Market Overview

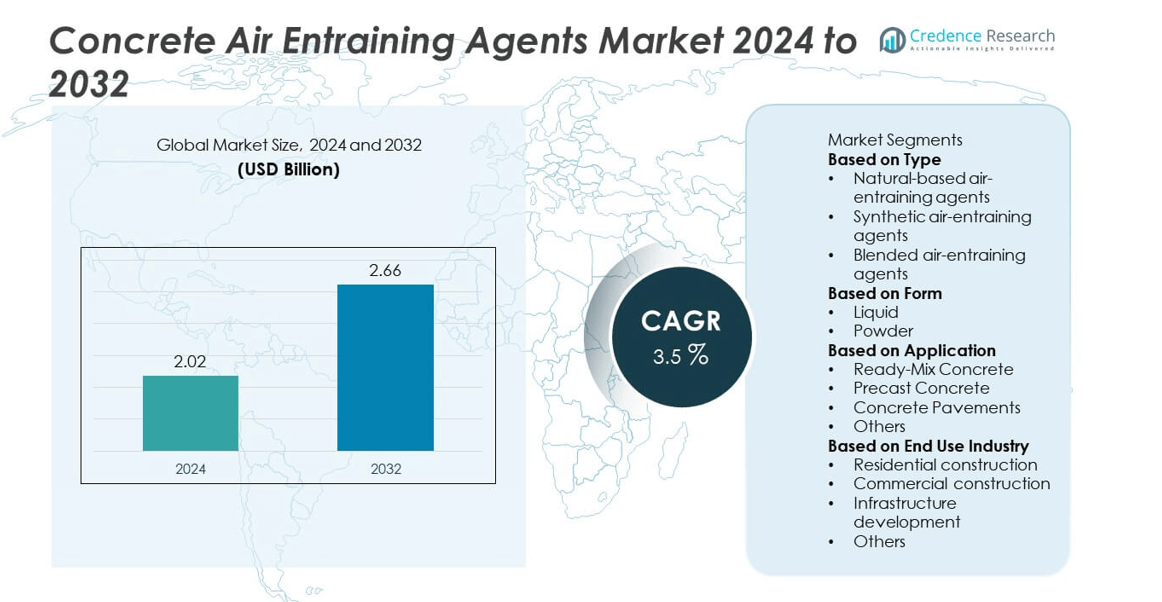

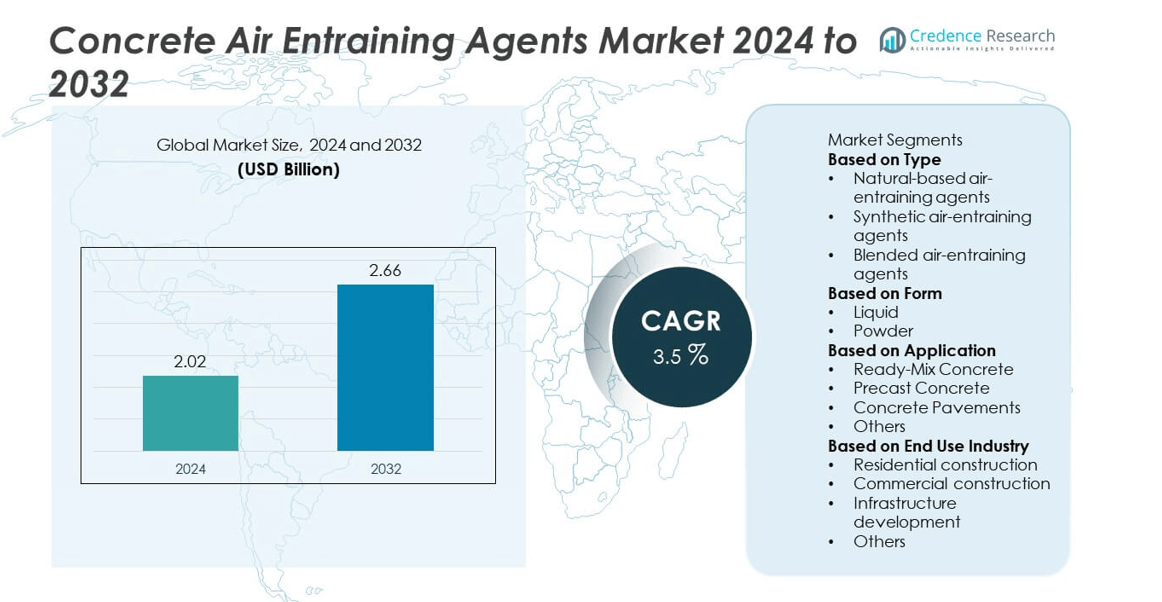

The global concrete air entraining agents market was valued at USD 2.02 billion in 2024 and is projected to reach USD 2.66 billion by 2032, registering a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Air Entraining Agents Market Size 2024 |

USD 2.02 billion |

| Concrete Air Entraining Agents Market, CAGR |

3.5% |

| Concrete Air Entraining Agents Market Size 2032 |

USD 2.66 billion |

The concrete air entraining agents market is dominated by leading companies such as Sika AG, BASF SE, GCP Applied Technologies, Mapei S.p.A., Fosroc International Limited, Kao Corporation, Arkema S.A., W. R. Grace & Co., CHRYSO Group, and LafargeHolcim Ltd. These players drive market growth through innovation in high-performance and eco-friendly admixtures designed to enhance concrete durability and frost resistance. Asia-Pacific led the global market with a 36% share in 2024, supported by rapid infrastructure expansion and government-driven construction projects. North America followed with a 31% share, driven by ongoing road and residential renovation activities, while Europe accounted for 27% owing to its strong focus on sustainable and high-quality concrete production standards.

Market Insights

- The concrete air entraining agents market was valued at USD 2.02 billion in 2024 and is projected to reach USD 2.66 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

- Increasing demand for durable, frost-resistant, and workable concrete in infrastructure and residential projects is driving market growth worldwide.

- Market trends show a rising shift toward bio-based and synthetic blended agents that enhance air stability and environmental performance.

- The market is moderately consolidated, with key players such as Sika AG, BASF SE, and Mapei S.p.A. focusing on product innovation, sustainable manufacturing, and expansion in emerging regions.

- Asia-Pacific led the market with a 36% share in 2024, followed by North America at 31% and Europe at 27%, while the liquid form segment dominated with a 63% share due to its superior dispersion and ease of application in ready-mix and precast concrete.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The synthetic air-entraining agents segment dominated the concrete air entraining agents market in 2024 with a 52% share. Its dominance stems from superior performance, consistency, and adaptability across a wide range of concrete mixes. Synthetic agents offer enhanced control over air bubble size and distribution, improving concrete durability and resistance to freeze-thaw cycles. Their compatibility with modern admixtures and low dosage requirements make them a preferred choice for infrastructure and commercial projects. Growing adoption in large-scale construction and infrastructure rehabilitation continues to drive demand for synthetic air-entraining agents globally.

- For instance, Sika AG developed its advanced synthetic air-entraining technology under the Sika® Aer range, capable of maintaining stable micro-air structures even after 300 freeze-thaw cycles in highway concrete. The system reduced surface scaling depth by up to 2 mm in ASTM C666 testing, showcasing superior resistance and long-term durability.

By Form

The liquid segment held a 63% share of the concrete air entraining agents market in 2024, driven by its ease of blending, accurate dosage control, and uniform dispersion in concrete mixtures. Liquid formulations are widely used in ready-mix and precast applications due to their superior solubility and reduced mixing time. They enhance workability and freeze-thaw resistance without affecting compressive strength. Construction firms prefer liquid forms for on-site use, as they ensure consistent performance and lower handling costs. Ongoing innovations in liquid admixture formulations are expected to sustain segment growth over the forecast period.

- For instance, Mapei S.p.A. introduced Mapeair AE 2, a liquid admixture for concrete and cementitious mortar, which is recommended for use in the production of concrete resistant to freeze/thaw cycles.

By Application

The ready-mix concrete segment accounted for a 48% share of the market in 2024, supported by rapid urbanization and infrastructure development worldwide. Air-entraining agents improve workability, reduce segregation, and enhance freeze-thaw resistance in ready-mix concrete, making them essential for durable construction. The rising use of ready-mix solutions in commercial and residential projects has strengthened segment dominance. Increasing government investments in sustainable infrastructure and smart city projects further drive adoption. Precast and pavement applications are also expanding steadily as manufacturers emphasize high-strength, long-lasting concrete for transportation and industrial projects.

Key Growth Drivers

Rising Demand for Durable and Freeze-Resistant Concrete

The increasing need for long-lasting and weather-resistant concrete in infrastructure and commercial projects is a key driver for the concrete air entraining agents market. These agents enhance freeze-thaw durability, reduce cracking, and improve concrete flexibility in harsh climates. Governments and private contractors are emphasizing the use of durable materials for roadways, bridges, and public infrastructure. The growing adoption of air-entrained concrete in cold regions such as North America and Europe continues to boost demand for high-performance admixtures.

- For instance, a Master Builders Solutions air-entraining admixture, like MasterAir AE 200, is used to increase the freeze-thaw durability of concrete, a property typically verified through ASTM C666 standards.

Expansion of Infrastructure and Construction Projects

Rapid urbanization, population growth, and investments in infrastructure are driving demand for concrete admixtures worldwide. Air-entraining agents improve concrete workability and reduce permeability, making them vital for large-scale civil and industrial projects. Rising construction of highways, tunnels, and high-rise buildings is creating new opportunities for product use. Emerging economies in Asia-Pacific and the Middle East are major contributors, as governments prioritize sustainable and resilient infrastructure to support long-term urban development.

- For instance, the Delhi Metro Phase IV project has required the use of specialized concrete admixtures to ensure concrete quality and workability under high-temperature conditions.

Increasing Focus on Sustainable Construction Practices

The shift toward sustainable and resource-efficient construction is accelerating the use of air-entraining agents. By optimizing concrete performance, these agents extend structural lifespan and reduce maintenance costs, aligning with green building standards. They help lower cement and water consumption, decreasing carbon emissions during concrete production. Construction firms are increasingly adopting such admixtures to meet environmental regulations and achieve LEED certifications. This growing focus on eco-friendly materials is positioning air-entraining agents as essential components in sustainable concrete solutions.

Key Trends & Opportunities

Innovation in Synthetic and Blended Formulations

Technological advancements are driving the development of new synthetic and blended air-entraining agents with improved stability and compatibility. Manufacturers are investing in formulations that enhance air distribution, minimize segregation, and maintain strength under variable site conditions. Blended agents combining natural and synthetic surfactants are gaining attention for their performance balance and environmental benefits. These innovations provide opportunities for manufacturers to meet diverse project requirements across regions while addressing sustainability and efficiency goals in modern construction.

- For instance, Arkema offers the Rhealis™ platform, which includes a range of specialty additives for vibrocompacting concrete and defoaming. The company also develops bio-based resins and additives for construction, including acrylic thickeners and adhesives, to improve sustainability.

Growing Adoption in Precast and High-Performance Concrete Applications

The expanding use of precast and high-performance concrete is creating new opportunities for air-entraining agents. Precast manufacturers increasingly rely on these additives to achieve uniform air distribution and improve resistance to damage during handling and installation. In high-performance concrete, air entrainment enhances long-term durability, freeze resistance, and water tightness. The growth of industrial construction, modular buildings, and transport infrastructure projects is supporting broader integration of air-entraining technology into specialized concrete applications.

- For instance, LafargeHolcim provided the cement and high-tech ready-mix concrete for certain sections of the Gotthard Base Tunnel. The company developed an innovative concrete formula that enabled the use of recycled rock from the excavation.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of raw materials used in air-entraining agent production poses a significant challenge to manufacturers. Petroleum-based surfactants and specialty chemicals often experience cost fluctuations due to supply chain disruptions and crude oil price instability. These variations impact profit margins and product pricing, particularly for small and mid-sized producers. Companies are increasingly exploring bio-based alternatives and localized sourcing strategies to mitigate cost pressures and maintain competitive pricing in the global market.

Limited Awareness and Technical Expertise in Developing Regions

In developing regions, limited awareness about the benefits of air-entraining agents and inadequate technical expertise hinder adoption. Many small-scale contractors still rely on traditional concrete mixtures, underestimating the long-term durability advantages of air-entrained concrete. Lack of standardized guidelines and proper training further restricts consistent product usage. Industry stakeholders and government bodies are addressing this challenge through awareness programs, technical support, and training initiatives aimed at promoting the use of advanced concrete admixtures in emerging markets.

Regional Analysis

North America

North America held a 32% share of the concrete air entraining agents market in 2024, driven by the region’s extensive infrastructure development and focus on durable construction materials. The United States leads demand due to the widespread use of air-entrained concrete in highways, bridges, and cold-weather construction. Rising government investments in transportation and urban renewal projects continue to strengthen product adoption. Canada also contributes significantly, with construction standards emphasizing freeze-thaw resistance and longevity. The strong presence of key admixture manufacturers and advanced R&D activities further support market expansion across the region.

Europe

Europe accounted for a 28% share of the global concrete air entraining agents market in 2024, supported by stringent environmental regulations and the adoption of sustainable construction materials. Countries such as Germany, France, and the United Kingdom are driving demand through modernization of transport and public infrastructure. The growing focus on green buildings and climate-resilient structures promotes the use of air-entraining admixtures for improved durability. The region’s mature construction industry and emphasis on performance-based concrete standards continue to fuel steady market growth, particularly in infrastructure renovation and energy-efficient building projects.

Asia-Pacific

Asia-Pacific dominated the concrete air entraining agents market with a 33% share in 2024, fueled by rapid urbanization, population growth, and large-scale infrastructure investments. China, India, and Japan lead the region’s demand, supported by government-backed road, bridge, and housing projects. The increasing use of ready-mix concrete and the expansion of industrial construction are boosting product utilization. Rising awareness of concrete performance enhancement and growing foreign investment in construction chemicals strengthen regional adoption. The presence of low-cost raw materials and local manufacturing facilities provides Asia-Pacific with a competitive advantage in global market supply.

Latin America

Latin America captured a 4% share of the global concrete air entraining agents market in 2024, supported by growing infrastructure modernization and urban development projects. Brazil and Mexico are the leading markets, driven by government initiatives to improve road networks, airports, and public facilities. The demand for high-performance concrete admixtures is increasing as construction activities expand across residential and industrial sectors. While market growth is steady, limited awareness and economic fluctuations present challenges. Nevertheless, rising foreign investment and regional partnerships with international manufacturers are expected to enhance long-term market prospects.

Middle East and Africa

The Middle East and Africa region accounted for a 3% share of the concrete air entraining agents market in 2024, driven by rapid construction of commercial and infrastructure projects. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are leading adopters due to large-scale developments in transport, housing, and industrial sectors. The growing need for heat- and crack-resistant concrete in harsh climates supports market demand. Ongoing initiatives under programs like Saudi Vision 2030 and Africa’s infrastructure expansion are boosting regional adoption. However, limited technical expertise continues to restrain faster market penetration.

Market Segmentations:

By Type

- Natural-based air-entraining agents

- Synthetic air-entraining agents

- Blended air-entraining agents

By Form

By Application

- Ready-Mix Concrete

- Precast Concrete

- Concrete Pavements

- Others

By End Use Industry

- Residential construction

- Commercial construction

- Infrastructure development

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete air entraining agents market includes major players such as Sika AG, BASF SE, GCP Applied Technologies, Mapei S.p.A., Fosroc International Limited, Kao Corporation, Arkema S.A., W. R. Grace & Co., CHRYSO Group, and LafargeHolcim Ltd. These companies hold strong market positions through diversified product portfolios, advanced admixture technologies, and extensive distribution networks. The competition focuses on product innovation aimed at improving freeze-thaw resistance, workability, and durability of concrete. Leading players are investing in eco-friendly and bio-based formulations to meet sustainability standards in the construction sector. Strategic mergers, acquisitions, and collaborations with concrete manufacturers are expanding their global footprint. Additionally, growing R&D activities in chemical performance enhancement and the integration of smart admixture systems are shaping future competitiveness. Companies are also targeting emerging markets in Asia-Pacific and Latin America, where infrastructure development and demand for high-performance concrete continue to accelerate.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Sika AG

- BASF SE

- GCP Applied Technologies

- Mapei S.p.A.

- Fosroc International Limited

- Kao Corporation

- Arkema S.A.

- R. Grace & Co.

- CHRYSO Group

- LafargeHolcim Ltd.

Recent Developments

- In May 2025, RPM International acquired The Pink Stuff, which could add to its portfolio of construction chemicals perhaps related to air-entraining agents.

- In February 2025, Saint-Gobain acquired FOSROC. This acquisition consolidates Saint-Gobain’s already strong presence in the construction chemicals market following the prior acquisition of GCP Applied Technologies.

- In September 2024, Mapei announced the expansion of its operations in the U.S. through the construction of a new admixtures production plant in Denver, Colorado.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for durable and weather-resistant concrete.

- Bio-based and eco-friendly air entraining agents will gain wider acceptance across regions.

- Infrastructure modernization projects will continue to drive consistent product demand.

- Asia-Pacific will remain the leading market due to rapid construction and urbanization.

- North America will see growth supported by concrete renovation and infrastructure repair.

- Technological advancements will improve air void distribution and long-term concrete performance.

- Manufacturers will focus on low-carbon and energy-efficient admixture formulations.

- Collaboration between chemical companies and construction firms will boost innovation.

- Liquid formulations will dominate as contractors prefer easy-to-use and consistent agents.

- Regulatory emphasis on sustainable building materials will influence future market development.