Market Overview

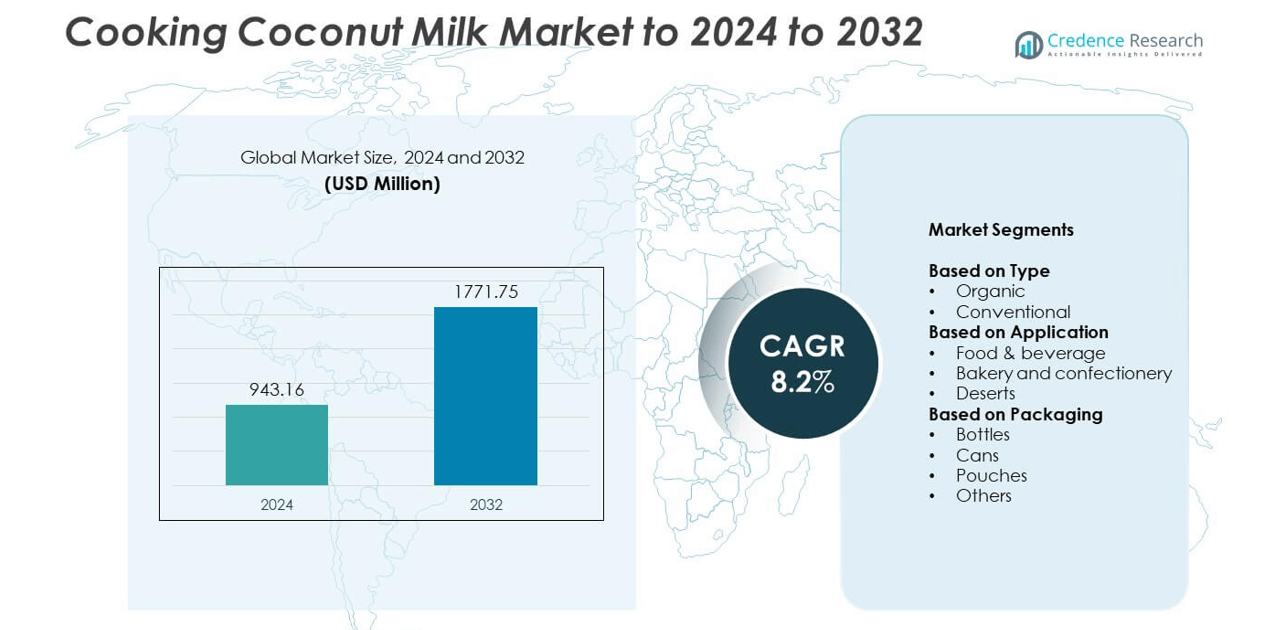

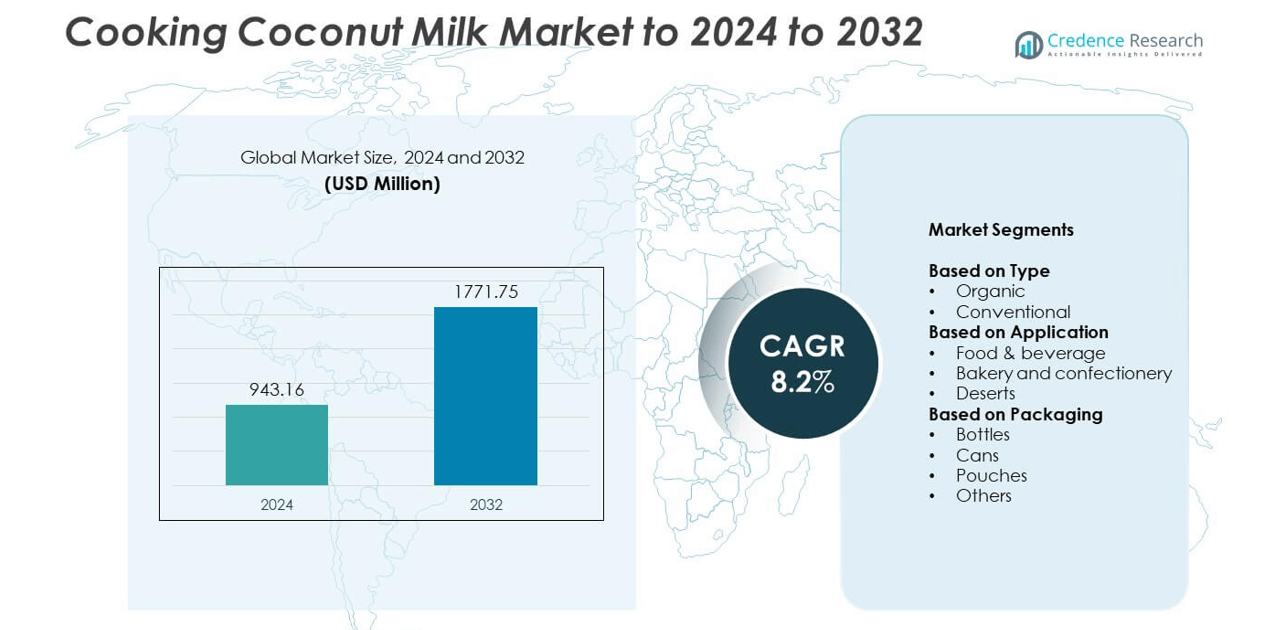

The global Cooking Coconut Milk Market size was valued at USD 943.16 million in 2024 and is anticipated to reach USD 1,771.75 million by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooking Coconut Milk Market Size 2024 |

USD 943.16 million |

| Cooking Coconut Milk Market, CAGR |

8.2% |

| Cooking Coconut Milk Market Size 2032 |

USD 1,771.75 million |

The Cooking Coconut Milk Market is driven by major players such as Danone (Silk), Trader Joe’s, Celebes Coconut, McCormick & Company, GraceKennedy, Aroy-D (Tropical Food Industries), Primex Coco Products, M&S Food, Theppadungporn Coconut, So Delicious Dairy Free, Chaokoh, Goya Foods, WhiteWave Foods, Native Forest, Thai Agri Foods, and Hunt Valley. These companies focus on expanding product portfolios through organic and clean-label innovations to meet growing vegan and health-conscious consumer demand. Asia-Pacific led the global market with a 34% share in 2024, supported by abundant coconut production and strong regional consumption, while North America and Europe followed, driven by increasing preference for plant-based food alternatives and sustainable product offerings.

Market Insights

- The global Cooking Coconut Milk Market was valued at USD 943.16 million in 2024 and is projected to reach USD 1,771.75 million by 2032, growing at a CAGR of 8.2%.

- Rising adoption of plant-based and lactose-free diets drives strong demand for coconut milk in both household and commercial applications.

- Clean-label and organic product trends are shaping new product launches, with manufacturers focusing on eco-friendly packaging and fortified formulations.

- The market is highly competitive, with players emphasizing flavor innovation, sustainable sourcing, and expanded online distribution to enhance brand reach.

- Asia-Pacific dominated with a 34% share in 2024, followed by North America at 29% and Europe at 26%, while the conventional segment held the largest share of around 67% within product types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The conventional segment dominated the cooking coconut milk market in 2024, accounting for nearly 67% of the total share. Its wide availability, lower cost, and strong distribution through retail chains make it the preferred choice for consumers and food manufacturers. Conventional coconut milk remains popular in processed foods, curries, and sauces due to consistent flavor and texture. However, demand for organic variants is increasing, driven by growing health awareness and preference for chemical-free ingredients, particularly in premium and export-oriented food categories.

- For instance, Theppadungporn (Chaokoh) processes at least 400,000 coconuts per day at its factory, backing large-scale conventional supply.

By Application

The food and beverage segment led the market with around 54% share in 2024. Rising use of cooking coconut milk in soups, curries, smoothies, and ready-to-eat meals drives this dominance. The product’s rich texture and nutritional benefits enhance flavor and mouthfeel in multiple cuisines. Bakery and confectionery applications are growing as manufacturers incorporate coconut milk in cakes, pastries, and vegan desserts. Increasing consumer inclination toward plant-based and lactose-free products further boosts demand across diverse culinary applications.

- For instance, Thai Agri Foods (Aroy-D) serves customers in over 70 countries, evidencing broad foodservice and retail usage.

By Packaging

Cans held the largest share of about 48% in 2024 within the packaging segment. Their durability, extended shelf life, and suitability for high-temperature sterilization make them ideal for retail and industrial use. Canned coconut milk is widely preferred by restaurants and food manufacturers for bulk storage and consistent quality. Pouches and bottles are gaining traction in the retail segment due to convenience and reduced packaging waste. Growing focus on lightweight, recyclable, and eco-friendly packaging options is further shaping innovation across the segment.

Key Growth Drivers

Rising Demand for Plant-Based Alternatives

Growing consumer preference for plant-based diets is a major growth driver for the cooking coconut milk market. Increasing lactose intolerance and awareness of vegan nutrition have accelerated the adoption of coconut milk as a dairy substitute. It offers rich taste, texture, and nutritional benefits, aligning with clean-label trends. Food manufacturers are increasingly integrating coconut milk into sauces, soups, and desserts, enhancing product diversity across retail and foodservice sectors worldwide.

- For instance, Vita Coco reported 17% sales growth in its latest quarter, reflecting strong plant-based beverage momentum.

Expanding Processed and Convenience Food Sector

The rapid expansion of processed and convenience food industries drives steady demand for cooking coconut milk. Ready-to-eat meals, frozen dishes, and instant curry bases widely use coconut milk for flavor and creaminess. Urbanization and changing eating habits encourage consumption of time-saving meal options, boosting the use of shelf-stable coconut milk. Food producers favor it for its versatility and long shelf life, supporting consistent growth in domestic and export markets.

- For instance, Thai Lee Foods states its capacity is 1,000 containers of coconut milk annually, supplying convenience categories.

Rising Health and Wellness Awareness

Health-conscious consumers increasingly favor coconut milk for its perceived nutritional benefits. It contains healthy fats, antioxidants, and minerals that support immunity and heart health. The growing popularity of functional and fortified foods encourages its inclusion in meal preparations and diet-based recipes. Manufacturers are leveraging this shift by promoting low-fat, organic, and preservative-free coconut milk variants, meeting wellness-focused purchasing behavior across key regions.

Key Trends and Opportunities

Growing Popularity of Organic and Clean-Label Products

Rising awareness about sustainability and food purity fuels the demand for organic coconut milk. Consumers prefer products free from synthetic additives, pesticides, and genetically modified ingredients. This trend offers manufacturers opportunities to expand certified organic product lines and strengthen brand loyalty. Clean-label claims such as “no added sugar” or “non-GMO” further enhance market positioning, especially among health-driven consumers in North America and Europe.

- For instance, Aroy-D markets UHT coconut milk in 500 ml packs with a stated 70% coconut extract content. This product also includes the emulsifier polysorbate 60 (E435) for stability. In some markets, Aroy-D offers an organic coconut milk containing only coconut extract and water.

Innovation in Packaging and Shelf-Life Enhancement

Advancements in packaging technology are reshaping the cooking coconut milk market. Lightweight pouches, resealable bottles, and recyclable cans improve storage convenience and product freshness. These innovations reduce waste and transportation costs, aligning with global sustainability goals. Improved aseptic processing and packaging materials also extend shelf life, supporting wider distribution across supermarkets and online retail platforms.

- For instance, Tetra Pak plant-based beverage systems specify 5,000–40,000 litres per hour capacity for coconut applications.

Expanding E-Commerce Distribution Channels

The growing prominence of e-commerce platforms has opened new sales opportunities for coconut milk brands. Online retailing allows small and large manufacturers to reach a wider consumer base and promote niche or premium products effectively. Subscription models and digital marketing campaigns enhance brand visibility, particularly among health-conscious urban consumers. This shift supports steady market penetration across emerging economies.

Key Challenges

Fluctuating Raw Material Availability

Dependence on coconut-producing countries like Indonesia, the Philippines, and India exposes manufacturers to supply instability. Seasonal variations, climate impacts, and natural disasters can disrupt raw material availability and increase production costs. Volatility in coconut prices directly affects profit margins, pressuring manufacturers to optimize sourcing and inventory strategies. Ensuring sustainable farming and supply chain resilience remains a critical challenge.

Intense Competition and Product Substitution

The market faces intense competition from soy, almond, and oat milk alternatives. These substitutes often provide similar functional benefits and are marketed as healthier or more affordable options. Differentiating coconut milk through flavor innovation, nutritional positioning, and sustainability claims is essential to maintain consumer interest. Continuous product diversification and targeted marketing strategies are required to counter substitute competition and retain market share.

Regional Analysis

North America

North America accounted for around 29% of the global cooking coconut milk market share in 2024. The region’s growth is driven by rising adoption of vegan diets and lactose-free food alternatives. Consumers increasingly use coconut milk in baking, smoothies, and ethnic cuisines, particularly in the United States and Canada. Expanding retail availability through supermarkets and online platforms further strengthens regional demand. The growing popularity of plant-based food startups and premium organic variants continues to fuel market expansion across urban households and commercial kitchens.

Europe

Europe held nearly 26% of the global market share in 2024, supported by a strong preference for clean-label and organic food products. Increasing consumption of plant-based alternatives and lactose-free diets in countries such as Germany, the UK, and France drives growth. The region’s established food processing industry integrates coconut milk into ready meals and desserts. Rising demand for sustainably sourced ingredients and eco-friendly packaging aligns with consumer expectations. Manufacturers are focusing on certified organic coconut milk variants to meet the region’s stringent food safety and sustainability regulations.

Asia-Pacific

Asia-Pacific dominated the global cooking coconut milk market with about 34% share in 2024. The region’s leadership stems from abundant coconut production in Indonesia, the Philippines, and India. Traditional cuisines in Southeast Asia rely heavily on coconut-based preparations, supporting consistent demand. Rapid urbanization and the rise of packaged food consumption in emerging economies also contribute to growth. Regional manufacturers benefit from strong export potential to Western markets and growing local consumption of organic and flavored coconut milk variants. Favorable government initiatives promoting sustainable agriculture enhance long-term market stability.

Latin America

Latin America captured roughly 7% of the global cooking coconut milk market share in 2024. The region’s market expansion is driven by the increasing use of coconut-based products in culinary and beverage applications. Brazil and Mexico are major contributors due to rising health-conscious consumer bases and growing vegan populations. The region’s tropical climate supports coconut cultivation, ensuring raw material availability. Expanding retail presence and adoption of Asian-inspired cuisines are further enhancing product visibility across supermarkets and online platforms, boosting growth opportunities for local and international brands.

Middle East & Africa

The Middle East & Africa region held nearly 4% of the global cooking coconut milk market share in 2024. The growing popularity of exotic cuisines and plant-based diets in urban centers like Dubai, Johannesburg, and Riyadh drives demand. Rising disposable incomes and increased health awareness encourage consumers to explore dairy alternatives. Import dependence from Asian suppliers remains high, influencing product prices. However, the expanding hospitality and foodservice sector offers significant opportunities for market penetration, supported by the growing trend of premium and organic coconut-based products.

Market Segmentations:

By Type

By Application

- Food & beverage

- Bakery and confectionery

- Deserts

By Packaging

- Bottles

- Cans

- Pouches

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Cooking Coconut Milk Market features key players such as Danone (Silk), Trader Joe’s, Celebes Coconut, McCormick & Company, GraceKennedy, Aroy-D (Tropical Food Industries), Primex Coco Products, M&S Food, Theppadungporn Coconut, So Delicious Dairy Free, Chaokoh, Goya Foods, WhiteWave Foods, Native Forest, Thai Agri Foods, and Hunt Valley. These companies compete through product innovation, flavor diversity, and expanding global distribution networks. Manufacturers focus on clean-label, organic, and vegan-certified variants to align with rising consumer demand for natural ingredients. Strategic collaborations with retailers and foodservice providers strengthen brand presence across regional markets. Companies are also investing in packaging innovation, digital marketing, and sustainability initiatives to enhance market differentiation. Increased emphasis on sourcing transparency, efficient supply chain management, and premium positioning supports long-term competitiveness, while continuous product diversification ensures responsiveness to evolving dietary trends and consumer preferences worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Danone (Silk)

- Trader Joe’s

- Celebes Coconut

- McCormick & Company

- GraceKennedy

- Aroy-D (Tropical Food Industries)

- Primex Coco Products

- M&S Food

- Theppadungporn Coconut

- So Delicious Dairy Free (part of Danone)

- Chaokoh (Theppadungporn Coconut)

- Goya Foods

- WhiteWave Foods

- Native Forest

- Thai Agri Foods

- Hunt Valley

Recent Developments

- In 2025, Trader Joe’s Trader Joe’s recalled Organic Açaí Bowls for possible plastic contamination; the product contains dried coconut among toppings

- In 2023, Danone launched new dairy-free creamers, such as the Sweet & Creamy Coconut milk Creamer for So Delicious Dairy Free, which offers a richer flavor.

- In 2023, Maryland-based The McCormick brand, and Tabitha Brown are expanding their partnership to add five new salt free, vegan seasoning products to grocery stores nationwide.

- In 2023, So Delicious Dairy Free (part of Danone) Launched 0g-added-sugar coconut-based yogurt alternatives, expanding coconut use.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Packaging and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising consumer shift toward plant-based and lactose-free diets will continue driving market demand.

- Expanding use of coconut milk in packaged and ready-to-eat foods will strengthen global consumption.

- Growth in vegan bakery and confectionery products will support wider ingredient adoption.

- Organic and clean-label coconut milk variants will gain higher preference among health-conscious consumers.

- Innovation in packaging for longer shelf life and sustainability will boost product appeal.

- Increasing online retail and e-commerce distribution will enhance accessibility across emerging markets.

- Manufacturers will focus on flavor innovation and fortified nutritional formulations to attract new consumers.

- Expanding export opportunities from Southeast Asia will ensure stable raw material supply and competitiveness.

- Rising investment in sustainable coconut farming will address long-term supply chain stability.

- Partnerships between food brands and coconut processors will drive new product launches and regional expansion.