| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Card Games Market Size 2024 |

USD 15,970.43 million |

| Card Games Market, CAGR |

6.61% |

| Card Games Market Size 2032 |

USD 26,645.23 million |

Market Overview

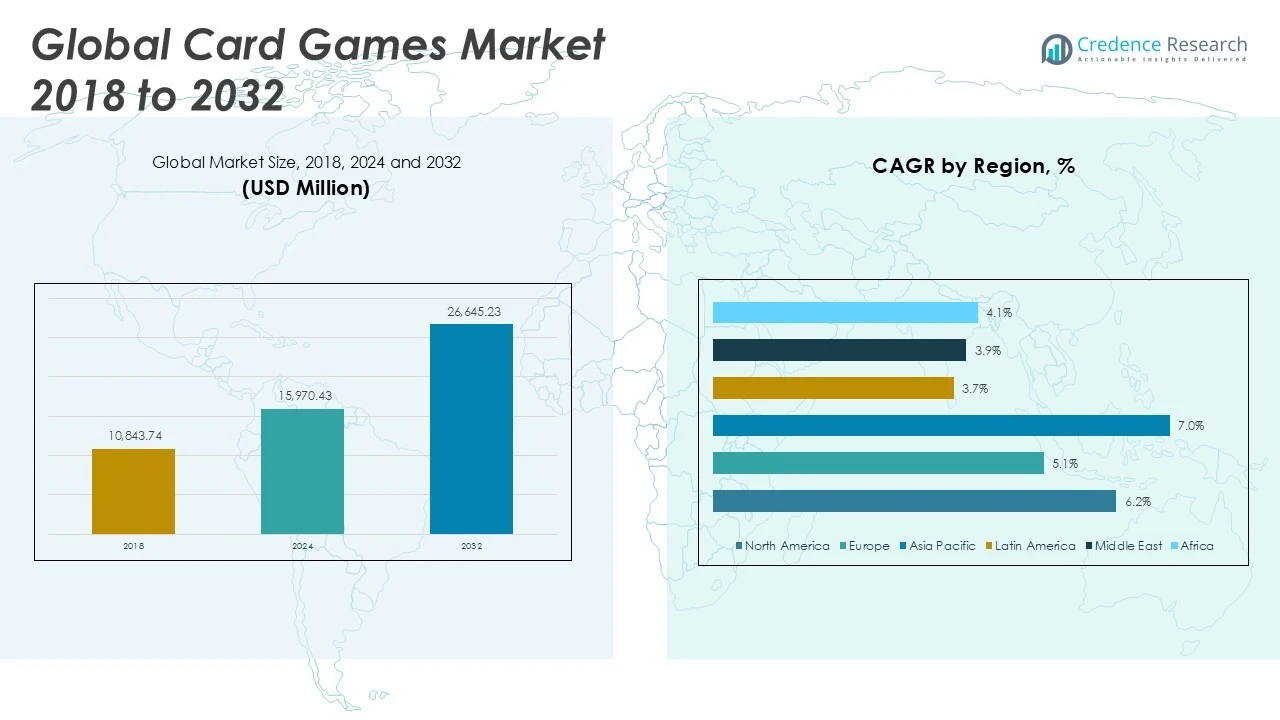

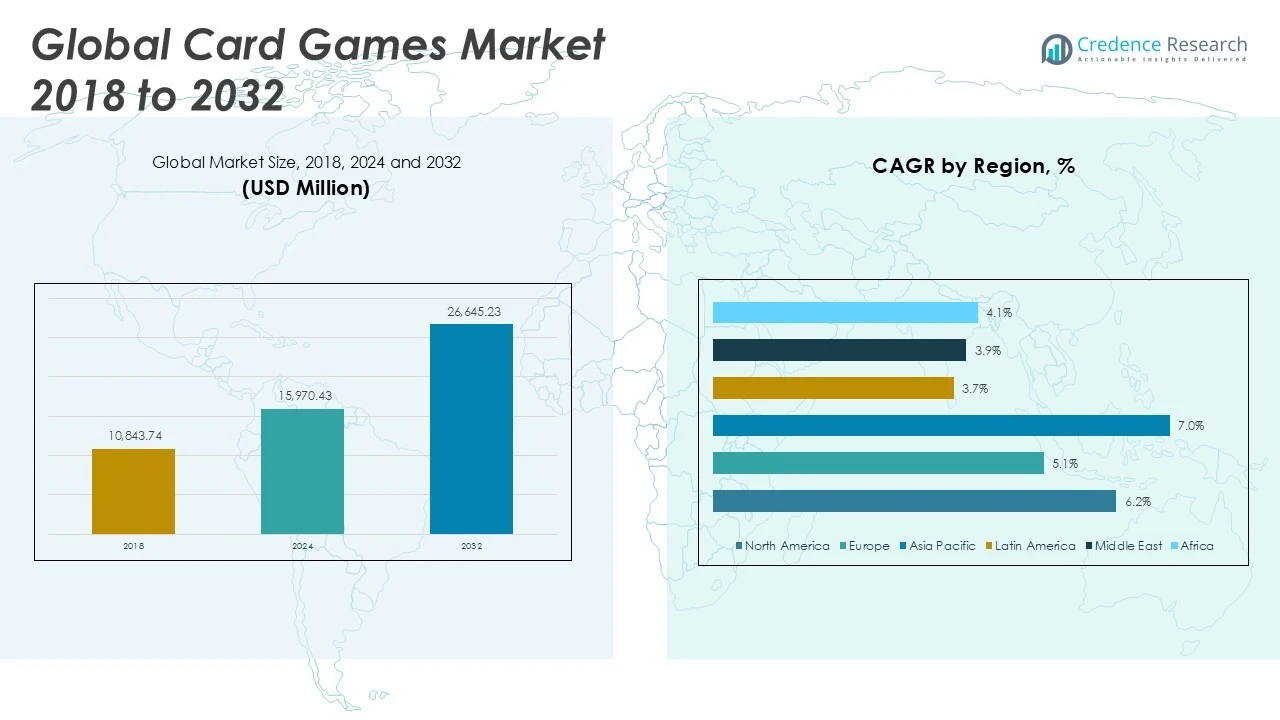

Card Games Market size was valued at USD 10,843.74 million in 2018 to USD 15,970.43 million in 2024 and is anticipated to reach USD 26,645.23 million by 2032, at a CAGR of 6.61% during the forecast period.

The Card Games Market experiences steady growth driven by increasing consumer interest in leisure and social gaming activities, supported by rising disposable incomes and expanding urban populations. Demand is further fueled by the resurgence of classic and collectible card games, alongside a wave of innovative digital adaptations that attract younger demographics. Market players leverage strategic collaborations with entertainment brands, which enhances product visibility and fosters strong brand loyalty. Online platforms and mobile applications have transformed accessibility, enabling multiplayer experiences and engaging global audiences. Eco-friendly materials and sustainable packaging gain traction, reflecting heightened environmental awareness among consumers. Seasonal promotions and limited-edition releases stimulate repeat purchases, while educational and cognitive benefits appeal to parents and educators, broadening the market’s reach. These trends, combined with robust e-commerce growth and targeted digital marketing, position the Card Games Market for continued expansion and diversification across both traditional retail and digital channels.

The Card Games Market exhibits robust growth across major regions, with North America, Europe, and Asia Pacific serving as primary hubs for innovation and consumer demand. North America leads in product development and digital adoption, driven by established gaming cultures and high internet penetration. Europe showcases a strong tradition of physical card games, supported by a growing preference for collectible and themed variants. Asia Pacific registers rapid expansion due to rising disposable incomes, increased urbanization, and a surge in mobile gaming activity. Key players shaping the competitive landscape include Hasbro, Inc., renowned for its extensive range of traditional and collectible card games; The Pokémon Company International, a leader in licensed collectible card games; and Konami Holdings Corporation, recognized for popular digital and physical titles. Bandai Namco Holdings Inc. also maintains a significant presence, driving innovation in both physical and digital card gaming segments.

Market Insights

- The Card Games Market was valued at USD 15,970.43 million in 2024 and is projected to reach USD 26,645.23 million by 2032, registering a CAGR of 6.61% during the forecast period.

- Growing consumer interest in leisure and social gaming activities fuels demand for both physical and digital card games.

- The market sees strong trends in digital integration, with mobile apps and online multiplayer platforms expanding access and driving engagement among younger audiences.

- Leading players such as Hasbro, Inc., The Pokémon Company International, and Konami Holdings Corporation continually invest in product innovation and brand collaborations to maintain their competitive edge.

- Market growth faces restraints from high competition, market saturation, and shifting preferences toward immersive digital entertainment options.

- North America remains a key hub for product development and digital adoption, while Asia Pacific records the fastest growth due to rising urbanization, disposable incomes, and mobile gaming adoption.

- The market benefits from evolving consumer preferences for themed, collectible, and eco-friendly card games, supported by diversified offerings and omnichannel distribution strategies

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Demand for Social and Recreational Activities

The Card Games Market gains momentum from rising interest in social and recreational activities across various age groups. Urbanization and changing lifestyles prompt consumers to seek interactive entertainment options that foster social connection. Card games offer an affordable and accessible way for families and friends to engage in shared experiences, supporting strong demand. Game nights, parties, and community gatherings often feature card games, highlighting their cultural relevance and wide appeal. The flexibility to play in both small and large groups further strengthens their popularity. Manufacturers respond by expanding product lines to cater to diverse themes and preferences, reinforcing the market’s growth trajectory.

- For instance, the India playing cards and board games market is driven by cultural significance, with traditional games being widely played during family gatherings and festivals.

Expansion of Digital and Mobile Gaming Platforms

The Card Games Market benefits from the rapid expansion of digital and mobile gaming platforms, which remove barriers related to time and geography. Companies invest in user-friendly applications and interactive online platforms that replicate the appeal of physical card games. Digital formats introduce multiplayer modes and competitive tournaments, broadening audience reach and encouraging repeat engagement. The integration of advanced graphics and customizable features enhances the user experience and keeps players invested. Young consumers show strong preference for mobile gaming, making it a key growth driver. This digital evolution allows the market to stay relevant amid shifting consumer behaviors.

Brand Collaborations and Licensing Initiatives

Strategic collaborations with entertainment brands and licensing initiatives drive significant activity in the Card Games Market. Manufacturers create themed decks and exclusive collections in partnership with popular franchises from movies, comics, and sports. These alliances attract dedicated fan bases, stimulate initial purchases, and foster long-term loyalty. Limited-edition and collectible card releases generate excitement and prompt rapid sales, particularly among collectors and enthusiasts. Licensing agreements allow companies to command premium pricing and access new distribution channels. These initiatives help maintain the market’s visibility and ensure ongoing product innovation.

- For instance, licensing agreements with major entertainment franchises have led to increased sales of collectible card games featuring characters from blockbuster films.

Growing Focus on Sustainability and Educational Value

The Card Games Market adapts to consumer demand for sustainable products and educational content. Companies prioritize the use of eco-friendly materials, recyclable packaging, and responsible manufacturing practices. These efforts align with growing environmental consciousness and influence purchase decisions. At the same time, educational card games gain traction, supported by parents and educators who recognize their role in developing critical thinking and social skills. Schools and learning centers integrate card games into curricula to support holistic learning. This focus on sustainability and education not only strengthens the market’s reputation but also expands its consumer base.

Market Trends

Growth of Digital and Hybrid Card Gaming Platforms

The Card Games Market observes a significant shift toward digital and hybrid platforms, where traditional gameplay merges with online functionality. Companies launch apps and web-based versions that mirror classic card games, allowing users to connect and compete from any location. This transition supports global multiplayer experiences and continuous engagement, appealing especially to tech-savvy and younger demographics. Hybrid formats that combine physical decks with digital components, such as QR codes or companion apps, enhance interactive gameplay and provide dynamic content updates. These innovations reduce geographic barriers and help brands reach new audiences. The market’s adoption of cross-platform capabilities ensures long-term engagement and diversified revenue streams.

- For instance, over 65% of card game enthusiasts now prefer digital platforms over physical ones, reflecting the growing adoption of online gaming.

Emergence of Themed and Collectible Card Games

Themed and collectible card games gain momentum in the Card Games Market, driven by strategic collaborations with popular entertainment franchises, sports leagues, and influencers. Brands release special editions featuring characters from movies, television, and gaming, which attract dedicated fan bases and collectors. Limited-run sets and exclusive artwork create scarcity and drive higher demand, while expansion packs sustain consumer interest over time. Social media campaigns and influencer partnerships amplify awareness, creating viral trends and boosting sales. The market benefits from growing consumer enthusiasm for nostalgia and pop culture, resulting in increased product launches and wider distribution channels.

- For instance, the collectibility factor and sense of community add to the continuing appeal of collectible card games, making them a key section of the global gaming and entertainment industry.

Focus on Sustainability and Eco-friendly Production

Sustainability remains a key trend in the Card Games Market, where companies prioritize eco-friendly materials and packaging. Manufacturers introduce recycled paper, biodegradable inks, and minimalistic packaging designs to align with environmental values and reduce carbon footprints. Consumers demonstrate greater awareness and preference for brands that commit to responsible production, influencing purchasing decisions. Industry players highlight sustainability in their branding, using certifications and eco-labels to build trust and differentiate products. These practices support long-term market reputation and appeal to environmentally conscious families and institutions. The trend fosters innovation in supply chains and product design.

Expansion of Educational and Skill-based Card Games

Educational and skill-based card games gain traction as parents, educators, and institutions seek tools to enhance cognitive development and critical thinking in children. The Card Games Market responds by launching products designed for learning, memory retention, and social skills. Schools integrate card games into curricula to encourage collaborative learning and problem-solving. Product developers partner with psychologists and educators to create age-appropriate content, ensuring educational value and safety. These card games appeal to a wide audience, including adults interested in brain training and lifelong learning. The trend diversifies product offerings and reinforces the market’s relevance in both recreational and educational contexts.

Market Challenges Analysis

Intense Competition and Market Saturation

The Card Games Market faces intense competition and saturation due to the presence of numerous established players and continuous entry of new brands. Manufacturers and retailers must differentiate their offerings to capture consumer attention in a crowded landscape, which often leads to price wars and reduced profit margins. Established brands leverage strong distribution networks and marketing campaigns, making it challenging for smaller or emerging companies to gain visibility. Rapid product innovation and frequent launches of new variants increase pressure to maintain relevance. It becomes difficult to secure long-term customer loyalty when consumers are frequently tempted by novel themes and limited-edition releases. Market saturation also limits growth opportunities in mature regions, requiring businesses to seek expansion in less penetrated Market.

- For instance, the playing cards and board games market is experiencing steady growth, driven by the increasing availability of diverse game options.

Digital Disruption and Shifting Consumer Preferences

The Card Games Market must address challenges posed by digital disruption and evolving consumer preferences. The proliferation of digital entertainment, including online and mobile games, often diverts consumer interest away from traditional card games. Younger demographics gravitate towards interactive and immersive digital experiences, which can reduce demand for physical card games. Companies need to continuously invest in digital integration and technology to remain competitive, which increases operational costs. Data privacy and cybersecurity concerns further complicate the transition to online platforms. Evolving consumer expectations demand a balance between traditional gameplay and digital innovation, making it imperative for market players to adapt their strategies quickly.

Market Opportunities

Expansion into Emerging Market and Untapped Demographics

The Card Games Market holds significant growth potential through expansion into emerging Market and targeting untapped demographics. Rising disposable incomes and increasing urbanization in regions such as Asia Pacific, Latin America, and Africa create new demand for social entertainment products. Companies can develop culturally relevant themes and region-specific designs to resonate with local audiences, broadening their reach. Marketing strategies that focus on family entertainment, educational benefits, and inclusive gameplay will attract a wider consumer base. Collaborations with local influencers and community organizations support deeper market penetration. By addressing the unique preferences and cultural nuances of these regions, the Card Games Market strengthens its global footprint.

Innovation in Digital Integration and Product Customization

The Card Games Market offers substantial opportunities for companies willing to invest in digital integration and product customization. The development of interactive online platforms, mobile applications, and augmented reality features enhances the user experience and attracts technology-driven consumers. Customizable decks and personalized themes appeal to individuals seeking unique and memorable products. Companies can leverage data analytics to understand consumer preferences and create tailored offerings, driving engagement and repeat purchases. Strategic partnerships with technology providers facilitate rapid innovation and seamless integration of new features. These initiatives position the Card Games Market for long-term growth and sustained consumer interest.

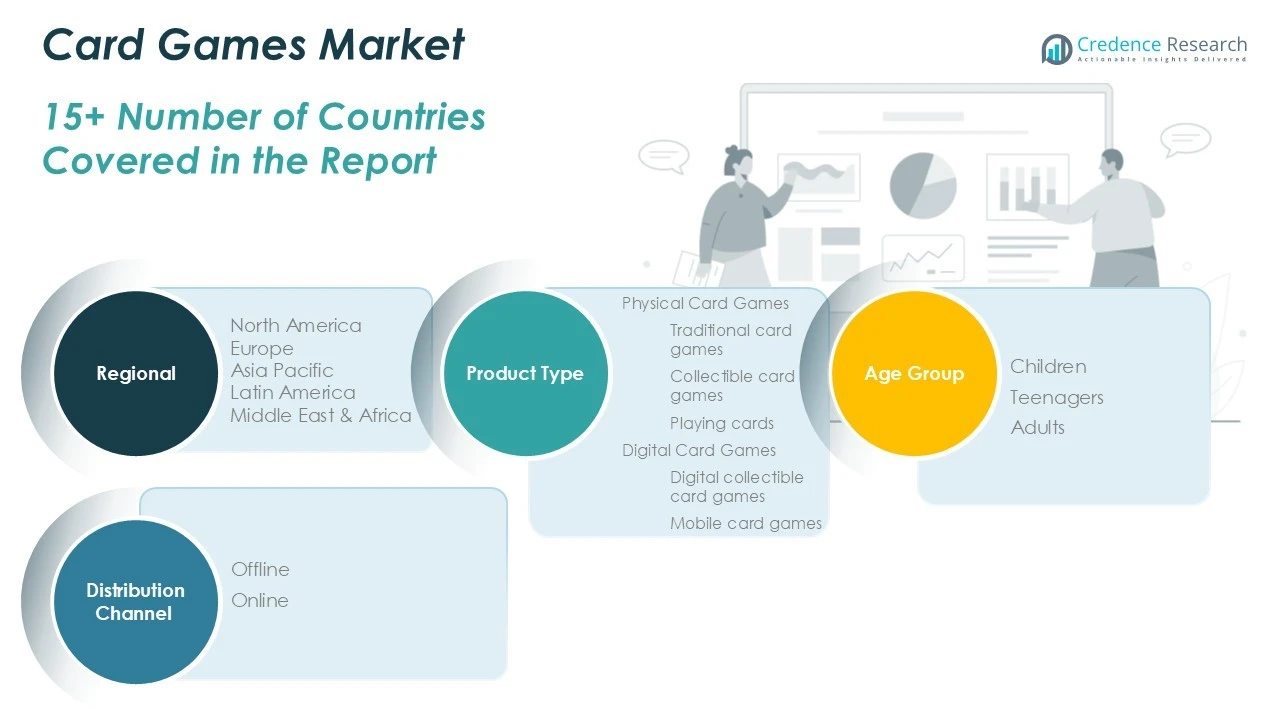

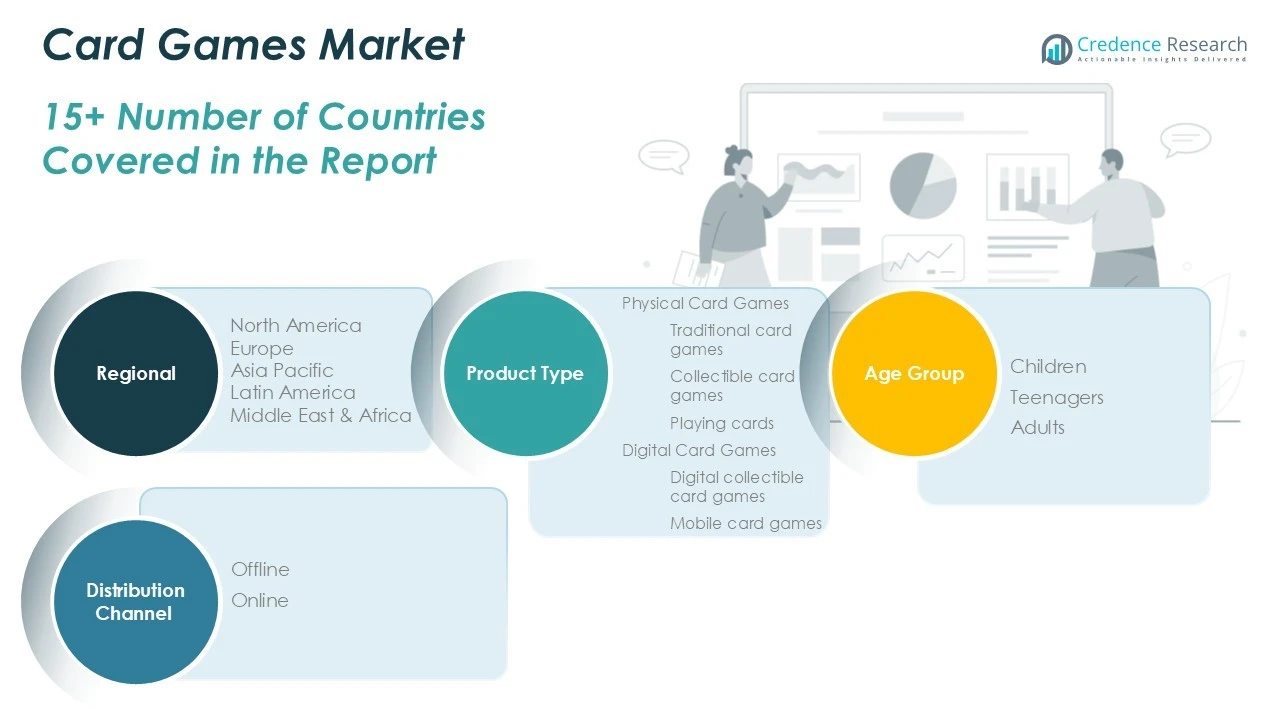

Market Segmentation Analysis:

By Product Type:

By product type, it encompasses physical card games including traditional card games, collectible card games, and playing cards and digital card games, such as digital collectible card games and mobile card games. Physical card games continue to attract families and hobbyists, while digital card games experience rapid growth due to technological advancements and increased smartphone penetration.

By Age Group:

Segmenting by age group, the market serves children, teenagers, and adults, with tailored offerings that address entertainment, social interaction, and educational needs for each demographic. The adult segment often drives demand for collectible and strategy-based games, while children and teenagers respond well to mobile and interactive digital formats.

By Distribution Channel:

By distribution channel, the market splits between offline and online sales. Offline retail channels, such as specialty stores and superMarket, retain strong presence, but online platforms expand rapidly by offering wider product access, convenience, and frequent digital promotions. This multifaceted segmentation enables the Card Games Market to respond dynamically to consumer preferences and emerging trends.

Segments:

Based on Product Type:

-

- Traditional card games

- Collectible card games

- Playing cards

-

- Digital collectible card games

- Mobile card games

Based on Age Group:

- Children

- Teenagers

- Adults

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Card Games Market

North America Card Games Market grew from USD 3,388.13 million in 2018 to USD 4,917.54 million in 2024 and is projected to reach USD 8,236.44 million by 2032, reflecting a CAGR of 6.2%. North America accounts for approximately 27% of the global market share in 2024. The United States leads the region, supported by strong participation from Canada and Mexico. Demand is fueled by the region’s rich tradition of family entertainment, strong retail infrastructure, and the popularity of collectible and strategy card games. Digitalization and the rise of online card gaming platforms also enhance market expansion. Major brands invest in licensing, partnerships, and digital integration to sustain growth and strengthen consumer engagement.

Europe Card Games Market

Europe Card Games Market grew from USD 2,356.78 million in 2018 to USD 3,307.68 million in 2024 and is expected to reach USD 5,092.24 million by 2032, posting a CAGR of 5.1%. Europe holds nearly 20% market share in 2024. The market features prominent countries such as the UK, Germany, France, Italy, and Spain, where classic and modern card games enjoy broad popularity. Growth is supported by innovation in game design, the expansion of board game cafes, and strong sales through specialty stores and e-commerce. Regulatory support and cultural appreciation for strategy games drive further adoption.

Asia Pacific Card Games Market

Asia Pacific Card Games Market grew from USD 4,201.41 million in 2018 to USD 6,445.43 million in 2024 and is projected to reach USD 11,490.09 million by 2032, reflecting a CAGR of 7.0%. Asia Pacific holds the largest regional share at about 39% in 2024. China, Japan, India, and South Korea are the principal Market driving demand, with digital and traditional card games gaining strong traction. The region benefits from large, youthful populations, growing disposable incomes, and a thriving gaming culture. Rapid urbanization and increasing access to digital platforms accelerate market expansion and introduce card games to new audiences.

Latin America Card Games Market

Latin America Card Games Market grew from USD 350.69 million in 2018 to USD 507.11 million in 2024 and is forecast to reach USD 703.24 million by 2032, at a CAGR of 3.7%. Latin America accounts for around 3% market share in 2024. Key countries include Brazil, Argentina, Chile, and Colombia, where the popularity of family gatherings and group entertainment drives steady demand. Retailers focus on expanding distribution in urban centers and leveraging e-commerce to reach broader demographics. Regional events and festivals often promote card game sales, supporting continued market activity.

Middle East Card Games Market

Middle East Card Games Market grew from USD 303.62 million in 2018 to USD 408.74 million in 2024 and is projected to reach USD 575.36 million by 2032, with a CAGR of 3.9%. The Middle East holds nearly 2% market share in 2024. The UAE, Saudi Arabia, and Israel represent key growth Market, supported by increasing interest in Western-style card games and digital gaming formats. Cultural adaptation, premium branding, and improved retail infrastructure encourage consumer participation. Brands tailor marketing strategies and product lines to suit local preferences and traditions, strengthening market position.

Africa Card Games Market

Africa Card Games Market grew from USD 243.12 million in 2018 to USD 383.95 million in 2024 and is expected to reach USD 547.85 million by 2032, at a CAGR of 4.1%. Africa makes up about 2% of the global market in 2024. Nigeria, South Africa, Egypt, and Morocco lead the region’s demand, driven by urbanization, a growing youth population, and increased availability of affordable card games. International brands partner with local distributors to expand product access, while community events and educational campaigns help boost awareness and participation. The region continues to show long-term growth potential as card games gain broader acceptance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hasbro, Inc.

- The Pokémon Company International

- Konami Holdings Corporation

- Mattel, Inc.

- Fantasy Flight Games

- Bandai Namco Holdings Inc.

- Nintendo Co., Ltd.

- Blizzard Entertainment (Activision Blizzard)

- Ravensburger AG

- CMON Limited

- Gamewright

- Upper Deck Company

- Cygames, Inc.

- Dire Wolf Digital

Competitive Analysis

The Card Games Market features a highly competitive landscape with leading players including Hasbro, Inc., The Pokémon Company International, Konami Holdings Corporation, Mattel, Inc., Fantasy Flight Games, Bandai Namco Holdings Inc., Nintendo Co., Ltd., Blizzard Entertainment (Activision Blizzard), Ravensburger AG, CMON Limited, Gamewright, Upper Deck Company, Cygames, Inc., and Dire Wolf Digital. These companies leverage strong brand recognition, diverse product portfolios, and strategic partnerships to strengthen their market presence. The shift toward digital card games and mobile applications has led to the launch of interactive platforms and online tournaments, expanding market reach and deepening user engagement. Strategic collaborations with entertainment franchises and licensing deals enhance product visibility and appeal to broader audiences. Companies also focus on sustainable materials and eco-friendly packaging to align with consumer expectations. Marketing strategies emphasize both traditional retail channels and online platforms, ensuring widespread distribution and accessibility. This dynamic and responsive approach allows established brands to maintain their competitive edge, while new entrants continue to challenge the market through niche offerings and targeted innovations.

Recent Developments

- In April 2025, Hasbro and Kayou launched the My Little Pony Card Game globally, marking the franchise’s first trading card game. The launch began in mainland China, with events and tournaments planned. The game features original card artwork and is designed for both collecting and social gameplay.

- In March 2025, Konami showcased its new Yu-Gi-Oh! Trading Card Game lineup at Toy Fair in New York. The 2025 lineup includes the “Supreme Darkness” set, released in January 2025, which introduces new “Evil HERO” monsters and a World Premiere theme, continuing the 25th Anniversary celebration.

- In February 2025, Fantasy Flight Games announced significant changes to its Living Card Game (LCG) model. The company introduced “Current” and “Legacy” environments for its major titles (e.g., Arkham Horror, Marvel Champions), retiring some expansions to streamline play and support new content. New expansions such as “The Drowned City” for Arkham Horror and “Agents of S.H.I.E.L.D.” for Marvel Champions are launching in 2025.

- In January 2024, The Pokémon Company increased the number of invitations for the 2025 Pokémon World Championships Trading Card Game Division for Hong Kong, reflecting growing participation and support for competitive play.

Market Concentration & Characteristics

The Card Games Market exhibits moderate to high market concentration, with a mix of established global brands and innovative niche players shaping the competitive landscape. It features strong brand loyalty, frequent product innovation, and a diverse range of offerings, from traditional card decks to digital and collectible formats. Large players maintain significant market influence through expansive distribution networks, licensing agreements, and collaboration with entertainment franchises. Smaller companies carve out positions by targeting specific demographics and introducing unique themes or sustainable products. The market adapts quickly to shifts in consumer preferences, especially the growing demand for digital platforms and eco-friendly materials. Its characteristics include a balance of heritage brands and emerging entrants, high product turnover, and a robust presence across both offline and online channels, supporting broad consumer engagement and sustained growth.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily through 2032, driven by increasing demand for both physical and digital card games.

- Digital transformation will continue to shape the industry, with mobile and online platforms expanding access and enhancing user engagement.

- Collectible and themed card games will gain popularity, attracting both traditional players and new audiences seeking unique gaming experiences.

- Sustainability initiatives, such as eco-friendly materials and packaging, will become more prominent, aligning with consumer preferences for environmentally responsible products.

- Educational and skill-based card games will see increased adoption in schools and learning centers, supporting cognitive development and collaborative learning.

- Emerging Market in Asia Pacific, Latin America, and Africa will offer significant growth opportunities due to rising disposable incomes and expanding urban populations.

- Integration of augmented reality (AR) and virtual reality (VR) technologies will enhance gameplay, providing immersive experiences that blend physical and digital elements.

- Esports and competitive card gaming will expand, with tournaments and online competitions fostering community engagement and brand loyalty.

- Strategic partnerships with entertainment franchises will drive the development of new card game themes, appealing to fans of movies, comics, and video games.

- Omnichannel distribution strategies, combining offline retail and online platforms, will ensure broad product accessibility and cater to diverse consumer preferences.