Market Overview

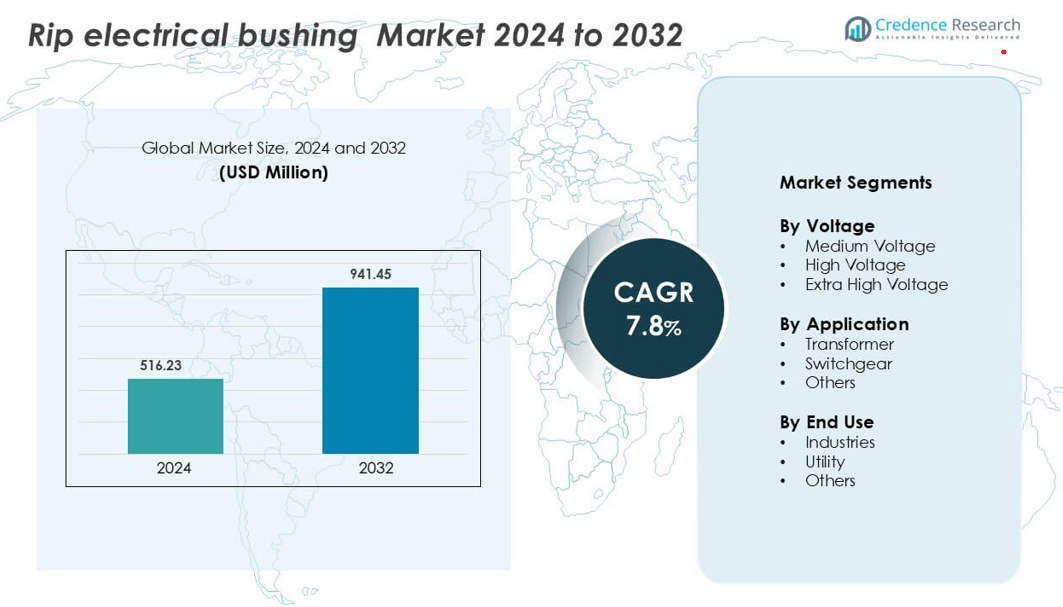

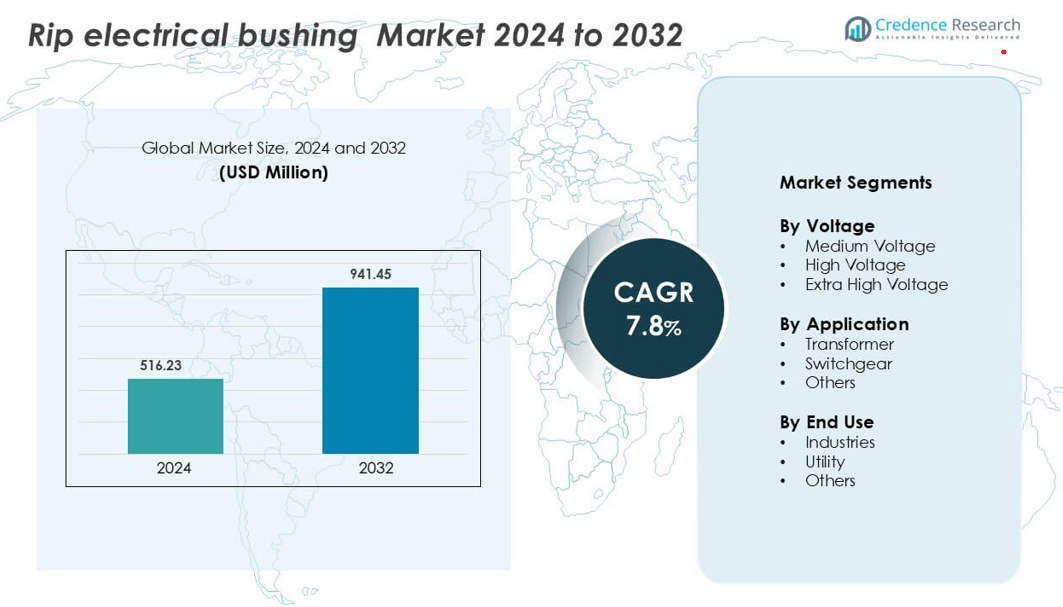

RIP (Resin-Impregnated Paper) Electrical bushing market was valued at USD 516.23 million in 2024 and is anticipated to reach USD 941.45 million by 2032, growing at a CAGR of 7.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RIP (Resin-Impregnated Paper) Electrical Bushing Market Size 2024 |

USD 516.23 million |

| RIP (Resin-Impregnated Paper) Electrical Bushing Market , CAGR |

7.8% |

| RIP (Resin-Impregnated Paper) Electrical Bushing Market Size 2032 |

USD 941.45 million |

The RIP (Resin-Impregnated Paper) Electrical Bushing market features strong competition among global manufacturers focused on innovation, reliability, and sustainability. Key players include Hitachi Energy, Jiangxi Johnson Electric Co., Ltd., Barberi Rubinetterie Industriali S.r.l., Elliot Industries, General Electric, GIPRO, Hubbell, ABB, Eaton, and CG Power and Industrial Solutions. These companies emphasize dry-type, oil-free insulation systems designed to meet high-voltage grid demands and minimize maintenance. Hitachi Energy and ABB dominate the premium segment with advanced polymer and epoxy technologies, while Eaton and GE strengthen their presence through grid modernization projects. Asia Pacific leads the global market, holding 40% of the total share, driven by large-scale transmission expansion in China and India. Europe and North America follow, supported by renewable integration and substation refurbishments. Competitive advantage increasingly relies on insulation performance, lifecycle efficiency, and compliance with international reliability standards.

Market Insights

- The RIP (Resin-Impregnated Paper) Electrical Bushing Market was valued at USD 516.23 million in 2024 and is expected to grow at a CAGR of 7.8% through 2032, driven by increasing demand for maintenance-free, oil-free insulation systems.

- Growing investments in renewable energy and grid modernization programs are driving consistent replacement and upgrade opportunities in high and medium voltage applications.

- Technological advancements in resin materials, dry insulation, and digital monitoring are improving reliability and reducing maintenance costs across substations and transformers.

- The market remains competitive with major players such as Hitachi Energy, ABB, Eaton, and General Electric focusing on R&D, regional expansion, and sustainability.

- Asia Pacific holds 40% of the market share, followed by North America and Europe with 20% each; by segment, high-voltage bushings account for 55%, driven by rapid renewable and infrastructure development projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

The high voltage segment dominates the RIP (Resin-Impregnated Paper) electrical bushing market due to its extensive deployment in power transmission systems. These bushings are preferred for their superior insulation, minimal partial discharge, and thermal endurance under high operational stress. Increasing grid modernization and expansion of transmission infrastructure support segment growth. Manufacturers are focusing on compact, maintenance-free high-voltage bushings to improve reliability and reduce downtime. The demand from utilities and substations for enhanced performance under fluctuating load conditions further strengthens this segment’s leadership in the market.

- For instance, Hitachi Energy’s GSA-O 550 kV dry-type RIP bushings are engineered for operation at continuous current ratings up to 4,000 A, achieving a tested partial discharge level below 5 pC and demonstrating a service life exceeding 30 years under continuous high-voltage stress, meeting IEC 60137 performance standards.

By Application

The transformer segment holds the largest market share, driven by the growing need for efficient power distribution and voltage regulation. RIP (RESIN-IMPREGNATED PAPER) bushings are widely used in transformers to prevent dielectric breakdown and ensure stable power flow. Their moisture-resistant design and high mechanical strength make them ideal for high-performance transformers in both indoor and outdoor installations. The rising replacement of conventional oil-impregnated bushings with dry-type alternatives enhances safety and sustainability, solidifying the dominance of transformer applications within the market.

- For instance, ABB’s Type GOB 420 kV RIP transformer bushings are designed for rated currents up to 3,150 A and can withstand power frequency voltages of 630 kV rms.

By End Use

The utility segment leads the market, fueled by large-scale investments in transmission and distribution networks. Utilities prefer RIP (Resin-Impregnated Paper) bushings for their long service life, environmental safety, and superior insulation reliability. Ongoing renewable energy integration and grid expansion projects increase demand for advanced electrical insulation components. Furthermore, the push toward eco-friendly and maintenance-free power infrastructure supports adoption across utilities globally. This segment benefits from strong regulatory emphasis on efficiency and grid safety, maintaining its leadership position in the market.

Key Growth Drivers

Growing Demand for Reliable Power Transmission Infrastructure

The increasing demand for uninterrupted and efficient power transmission is a major growth driver in the RIP (Resin-Impregnated Paper) electrical bushing market. Rapid industrialization and urbanization have boosted electricity consumption, requiring high-performance components that ensure stable grid operations. RIP (Resin-Impregnated Paper) bushings, with their dry insulation and low partial discharge characteristics, offer superior reliability and safety compared to oil-impregnated alternatives. Governments and utilities are investing in modernizing transmission lines and substations to reduce losses and enhance operational efficiency. The replacement of aging assets in mature power networks across North America and Europe also fuels demand. Furthermore, Asia-Pacific countries like China and India are deploying high-voltage transmission projects, driving large-scale adoption of RIP (Resin-Impregnated Paper) bushings in transformers and switchgear systems.

- For instance, Siemens Energy’s 500 kV RIP bushings used in its gas-insulated switchgear are designed to operate at continuous current ratings up to 4,000 A with partial discharge levels below 5 pC, meeting IEC 60137 standards and demonstrating a service lifespan of more than 30 years in continuous grid operations.

Rising Focus on Grid Modernization and Renewable Integration

The transition toward smart grids and renewable energy systems significantly supports market expansion. Integration of solar and wind power into national grids requires advanced insulation components capable of managing variable voltage and high fault currents. RIP (Resin-Impregnated Paper) bushings provide stable electrical performance under dynamic operating conditions, making them ideal for such applications. Countries are focusing on upgrading their transmission and distribution (T&D) infrastructure to handle distributed energy resources efficiently. Utilities are adopting dry-type bushings for enhanced safety and maintenance-free operation, aligning with clean energy goals. Investments in renewable grid expansion projects by major players, such as Siemens Energy and Hitachi Energy, are further driving innovation in high-voltage RIP (Resin-Impregnated Paper) bushing designs.

- For instance, Hitachi Energy’s AirRIP ® technology integrates 800 kV bushings capable of carrying rated currents up to 5,000 A and achieving partial discharge levels below 3 pC under full-load conditions.

Shift Toward Maintenance-Free and Environmentally Safe Insulation Systems

Environmental concerns and stricter safety standards are accelerating the shift toward dry-type bushings. Unlike traditional oil-impregnated systems, RIP (Resin-Impregnated Paper) bushings eliminate leakage risks and minimize fire hazards. Their epoxy-impregnated insulation ensures excellent moisture resistance and long operational life, reducing the need for frequent maintenance. This makes them suitable for critical installations in harsh or remote environments. Growing awareness of lifecycle cost savings and sustainability advantages has prompted utilities and industrial users to adopt eco-friendly alternatives. The increasing preference for SF₆-free and non-flammable systems across Europe and Asia supports this shift. Manufacturers are investing in recyclable materials and low-emission production processes, aligning with ESG and green grid policies worldwide.

Key Trends & Opportunities

Increasing Adoption in Renewable and Smart Grid Projects

The expansion of renewable energy and smart grid initiatives creates new opportunities for RIP (Resin-Impregnated Paper) electrical bushing manufacturers. As nations transition toward sustainable energy, grid reliability and efficiency have become top priorities. RIP (RESIN- Resin-Impregnated Paper) bushings’ ability to perform under fluctuating voltage conditions makes them essential for hybrid systems integrating solar, wind, and hydropower sources. Smart substations and digital monitoring solutions are also boosting demand for sensor-integrated bushings that provide real-time performance diagnostics. Utilities are deploying these solutions to enhance predictive maintenance and operational control. This trend is expected to expand further with global commitments to decarbonize power infrastructure by 2030.

- For instance, ABB Ltd. developed its GSA bushings using Resin Impregnated Paper (RIP) insulation, achieving a typical dielectric strength of around 18 kV/mm (for the silicone rubber outer insulation) and an inner core material tensile strength of approximately 88 MPa.

Advancements in Composite Material and Design Technologies

Manufacturers are introducing advanced composite materials to improve the performance and reliability of RIP (Resin-Impregnated Paper) bushings. Epoxy resins reinforced with glass fibers enhance dielectric strength, reduce weight, and increase mechanical endurance. This innovation enables compact and lightweight designs suitable for modern switchgear and transformer applications. Additionally, digital simulation tools are helping optimize design parameters, ensuring superior thermal and electrical performance. Opportunities are emerging for developing high-temperature and corrosion-resistant bushings tailored for offshore and renewable energy installations. These material innovations support longer service life and align with global sustainability standards, creating growth prospects for advanced bushing solutions.

Growing Investments in High-Voltage Transmission Expansion

The surge in high-voltage transmission projects worldwide offers substantial growth opportunities for RIP (Resin-Impregnated Paper) bushing suppliers. Many countries are expanding their cross-border interconnections and upgrading existing substations to handle rising power loads. These projects require robust, long-life insulation systems that perform reliably in extreme voltage environments. The high-voltage segment benefits from continued investment in 400 kV and above transmission systems, particularly in Asia-Pacific and the Middle East. Market leaders are focusing on localized manufacturing and digitalized testing facilities to meet regional quality standards. Such initiatives support cost-efficient production and faster delivery, strengthening market competitiveness.

Key Challenges

High Manufacturing and Installation Costs

The complex production process and use of premium insulation materials make RIP (Resin-Impregnated Paper) bushings more expensive than conventional oil-filled alternatives. Manufacturers face high costs associated with epoxy resin curing, vacuum impregnation, and testing procedures to ensure long-term performance. These factors can limit adoption among cost-sensitive utilities in developing economies. Additionally, installation requires skilled personnel and specialized handling due to the product’s rigidity and precision alignment requirements. While lifecycle benefits outweigh initial costs, budget constraints in certain regions slow large-scale replacement projects. Balancing affordability with performance remains a key challenge for manufacturers and system operators alike.

Limited Retrofit Compatibility and Supply Chain Constraints

Compatibility issues with legacy electrical infrastructure hinder the retrofit of RIP (Resin-Impregnated Paper bushings in older systems. Differences in size, insulation design, and connection standards often require customized solutions, extending project timelines. Moreover, the global supply chain faces shortages of epoxy resins and high-grade conductors, affecting timely production and delivery. Manufacturers are also challenged by fluctuating raw material prices and transportation delays. These constraints impact project planning, especially for utilities operating under tight schedules. Developing standardized bushing interfaces and strengthening regional production networks are essential to overcoming these bottlenecks and ensuring consistent market growth.

Regional Analysis

Asia Pacific

Asia Pacific commands around 38-42% of the global RIP (Resin-Impregnated Paper) electrical bushing market share. Rapid grid expansion in China, India and Southeast Asia drives high demand for transformer-bushing upgrades. Utilities focus on durable, low-maintenance components at high voltage levels to support renewables and industrial growth. Local manufacturing hubs enable cost advantages and better lead-times for major OEMs. The region’s share reflects both volume scale and accelerating infrastructure modernisation.

Europe

Europe holds an estimated 18-20% share in the RIP (Resin-Impregnated Paper) electrical bushing market. Transmission network ageing, offshore wind integration and strict environmental standards fuel the need for resin-impregnated paper bushings. Utilities demand leak-free, high-reliability insulation for dense urban grids and HVDC links. Regional OEMs with strong compliance credentials strengthen supply chains. Europe’s share reflects premium adoption rather than sheer volume.

North America

North America accounts for roughly 20-22% of the RIP (Resin-Impregnated Paper) electrical bushing market. Significant grid-hardening programmes, utility investment in resilience, and renewable interconnections underpin demand. Oil-free, maintenance-light bushings appeal to utilities aiming for lifecycle cost savings. Domestic manufacturing and nearshore sourcing reinforce regional supply security. The region’s share signifies quality and upgrade-driven procurement.

Middle East & Africa

The Middle East & Africa region contributes approximately 8-10% of the global market. Large infrastructure projects in the Gulf, solar-grid expansions and mining-linked electrification drive bushing installations. Harsh ambient conditions and remote site access favour advanced RIP (Resin-Impregnated Paper) designs. Strategic localisation of assembly and regional partnerships support growth. The share reflects emerging demand in infrastructure-heavy markets.

Latin America

Latin America holds about 6-8% of the global market share. Brazil and Mexico lead with transformer and T&D upgrades tied to renewable targets and mining operations. Utilities prioritise robust insulation solutions for remote networks and harsh environments. Currency, financing and logistics challenges slow uptake but long-term potential remains strong. The region’s share reflects steady modernisation with selective volume demand.

Market Segmentations:

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Application

- Transformer

- Switchgear

- Others

By End Use

- Industries

- Utility

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RIP (Resin Impregnated Paper) electrical bushing market is competitive, with global leaders focusing on reliability, dielectric strength, and long-term operational safety. ABB and Hitachi Energy dominate through advanced RIP (Resin-Impregnated Paper) bushing technologies featuring moisture-resistant insulation and smart monitoring capabilities for high-voltage substations. General Electric and Eaton emphasize product innovation with composite materials that enhance thermal endurance and minimize partial discharge risks. CG Power and Industrial Solutions and Jiangxi Johnson Electric Co., Ltd. expand their presence across emerging markets by offering cost-efficient, high-performance bushings for transformers and switchgear applications. European players such as Barberi Rubinetterie Industriali S.r.l. and GIPRO specialize in precision-engineered bushings for industrial and railway systems. Elliot Industries and Hubbell strengthen the market through durable, custom-designed bushings optimized for harsh environments. Companies are investing in digital condition monitoring, improved epoxy resin systems, and modular designs to ensure reliability, safety, and compliance with evolving grid modernization standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2024, Jiangxi Johnson Electric Co., Ltd. has announced the official start of construction at their Qiangsheng Electric Porcelain Factory. This milestone marks a new chapter for the factory, highlighting its dedication to growth and innovation in the electric porcelain manufacturing sector.

- In December 2023, yash Highvoltage announced the launch of its new 245 kV oil impregnated paper transformer bushings for transmission utilities, EPCs and OEMs.

- In April 2023, Eaton has announced its successful acquisition of a stake in Jiangsu Ryan Electrical Co. Ltd., a company specializing in power distribution systems and sub-transmission transformers. This strategic acquisition boosts Eaton’s global presence and fortifies its position in the energy, utility, and industrial sectors

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising renewable energy integration will increase demand for high-voltage RIP bushings.

- Grid modernization programs worldwide will strengthen replacement and upgrade opportunities.

- Advancements in dry insulation technology will enhance thermal and mechanical performance.

- Growing focus on fire safety and environmental standards will boost oil-free bushing adoption.

- Expansion of smart grids will drive demand for digitally monitored bushing systems.

- Local manufacturing and supply chain optimization will reduce procurement costs and lead times.

- Increasing electrification in developing economies will support steady market growth.

- Strategic partnerships between OEMs and utilities will foster product innovation and standardization.

- Rising investments in HVDC and offshore transmission networks will create new installation opportunities.

- Continuous R&D in resin materials and design optimization will improve product durability and lifespan.