Market Overview

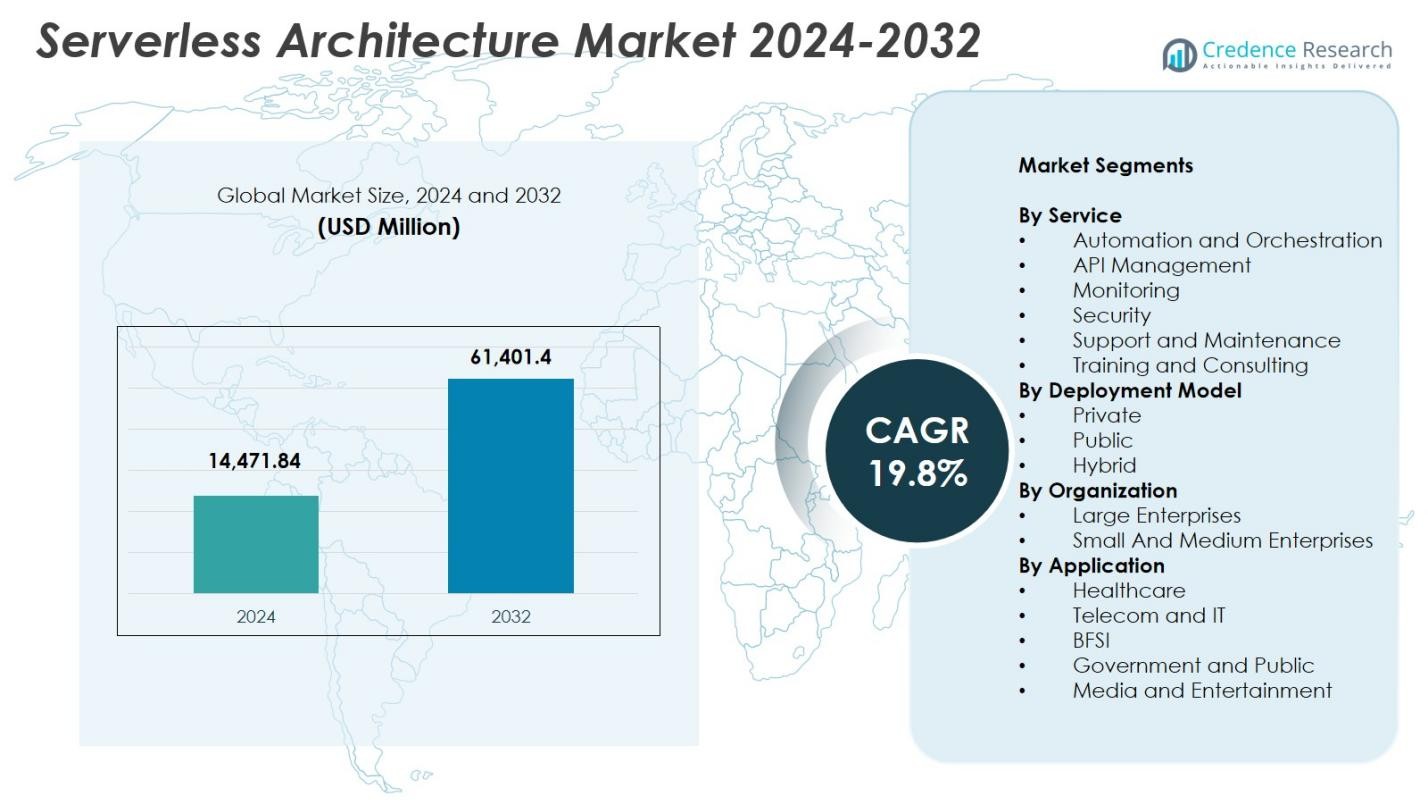

Serverless Architecture market size was valued at USD 14,471.84 Million in 2024 and is anticipated to reach USD 61,401.4 Million by 2032, at a CAGR of 19.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Serverless Architecture market Size 2024 |

USD 14,471.84 Million |

| Serverless Architecture market, CAGR |

19.8% |

| Serverless Architecture market Size 2032 |

USD 61,401.4 Million |

Serverless Architecture market is shaped by major players such as Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, Alibaba Cloud, Dynatrace, Joyent Inc., Fiorano Software, and Galactic Fog IP, Inc., all focusing on enhancing automation, API management, and real-time execution capabilities to support modern cloud-native applications. North America led the market with 41.6% share in 2024, driven by mature cloud adoption and strong innovation from hyperscale providers. Europe followed with 27.4% share, supported by regulatory-driven digital transformation, while Asia-Pacific held 22.8% share, emerging as the fastest-growing region due to rapid digitalization and expanding cloud investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Serverless Architecture market was valued at USD 14,471.84 million in 2024 and is projected to reach USD 61,401.40 million by 2032, registering a CAGR of 19.8%.

- Growth is driven by rising adoption of microservices, increased cloud migration, and enterprise demand for cost-efficient, scalable application deployment models.

- Key trends include expanding use of serverless in AI/ML workloads, automation pipelines, and event-driven applications, along with growing multi-cloud and hybrid deployment adoption.

- Major players such as AWS, Microsoft, Google, IBM, and Alibaba Cloud strengthen their presence through platform enhancements, ecosystem expansion, and integrations, while API Management led the service segment with 32.4% share in 2024.

- North America held 41.6% share, Europe 27.4%, and Asia-Pacific 22.8% as the fastest-growing region, supported by digital transformation initiatives and strong cloud infrastructure development.

Market Segmentation Analysis

By Service

The Serverless Architecture Market by service is led by the API Management segment, accounting for 32.4% share in 2024, driven by expanding microservices adoption, application modernization, and the need for seamless integration across cloud-native environments. API Management enables developers to efficiently create, secure, and scale APIs, supporting rapid deployment cycles and reducing operational overheads. Monitoring follows as a fast-growing segment as organizations prioritize real-time visibility and performance optimization. Automation and Orchestration also gain traction due to increasing workflow automation demands in complex multi-cloud infrastructures. Security and Support & Maintenance remain essential to ensuring reliability and compliance in distributed environments.

- For instance, Google Cloud combines Cloud Run with Cloud Monitoring and OpenTelemetry-based observability stacks, allowing teams to collect metrics, logs, and traces in real time and optimize performance of serverless services across hybrid and multicloud environments.

By Deployment Model

The public cloud deployment model dominated the market with 58.7% share in 2024, supported by its cost efficiency, on-demand scalability, and widespread adoption among digital-first enterprises. Public cloud vendors offer extensive serverless toolsets, reducing infrastructure management requirements and accelerating application development. Hybrid deployment is emerging rapidly as organizations seek flexible environments that balance security-sensitive workloads with scalable cloud resources. Private deployment maintains relevance in regulated sectors where data governance and compliance are critical. Overall, rising cloud migration initiatives and the growth of distributed application architectures continue to propel demand across deployment models.

- For instance, the Amazon Web Services (AWS) continues to lead global adoption of public-cloud deployment.

By Organization

Large Enterprises led the market with 64.1% share in 2024, driven by aggressive digital transformation strategies, adoption of microservices frameworks, and prioritization of operational agility. These enterprises leverage serverless platforms to reduce infrastructure costs, enhance scalability, and streamline DevOps practices. Small and Medium Enterprises (SMEs) are expanding rapidly as they benefit from lower upfront costs, pay-as-you-use models, and simplified application deployment environments. Increasing availability of developer-friendly serverless tools and reduced maintenance burdens further accelerates adoption among SMEs, positioning the segment as a strong contributor to future market growth.

Key Growth Drivers

Rapid Adoption of Microservices and Cloud-Native Development

The rise of microservices and cloud-native development frameworks serves as a major growth driver for the Serverless Architecture market. Organizations are increasingly migrating from monolithic applications to modular, containerized, and event-driven architectures to enhance agility, scalability, and deployment efficiency. Serverless platforms align seamlessly with microservices by eliminating the need to manage underlying infrastructure, allowing developers to focus entirely on code execution and feature innovation. This reduces operational complexities, accelerates release cycles, and minimizes infrastructure costs. Enterprises also leverage serverless to integrate distributed systems and support dynamic workloads, making the approach well-suited for digital transformation programs. As demand intensifies for high-performance cloud-native applications, serverless becomes foundational for improving automation, enabling CI/CD pipelines, and supporting modern DevOps models.

- For instance, Coca-Cola powers its Freestyle vending machines with AWS serverless functions via API Gateway and Lambda, processing real-time transactions and data from over 200 drink options.

Cost Efficiency and Operational Simplification for Enterprises

Serverless Architecture significantly reduces operational expenditures, making it a powerful driver for adoption across industries. The pay-as-you-use pricing model eliminates idle resource costs, allowing organizations to scale applications dynamically based on actual usage patterns. This drastically improves cost predictability and efficiency compared with traditional and container-based environments. Serverless also offloads infrastructure provisioning, patching, and capacity planning responsibilities, reducing IT workloads and enabling smaller teams to manage complex systems effortlessly. Large enterprises benefit from streamlined workflows and reduced time-to-market, while SMEs gain access to high-performance computing without heavy capital investment. As businesses seek to optimize cloud spending and minimize technical debt, serverless emerges as a preferred architecture for accelerating innovation.

- For instance, Google Cloud highlighted that Cloud Run’s request-based billing helped customers reduce compute costs by up to 50% compared with always-on container deployments.

Growing Demand for Real-Time Data Processing and Event-Driven Applications

The increasing need for real-time analytics, automation, and event-driven workflows is a major driver propelling the Serverless Architecture market. Businesses generate massive data volumes through IoT devices, digital transactions, streaming platforms, and connected applications, requiring compute models that scale instantly and respond to triggers in milliseconds. Serverless platforms enable event-driven execution for fraud detection, personalization engines, predictive maintenance, chatbots, and real-time monitoring systems. As industries adopt AI, machine learning, and edge computing, serverless becomes essential for orchestrating distributed, highly responsive workloads. The ability to execute thousands of concurrent events with low latency strengthens serverless as a core component of next-generation enterprise architectures.

Key Trends & Opportunities

Integration of AI/ML and Automation into Serverless Platforms

One of the most transformative trends in the Serverless Architecture market is the integration of artificial intelligence, machine learning, and advanced automation. Cloud providers now offer serverless AI pipelines, automated model training, and inference capabilities, enabling enterprises to deploy intelligent applications without managing infrastructure. This convergence supports autonomous decision-making, real-time optimization, and high-speed data processing. As AI adoption increases across sectors, serverless provides a cost-efficient and scalable execution layer for ML workloads. Opportunities arise in intelligent customer engagement, automated supply chain analytics, cybersecurity monitoring, and digital labor solutions. The trend democratizes AI by offering accessible, infrastructure-free environments for rapid innovation.

- For instance, Amazon SageMaker introduced a “Scale Down to Zero” capability for its serverless inference endpoints in November 2024 meaning when no inference requests are incoming, the endpoint scales to zero instances, minimizing cost for intermittent or unpredictable AI workloads.

Surge in Multi-Cloud and Hybrid Serverless Deployments

Multi-cloud and hybrid serverless architectures are gaining momentum as organizations prioritize flexibility, resilience, and vendor independence. Enterprises deploy workloads across multiple clouds to avoid lock-in, enhance geopolitical compliance, and optimize performance. Hybrid serverless models allow sensitive workloads to remain on private infrastructure while leveraging public cloud elasticity for event-driven functions. The rise of open-source frameworks such as Knative and OpenFaaS further enables workload portability and standardized orchestration across cloud ecosystems. This trend supports modernization of legacy systems, smoother cloud migrations, and unified governance. It presents strong opportunities for enterprises aiming to build scalable, interoperable, and future-ready architectures.

- For instance, Red Hat OpenShift Serverless which builds on Knative offers true multicloud/hybrid portability: it lets organizations run serverless workloads consistently whether on-premise, in private cloud, or across public clouds.

Key Challenges

Security, Compliance, and Visibility Limitations

Serverless introduces unique security challenges due to its distributed, dynamic, and highly abstracted execution model. Lack of visibility into the underlying infrastructure complicates monitoring, vulnerability assessment, and anomaly detection. Misconfigurations, insecure APIs, and weak IAM policies increase exposure to threats. Multi-tenancy adds concerns related to data privacy, isolation, and regulatory compliance. Traditional security tools are incompatible with ephemeral serverless functions that spin up for milliseconds. Organizations must adopt specialized runtime security, API protection, and automated policy enforcement tools to address these risks. These complexities slow adoption in highly regulated sectors where compliance and traceability are paramount.

Vendor Lock-In and Limited Interoperability

Vendor lock-in remains a major barrier to widespread serverless adoption. Most leading cloud providers offer proprietary runtimes, tightly integrated services, and unique APIs that limit portability across platforms. Once applications are built using provider-specific architectures, migration becomes expensive and technically complex, reducing organizational flexibility. Interoperability challenges also arise when integrating serverless functions across heterogeneous environments, complicating orchestration, monitoring, and lifecycle management. Although open-source serverless frameworks exist, they often lack the maturity and ecosystem depth of major cloud offerings. As enterprises increasingly pursue multi-cloud strategies, addressing lock-in concerns becomes essential for ensuring long-term scalability and strategic freedom.

Regional Analysis

North America

North America dominated the Serverless Architecture market with 41.6% share in 2024, driven by strong cloud adoption, mature IT infrastructure, and high demand for microservices-based applications. Major technology providers, including AWS, Google, and Microsoft, fuel innovation through extensive serverless offerings and continuous platform enhancements. Enterprises across BFSI, retail, healthcare, and media rapidly adopt serverless to optimize costs and accelerate development cycles. The region also benefits from widespread use of AI, automation, and real-time analytics, further increasing demand. Growing investments in digital transformation strengthen North America’s leading position.

Europe

Europe accounted for 27.4% share in 2024, supported by rising enterprise focus on cloud modernization, data security, and scalable IT architectures. The region’s stringent regulatory environment encourages adoption of serverless models that enhance governance and reduce operational complexities. Industries such as automotive, manufacturing, and financial services increasingly integrate serverless computing to support automation and IoT-driven processes. Cloud providers expand their data center footprints across Germany, the U.K., France, and the Nordics, improving performance and accessibility. Continued emphasis on sustainable cloud operations further enhances market growth.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with 22.8% share in 2024, driven by rapid digitalization, expanding e-commerce ecosystems, and rising cloud investments across China, India, Japan, and Southeast Asia. SMEs and startups adopt serverless platforms to reduce infrastructure costs and accelerate time-to-market, while large enterprises embrace it to support AI-driven applications, mobile platforms, and high-volume transaction processing. Government-backed digital transformation programs further boost adoption across public and private sectors. The expansion of hyperscale cloud facilities and a growing developer ecosystem position Asia-Pacific for sustained high growth.

Latin America

Latin America captured 5.1% share in 2024, supported by rising adoption of public cloud services and the increasing need for cost-efficient IT architectures among enterprises. Countries such as Brazil, Mexico, and Chile experience growing demand for serverless solutions across fintech, retail, and telecom industries. Cloud providers continue to invest in local infrastructure, improving service reliability and lowering latency. Although budget constraints and limited technical expertise pose challenges, digital transformation initiatives and expanding developer communities support steady market progression across the region.

Middle East & Africa

The Middle East & Africa region held 3.1% share in 2024, with growth driven by rising cloud adoption in the UAE, Saudi Arabia, and South Africa. Serverless architectures are increasingly used to support smart city programs, e-government services, and digital infrastructure modernization. Telecom operators and financial institutions leverage serverless for automation, mobile applications, and real-time data processing. While limited cloud penetration in some countries restricts faster adoption, ongoing investments from global cloud providers and national digital strategies are gradually expanding market opportunities across MEA.

Market Segmentations

By Service

- Automation and Orchestration

- API Management

- Monitoring

- Security

- Support and Maintenance

- Training and Consulting

By Deployment Model

By Organization

- Large Enterprises

- Small And Medium Enterprises

By Application

- Healthcare

- Telecom and IT

- BFSI

- Government and Public

- Media and Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Serverless Architecture market features a dynamic and rapidly evolving competitive landscape, driven by continuous innovation from global cloud service providers and specialized technology vendors. Leading companies such as Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, and Alibaba Cloud dominate the market through extensive serverless platforms, strong developer ecosystems, and broad integration capabilities across cloud-native environments. These players prioritize enhancing automation, API management, orchestration, and real-time monitoring features to meet enterprise demands for scalability and agility. Emerging vendors like Dynatrace, Joyent Inc., Fiorano Software, and Galactic Fog IP, Inc. contribute to market growth by offering advanced observability, cloud optimization, and containerless computing solutions. Strategic partnerships, product enhancements, and multi-cloud support play pivotal roles in strengthening competitive positioning. As demand increases for microservices, AI-driven capabilities, and hybrid deployments, competition intensifies, pushing companies to expand global infrastructure, strengthen security features, and deliver cost-efficient serverless solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Galactic Fog IP, Inc.

- Google LLC

- Amazon Web Services, Inc.

- Joyent Inc.

- Microsoft Corporation

- CA Technologies

- Fiorano Software, Inc.

- IBM Corporation

- Alibaba Cloud

- Dynatrace

Recent Developments

- In December 2025, Akamai Technologies acquired Fermyon a serverless WebAssembly (Wasm) function-as-a-service provider to integrate Fermyon’s cloud-native Wasm FaaS and open-source tools into Akamai’s global edge platform.

- In October 2025, Caylent an Amazon Web Services (AWS) Premier-Tier Partner acquired fellow AWS partner Trek10 Inc., expanding Caylent’s managed-services portfolio and strengthening its ability to deliver end-to-end AWS (including serverless) services.

- In May 2025, Databricks announced its intent to acquire Neon, a serverless Postgres company, to deliver AI-driven serverless Postgres for developers and database workloads.

Report Coverage

The research report offers an in-depth analysis based on Service, Deployment Model, Organization, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as enterprises accelerate cloud-native and microservices adoption.

- Serverless platforms will increasingly integrate AI, ML, and automation to enhance application intelligence.

- Multi-cloud and hybrid serverless deployments will expand as organizations seek flexibility and reduced vendor dependency.

- Real-time data processing and event-driven architectures will drive broader use across industries.

- Developer productivity will improve as serverless tools become more intuitive and automation-driven.

- Observability, monitoring, and security solutions for serverless workloads will gain higher investment.

- Edge computing integration will grow, enabling low-latency serverless applications in IoT ecosystems.

- Enterprises will adopt serverless for cost optimization, reducing infrastructure management burdens.

- Open-source serverless frameworks will gain traction, supporting interoperability and portability.

- The market will see increased adoption among SMEs due to simplified deployment and scalable pay-as-you-go models.