Market Overview

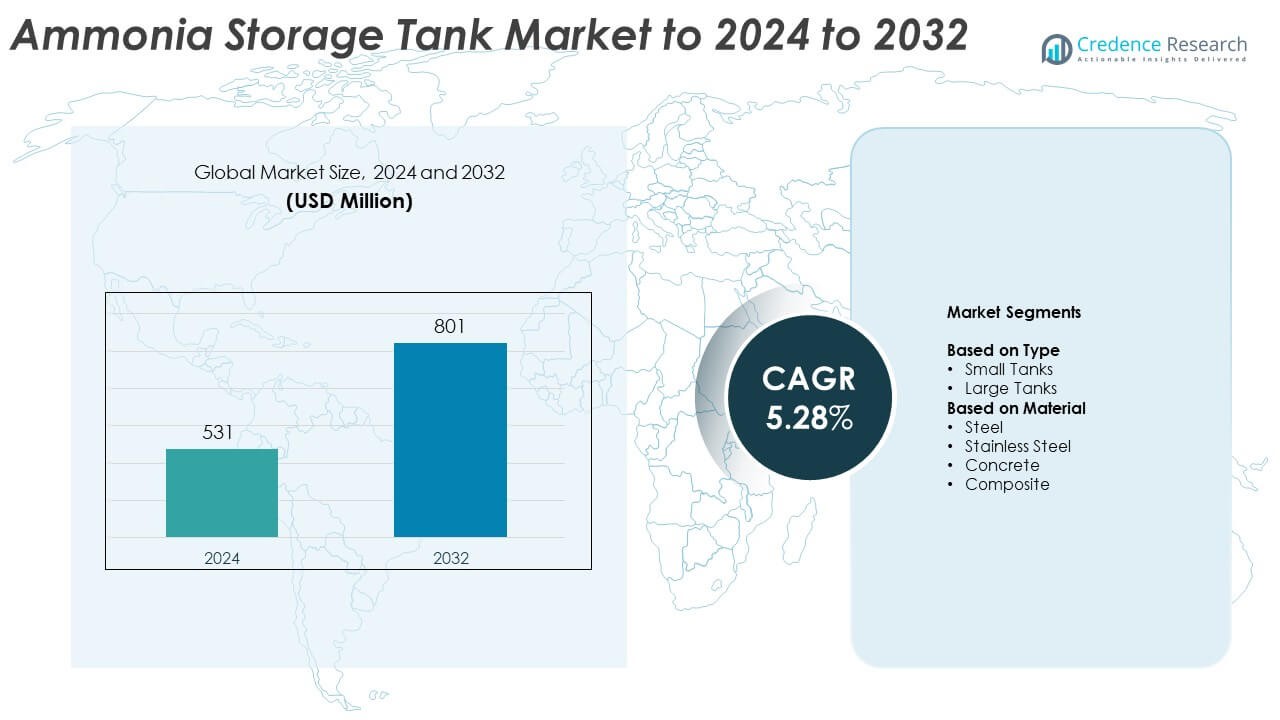

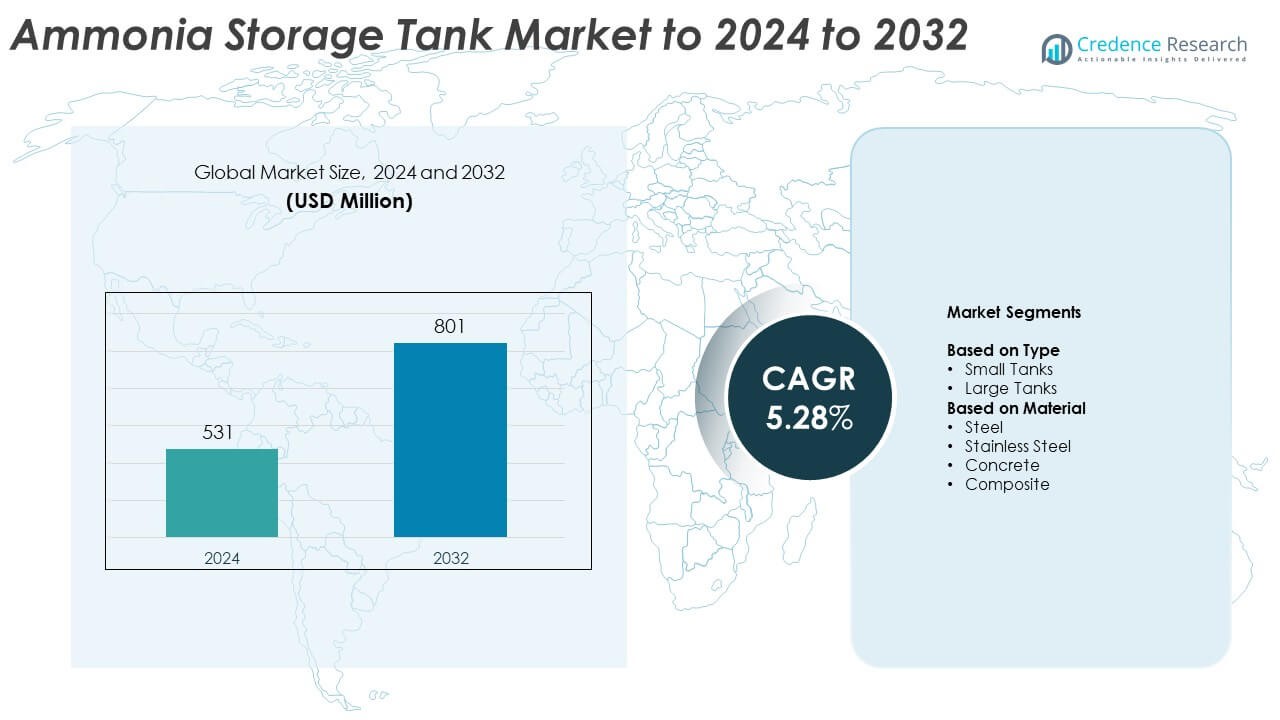

The Ammonia Storage Tank Market size was valued at USD 531 million in 2024 and is anticipated to reach USD 801 million by 2032, at a CAGR of 5.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ammonia Storage Tank Market Size 2024 |

USD 531 Million |

| Ammonia Storage Tank Market, CAGR |

5.28% |

| Ammonia Storage Tank Market Size 2032 |

USD 801 Million |

The ammonia storage tank market is highly competitive, with key players such as CB&I, KLNG, Sojitz, SHV Energy, TGE, Messer, Gulf Cryo, IHI Corporation, Sinopec, and Worthington Industries driving innovation and capacity expansion. These companies focus on advanced engineering solutions, safety compliance, and material efficiency to meet growing industrial and energy demands. Asia-Pacific led the global market with a 33.8% share in 2024, supported by rapid industrialization and large-scale fertilizer production. Europe followed with 28.6%, driven by investments in green ammonia infrastructure and renewable energy integration. North America accounted for 31.4%, emphasizing modernization and regulatory compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ammonia storage tank market was valued at USD 531 million in 2024 and is projected to reach USD 801 million by 2032, growing at a CAGR of 5.28%.

- Rising demand for ammonia in fertilizer production and industrial applications is driving steady market expansion, supported by infrastructure modernization and safety compliance standards.

- Growing adoption of advanced materials such as composite and stainless steel, along with IoT-based monitoring systems, defines key market trends enhancing performance and efficiency.

- The market remains moderately competitive with global players focusing on product innovation, partnerships, and expansion of green ammonia storage facilities to strengthen their global footprint.

- Asia-Pacific led with a 33.8% share in 2024, followed by North America at 31.4% and Europe at 28.6%, while the large tanks segment dominated with 68.7% due to high demand in fertilizer and chemical storage applications.

Market Segmentation Analysis:

By Type

The large tanks segment dominated the ammonia storage tank market in 2024 with a 68.7% share. Their dominance is driven by widespread use in industrial-scale ammonia storage for fertilizer production, power generation, and chemical manufacturing. Large tanks are preferred for their higher capacity, long-term cost efficiency, and reduced maintenance frequency. Expanding fertilizer plants in Asia-Pacific and Europe, along with the growing demand for bulk ammonia storage in green hydrogen projects, are key factors supporting segment growth. Small tanks hold steady demand in localized and mobile applications where compact storage is essential.

- For instance, CB&I built two refrigerated ammonia tanks for QAFCO, each 50,000 tonnes. The tanks are ~50 m diameter and 40.5 m high. Each foundation uses about 250 piles.

By Material

The steel segment accounted for the largest market share of 46.3% in 2024, supported by its superior strength, pressure resistance, and cost-effectiveness. Steel tanks are widely adopted for both refrigerated and pressurized ammonia storage systems due to their durability and compatibility with large-scale operations. Growing investment in industrial infrastructure and fertilizer facilities further enhances demand for steel-based designs. Stainless steel follows with rising adoption in high-purity and corrosion-prone environments. Concrete and composite tanks are emerging alternatives, offering benefits in structural stability and long service life for stationary installations.

- For instance, Geldof delivered a 22,000 m³ cold ammonia tank with carbon-steel inner and concrete outer shells. The design follows EN 14620 requirements. Dimensions are 32 m diameter and 29.6 m height (inner). The outer tank has a diameter of 35.3 m and a height of 30.9 m.

Key Growth Drivers

Rising Demand from Fertilizer Production

The growing global fertilizer industry remains a primary driver for ammonia storage tank demand. Ammonia serves as a critical raw material for nitrogen-based fertilizers, with rising agricultural output and food security needs boosting consumption. Developing regions, particularly Asia-Pacific, are expanding ammonia storage infrastructure to support continuous fertilizer supply. Increasing government support for agricultural modernization and large-scale fertilizer manufacturing projects accelerates investment in high-capacity storage systems, strengthening the market’s industrial base.

- For instance, Proton Ventures engineered Estonia’s facility with two 30,000-ton refrigerated tanks at −33 °C. Four UAN tanks of 20,000 tons each were added. Rail and marine loading systems were included.

Expansion of Green Ammonia Projects

The shift toward sustainable energy solutions is driving new investments in green ammonia production and storage. Renewable hydrogen-based ammonia requires specialized storage systems capable of handling cryogenic and pressurized conditions. As global decarbonization targets advance, energy companies and industrial players are expanding ammonia infrastructure for use as a hydrogen carrier and carbon-neutral fuel. This transition is encouraging partnerships and large-scale construction of advanced storage facilities, supporting market growth across developed and emerging economies.

- For instance, Vesta Terminals’ Vlissingen site has two 30,000 m³ refrigerated ammonia tanks. Initial throughput targets one million tonnes per year. A second phase plans to double throughput.

Industrial Growth and Infrastructure Modernization

Rising industrialization and chemical manufacturing expansion are fueling demand for efficient ammonia storage systems. Refineries, refrigeration units, and power generation plants rely on secure and high-capacity tanks to meet production and safety requirements. Governments are investing in modernizing storage networks and compliance standards to prevent leaks and enhance sustainability. The adoption of advanced monitoring systems and automation in tank design improves safety, operational efficiency, and regulatory adherence, further strengthening market adoption across multiple sectors.

Key Trends & Opportunities

Adoption of Advanced Materials and Smart Monitoring

Technological advancements in material science and digital control systems are reshaping tank design. Composite and corrosion-resistant alloys extend tank life and reduce maintenance needs. Integration of IoT-based sensors and automated leak detection systems enhances real-time monitoring, improving safety and regulatory compliance. These smart technologies offer significant opportunities for manufacturers to deliver efficient, long-lasting, and intelligent storage solutions tailored to industrial and renewable energy requirements.

- For instance, Dräger’s Polytron 8100 supports NH₃ sensors with 0–300 ppm and 0–1,000 ppm ranges. The default calibration interval is six months (or 180 days). The typical T90 response time for the ammonia sensors is approximately 15 to 30 seconds.

Expansion of Ammonia as an Energy Carrier

Ammonia’s potential as a carbon-free fuel and hydrogen carrier is opening new opportunities in the global energy sector. Infrastructure expansion for ammonia bunkering, transport, and long-term storage is gaining momentum, particularly in Europe and Asia. Growing interest from the shipping industry and renewable energy producers supports the development of specialized storage tanks capable of handling cryogenic temperatures. This trend positions ammonia storage as a key enabler in the global energy transition.

- For instance, IHI notes typical industry tanks in Japan store 10,000–20,000 tons. Current single-tank technology limits are about 40,000 tons (~60,000 m³). IHI is developing larger import terminals.

Key Challenges

Stringent Safety and Environmental Regulations

Ammonia’s toxic and hazardous nature imposes strict design and operational requirements on storage facilities. Compliance with evolving safety and environmental standards increases installation costs and maintenance complexity. Operators must adopt advanced containment systems and continuous monitoring to prevent leaks and minimize environmental risks. Regulatory delays and high certification expenses can slow project execution, creating challenges for small and medium manufacturers in maintaining cost competitiveness.

High Initial Investment and Maintenance Costs

Ammonia storage tank systems require substantial capital investment due to specialized materials, insulation, and pressure-resistant design. Installation, inspection, and maintenance involve high costs to meet industrial safety standards. These expenses are particularly challenging for developing markets where cost optimization is a priority. The need for periodic upgrades, advanced sensors, and corrosion control measures further adds to operational costs, limiting adoption among smaller industrial users.

Regional Analysis

North America

North America held a 31.4% share of the ammonia storage tank market in 2024, driven by strong demand from fertilizer, refrigeration, and energy sectors. The United States leads regional growth with large-scale industrial storage projects and modernization of existing facilities. Rising investment in green ammonia production and hydrogen storage supports the market expansion. Stringent safety regulations and technological innovations in tank design encourage the adoption of advanced steel and stainless-steel storage systems, ensuring operational efficiency and compliance across large chemical and agricultural facilities.

Europe

Europe accounted for 28.6% of the global market share in 2024, supported by the region’s focus on decarbonization and sustainable ammonia applications. The increasing number of green ammonia projects across Germany, the Netherlands, and the UK drives demand for advanced storage infrastructure. Regulatory emphasis on low-emission technologies and safe handling standards promotes upgrades in tank materials and monitoring systems. Rising investments in ammonia bunkering facilities and renewable hydrogen transport also strengthen Europe’s position as a key market for ammonia storage innovation and industrial transformation.

Asia-Pacific

Asia-Pacific dominated the global market with a 33.8% share in 2024, led by rapid industrialization and agricultural expansion. Countries such as China, India, and Japan are major consumers due to growing fertilizer demand and chemical manufacturing. Government-backed projects for ammonia storage and green energy integration enhance regional growth prospects. Expanding industrial infrastructure and favorable investment policies attract international companies to develop high-capacity storage solutions. The region’s strategic focus on sustainable production and export-oriented ammonia industries positions it as the fastest-growing market globally.

Latin America

Latin America captured a 3.7% market share in 2024, driven by rising fertilizer production and agricultural exports. Brazil and Argentina are leading contributors, supported by government initiatives to strengthen fertilizer self-sufficiency. Expanding industrial ammonia storage capacity in port facilities and agrochemical plants also supports steady demand. However, high installation costs and limited domestic manufacturing capabilities restrict faster adoption. Ongoing investments in modern storage systems and public-private partnerships are expected to improve regional competitiveness and safety standards in the coming years.

Middle East & Africa

The Middle East & Africa region held a 2.5% share of the ammonia storage tank market in 2024. Growth is fueled by large-scale ammonia production and export facilities in Saudi Arabia, the UAE, and South Africa. Strategic investments in green ammonia projects for hydrogen export are transforming the regional energy landscape. Expanding petrochemical infrastructure and favorable trade policies encourage the construction of high-capacity ammonia terminals. Despite slower adoption of advanced materials, government-backed industrial diversification plans are expected to strengthen market presence across the region.

Market Segmentations:

By Type

By Material

- Steel

- Stainless Steel

- Concrete

- Composite

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ammonia storage tank market features several prominent players such as CB&I, KLNG, Sojitz, SHV Energy, TGE, Messer, Gulf Cryo, IHI Corporation, Sinopec, Moosburger, Worthington Industries, JBGas, Cryolor, North Star Cryogenics, Praxair, Kryogas, Fetrotech, and Sol Engineering. The market is characterized by strong competition among global and regional manufacturers focusing on innovation, capacity expansion, and compliance with safety standards. Companies are emphasizing material advancements, such as high-strength steel and composite designs, to enhance durability and minimize leakage risks. Increasing investments in automation, digital monitoring, and modular tank systems are reshaping product portfolios to meet industrial demands. Strategic collaborations with energy and chemical producers are driving large-scale infrastructure projects supporting green ammonia and hydrogen storage. Additionally, long-term contracts with fertilizer and industrial clients ensure stable revenue streams. Continuous focus on sustainability, energy efficiency, and regulatory alignment strengthens competitive positioning across global and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CB&I

- KLNG

- Sojitz

- SHV Energy

- TGE

- Messer

- Gulf Cryo (Gulf Industrial Investment Company)

- IHI Corporation

- Sinopec

- Moosburger

- Worthington Industries

- JBGas

- Cryolor

- North Star Cryogenics

- Praxair (Linde)

- Kryogas

- Fetrotech

- Sol Engineering

Recent Developments

- In 2024, CB&I, a wholly owned subsidiary of McDermott, was awarded a contract by the Saipem Clough joint venture. The contract is for the engineering, procurement, and construction (EPC) of ammonia storage and process tanks for the Perdaman Chemicals and Fertilisers Urea Plant on the Burrup Peninsula in Western Australia.

- In 2024, IHI Corporation, along with five other companies (Hokkaido Electric Power Co., Hokkaido Mitsui Chemicals, Marubeni Corporation, Mitsui & Co., Ltd., and Tomakomai Futo Co., Ltd.), announced the launch of a joint study for the establishment of an ammonia supply chain based in the Tomakomai area of Hokkaido, Japan.

- In 2024, TGE Gas Engineering completed and commissioned the EPC project for an ammonia storage facility in Samsun, Turkey for Eti Bakır A. Ş. The project included the design and construction of a 15,000 metric ton full containment ammonia tank and became fully operational after the first ship unloading operation.

Report Coverage

The research report offers an in-depth analysis based on Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of green ammonia will drive demand for advanced storage systems worldwide.

- Asia-Pacific will remain the fastest-growing regional market due to expanding fertilizer production.

- Technological innovation in composite and stainless-steel materials will enhance tank durability.

- Integration of smart monitoring systems will improve safety and reduce operational risks.

- Increasing ammonia use as a hydrogen carrier will create new infrastructure opportunities.

- Government incentives for sustainable energy projects will accelerate ammonia storage expansion.

- Industrial modernization and refinery upgrades will strengthen long-term market stability.

- Strategic investments in cryogenic storage systems will support global ammonia trade.

- Collaboration between energy and chemical companies will boost large-scale facility construction.

- Rising environmental regulations will encourage adoption of eco-efficient and compliant storage designs.