the growing demand from China and other Asia Pacific countries.

- In March 2023, NanoTech Inc. launched their flagship product, the Nano Shield cool roof coat, a coating designed for application on existing commercial roofs. This specialized coating is aimed to be used on commercial roofs.

Report Coverage

The research report offers an in-depth analysis based on Type, Roof Slope, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising adoption of energy-efficient roofing solutions.

- Demand will increase due to stricter building energy codes and green certifications.

- Advanced IR-reflective coatings will gain more traction across commercial projects.

- Manufacturers will invest more in eco-friendly and low-VOC formulations.

- Retrofitting of existing buildings will become a major growth driver.

- Urban heat island mitigation programs will support large-scale installations.

- Partnerships between coating producers and construction firms will strengthen distribution.

- Emerging economies will see faster adoption supported by smart city projects.

- Digital tools and cool roof performance analytics will enhance product optimization.

- Global sustainability goals will continue to shape innovation and market expansion.