Market Overview

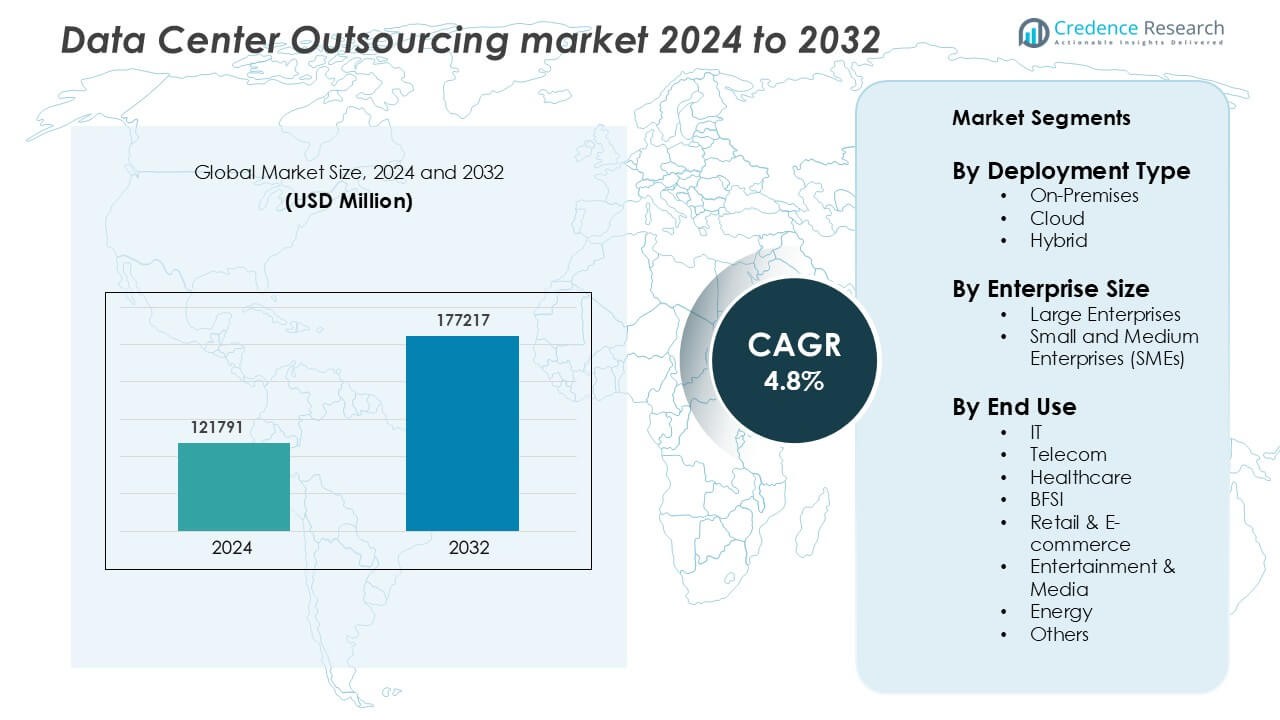

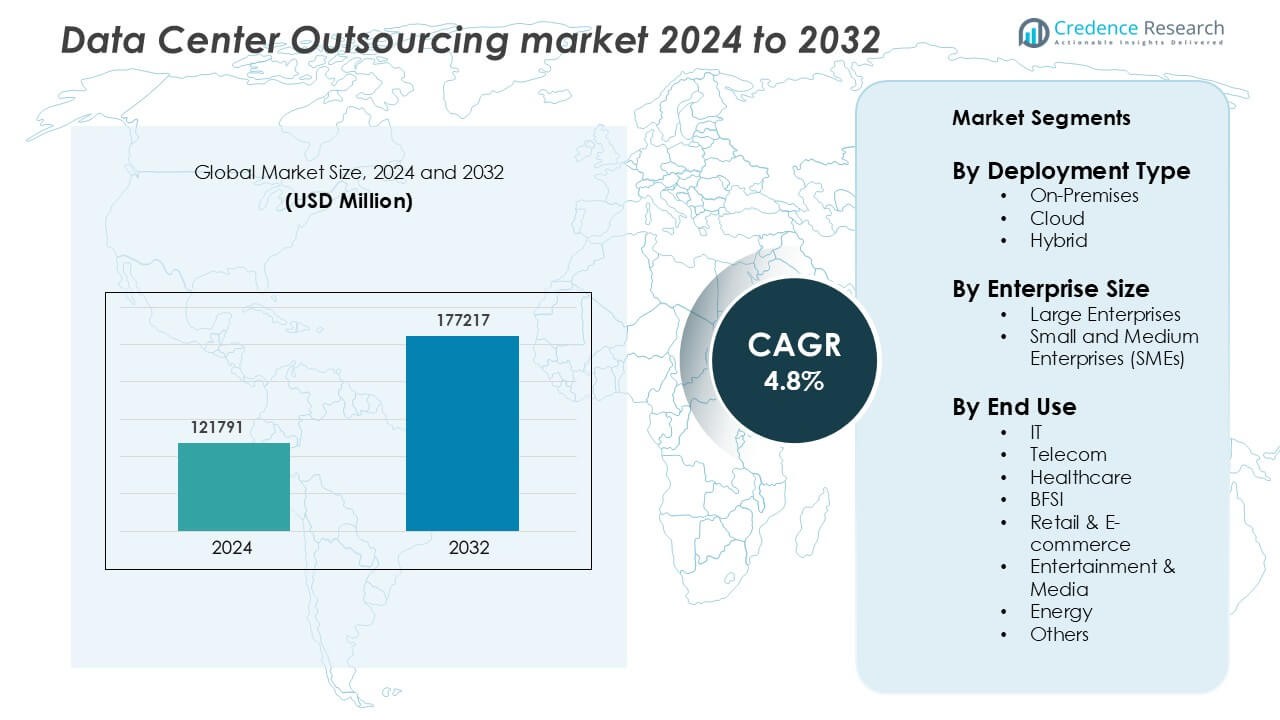

Data Center Outsourcing Market was valued at USD 121791 million in 2024 and is anticipated to reach USD 177217 million by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Outsourcing Market Size 2024 |

USD 121791 Million |

| Data Center Outsourcing Market, CAGR |

4.8% |

| Data Center Outsourcing Market Size 2032 |

USD 177217 Million |

The Data Center Outsourcing Market is led by prominent players such as IBM Corporation, Fujitsu, Capgemini, HCL, Amazon Web Services (AWS), Atos, Google Cloud, DXC Technologies, Cognizant, and Accenture. These companies dominate through advanced managed services, cloud migration expertise, and integrated hybrid infrastructure solutions. Continuous investment in automation, cybersecurity, and sustainable data centers strengthens their competitive position. IBM and AWS lead in AI-driven operations and hyperscale deployments, while Capgemini and Atos emphasize green IT initiatives. North America stands as the leading region, commanding a 37% market share, supported by robust digital infrastructure, early cloud adoption, and strong enterprise demand for high-availability outsourcing services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Center Outsourcing Market was valued at USD 121791 million in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2032.

- Increasing demand for cost-efficient IT infrastructure and cloud integration drives market expansion across enterprises of all sizes.

- The market is witnessing a strong trend toward hybrid and AI-driven data center operations, enhancing efficiency and scalability.

- Key players such as IBM Corporation, AWS, Capgemini, Atos, and HCL dominate through advanced automation, sustainability initiatives, and strategic partnerships.

- North America leads the market with a 37% share, while the cloud segment holds 54% and large enterprises account for 63% of total revenue, reflecting strong regional and segmental dominance.

Market Segmentation Analysis:

By Deployment Type

The cloud segment dominates the Data Center Outsourcing Market with a 54% share, driven by the rapid adoption of scalable and cost-efficient IT infrastructure. Organizations prefer cloud-based outsourcing to enhance agility, minimize capital expenses, and support remote operations. The growing use of AI, machine learning, and big data analytics has accelerated cloud integration across industries. Additionally, cloud platforms enable automated resource management and disaster recovery solutions, which are critical for modern enterprise operations. Increasing investment in data sovereignty and hybrid connectivity further strengthens this segment’s leadership.

- For instance, AWS has announced plans for 10 more Availability Zones and 3 more AWS Regions (in the Kingdom of Saudi Arabia, Chile, and the AWS European Sovereign Cloud).

By Enterprise Size

Large enterprises hold the largest market share of 63% in the Data Center Outsourcing Market, supported by their high demand for secure, high-capacity data storage and managed services. These organizations often operate globally and require continuous uptime, advanced cybersecurity, and compliance with data regulations. Outsourcing allows large enterprises to optimize IT efficiency while focusing on core business strategies. In contrast, SMEs are steadily adopting outsourcing to reduce operational costs and access advanced infrastructure without heavy capital investment.

- For instance, HCL Technologies delivers managed IT operations for over 200 Fortune 500 companies, utilizing its DRYiCE automation platform to reduce incident resolution time by 40% across global enterprise networks.

By End Use

The IT and telecom segment leads the Data Center Outsourcing Market with a 31% share, driven by rising data volumes, network expansion, and the need for continuous service delivery. Companies in this sector rely on outsourcing for infrastructure scalability, real-time monitoring, and data security compliance. The healthcare and BFSI industries are also emerging users due to strict regulatory standards and the growing need for data integrity and backup solutions. Meanwhile, retail, media, and energy sectors increasingly use outsourcing to support e-commerce, content delivery, and grid digitization.

Key Growth Drivers

Rising Demand for Cost-Efficient IT Infrastructure

The growing need to minimize capital expenditure and operational costs is a key driver for data center outsourcing. Businesses are increasingly shifting from maintaining in-house infrastructure to outsourcing data center operations to specialized providers. This approach reduces expenses related to equipment upgrades, maintenance, and skilled labor while ensuring access to advanced technologies. Service providers offer scalable solutions that help enterprises align IT spending with business growth. The adoption of managed hosting, cloud migration, and virtualized environments further enhances efficiency. Companies benefit from predictable pricing models and improved ROI, making outsourcing an attractive long-term strategy.

- For instance, Equinix operates more than 270 data centers globally across 77 major markets in 36 countries, supporting over 10,000 customers. Its interconnection services, like Equinix Fabric, can help reduce enterprise IT operating costs, with some case studies suggesting potential infrastructure spend reductions of up to 70% depending on the specific use case and implementation.

Expansion of Cloud and Hybrid IT Models

The rapid adoption of cloud computing and hybrid architectures fuels the expansion of the data center outsourcing market. Enterprises are integrating private and public cloud platforms to improve workload flexibility and data accessibility. Hybrid models provide the benefits of scalability and data control, enabling businesses to meet dynamic demand while maintaining compliance. Outsourcing providers deliver end-to-end solutions that include cloud migration, orchestration, and managed security. This transition also supports emerging technologies such as AI-driven monitoring and edge computing. Growing demand for hybrid solutions, especially in industries with variable data requirements, continues to drive market growth.

- For instance, A Forrester study for Google Cloud Spanner found an 80% reduction in time to onboard new applications and a 132% ROI.

Growing Focus on Core Business Competencies

Organizations increasingly outsource data center operations to concentrate on strategic priorities rather than infrastructure management. By partnering with managed service providers, companies can reallocate resources toward innovation, product development, and customer engagement. Outsourcing eliminates the burden of managing complex IT systems, ensuring better performance through expert management and automation. Enterprises gain faster access to emerging technologies without significant investment. This strategic shift not only improves productivity but also accelerates time-to-market. As digital transformation deepens across industries, outsourcing becomes a key enabler for agility and business continuity.

Key Trends & Opportunities

Integration of AI and Automation in Data Center Management

The adoption of artificial intelligence and automation technologies is transforming data center operations. AI-driven analytics enable predictive maintenance, workload optimization, and energy efficiency improvements. Automation tools streamline monitoring, resource allocation, and failure detection, reducing human errors and downtime. Service providers leverage machine learning to enhance security and improve data flow management. Automated infrastructure also supports faster scalability and reduces manual intervention in configuration and deployment. The integration of AI into data center outsourcing models enhances service reliability, offering clients improved visibility, real-time analytics, and proactive system management capabilities.

- For instance, IBM’s Watson AIOps platform helps organizations manage the complexity of modern IT environments by applying artificial intelligence (AI), machine learning, and natural language processing to vast amounts of operational data (logs, metrics, events, and tickets) from across hybrid multicloud.

Growing Adoption of Edge Computing

Edge computing is emerging as a major opportunity in the data center outsourcing market, driven by the proliferation of IoT, 5G, and real-time data processing. Enterprises require localized data centers to support low-latency applications and faster decision-making. Outsourcing providers are expanding their edge infrastructure to meet these demands efficiently. This distributed architecture minimizes data transfer costs and enhances responsiveness in sectors such as manufacturing, telecom, and healthcare. By combining edge and centralized data center capabilities, service providers deliver hybrid frameworks that optimize performance. The shift toward edge computing presents new growth avenues for vendors offering managed and co-located services.

- For instance, Dell is a major provider of edge hardware and software solutions (e.g., Dell NativeEdge, PowerEdge XR servers) used by Fortune 100 companies and specific clients like McLaren Racing and Duos to enable faster data processing at the source.

Key Challenges

Data Security and Regulatory Compliance Risks

Data privacy and regulatory compliance pose significant challenges for data center outsourcing providers. Industries such as BFSI and healthcare handle sensitive information governed by strict data protection laws. Outsourcing to third-party providers introduces concerns over data breaches, unauthorized access, and cross-border data transfers. Providers must comply with frameworks such as GDPR, HIPAA, and ISO standards while ensuring encryption and continuous monitoring. Any non-compliance can lead to legal penalties and reputational damage. Building customer trust through transparent policies and secure architectures is essential for sustaining long-term outsourcing relationships.

Dependence on Vendor Reliability and Service Continuity

Dependence on third-party vendors increases operational risk if service-level agreements (SLAs) are not met. Outages, downtime, or vendor mismanagement can severely impact enterprise operations and data accessibility. Transitioning between vendors can also lead to data migration challenges and additional costs. The reliability of outsourcing partners is therefore crucial for maintaining business continuity. Enterprises must carefully evaluate provider performance, redundancy measures, and backup capabilities. Establishing strong governance frameworks and regular audits helps mitigate risks and ensures consistent service delivery across distributed environments.

Regional Analysis

North America

North America holds the largest share of 37% in the Data Center Outsourcing Market, driven by strong digital infrastructure, high cloud adoption, and the presence of major technology providers. The U.S. dominates regional demand due to its advanced data management standards and high enterprise IT spending. Growing investment in hyperscale facilities and hybrid IT models further boosts market growth. Key players such as IBM, HPE, and Dell Technologies are expanding managed service portfolios to meet evolving client requirements. The region’s focus on automation, AI integration, and regulatory compliance continues to strengthen its leadership.

Europe

Europe accounts for 28% of the global Data Center Outsourcing Market, supported by the growing demand for energy-efficient and compliant IT infrastructure. The UK, Germany, and the Netherlands lead regional adoption due to strict data protection laws and cloud-first policies. Enterprises in banking, manufacturing, and public sectors increasingly rely on outsourcing to manage complex workloads. Sustainability initiatives and renewable-powered data centers drive innovation in the region. Companies such as Atos, Capgemini, and T-Systems play a major role in providing managed services aligned with GDPR and green IT objectives.

Asia-Pacific

Asia-Pacific holds a 24% market share, fueled by rapid digital transformation and expanding cloud ecosystems across China, India, and Japan. The region experiences strong demand from telecom, e-commerce, and BFSI sectors seeking scalable and cost-effective outsourcing solutions. Government initiatives supporting data localization and infrastructure modernization further enhance growth. Providers like NTT Communications, Tata Communications, and Fujitsu are expanding their regional presence with hybrid and cloud data centers. The increasing adoption of edge computing and AI-based automation reinforces Asia-Pacific’s position as a high-growth market for data center outsourcing.

Latin America

Latin America captures an 8% share in the Data Center Outsourcing Market, driven by improving IT infrastructure and growing enterprise digitization. Brazil and Mexico lead adoption, supported by investments from global providers in colocation and cloud infrastructure. Rising internet penetration and expansion of financial services fuel outsourcing demand across SMEs. Market growth is also aided by data center modernization initiatives and regional data compliance frameworks. Partnerships between local operators and multinational providers such as IBM and Equinix continue to strengthen service reliability and market competitiveness.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share, supported by growing investments in digital infrastructure and smart city projects. Countries such as the UAE, Saudi Arabia, and South Africa are emerging as key data center hubs. Increasing enterprise cloud adoption, coupled with the expansion of regional hyperscale facilities, drives outsourcing opportunities. Government-backed digital transformation programs are promoting data sovereignty and secure hosting services. Global players including Amazon Web Services and Etisalat are enhancing service capabilities to meet rising regional demand for managed IT operations.

Market Segmentations:

By Deployment Type

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End Use

- IT

- Telecom

- Healthcare

- BFSI

- Retail & E-commerce

- Entertainment & Media

- Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Data Center Outsourcing Market is highly competitive, with major players focusing on innovation, automation, and strategic partnerships to enhance service delivery. Leading companies such as IBM Corporation, Fujitsu, Capgemini, HCL, Amazon Web Services (AWS), Atos, Google Cloud, DXC Technologies, Cognizant, and Accenture dominate the global landscape. These providers compete on service reliability, scalability, and cybersecurity capabilities while expanding their cloud and hybrid data center portfolios. Strategic mergers, acquisitions, and collaborations are common as firms aim to strengthen their presence across key regions. For instance, IBM has advanced AI-driven automation in managed services, while AWS continues to invest in hyperscale data centers for enterprise clients. Similarly, Capgemini and Atos focus on sustainable, energy-efficient infrastructure to meet environmental goals. Continuous investment in AI, edge computing, and data protection frameworks enables these companies to maintain a competitive edge in delivering secure and high-performance outsourced data center operations.

Key Player Analysis

- IBM Corporation

- Fujitsu

- Capgemini

- HCL

- Amazon Web Services (AWS)

- Atos

- Google Cloud

- DXC Technologies

- Cognizant

- Accenture

Recent Developments

- In July 2025, Google spent over USD 25 billion to improve data center and AI infrastructure in the largest electric grid in the U.S. i.e., PJM Interconnection across 13 states. Google is also spending an extra three billion US dollars in the modernization of hydropower plants to obtain greener and renewable energy to support its activities.

- In April, 2025, Microsoft invested in increasing its European data center availability by 40 percent within two years, as it read the rise in demand of AI and cloud services in the region. The investment is intended to expand physical infrastructure as well as promoting data sovereignty and regulatory conformity. To facilitate these efforts, Microsoft also announced the creation of a European Data Boundary Board, which will have oversight over all the legal and operational alignment with applicable EU data protection laws.

- In March 2025, NTT DATA, Inc. unveiled its Agentic AI Services for Hyperscaler AI Technologies, a groundbreaking suite designed to help organizations integrate, build, manage, and scale AI-powered agents. These services aim to improve operational efficiency, drive innovation, and enhance employee and customer experiences, ultimately maximizing the return on AI investments.

- In October 2024, Fujitsu and Supermicro announced a partnership to provide liquid-cooled, energy-efficient AI infrastructure for data centers, including Fujitsu’s FUJITSU-MONAKA Arm-based processor and Supermicro rack-scale GPU servers as the foundation for green AI implementations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment Type, Enterprise Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as enterprises increasingly adopt hybrid and multi-cloud environments.

- AI and automation will play a key role in optimizing data center operations and reducing downtime.

- Demand for sustainable and energy-efficient data centers will rise due to stricter environmental regulations.

- Edge computing adoption will accelerate, driving the need for localized outsourcing solutions.

- Cybersecurity and data compliance will become central to vendor selection and service contracts.

- Partnerships between cloud providers and managed service firms will increase to enhance service integration.

- Large enterprises will continue to dominate, while SME adoption will grow steadily through cost-effective models.

- Investment in modular and scalable data center infrastructure will gain momentum worldwide.

- Emerging markets in Asia-Pacific and the Middle East will experience strong growth driven by digital transformation.

- Vendors will focus on service differentiation through AI-based analytics, automation, and sustainability initiatives.