Market Overview:

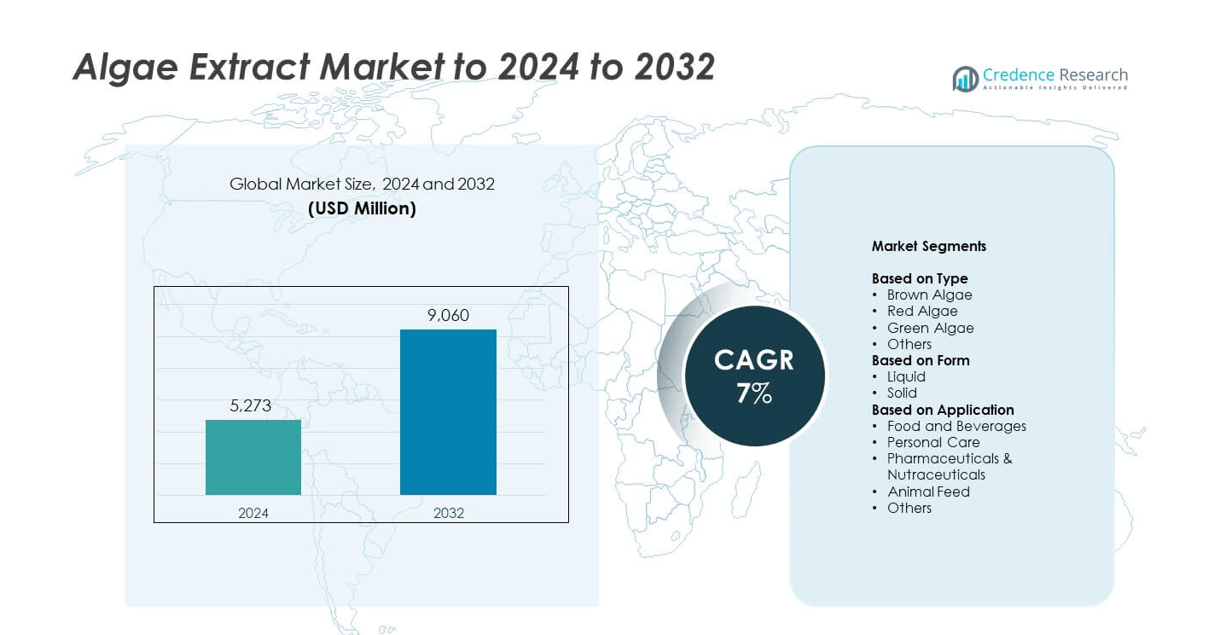

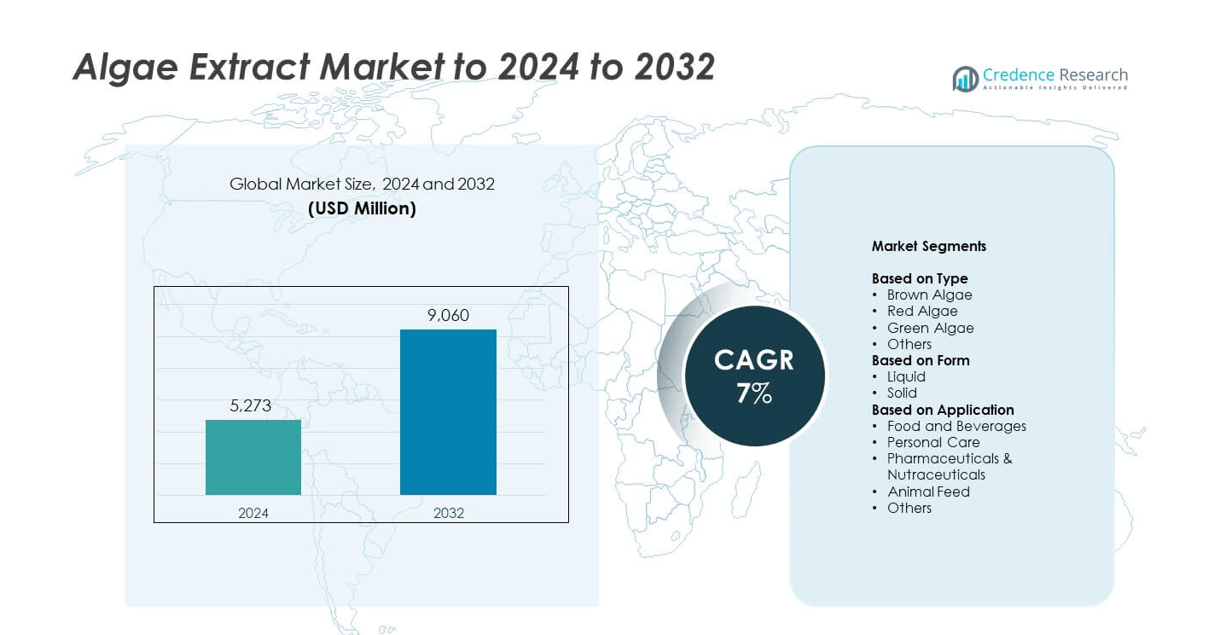

Algae Extract Market size was valued USD 5,273 Million in 2024 and is anticipated to reach USD 9,060 Million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Extract Market Size 2024 |

USD 5,273 Million |

| Algae Extract Market, CAGR |

7% |

| Algae Extract Market Size 2032 |

USD 9,060 Million |

The algae extract market is led by key players including Corbion NV, Cyanotech Corporation, Algatechnologies, Earthrise Nutritionals LLC. (DIC Corporation), Allmicroalgae, Blue Evolution, and Phycom Microalgae. These companies focus on expanding large-scale algae cultivation, developing advanced extraction technologies, and launching high-quality marine-based ingredients for food, cosmetics, and nutraceutical applications. Strategic investments in sustainable aquaculture and bioactive innovation strengthen their market presence. North America remained the leading region with a 34.2% share in 2024, followed by Europe with 29.8% and Asia-Pacific with 26.7%, supported by robust industrial adoption, government-backed marine biotechnology initiatives, and rising demand for clean-label, algae-derived products.

Market Insights

- The algae extract market was valued at USD 5,273 million in 2024 and is projected to reach USD 9,060 million by 2032, growing at a CAGR of 7%.

• Rising demand for natural and plant-based ingredients across food, nutraceutical, and personal care sectors drives market growth, supported by the shift toward sustainable and eco-friendly formulations.

• Technological advancements in extraction processes and cultivation methods enhance yield efficiency, while clean beauty and marine-sourced products continue to gain popularity.

• The market is moderately consolidated, with leading companies focusing on R&D, sustainable aquaculture, and partnerships to expand their global footprint.

• North America held a 34.2% share in 2024, followed by Europe with 29.8% and Asia-Pacific with 26.7%; among product types, brown algae dominated with a 48.6% share, driven by its extensive use in cosmetics and functional food applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The brown algae segment dominated the algae extract market with a 48.6% share in 2024. Its leadership stems from high content of fucoidan, alginate, and laminarin compounds that enhance demand across nutraceutical and skincare formulations. Brown algae are preferred for antioxidant and anti-inflammatory properties that support health supplements and cosmetic products. Rising extraction efficiency through enzymatic and solvent-based technologies also drives its utilization. Expanding seaweed farming in regions such as Japan, China, and South Korea ensures consistent raw material availability, further supporting segment growth.

- For instance, Marinova’s Maritech fucoidan from Fucus vesiculosus contains 70–95% fucoidan with 20–30% sulfate and <100 ppm iodine, per FDA GRAS filing.

By Form

The liquid form segment accounted for a 57.2% share in 2024, leading the algae extract market. This dominance is driven by its higher solubility, easy blending in formulations, and suitability for beverages, cosmetics, and pharmaceuticals. Liquid extracts enable uniform nutrient dispersion and better absorption, enhancing product effectiveness in end-use applications. Growing adoption in skincare serums and functional drinks further propels demand. Continuous innovation in cold-press extraction and microencapsulation methods improves nutrient retention, strengthening the preference for liquid-based algae extracts in global markets.

- For instance, dsm-firmenich’s life’sDHA B54-0100 algal oil delivers 545 mg DHA and 80 mg EPA per gram, enabling high-load liquid formulations.

By Application

The personal care segment led the algae extract market with a 42.3% share in 2024. Its growth is supported by increasing use in anti-aging, moisturizing, and UV-protection products. Algae extracts are rich in vitamins, amino acids, and antioxidants that support skin hydration and rejuvenation. Rising demand for natural and marine-based cosmetic ingredients among premium brands drives this segment’s dominance. Manufacturers are focusing on sustainable sourcing and bioactive extraction methods to cater to clean-label skincare trends, boosting the use of algae-derived ingredients in creams, lotions, and serums.

Key Growth Drivers

Rising Demand for Natural Ingredients

Increasing consumer shift toward natural and plant-based ingredients drives algae extract adoption across cosmetics, food, and nutraceuticals. Algae-derived bioactives such as polysaccharides, carotenoids, and amino acids enhance product appeal due to their antioxidant and anti-aging benefits. The demand for sustainable, chemical-free formulations in skincare and dietary supplements strengthens market growth. Manufacturers are replacing synthetic additives with marine-sourced alternatives to meet clean-label and eco-conscious consumer preferences, fueling large-scale algae cultivation and extraction investments globally.

- For instance, Gelymar doubled carrageenan output capacity to about 10,000 metric tons after a two-year expansion, reflecting rising hydrocolloid demand in 2019.

Expansion in Nutraceutical and Functional Food Applications

Algae extracts are gaining prominence in the nutraceutical sector for their high protein, omega-3, and vitamin content. Rising awareness about preventive healthcare and immunity-boosting products is increasing their use in supplements, fortified beverages, and health foods. The extracts provide natural colorants and bioactive compounds, improving product functionality and nutrition. With growing health consciousness and demand for vegan formulations, the integration of algae-based ingredients in functional foods continues to accelerate, expanding their commercial potential across global nutrition markets.

- For instance, Fermentalg’s DHA ORIGINS range of algal oil includes a naturally concentrated product with over 550 mg/g DHA (as fatty acid, or >55%) by weight.

Advancements in Extraction and Cultivation Technologies

Innovations in bioprocessing and extraction technologies are enhancing yield and quality of algae extracts. Techniques like supercritical CO₂ extraction and ultrasonic-assisted methods ensure better recovery of bioactive compounds while reducing solvent usage. Cultivation improvements using photobioreactors and controlled aquaculture systems support year-round production and quality consistency. These advancements enable scalability and cost efficiency, attracting new investments in algae-based ingredient manufacturing and driving broader adoption across cosmetics, pharmaceuticals, and food sectors.

Key Trends & Opportunities

Growing Use in Clean Beauty and Marine Cosmetics

Algae extracts are increasingly used in premium skincare and marine cosmetic formulations due to their hydrating and antioxidant benefits. Global beauty brands are adopting marine-based actives to replace synthetic compounds and align with sustainable product trends. The rising popularity of clean beauty products supports demand for algae-derived ingredients in serums, moisturizers, and anti-aging solutions. Expanding awareness of ocean-friendly cosmetics further strengthens opportunities in the personal care segment.

- For instance, Mibelle Biochemistry’s Snow Algae Powder showed up to 47% Klothogene stimulation and improved dermal metrics in clinical studies.

Sustainability and Circular Bioeconomy Integration

The algae extract industry is witnessing opportunities through integration with circular bioeconomy models. Companies are developing eco-friendly cultivation systems using wastewater and CO₂ capture to reduce environmental impact. Algae-based production aligns with global sustainability goals by offering renewable biomass sources. The use of by-products in biofertilizers and bioplastics adds value while minimizing waste, enhancing profitability across multiple industries.

- For instance, Notpla’s seaweed-coated takeaway boxes decomposed in four weeks in home compost; a UK trial with 11 restaurants aimed to displace 30,000 plastic boxes and cut 46,000 plastic sachets.

Key Challenges

High Production and Processing Costs

Despite strong demand, high production and processing costs remain a key restraint for algae extract manufacturers. Cultivation requires controlled environments, nutrient inputs, and energy-intensive drying or extraction systems. These factors limit scalability and raise final product pricing. Smaller producers face challenges in achieving cost competitiveness against synthetic alternatives. Continued R&D in cost-effective extraction and large-scale cultivation technologies is essential to overcome this limitation and ensure sustainable market expansion.

Quality Standardization and Supply Chain Constraints

Variations in algae species, cultivation conditions, and extraction methods result in inconsistent product quality. Lack of global standardization for algae-derived ingredients hinders wider acceptance in regulated sectors such as pharmaceuticals and food. Seasonal availability and limited cold-chain logistics further affect raw material supply. Ensuring batch-to-batch consistency, standardized quality benchmarks, and transparent traceability across the supply chain are crucial challenges for market players seeking large-scale commercialization.

Regional Analysis

North America

North America held a 34.2% share of the algae extract market in 2024, driven by rising demand for natural ingredients in cosmetics, nutraceuticals, and food products. The United States leads due to the strong presence of clean-label and sustainable product manufacturers. Increasing investments in biotechnology and algae-based farming support market expansion. Nutraceutical producers are incorporating algae extracts for their high nutrient density and functional benefits. Supportive regulatory standards promoting natural additives and eco-friendly formulations further enhance the region’s dominance in the global algae extract industry.

Europe

Europe accounted for a 29.8% share of the algae extract market in 2024, supported by growing use in personal care, pharmaceuticals, and dietary supplements. Countries like France, Germany, and the United Kingdom are key consumers due to advanced marine biotechnology and sustainable sourcing initiatives. EU policies promoting bio-based and vegan ingredients drive demand across multiple sectors. Expanding algae cultivation projects in coastal nations strengthen raw material supply. Increasing consumer preference for organic and marine-sourced products continues to sustain the region’s leading position in the global market.

Asia-Pacific

Asia-Pacific captured a 26.7% share of the algae extract market in 2024, emerging as the fastest-growing region. High availability of raw materials and expanding seaweed aquaculture in China, Japan, Indonesia, and South Korea support large-scale production. Rising demand for natural skincare and dietary supplements boosts consumption across domestic markets. Government support for marine biotechnology and export-oriented algae farming further strengthens the regional supply base. Growing awareness of algae’s nutritional and therapeutic properties drives its use in both consumer and industrial applications across the region.

Latin America

Latin America held a 5.4% share of the algae extract market in 2024, with growth led by Brazil and Chile. Expanding marine resources and increasing focus on aquaculture support production. The food and beverage sector is adopting algae-derived ingredients for natural coloring and fortification purposes. Rising consumer preference for plant-based and nutrient-rich products drives demand. Regional research initiatives focused on developing sustainable algae extraction techniques contribute to market development, though limited large-scale infrastructure continues to restrain higher output.

Middle East & Africa

The Middle East & Africa accounted for a 3.9% share of the algae extract market in 2024. Market growth is supported by increasing use of algae extracts in cosmetics, health supplements, and animal feed. Coastal countries such as South Africa and the United Arab Emirates are investing in small-scale algae farming and research partnerships to diversify their bio-based economies. Rising awareness of marine biotechnology and sustainable ingredients promotes gradual adoption. However, limited cultivation capacity and climatic challenges still restrict large-scale commercial expansion across the region.

Market Segmentations:

By Type

- Brown Algae

- Red Algae

- Green Algae

- Others

By Form

By Application

- Food and Beverages

- Personal Care

- Pharmaceuticals & Nutraceuticals

- Animal Feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The algae extract market features a competitive landscape led by companies such as Corbion NV, Cyanotech Corporation, Allmicroalgae, Texas A&M AgriLife Research, Blue Evolution, Phycom Microalgae, Earthrise Nutritionals LLC. (DIC Corporation), Algatechnologies, Goerlich Pharma GmbH, Solazyme, Tagrow Co., Ltd, Kelp, Olmix Group, Lallemand Health Solutions, Phytoalgae, and Arizona Algae Products, LLC. Market participants are focusing on scaling sustainable algae cultivation and advancing extraction technologies to enhance yield and purity of bioactive compounds. Strategic partnerships with nutraceutical, cosmetic, and food manufacturers are driving new product formulations using marine-derived ingredients. Many firms are investing in photobioreactor systems, eco-friendly solvent extraction, and biotechnology R&D to improve operational efficiency and cost-effectiveness. Emphasis on traceable sourcing and compliance with international quality standards strengthens brand positioning. The competitive environment continues to evolve through innovation, regional expansion, and diversification across high-value applications such as skincare, dietary supplements, and functional foods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corbion NV

- Cyanotech Corporation

- Allmicroalgae

- Texas A&M AgriLife Research

- Blue Evolution

- Phycom Microalgae

- Earthrise Nutritionals LLC. (DIC Corporation)

- Algatechnologies

- Goerlich Pharma GmbH

- Solazyme

- Tagrow Co., Ltd

- Kelp

- Olmix Group

- Lallemand Health Solutions

- Phytoalgae

- Arizona Algae Products, LLC.

Recent Developments

- In May 2025, Blue Evolution launched Orca Minerals, the first U.S.-based platform focused on regenerative biomining of critical minerals using cultivated seaweed.

- In 2024, Lallemand Health Solutions introduced its new probiotic formula, Prenatis, at SupplySide West.

- In 2023, Corbion launched AlgaPrime DHA P3, a new algae-based omega-3 ingredient specifically aimed at enhancing the sustainability and nutritional profile of pet food products.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing consumer shift toward natural and vegan ingredients will boost algae extract adoption.

- Expansion of marine biotechnology will enhance large-scale algae cultivation efficiency.

- Rising demand for bioactive compounds will strengthen applications in nutraceuticals and cosmetics.

- Technological advances in extraction methods will improve yield and product quality.

- Growing investments in sustainable aquaculture will support consistent raw material availability.

- Clean-label and eco-friendly product trends will create new opportunities for algae-based formulations.

- Strategic collaborations between food and cosmetic manufacturers will drive product innovation.

- Expanding algae research will uncover new species with high-value nutritional profiles.

- Supportive government policies will encourage green manufacturing and bio-based ingredient adoption.

- Integration with circular bioeconomy models will improve sustainability and reduce production costs.