Market Overview

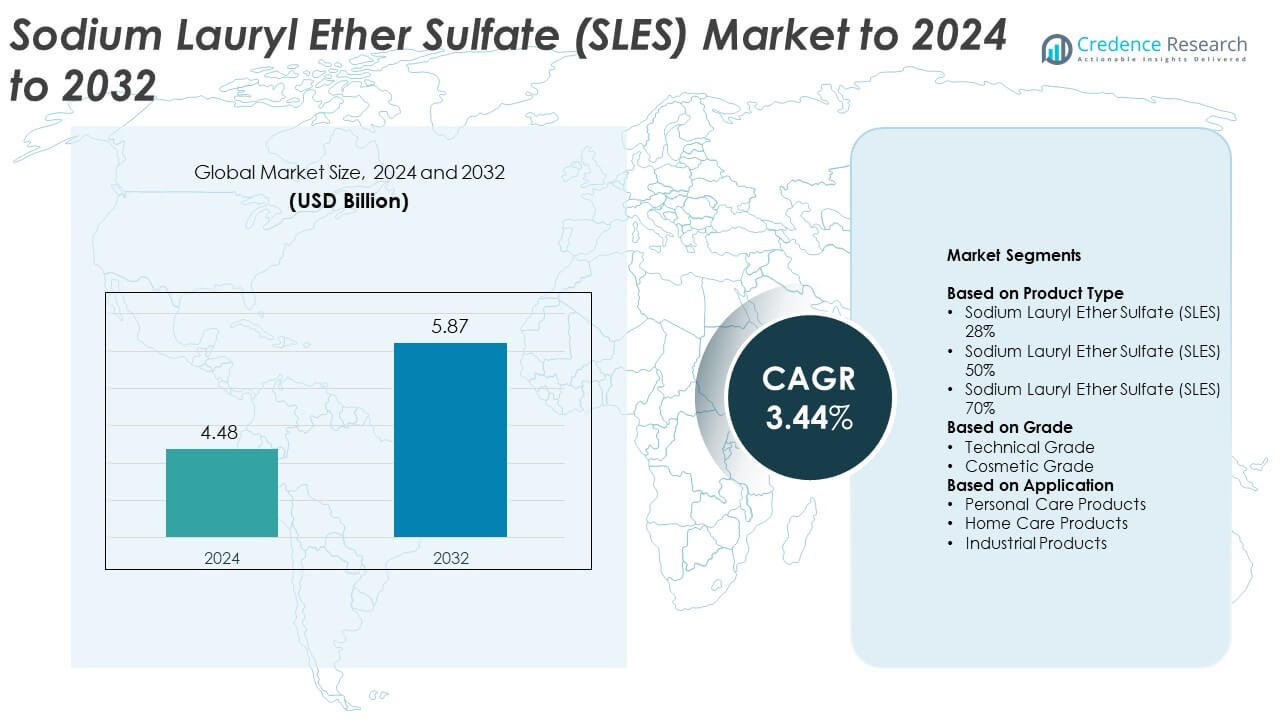

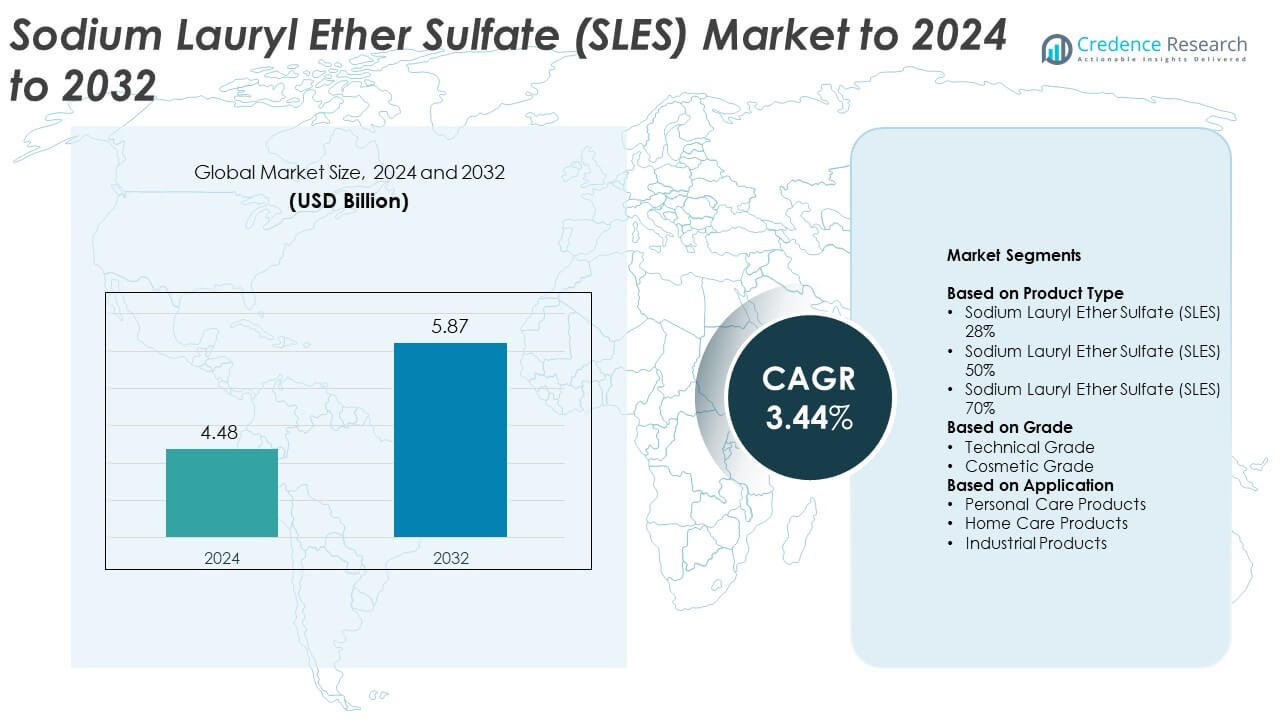

Sodium Lauryl Ether Sulfate (SLES) Market size was valued at USD 4.48 Billion in 2024 and is anticipated to reach USD 5.87 Billion by 2032, at a CAGR of 3.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Lauryl Ether Sulfate (SLES) Market Size 2024 |

USD 4.48 Billion |

| Sodium Lauryl Ether Sulfate (SLES) Market, CAGR |

3.44% |

| Sodium Lauryl Ether Sulfate (SLES) Market Size 2032 |

USD 5.87 Billion |

The Sodium Lauryl Ether Sulfate (SLES) market is led by key players such as BASF, Lonza, Huntsman, Solvay, Galaxy Surfactants, Croda International, Dow, Evonik, and Kao Chemicals. These companies focus on expanding production capacities, improving bio-based surfactant technologies, and enhancing supply chain integration to strengthen global presence. Product innovation centered on mildness and biodegradability remains a key strategy to meet evolving consumer and regulatory demands. Regionally, Asia-Pacific dominates the market with a 33.8% share in 2024, driven by rapid industrial expansion, growing personal care manufacturing, and strong domestic consumption across China, India, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sodium Lauryl Ether Sulfate (SLES) market was valued at USD 4.48 Billion in 2024 and is projected to reach USD 5.87 Billion by 2032, growing at a CAGR of 3.44%.

- Rising demand for personal care and household cleaning products is a major growth driver, supported by increased hygiene awareness and urbanization.

- The market trend is shifting toward bio-based and sustainable formulations, with manufacturers investing in eco-friendly production technologies.

- Competition remains strong, with major players expanding capacity and focusing on product innovation to improve mildness and biodegradability.

- Asia-Pacific dominated with 33.8% share in 2024, followed by North America at 27.4% and Europe at 25.6%, while the SLES 70% product segment led the market with a 46.3% share.

Market Segmentation Analysis:

By Product Type

The Sodium Lauryl Ether Sulfate (SLES) 70% segment dominated the market in 2024 with a 46.3% share. Its dominance is due to its high active matter concentration, which provides better foaming and cleaning efficiency in detergents and shampoos. The segment is preferred for industrial formulations and high-performance cleaning products where dilution flexibility is required. Rising production of concentrated personal and home care products continues to drive this category’s growth, supported by steady demand from leading FMCG and detergent manufacturers.

- For instance, BASF’s Texapon N 70 lists Sodium Laureth Sulfate at 68–73 % content, formulated for concentrated detergents and shampoos.

By Grade

The cosmetic grade segment accounted for the largest share of 58.2% in 2024. Its leadership stems from its use in mild formulations for shampoos, facial cleansers, and body washes. The segment’s purity and lower impurities make it ideal for skin-contact products, ensuring safety and consumer acceptance. Growing personal grooming and hygiene awareness, coupled with rising consumption of premium cosmetic products, continues to strengthen demand for cosmetic-grade SLES globally.

- For instance, NCSP specifies cosmetic-suitable SLES 2EO with 68–70 % active matter and ≤ 15 ppm 1,4-dioxane.

By Application

The personal care products segment led the market with a 51.7% share in 2024. This dominance is driven by extensive use in shampoos, body washes, hand cleansers, and facial foams for its strong surfactant and emulsifying properties. Expanding skincare and haircare industries in Asia-Pacific and Europe, combined with increasing urban lifestyles, support steady product consumption. Continuous innovations in sulfate-based formulations and demand for cost-effective cleansing agents further reinforce the segment’s leadership.

Key Growth Drivers

Rising Demand for Personal and Home Care Products

Growing global demand for shampoos, detergents, and liquid soaps is driving SLES consumption. The compound’s strong foaming and cleansing properties make it essential in these formulations. Expanding urban populations and rising hygiene awareness in emerging economies further boost usage. Increasing product launches by personal care brands using concentrated surfactants also contribute to sustained market growth.

- For instance, Unilever reported Home Care underlying sales up 2.9% with 4.0% volume growth in FY 2024

Cost-Effective and High-Performance Surfactant Properties

SLES offers a balance of strong cleaning performance, mildness, and low production cost, which supports its broad industrial adoption. It serves as a preferred alternative to expensive organic surfactants in both cosmetic and detergent applications. Manufacturers favor its versatility in formulations requiring high foam and viscosity control. The affordability of SLES ensures consistent demand across household and commercial product categories.

- For instance, Biariq’s SLES 70% TDS (Technical Data Sheet) provides specific chemical specifications for their cosmetic-grade product, showing an active matter content of 68–73% (with 70% being the nominal value), a maximum of ≤ 30 ppm for 1,4-dioxane content, and a maximum of ≤ 1.0% for sodium sulfate content.

Expansion of FMCG and Detergent Manufacturing Sector

Rapid industrial expansion of FMCG and detergent manufacturing in Asia-Pacific drives large-scale SLES consumption. Major detergent producers are increasing output to meet domestic and export demand, strengthening regional production networks. Growth in e-commerce distribution channels supports faster market penetration for SLES-based cleaning products. Additionally, industrial clusters in China and India have improved raw material access and economies of scale.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Trends & Opportunities

Shift Toward Sustainable and Biodegradable Formulations

Manufacturers are focusing on eco-friendly variants of SLES derived from renewable feedstocks such as palm and coconut oil. This aligns with global sustainability goals and rising consumer preference for biodegradable surfactants. Product innovation in green chemistry helps companies reduce environmental footprint while maintaining performance standards. Regulatory support for low-toxicity formulations creates new opportunities in the cosmetic and detergent sectors.

- For instance, AGAE Technologies announced that its newly retrofitted manufacturing plant in Asia—covering 41,000 square feet—has a production capacity of over 1,000 metric tons of rhamnolipid biosurfactants annually.

Technological Advancements in Manufacturing Processes

Developments in ethoxylation and sulfation technologies are improving the purity and consistency of SLES products. Automation and continuous process control reduce impurities and enhance yield efficiency. These advancements enable tailored surfactant formulations suitable for sensitive-skin products. Increased focus on energy-efficient production methods also lowers operational costs, strengthening manufacturers’ competitiveness.

- For instance, Stepan notes that storage above 25 °C can accelerate 1,4-dioxane formation, guiding tighter temperature control in SLES processing.

Growing Penetration in Emerging Markets

Rising disposable incomes and hygiene awareness across emerging regions are expanding product use. Multinational brands are investing in localized production facilities to reduce logistics costs and cater to domestic demand. Growth in organized retail and online sales channels further supports product accessibility. This trend offers significant opportunities for market players to establish a strong regional presence.

Key Challenges

Health and Environmental Concerns

SLES faces growing scrutiny for potential skin irritation and ecological toxicity in wastewater systems. Public perception of sulfate-based surfactants as harsh or non-sustainable affects brand positioning in cosmetics. Regulatory agencies are imposing stricter safety and biodegradability requirements. These challenges compel manufacturers to reformulate or develop milder alternatives to retain consumer trust.

Fluctuating Raw Material Prices

Volatility in prices of ethylene oxide and fatty alcohols, key inputs for SLES, impacts production costs. Dependence on petrochemical feedstocks exposes manufacturers to crude oil price fluctuations. Supply chain disruptions and trade restrictions can further elevate costs. Such instability pressures profit margins and may shift buyer preferences toward alternative surfactants.

Regional Analysis

North America

North America held a 27.4% share of the Sodium Lauryl Ether Sulfate (SLES) market in 2024. Growth is supported by high demand for personal and home care products, particularly liquid detergents, shampoos, and body washes. Strong presence of established FMCG brands and rising adoption of concentrated formulations enhance regional sales. Increasing awareness about hygiene, coupled with the development of eco-friendly SLES blends, drives further growth. The United States dominates regional demand, supported by continuous innovation in cleaning formulations and large-scale manufacturing capacity among key detergent producers.

Europe

Europe accounted for 25.6% of the market share in 2024. The region’s growth is driven by strict regulatory standards promoting safe, biodegradable, and skin-friendly surfactants. Rising consumer preference for sustainable and sulfate-free personal care products is influencing production trends. Major producers in Germany, France, and the UK are investing in green chemical processes and plant-based SLES variants. Expanding applications in household cleaning and industrial formulations also sustain market growth, while growing awareness of ingredient transparency supports continued product innovation across Western Europe.

Asia-Pacific

Asia-Pacific dominated the Sodium Lauryl Ether Sulfate (SLES) market in 2024, holding a 33.8% share. The dominance is attributed to expanding detergent and personal care manufacturing sectors in China, India, and South Korea. Rapid urbanization, rising disposable income, and increasing hygiene awareness among consumers fuel strong consumption growth. Favorable government policies supporting industrial expansion further enhance production capabilities. Regional manufacturers benefit from easy access to raw materials and low production costs, making Asia-Pacific the leading global supplier and consumer of SLES-based formulations.

Latin America

Latin America represented 7.8% of the global market share in 2024. Rising household income levels and growing urban populations contribute to increasing demand for cleaning and personal care products. Brazil and Mexico serve as key production and consumption hubs in the region. Local manufacturers are expanding capacity to meet rising domestic demand for affordable detergents and shampoos. Strategic investments by multinational companies in manufacturing and distribution networks further support regional growth, with an increasing focus on value-driven product lines targeting mass-market consumers.

Middle East & Africa

The Middle East & Africa region accounted for 5.4% of the Sodium Lauryl Ether Sulfate (SLES) market in 2024. Growth is primarily driven by increasing adoption of personal hygiene and home care products, supported by rising urbanization and population expansion. The Gulf countries and South Africa are key markets due to their growing FMCG and cosmetics sectors. Investments in local production facilities help reduce import dependence and improve supply efficiency. Expanding retail networks and greater consumer exposure to branded products further enhance regional market penetration.

Market Segmentations:

By Product Type

- Sodium Lauryl Ether Sulfate (SLES) 28%

- Sodium Lauryl Ether Sulfate (SLES) 50%

- Sodium Lauryl Ether Sulfate (SLES) 70%

By Grade

- Technical Grade

- Cosmetic Grade

By Application

- Personal Care Products

- Home Care Products

- Industrial Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sodium Lauryl Ether Sulfate (SLES) market features major participants such as BASF, Lonza, Huntsman, Solvay, Galaxy Surfactants, Croda International, Dow, Evonik, PCC Group, Godrej, Sasol, Stepan, Clariant, Cepsa Quimica, Kao Chemicals, AkzoNobel, Univar Solutions, and Innospec. The market remains highly competitive, with global and regional manufacturers emphasizing technological innovation, capacity expansion, and sustainability-driven production. Companies are focusing on bio-based surfactant development and improved ethoxylation processes to reduce environmental impact. Strategic collaborations with FMCG brands enhance supply reliability and strengthen market presence. Continuous product portfolio diversification helps firms serve varied applications in personal care, household, and industrial sectors. Additionally, regional expansion across Asia-Pacific and Europe is driven by growing local demand and cost advantages. R&D investments are increasingly directed toward improving product mildness and biodegradability to align with evolving consumer and regulatory expectations, ensuring long-term market competitiveness.

Key Player Analysis

- BASF

- Lonza

- Huntsman

- Solvay

- Galaxy Surfactants

- Croda International

- Dow

- Evonik

- PCC Group

- Godrej

- Sasol

- Stepan

- Clariant

- Cepsa Quimica

- Kao Chemicals

- AkzoNobel

- Univar Solutions

- Innospec

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In December 2023, Godrej Consumer Products launched the new ‘Godrej Fab’ liquid detergent in the South Indian markets, a product line that incorporates SLES.

- In August 2023, Univar Solutions, a major distributor of SLES and other surfactants, was acquired by Apollo Global Management Inc. for $8.1 billion to enhance Apollo’s presence in specialty chemicals distribution.

- In January 2023, Cepsa Quimica introduced NextLab, the world’s first linear alkylbenzene (LAB) produced with a renewable and certified material attributed via mass balance. LAB is a key raw material for the SLES alternative, LAS.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of SLES in personal care products will continue driving steady global demand.

- Rising awareness of hygiene and grooming in developing economies will expand product applications.

- Advancements in bio-based and plant-derived surfactants will support sustainable product innovation.

- Increasing use of SLES in industrial cleaning and institutional detergents will strengthen market growth.

- Strategic investments by FMCG manufacturers in emerging markets will boost regional production.

- Development of mild, low-irritation formulations will enhance usage in premium skincare and haircare products.

- Expansion of online retail channels will improve accessibility for household cleaning and personal care products.

- Continuous research in eco-friendly surfactant chemistry will create new opportunities for manufacturers.

- Regulatory focus on biodegradability and consumer safety will shape future product formulations.

- Integration of advanced production technologies will enhance efficiency and ensure long-term supply stability.