Market overview

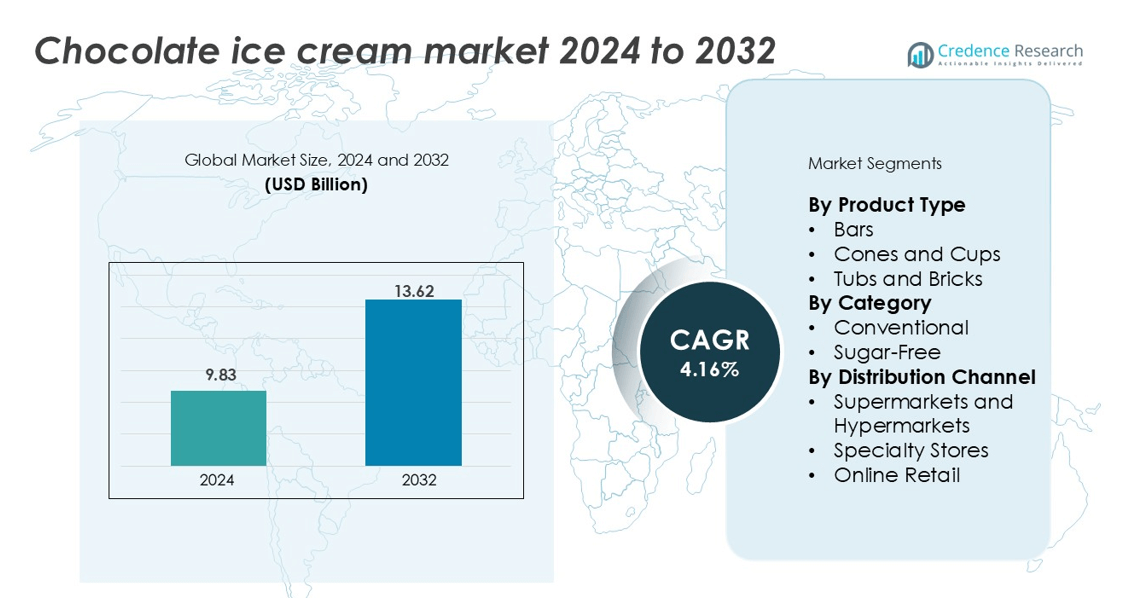

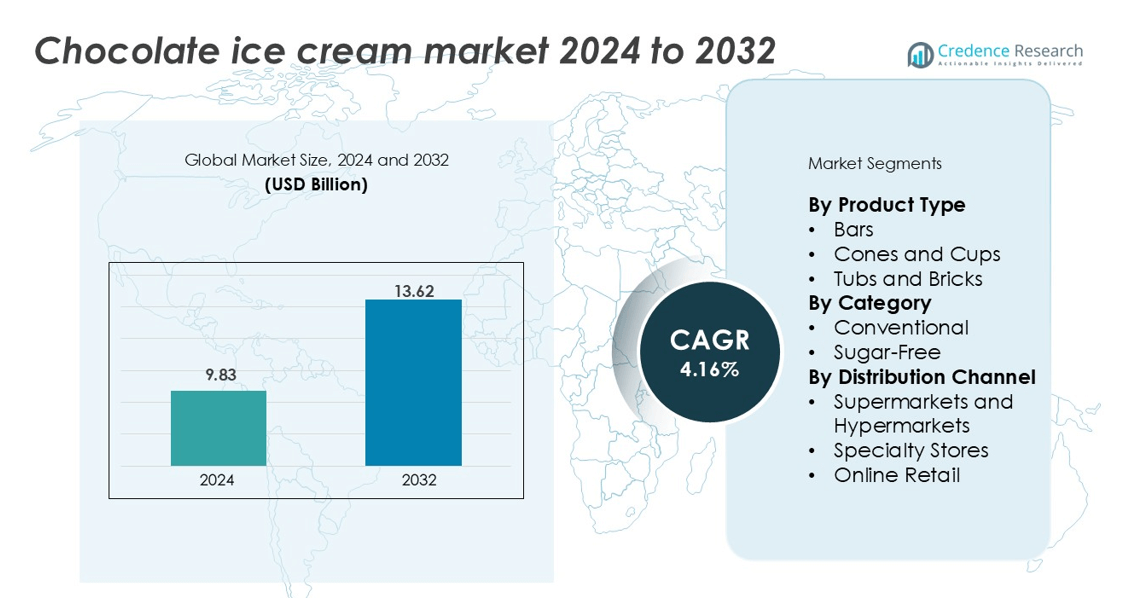

The Chocolate Ice Cream Market was valued at USD 9.83 billion in 2024 and is anticipated to reach USD 13.62 billion by 2032, growing at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chocolate Ice Cream Market Size 2024 |

USD 9.83 billion |

| Chocolate Ice Cream Market, CAGR |

4.16% |

| Chocolate Ice Cream Market Size 2032 |

USD 13.62 billion |

The chocolate ice cream market is led by prominent players such as Nestlé S.A., Lotte Confectionery, Gujarat Co-Operative Milk Marketing Federation Ltd, General Mills Inc., Dairy Farmers of America, Jude’s Ice Cream, Halo Top Creamery, Blue Berry Creameries, and Ben & Jerry’s. These companies dominate through strong brand recognition, diverse product portfolios, and global distribution networks. Innovation in premium and low-sugar chocolate variants strengthens their competitive edge across developed and emerging markets. North America remained the leading region with a 38.6% market share in 2024, supported by high per capita consumption, advanced cold-chain logistics, and growing demand for premium and plant-based chocolate ice cream offerings.

Market Insights

- The chocolate ice cream market was valued at USD 9.83 billion in 2024 and is projected to reach USD 13.62 billion by 2032, growing at a CAGR of 4.16%.

- Growing demand for premium and indulgent flavors, along with expanding retail and e-commerce networks, drives market growth globally.

- Trends such as plant-based, sugar-free, and ethically sourced cocoa ice creams are reshaping consumer preferences toward sustainable and health-oriented choices.

- Leading companies including Nestlé S.A., Lotte Confectionery, and Ben & Jerry’s compete through innovation, clean-label formulations, and eco-friendly packaging.

- North America held the largest regional share at 38.6%, while the tubs and bricks segment led with 47.6% share; the conventional category dominated with 81.4%, reflecting strong demand for traditional chocolate ice cream across households and retail channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The tubs and bricks segment dominated the chocolate ice cream market in 2024, accounting for 47.6% of the total share. Its leadership is driven by family-sized packaging, cost efficiency, and storage convenience. Tubs appeal to households seeking bulk purchases for regular consumption and celebrations. Manufacturers are introducing premium and layered variants with rich cocoa blends and inclusions to enhance flavor appeal. Growing availability in multi-serve packs across supermarkets and convenience stores further strengthens segment growth, particularly in North America and Europe where home-based dessert consumption remains high.

- For instance, Breyers introduced a 48-ounce tub of its Lactose-Free Chocolate ice cream made with Perfect Day’s precision-fermented whey protein.

By Category

The conventional chocolate ice cream segment held a leading 81.4% market share in 2024, supported by wide consumer acceptance and availability across retail formats. Traditional formulations remain popular due to their rich taste and creamy texture. Manufacturers are using high-quality cocoa and dairy ingredients to retain authenticity and flavor depth. However, rising health awareness is gradually boosting sugar-free alternatives. The conventional segment continues to expand through seasonal launches and indulgent variants that attract both adult and youth consumers globally.

- For instance, Häagen‑Dazs lists its Chocolate flavour in multiple tub sizes (14 oz, 28 oz) and highlights just five simple ingredients — cream, skim milk, sugar, cocoa processed with alkali, and egg yolks — to emphasise purity and indulgence.

By Distribution Channel

The supermarkets and hypermarkets segment accounted for 58.3% of the chocolate ice cream market share in 2024. Strong refrigeration infrastructure, product visibility, and promotional campaigns drive its dominance. Consumers prefer these outlets for brand variety and discount-based bulk purchases. Retail chains are increasingly offering dedicated frozen dessert aisles featuring both premium and mass-market brands. Product innovations and attractive in-store displays by companies enhance impulse buying. Expansion of organized retail networks in Asia-Pacific and Latin America further fuels segment growth through improved accessibility and affordability.

Key Growth Drivers

Rising Demand for Premium and Indulgent Flavors

Consumer preference for rich, indulgent experiences is driving demand for premium chocolate ice cream. Manufacturers are using high-quality cocoa, natural sweeteners, and exotic inclusions such as Belgian chocolate, caramel swirls, and brownie chunks. Premiumization enhances brand differentiation and supports higher margins in mature markets like North America and Europe. For instance, brands are launching artisanal and handcrafted chocolate ice creams emphasizing origin-specific cocoa and reduced artificial additives. Growing willingness among millennials and Gen Z consumers to spend on indulgent desserts further fuels this segment’s expansion across retail and foodservice channels.

- For instance, Hangyo and SMOOR launched the “Black Gold” ice cream, blending Hangyo’s creamy base with SMOOR’s couverture chocolate in India.

Expanding Retail Infrastructure and E-commerce Penetration

Rising accessibility through supermarkets, hypermarkets, and online platforms significantly drives market growth. Modern retail formats provide better product visibility, attractive discounts, and cold-chain efficiency. E-commerce channels enable doorstep delivery with temperature-controlled logistics, expanding the customer base in urban regions. Brands are partnering with food delivery apps to offer convenient access to frozen desserts. Digital promotions and subscription-based frozen dessert models attract repeat purchases. The expansion of organized retail in Asia-Pacific and Middle Eastern countries is also enhancing product reach and boosting overall consumption levels.

- For instance, Jeni’s “Pint Club” subscription delivers four pints monthly in insulated packaging with dry-ice to maintain frozen state.

Growing Health-Oriented and Functional Offerings

The chocolate ice cream market is witnessing strong growth from health-conscious consumers seeking balanced indulgence. Manufacturers are developing low-fat, sugar-free, and plant-based formulations using natural sweeteners like stevia and erythritol. Demand for dairy-free chocolate ice creams made with oat, almond, and coconut milk is rising rapidly among lactose-intolerant and vegan populations. Nutrient-enriched variants with protein or fiber fortification appeal to fitness-focused consumers. Continuous innovation in functional dessert lines helps brands address evolving dietary needs while maintaining taste. This shift supports diversification and long-term sustainability for major ice cream producers globally.

Key Trends & Opportunities

Sustainable and Ethical Cocoa Sourcing

Sustainability has become central to chocolate ice cream production. Companies are adopting ethically sourced cocoa certified by organizations such as Fairtrade and Rainforest Alliance to meet growing consumer awareness about responsible sourcing. This trend enhances brand reputation and customer loyalty, especially in premium segments. Manufacturers are also investing in traceable supply chains and eco-friendly packaging to minimize environmental impact. The focus on sustainability aligns with global ESG commitments and presents a strong opportunity for differentiation in competitive markets dominated by multinational brands.

- For instance, Ben & Jerry’s became the first ice-cream company to pay a living income price for its cocoa base mix and is transitioning to fully traceable cocoa beans under the Open Chain model.

Innovation in Packaging and Portion Control

Packaging innovation is creating new opportunities in the chocolate ice cream market. Single-serve cups, resealable tubs, and insulated delivery-friendly containers enhance portability and freshness. Portion-controlled formats appeal to calorie-conscious consumers seeking moderation without sacrificing indulgence. Advances in biodegradable and recyclable packaging materials are improving the product’s environmental profile. Brands adopting smart labeling and QR codes for ingredient transparency are gaining consumer trust. These developments align with evolving consumer habits favoring convenience, hygiene, and sustainability, thereby supporting long-term brand engagement.

- For instance, Stanpac offers single-serve cups ranging from 3 oz to 5.8 oz and provides paperboard lids for improved recyclability.

Key Challenges

Rising Raw Material and Energy Costs

Fluctuating cocoa and dairy prices remain a major challenge for chocolate ice cream manufacturers. High energy costs associated with refrigeration, storage, and transportation add to production expenses. Global supply chain disruptions and inflationary pressures affect ingredient procurement and logistics. Maintaining profit margins while offering competitive prices becomes difficult, particularly for small and medium producers. Companies are increasingly adopting cost-optimization strategies, sourcing alternatives, and energy-efficient production technologies to mitigate financial pressures without compromising product quality or flavor consistency.

Health Concerns and Sugar Regulations

Growing awareness of sugar-related health risks poses a challenge to conventional chocolate ice cream products. Several countries are imposing taxes and restrictions on high-sugar foods, pressuring brands to reformulate. Consumers are becoming more cautious about calorie intake and artificial additives. Reformulating chocolate ice cream without affecting texture or taste is technologically complex and expensive. Manufacturers must balance indulgence with nutritional responsibility by developing low-sugar, plant-based, and clean-label alternatives to meet evolving health and regulatory standards.

Regional Analysis

North America

North America dominated the chocolate ice cream market with a 38.6% share in 2024. The region’s leadership is driven by strong demand for premium and artisanal ice cream, supported by high per capita consumption. Major players continuously launch innovative flavors and limited-edition products targeting health-conscious and indulgent consumers. The U.S. leads due to widespread retail availability and rising demand for low-sugar and dairy-free variants. Strong marketing campaigns and expanded e-commerce distribution further strengthen regional dominance, with Canada also showing notable growth in vegan and lactose-free chocolate ice cream offerings.

Europe

Europe held a 28.4% share of the chocolate ice cream market in 2024, supported by strong consumer preference for indulgent desserts and premium cocoa-based products. Countries such as the U.K., Germany, and Italy contribute significantly to market revenues through innovation in natural and organic ice cream categories. Increasing focus on sustainable cocoa sourcing and eco-friendly packaging aligns with EU environmental policies. The region’s well-developed retail and cold-chain infrastructure, coupled with seasonal demand peaks during summer, sustains consistent sales growth across both conventional and sugar-free chocolate ice cream segments.

Asia-Pacific

The Asia-Pacific region accounted for a 21.7% market share in 2024 and is projected to witness the fastest growth during the forecast period. Rising disposable income, urbanization, and westernization of eating habits are driving higher ice cream consumption. China, India, and Japan lead the regional demand, supported by local flavor innovations and expansion of cold storage facilities. Growing middle-class populations and youth preference for chocolate-based indulgent desserts fuel sales. E-commerce channels and partnerships with food delivery apps are further enhancing accessibility, particularly in densely populated urban centers across Southeast Asia.

Latin America

Latin America captured a 6.8% share of the chocolate ice cream market in 2024, supported by growing consumer preference for premium frozen desserts. Brazil and Mexico dominate regional sales due to expanding supermarket networks and local chocolate flavor innovations. Rising urban middle-class populations with higher discretionary income are boosting out-of-home consumption. Local brands are introducing tropical-inspired chocolate variants to attract younger consumers. Product diversification and retail modernization, along with increased digital promotions, are helping international and domestic manufacturers strengthen their foothold in this emerging market.

Middle East & Africa

The Middle East & Africa region accounted for a 4.5% share in 2024, driven by rising demand in Gulf Cooperation Council (GCC) countries. Premiumization trends, tourism recovery, and increased café culture contribute to regional growth. The UAE and Saudi Arabia lead sales due to expanding modern retail infrastructure and rising expatriate populations with Western preferences. Local manufacturers are investing in new cold storage facilities to improve distribution efficiency. The growing influence of global ice cream brands and the popularity of single-serve chocolate desserts continue to support steady market expansion.

Market Segmentations:

By Product Type

- Bars

- Cones and Cups

- Tubs and Bricks

By Category

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chocolate ice cream market is highly competitive, featuring global and regional players focusing on flavor innovation, premiumization, and sustainable sourcing. Key companies include Nestlé S.A., Lotte Confectionery, Gujarat Co-Operative Milk Marketing Federation Ltd, General Mills Inc., Dairy Farmers of America, Jude’s Ice Cream, Halo Top Creamery, Blue Berry Creameries, and Ben & Jerry’s. These firms compete through product differentiation, advanced cold-chain logistics, and digital retail expansion. Leading brands emphasize clean-label formulations, reduced sugar content, and eco-friendly packaging to appeal to health-conscious consumers. Partnerships with e-commerce platforms and quick-service restaurants enhance distribution reach. Continuous investment in R&D for plant-based and lactose-free chocolate variants further supports market leadership. Strategic mergers, new product launches, and sustainability commitments remain central to strengthening global presence and brand loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé S.A.

- Lotte Confectionery

- Gujarat Co-Operative Milk Marketing Federation Ltd

- General Mills, Inc.

- Dairy Farmers of America

- Jude’s Ice Cream

- Halo Top Creamery

- Blue Berry Creameries

- Ben & Jerry’s

Recent Developments

- In April 2024, Unilever’s Magnum brand introduced the Magnum Pleasure Express, a trio of mood-inspired ice cream flavors that represent a significant innovation for the brand. The three new Magnum Pleasure Express flavors are Magnum Euphoria, a lemon ice cream with a raspberry sorbet core and white chocolate shell with popping candy; Magnum Wonder, toffee-flavored ice cream with a dated core, golden chocolate, and caramelized almonds; and Magnum Chill, a vegan option with vanilla-biscuit ice cream, blueberry sorbet core, cookie pieces, and vegan chocolate couverture. The launch of these ice creams is part of a comprehensive multi-channel customer journey, supported by Magnum’s award-winning advertisements and a media campaign featuring Magnum enthusiasts boarding the ‘Pleasure Express’ train.

- In April 2024, Cold Stone Creamery launched a limited-time offering called the Waffle Ice Cream Taco, available exclusively from April 30 to May 5, 2024, at its stores nationwide. This unique creation features Sweet Cream Ice Cream within a freshly made waffle taco shell, coated with rich chocolate and sprinkled with crunchy peanuts.

- In February 2024, Nestlé announced its 2024 range of sharing bags inspired by popular ice cream flavors. The new selection includes Aero Melts, a Neapolitan flavor, Munchies Cookie Dough Ice Cream, Raspberry Ripple, Milkybar Buttons, and ice cream-shaped Rowntree’s Randoms Foamies.

- In March 2024, Dairy Queen announced the opening of the DQ Freezer for the first time, which contains all past Blizzard Treat flavors. To celebrate, two iconic flavors-Frosted Animal Cookie and Brownie Batter-will return for a limited time as part of the Summer Blizzard Treat Menu, available from April 1. New flavors include Peanut Butter Cookie Dough Party Blizzard Treat, Picnic Peach Cobbler Blizzard Treat, and Ultimate Cookie Blizzard Treat.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and artisanal chocolate ice cream will continue to grow worldwide.

- Manufacturers will focus on clean-label and natural ingredient formulations to meet health preferences.

- Plant-based and dairy-free chocolate variants will gain popularity among vegan and lactose-intolerant consumers.

- Sustainable and ethically sourced cocoa will become a standard across global brands.

- Innovation in packaging and portion control will improve convenience and freshness.

- E-commerce and quick delivery platforms will expand product accessibility in urban areas.

- Emerging markets in Asia-Pacific and Latin America will drive future consumption growth.

- Sugar-free and low-calorie chocolate ice creams will see increased adoption among health-conscious buyers.

- Strategic partnerships and acquisitions will strengthen brand portfolios and global reach.

- Continuous investment in cold-chain logistics and flavor technology will enhance product quality and shelf life.