Market Overview

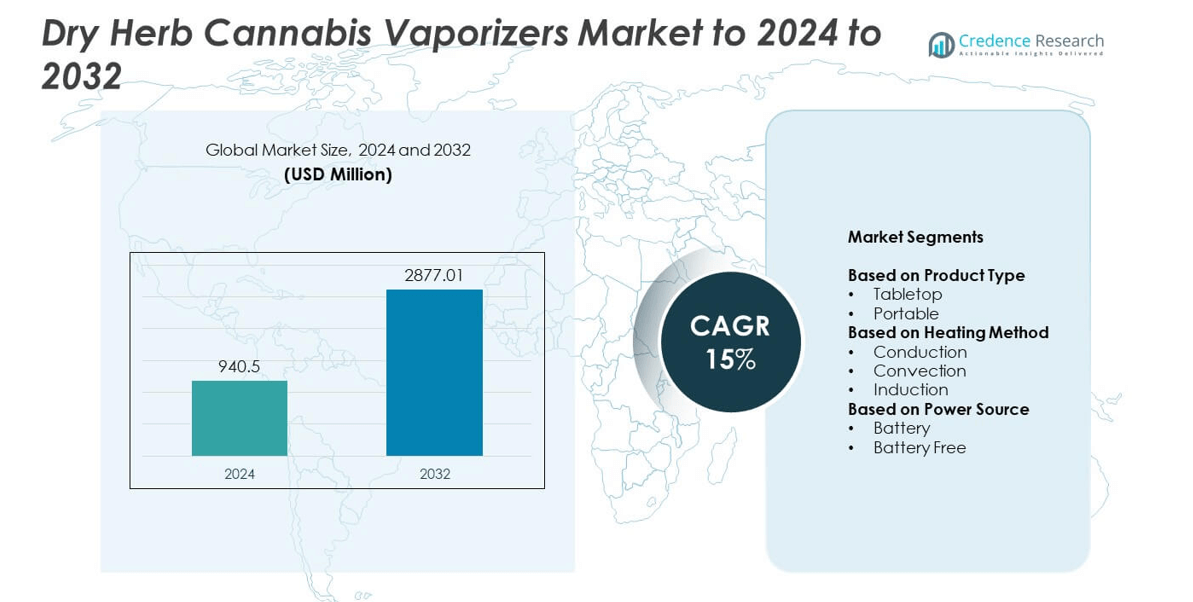

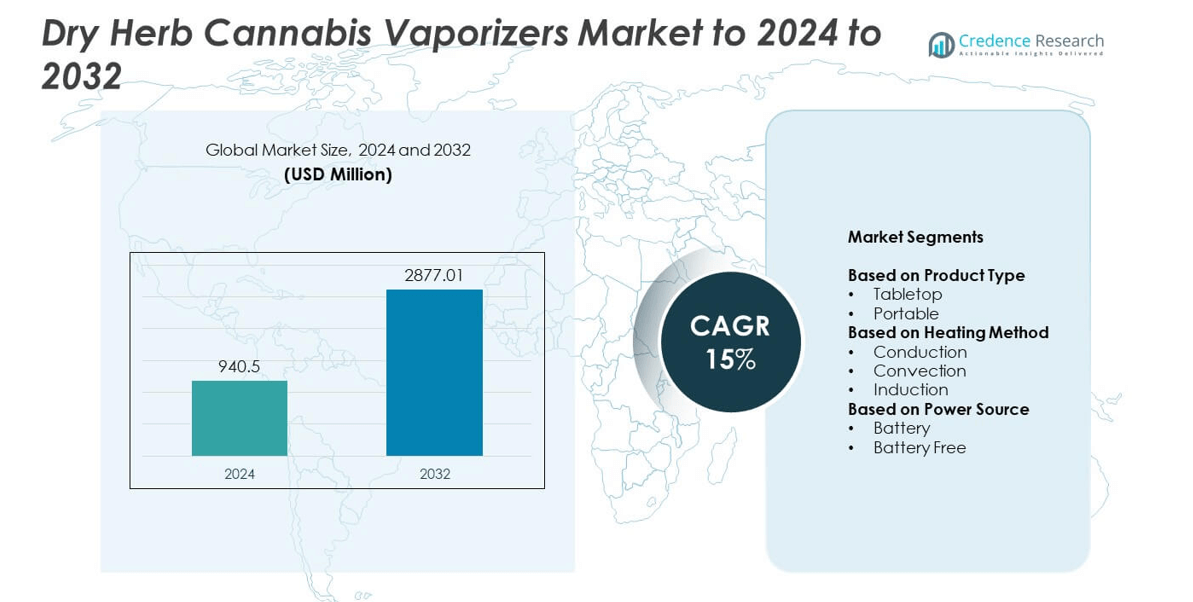

The Dry Herb Cannabis Vaporizers market size was valued at USD 940.5 million in 2024 and is anticipated to reach USD 2,877.01 million by 2032, at a CAGR of 15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Herb Cannabis Vaporizers MarketSize 2024 |

USD 940.5 million |

| Dry Herb Cannabis Vaporizers Market, CAGR |

15% |

| Dry Herb Cannabis Vaporizers Market Size 2032 |

USD 2,877.01 million |

The Dry Herb Cannabis Vaporizers market is shaped by key players such as Boundless Technology, Pax Labs, KandyPens, Flowermate, Apollo Airvape, Grenco Science, DynaVap, Topgreen Technology, Planet of the Vapes, DaVinci Vaporizer, Storz & Bickel, Arizer, SLANG Worldwide, Ooze, Healthy Rips, and Open Slang Worldwide. These companies compete through innovation in heating technology, compact design, and improved battery performance. The market benefits from strong product diversification and brand presence across North America and Europe. North America led the global market with a 46% share in 2024, supported by cannabis legalization, advanced retail distribution, and growing consumer preference for portable vaporizer solutions.

Market Insights

- The Dry Herb Cannabis Vaporizers market was valued at USD 940.5 million in 2024 and is expected to reach USD 2,877.01 million by 2032, growing at a CAGR of 15%.

- Rising legalization of cannabis for medical and recreational use and increasing demand for smoke-free consumption methods are key market drivers.

- Technological advancements such as hybrid heating systems, smart connectivity, and improved battery efficiency are shaping market trends.

- The market is highly competitive, with players focusing on product innovation, design differentiation, and strategic partnerships to expand their consumer base.

- North America led with a 46% share in 2024, followed by Europe at 28% and Asia-Pacific at 17%, while the portable vaporizer segment dominated globally with around 68% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Portable vaporizers dominated the Dry Herb Cannabis Vaporizers market in 2024, holding nearly 68% of the total share. Their dominance stems from compact design, ease of use, and growing preference among recreational and medical users. Consumers favor portable models for discreet consumption and on-the-go convenience, especially in markets like North America and Europe. Tabletop vaporizers maintain steady demand among enthusiasts seeking higher vapor quality and temperature control. Rising innovation in miniaturized heating chambers and improved battery life continues to strengthen the portable segment’s leadership.

- For instance, Storz & Bickel lists the MIGHTY+ heat-up time as approximately 60 seconds (for 180 °C). While its airflow is fixed, the airflow of the newer Venty vaporizer is adjustable, with a maximum setting of up to 20 liters per minute. This provides a higher degree of customization for the user’s draw resistance and vapor output.

By Heating Method

Conduction-based vaporizers held the largest share of around 52% in 2024. This method’s affordability and faster heating time make it popular among first-time and casual users. Conduction models offer consistent performance with minimal maintenance, driving high adoption in entry-level devices. However, convection and induction systems are gaining traction due to superior flavor and efficient heat distribution. The rising focus on advanced vapor quality and temperature precision is encouraging manufacturers to integrate hybrid heating mechanisms combining conduction and convection benefits.

- For instance, Firefly states Firefly 2+ heats in ~3 seconds using dynamic convection.

By Power Source

Battery-powered vaporizers accounted for approximately 79% of the market share in 2024. The widespread use of rechargeable lithium-ion batteries enhances portability, convenience, and extended usage time. Increasing innovation in fast-charging and long-life battery technologies has accelerated demand for wireless and travel-friendly vaporizers. Battery-free models, often powered by butane or manual heat sources, serve a niche segment seeking durability and simplicity. The shift toward sustainable, rechargeable systems aligns with consumer preferences for eco-friendly and low-maintenance vaping solutions, reinforcing the dominance of battery-driven designs.

Key Growth Drivers

Rising Legalization of Cannabis Use

The expanding legalization of medical and recreational cannabis across major economies remains a key driver for the Dry Herb Cannabis Vaporizers market. Countries such as the U.S., Canada, and Germany have experienced significant adoption as regulations ease. Legal frameworks are enabling broader retail availability, increasing consumer confidence, and driving technological investment by manufacturers. This regulatory shift continues to normalize vaporizer use and attract new consumers seeking safer alternatives to traditional smoking methods.

- For instance, Green Thumb Industries reported 101 retail sites in 2024, expanding access to vape formats.

Growing Preference for Smoke-Free Consumption

Increasing awareness of health concerns linked to combustion-based smoking has accelerated the demand for vaporizers. Dry herb vaporizers provide users with a cleaner inhalation experience by heating herbs without burning. This smoke-free method appeals to health-conscious users and medical cannabis patients. The growing shift toward wellness-oriented consumption is expected to sustain strong adoption, particularly among younger demographics and first-time users exploring safer cannabis delivery formats.

- For instance, PAX devices have different specifications depending on the model. The PAX Mini heats up in approximately 22 seconds and operates in an optimized temperature range of 380–420°F. In comparison, the PAX Plus has a heat-up time of 30 to 40 seconds and offers four Experience Modes within a similar temperature range.

Technological Advancements in Vaporizer Design

Continuous product innovation, including precise temperature control, hybrid heating systems, and compact designs, is propelling market growth. Manufacturers are introducing smart features such as Bluetooth connectivity, mobile app integration, and rapid heat-up mechanisms. These advancements improve usability and enhance vapor quality, making devices more attractive to both new and experienced consumers. Such technological improvements also expand the appeal of premium vaporizers and strengthen brand differentiation across competitive global markets.

Key Trends & Opportunities

Shift Toward Portable and Smart Vaporizers

Consumer demand for compact, high-performance vaporizers is rising sharply. Portable devices with long battery life and sleek designs are gaining preference over larger tabletop models. Smart vaporizers with digital interfaces, app-based controls, and customizable temperature settings are reshaping user engagement. This trend aligns with broader digitalization and personalization in consumer electronics, creating new opportunities for brands to target tech-savvy cannabis users globally.

- For instance, Storz & Bickel’s VENTY portable vaporizer heats up in approximately 20 seconds. The temperature can be precisely adjusted from 40°C to 210°C directly on the device using buttons, or through a web application connected via Bluetooth.

Expansion of Retail and E-commerce Channels

The widening accessibility of vaporizers through licensed dispensaries, specialty stores, and online platforms is expanding market reach. E-commerce channels are particularly influential, offering discreet purchases, product comparisons, and educational content for new users. As online legalization frameworks strengthen, vaporizer brands can leverage digital marketing and direct-to-consumer sales strategies. This multi-channel expansion supports consistent revenue growth and increases consumer trust in regulated markets.

- For instance, Trulieve reported operating 229 retail dispensaries in the United States as of May 7, 2025, according to its first-quarter earnings report.

Sustainability and Eco-Friendly Product Development

Sustainability is emerging as a strategic opportunity, with brands focusing on recyclable materials and energy-efficient battery systems. Consumers are becoming more conscious of environmental impact, influencing purchase decisions toward eco-friendly vaporizers. Companies developing biodegradable components and reusable cartridges are gaining competitive advantage. This focus on sustainability aligns with global environmental initiatives, creating differentiation and long-term brand loyalty among green-conscious consumers.

Key Challenges

Regulatory Uncertainty and Compliance Issues

Despite legalization progress, inconsistent regulatory frameworks across regions hinder uniform market expansion. Stringent approval processes, import restrictions, and advertising bans create operational hurdles for manufacturers. Compliance with varying standards for device safety, labeling, and packaging increases production complexity. This fragmented environment slows global distribution and limits consumer education, particularly in emerging cannabis markets where laws remain unclear or restrictive.

High Product Cost and Market Competition

Premium vaporizers with advanced features often carry high prices, limiting affordability for entry-level consumers. Cost-sensitive buyers in developing regions continue to rely on low-cost or traditional smoking options. Intense competition among established brands and new entrants further pressures pricing strategies. Balancing affordability with technological sophistication remains a key challenge for sustaining long-term growth and retaining consumer loyalty in a highly competitive landscape.

Regional Analysis

North America

North America dominated the Dry Herb Cannabis Vaporizers market in 2024 with a 46% share. The region’s leadership is driven by widespread legalization of cannabis use across the U.S. and Canada. Increasing adoption among recreational and medical consumers continues to boost product demand. The presence of established manufacturers, advanced retail networks, and rising technological innovations in portable devices further strengthen the regional outlook. Growing acceptance of cannabis-based wellness products and expanding e-commerce distribution channels are expected to sustain steady market growth across North America during the forecast period.

Europe

Europe held a 28% share of the Dry Herb Cannabis Vaporizers market in 2024. Demand is rising due to expanding medical cannabis legalization in countries such as Germany, the Netherlands, and the U.K. Consumers are increasingly shifting toward vaporizers as a cleaner and safer consumption method. The growing retail presence and awareness of smoke-free cannabis use are further supporting market penetration. Manufacturers are also investing in design innovation and sustainable materials to meet evolving European regulations, helping maintain consistent product acceptance across both recreational and therapeutic segments.

Asia-Pacific

Asia-Pacific accounted for 17% of the market share in 2024, driven by growing awareness and emerging legalization trends in select countries. Australia and New Zealand are leading adoption through medical cannabis programs, while parts of Southeast Asia are showing gradual regulatory relaxation. Rising urbanization and disposable incomes are fueling demand for portable and advanced vaporizer technologies. Increasing influence from Western lifestyle trends is encouraging acceptance of modern cannabis consumption methods. The region is expected to witness significant growth as legalization and public awareness continue to expand in the coming years.

Latin America

Latin America captured a 6% share of the Dry Herb Cannabis Vaporizers market in 2024. The region’s growth is supported by expanding cannabis regulation frameworks in countries like Uruguay, Mexico, and Colombia. Rising public acceptance of cannabis for medical use is encouraging demand for vaporizer devices. The development of licensed dispensaries and online retail platforms is improving product accessibility. However, limited consumer awareness and pricing constraints restrict broader market expansion. Increasing partnerships between regional suppliers and international brands are expected to strengthen market penetration over the forecast period.

Middle East & Africa

The Middle East and Africa region held a 3% market share in 2024, representing an emerging yet constrained market. Regulatory restrictions on cannabis use continue to limit widespread adoption, though certain African nations are beginning to legalize medical applications. South Africa leads the regional market, supported by a growing number of small-scale vaporizer distributors and rising health awareness. Gradual policy shifts and increased discussions around medical legalization are expected to open future opportunities. Nonetheless, limited infrastructure and strict regulations remain key challenges for market growth in this region.

Market Segmentations:

By Product Type

By Heating Method

- Conduction

- Convection

- Induction

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Dry Herb Cannabis Vaporizers market features strong competition among key players such as Boundless Technology, Pax Labs, KandyPens, Flowermate, Apollo Airvape, Grenco Science, DynaVap, Topgreen Technology, Planet of the Vapes, DaVinci Vaporizer, Storz & Bickel, Arizer, SLANG Worldwide, Ooze, Healthy Rips, and Open Slang Worldwide. The competitive landscape is defined by rapid technological innovation, design differentiation, and product reliability. Manufacturers are focusing on developing compact, user-friendly, and efficient vaporizers with advanced heating systems and extended battery life. Strategic collaborations with cannabis brands and distributors are enhancing global reach and brand positioning. Companies are investing in digital marketing, retail expansion, and regulatory compliance to strengthen consumer trust and visibility. Product innovation centered on temperature precision, vapor quality, and eco-friendly materials remains a primary competitive advantage. The growing emphasis on sustainability, along with continuous R&D in smart vaporization technologies, is expected to intensify market competition over the forecast period.

Key Player Analysis

- Boundless Technology

- Pax Labs

- KandyPens

- Flowermate

- Apollo Airvape

- Grenco Science

- DynaVap

- Topgreen Technology

- Planet of the Vapes

- DaVinci Vaporizer

- Storz & Bickel

- Arizer

- SLANG Worldwide

- Ooze

- Healthy Rips

- Open Slang Worldwide

Recent Developments

- In 2025, PAX released the new PAX FLOW vaporizer, offers significant improvements in airflow, providing a smoother, higher-output vapor experience with up to six times more airflow than previous PAX models.

- In 2025, DynaVap unveiled a new Fall Color Lineup, including the two-toned M 7 TwoToniuM and the striped TygerDyn.

- In 2023, Storz & Bickel launched the VENTY, a faster and more customizable vaporizer. It was designed with significant advancements in airflow and heat-up speed compared to previous models.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Heating Method, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing legalization of cannabis across new markets will expand global vaporizer adoption.

- Portable vaporizers will continue dominating due to convenience and discreet usage preferences.

- Technological innovation will drive demand for smart, connected vaporizer devices with app integration.

- Manufacturers will focus on improving battery efficiency and heat control for enhanced performance.

- The medical cannabis segment will witness growing demand for precise temperature-controlled vaporizers.

- Sustainability will influence product design, encouraging use of recyclable and eco-friendly materials.

- Expansion of e-commerce platforms will improve product accessibility and consumer education.

- Hybrid heating technologies combining conduction and convection will gain popularity for vapor quality.

- Partnerships between cannabis producers and device manufacturers will enhance product innovation.

- Emerging markets in Asia-Pacific and Latin America will experience accelerated growth with easing regulations.