Market Overview

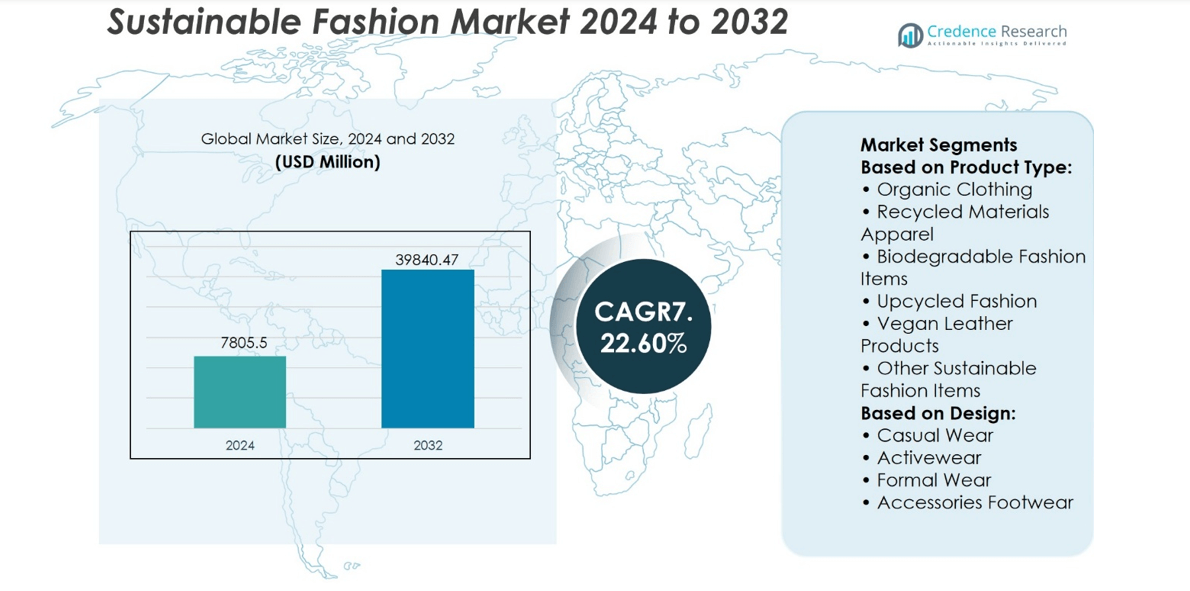

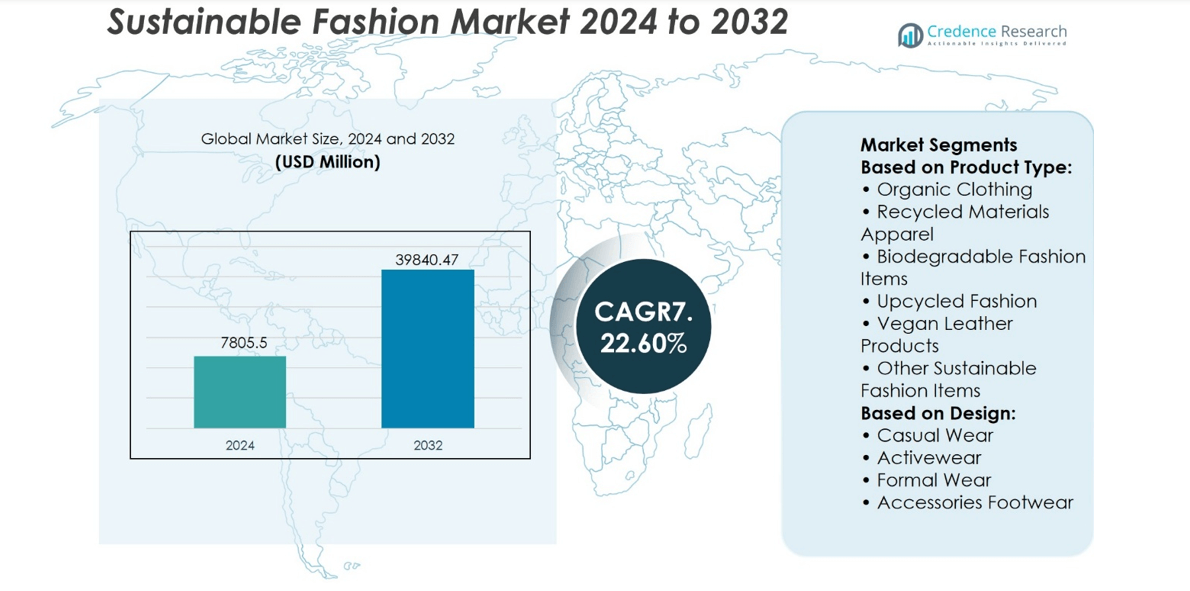

Sustainable Fashion Market size was valued at USD 7805.5 million in 2024 and is anticipated to reach USD 39840.47 million by 2032, at a CAGR of 22.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable Fashion Market Size 2024 |

USD 7805.5 million |

| Sustainable Fashion Market, CAGR |

22.60% |

| Sustainable Fashion Market Size 2032 |

USD 39840.47 million |

The Sustainable Fashion Market grows through strong drivers such as rising consumer awareness, regulatory pressure, and technological innovation in eco-friendly materials and production processes. It benefits from increasing demand for transparency, ethical sourcing, and circular economy models that include resale, rental, and recycling initiatives. Market trends highlight rapid adoption of digital traceability tools, expansion of bio-based and biodegradable textiles, and integration of inclusivity and social responsibility into brand strategies. Growing collaborations between fashion houses and biotech firms further accelerate innovation. These dynamics reinforce sustainability as both a competitive differentiator and a long-term growth pathway for global fashion brands.

The Sustainable Fashion Market shows strong regional presence, with Europe leading due to strict regulations and consumer preference, followed by North America with advanced retail models and high awareness. Asia-Pacific grows rapidly, driven by manufacturing transformation and rising middle-class demand, while Latin America and Middle East & Africa display emerging opportunities. Key players include H&M, Inditex, Nike, Adidas, Levi Strauss & Co., VF Corporation, Fast Retailing, Gap Inc., Prada, and Kering, all driving innovation and global sustainability adoption.

Market Insights

- The Sustainable Fashion Market size was valued at USD 7805.5 million in 2024 and is expected to reach USD 39840.47 million by 2032, growing at a CAGR of 22.60%.

- Rising consumer awareness, regulatory frameworks, and investment in eco-friendly materials drive strong market expansion.

- Growing adoption of circular economy models such as resale, rental, and recycling strengthens long-term demand.

- Rapid integration of digital traceability tools and bio-based textiles defines major market trends.

- Competition intensifies as leading brands focus on transparency, ethical sourcing, and innovation to secure differentiation.

- High costs of sustainable materials and risks of greenwashing remain key restraints for industry growth.

- Europe leads the market share, followed by North America, while Asia-Pacific shows rapid expansion and Latin America with Middle East & Africa represent emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Awareness and Ethical Purchasing

Growing consumer awareness of environmental and social issues drives the Sustainable Fashion Market. Shoppers increasingly evaluate brands based on their commitment to ethical sourcing, reduced waste, and fair labor practices. It responds to a stronger preference for transparency, with digital platforms allowing consumers to trace product origins. Demand for organic cotton, recycled fabrics, and cruelty-free alternatives continues to rise. Fashion houses that prioritize certifications and sustainable labeling build deeper trust with eco-conscious buyers. The shift in consumer mindset forms a critical driver of market expansion.

- For instance, H&M reported that it collected and recycled more than 18,800 tonnes of textiles through its global Garment Collecting program in 2023, equivalent to over 93 million T-shirts being diverted from landfills.

Regulatory Pressure and Policy Frameworks

Governments and international bodies establish stringent sustainability regulations, shaping the Sustainable Fashion Market. Policies promoting circular economy practices, waste reduction, and carbon-neutral initiatives encourage brands to adopt greener operations. It faces direct compliance requirements, from extended producer responsibility laws to restrictions on harmful chemicals. Tax incentives and subsidies also motivate investment in sustainable technologies and materials. Mandatory disclosure of supply chain practices ensures accountability and improves brand credibility. Regulatory alignment across regions strengthens global adoption of sustainable practices.

- For instance, Levi Strauss & Co. reduced its freshwater use by 12 billion liters between 2011 and 2023 through its Water<Less® manufacturing program.

Technological Advancements in Materials and Processes

Innovations in textile engineering and manufacturing accelerate progress in the Sustainable Fashion Market. Companies deploy bio-based fibers, waterless dyeing technologies, and closed-loop recycling systems to reduce ecological impact. It benefits from scalable solutions such as 3D knitting and AI-driven production planning, which lower waste and optimize resource use. Breakthroughs in biodegradable polymers and plant-based leather alternatives open new opportunities for design flexibility. Collaborations between fashion brands and biotech firms enhance material diversity while reducing dependence on traditional inputs. These advancements strengthen the balance between style and sustainability.

Brand Differentiation and Competitive Advantage

Sustainability emerges as a strategic differentiator within the fashion sector, boosting the Sustainable Fashion Market. Leading brands leverage eco-conscious collections to attract new customer segments and retain loyalty in competitive landscapes. It enables companies to reposition themselves as forward-looking, responsible, and innovative. Marketing campaigns highlighting sustainable values resonate strongly with younger demographics, particularly millennials and Gen Z. Partnerships with influencers and NGOs reinforce authenticity and expand consumer outreach. The ability to link profitability with purpose secures long-term competitive advantage.

Market Trends

Expansion of Circular Fashion Models

The Sustainable Fashion Market experiences strong growth in circular models, with brands integrating resale, rental, and repair services. Consumers engage in second-hand platforms and clothing rental systems that extend product lifecycles. It encourages businesses to design for durability and recyclability, reducing dependency on fast fashion. Major retailers launch take-back schemes and upcycling initiatives to capture value from used garments. Partnerships between technology firms and fashion houses streamline reverse logistics. Circular fashion establishes itself as a mainstream trend rather than a niche offering.

- For instance, Inditex (Zara) launched its “Pre-Owned” platform in 2022 across the UK, enabling resale, donation, and repair services, and by 2023 it had facilitated over 300,000 product repairs and garment reuse transactions.

Integration of Digital Technologies and Transparency Tools

Digital transformation shapes the trajectory of the Sustainable Fashion Market by enabling real-time transparency. Brands deploy blockchain, QR codes, and digital product passports to verify sustainable sourcing. It allows customers to trace raw materials from origin to finished apparel, increasing trust in sustainability claims. Advanced analytics and AI optimize inventory management and minimize overproduction. Virtual fashion shows and digital try-on tools reduce the carbon footprint of traditional retail models. This integration strengthens consumer engagement while promoting responsible choices.

- For instance, Prada Group implemented the Aura Blockchain Consortium in 2021 to enhance product traceability, and by 2023 it had integrated over 1.5 million products with digital IDs, allowing consumers to access verified data on origin and sustainability practices.

Growth in Alternative and Bio-Based Materials

Material innovation remains a defining trend in the Sustainable Fashion Market, driven by advances in biotechnology and sustainable chemistry. Companies invest in plant-based leathers, mushroom mycelium fabrics, and recycled ocean plastics. It helps fashion brands diversify material supply chains while reducing reliance on resource-intensive textiles like conventional cotton. Investments in biodegradable fibers enhance compostability and lower environmental impact. Collaborative research accelerates commercial-scale production of next-generation fabrics. The emphasis on bio-based innovation signals a long-term shift in material sourcing.

Rise of Social Responsibility and Inclusive Branding

Ethical positioning evolves into a central trend within the Sustainable Fashion Market. Brands incorporate inclusivity, diversity, and fair trade practices into their sustainability narratives. It builds deeper consumer loyalty by aligning social values with purchasing behavior. Transparent wage policies, equitable representation in campaigns, and community-based production gain prominence. Fashion houses highlight cultural authenticity while avoiding exploitative practices. The linkage of social responsibility with sustainability strengthens the holistic appeal of ethical fashion.

Market Challenges Analysis

High Costs and Supply Chain Complexity

The Sustainable Fashion Market faces significant challenges from the high costs of eco-friendly materials and complex supply chain management. Organic fabrics, bio-based textiles, and recycled fibers often require greater investment compared to conventional alternatives. It creates financial pressure for small and mid-sized brands that struggle to compete with large-scale fast fashion companies. Supply chain traceability demands advanced digital tools and extensive monitoring, which increase operational expenses. Limited availability of certified raw materials also leads to bottlenecks in production. Brands encounter difficulty in balancing affordability with genuine sustainability commitments.

Greenwashing Risks and Consumer Skepticism

Market growth is hindered by greenwashing practices, where companies exaggerate or misrepresent sustainability claims. The Sustainable Fashion Market relies on trust, and misleading communication undermines consumer confidence. It compels regulators and watchdog groups to enforce stricter guidelines on labeling and marketing disclosures. Consumers demand proof of ethical sourcing and measurable impact, which many brands find challenging to deliver consistently. High expectations around transparency place pressure on businesses without mature verification systems. Persistent skepticism creates barriers to adoption, slowing the transition toward fully sustainable operations.

Market Opportunities

Expanding Consumer Demand and New Business Models

The Sustainable Fashion Market creates strong opportunities through rising consumer preference for eco-conscious and ethically produced apparel. Younger generations, particularly millennials and Gen Z, drive demand for transparency, traceability, and responsible sourcing. It enables brands to capture loyalty by offering resale, rental, and subscription-based models that extend product lifecycles. The expansion of online platforms dedicated to second-hand and upcycled fashion further broadens reach. Companies that integrate sustainability into their brand identity gain access to premium positioning and global recognition. This shift opens profitable pathways for both established players and emerging labels.

Technological Innovation and Material Advancements

Opportunities expand as technological progress reshapes the Sustainable Fashion Market with advanced manufacturing methods and new material development. Bio-fabricated textiles, biodegradable fibers, and low-impact dyeing solutions enhance efficiency and reduce environmental footprints. It supports the growth of scalable, commercially viable alternatives to traditional cotton, polyester, and leather. Integration of blockchain and AI ensures transparency across production and logistics, boosting consumer confidence. Strategic collaborations with biotechnology firms, material innovators, and digital platforms accelerate product innovation. These advancements allow companies to align profitability with sustainability while strengthening competitive advantage.

Market Segmentation Analysis:

By Product Type

The Sustainable Fashion Market demonstrates diverse growth across product types, reflecting shifts in consumer preferences and technological advancements. Organic clothing maintains strong demand, supported by rising adoption of chemical-free cotton and natural fibers that reduce ecological impact. Recycled materials apparel, including garments made from PET bottles and textile waste, secures rapid traction with brands investing in closed-loop systems. It also benefits from biodegradable fashion items, where innovations in plant-based fibers and compostable fabrics reduce post-consumer waste. Upcycled fashion emerges as a niche yet impactful segment, appealing to consumers who value uniqueness and creativity in repurposed designs. Vegan leather products gain visibility with mushroom-based and lab-grown alternatives, reducing reliance on animal-derived materials. Other sustainable fashion items, such as eco-friendly accessories, jewelry, and blended fabrics, contribute to the broader adoption of ethical consumerism.

- For instance, Patagonia sourced more than 25,000 metric tons of certified organic cotton in 2022, which was used across 480 product styles, eliminating the use of synthetic pesticides and fertilizers from its cotton supply chain.

By Design

By design, the Sustainable Fashion Market addresses varied lifestyle needs through specialized product categories. Casual wear dominates due to its frequent use and consumer preference for sustainable everyday essentials. It extends into activewear, where demand grows for high-performance apparel made from recycled polyester and moisture-wicking eco-materials. Formal wear integrates sustainable fabrics into premium collections, offering environmentally conscious options for professional and event-driven markets. Accessories, including handbags, belts, and jewelry crafted from recycled or vegan materials, reinforce sustainability in fashion identity. Footwear, a rapidly evolving segment, introduces biodegradable soles and plant-based uppers that align with consumer expectations of comfort and responsibility. Together, these categories illustrate how sustainable fashion expands beyond niche products into mainstream wardrobes.

- For instance, Levi Strauss & Co. produced over 22 million pairs of jeans under its process in 2023, cutting water usage by up to garment and positioning sustainable casual wear as a scalable mainstream offering.

Segments:

Based on Product Type:

- Organic Clothing

- Recycled Materials Apparel

- Biodegradable Fashion Items

- Upcycled Fashion

- Vegan Leather Products

- Other Sustainable Fashion Items

Based on Design:

- Casual Wear

- Activewear

- Formal Wear

- Accessories Footwear

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of around 32% in the Sustainable Fashion Market, driven by strong consumer awareness and regulatory pressure on brands to adopt ethical practices. The United States and Canada lead adoption, with fashion retailers integrating eco-friendly fabrics, digital traceability, and resale models into mainstream offerings. It benefits from high purchasing power, which enables consumers to support premium sustainable brands and invest in ethically sourced apparel. Large retailers and e-commerce platforms expand resale and rental services, further increasing adoption across urban centers. Strong marketing campaigns highlight transparency and fair trade, resonating with millennial and Gen Z buyers. Investment in recycled materials and corporate sustainability commitments positions the region as a global leader in driving adoption.

Europe

Europe accounts for a market share of nearly 38%, making it the largest regional contributor to the Sustainable Fashion Market. Stringent regulations such as the European Union’s Green Deal and circular economy initiatives push brands to meet strict sustainability targets. It emphasizes material innovation, with bio-based textiles and vegan alternatives gaining rapid traction in Germany, France, and the UK. Fashion capitals such as Paris, Milan, and London serve as hubs for sustainable luxury fashion, while Scandinavian countries set benchmarks in eco-friendly design and circular retail practices. European consumers actively prioritize certified clothing and demand high levels of transparency in supply chains. The strong alignment between consumer expectations, government regulations, and corporate strategies ensures Europe maintains its leading role in sustainable adoption.

Asia-Pacific

The Asia-Pacific region represents a market share of about 20%, reflecting rapid expansion fueled by manufacturing transformation and rising consumer awareness. Countries such as China, India, Japan, and South Korea experience growing demand for organic cotton, recycled fabrics, and sustainable footwear. It benefits from the large-scale textile industry shifting toward cleaner production methods and compliance with international sustainability standards. Rising middle-class populations and expanding e-commerce platforms accelerate sustainable consumption, particularly among urban buyers. Governments in the region introduce waste reduction targets and support innovation in biodegradable fibers. Global brands partner with regional manufacturers to establish eco-friendly supply chains, which enhances the region’s contribution to global sustainability goals.

Latin America

Latin America holds a market share of nearly 6%, with Brazil and Mexico driving regional adoption of sustainable fashion practices. It witnesses rising interest in local textile innovation, with brands experimenting in organic cotton, artisanal designs, and upcycled fashion items. Consumer awareness increases in urban centers, where eco-conscious millennials support brands with strong ethical positioning. Limited affordability and infrastructure challenges slow broader adoption, yet niche brands gain recognition through cultural authenticity and fair trade practices. International retailers also expand their sustainable product lines in the region, creating opportunities for growth. Government initiatives encouraging sustainable agriculture and textile recycling complement market development.

Middle East and Africa

The Middle East and Africa together capture a market share of around 4%, reflecting early-stage adoption but strong potential. It faces structural challenges such as limited supply chain transparency and lower consumer awareness outside major cities. However, markets such as the UAE and South Africa show rising demand for sustainable luxury and eco-friendly everyday wear. International fashion houses introduce sustainable collections in premium malls, supported by expatriate-driven demand for ethical products. Local designers in Africa experiment with upcycling and traditional fabrics to create eco-conscious fashion aligned with cultural heritage. Government programs promoting recycling and waste reduction support gradual adoption, positioning the region for long-term growth in sustainable fashion consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Levi Strauss & Co.

- Prada

- Nike

- Fast Retailing (Uniqlo)

- H&M

- VF Corporation

- Adidas

- Inditex (Zara)

- Kering (Gucci)

- Gap Inc.

Competitive Analysis

The Sustainable Fashion Market such as H&M, Inditex (Zara), Gap Inc., Kering (Gucci), Nike, Adidas, Levi Strauss & Co., VF Corporation, Fast Retailing (Uniqlo), and Prada. The Sustainable Fashion Market reflects rising competition as brands position sustainability at the core of their business strategies. Companies invest heavily in eco-friendly materials, circular economy models, and transparent supply chains to meet growing consumer demand for ethical apparel. Innovation in recycling technologies, biodegradable fabrics, and digital traceability strengthens brand differentiation while reducing environmental impact. Market leaders also expand resale, rental, and upcycling initiatives to capture new revenue streams and extend product lifecycles. Competitive intensity increases as both mass-market and luxury segments embrace sustainability, making responsible practices a key factor in consumer loyalty and brand reputation. The ability to balance affordability with genuine sustainability commitments defines long-term success in this evolving landscape.

Recent Developments

- In March 2025, Prada published a new sustainability strategy focusing on growth, enhancement for the planet, people, and culture. It emphasizes circular luxury and responsible sourcing.

- In January 2025, Prada deepened its commitment with the “Re-Nylon 2025” project, featuring partnerships with National Geographic and UNESCO’s IOC to promote ocean literacy.

- In October 2024, PUMA launched the world’s first piece of clothing completely made from textile waste by using bio-recycling technology.

- In January 2024, Celanese partnered with Under Armour to develop a new fabric material called NEOLAST. This stretch fabric offers high high-performing substitute for elastane and aids in addressing sustainable challenges associated with elastane.

Market Concentration & Characteristics

The Sustainable Fashion Market demonstrates moderate concentration, with a mix of global giants and emerging niche players shaping competitive dynamics. Large multinational retailers dominate through extensive distribution networks, strong supply chain capabilities, and high investment in material innovation. It maintains diversity by enabling smaller brands and startups to gain traction through unique positioning in upcycled fashion, vegan materials, and artisanal collections. The market is characterized by high transparency demands, regulatory influence, and rapid adoption of circular models such as resale and rental. Consumer expectations for authenticity and measurable impact push companies to integrate certifications, digital product passports, and ethical sourcing standards. Continuous innovation in fabrics, combined with evolving lifestyle trends, ensures the market remains highly dynamic, with competition driven by sustainability credibility, affordability, and brand differentiation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Design and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumer demand for eco-friendly apparel will accelerate adoption of sustainable practices across all fashion segments.

- Circular economy models such as resale, rental, and repair will expand as mainstream business strategies.

- Brands will increase investment in bio-based, recycled, and biodegradable materials to reduce environmental impact.

- Digital product passports and blockchain tools will enhance transparency and supply chain accountability.

- Luxury and premium fashion will integrate sustainability as a core value to strengthen brand positioning.

- Sportswear and activewear will drive material innovation with performance-focused sustainable textiles.

- Governments will enforce stricter regulations on waste reduction, carbon emissions, and ethical sourcing.

- Emerging markets will see rising adoption as awareness and middle-class purchasing power grow.

- Collaborations between fashion companies and biotech firms will accelerate new material development.

- Consumer loyalty will increasingly depend on measurable sustainability commitments and brand authenticity.