Market Overview

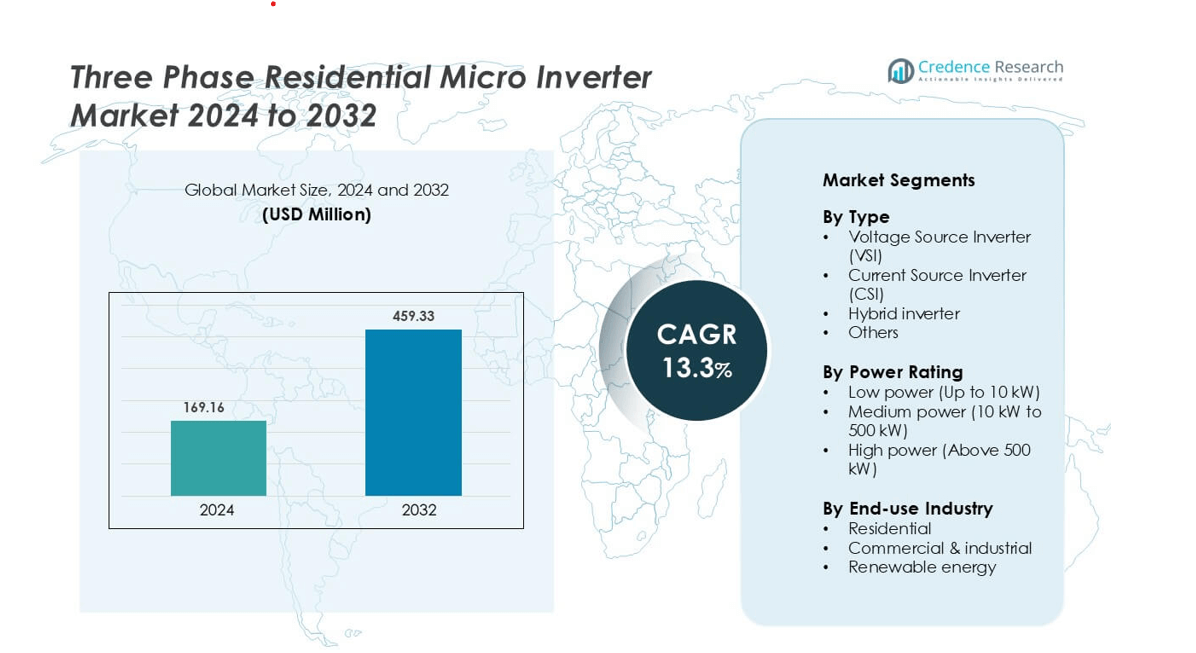

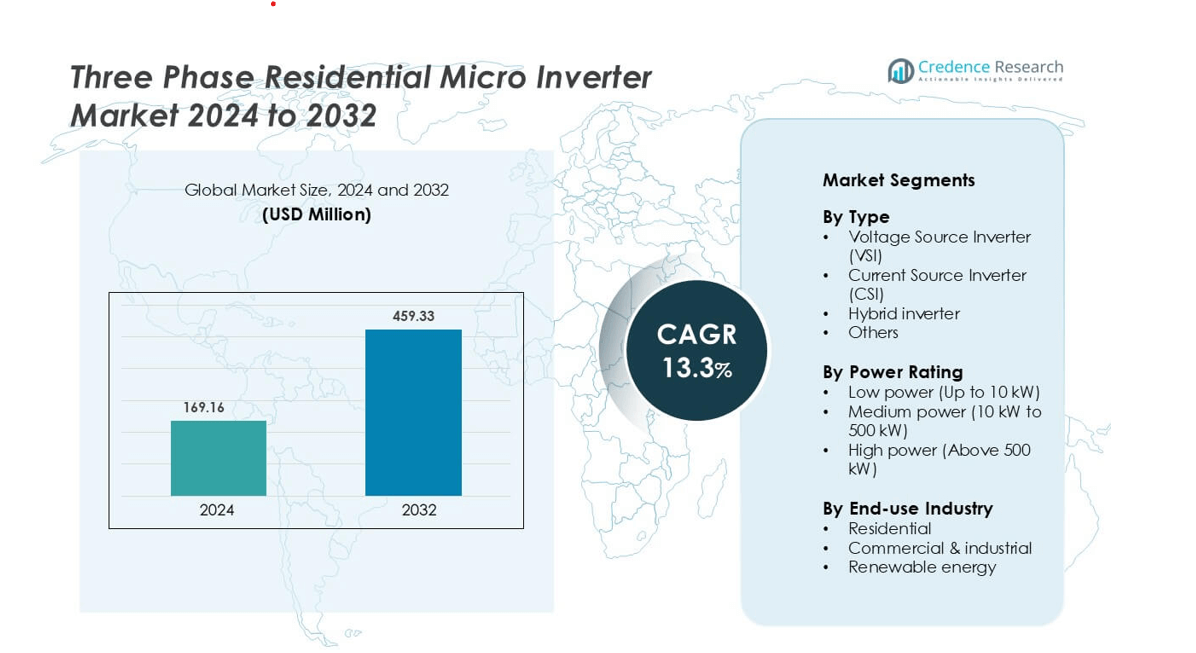

Three Phase Residential Micro Inverter market was valued at USD 169.16 million in 2024 and is anticipated to reach USD 459.33 million by 2032, growing at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Residential Micro Inverter MarketSize 2024 |

USD 169.16 million |

| Three Phase Residential Micro Inverter Market, CAGR |

13.3% |

| Three Phase Residential Micro Inverter Market Size 2032 |

USD 459.33 million |

The leading players in the global three‑phase residential micro‑inverter market include Altenergy Power System, Darfon Electronics Corporation, Enphase Energy, Hoymiles, JMHPOWER, Sparq System, Sungrow, Solax Power, Sunrover Power and Tata Power Solar. Among regions, North America leads with roughly 35.2% of the market share, driven by high residential solar adoption, widespread three‑phase wiring in homes and strong installer networks.

Market Insights

- The global three‑phase residential micro‑inverter market stood at USD 169.16 million in 2024 and is projected to reach USD 459.33 million by 2032, growing at a CAGR of 13.3 %.

- Rising residential solar adoption and stricter grid‑integration requirements are driving demand for panel‑level optimisation and three‑phase micro-inverters.

- Key trends include bundled energy‑storage integration, advanced monitoring systems, and cost-effective solutions targeting emerging markets.

- Competitive intensity remains high as leading players expand globally, while high upfront costs and installer skill gaps act as market restraints.

- Regionally, North America leads with roughly 35.2 % market share, followed by Asia-Pacific, driven by infrastructure expansion and increasing solar adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Three Phase Residential Micro Inverter market, the Voltage Source Inverter (VSI) segment dominates with the largest market share, capturing around 52% of total revenue. Its dominance is driven by superior efficiency, reliable voltage regulation, and compatibility with residential solar systems. The CSI and Hybrid inverter segments are growing steadily, supported by technological advancements that enhance grid stability and enable bidirectional power flow. Demand for VSI units is further bolstered by increasing residential rooftop solar adoption, rising awareness of energy independence, and government incentives for renewable energy integration. The “Others” segment remains niche but benefits from specialized applications.

- For instance, SMA Solar Technology AG’s “Sunny Tripower X 12/15/20/25 kW” three-phase inverter series offers a maximum efficiency of 98.2%, supports a maximum PV generator power of 18,000 Wp, has a maximum input voltage of 1000 Vdc, and includes three independent MPP trackers.

By Power Rating

Low-power micro inverters (up to 10 kW) lead the market with approximately 58% share due to their suitability for individual residential installations. Medium-power inverters (10–500 kW) and high-power inverters (above 500 kW) are witnessing growth in multi-unit residences and small commercial setups. The low-power segment benefits from easier installation, lower cost, and compatibility with decentralized solar setups. Drivers include the rising adoption of rooftop solar systems, urban energy efficiency initiatives, and increasing consumer demand for reliable energy solutions.

- For instance, Enphase’s IQ7+ micro-inverter supports a recommended PV module pairing of 235 W to 440 W, has a maximum input DC voltage of 60 V, and delivers a peak AC output power of 295 VA per unit

By End-use Industry

The residential segment is the dominant end-user, holding nearly 60% of the market, supported by widespread adoption of rooftop solar systems. Commercial and industrial applications are expanding due to energy cost savings, sustainability mandates, and large-scale solar integration projects. The renewable energy sector drives adoption across all segments, particularly in regions with strong solar capacity growth and government incentives. Residential dominance is fueled by rising consumer awareness of green energy, technological improvements in inverter efficiency, and supportive policies for distributed energy resources.

Key Growth Drivers

Surge in Residential Solar Adoption

The expansion of rooftop solar systems in homes directly drives demand for three‑phase residential micro inverters. Homeowners seek efficient devices that convert DC from solar panels into balanced three‑phase AC, improving energy use and export potential. Regulation and incentives for residential solar deployments further support adoption. As homeowners upgrade systems or install new PV arrays, manufacturers of three‑phase micro inverters capture increased volume. This residential solar uptake strengthens the market foundation and accelerates equipment penetration.

- For instance, Hoymiles HMT‑1800‑6T is a three-phase micro-inverter rated at 1,800 VA output, supports up to 6 PV modules per unit, has a maximum DC input voltage of 60 V, and operates from a startup DC voltage of 22 V.

Grid Modernisation and Energy Stability Requirements

tility efforts towards smarter grids, increased reliability and energy resilience heighten the need for advanced inverter solutions. Three‑phase micro inverters enable better grid interaction, phase balancing and fault tolerance in residential settings. With grid‑tie mandates and net‑metering policies, these inverters help homeowners meet regulatory standards and feed surplus power back efficiently. The combination of regulatory compliance and grid stability improves market prospects for three‑phase models.

- For instance, the NEP BDM-800 single phase microinverter is indeed rated for 800 W output, produces a pure sine AC waveform, and is suitable for residential on-grid applications where grid compliance is essential.

Technological Innovation in Materials and Monitoring

Manufacturers are investing in new materials, embedded sensors and monitoring platforms that boost performance of three‑phase residential micro inverters. Innovations such as improved conversion efficiency, thermal management, online diagnostics and IoT connectivity make these inverters more appealing. These enhancements reduce downtime, increase lifespan and improve power harvest from the panels. As premium features become standard, the perceived value increases and drives adoption across mid‐ and high‐tier residential projects.

Key Trends & Opportunities

Integration with Battery Storage and Smart Home Systems

A key trend in the three‑phase residential micro inverter market is the integration with energy storage systems and smart‑home platforms. Homeowners increasingly demand systems that not only convert solar power but also manage storage and enable home energy optimisation via apps. This convergence opens opportunities for micro inverter providers to bundle storage, monitoring and control services, enhancing average selling price and unlocking higher margin segments.

- For instance, SolarEdge’s Home solution combines the Home Hub inverter with modular Home Battery units (each module provides 4.6 kWh usable capacity), supports 5 kW continuous battery discharge per battery and allows stacking up to three modules for extended backup and app-based control via the mySolarEdge platform.

Emergence of Emerging Markets and Entry‑Level Segments

Markets in Asia‑Pacific, Latin America and Middle East are emerging as growth hotspots for residential solar and related equipment. Rising disposable incomes and urban expansion support deployment of three‑phase inverter systems, even in multi‑phase residential buildings. Brands that introduce cost‑effective entry‑level three‑phase solutions tailored for these regions can capture substantial early market share. This geographic diversification presents untapped opportunity beyond mature markets.

- For instance, WAAREE introduced its W3 range of three-phase on-grid inverters for residential/rooftop use in India with models from 50 kW to 80 kW output and integrated Wi-Fi/GPRS remote monitoring – targeting multi-unit apartment blocks and small commercial rooftops in emerging markets.

Key Challenges

High Initial Cost and Complexity of Three‑Phase Systems

One significant challenge in the market is the higher upfront cost and complexity associated with three‑phase micro inverters compared to simpler single‑phase systems. These costs may deter homeowners, especially in markets where single‑phase supply prevails or where budget constraints exist. Installation, configuration and wiring of three‑phase systems can also be more demanding. Such barriers limit uptake in cost‑sensitive residential segments and slow growth in some geographies.

Compatibility, Standards and Grid‑Integration Hurdles

Another major restraint relates to compatibility issues with existing grid infrastructure and the need to comply with varied regional standards. Residential installations may face grid‑connection limitations, phase imbalance concerns or regulatory constraints when deploying three‑phase micro inverters. These technical and regulatory hurdles raise entry barriers for manufacturers and installers. Until harmonisation improves, these issues remain a drag on broader market adoption.

Regional Analysis

North America

North America commands a leading share of approximately 35.2% of the three‑phase residential micro‑inverter market. The region benefits from mature rooftop solar adoption, extensive three‑phase home wiring, and stringent grid‑tie standards that favour panel‑level conversion. Manufacturers focus on high‑efficiency products and advanced monitoring systems to meet homeowner expectations. Innovation and large residential solar portfolios further boost the segment’s dominance, while expansion into multi‑unit housing and refurbishment of older systems sustain long‑term demand.

Europe

Europe holds a market share near 23.6% in the three‑phase residential micro‑inverter sector. The region’s growth is underpinned by aggressive decarbonisation policies, strong home‑solar subsidies, and prevalent three‑phase electrical wiring in multi‑storey residences. Key countries such as the UK, Germany and France lead in installations of panel‑level inverters. Suppliers capitalise on strong consumer awareness, bundled smart‑home energy systems and retrofit opportunities in aging housing stock to maintain momentum.

Asia Pacific

Asia Pacific accounts for approximately 20% of the global market for three‑phase residential micro‑inverters. Rapid urbanisation, rising disposable income and expanding solar infrastructure drive uptake in India, China and Southeast Asia. While many homes still use single‑phase supply, multi‑unit residential developments increasingly adopt three‑phase systems to support rooftop PV. Vendors target this region with cost‑effective entry‑level solutions to tap growth before market saturation in mature territories.

Latin America

Latin America holds roughly a 9.6% share of the global market for three‑phase residential micro‑inverters. Growth stems from expanding solar programmes, rising energy costs, and increased residential electricity consumption in Brazil and Argentina. Homes in many countries are moving toward three‑phase connections to support larger PV systems and appliances, creating openings for specialized micro‑inverter solutions. The region’s price sensitivity drives focus on value‑oriented offerings and local distribution networks.

Middle East & Africa (MEA)

The Middle East & Africa region contributes around 4.2% to the global three‑phase residential micro‑inverter market. Significant drivers include investments in sports and residential infrastructure, increased electrification and solar uptake in Gulf states and North Africa. With many homes already wired for three‑phase load, micro‑inverter adoption accelerates in new residential builds and solar retrofit projects. However, economic variances and diverse regulatory frameworks present challenges to uniform market expansion.

Market Segmentations:

By Type

- Voltage Source Inverter (VSI)

- Current Source Inverter (CSI)

- Hybrid inverter

- Others

By Power Rating

- Low power (Up to 10 kW)

- Medium power (10 kW to 500 kW)

- High power (Above 500 kW)

By End-use Industry

- Residential

- Commercial & industrial

- Renewable energy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the three‑phase residential micro‑inverter market remains moderately consolidated, with key players such as Enphase Energy, Sungrow, Hoymiles and Tata Power Solar driving innovation and scaling globally. These firms leverage deep R&D, strategic alliances and strong installer networks to lead in premium segment adoption; smaller rivals focus on cost‑efficient entry models to capture emerging markets. Intense rivalry compels frequent product launches, performance upgrades and aggressive pricing. At the same time, regional manufacturers exploit local distribution and market knowledge to challenge incumbents, especially in Asia Pacific and Latin America. As a result, differentiation via advanced monitoring, grid‑support functions and smart home integration is becoming vital to maintain competitive advantage in this evolving space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sungrow

- Tata Power Solar

- Solax Power

- Darfon Electronics Corporation

- Sunrover Power

- Hoymiles

- Enphase

- Altenergy Power System

- JMHPOWER

- Sparq System

Recent Developments

- In June 2024, Hoymiles introduced a 5 kW three-phase microinverter designed specifically for large residential PV systems and commercial applications. This new product boasts a maximum input voltage of 140 V and is equipped with four Maximum Power Point Tracking units, with one input designated for each MPPT. The company aims to continue to reinforce its position by this launch as a leader in innovative solar solutions, catering to the growing demand for reliable and efficient microinverter systems.

- In May 2022, China-based inverter manufacturer APsystems introduced a three-phase microinverter designed for residential and commercial solar projects, featuring a power output of up to 2,000 VA. This microinverter includes reactive power control, enabling it to interact effectively with power grids. This functionality helps manage fluctuations in photovoltaic power while providing a reliable solution for small and medium-sized commercial solar installations worldwide

Report Coverage

The research report offers an in-depth analysis based on Type, Power rating, End use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly launch three‑phase residential micro inverters with integrated battery storage to capture the growing energy storage market.

- Adoption of smart grid‑compatible three‑phase micro inverters will accelerate as grid codes evolve to favour panel‑level power conversion and phase balancing.

- Growth will expand in multi‑unit residential buildings as three‑phase wiring becomes standard in urban housing, driving increased installer demand.

- Vendors will push cost‑reduced models to penetrate emerging markets in Asia Pacific and Latin America, creating new entry‑level volume streams.

- Inverter makers will leverage IoT and AI‑enabled monitoring features in three‑phase systems to boost service revenue and system optimisation.

- Strategic partnerships with solar panel manufacturers and home‑energy platforms will grow, enabling bundled residential solutions featuring three‑phase micro inverters.

- Premium three‑phase micro inverters will capture share as homeowners upgrade to higher‑wattage solar modules requiring multi‑input optimisation.

- Regulatory incentives for distributed energy systems will favour three‑phase micro inverter adoption in residential settings.

- Intense competition and increasing module‑level electronics exposure will drive consolidation and margin pressure among three‑phase micro inverter providers.

- Rising consumer interest in sustainable homes will push manufacturers to offer eco‑friendly three‑phase micro inverters with recycled materials and extended lifespans.