Market Overview

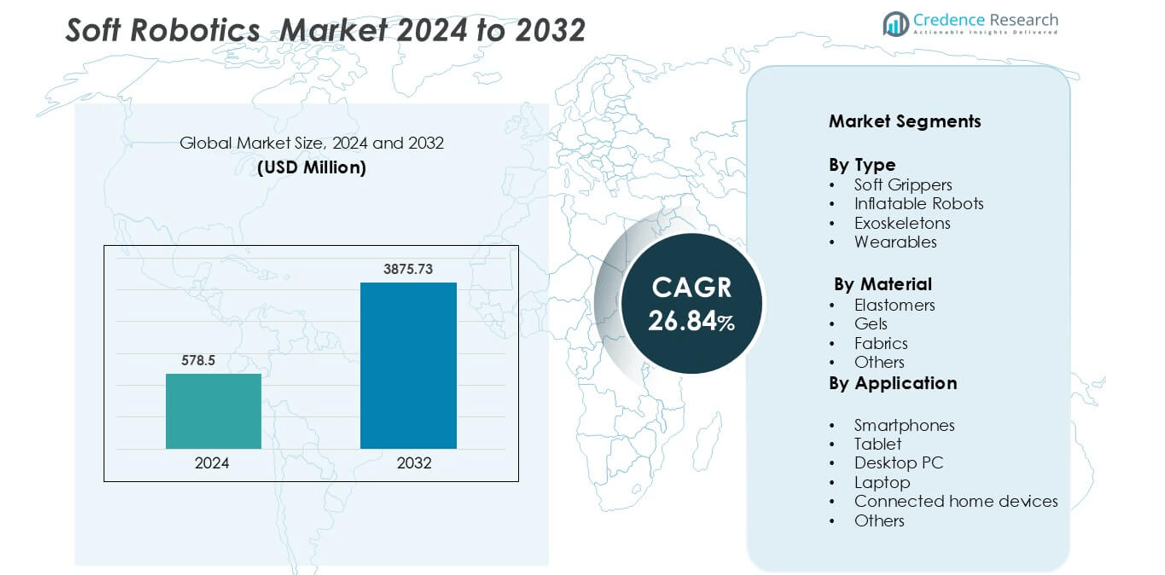

Soft Robotics market was valued at USD 578.5 million in 2024 and is anticipated to reach USD 3875.73 million by 2032, growing at a CAGR of 26.84 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soft Robotics Market Size 2024 |

USD 578.5 million |

| Soft Robotics Market, CAGR |

26.84% |

| Soft Robotics Market Size 2032 |

USD 3875.73 million |

The Soft Robotics Market is led by key players such as Soft Robotics Inc., Festo AG, Roam Robotics, Bioservo Technologies AB, Ekso Bionics Holdings Inc., Righthand Robotics Inc., Cyberdyne Inc., ReWalk Robotics Ltd., Yaskawa Electric Corporation, and F&P Robotics AG. These companies focus on developing advanced soft actuators, adaptive robotic grippers, and wearable exoskeletons for diverse applications across healthcare, industrial automation, and logistics. Strategic initiatives such as product innovation, AI integration, and collaborations with research institutions are central to their growth strategies. North America dominates the market with a 36% share, driven by strong R&D capabilities, rapid automation adoption, and early integration of robotics in healthcare and industrial sectors.

Market Insights

- The Soft Robotics Market was valued at USD 578.5 million in 2024 and is projected to grow at a CAGR of 26.84% through 2032, driven by strong adoption in healthcare, logistics, and manufacturing.

- Growing demand for flexible automation and safer human-robot collaboration in industrial processes is a key driver fueling market expansion.

- A major trend involves the integration of AI, machine learning, and smart materials, improving precision, adaptability, and real-time responsiveness in robotic operations.

- The competitive landscape features players such as Soft Robotics Inc., Festo AG, and Ekso Bionics Holdings Inc., focusing on innovations in soft actuators and wearable robotics.

- Regionally, North America leads with 36% share due to advanced R&D and automation adoption, followed by Europe with 29% and Asia-Pacific with 25%, while the soft grippers segment dominates by holding the largest share within product categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Soft grippers hold the largest share in the Soft Robotics Market, driven by their adaptability in handling delicate and irregularly shaped objects. They are widely adopted in food processing, logistics, and medical industries due to their ability to perform complex manipulation tasks with precision. The growing demand for automation in industries where human-like dexterity is needed further boosts this segment. Exoskeletons and wearable robots are also gaining traction in rehabilitation and industrial support applications, enhancing human strength and reducing fatigue during repetitive or heavy-duty tasks.

- For instance, OnRobot’s Soft Gripper model handles irregular shapes with a maximum payload of 2.2 kg and grip dimensions from 11 mm to 118 mm.

By Material

Elastomers dominate the material segment due to their flexibility, durability, and biocompatibility, making them ideal for designing soft actuators and grippers. Their high deformation capacity allows smooth motion and safe human-robot interaction, essential in healthcare and collaborative robotics. The development of silicone- and polyurethane-based elastomers with superior tensile strength drives innovation. Gels and fabrics are also emerging as supportive materials for pressure-sensitive and wearable robotic applications, improving responsiveness and comfort for human users in medical and assistive technologies.

- For instance, a super-stretchable silicone elastomer developed at Technical University of Denmark can be uniaxially stretched to 2400% strain, with a modulus of about 0.32 MPa at 1000–1500% strain.

By Application

Connected home devices lead the application segment, holding the largest market share due to rising adoption of robotic assistants, automated appliances, and smart interaction systems. Soft robotics enhance the safety and adaptability of these devices, improving user experience in everyday tasks. The integration of AI and IoT enables smarter control and predictive response in connected environments. Additionally, applications in smartphones and tablets are expanding as manufacturers explore flexible robotic components for haptic feedback and foldable device technologies, supporting the broader shift toward soft, adaptive interfaces.

Key Growth Drivers

Rising Adoption in Healthcare and Rehabilitation

The healthcare industry is a major growth driver for the soft robotics market, as soft actuators and exoskeletons are increasingly used in surgical assistance, rehabilitation therapy, and elderly care. These systems provide natural motion, high flexibility, and enhanced safety in physical interaction with patients. Soft robotic gloves and assistive suits help restore limb movement and reduce recovery time for stroke patients. Hospitals and rehabilitation centers are integrating these devices to improve treatment precision and patient outcomes. The development of bio-inspired and wearable robotic systems is also strengthening adoption across medical applications, enabling personalized and minimally invasive care.

- For instance, a study of the glove device SEM Glove (by Bioservo Technologies AB) involved 15 participants using the glove at home for a minimum of 4 h per day for 12 weeks, and the palmar‐grasp length improved from 29.1 cm (±6.0 cm) to 45.8 cm (±6.8 cm).

Expanding Automation in Manufacturing and Logistics

Industrial automation and logistics are witnessing rising demand for soft robotic grippers due to their ability to handle delicate, irregular, or fragile objects. Unlike traditional rigid robots, soft robots adapt to varying shapes and surfaces, making them ideal for packaging, food processing, and electronics assembly. Companies are investing in flexible automation to address workforce shortages and improve operational safety. Collaborative robots equipped with soft end-effectors are also enhancing human-robot cooperation in shared environments. As industries aim for high throughput and safety compliance, soft robotics are becoming key tools for efficient, adaptive automation across sectors.

Advancements in Material Science and AI Integration

Continuous advancements in materials such as elastomers, gels, and shape-memory polymers are improving the performance and durability of soft robots. The integration of AI and machine learning enhances control, sensing, and adaptability in these robots. AI-driven algorithms allow self-learning, enabling real-time decision-making and motion correction. Additionally, the combination of sensor fusion and cloud computing enables precise feedback systems for dynamic environments. Manufacturers are developing AI-embedded soft actuators capable of recognizing and responding to touch, temperature, and pressure variations, significantly broadening their use in autonomous operations and service robotics applications.

Key Trends & Opportunities

Emergence of Bio-Inspired and Wearable Robotics

Bio-inspired robotics is reshaping the market by replicating the natural movement of animals and humans. These systems are applied in prosthetics, rehabilitation, and industrial tools requiring precision and adaptability. Soft exoskeletons designed to mimic muscle dynamics reduce fatigue and improve endurance for workers and patients. This trend supports human augmentation in physically demanding tasks and enhances user comfort in wearable devices. As demand for mobility assistance grows, companies are developing lightweight, energy-efficient designs using soft actuators that provide high torque output with minimal power consumption.

- For instance, a wrist exosuit actuated by fabric pneumatic artificial muscles weighed 160 g and produced a peak torque of 3.3 Nm across wrist flexion/extension motions.

Integration with Smart Sensors and IoT

Integration of smart sensors and IoT connectivity offers significant growth opportunities in the soft robotics market. Embedded sensors enable data-driven motion control, predictive maintenance, and adaptive learning. IoT-linked soft robots can communicate operational data for performance optimization and remote monitoring. This connectivity improves accuracy and reliability, especially in applications such as precision agriculture and logistics automation. The adoption of cloud-based robotic management platforms further enhances scalability, allowing centralized control of large robotic fleets and supporting next-generation industrial and healthcare ecosystems.

- For instance, a soft robotic gripper prototype embedded with a liquid-metal microfluidic sensor array exhibited a force measurement range of 4.69 N, sensitivity of 1,169 pm/N, and repeatability with an RMSE of 0.12 N.

Expansion in Service and Consumer Robotics

The demand for soft robotics in service sectors, including household assistance, retail, and hospitality, is growing rapidly. Their human-friendly interaction, lightweight construction, and adaptability make them ideal for consumer-facing roles. Soft robotic systems are being embedded into smart home devices, wearable companions, and personal assistance robots to perform tasks safely alongside humans. With increasing investment in social and entertainment robots, companies are leveraging soft materials to design expressive, responsive systems that improve user engagement, paving the way for widespread consumer adoption.

Key Challenges

High Manufacturing Cost and Complex Design

The high cost of materials and complex fabrication processes limits the large-scale commercialization of soft robotics. The requirement for precise material control and multi-layered actuator design increases production expenses. Moreover, manufacturing techniques such as 3D printing and molding for soft structures are still in the early stages of optimization. These cost barriers restrict adoption among small and medium enterprises. Developing standardized, cost-effective production methods is essential to make soft robots accessible for broader industrial and healthcare applications.

Limited Durability and Control Precision

Soft robots face durability challenges due to material fatigue, deformation, and wear during repetitive use. Their flexible structure, while advantageous for safety, often compromises control precision and load-bearing capacity. Maintaining consistent motion accuracy in unpredictable environments remains difficult. Additionally, integrating robust sensors within soft materials without affecting flexibility is technically complex. These limitations affect reliability in high-performance applications such as heavy manufacturing and outdoor robotics. Continuous research in hybrid materials and improved actuation mechanisms is vital to overcome these performance challenges.

Regional Analysis

North America

North America holds the largest share of 36% in the Soft Robotics Market, driven by strong adoption across healthcare, logistics, and manufacturing industries. The United States leads due to high R&D investment in robotic automation and medical robotics. Universities and companies are collaborating to advance soft actuator design and AI integration. The presence of key players focusing on robotic prosthetics and industrial automation further supports growth. Increasing demand for flexible grippers in e-commerce and packaging sectors also fuels regional expansion, positioning North America as the innovation hub for advanced soft robotic systems.

Europe

Europe accounts for 29% of the global market share, supported by government initiatives promoting robotics research and industrial automation. Germany, the UK, and France lead adoption due to their strong manufacturing base and advanced healthcare infrastructure. European firms are investing in soft robotics for collaborative industrial environments and surgical assistance applications. The growing integration of soft exoskeletons in rehabilitation centers and industrial ergonomics enhances demand. Strategic partnerships between research institutions and technology firms strengthen Europe’s position in developing bio-inspired and energy-efficient robotic systems for industrial and medical use.

Asia-Pacific

Asia-Pacific captures 25% of the market share, driven by rapid industrialization and robotics adoption in Japan, China, and South Korea. The region benefits from a robust electronics and manufacturing ecosystem integrating soft grippers and wearable robotics. Japan leads with advancements in humanoid and assistive soft robots, while China’s investments in automation under “Made in China 2025” accelerate production innovation. The region also witnesses growing applications in agriculture and healthcare robotics. Expanding government support for automation technologies positions Asia-Pacific as the fastest-growing region in the global soft robotics landscape.

Latin America

Latin America holds a 6% market share, with Brazil and Mexico driving demand through increased automation in food processing, logistics, and healthcare. The region is witnessing gradual adoption of robotic technologies to improve productivity and safety in industrial operations. Universities and research institutions are exploring soft materials and actuator systems to localize robotics innovation. Despite limited infrastructure, international collaborations are boosting access to advanced technologies. Government initiatives supporting digital transformation and industrial automation are expected to accelerate market growth, particularly in sectors requiring safe and adaptive handling systems.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share, primarily led by the United Arab Emirates and Saudi Arabia. Investments in smart manufacturing and healthcare modernization under national transformation programs are fostering the adoption of soft robotics. Hospitals and rehabilitation centers are exploring wearable exoskeletons to enhance patient care and recovery efficiency. Industrial applications are also increasing in oil and gas operations for maintenance and inspection tasks. Although adoption is in its early stages, strategic government funding and technology imports from Western markets are expected to strengthen regional market potential.

Market Segmentations:

By Type

- Soft Grippers

- Inflatable Robots

- Exoskeletons

- Wearables

By Material

- Elastomers

- Gels

- Fabrics

- Others

By Application

- Smartphones

- Tablet

- Desktop PC

- Laptop

- Connected home devices

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The soft robotics market is highly innovative, driven by advancements in flexible actuators, adaptive control systems, and human-robot collaboration technologies. Soft Robotics Inc. and Righthand Robotics Inc. lead in adaptive gripping solutions using compliant materials and AI-driven motion control for automation in food, logistics, and e-commerce sectors. Festo AG and Yaskawa Electric Corporation focus on industrial soft robots that combine pneumatic actuation with precision sensors to enhance flexibility and efficiency in manufacturing. Roam Robotics and Ekso Bionics Holdings, Inc. specialize in wearable exoskeletons that improve mobility and reduce fatigue in healthcare and defense applications. Cyberdyne Inc. and Rewalk Robotics Ltd. advance medical robotics through biofeedback-based systems that assist rehabilitation and physical therapy. Bioservo Technologies AB and F&P Robotics AG emphasize ergonomic and assistive robots designed for safe human interaction. Companies are prioritizing material innovation, AI integration, and hybrid control systems to expand soft robotics adoption across diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Soft Robotics Inc.

- Festo AG

- Roam Robotics

- Bioservo Technologies AB

- Ekso Bionics Holdings, Inc.

- Righthand Robotics Inc.

- Cyberdyne Inc.

- Rewalk Robotics Ltd.

- Yaskawa Electric Corporation

- F&P Robotics AG

Recent Developments

- In February 2024, RightHand Robotics, one of the leaders in autonomous AI robotic picking solutions for order completion, announces a multi-year agreement with Staples Inc., one of the Americas leaders in workspace products and solutions. The agreement allows Staples to deploy and install the RightPick item-handling system to automate operations for higher service levels and Next-Day Delivery to over 98% of the United States.

- In December 2023, ReWalk Robotics, Ltd., one of the leading providers of innovative technologies that enable mobility and wellness in rehabilitation and daily life for individuals with neurological conditions, announced the successful demonstration of a proof-of-concept next-generation exoskeleton.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for soft robotic grippers in manufacturing and logistics will continue to grow rapidly.

- Healthcare applications such as rehabilitation and surgical assistance will drive widespread adoption.

- Integration of AI and machine learning will enhance the adaptability and precision of soft robotic systems.

- Wearable robotics and exoskeletons will expand across industrial and medical use cases.

- Advancements in smart materials will improve flexibility, durability, and performance efficiency.

- Collaborative robotics will gain traction in industries requiring safe human-robot interaction.

- The consumer electronics sector will adopt soft robotics for advanced tactile and haptic technologies.

- Government and academic partnerships will strengthen innovation and commercialization in soft robotics research.

- Asia-Pacific will emerge as the fastest-growing regional market due to automation expansion.

- Cost reduction and modular design improvements will make soft robotic solutions more accessible to SMEs.