Market overview

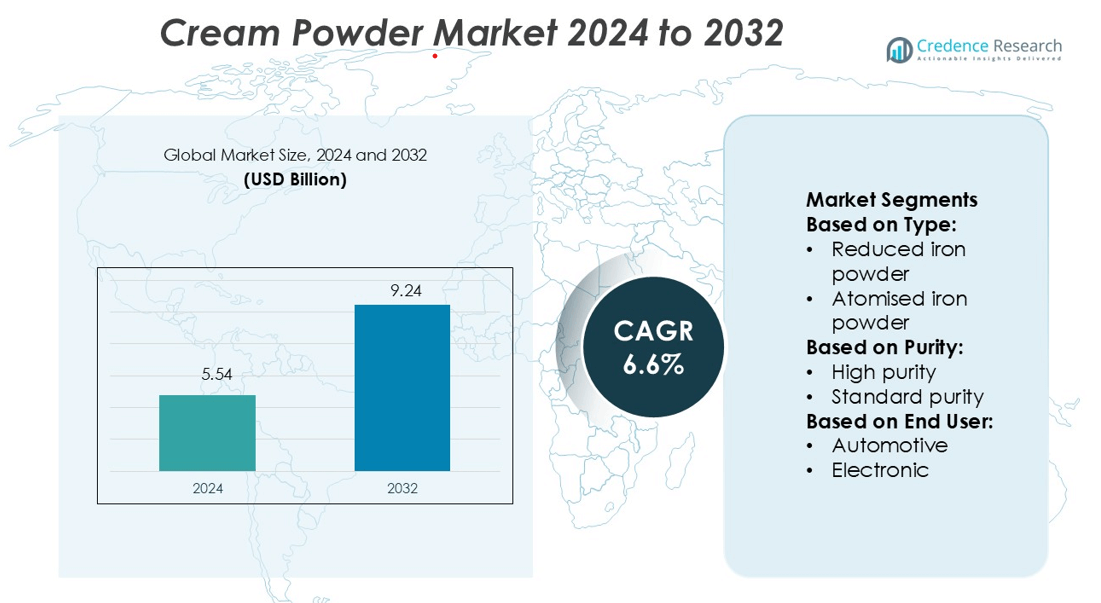

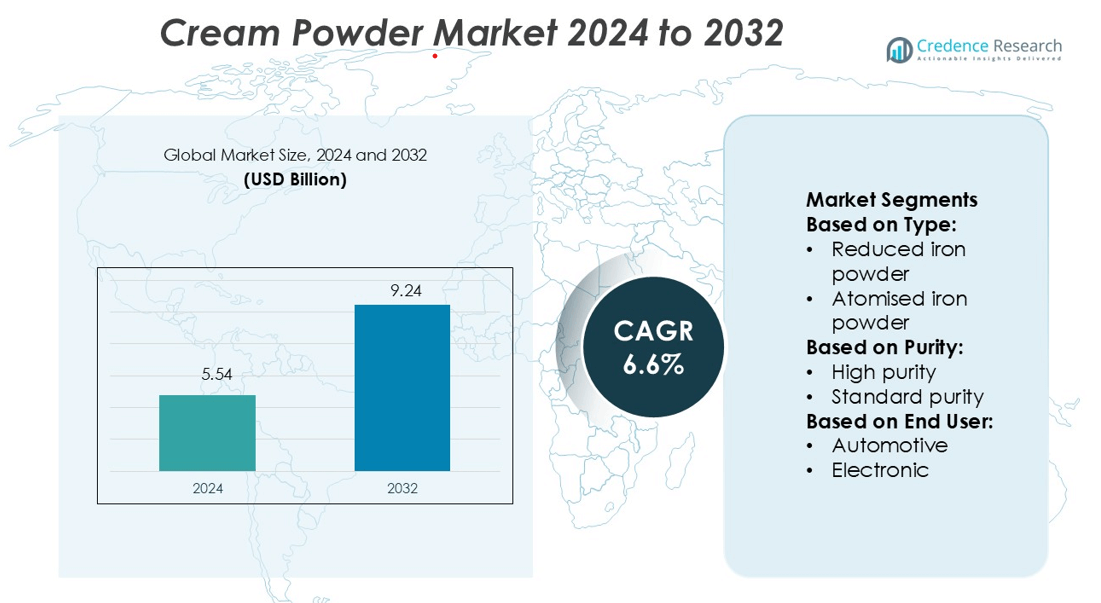

Cream Powder Market size was valued USD 5.54 billion in 2024 and is anticipated to reach USD 9.24 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cream Powder Market Size 2024 |

USD 5.54 billion |

| Cream Powder Market, CAGR |

6.6% |

| Cream Powder Market Size 2032 |

USD 9.24 billion |

The cream powder market is characterized by the presence of several prominent players, including Rio Tinto Metal Powder, CNPC Powder, Industrial Metal Powders (India) Pvt. Ltd., Pometon, BASF SE, Belmont Metals, Hoganas, American Element, JFE Steel Corporation, and Reade. These companies emphasize technological advancements, product consistency, and sustainable processing to strengthen their global footprint. Asia-Pacific leads the cream powder market with a 34% share, supported by rapid urbanization, expanding food processing industries, and rising demand for convenient dairy ingredients. Strong distribution networks, government-backed dairy initiatives, and increasing consumer preference for long-shelf-life dairy products reinforce the region’s leadership in global production and consumption.

Market Insights

- The Cream Powder Market was valued at USD 5.54 billion in 2024 and is projected to reach USD 9.24 billion by 2032, growing at a CAGR of 6.6%.

- Rising demand for convenient, shelf-stable, and high-quality dairy ingredients drives market growth across bakery, beverage, and confectionery sectors.

- Technological advancements in spray-drying and emulsification enhance product quality, while key players focus on sustainable sourcing and efficiency improvements.

- High production costs and price fluctuations in raw materials act as key restraints, limiting profitability for smaller manufacturers.

- Asia-Pacific dominates the global market with a 34% share, supported by strong dairy processing infrastructure and consumer preference for long-lasting dairy products, while the bakery segment leads consumption with over 40% share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The atomised iron powder segment dominates the Cream Powder Market, holding a 48% market share due to its superior compressibility and flow properties. This type is widely preferred in automotive and electronics manufacturing for sintered components and magnetic products. Reduced iron powder follows, supported by its cost efficiency in welding and chemical applications. Electrolytic iron powder caters to specialized sectors requiring high purity and fine particle distribution. Increasing demand for precision metal components and advancements in additive manufacturing processes continue to strengthen the dominance of atomised iron powder in industrial applications.

- For instance, Raymarine operates a distribution and service network spanning 7,500 dealers across 110 countries, ensuring global product support coverage for its marine electronics.

By Purity

High-purity iron powder leads the market with a 63% share, driven by its essential role in producing high-performance alloys and electronic components. Its superior consistency and low impurity levels make it suitable for precision engineering and battery applications. Standard purity powder serves general industrial uses where cost-effectiveness outweighs extreme performance needs. Growing demand for miniaturized electronic devices and energy-efficient systems enhances the use of high-purity powder, particularly in high-end manufacturing processes where accuracy and material integrity are critical.

- For instance, Emerson’s DeltaV Edge Environment 2.0 securely delivers read-only replicas of distributed control system data for batch and life sciences operations. It enables control-system data egress for near-real-time analytics, with the potential for very low latency (e.g., less than 100 milliseconds), depending on system configuration and network conditions.

By End User

The automotive sector holds the largest share of 39% in the Cream Powder Market, supported by extensive use in powder metallurgy for gears, bearings, and filters. Electronics is the next major contributor, with rising adoption in magnetic cores and EMI shielding materials. General and consumer industries rely on iron powder for surface coatings, appliances, and chemical catalysts. Construction applications are gradually expanding due to its role in structural materials and welding consumables. The automotive industry’s focus on lightweight and durable components continues to drive significant market demand.

Key Growth Drivers

Rising Demand for Convenient Dairy Alternatives

The growing consumer shift toward easy-to-use dairy products is fueling demand for cream powder. Its long shelf life, easy storage, and quick reconstitution make it ideal for household and foodservice applications. Increasing consumption in bakery, confectionery, and beverage industries further supports market expansion. Food manufacturers prefer cream powder for consistent texture and cost efficiency. The convenience factor is particularly appealing in urban areas where consumers seek time-saving meal solutions, strengthening the adoption of powdered dairy ingredients across multiple sectors.

- For instance, Northrop Grumman’s Digital Pathfinder program, through its Model 437 Vanguard demonstrator, reduced engineering rework from about 15–20 percent to less than 1 percent while shrinking the time from design start to first flight to 21 months.

Expanding Applications in Food Processing

Cream powder is widely used in bakery, ice cream, sauces, soups, and ready-to-eat foods due to its rich flavor and stability. Food processors value its ability to enhance texture and creaminess without refrigeration, reducing logistics costs. The product’s versatility supports product innovation across dairy-based and non-dairy formulations. As global food production grows, especially in emerging markets, manufacturers increasingly incorporate cream powder for its formulation benefits, scalability, and reduced waste, making it an essential ingredient in modern food processing systems.

- For instance, Honeywell has converted more than 975 LED lighting and controls projects across its facilities, resulting in annual savings exceeding $11 million, and cutting GHG emissions by 50,000 metric tons.

Growth in Export-Oriented Dairy Production

Rising dairy exports from countries such as New Zealand, India, and the EU have significantly driven the cream powder trade. The product’s lightweight and non-perishable nature make it ideal for international shipping. Exporters benefit from growing demand in regions lacking cold storage infrastructure. Additionally, government-backed dairy initiatives encourage milk powder production for foreign markets. This global trade dynamic enhances supply chain resilience and expands manufacturer profitability, positioning cream powder as a key value-added product within the global dairy export ecosystem.

Key Trends & Opportunities

Shift Toward Premium and Fortified Formulations

Manufacturers are launching fortified cream powders enriched with vitamins, proteins, and natural flavors. This trend caters to health-conscious consumers seeking nutritional convenience. The inclusion of probiotics and lactose-free variants appeals to diverse dietary preferences. Premium formulations also enable differentiation in competitive markets, supporting brand value. Growing awareness of nutritional intake and clean-label demand is creating opportunities for producers to innovate using natural and functional ingredients, encouraging strong R&D investment in the segment.

- For instance, the Dynafin™ technology is aimed at medium-sized vessels like ferries, with power units in the 1-4 megawatt range, delivering up to 22 percent propulsion energy savings relative to a conventional shaftline.

Expansion in E-Commerce Distribution Channels

The rapid growth of online grocery platforms is expanding consumer access to cream powder products. Digital retailing supports smaller brands in reaching wider audiences without extensive distribution networks. Subscription-based delivery models and targeted online marketing are helping companies boost recurring sales. Convenience-driven consumers increasingly prefer online purchasing due to transparent product information and competitive pricing. This shift enhances brand visibility, reduces marketing costs, and presents long-term opportunities for sustained sales growth through digital transformation.

- For instance, Braun’s EasyPrep 4-Cup Chopper (model CH3012BK) features QuadBlade™ technology with four layered stainless-steel blades, allowing up to 25 % more ingredients to be processed in one cycle (versus dual blade designs).

Technological Advancements in Spray Drying

Improved spray-drying and encapsulation technologies are enhancing cream powder quality, texture, and solubility. These advancements allow better flavor retention and fat emulsification during processing. Manufacturers are investing in energy-efficient drying systems to reduce production costs and environmental impact. Adoption of automation and process control systems ensures consistent particle size and product uniformity. Such innovations strengthen production capabilities, improve yield, and open opportunities for high-performance cream powders tailored to specific food applications.

Key Challenges

Fluctuating Raw Material Prices

Volatility in milk and cream prices directly affects the cost structure of cream powder production. Seasonal variations, feed costs, and supply chain disruptions often lead to unstable profit margins for manufacturers. This price instability challenges long-term planning and global competitiveness. Producers must adopt strategic sourcing and forward contracts to mitigate risks. Furthermore, rising energy and transportation costs compound manufacturing expenses, creating operational inefficiencies and limiting scalability in developing markets.

Competition from Non-Dairy Alternatives

The increasing popularity of plant-based cream substitutes poses a significant challenge to traditional cream powder manufacturers. Vegan and lactose-intolerant consumers are shifting toward almond, soy, and oat-based cream powders. These alternatives are marketed as healthier and more sustainable, appealing to environmentally aware consumers. This competitive pressure compels dairy producers to reformulate and innovate to retain market share. Adapting to evolving consumer preferences while maintaining quality and cost-effectiveness remains a major strategic challenge.

Regional Analysis

North America

North America holds a 32% share of the global cream powder market, driven by strong demand from the bakery, confectionery, and ready-to-drink beverage industries. The U.S. leads regional consumption, supported by a mature food processing sector and widespread use of dairy powders in industrial applications. Rising adoption of lactose-free and organic cream powders reflects growing health awareness among consumers. Technological advancements in spray drying and ingredient blending further enhance product quality. The presence of major dairy producers and efficient supply chains continues to strengthen North America’s position in the global market.

Europe

Europe accounts for 27% of the cream powder market, with Germany, France, and the Netherlands leading production and exports. High demand from bakery, confectionery, and dessert manufacturers drives consistent market performance. The region emphasizes sustainable dairy sourcing and clean-label formulations to meet regulatory and consumer standards. Ongoing innovation in fat content optimization and flavor enhancement supports premium product categories. Increasing demand for lactose-free and fortified dairy ingredients, along with export expansion to Asia and Africa, reinforces Europe’s role as a key global supplier of high-quality cream powder.

Asia-Pacific

Asia-Pacific dominates the cream powder market with a 34% share, led by China, India, and Japan. Rapid urbanization, rising disposable income, and growth in the bakery and beverage sectors are major contributors. The region’s expanding dairy industry and investments in processing infrastructure boost supply capacity. Local manufacturers focus on cost-effective production and export potential. Increasing awareness of nutritional products and convenience-based consumption further drives market growth. Government support for dairy processing and the rising influence of e-commerce platforms strengthen Asia-Pacific’s leadership in the global cream powder market.

Latin America

Latin America captures an 11% share of the cream powder market, with Brazil and Argentina as primary producers. The region benefits from a growing food and beverage industry and expanding export channels. Economic development and rising urban middle-class populations contribute to higher consumption of processed dairy products. Manufacturers are investing in modern production technologies and dairy cooperatives to improve yield and quality. Although limited cold chain infrastructure poses challenges, the shelf stability of cream powder supports broad distribution across retail and industrial sectors, reinforcing regional growth momentum.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the global cream powder market, driven by increasing demand in foodservice, confectionery, and bakery industries. Countries such as Saudi Arabia, the UAE, and South Africa lead imports due to limited domestic milk production. Rising disposable incomes and changing dietary habits boost demand for convenient dairy alternatives. The product’s long shelf life makes it suitable for regions with limited refrigeration. Strategic imports and government initiatives to improve local dairy processing capacity are fostering gradual market expansion across the region.

Market Segmentations:

By Type:

- Reduced iron powder

- Atomised iron powder

By Purity:

- High purity

- Standard purity

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cream powder market features strong competition among key players including Rio Tinto Metal Powder, CNPC Powder, Industrial Metal Powders (India) Pvt. Ltd., Pometon, BASF SE, Belmont Metals, Hoganas, American Element, JFE Steel Corporation, and Reade. The cream powder market is highly competitive, driven by continuous innovation, quality enhancement, and production efficiency. Manufacturers focus on improving texture, solubility, and shelf life to meet evolving food industry demands. Strategic collaborations with bakery, confectionery, and beverage producers support product diversification and brand positioning. Companies are investing in advanced spray-drying technologies and sustainable sourcing to optimize yield and reduce environmental impact. Expansion into emerging markets through e-commerce and local distribution networks strengthens global reach. Continuous R&D in formulation and flavor enhancement enables manufacturers to cater to health-conscious consumers, ensuring long-term competitiveness in the dairy ingredient market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rio Tinto Metal Powder

- CNPC Powder

- Industrial Metal Powders (India) Pvt. Ltd.

- Pometon

- BASF SE

- Belmont Metals

- Hoganas

- American Element

- JFE Steel Corporation

- Reade

Recent Developments

- In February 2025, Dole has partnered with Givaudan to distribute Green Banana Powder, a recycled ingredient developed by Dole Specialty Ingredients (DSI). The collaboration will enhance Givaudan’s Sense Texture range with sustainable emulsifier and texturizer solutions.

- In October 2024, Fruit d’Or, a global leader in cultivating and processing premium cranberries and wild blueberries, unveiled Blue d’Or Vitality at SupplySide West 2024. Tailored for the sports nutrition and nutraceutical sectors, Blue d’Or Vitality represents the forefront of clean-label, organic solutions, championing vitality and holistic wellness.

- In May 2024, Döhler expanded its Paarl facility in South Africa by adding new production lines for powdered flavors and compounds, including fruit powders, to enhance local processing capabilities.

- In April 2024, Thrive Freeze Dry, backed by Entrepreneurial Equity Partners and Mubadala Capital, acquired Paradiesfrucht GmbH to strengthen its European market position and expand freeze-dried product capabilities. This acquisition enhances Thrive’s product range in freeze-dried fruits and specialized food ingredients while leveraging Paradiesfrucht’s sustainability and innovation expertise

Report Coverage

The research report offers an in-depth analysis based on Type, Purity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for convenient and shelf-stable dairy ingredients will continue to increase globally.

- Growth in bakery, confectionery, and beverage sectors will boost cream powder consumption.

- Manufacturers will invest in energy-efficient spray-drying technologies to enhance production.

- Rising preference for lactose-free and fortified formulations will shape product innovation.

- E-commerce platforms will play a larger role in retail distribution and brand visibility.

- Sustainability initiatives will drive the adoption of eco-friendly packaging and sourcing practices.

- Expanding dairy exports from Asia-Pacific and Europe will support market diversification.

- Technological advancements will improve texture, flavor, and reconstitution performance.

- Strategic partnerships between dairy processors and food manufacturers will strengthen supply chains.

- Increasing health awareness will fuel demand for clean-label and high-protein cream powder variants.