Market Overview

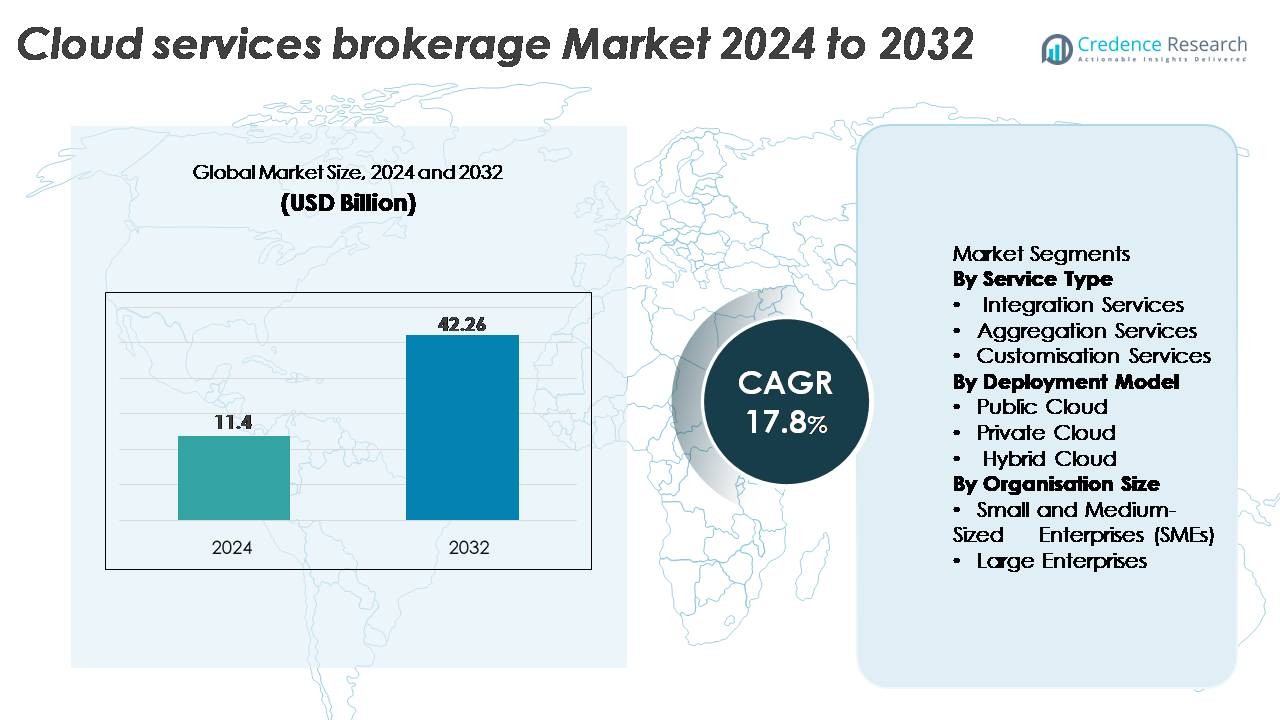

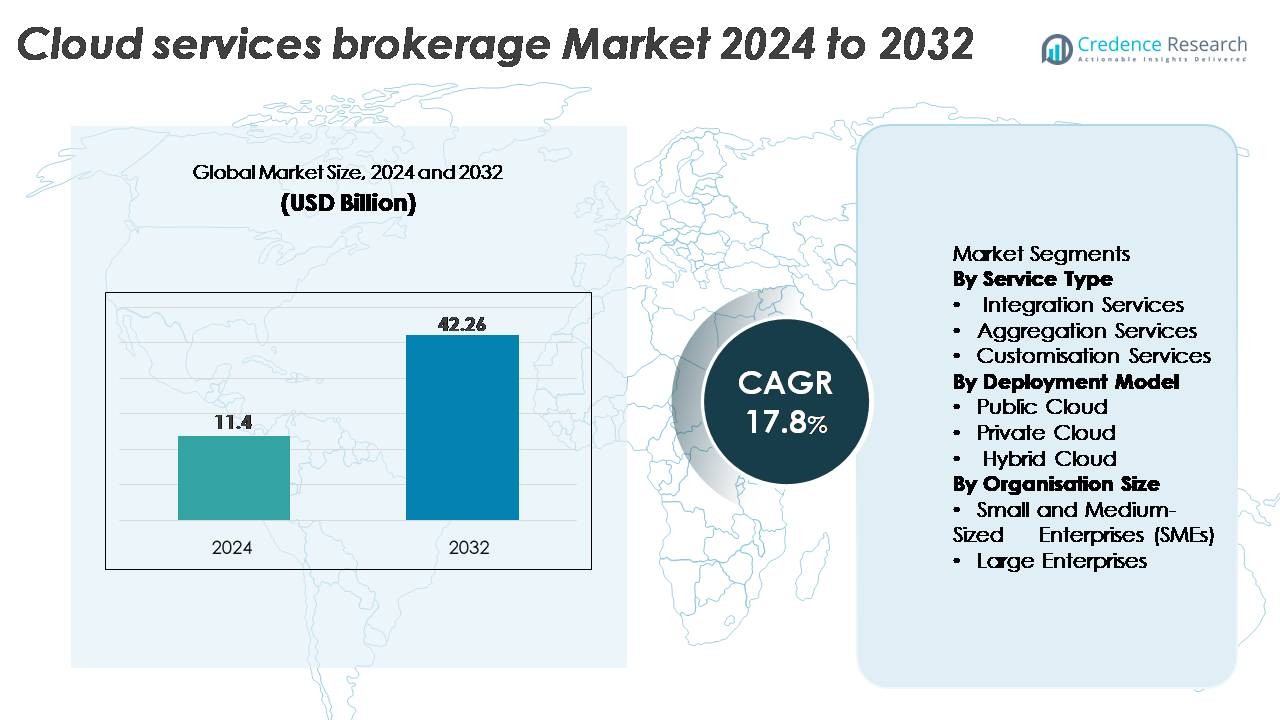

The global cloud services brokerage market was valued at USD 11.4 billion in 2024 and is projected to reach USD 42.26 billion by 2032, registering a robust CAGR of 17.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

|

|

USD 11.4 Billion |

| Cloud Services Brokerage Market, CAGR |

17.8% |

| Cloud Services Brokerage Market Size 2032 |

USD 42.26 Billion |

The cloud services brokerage market is shaped by major players such as DXC Technology, Infosys, Cisco Systems, Capgemini, VMware, Accenture, Wipro, IBM, TCS, and ServiceNow, each strengthening their portfolios through multi-cloud integration, automation, and governance capabilities. These companies focus on AI-driven optimization, unified service orchestration, and enhanced cost-management tools to support complex enterprise cloud environments. North America remains the leading region, accounting for 38% of the global market, supported by high multi-cloud adoption and strong enterprise digital transformation initiatives. Europe and Asia-Pacific follow, driven by regulatory requirements, accelerated cloud modernization, and rapid SaaS ecosystem expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global cloud services brokerage market was valued at USD 11.4 billion in 2024 and is projected to reach USD 42.26 billion by 2032, expanding at a CAGR of 17.8% during the forecast period.

- Growing enterprise adoption of multi-cloud and hybrid environments is a key market driver, with integration services emerging as the largest segment, supported by rising demand for unified governance, workload orchestration, and seamless cloud interoperability.

- AI-driven automation, cloud cost-optimization tools, and industry-specific compliance solutions are shaping major market trends as organizations prioritize intelligent cloud management and policy-based operations.

- The competitive landscape is dominated by players such as Accenture, IBM, TCS, Wipro, Cisco, and VMware, each enhancing automation, advisory, and multi-cloud lifecycle capabilities; however, challenges persist in managing security, compliance, and legacy integration across complex IT environments.

- Regionally, North America leads with 38%, followed by Europe at 27% and Asia-Pacific at 22%, reflecting strong digital transformation efforts and accelerated enterprise migration to scalable cloud platforms.

Market Segmentation Analysis:

By Service Type

Integration services represent the dominant sub-segment, capturing the largest market share due to rising enterprise demand for seamless interoperability across multi-cloud and hybrid environments. Organizations increasingly require brokers to unify disparate cloud workloads, automate provisioning, and streamline identity management, driving strong adoption. Aggregation services continue to grow as businesses consolidate third-party cloud offerings under a single contractual and billing framework. Customisation services also expand steadily as enterprises seek tailored governance policies, workflow automation, and security configurations aligned with industry-specific compliance mandates.

- For instance, Cisco’s cloud integration portfolio enables workload orchestration across a large number of enterprise deployments, with its API-driven Cisco Intersight platform managing approximately 1 million servers (or around 37 million network devices) and automating tens of thousands of cloud configuration workflows daily.

By Deployment Model

The public cloud segment leads the market with the highest share, supported by its scalability, cost efficiency, and rapid adoption among digital-first enterprises. Cloud brokers play a key role in optimizing migration, managing public cloud APIs, and orchestrating multi-tenant environments, strengthening this segment’s dominance. Private cloud brokerage grows steadily as regulated industries prioritize enhanced data sovereignty and control. Meanwhile, hybrid cloud brokerage accelerates as companies adopt distributed architectures, requiring unified management, workload portability, and policy enforcement across on-premise and cloud ecosystems.

- For instance,VMware’s hybrid and public cloud orchestration stack manages tens of millions of virtual machines globally and supports hundreds of thousands of enterprise customers. The VMware Cloud Foundation (VCF) solution enables automated workload deployment across a vast global network of hyperscale data center regions, including those offered by major partners like AWS, Microsoft Azure, Google Cloud, and Oracle Cloud.

By Organisation Size

Large enterprises hold the dominant market share, driven by their complex IT ecosystems and the need for advanced workload orchestration, multi-cloud governance, and cost-optimization tools. These organizations increasingly rely on brokerage platforms to streamline vendor management, enhance security compliance, and accelerate cloud modernization. SMEs, however, are emerging as a fast-growing segment as they adopt cloud brokerage services to simplify multi-cloud adoption, reduce operational overhead, and gain access to pre-configured cloud bundles that improve deployment speed and lower total cost of ownership.

Key Growth Drivers:

Rising Adoption of Multi-Cloud and Hybrid Cloud Architectures

The rapid shift toward multi-cloud and hybrid deployments remains a primary growth driver for the cloud services brokerage market. Enterprises increasingly use multiple cloud platforms to enhance resilience, avoid vendor lock-in, and optimize workloads. As complexity rises, they rely on brokers for unified governance, cross-cloud orchestration, API integration, and centralized policy enforcement. Brokers also facilitate automated provisioning, identity federation, and secure data migration between cloud environments, reducing operational overhead. This growing need for seamless interoperability across disparate cloud ecosystems continues to expand adoption, making brokerage platforms integral to enterprise-wide cloud transformation strategies.

- For instance, IBM’s hybrid cloud platform built on Red Hat OpenShift supports more than 3,800 enterprise clients globally and manages over 20 billion containerized application transactions monthly, enabling unified operations across on-premise, private, and public clouds.

Acceleration of Digital Transformation and IT Modernization Initiatives

Enterprises across industries are aggressively modernizing their legacy infrastructures, deploying cloud-native applications, and adopting DevOps frameworks. These initiatives fuel demand for cloud brokerage services that streamline workload deployment, automate configuration management, and optimize cloud spending. Brokers play a critical role in helping organizations align cloud services with business goals, offering advisory capabilities, governance frameworks, and lifecycle management tools. As digital transformation budgets expand, companies increasingly depend on cloud brokers to navigate service selection, security compliance, and integration complexity, accelerating brokerage uptake in both large enterprises and emerging digital-first businesses.

· For instance, the broader Accenture organization had more than 100,000 cloud professionals as of late 2020 and announced the creation of its dedicated Accenture Cloud First group with 70,000 experts backed by a $3 billion investment. The firm has served clients across more than 34,000 cloud projects across 68 countries, leveraging advanced migration accelerators and multi-cloud engineering frameworks.

Increasing Focus on Cost Optimization and Cloud Financial Management

With rising cloud consumption, cost governance has become a major enterprise priority. Cloud brokers enable organizations to monitor usage, prevent overprovisioning, and allocate costs accurately across departments. Their financial management capabilities including policy-based cost controls, predictive analytics, and real-time billing consolidation help enterprises gain visibility and reduce unnecessary spending. As multi-cloud environments introduce complex pricing structures, more businesses rely on brokerage platforms to compare offers, negotiate contracts, and automate cost optimization. This focus on cloud value realization strengthens the market’s momentum, driving sustained demand for brokerage solutions that balance performance with financial efficiency.

Key Trends & Opportunities:

Growing Demand for AI-Driven Automation and Cloud Optimization Tools

A major market trend is the integration of AI and machine learning into cloud brokerage platforms to automate decision-making and operational workflows. AI-powered brokers can analyze real-time cloud utilization, recommend workload placement, optimize resource allocation, and identify security anomalies. This trend opens new opportunities for intelligent governance, automated remediation, and predictive maintenance. As enterprises adopt AI-driven analytics for cloud operations (AIOps), brokers that offer advanced automation capabilities gain a competitive advantage. This technological evolution increases operational agility and reduces manual workload, strengthening brokerage value across large-scale cloud environments.

- For instance,”ServiceNow’s AI and automation capabilities enable large-scale optimization of cloud resources and operational processes across global enterprise environments, facilitating significant efficiency gains and task automation for its customers.”

Expansion of Industry-Specific and Compliance-Focused Brokerage Solutions

Vertical industries such as BFSI, healthcare, retail, and government are adopting cloud brokerage services tailored to regulatory and compliance needs. This trend creates opportunities for brokers to offer sector-specific templates, security frameworks, and certification-ready architectures. Demand for compliance automation, audit readiness, and data sovereignty tools is rising as regulations become more stringent. Brokers that provide domain-focused service catalogs, pre-configured policy engines, and sector-aligned governance models benefit from increased adoption. The expansion of tailored brokerage services supports market growth by enabling enterprises in regulated industries to accelerate secure cloud transformation.

- For instance, Wipro’s Cybersecurity & Risk Services platform supports more than 1,200 regulated-enterprise clients globally and processes over 40 billion security events per day, enabling automated compliance checks, governance reporting, and regulatory workflow enforcement across multi-cloud ecosystems.

Growth of Cloud Marketplace Integration and SaaS Aggregation Models

Cloud marketplaces are expanding rapidly, encouraging brokers to integrate SaaS aggregation, subscription management, and vendor monetization capabilities. This trend creates opportunities for brokers to streamline procurement, unify billing, and manage multi-vendor SaaS portfolios. Organizations adopting hundreds of SaaS tools require centralized oversight and identity governance, driving strong demand for brokerage solutions. As SaaS ecosystems grow, brokers offering marketplace integration and automated license optimization gain significant market traction.

Key Challenges:

Complexity in Managing Security, Compliance, and Data Governance Across Clouds

Despite growing adoption, cloud brokers face challenges addressing increasingly complex security and compliance requirements. Multi-cloud ecosystems contain diverse security models, encryption standards, and access control mechanisms, making unified governance difficult. Enterprises must comply with evolving regulations related to data sovereignty, retention, and auditability, increasing the complexity of brokerage service delivery. Brokers must continually update frameworks, integrate advanced security tools, and maintain interoperability with multiple cloud providers. This complexity slows adoption in highly regulated industries and requires significant investment in security automation and compliance management capabilities.

Integration Difficulties with Legacy Systems and Fragmented IT Environments

Many enterprises still rely on extensive legacy infrastructure, making integration with modern cloud services a major challenge. Cloud brokers must manage compatibility issues, outdated APIs, inconsistent data formats, and legacy application constraints. These limitations complicate workload migration, prolong deployment timelines, and increase implementation costs. The lack of standardized integration protocols across cloud providers further intensifies the challenge. Organizations also struggle with cultural and skill gaps that hinder successful cloud adoption. These integration barriers slow digital transformation and require brokers to deliver more robust advisory, modernization, and interoperability solutions.

Regional Analysis:

North America

North America holds the largest share of the cloud services brokerage market, accounting for approximately 38% of global revenue. The region benefits from high multi-cloud adoption, strong enterprise digital transformation initiatives, and extensive use of SaaS and IaaS platforms. Large enterprises in the U.S. increasingly rely on brokerage platforms for cost optimization, API integration, and unified governance across AWS, Azure, and Google Cloud. The presence of advanced cloud management solution providers and strong regulatory frameworks supporting secure cloud migration further reinforce North America’s leadership position in the global market.

Europe

Europe captures around 27% of the cloud services brokerage market, driven by strict regulatory environments such as GDPR, which accelerate adoption of compliance-centric brokerage solutions. Enterprises in Germany, the U.K., France, and the Nordics increasingly embrace hybrid and sovereign cloud architectures, using brokers to streamline governance and maintain data sovereignty. Rising demand for integration services and cross-border cloud orchestration strengthens the market’s expansion. The growing focus on secure cloud transformation in banking, healthcare, and government sectors continues to underpin Europe’s steady growth trajectory in cloud service brokerage adoption.

Asia-Pacific

Asia-Pacific accounts for approximately 22% of the market and represents the fastest-growing region, driven by rapid cloud adoption across China, India, Japan, and Southeast Asia. SMEs and large enterprises increasingly adopt multi-cloud strategies to support digitalization, e-commerce expansion, and large-scale IT modernization. Cloud service brokers gain strong traction as organizations seek scalable integration, cost governance, and automated management tools. Government-led cloud acceleration programs in countries like India and Singapore further strengthen demand. The region’s expanding technology ecosystem and rising investments in cloud-native development enhance Asia-Pacific’s growing influence in the global market.

Latin America

Latin America holds around 8% of the market, with growth supported by expanding cloud deployment across Brazil, Mexico, Chile, and Colombia. Enterprises increasingly adopt brokerage services to simplify hybrid cloud adoption, reduce integration complexity, and manage cloud spend. The region’s rising digital transformation investments, along with the growing presence of hyperscale data centers, are accelerating demand for cloud management and optimization platforms. While challenges such as variable infrastructure maturity persist, the increasing adoption of SaaS and compliance-driven cloud usage is strengthening the region’s market position.

Middle East & Africa

The Middle East & Africa region represents approximately 5% of the global cloud services brokerage market, supported by growing cloud adoption in the UAE, Saudi Arabia, South Africa, and Israel. Governments and large enterprises are prioritizing cloud modernization initiatives, driving demand for brokerage platforms that manage multi-cloud governance and ensure regulatory compliance. The rise of regional cloud data centers and increased investment in digital economy programs contribute to higher adoption of integration and workload orchestration services. Although the market is still developing, expanding digital infrastructure continues to unlock strong growth potential.

Market Segmentations:

By Service Type

- Aggregation Services

- Customization Services

By Deployment Model

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the cloud services brokerage market is characterized by a mix of global cloud providers, specialized brokerage platforms, and enterprise-focused integration service firms competing to deliver advanced multi-cloud management capabilities. Leading players differentiate through AI-driven automation, unified governance frameworks, and expanded service catalogs integrating IaaS, PaaS, and SaaS offerings. Vendors increasingly invest in cost-optimization tools, API orchestration, and compliance automation to support large, regulated enterprises adopting hybrid and multi-cloud environments. Strategic partnerships with hyperscalers such as AWS, Microsoft Azure, and Google Cloud strengthen market positioning and enable deeper ecosystem integration. Additionally, mergers and acquisitions are accelerating as firms seek to enhance their cloud consulting, migration, and security capabilities. With enterprises prioritizing interoperability, lifecycle management, and end-to-end visibility, competition intensifies around delivering scalable, secure, and intelligent brokerage solutions tailored to diverse industry needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In October 2025, DXC Technology the company rolled out Assure Smart Apps, a suite of AI-driven, workflow-oriented applications to help insurers automate and modernize operations, leveraging cloud integration (e.g. via AWS) and intelligent data tools.

- In August 2025, Capgemini signed an agreement to acquire Cloud4C, a hybrid-cloud and managed-cloud platform services provider, to strengthen its managed services, automation, and hybrid-cloud delivery capabilities.

- In May 2025, Infosys was ranked No. 8 in the “Solution Provider 500” list, reflecting its growing footprint and recognition among global IT/cloud services vendors.

Report Coverage:

The research report offers an in-depth analysis based on Service type, Deployment model, Organisation size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud service brokerages will increasingly adopt AI-driven automation to enhance workload placement, compliance management, and cost optimization.

- Multi-cloud and hybrid cloud orchestration will become the standard approach for enterprises seeking flexibility and resilience.

- Demand for industry-specific brokerage solutions will rise as regulated sectors require tailored governance and security frameworks.

- Cloud financial management and predictive cost analytics will gain importance as organizations prioritize value-driven cloud spending.

- Integration of SaaS marketplaces and subscription management will accelerate, enabling centralized procurement and license oversight.

- Security-centric brokerage capabilities will expand to address data sovereignty, zero-trust architectures, and unified identity governance.

- Partnerships between brokers and hyperscalers will deepen, enabling richer service catalogs and tighter API interoperability.

- SMEs will adopt brokerage platforms more aggressively to simplify cloud operations and reduce IT complexity.

- Brokerage platforms will incorporate enhanced observability and real-time analytics to improve cloud performance monitoring.

- Automation-first cloud governance frameworks will drive consistent policy enforcement across complex, distributed environments.