Market Overview:

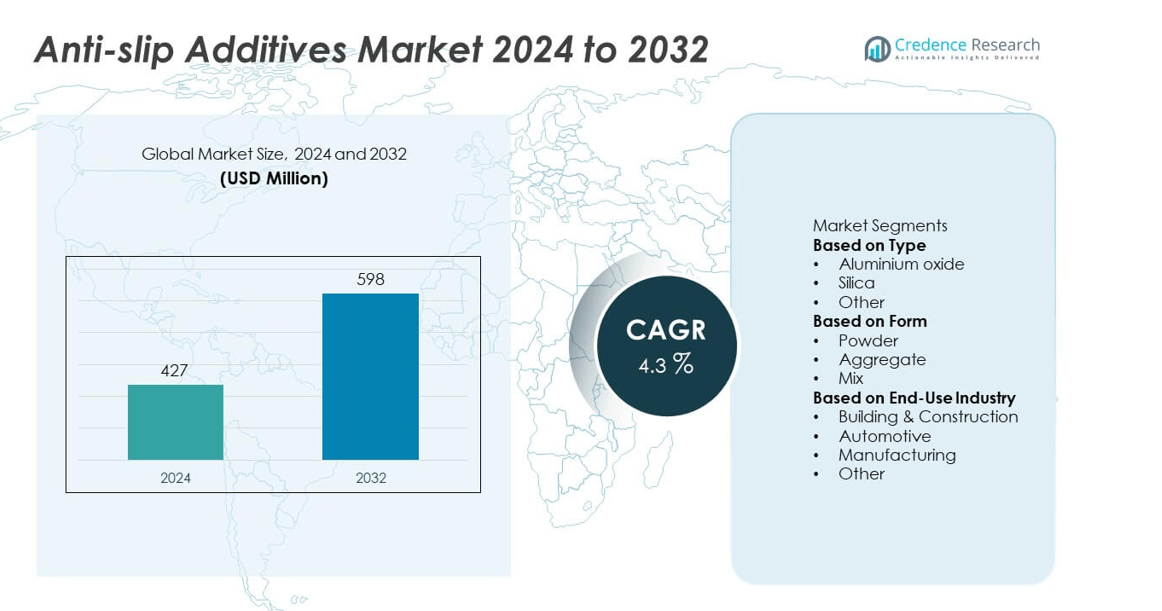

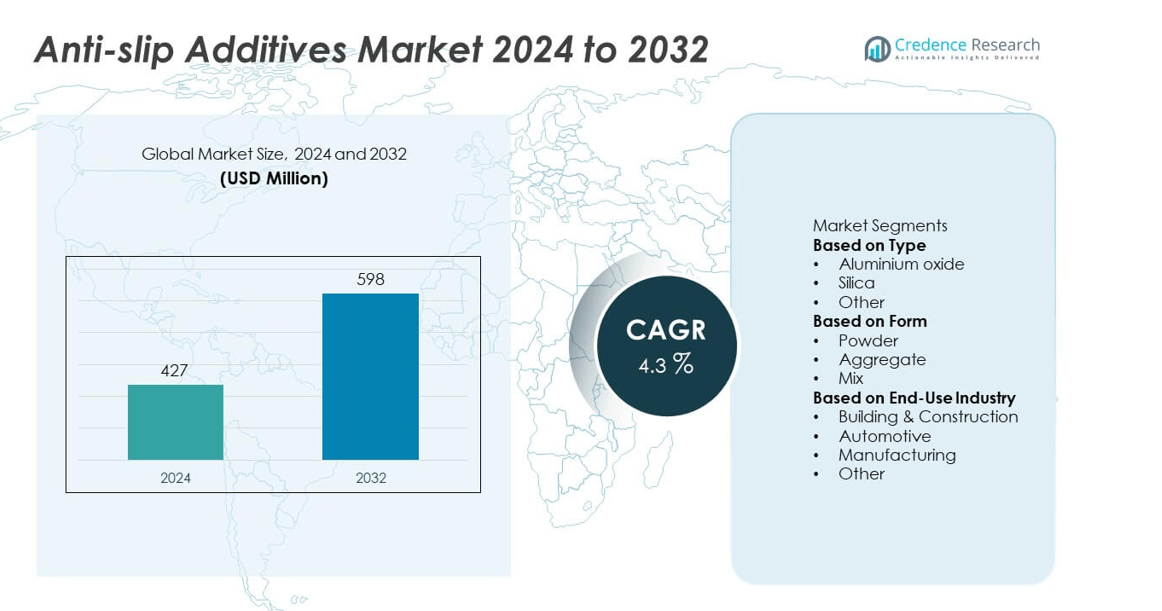

The global anti-slip additives market was valued at USD 427 million in 2024 and is projected to reach USD 598 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-slip Additives Market Size 2024 |

USD 427 million |

| Anti-slip Additives Market, CAGR |

4.3% |

| Anti-slip Additives Market Size 2032 |

USD 598 million |

The top players in the anti-slip additives market include Rust-Oleum, Saicos Colour GmbH, Hempel A/S, PPG Industries, Inc., Associated Chemicals, Vexcon Chemicals, BYK (Altana), Jotun, Coo-Var, and Axalta Coating Systems. These companies lead through innovation in durable and sustainable coating solutions designed for construction, marine, and industrial applications. Asia-Pacific dominated the global market with a 30.6% share in 2024, driven by rapid industrialization and large-scale infrastructure projects. North America followed with a 34.2% share, supported by strong safety regulations and advanced industrial flooring systems, while Europe accounted for 28.4%, fueled by eco-friendly product demand and strict construction standards.

Market Insights

- The global anti-slip additives market was valued at USD 427 million in 2024 and is projected to reach USD 598 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Increasing focus on workplace and public safety across construction, automotive, and industrial sectors drives demand, with the building and construction segment holding a 48.5% share due to stringent safety standards.

- Key trends include the shift toward eco-friendly, low-VOC formulations and advanced silica- and polymer-based additives offering enhanced durability and weather resistance.

- Leading companies such as PPG Industries, Jotun, Axalta Coating Systems, and Rust-Oleum focus on R&D, product innovation, and sustainable coating technologies to strengthen their global presence and competitiveness.

- North America led the market with a 34.2% share in 2024, followed by Europe with 28.4% and Asia-Pacific with 30.6%, supported by expanding construction projects, infrastructure investments, and regulatory emphasis on surface safety.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the type segment, the silica sub-segment dominated the anti-slip additives market with a 46.2% share in 2024. Its leadership is attributed to excellent surface roughness, chemical resistance, and cost-effectiveness. Silica-based additives are widely used in coatings and flooring applications to improve traction and prevent slippage, especially in wet or high-traffic areas. Their compatibility with epoxy, polyurethane, and acrylic resins further enhances their demand. Increasing use in construction and industrial flooring, where durability and safety are critical, continues to strengthen the dominance of silica-based additives across global markets.

- For instance, Jotafloor Non-Slip Aggregate by Jotun uses high-quality silica quartz in fine, medium and coarse sizes, and is specifically applied for industrial flooring in warehouses where liquids may be present.

By Form

The aggregate form segment held the largest market share of 52.8% in 2024, driven by its superior performance in heavy-duty applications. Aggregates provide long-lasting slip resistance and withstand mechanical abrasion, making them suitable for industrial floors, walkways, and marine decks. They are increasingly adopted in epoxy and concrete coatings for outdoor environments exposed to oil, grease, or water. The growing demand for durable, maintenance-free flooring solutions in manufacturing plants and logistics facilities supports the segment’s growth, while powder forms gain traction in decorative and light-duty applications.

- For instance, Safety Grip by Watco is a coarse-textured epoxy resin coating that achieves a cured film thickness of 320 microns and covers 5 m² per unit, designed specifically for wet or oily loading bays and ramps.

By End-Use Industry

The building and construction industry accounted for the largest share of 48.5% in the anti-slip additives market in 2024. The segment’s growth is driven by stringent safety regulations, rising infrastructure investments, and increasing demand for anti-slip coatings in commercial and residential buildings. These additives enhance surface friction in walkways, driveways, and public spaces, reducing the risk of accidents. Expanding construction activity in emerging economies and growing adoption of sustainable, high-performance coatings further support market growth. The automotive and manufacturing sectors also contribute steadily through applications in production floors, vehicle coatings, and maintenance areas.

Key Growth Drivers

Increasing Focus on Workplace and Public Safety

Rising awareness of safety standards across industrial, commercial, and residential sectors is driving demand for anti-slip additives. Governments and organizations are enforcing stricter regulations to prevent workplace accidents caused by slippery surfaces. Industries such as construction, manufacturing, and transportation increasingly adopt anti-slip coatings to enhance surface grip and reduce injury risks. The use of additives in floors, walkways, and production areas aligns with global safety compliance norms, strengthening their integration in flooring and coating systems worldwide.

- For instance, 3M reports that their Safety-Walk™ Slip-Resistant Conformable Tapes (Series 500) achieve a wet static coefficient of friction (SCOF) greater than 0.60, meeting the criteria for “high traction” as defined by the National Floor Safety Institute, thereby helping reduce slip-and-fall incidents.

Growth in Construction and Infrastructure Projects

Expanding construction activities across developing economies, including large-scale infrastructure and commercial projects, significantly boost the adoption of anti-slip additives. These materials are essential for maintaining safety in high-traffic areas such as airports, malls, parking zones, and residential complexes. Rapid urbanization and increased investment in smart cities are driving the use of anti-slip coatings in both indoor and outdoor surfaces. Builders and contractors increasingly prefer durable, chemical-resistant additives that enhance surface traction and meet long-term maintenance goals.

- For instance, Evonik Industries produces nano-silica products, such as the NANOPOX® line, which are used as additives to significantly improve the abrasion resistance and thermal stability of epoxy-based coatings and composites.

Advancement in Coating Formulations and Surface Technologies

Technological innovations in surface coatings and additive chemistry are creating new growth avenues for the anti-slip additives market. Manufacturers are developing advanced silica, aluminum oxide, and polymer-based solutions that offer improved abrasion resistance, UV stability, and surface uniformity. These innovations enhance coating performance while maintaining aesthetic appeal. Integration of nanotechnology and hybrid materials enables precise control over particle size and friction levels, optimizing slip resistance. Continuous R&D investment and material engineering are expected to strengthen the product portfolio of key manufacturers.

Key Trends and Opportunities

Shift Toward Eco-Friendly and Sustainable Additives

The growing emphasis on sustainability is encouraging manufacturers to develop eco-friendly anti-slip additives. Waterborne and solvent-free formulations with low VOC emissions are gaining preference in green construction projects. Silica and natural mineral-based additives are being used to replace synthetic or hazardous compounds. This shift supports compliance with environmental regulations and sustainability certifications such as LEED and BREEAM. Demand for recyclable and biodegradable surface additives continues to rise, presenting opportunities for innovation in sustainable product development.

- For instance, Hempel A/S offers its “Anti-Slip Pearls 69070” which can be added to topcoats and varnishes and features a reported VOC content of 0 g/L in its EU-legislation version.

Rising Adoption in Marine and Industrial Applications

The marine and heavy manufacturing industries are emerging as significant consumers of anti-slip additives. Ships, offshore platforms, and industrial floors require high-friction coatings to prevent slippage under extreme conditions. Additives designed for these applications offer strong chemical and saltwater resistance, ensuring long-term performance. Growing shipbuilding activities and industrial modernization in Asia-Pacific and Europe are driving product demand. This trend provides manufacturers with lucrative opportunities to introduce corrosion-resistant and heavy-duty anti-slip solutions tailored for harsh environments.

- For instance, EPMAR Corporation (SynDeck™) offers a Slip Resistant Additive SD5220 / SD5250 that is zero VOC and recommended at 2-4 fluid ounces per 0.75 gallons of clear topcoat to achieve required roughness for marine deck systems.

Integration of Smart Coatings and Functional Additives

The integration of smart materials into anti-slip coatings is an emerging opportunity. Additives with self-cleaning, anti-corrosion, and color-stable properties are gaining attention for multipurpose surfaces. Developments in digital monitoring technologies allow predictive maintenance of coated areas, extending service life. Smart flooring solutions with embedded sensors for slip detection are also under exploration. These advancements create avenues for next-generation coating systems that combine safety, functionality, and durability in industrial and architectural applications.

Key Challenges

Fluctuating Raw Material Costs

Volatility in the prices of raw materials such as aluminum oxide, silica, and resins poses a challenge to manufacturers. Supply chain disruptions, energy costs, and geopolitical tensions further impact production expenses. High material costs can limit adoption in cost-sensitive markets, especially in developing regions. Manufacturers are focusing on optimizing production efficiency and exploring alternative mineral sources to maintain profitability. Strategic sourcing and sustainable supply chain management are becoming critical to mitigate pricing instability and ensure steady market growth.

Performance Consistency and Application Limitations

Achieving consistent surface performance across varying substrates and environmental conditions remains a key challenge. Improper additive dispersion can lead to uneven texture, reduced aesthetics, or insufficient slip resistance. Harsh conditions such as moisture, chemicals, or UV exposure may degrade coating durability over time. Ensuring compatibility with diverse coating systems like epoxy, polyurethane, and acrylic requires continuous formulation refinement. Manufacturers are investing in advanced testing, quality control, and technical support to ensure reliable application performance and meet diverse end-user requirements.

Regional Analysis

North America

North America held a 34.2% share of the global anti-slip additives market in 2024, driven by strong demand from construction, automotive, and industrial flooring sectors. The United States dominates the regional market due to robust safety regulations and widespread adoption of anti-slip coatings in public and commercial infrastructure. Investments in renovation projects and industrial safety upgrades continue to propel growth. Manufacturers are introducing durable, weather-resistant additives to meet OSHA and EPA standards. The expansion of marine and logistics facilities in the U.S. and Canada further contributes to regional market performance.

Europe

Europe accounted for 28.4% of the global anti-slip additives market in 2024, supported by strict workplace safety regulations and sustainability-driven construction practices. Countries such as Germany, the United Kingdom, and France are key contributors, with strong demand from residential, industrial, and transportation infrastructure projects. The region’s commitment to green building standards promotes the use of low-VOC, eco-friendly anti-slip coatings. Growing refurbishment of aging infrastructure and advancements in polymer and silica-based materials fuel demand. The marine and manufacturing industries in Northern Europe also drive consistent product adoption.

Asia-Pacific

Asia-Pacific dominated the anti-slip additives market with a 30.6% share in 2024, led by China, India, Japan, and South Korea. Rapid urbanization, large-scale infrastructure projects, and expanding construction activities are major growth drivers. The rise in commercial complexes, industrial facilities, and marine ports boosts demand for high-durability anti-slip solutions. Governments across the region are enforcing stricter building safety codes, creating favorable conditions for product adoption. Local manufacturers are investing in cost-effective aggregate and silica-based additives to serve expanding domestic and export markets, strengthening the region’s leadership position.

Latin America

Latin America captured a 4.2% share of the global anti-slip additives market in 2024, supported by steady growth in the construction and automotive sectors. Brazil and Mexico lead the region, driven by infrastructure modernization and industrial safety initiatives. The growing focus on improving public infrastructure, such as airports, ports, and public walkways, drives the use of anti-slip coatings. However, market expansion is limited by fluctuating raw material costs and moderate construction spending. Partnerships between local producers and global coating manufacturers are enhancing product availability and performance consistency across the region.

Middle East & Africa

The Middle East and Africa held a 2.6% share of the global anti-slip additives market in 2024, driven by rapid industrialization and infrastructure development. The UAE, Saudi Arabia, and South Africa are leading markets, supported by large-scale construction and energy projects. Expanding marine operations and increased emphasis on workplace safety regulations are boosting demand. Regional focus on weather-resistant and UV-stable coatings for outdoor applications further supports adoption. Continuous investments in oil, gas, and commercial real estate projects are expected to create long-term growth opportunities for anti-slip additive suppliers in the region.

Market Segmentations:

By Type

- Aluminium oxide

- Silica

- Other

By Form

By End-Use Industry

- Building & Construction

- Automotive

- Manufacturing

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-slip additives market includes key players such as Rust-Oleum, Saicos Colour GmbH, Hempel A/S, PPG Industries, Inc., Associated Chemicals, Vexcon Chemicals, BYK (Altana), Jotun, Coo-Var, and Axalta Coating Systems. These companies focus on developing advanced surface coatings and high-performance additives to improve safety, durability, and aesthetics across construction, marine, and industrial applications. Leading manufacturers are expanding product portfolios with eco-friendly, low-VOC formulations and enhanced abrasion resistance to meet evolving environmental regulations. Strategic initiatives such as mergers, collaborations, and regional expansions are strengthening their global footprint. For instance, PPG Industries and Jotun invest heavily in R&D to deliver weather-resistant solutions for outdoor flooring, while BYK and Axalta emphasize innovation in polymer-based additives for long-lasting grip and coating uniformity. The market remains moderately fragmented, with strong competition driven by performance differentiation and sustainability-focused product innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rust-Oleum

- Saicos Colour GmbH

- Hempel A/S

- PPG Industries, Inc.

- Associated Chemicals

- Vexcon Chemicals

- BYK (Altana)

- Jotun

- Coo-Var

- Axalta Coating Systems

Recent Developments

- In August 2025, BYK further announced a strategic expansion in South America by founding a new entity “BYK do Brasil” and strengthening its local presence and innovation outreach for coating additive solutions, thereby enhancing its geographic support for specialty additive markets including anti-slip applications.

- In December 2024, BYK‑Additives & Instruments (division of ALTANA AG) outlined new additive solutions including PFAS-free technologies and automated high-throughput screening facilities capable of testing up to 220 samples in 24 hours, supporting faster development of sustainable surface-treatment systems.

- In May 2024, Rust‑Oleum Corporation published updated safety documentation for its Non-Skid 200 & 300 Additives, confirming they are safe for industrial use and compliant with EU “REACH” regulations as of 3 May 2024.

- In January 2024, AkzoNobel and the University of Twente in the Netherlands entered a collaboration to develop bio-based and sustainable anti-slip additives for coatings

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anti-slip additives market will grow steadily with increasing focus on workplace and surface safety across industries.

- Construction and infrastructure development in emerging economies will boost the adoption of anti-slip coatings and additives.

- Manufacturers will prioritize eco-friendly, low-VOC, and recyclable additives to align with sustainability goals.

- Technological advancements will enhance product performance, offering longer durability and improved surface grip.

- Marine, automotive, and industrial sectors will increasingly integrate high-traction coatings for safety compliance.

- Asia-Pacific will remain the fastest-growing region, driven by rapid industrialization and urban construction projects.

- North America and Europe will maintain strong market positions due to strict safety and environmental regulations.

- Strategic collaborations between coating manufacturers and chemical companies will drive product innovation.

- Price fluctuations of silica and aluminum oxide will encourage sourcing optimization and process efficiency.

- Growing use of digital technologies in material testing will support quality control and performance validation.