Market Overview

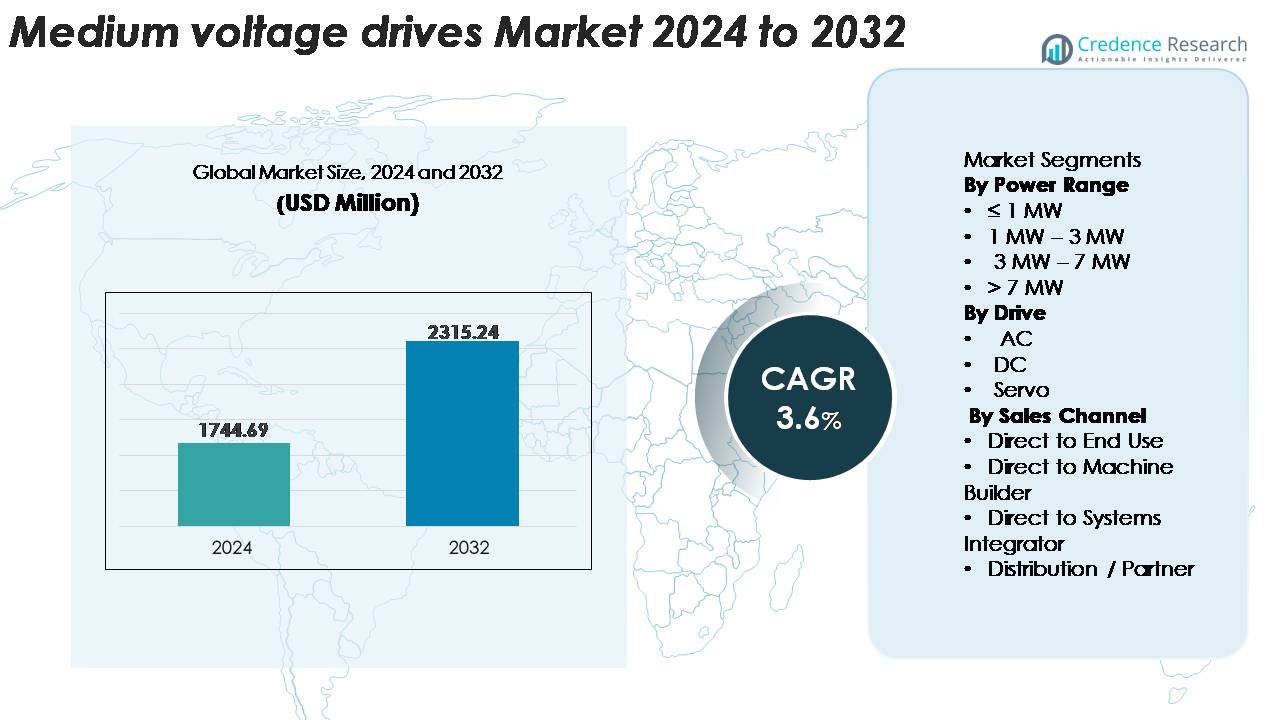

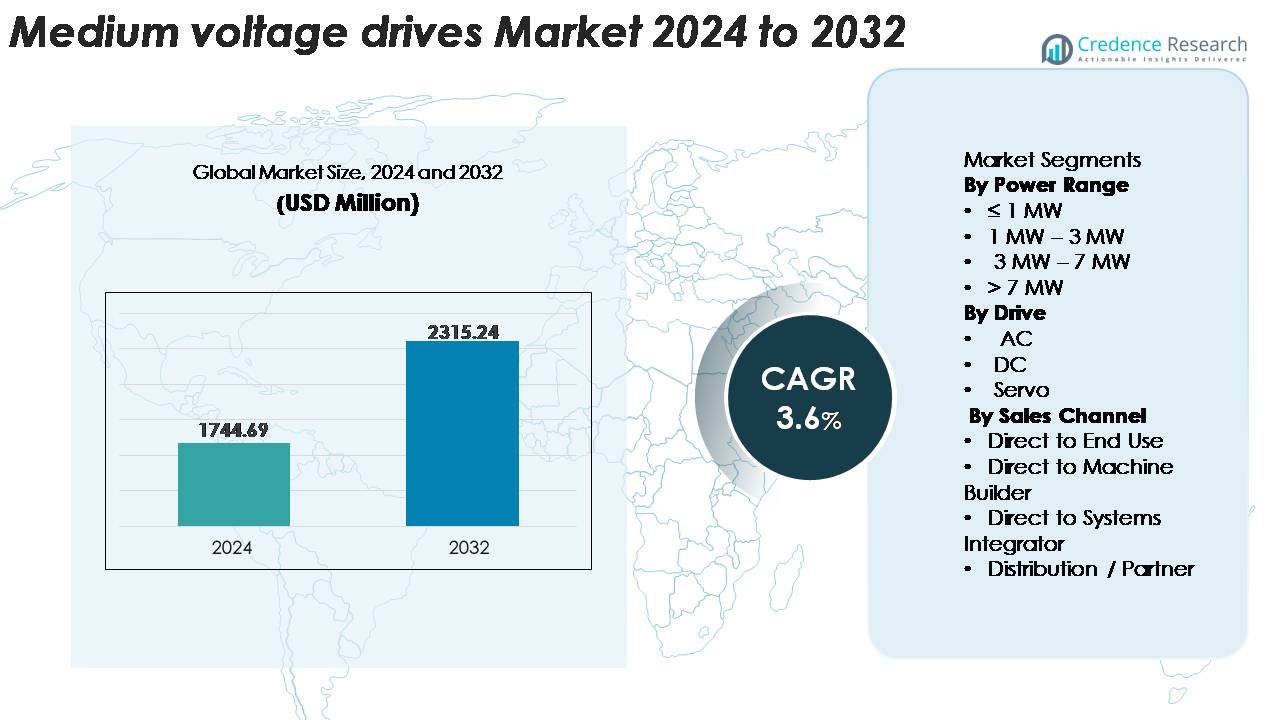

The global Medium Voltage Drives Market was valued at USD 1,744.69 million in 2024 and is anticipated to reach USD 2,315.24 million by 2032, registering a CAGR of 3.6% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Drives Market Size 2024 |

USD 1,744.69 Million |

| Medium Voltage Drives Market, CAGR |

3.6% |

| Medium Voltage Drives Market Size 2032 |

USD 2,315.24 Million |

The medium-voltage drives market is shaped by a diverse group of global and regional leaders, including Johnson Controls, Delta Electronics, Ingeteam, Fuji Electric, Danfoss, Hitachi Hi-Rel Power Electronics, General Electric, CG Power & Industrial Solutions, Eaton, and ABB. These companies compete through advanced motor-control technologies, energy-efficient architectures, and digitalized drive platforms that support predictive maintenance and high-reliability operations. They maintain strong partnerships with OEMs, EPC contractors, and system integrators to expand deployment across industrial segments. Asia-Pacific leads the global market with approximately 33–35% share, driven by large-scale industrialization, infrastructure development, and rapid adoption of automation solutions in manufacturing, power, and process industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The medium-voltage drives market was valued at USD 1,744.69 million in 2024 and is projected to reach USD 2,315.24 million by 2032, expanding at a CAGR of 3.6% during the forecast period.

- Demand grows as industries modernize pumping, compression, and conveyor systems, with strong adoption of 1–3 MW drives, the dominant power-range segment due to balanced efficiency and reliability for continuous-duty applications.

- Key trends include integration of digital diagnostics, predictive maintenance, and low-harmonic architectures, enabling smarter, energy-efficient motor control aligned with Industry 4.0 upgrades.

- Competition is driven by technology differentiation from players such as ABB, Eaton, Danfoss, Fuji Electric, GE, Johnson Controls, Delta Electronics, and CG Power, focusing on high-efficiency converters and service-centric digital platforms.

- Regionally, Asia-Pacific leads with 33–35% share, followed by North America at 32–34% and Europe at 26–28%, while Latin America and the Middle East & Africa collectively contribute niche but expanding market opportunities.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Power Range

The 1 MW–3 MW segment holds the largest share of the medium-voltage drives market, driven by its strong adoption in industrial pumping, compression, and fan applications across oil & gas, water treatment, and metals processing plants. This range offers an optimal balance between efficiency, torque output, and system cost, making it the preferred choice for mid-scale continuous-duty operations. The ≤1 MW segment continues to grow due to rising retrofits in utilities and HVAC systems, while 3–7 MW and >7 MW systems gain traction in heavy-duty processes requiring high reliability and robust load-handling.

· For instance, Rockwell Automation’s PowerFlex 6000T medium-voltage drive supports power ratings up to 11,000 kW and is designed for global voltage classes from 2.3 kV to 11 kV. The drive also features a unified control platform based on Rockwell’s Studio 5000 and ControlLogix architecture, allowing consistent motor-control logic and simplified integration across plant systems.

By Drive Type

AC drives dominate the market, capturing the majority share due to their superior efficiency, adaptive speed control, and compatibility with high-duty industrial motor systems. Their widespread use in compressors, conveyors, and high-horsepower pumps reinforces their leading position. DC drives retain relevance in legacy industrial infrastructures where fixed-speed control and high starting torque remain essential. Servo drives, though smaller in share, are expanding steadily as industries adopt precision-motion solutions for advanced manufacturing, high-accuracy positioning, and automated production lines requiring fast response and dynamic torque performance.

- For instance, Siemens’ SINAMICS DCM DC drive platform offers rated output currents up to 3,000 A and supports a broad power range extending into multi-megawatt applications. The system is used worldwide in heavy industrial processes that continue to rely on large DC motors, including metals and processing plants where legacy DC infrastructure remains in operation.

By Sales Channel

The Direct to End-Use segment leads the market, holding the highest share as large industrial operators prefer direct engagement with manufacturers for system customization, lifecycle support, integration services, and performance validation. Direct sales also enable vendors to deliver tailored drive configurations suited to client-specific load profiles. The Direct to Machine Builder channel gains momentum in packaged equipment solutions, while Systems Integrators play a key role in complex automation and brownfield modernization. The Distribution/Partner network expands the market reach, particularly in regions with fragmented industrial capability and high demand for aftermarket services.

Key Growth Drivers

Rising Industrial Electrification and Efficiency Mandates

Industrial facilities increasingly prioritize energy-efficient motor control solutions as governments strengthen regulations on power consumption, carbon intensity, and operational emissions. Medium-voltage drives enable precise speed modulation, reduced mechanical stress, and lower electrical losses, making them central to modernization programs across process industries. Utilities, desalination plants, and mining operators adopt MV drives to optimize pump, blower, and conveyor loads that operate continuously under demanding conditions. The shift from fixed-speed motor systems to variable-speed architectures further accelerates adoption, particularly in brownfield sites. Electrification trends in oil & gas compression, wastewater aeration, and cement grinding continue to push the need for advanced MV drive systems offering robust thermal design, harmonic mitigation, and grid-friendly starting capabilities. These performance improvements directly contribute to reduced lifecycle costs, extended equipment longevity, and improved plant reliability, reinforcing the role of MV drives in both new installations and energy-efficiency retrofits.

· For instance, GE Vernova’s MV7 Series medium-voltage drive uses a multilevel voltage-source inverter design and supports high-power applications up to 40 MW in a single configuration. The platform is deployed in demanding industrial processes such as compressors, pumps, and material-handling systems where precise speed control and high reliability are required.

Expansion of Automation and Intelligent Motor Control

The increasing penetration of automation, predictive maintenance, and digital twin technologies drives sustained demand for intelligent medium-voltage drives. Modern MV drives integrate advanced diagnostics, real-time vibration analytics, self-tuning algorithms, and condition-based monitoring that enhance asset reliability and operational visibility. Industries with mission-critical processes such as refining, petrochemicals, steel manufacturing, and power generation adopt these solutions to minimize downtime and optimize throughput. The push toward Industry 4.0 also accelerates the deployment of MV drives with embedded communication protocols such as PROFINET, EtherNet/IP, and Modbus TCP, enabling seamless plant-wide integration. These digital capabilities help operators detect anomalies earlier, optimize load balancing, and stabilize power quality across dynamic operating environments. As plants pursue higher automation maturity, MV drives offering intelligent torque control, embedded safety functions, and remote fleet management become indispensable assets across global industrial value chains.

- For instance, Siemens’ SINAMICS Perfect Harmony GH180 uses a cell-based multilevel inverter design in which low-voltage power cells are connected in series to produce a clean medium-voltage output. The drive also features built-in cell-bypass capability, allowing continued operation even if a power cell fails, which helps maintain uptime in heavy industrial processes.

Infrastructure Modernization Across Water, Energy, and Transportation

Large-scale infrastructure programs particularly in water treatment, renewable energy integration, and mass-transit electrification continue to expand the addressable market for medium-voltage drives. Municipal water utilities deploy MV drives for high-capacity pumping systems in urban distribution grids, desalination units, and treatment plants undergoing modernization. Renewable energy facilities, including wind farms, hydropower stations, and grid-connected storage systems, require MV drives for turbine control, auxiliary motor systems, and power conditioning operations. Rail operators and metro systems increasingly incorporate MV drives into traction substations and ventilation networks as electrified mobility scales. These infrastructure developments demand equipment with high reliability, thermal robustness, and grid-stability features, strengthening long-term demand. Government-funded capital investments in power transmission rehabilitation and industrial corridors further support MV drive adoption by enabling large-capacity motor installations and modernized electrical systems designed for long operating cycles.

Key Trends & Opportunities

Integration of Medium-Voltage Drives with Digital Ecosystems

A prominent trend shaping the market is the integration of MV drives into unified digital ecosystems supporting predictive maintenance, adaptive load management, and cloud-based operational analytics. Manufacturers enhance their product portfolios with machine-learning-based fault prediction, cyber-secured remote diagnostics, and embedded asset-health scoring. This integration unlocks opportunities for service-centric business models, including long-term maintenance agreements, remote monitoring contracts, and analytic-driven optimization services. Industrial operators benefit from reduced downtime and improved planning accuracy, making digitally enabled MV drives a central component of smart plant architectures. The expansion of 5G-enabled industrial communication networks further accelerates this trend by enabling low-latency, high-bandwidth connectivity essential for real-time motor performance monitoring and grid-interactive operation.

- For instance, ABB’s Ability™ Condition Monitoring service tracks real-time parameters such as motor speed, torque, current, and thermal status on medium-voltage drives like the ACS580MV and ACS6080. The platform supports remote diagnostics and predictive maintenance through ABB’s cloud analytics, helping reduce unplanned downtime in industrial sites.

Growing Shift Toward Medium-Voltage Drives in Electrified Heavy Machinery

Electrification trends in mining trucks, marine vessels, and large construction equipment create emerging opportunities for MV drive suppliers. Heavy-duty vehicles and vessels increasingly adopt electric propulsion systems requiring reliable medium-voltage motor control with high torque density and robust overload capabilities. This shift opens new market spaces beyond traditional stationary industrial environments. As OEMs redesign heavy machinery platforms around electric powertrains, demand rises for compact, integrated MV drive systems optimized for variable-torque operations. Advancements in semiconductor materials, particularly SiC-based switching devices, also unlock new efficiency levels, thermal performance benefits, and reduced converter footprints expanding the applicability of MV drives in mobile or hybrid-electric platforms.

- For instance, TMEIC’s TMdrive-MVe2 medium-voltage drive supports output voltages up to 11 kV and is available in ratings reaching 7,350 kVA for demanding industrial loads. Its multilevel inverter design delivers low harmonic distortion and high efficiency, making it suitable for heavy-duty applications such as large pumps, conveyors, and compressors in mining and process industries.

Opportunities in Grid Stability, Power Quality, and Harmonic Reduction

As industries adopt more variable-speed motor systems, the need for power-quality enhancement technologies grows significantly. Medium-voltage drives equipped with active front-end (AFE) rectifiers, harmonic filters, dynamic VAR compensation, and regenerative braking functions provide strategic advantages for facilities seeking to stabilize electrical networks. These features open new opportunities in sectors dealing with fluctuating loads or poor grid conditions, such as remote mining operations or offshore platforms. Utilities and large industrial facilities increasingly procure MV drives with built-in harmonic-mitigation and low-THD performance to ensure compliance with grid codes and avoid penalties. This shift positions MV drives not only as motion-control equipment but also as critical power-quality assets.

Key Challenges

High Capital Investment and Retrofitting Complexity

Medium-voltage drives require substantial upfront capital expenditure, particularly when deployed in high-power industrial loads needing specialized transformers, cooling infrastructure, and harmonic mitigation systems. For many brownfield facilities, retrofitting fixed-speed motors with MV drives involves complex rewiring, switchgear upgrades, reinforcement of auxiliary systems, and downtime planning factors that discourage rapid adoption. The total cost of ownership becomes a critical barrier for industries facing tight production schedules or limited modernization budgets. Additionally, specialized engineering expertise is required to ensure proper integration, commissioning, and safety-compliance, making deployment lengthy and resource-intensive. These challenges are particularly pronounced in developing regions where industrial electrification is growing but capital availability remains constrained.

Technical Skill Shortage and Increasing Cybersecurity Risks

The advanced digital capabilities of modern MV drive remote monitoring, IoT connectivity, and cloud-based analytics introduce challenges related to workforce readiness and cybersecurity. Many industrial plants lack personnel capable of configuring, programming, and maintaining digitally enabled MV drives, slowing adoption and increasing reliance on external technical support. At the same time, as MV drives become more network-connected, the risk of cyber intrusion grows, requiring robust encryption, secure firmware, and continuous patching. Operators must balance digital innovation with rigorous cybersecurity governance. These factors create both operational and compliance challenges, particularly for critical infrastructure sectors handling sensitive industrial data or operating under strict regulatory frameworks.

Regional Analysis

North America

North America holds around 32–34% of the medium-voltage drives market, supported by strong industrial electrification, advanced automation adoption, and well-established energy, oil & gas, and wastewater treatment infrastructure. The U.S. leads with high spending on modernizing pumping, compression, and conveyor systems in refining, LNG processing, and mining operations. Utilities increasingly deploy MV drives to improve energy efficiency and grid-connected motor reliability. The region also benefits from rapid integration of digitalized drive systems with predictive maintenance platforms, strengthening its demand for intelligent, high-efficiency MV drive architectures across heavy industrial applications.

Europe

Europe accounts for roughly 26–28% of global share, driven by stringent energy-efficiency regulations, robust renewable energy expansion, and continuous modernization of industrial assets. Germany, the U.K., France, and the Nordics lead adoption due to strong investments in water treatment, chemical processing, and district heating infrastructure requiring reliable medium-voltage motor control. The region emphasizes low-harmonic, grid-compliant MV drive systems as part of decarbonization and electrification programs. Growing automotive electrification, combined with digital factory initiatives, further accelerates deployment of advanced MV drives equipped with intelligent diagnostics and remote-monitoring capabilities.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing region, holding 33–35% market share, supported by massive industrial expansion and heavy investment in manufacturing, power generation, and public infrastructure. China and India drive significant demand for MV drives across steel plants, cement mills, mining sites, and high-capacity water pumping systems. The region’s accelerating renewable energy build-out especially hydro, wind, and grid-connected storage further increases adoption of medium-voltage motor control solutions. Rapid urbanization and government-led industrial corridor development create sustained opportunities for MV drive deployments in HVAC, utilities, and large-scale process industries.

Latin America

Latin America holds approximately 6–7% of the market, with demand concentrated in Brazil, Mexico, Chile, and Argentina. Expansion of mining, oil extraction, and municipal water management drives steady adoption of medium-voltage drives for high-horsepower pumps, crushers, and compressors. Regional industries increasingly modernize aging motor systems to improve uptime and reduce energy consumption. While capital investment cycles remain uneven, growth is reinforced by new infrastructure projects and renewable energy development. Vendors see rising opportunities in digitally supported MV drives as industrial operators pursue modernization and efficiency gains across distributed facilities.

Middle East & Africa

The Middle East & Africa region accounts for 4–5% of global share, supported primarily by oil & gas processing, desalination, and large industrial complexes. Gulf countries increasingly deploy MV drives in high-capacity pumping, gas compression, and district cooling systems to improve operational efficiency and reduce maintenance costs. Africa shows emerging demand driven by mining expansion and urban water distribution projects. Regional focus on energy efficiency, combined with investments in petrochemical plants and power generation assets, supports incremental market growth. Adoption continues to rise as industries upgrade to reliable, rugged MV drive systems suited to harsh operating environments.

Market Segmentations:

By Power Range

- ≤ 1 MW

- 1 MW – 3 MW

- 3 MW – 7 MW

- > 7 MW

By Drive

By Sales Channel

- Direct to End Use

- Direct to Machine Builder

- Direct to Systems Integrator

- Distribution / Partner

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The medium-voltage drives market is characterized by strong competition among global automation and power technology leaders that differentiate through efficiency, digital integration, and high-reliability performance. Companies such as ABB, Siemens, Schneider Electric, Rockwell Automation, Toshiba, and Mitsubishi Electric maintain significant presence with extensive portfolios covering MV drives optimized for pumps, compressors, fans, and heavy-duty industrial loads. These vendors invest in advanced semiconductor technologies, active front-end architectures, and predictive analytics platforms to enhance operational visibility and reduce downtime. Partnerships with EPC contractors, system integrators, and industrial OEMs strengthen market reach, while service-centric business models such as remote diagnostics and long-term maintenance programs are increasingly used to retain customers. Competitors also emphasize modular designs, low-harmonic performance, and grid-compliant capabilities to address sector-specific requirements. Regional players expand footprints in emerging markets through cost-competitive offerings and localized manufacturing, intensifying overall competitive pressure across the global MV drives ecosystem.

Key Player Analysis

- Delta Electronics

- Ingeteam

- Fuji Electric

- Danfoss

- Hitachi Hi-Rel Power Electronics

- General Electric

- CG Power & Industrial Solutions

- Eaton

- ABB

Recent Developments

- In Nov 2024, ABB announced the launch of its new medium-voltage air-cooled drive, the ACS8080. The drive promises high efficiency (up to 98%), reduced harmonic distortion, and faster diagnostics for industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Power range, Drive, Sales channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Medium-voltage drives will see wider adoption as industries accelerate electrification and replace fixed-speed motor systems with high-efficiency variable-speed solutions.

- Intelligent MV drives with built-in diagnostics, analytics, and remote monitoring will become standard as plants advance toward fully connected digital operations.

- Semiconductor advancements, especially SiC-based power devices, will enhance drive efficiency, thermal stability, and compactness for demanding industrial environments.

- Integration of MV drives with renewable energy infrastructure and energy-storage systems will strengthen as grids require flexible, high-capacity motor control.

- Water, wastewater, and desalination projects will drive sustained demand for MV drives in large pumping systems across developing regions.

- Electrification of mining, marine, and heavy mobile machinery will open new growth avenues for rugged, high-torque MV drive systems.

- Service-centric business models will expand, with vendors offering lifecycle maintenance, remote support, and performance optimization contracts.

- More industries will adopt low-harmonic, grid-compliant MV drives to meet stricter power-quality and emissions regulations.

- Modular, scalable MV drive platforms will gain traction to reduce installation time and simplify integration in both greenfield and brownfield projects.

- Regional manufacturing and localization strategies will strengthen competitiveness as suppliers target emerging markets with cost-optimized MV drive solutions.

Market Segmentation Analysis:

Market Segmentation Analysis: